Okay, time to backtrack a little: Remember how in Chapter 2 we were talking about how money doesn’t grow on trees? Or in Chapter 4 about how there’s no such thing as a free ride in the moneymaking world? Well, those statements weren’t lies—technically, both of those things are true. But…

…if there’s anything that comes close to either a money tree or a free ride, it’s investing.

You can think of investing as saving—but with extra oomph! So are you ready to plant yourself down, learn how to use compound interest, and do some math? (C’mon, you didn’t think you’d pick up a book about money and not have to use your math brain, did you? Relax, this is going to be painless.)

Magic. That’s how a lot of people describe compound interest when they’re saving or investing their money for the long haul. Because while it’s true that compound interest is evil on a credit-card bill, it’s incredible when it’s working for you and your investments.

And here’s why: it can turn $1,000 into a million bucks! Not a word of a lie. In order to make that happen, all you need are three things:

When you grow a lettuce plant on your window ledge or in your garden, the process is pretty simple. You take a seed, add stuff that will make it grow, walk away, and—poof!—when you come back there’s a seedling. Here’s the cool part. You can either pick it right then for a tasty, tiny snack, or leave and come back in a few weeks. By then, that plant is perfect, as long as the growing conditions were still good while you were away. And into the salad bowl it goes.

The same applies to money. Put it into an investment, add an interest rate and some time, and voilà! More money.*

*Well, sometimes. Like that lettuce plant, without proper growing conditions, an investment could also shrivel up…and die. But we can come back to this point in a minute.

Before we go any further, now is a great time to explain a few financial concepts, words, and phrases.

Ever hear the old saying “You’ve got to spend money to make money”? That couldn’t be more true than with investing. An investment is something you pay money into with the expectation that someday you’ll turn a profit and make even more money.

But just what is this “something” you’re investing your money in? Turns out, it can be a few things…

A share of stock is actually a piece of a company. If you own a share of a popular toy company and they release a new game everybody wants, the company will make a profit—and so will you!

A bond is a debt that companies actually sell. Sounds kooky? Think of it this way. If an ice cream company is having a hard time selling its chilly product in the winter, it could sell bonds to generate money for the slow months. People like you and me buy the bonds for, say, $10 each with the understanding that come busy summertime, the company will pay us back plus give us interest. Both governments and companies offer bonds.

This is a whole bunch of stocks and bonds together. The theory is if you buy a mutual fund, you won’t be sinking all your money into one company. You spread the joy (and the risk) around. If one of the companies tanks, the others will hopefully still be doing okay, so you won’t lose as much. Sometimes it works, and sometimes it doesn’t.

These are funds you use to pay for your retirement (yes, as in “when you don’t have to work anymore”). In the U.S., they’re called a 401K; in Canada, they’re called an RRSP. Whatever you call them, they’re a good way to save money for the long, long haul. That’s because you often end up paying less tax on the money, plus employers sometimes stick money in the account for you, too.

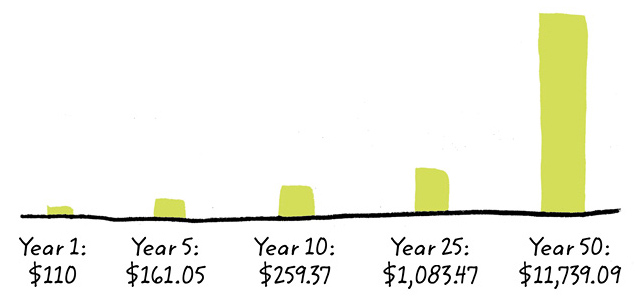

Regardless of how you invest your money, let’s take a closer look at how an investment works. Say you’ve been sticking your birthday money and allowance in a jar for a while. You’ve got $100. Now imagine that you ask your parents to invest it for you. They pick something that gives you an annual growth rate of 10 percent. In other words, at the end of the year you’ll have $110. Pretty sweet, because you didn’t have to do anything at all to make that extra $10. Just sit tight and wait.

