Introduction

The crisis that hit the coffee market after the International Coffee Organization (ICO) agreement collapsed in 1989 led Italian company illycaffè to look beyond the typical business model that had characterized the coffee industry to date. illycaffè decided to embrace a new strategic challenge and focus on a direct-purchasing model. They would bypass the intermediaries and reward their chosen growers by paying them a premium over the market price.

In the early 1990s, Brazil was the world’s largest producer of coffee, but had a reputation for low-quality products and poorly paid producers. But illycaffè prided itself on the high-quality coffee it offered consumers, and so the company had to find a way to overcome the quality problems associated with Brazilian coffee. They had to identify Brazilian coffee producers who were able to supply the high-quality beans the company required. Innovation translated into quality and networking translated into knowledge transfer thus became the drivers behind illycaffè’s strategy, looking for and demanding quality, and teaching producers how to deliver that quality. Ultimately, the company had to build a new kind of relationship with relevant stakeholders along the supply chain, starting from the cultivation of coffee, continuing through the purchase, and culminating in the roasting, packaging, and selling of high-quality coffee blends.

Innovation translated into quality and networking translated into knowledge transfer became, in fact, the main drivers of sustainability, enabling illycaffè to incorporate environmental and social concerns within a strategy of corporate sustainability (CS). This strategy produced interesting results in Brazil in terms of company growth, but now management had to assess illycaffè’s sustainable strategy against the impact of several factors, including the CS strategies of competitors and market reaction in the long-term. They also had to determine whether their own strategy was robust. Was illycaffè’s CS strategy really a key differentiator in the coffee industry supply chain?

The Coffee Industry

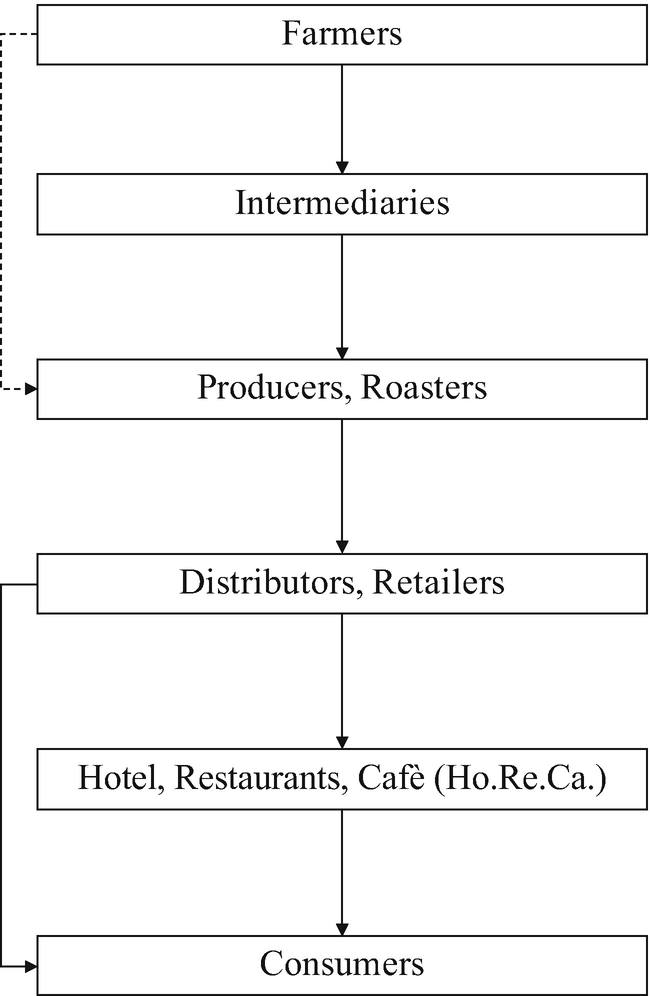

The coffee industry supply chain

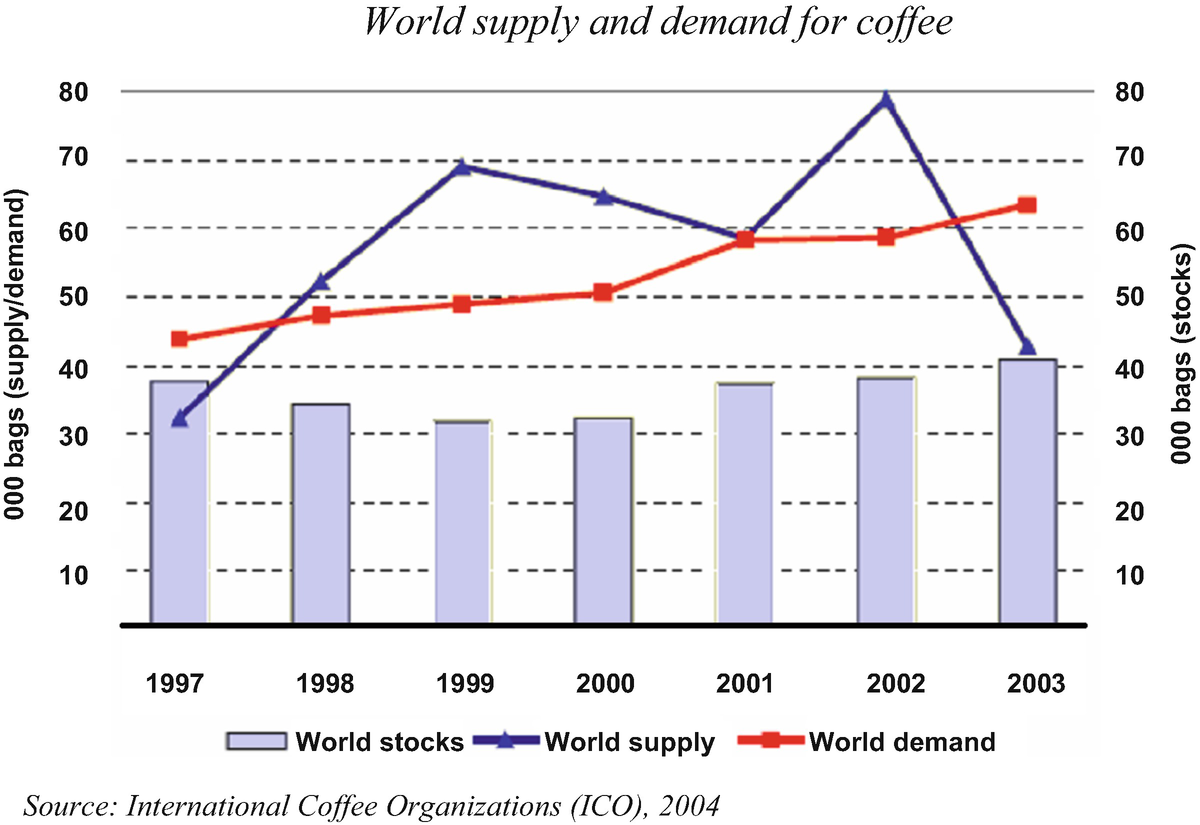

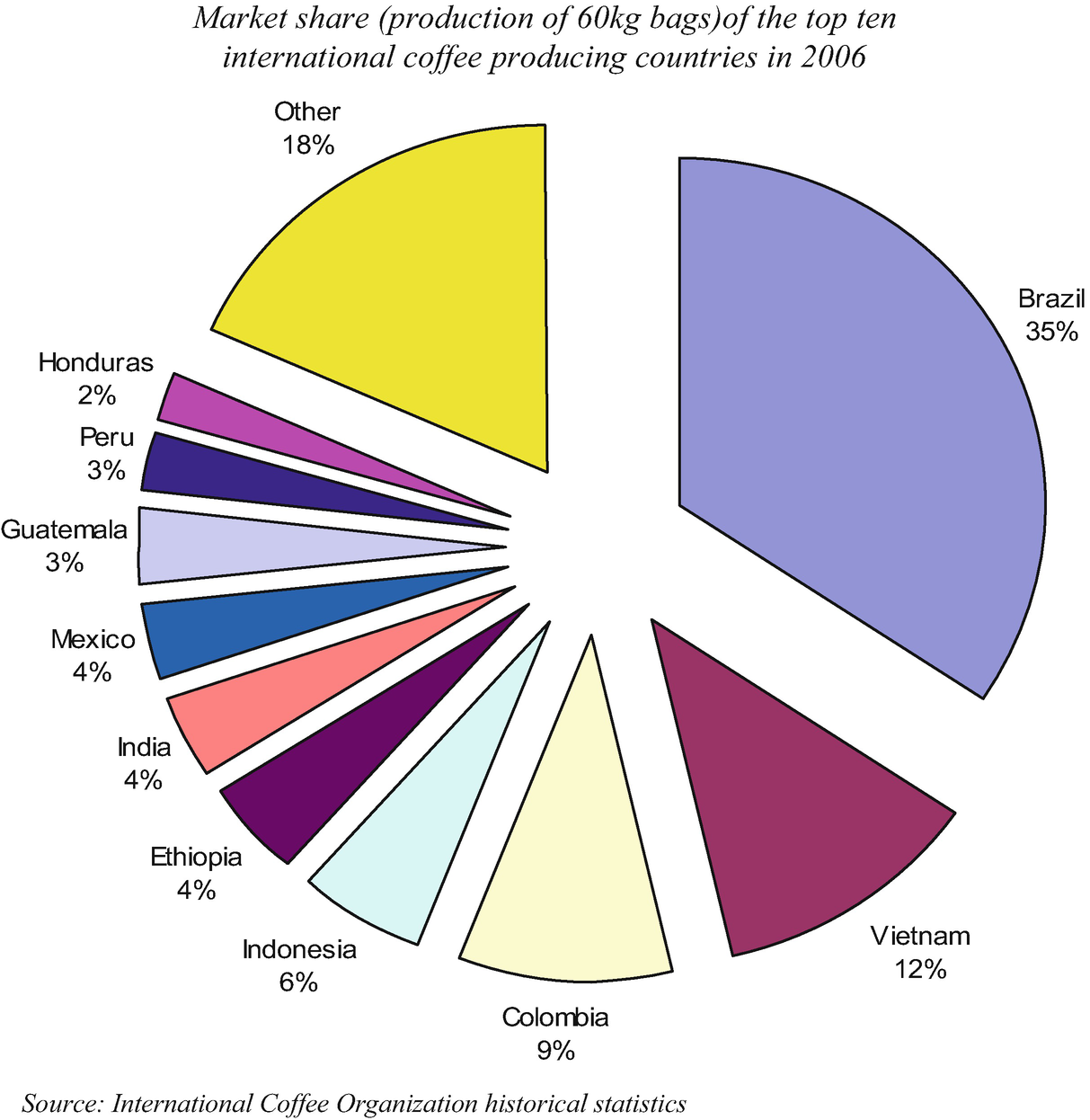

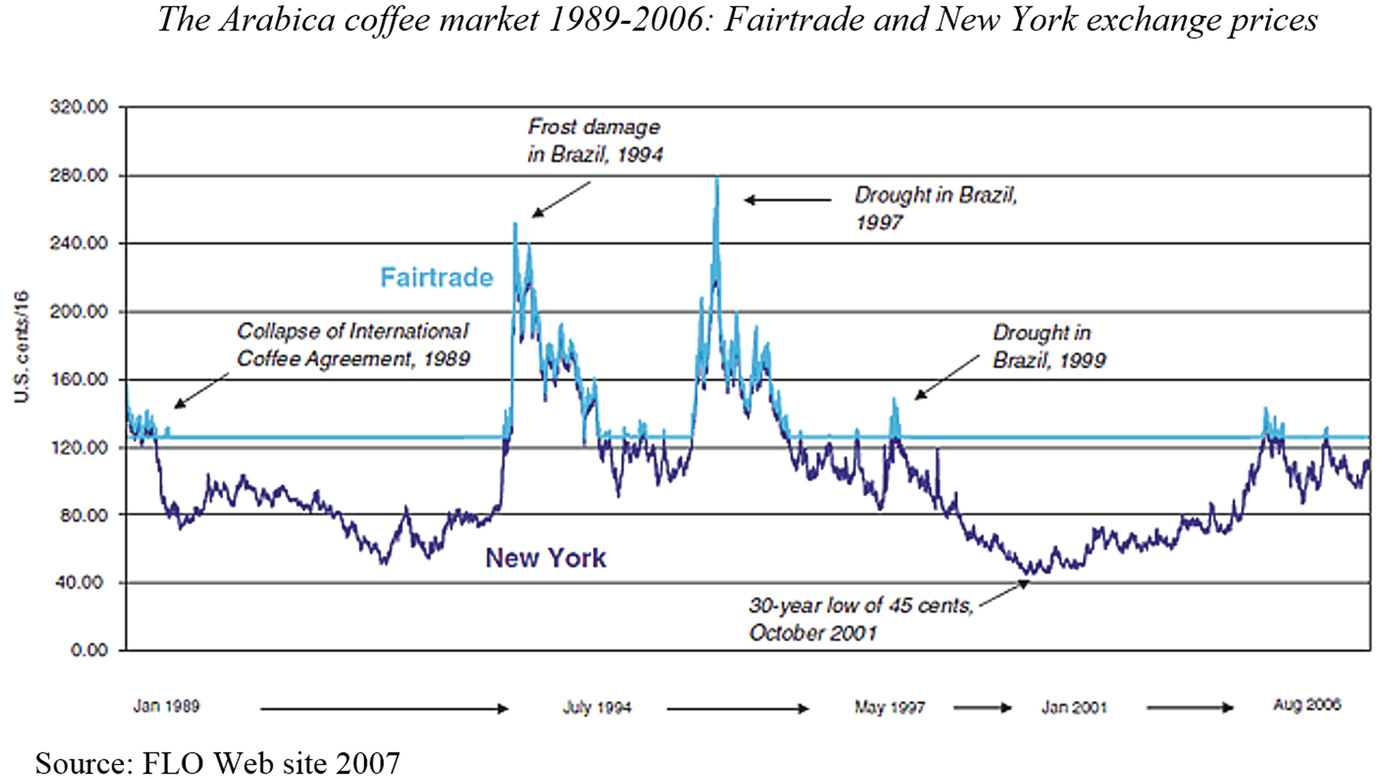

Fluctuations in production and market prices for coffee are shown in Exhibit 18.2. Between 1980 and 1990, the average production of the main exporting countries was 90 million bags (each weighing 60 kg), increasing to 112 million bags in the 2000–2005 period. In 2006, world-wide production of coffee was 124 million bags against a global consumption estimated at 116 million bags in the same year, compared to 115 million bags in 2005. In general, total coffee production exceeded demand for most of the period from 1997 to 2003 (see Exhibit 18.3). Consumption showed an increase in some coffee-importing countries during 2002–2005, with per capita consumption rising. In 2005, per capita consumption in the EU was 4.71 kg, and 4.18 kg in the USA.