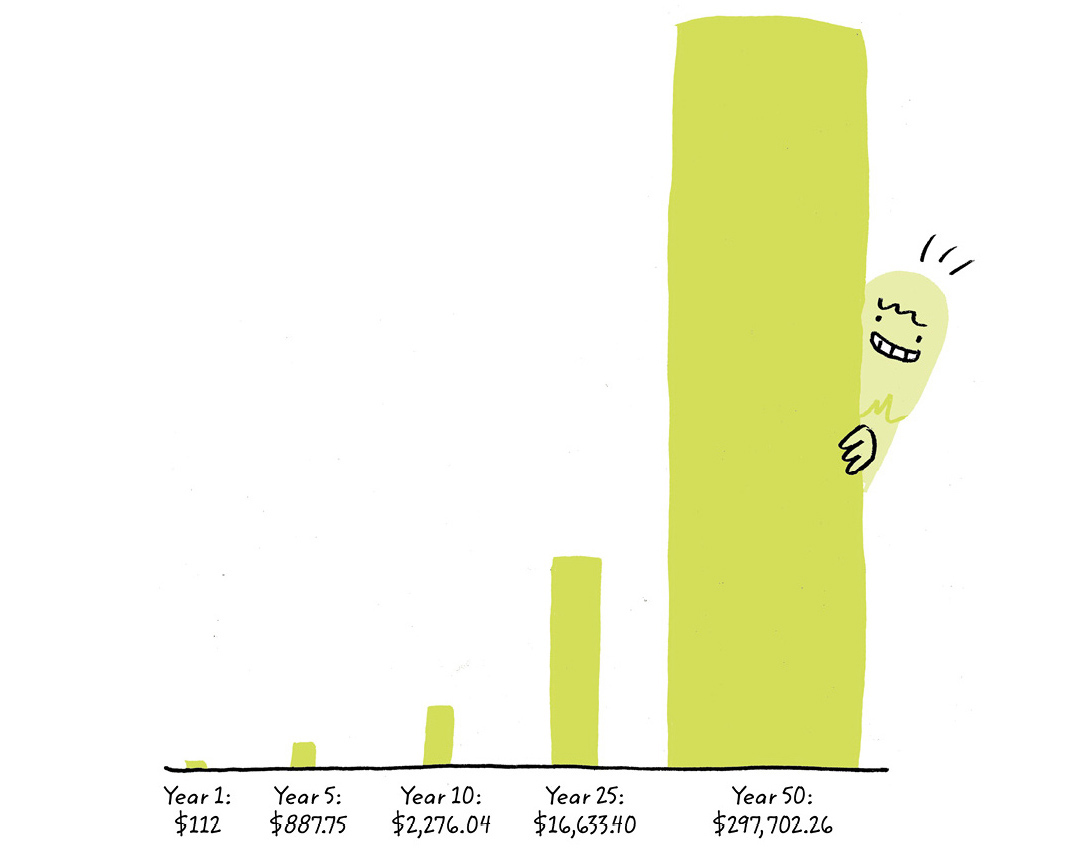

But what happens after five years, 10 years, or even 25 or 50 years?

If you’re 12 years old now, by the time you’re 62, that $100 bill will be worth over $11,700! That’s because you don’t just make interest on your money, you make interest on your interest, too. So the more money you make, the more it grows. Sure, inflation will mean that money won’t be worth as much in 50 years, but it will still be worth much more than the $100 you started with.