Coffee-growing countries exported on average about 75% of their total production during the period 1980–2005. Domestic consumption in exporting countries in 2006 was estimated at 31 million bags (30 million bags in 2005), against a consumption of around 85 million bags in importing countries in 2006, basically unchanged compared to 85.5 million bags in 2005.

Meanwhile, market prices were falling. From 1980 to 1990, prices averaged US$1.20 per pound, but fell to an average price of US$0.60s per pound, at a CAGR of −22%, for the period between 2000 and 2005.

Brazil unquestionably produced more coffee than any other country. Having contributed more than 42 million 60 kg bags of coffee in the 2006 harvest, Brazil had a market share of 35%, more than one-third of the world’s coffee (see Exhibit 18.4).

The breakdown in the ICO Agreement in 1989 and the economic damage that resulted led to substantial pressure on coffee importers to use their market leverage to alleviate the economic hardships faced by coffee growers and their employees. Leading companies in the coffee industry responded with CS initiatives. At the same time, several organizations were formed to address particular aspects of the situation. The Brazil Speciality Coffee Association (BCSA) dedicated itself to improving the reputation and quality of Brazilian coffee, the Rainforest Alliance focused on sustainable livelihoods, and Utz Kapeh was founded to certify the social and environmental quality of coffee production, identifying responsible coffee producers (for more information on these organizations, see Exhibit 18.5).

Looking at the coffee industry, I have to say that CS is ignored in general. To the supply process side of the coffee industry in Brazil, CS is not an issue; most of the companies might not even know what we are talking about. They get their supplies to the market in formalized transactions that can be accomplished through intermediaries. If you have brands, like illycaffè, you might not have to consider CS as a cost, but as a cost-and-benefit issue, as illycaffè does. You have a market that values CS. CS of course can be an expensive strategy, but also, reading the literature, I feel that final consumers recognize the high value of those brands that behave responsibly.

Coffee and Fair Trade

Coffee was the first product to carry the Fair Trade label promoted by the group Fair Trade Labelling Organizations International (FLO). The idea was born when Frans van der Hof, a Dutch missionary living in Mexico, noticed that coffee growers in Oaxaca were selling their coffee to intermediaries at extremely low prices. A plan was developed with Dutch NGO Solidaridad to help the farmers sell their coffee direct to the market.

The Fair Trade movement is described by Wikipedia as a ‘market-based approach to alleviating global poverty and promoting sustainability’. Fairtrade coffee sales benefit producers both directly and indirectly. In contrast to Codes of Conduct and other social labels, the Fairtrade Standards are not simply a set of minimum standards for socially sustainable production and trade. The Fairtrade Standards go farther: they guarantee a minimum price considered as fair to producers. They provide a Fairtrade Premium that the producer must invest in projects that enhance social, economic, and environmental development. They strive for mutually beneficial long-term trading relationships. They set clear minimum and developmental criteria and objectives for social, economic, and environmental sustainability. Fairtrade Standards must be met by producers, their organizations, and the traders who deal with Fairtrade products (see Exhibit 18.6 for more information).

...Worldwide, sales of Fairtrade-certified coffee have increased from $22.5m per year to $87m per year since 1998. This is still only a tiny fraction of the overall world coffee trade, worth $10 billion annually. But there are plenty of other niche markets for high-quality coffee. Some small producers can charge more by marketing their coffee as organic—a switch which takes five years or so—or ‘bird-friendly’ because, unlike large, mechanised plantations, they have retained shade trees.

The well-known growth of the Fair Trade movement is only the first step toward sustainability, since the fair trade will continue no matter what the quality of its product. My triple concern is, first, that higher prices do not always mean higher value and quality; second, that producers looking for ad hoc certifications have to manage higher costs that spread throughout the supply chain; third, that sustainability does not always last, so that, in the long run, if the fair trade requirements are not met, the market (i.e., producers) might go back to the previous business model very quickly.

Andrea Illy, Chairman and CEO, illycaffè

The illycaffè Group

illycaffè S.p.A. was founded by Francesco Illy in 1933, and was dedicated to providing quality coffee. Francesco was succeeded by his son, Ernesto, soon after World War II, and in 1994, Andrea Illy became Chairman and CEO.