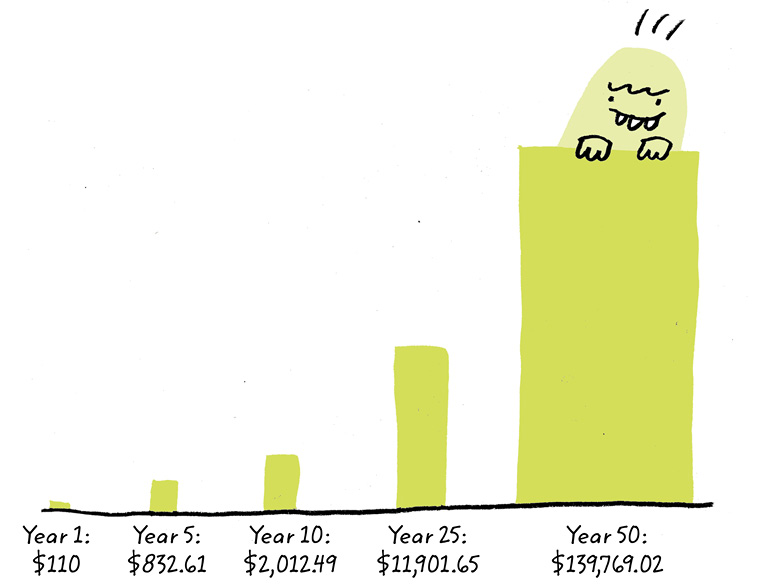

Now let’s see what would happen if you started with $100 and invested another $100 every year.

You notice what happened? After ten years (and $1,000 invested you doubled your money—just by placing it in the investment! Plus, you ended up over $130,000 richer. Granted, over 50 years, you invested a total of $5,000, but that’s chump change compared to what you end up with.

And what would happen if your growth rate was only 2 percent bigger? Say 12 percent?

Again, you’ve invested only $5,000 in total, but if your investments earn a 12 percent return instead of 10 percent, you’ll have nearly $300,000 someday.

So where is all this extra money coming from? To put it simply, when you invest that $100, someone somewhere is borrowing it from you. And you are charging them compounding interest for the privilege.

Sometimes you just want to have a little fun with your money now. That’s why a lot of people buy company shares of stock—just a fancy name for a tiny piece of a business. By owning a slice of a company that sells something you love, you can have a lot of fun researching it and following how the company is doing. You can follow the news in business sections of newspapers, online, or on TV.

Did your company just announce a cool new product? Watch your money grow. Did their factory just burn down? Watch out! That’s going to cost you, too.

Time might heal all wounds, but as the charts show it is also one of the most important ingredients to investment success. And that’s why your age makes you an incredibly powerful force. Because you have so much time to let your investments grow, you can start out with only enough money to buy a new outfit and end up with enough to take a trip to Disneyland, or wait a little longer and buy a house! (Okay, you’ll be taking your own kids or grandkids to the theme park, but still…)

Does everything here sound a little too good to be true? Can’t believe that investing would be that simple? Or reliable? Well, okay, you’re right, it’s not. Just as you need to tend to a plant to make sure it’s growing well, you need to check in on your investments and make changes from time to time.

That’s because not every investment is going to follow a straight line like the ones shown here. Like gardening, some investing years are better than others. One year there might be bright sun and ample rain, so your plant grows tall. The next year? A plague of locusts turns a whole garden into a chomped-up mess—and everybody’s plants are leveled to the ground.

The same idea applies to investing. You buy stock from Busy Bee Honey Co., and for the first two years you’re making some sweet cash. But look out! Thousands of bees get sick one year and die. Suddenly the company stock isn’t worth as much anymore because there’s less chance the business will be profitable. Your investment loses money.

So how can you protect that money? Here’s one way: Diversify your investments. That’s just a complicated way to say, “Don’t put all your eggs in one basket,” and in many cases, the system works. Good investors know that if they put some of their money in company stocks close to home, some in international stocks, and then invest in gold, too (just as an example), at least a couple of those investments will probably make enough money to pick up the slack if the third one tanks. Remember mutual funds? They’re based on the same idea.

Other people protect their money from big dips by investing only in companies that are pretty safe bets. They’re usually big, well-known corporations that show steady profits year over year. These investments typically don’t make a ton of money, but they rarely lose a huge amount.

Congratulations! You just got your very first paycheck for putting in two weeks at the local hockey arena selling chips and hotdogs. You’ve been dreaming about this day since you took the job—and know exactly how much cash you’ll be taking to the bank. So you open the envelope and…what’s this?! Hey! Who took a chunk of your money? Relax. That’s called paying taxes. It’s something everyone eventually shells out for somehow through income or sales tax.

A tax is money the government collects from its citizens to pay for public schools, safe highways, clean water, garbage collection, prisons, hospitals, and other services. But why do these things need to be paid using tax money? Why can’t we just pay for what we use instead? Simple. No one person (unless you were wildly rich) would be able to afford it. By pooling all our money together, though, governments can.

Tax systems around the world, including those in North America, are subject to a lot of debate, but they are generally based on our ability to pay. The richer you are, the more tax you can afford to pay. If you are making very little, however, you pay less.

No one likes to pay taxes, but everybody has to. Even you. (Hey, think of it as a sign of maturity. Now you can grumble about taxes along with your parents!)

Just know that history has shown us that even as investments go down over the course of days, weeks, and years, sometimes they eventually gain value and climb again—and investors make their money back. That is, if they are able to wait around long enough for the swing back up. Even after something as disastrous as the Great Depression, the markets eventually rebounded and it was back to “buy low and sell high” all over again.

But sometimes an investment loses money for a long time or never recovers. A public company goes bankrupt. A mining business never hits gold. For a lot of people (including me), it’s really hard to know when to sell an investment or when to hold on a little longer and see if it starts making money again.

It’s worrisome stuff, especially if you were planning on using that money soon. How would you like it if you invested $20 in your friend’s fishing bait-and-tackle business (We DIG Worms!™), hoping to use the profits next month to buy a baseball ticket, and your enterprising buddy decided he hated dirt? You paid for his shovels and plastic containers, thinking he would both pay you back and give you a cut of the profits. Then nothing. Good-bye, ballgame.

When a private company slices itself up and offers those pieces to the public to buy. Yes, if you own stock in a company, you really do own a piece of it, you old moneybags.

Knowing investments can lose big money, maybe you’re wondering why anyone bothers with them. Easy. A lot of the time investing pays off and people end up with more money than they started with.

One more thing. Knowing what you know now, are you interested in investing? You’ll have to get your parents to help you, since kids aren’t actually allowed to own stock, including mutual funds and some types of bonds. In many places you have to wait until you turn 18 before investments can be in your own name.

In the meantime, you can open a bank account or just plunk a jar on your desk and throw 10 percent of all the money that comes your way into it. Use the time to learn as much as you can about investing. Read newspapers, visit online sites, or talk to some people who know their stuff.

When things are sunny on the money front for everyone, we say we’re experiencing a bull market. But when stocks take a nosedive and no one wants to buy, that’s a bear market. You’ve got to wonder, though. Why pick a bull to represent happy times? Wouldn’t it be easier to remember the term if we called it a fluffy bunny market or sweet kitten market? I’m just saying…

Amanda Mills,

Loose Change, Canada

What the heck is a financial therapist? Ask Amanda Mills. She’s the founder of Loose Change in Toronto and one of the few people on the planet who listens to people talk about their money emotions for a living.

Often people will come to her when they’re feeling stressed or anxious about how they handle their cash. Some clients go on huge shopping sprees and can’t figure out why they’re drowning in debt. Other people visit Amanda, who also happens to be an accountant, because they hoard their money and are terrified to spend it. Amanda’s job is to listen and then help them figure out why they feel the way they do about money. Remember we said that money is never just about money? That money also influences feelings? Amanda believes that, too.

“Silence is at the root of a lot of the problems we have with money,” she says, mentioning that because a lot of parents don’t talk about money—things like how they earn or invest it—a lot of kids grow up feeling stupid about money. So they make a lot of mistakes when they grow up.