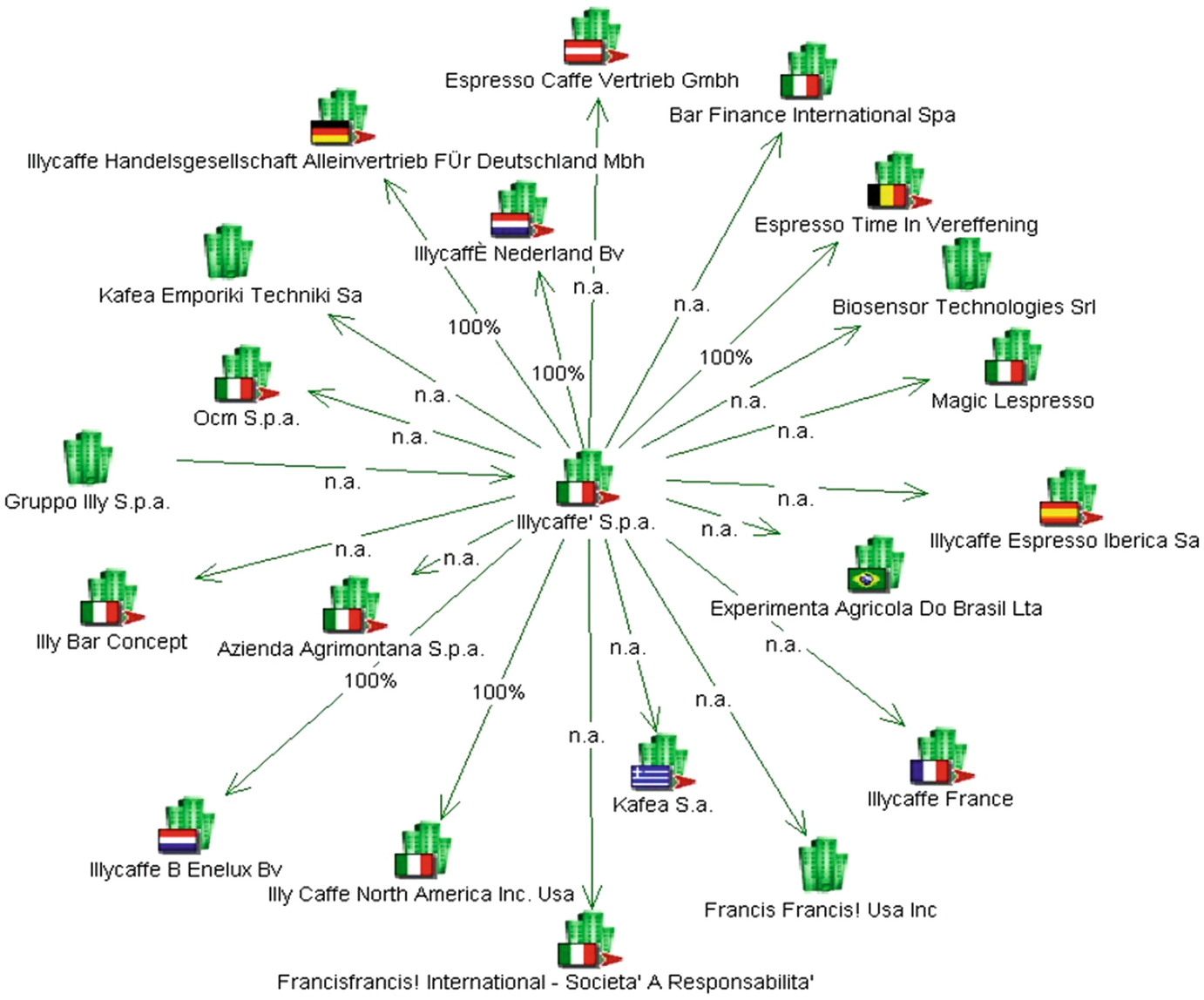

The illycaffè group worldwide network (2007) (Source: Amadeus Database)

illycaffè ranks among the top performers in the European coffee industry. Among companies in the Processing of Tea and Coffee industry (NACE Rev. 1.1, code 1586), illycaffè had a market share of 2.27% in 2005, ranking it the sixth largest company in terms of turnover in Europe, following larger companies such as Unilever N.V., Sara Lee International B.V., Kraft Foods France, Luigi Lavazza S.p.a., and Kraft Foods Schweiz Ag (see Exhibit 18.7). Turnover for illycaffè increased from €130 million in 1998 to €228 million in 2005, representing a CAGR of 7% over the 8 years (see Exhibits 18.8 and 18.9 for illycaffè’s financial results and relevant ratios). illycaffè diversified through acquisitions that built the coffee portfolio and took the company into the tea and chocolate businesses. The company accredits its results to unique managerial practices that mirror its organizational identity. Innovation and quality are critical elements of that organizational identity.

A History of Innovation

illycaffè’s dedication to innovation stems from 1935, when Francesco Illy invented the ‘illetta’, a revolutionary espresso machine that substituted the traditional steam method with compressed air and a system of pressurization to better preserve the flavour of his coffee blend.

Soon after he took control of the company, Ernesto Illy started a research laboratory that rapidly began to produce a range of products and inventions related to coffee roasting, brewing and drinking. Fourteen new patents were awarded to illycaffè between 1981 and 2006.

Throughout the years, the concept of innovation at illycaffè has been expanded to include a range of projects embracing many different faces of the coffee world. ‘illy art collections’, ‘illywords’, ‘In Principio’, and ‘illystories’ are examples of the linkages that illycaffè has built between its network of suppliers, consumers, collaborators and young artists, writers and photographers.

‘Excellence and Ethics’

The place to start was with quality, a concept basic to illycaffè’s business model and the fundamental value that grounded the company’s strategies and production processes. illycaffè believed that it could reach its objectives with greater efficacy by means of a business philosophy based on CS, and developed guiding principles founded on quality and encompassing partnerships and social commitment (see Exhibit 18.10).illycaffè is a stakeholder company, not a shareholder company. We have always paid primary attention to several stakeholders – specifically clients, partners, collaborators, suppliers, local communities, and then shareholders. We manage our relationship with these stakeholders by activating our two main values, excellence and ethics, which drive the company, while striving for perfection in all that we do. Of course illycaffè is a private company that has to manage its cash flows; but cash flows together with environmental and social concerns comprise our approach to sustainability, through which we respond to our stakeholders’ needs.

illycaffè was the first coffee company in Europe to obtain Quality System ISO 9001 certification from Det Norske Veritas, Italy (DNV). Further certification included ISO 9001:2000, UNI EN ISO 14001 and the environmental ISO 14001 in 2003. In 2004, illycaffè registered with the Eco-Management and Audit Scheme (EMAS), and published its first Environmental Declaration.

illycaffè established a strong collaborative relationship with its suppliers, starting by selecting the best local growers around the world, mainly in Brazil but also in Central America, India and Africa. illycaffè also began looking for optimum coffee growing conditions in areas not yet planted with coffee trees. According to Marino Petracco, Research and Technical Development Department at illycaffè (and Chair of the Food Products ‘Coffee’ Technical Committee at ISO), they were also looking for something else:At illycaffè, we know that value is created on the tree. As you move along the supply chain, starting with the harvest, you lose value and quality. The key skill, therefore, is to capture and preserve the quality you have on the tree. To make this possible, illycaffè has always valued its relationship with farmers. We buy green coffee directly from those growers who produce the highest-quality Arabica coffee beans, rather than purchasing it on the market. The farmers have to work hard to produce the highest-quality coffee, and this involves personal, economic, as well as managerial efforts. But illycaffè remunerates these efforts, we pay about 30–35% more than the market price.

Successful collaboration only works if a long-term, mutually beneficial relationship is established. For illycaffè, this meant finding growers willing to join them in a virtuous cycle of sustainability (see Exhibit 18.11). Alessandro Bucci, Buyer of the Green Coffee Department at illycaffè, described how their grower partnerships were based on trust… among the others, factors are climate, environment, and techniques, but also love and passion for what you do. If you cannot transfer love and passion in your day-to-day work, you cannot have the highest-quality coffee.

Throughout the years, illycaffè has worked on building a strong relationship with local growers that is essentially based on trust. If I have to use a Brazilian Portuguese word to describe this situation, I would say ‘parceria,’ which means a partnership between illycaffè and our suppliers, in which both parties gain excellent results. We get the highest-quality Arabica coffee beans we are looking for, they receive knowledge, competences, support, and margins of course. Our suppliers often do not bargain over the price, actually, because they know that we are offering the best price they can get. illycaffè pays more than a fair price; illycaffè pays for the effort to produce quality.

When it arrived in Brazil in 1990, illycaffè was almost unknown among Brazilian coffee producers. The company developed specific initiatives to raise awareness and help it to implement its sustainable strategy. The first major project was the launch of the illycaffè Brazil Quality Espresso Coffee Award in 1991, the second significant launch was the illycaffè University of Coffee, established in 2000.

illycaffè Brazil Quality Espresso Coffee Award

Brazil’s reputation for low-quality coffee presented a challenge, since quality was integral to illycaffè’s business model. In order to find the best growers, and therefore to guarantee procurement of high-quality raw material, illycaffè began a competition. The growers would present samples of their coffee, these samples would be analysed by illycaffè, and, if approved, purchased. The illycaffè Brazil Quality Espresso Coffee Award (Prêmio Brasil de Qualidade do Café para Espresso) was created to provide incentives and to recognize growers’ efforts to produce high-quality coffee. The best coffee of the year was rewarded through a monetary prize, and purchase of a significant amount of the coffee at prices higher than the market value. The number of participants grew from one year to the next, along with the quality of their coffee.

Evidence that the Espresso Coffee Award improved Brazilian coffee can be seen in the fact that some regions previously thought unfit for coffee cultivation have been discovered and their coffee-growing potential exploited. Such was the case for the Cerrado region, an area that is now producing high-quality coffee. After the first competition, it was discovered that this region had produced some interesting samples. Eventually, a number of growers from the state of Paranà, which had been repeatedly hit by frost, decided to relocate to Cerrado. Other coffee producing areas, such as Sul de Minas and Alta Mogiana, both in the state of São Paulo, subsequently joined the competition seeking to improve the quality of their crops.

Out of the approximately 450,000 growers in Brazil, illycaffè only buys Arabica coffee beans from about 72 suppliers regularly. Moreover, we only buy 10 to 15 percent of their production on average, as this is the amount of coffee that meets our requirements. Nevertheless, commitment by coffee producers is very high.

The illycaffè Brazil Quality Espresso Coffee Award and the Clube illy do Café built up a mechanism through which Brazilian coffee producers were able to learn and become capable of producing high-quality coffee.

The illycaffè University of Coffee

In 2000, the first academic institution dedicated to coffee producers, the illycaffè University of Coffee (Universidade illy do Cafè), was established in Brazil in collaboration with the University of São Paolo. The goal was to transfer illycaffè knowledge to current growers, operators, and technicians in the coffee supply chain, as well as to future generations, in order to enrich and improve their productivity and managerial skills. Brazil was chosen because it was the largest producer of green coffee in the world, therefore an excellent place from which to harvest the growth that originated the best blends.

The illycaffè University of Coffee network (Source: Adaptation from University of Coffee Web site 2007)

The main objective of the illycaffè University of Coffee is to transfer competences to, and build new professionals among farmers. The logic that we apply throughout our courses at the university is strictly related to what theorists call stakeholder theory. Growers are not just suppliers, but stakeholders of the firm. Therefore, following a sustainable approach we have to transfer knowledge and techniques to growers wherever they are, even if they do not supply illycaffè.

Voices from the Supply Chain

Ednilson Alves Dutra and Walter César Dutra have owned Fazenda Dutra since 1950. The company has three fazenda of about 500 ha in the Manhuaçu region employing between 200 and 600 people according to season and producing 1,500 bags of coffee. Fazenda Dutra is Utz Kapeh and BSCA certified. The Dutras emphasized the benefits of learning how to make high-quality Arabica coffee:Since 1990, we have changed the way we produce coffee. Comparing coffee with cars, until that time we didn’t know we could produce a Ferrari; we thought that we probably could produce a Fiat. illycaffè told us that our coffee was very good, something we hadn’t known. Today, we are very proud to know that we produce the best coffee in the world. We learned a lot from illycaffè about the best way to produce high-quality coffee and obtain certifications, indicating compliance with social and environmental issues; nevertheless, if certifications do not bring in income, they do not produce miracles and are not real. The main issue is that we work to make a profit and we have to care about cash flows.

Josè Aparecido Naimeg cultivates 560 ha of coffee in four fazenda in the Cerrado region, produces 2,000 bags of coffee a year and has been supplying illycaffè since 1992. He had direct experience of the change in the supply-chain structure:We learned a lot from the course with illycaffè, and we were able to improve the quality of our coffee. In 1999, we sold our coffee to illycaffè for the first time, the next year, in 2000, we were fourth at the illycaffè Brazil Quality Espresso Coffee Awards. Becoming a supplier of illycaffè helped eliminate the prejudices against our region and local community, which learned to value the quality of our coffee. It was a long process, but now we can sell our coffee, and thanks to illycaffè, which we really think of as our family.

Francisco Sergio de Assis, who has supplied illycaffè since 1992 from his 5 fazenda, has 50 permanent employees and 250 seasonal employees during the harvest. He suggested how CS and specific corporate strategies might be related:Becoming an illycaffè supplier was an opportunity more than a decision. We began in 1992, when we also won first prize at the illycaffè Brazil Quality Espresso Coffee Award competition. The award was satisfying to us of course, but the important thing was joining the illycaffè network. We do not have relationships with intermediaries, we just trust illycaffè, as illycaffè trusts us. It is actually a cooperative relationship. The University is also a network. You can learn, of course, but can also participate in a dynamic exchange of ideas and knowledge, not just between illycaffè and its suppliers, but, most important, between producers.

Coffee producers clearly understood that recognised certification could become a managerial tool with which to manage their relationships with stakeholders, but there were also broader impacts on sustainability in the supply chain. Public authorities as well as the financial system, for example, have been increasingly influencing the operations of coffee producers. Ednilson Alves Dutra again:Even small producers can benefit from the corporate strategies that illycaffè brought to Brazil. The first was innovation in our cultivation techniques and technologies, which we learned at the illycaffè University of Coffee. Second, illycaffè changed the history of coffee production in Brazil since they took the responsibility of rewarding our efforts to achieve the quality they required; now they still pay a fair premium that rewards the quality and innovation we have applied to improving our production processes.

Joao Carlos de Souza Meirelles, the Secretary of Agriculture, sees illycaffè’s contribution as significant: ‘The Illys were pioneers. They helped us learn to produce high-quality coffee, first for them and then for everybody else. Today, we don’t think anymore in terms of quantity of production. We think in terms of quality of production.’ And this was echoed in a Fortune report in 2002,4Banks no longer just ask for our financial status. They now require social and environmental responsibility before funding our firms, and the same pressure comes from the Secretary of the Environment and the Ministry of Labour. We joined the certification program because we aspired to a level of competence that would help us increase our volumes of high-quality coffee and to better structure managerial practices in our firm. That is why we focused our attention on labour conditions, the environment, and health and safety as well, even though keeping up the standards of these certifications is expensive.

... the indirect benefits illycaffè has brought to Brazil may be even more valuable than the millions of dollars a year the company puts in the pockets of the country’s coffee farmers. illycaffè taught Brazilian growers how to produce high-quality coffee, in the process helping Brazil shake its bad reputation among the gourmet coffee crowd. As a result, the Brazilian growers who supply illycaffè – and those who don’t – get more for their coffee today, relative to the market price, than a decade ago.