Is it time to break the cycle in your house?

“One of the most important things that kids can do with their parents is to urge them to teach and talk about money,” she says.

Amanda admits her own family didn’t chat about earning, spending, or saving much when she was a girl. But now that she has a job that allows her to talk about money all day long, she’s inspired.

“I love how real these conversations are. When people talk frankly about money, there’s no bull. If you really understand how the money works, you can understand a lot about a person,” she says.

So that unbearably cool skateboard is calling your name. Just think about all those totally awesome ollies and kickflips… Guess what? It looks like you’ve got yourself a financial goal there, dude. Amanda says that if you pick something that you really, really want, you’ll have an easier time saving for it because other things you could spend your money on will seem like a waste. Instead, keep your eye on the prize.

In other words, grab your parents and go meet your bank manager. You might be a kid now, but you’re also a future customer. Or ask your mom or dad to teach you how to look at your bank account online so you can keep tabs on how fast your money is growing. The point is, if you give your money more than a passing thought, you can build the skills you need to save up for things you want. (And yes, you can still splurge on music, candy, or a night at the movies with friends. Who wants to be a miser?)

“If your parents aren’t paying you an allowance, they’re really cheating you. They’re controlling all of the money decisions, and that’s not fair,” says Amanda. (Don’t you wish she were your favorite aunt or something? Me, too.) She has a point. Even if your parents can afford only 50 cents a week, it’s important that you learn how to spend and save your money responsibly. Learning what to do with your allowance now will teach you how to handle your salary in the future. So negotiate an allowance and open a bank account.

Save money, good. Spend every cent, bad. It’s not rocket science, right? So why, despite having all this evidence, do so many of us drag our heels when it comes to saving ? Lots of reasons, really. We worry we’re going to make bad investment choices, or think we don’t understand enough about investing in the first place. And sometimes we simply don’t have any money to invest. Not much you can do about that one.

But there’s one other giant reason that keeps a lot of people from spending money to make money. It’s called inertia. Huh?

Ever tried to push a train? Right—it’s heavy and takes forever to get moving. It’s “inert.” But if you stick with it and get that train going, it becomes next to impossible to stop. That force is called momentum.

In a way, learning to save and invest is the same thing. If you don’t put any effort into it, inertia rules and you go nowhere. But stick with it and build up some momentum, and your savings can really fly.

Before you go to bed at night, chances are some grown-up asks you if you’ve done your homework. Oops! But instead of cracking open the books, you brush your teeth and hit the hay with a sinking feeling in the pit of your tummy.

So what happened? You froze. The task just seemed so big, you did nothing.

But some scientists have found that the secret to happiness is kicking fear, worry, and plain old inertia to the curb and doing something—anything!

There’s just one problem—humans may be hard-wired for laziness. If given a choice, we’re more likely to take the easy path in order to save energy. And that’s exactly what researchers discovered when they asked a bunch of students to fill in a survey and then walk to one of two locations to hand it in. One station was close, the other far away. It turned out that the students who took a hike said they felt happier than the ones who wussed out.

So do something. Build some momentum. Not only will your savings thank you, but you’ll feel pretty good about it.

That said, if we know that we’re a lazy bunch, why not use this trait and turn it into a good thing?

As it turns out, some companies are doing just that—and their employees are getting to save money without even thinking about it. That’s because researchers discovered that even though a lot of companies give their workers the option to save some of their paycheck every month in an investment, a third of the employees can’t be bothered. Or they forget to sign up.

So they tried another approach. The researchers looked at what happened when companies automatically signed up every new employee and made them save. If people wanted out, they’d have to fill out a pesky form. But it seems even that simple task was too much hassle. In the end, 96 percent of the workers were stockpiling money in an investment every month because it was easier than opting out.

It looks like there’s something to be said for laziness. At least sometimes.