Other Approaches to CS in the Coffee Supply Chain

Larger players in the global coffee industry have different business models. In 2002, Nestlé stated that only 13% of the estimated 13 million bags of coffee it bought each year came directly from the farm. Sara Lee claimed 10%, and Procter & Gamble (P&G) and Kraft didn’t buy directly at all. But regardless of their individual commitments, none of the so called ‘Big Four’ believed direct purchasing was a long-term solution for ailing growers. ‘For us it would be impractical and less financially feasible to manage commercial relationships and bean quality at the farm level,’ said P&G spokeswoman Tonia Hyatt. ‘We would have to work with one million growers to buy directly’.5 In order to somehow respond to this situation, P&G announced in September 2003 that it would sell FT coffee through its Millstone label. Sara Lee also later began to sell FT coffee, but this represented slightly less than 1% of total American coffee consumption.6

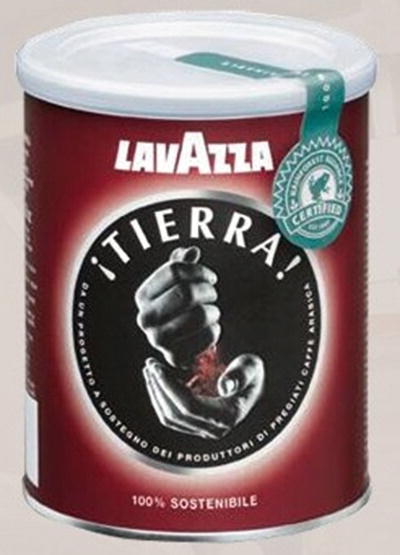

Projects comparable to illycaffè’s sustainable strategy included the ¡Tierra! Project of Luigi Lavazza S.p.a., the Nespresso AAA SUSTAINABLE QUALITY™ Program of Nestlé, and C.A.F.E Practices by Starbucks (see below). The contrast between the Starbucks approach and that of illycaffè were highlighted by Wendy Liebmann, President of market researcher WSL Strategic Retail, who stated that ‘Starbucks is less about coffee and more about community. illycaffè is about the elegance of coffee... It is elitist.’7

Luigi Lavazza S.p.a.: ¡Tierra! (Source: Lavazza Web Site 2007)

Luigi Lavazza S.p.a., established in 1894, had a turnover of over €850 million in 2005 and was the leading Italian coffee producer. The company had seven foreign subsidiaries and a wide-reaching international distribution network. In 2007, more than 16 million families in Italy claimed to buy Lavazza coffee, and the company challenge was to become a worldwide leader in the coffee industry.

In 2004, the ¡Tierra! project was conceived, organized, and implemented based on the triple-bottom-line approach, which means taking into account the social, economic, and environmental impacts of coffee production. As declared by Lavazza: ‘The objective of ¡Tierra! is to enable its beneficiaries – communities of small-scale coffee producers who currently live in extremely disadvantaged situations – to improve their living conditions and the quality of their products, to acquire new tools in order to trade under more favourable conditions and, finally, to be truly more competitive and autonomous in their choices and in the economic management of their production.’

Implementation was supported by Volcafè, one of the world’s leading coffee-exporting groups, and guidelines were drawn up with the help of the Rainforest Alliance. ¡Tierra! aimed at building differentiated operations that involved not just the coffee-production process, but also education, health, and homes. The project was rolled out in communities in three different coffee-producing countries, Honduras, Colombia, and Peru, and participants were directly involved in the project, bringing in both their direct experience and their needs.

The communities involved aimed to meet the social and environmental requirements for Rainforest Alliance Certification. In its final stage, the communities directly involved in ¡Tierra! were producing 100% Arabica coffee, and the result was a coffee blend of extraordinary quality but at no extra cost to the final consumer, because the costs of the entire project were part of Lavazza’s commitment to CS.

Nestlé: Nespresso AAA Sustainable Quality™ (Source: Nespresso Web Site 2007)

As of 2007, Nestlé, with its headquarters in Vevey, Switzerland, was the world’s biggest food and beverage company. Sales for 2006 were CHF 98.5 billion, with a net profit of CHF nine billion. Nestlé employed approximately 260,000 people and had factories or operations in almost every country in the world.

The Nespresso AAA SUSTAINABLE QUALITY™ Program was launched in 2003. It was based on an extensive collaboration with farmers across the coffee-producing world, as well as on collaborative partnerships with the Rainforest Alliance. ‘The AAA SUSTAINABLE QUALITY™ Program is a set of practices that together enable farmers to benefit directly from the cultivation of the highest- quality coffees. It is not a solution to all of the problems affecting coffee producers around the world, but it is our clear commitment to the farmers who produce Nespresso AAA coffees that they benefit from their relationship with us.’ Farmers were introduced to the principles of AAA through the Tool for Assessment of Sustainable Quality (TASQ™). In collaboration with the Rainforest Alliance, Nespresso’ agronomists set up workshops for farmers and trained them in AAA farm practices. Then the farms were assessed by agronomists, and later on Rainforest Alliance independently verified if an individual farm management plan conformed to AAA practices.

The program was based on a few simple principles established at Nestlé: ‘First, we pay a premium price for the AAA coffees we buy. Second, we invest in the whole farm assessment and verification process and do not pass this cost on to the farmer. Third, we analyse the data from the TASQ™ assessments and work with the farmers to suggest and make improvements at the farm and regional level. Fourth, we set up technical training and assistance workshops for farmers. Finally, we invest in specific projects in the communities.’

The Nespresso AAA SUSTAINABLE QUALITY™ Program has produced interesting results. In 2005, Volluto, one of the most popular brands, became Grands Crus, the first 100% AAA SUSTAINABLE QUALITY™ coffee in the Nespresso range, as independently verified by the Rainforest Alliance. The next year, in 2006, Caffè Forte for the B2B market was added to the range of Nespresso Grand Crus sourced 100% from the AAA SUSTAINABLE QUALITY™ Program. In 2007, the 30% of the total green coffee beans bought by Nespresso came from the AAA program, and the objective was to reach 50% by 2010.

Starbucks: C.A.F.E Practices (Source: Starbucks Web Site 2007, and Starbucks ‘Beyond the Cup. Highlights of Starbucks Corporate Social Responsibility,’ 2006)

Starbucks Coffee Company is the leading retailer, roaster, and brand of specialty coffee in the world, with more than 6,000 retail locations in North America, Latin America, Europe, the Middle East, and the Pacific Rim. Born in 1970 in Seattle, Starbucks is committed to offering its customers the world’s best coffee and the finest coffee experience, while also conducting its business in ways that produce social, environmental, and economic benefits for the communities in which it does business.

CS at Starbucks runs deeply throughout the company. Starting from its mission statement, several actions are implemented every day for relevant stakeholders: commitment to origins™, environment, communities, and partners. Within this mission, the C.A.F.E. (Coffee And Farmer Equity) Practices were developed and launched in 2001. C.A.F.E. Practices evaluated, recognized, and rewarded producers of high-quality, sustainably grown coffee. Guidelines were developed in collaboration with Scientific Certification Systems (SCS), a third-party evaluation and certification firm. C.A.F.E. Practices sought to ensure that Starbucks sourced sustainably grown and processed coffee by evaluating the economic, social, and environmental aspects of coffee production against a defined set of criteria.

Starbucks buys high-quality Arabica coffee. According to its commitment to origins™, Starbucks pays premium prices that result in a profit for the farmers and their families. In 2005, Starbucks paid on average $1.28 per pound for high-quality coffee beans. This was 23% higher than the average New York ‘C’ market price (NYC).

Starbucks’s purchases of coffee from C.A.F.E. and fair trade systems

2004 | 2005 | |||

|---|---|---|---|---|

Coffee purchased (lb Mln) | % of total coffee purchases | Coffee purchased (lb Mln) | % of total coffee purchases | |

C.A.F.E. practices | 43.5 | 14.5 | 76.8 | 24.6 |

Fair trade certified™ coffee | 4.8 | 1.6 | 11.5 | 3.7 |

The Business Dilemma

If we consider the international coffee industry, we are happy to see that today CS-related actions are gaining momentum among several organizations, but we believe that more can be done. We believe CS is not just a matter of social and environmental issues, but strictly refers to companies’ responsibility. That is why we manufacture coffee focusing on innovation, that is the quality, and the networking, that is the knowledge transfer, as drivers of sustainability (Andrea Illy)

Managers now need to determine whether the illycaffè CS concept is different, what impact its initiatives have had on sustainability in the supply chain, and whether this approach really is a source of competitive advantage over rivals – is illycaffè’s sustainable strategy sufficiently differentiated from other business models that it offers the potential for value creation within the company?

Several other issues must also be explored. What are the future challenges for illycaffè? Are competitors imitating illycaffè’s CS strategy, and if so, how long does it take them to catch up? Is the illycaffè model viable on a larger scale? Is the illycaffè CS concept the most efficient initiative for emerging markets? Where should illycaffè position itself in the market? Do its sourcing and delivering strategies support the brand? Is illycaffè’s business model applicable to other industries?

illycaffè Social Value Improvements (2007–2014)

During the last years, illycaffè strengthened its commitment towards corporate sustainability. A clear example is the value of “Ethics”, evidently stated by the company. Actually, illycaffè kept on reinforcing its aim of creating value for all the stakeholders, merging high-quality products with sustainability, transparency and personal growth.

illycaffè is a fundamental part of Gruppo Illy S.p.A., a holding company including different high-quality food and drinks firms. The whole group encompasses all companies that consider sustainability as a key business driver. Moreover, to underline the commitment towards corporate sustainability, illycaffè research and innovation is intended to develop new environmental friendly industrial activities (especially concerning with recycle materials), partnering with Universities of Padova and Trieste, together with the Agricultural Institute of Slovenia.

One of the main achievements accomplished in the last years concerned the Sustainable Value Report, which clearly and transparently stated all the declared goals, actions and projects carried out by illycaffè to implement corporate sustainability in three different forms: economic, social, and environmental.

The report has been prepared following the GRI-G3.1 sustainability reporting guidelines and audited by an independent third-party. It depicted how performance is linked to responsible management.

Actually, the report explained the main actions implemented by illycaffè during the period up to 2013, highlighting the company desire to create an environment that brings sustainability at the core of all the business activities. For example, the company governance structure has been composed by a Sustainability Committee, whose role and responsibilities enclosed the engagement towards responsible management, the accountability of the Value Report, the environmental critical considerations, and other activities performed to support corporate sustainability.

As a result of the corporate sustainability strategy implemented by illycaffè, one of the most important achievements was the Responsible Supply Chain Process Certification obtained in 2011, which awarded the sustainable green coffee supply chain process and the ability of creating value for all the stakeholders following the principles of traceability, reciprocity and quality. An independent third-party principally certified that all the coffee has been purchased without intermediaries (directly from coffee growers) and coffee growers have been paid a higher price with respect to market average. To give some interesting data of the collaboration born with suppliers: from 2010 to 2013 more than 5,000 coffee growers attended courses and meetings to improve and to share know-how, in order to achieve always better product quality, following an ethical approach common to all the supply chain.

Furthermore, the company reinforced its sustainable programs by adhering in 2012 to the Global Compact and drafting a Sustainability Manifesto that, together with the Code of Ethics, represented a fundamental step in order to share the strategy of sustainable and ethical business with all the stakeholders. Regarding the Global Compact, it is a United Nations initiative to encourage sustainable global economy with the adhesion to ten principles concerning human rights, environment, labour and corruption. illycaffè, in compliance with Global Compact, committed to follow those ten principles in pursuing its business activities. The Sustainability Manifesto was a clear example of the company commitment, because it stated the ethical principles applied inside the organization. Moreover, illycaffè adhered to the International Labour Organization (ILO) principles, purchasing coffee by suppliers that do not employ children younger than 14 years old.

Besides certification and adhesion to important initiatives, illycaffè strengthened its contributions to the territories and communities where it was and is still operating. As far as suppliers are concerned, the company supported projects to develop infrastructures in order to enhance the living conditions of coffee growing communities and committed to apply, as a general rule, the employment of local resources. In addition, the company also kept on monitoring all the suppliers, with who illycaffè continued to apply the strategy of building increasingly strong and long-lasting relationships.

Other contributions to local communities and territories have been made possible by Ernesto Illy Foundation, a non-profit organization aimed at increasing ethics and sustainability through initiatives with producing countries and other territories where business is carried out. To give an example, among the Foundation activities, there was the Master degree in coffee economics and science to enhance quality and corporate sustainability strategies.

A closer eye on environmental activities cannot be avoided. On the one hand, there was a commitment to reduce illycaffè direct environmental impact and on the other hand, this commitment tended to be spread to collaborators in order to efficiently and effectively implement the Comprehensive Environmental Management System. The latter was developed to minimize the direct environmental impact, reducing waste and pollution. To stress its commitment illycaffè signed an agreement with the Ministry of the Environment regarding the analysis of the impact of climate on coffee sector. Moreover, in 2012, the company implemented the LCA – Life Cycle Assessment – using software to reduce the environmental impact during the business processes. In addition, illycaffè promoted in the areas where coffee was produced agricultural activities with responsible water consumption, low waste and little employment of chemical fertilizers.

Also concerning with the environment, illycaffè managed to win “The Impresa Ambiente Pirze”, one of the most prestigious Italian award.

Two final important recognitions underlined how corporate sustainability was appreciated particularly externally. As a matter of fact, illycaffè was an official partner of EXPO 2015 and the Ethisphere Institute recognized the company as one of the World’s Most Ethical Companies for 2014, thanks to its achievements in corporate governance, its code of ethics, its CSR strategies and investments to innovate its processes in a sustainable manner. This award was of particular interest in light of the fact that illycaffè was the only one Italian company included by Ethisphere Institute in its list.

To sum up, illycaffè improved its strategy based on corporate sustainability, especially by setting a reporting activity and transparently committing to sustainable present and future projects. To make some example, among future goals written in the Sustainable Value Report, there were, first of all, the ability of increasing the number of coffee producers with Supply Chain certification, the implementation of a Sustainability Road Map to develop initiatives in line with Global Compact principles and the improvement of stakeholders’ engagement.

Exhibit 18.1: The International Coffee Organization

The International Coffee Organization (ICO) is the main intergovernmental organization for coffee, bringing together producing and consuming countries. The ICO was established in 1963, a year after the first 5-year International Coffee Agreement came into force in 1962. As of January 2007, ICO members comprise 45 exporting countries and 32 importing countries from all over the world. ICO members have to comply with the International Coffee Agreement. The text of the new International Coffee Agreement was written at a meeting of the 63 Member Governments of the International Coffee Council in London on 27 and 28 September 2000. It was formally adopted by the Council in Resolution 393.

A 6-year collaboration to strengthen international cooperation among producing and consuming countries became provisionally operative on 1 October 2001 and definitively on 17 May 2005. It includes a number of new objectives reflecting the ICO mission, such as encouraging members to develop a sustainable coffee economy, promoting coffee consumption and the quality of coffee, providing a forum for the private sector, promoting training and information programmes designed to assist the transfer of technology relevant to member countries, and analyzing and consulting on suitable projects to benefit the world coffee economy.

Source: International Coffee Organization Web site 2007

Exhibit 18.2: Production and Market Prices of Coffee, 1980–2005

Exhibit 18.3

Exhibit 18.4

Exhibit 18.5: Certifications in the Coffee Industry

The Brazil Specialty Coffee Association

BSCA’s purpose is to obtain thorough research and quality-control techniques that comply with the standards of excellence of Brazilian coffees offered to the international market. Founded in 1991, it has sent representatives to major international events related to the specialty coffees. Since 1992, BSCA has attended all Conferences and Shows of the Specialty Coffee Association of America (SCAA). It has its own booth that exhibits a large variety of Brazilian gourmet coffees, and it organizes lectures and promotional events.

Since 1993, the entity is also responsible for organizing meetings in Europe, together with gourmet roasting companies. Representing Brazilian coffees, BSCA actively participates in congresses and fairs in Germany, Switzerland, Italy, Austria, the United Kingdom, France, Spain, and Norway. At these events, it distributes relevant information and promotional samples, as well as tests to demonstrate the quality of its member companies’ specialty coffees.

The Rainforest Alliance works to conserve biodiversity and ensure sustainable livelihoods by transforming land-use practices, business practices, and consumer behaviour. Producers who want their farms to be successful, productive, efficient, and sustainable follow the farm-management guidelines continuously developed since 1992 by the Sustainable Agriculture Network, a coalition of independent NGOs. By following the guidelines, farmers can reduce costs, conserve natural resources, control pollution, conserve wildlife habitat, ensure rights and benefits for workers, improve the quality of their harvest, and earn the Rainforest Alliance Certified seal of approval.

The founders created an organization that could stand independently from the producers and the roasters. They chose the name ‘Utz Kapeh’ which means ‘good coffee’ in the Mayan language Quichù. An office was opened in Guatemala City in 1999. In 2002, the head office was opened in The Netherlands. In March 2007, Utz Kapeh updated its name to UTZ CERTIFIED, ‘Good inside.’ This updated name combines confidence in the model and pride in their heritage, with clearer communication for the international market. UTZ CERTIFIED assures the social and environmental quality of coffee production. The idea behind UTZ CERTIFIED is to create recognition for sustainable coffee producers and tools for roasters and brands to respond to a growing demand for assurance of responsibly produced coffee.

Source: BSCA, Rainforest Alliance, and Utz Kapeh Web sites, 2007

Exhibit 18.6: The Fair Trade Movement

Fair Trade is a trading partnership, based on dialogue, transparency, and respect, which seeks greater equity in international trade. It contributes to sustainable development by offering better trading conditions to, and securing the rights of, marginalized producers and workers, especially in the south. Fair Trade organizations (backed by consumers) are engaged actively in supporting producers, awareness rising, and in campaigning for changes in the rules and practice of conventional international trade.

FLO Standards

Pay a price to producers that at least covers the costs of sustainable production: the Fairtrade Minimum Price.

Pay a premium that producers can invest in development: the Fairtrade Premium.

Partially pay in advance, when producers ask for it.

Sign contracts that allow for long-term planning and sustainable production practices.

Product description. The Fairtrade Standards cover two varieties of coffee: Arabica coffee (Coffea Arabica) and Robusta coffee (Coffea Canephora).

Procure a Long-Term and Stable Relationship. Buyers and sellers will strive to establish a long-term and stable relationship in which the rights and interests of both are mutually respected.

International Customary Conditions. All other customary conditions applicable to any international transaction will apply, such as the conditions of the European Contract of Coffee, unless overruled by any of the special FLO conditions.

Pricing and Premium. Buyers shall pay producer organizations at least the Fairtrade minimum price as set by FLO. The Fairtrade minimum prices vary according to the type and origin of the coffee. In addition to the Fairtrade minimum price, the buyers shall pay a Fairtrade Premium as set by FLO at 5 US cents per pound of coffee. For certified organic coffee, an additional premium of 15 US cents per pound of green coffee will be due, in addition to the Fairtrade minimum price or the market reference price, respectively. If the market price is higher than the Fairtrade minimum price, the market price shall apply. At various times between 1997 and 2003, the Fairtrade coffee price was double that of the world market (see Figure, below).

Prefinancing/credit. The buyer shall make available up to 60% of the contract value, according to what the seller stipulates.

Fair trade minimum price and premium information (December 2005)

Fairtrade minimum price (US cents/lb) | Fairtrade Premium | ||||

|---|---|---|---|---|---|

Conventional | Organic | Conventional and organic | |||

Type of coffee | Central America, Mexico, Africa, Asia | South America, Caribbean Area | Central America, Mexico, Africa, Asia | South America, Caribbean Area | All regions |

Washeda Arabica | 121 | 119 | 136 | 134 | 5 |

Non-washed Arabica | 115 | 115 | 130 | 130 | 5 |

Washeda Robusta | 105 | 105 | 120 | 120 | 5 |

Non-washed Robusta | 101 | 101 | 116 | 116 | 5 |

Product | 2004 | 2005 | Var. |

|---|---|---|---|

Bananasa | 80,640 | 103,877 | 29% |

Beerb | 62,934 | 123,758 | 97% |

Cocoaa | 4201 | 5657 | 35% |

Coffeea | 24,222 | 33,992 | 40% |

Cottona | 0 | 1402 | ++ |

Dried fruita | 238 | 306 | 29% |

Flowersc | 101,610,450 | 113,535,910 | 12% |

Fresh fruita | 5156 | 8289 | 61% |

Honeya | 1240 | 1331 | 7% |

Juicesa | 4543 | 4856 | 7% |

Othersa | 611 | 833 | 36% |

Ricea | 1384 | 1706 | 23% |

Sportballsd | 55,219 | 64,144 | 16% |

Sugara | 1960 | 3613 | 84% |

Teaa | 1965 | 2614 | 33% |

Wineb | 617,744 | 1,399,129 | 126% |

Attracted by Fairtrade’s success with consumers, more companies knocked on the door of the labelling organizations. Marks and Spencer, one of the largest food and clothes retailers in the UK, switched its entire range coffee and tea to Fairtrade, totalling 38 lines, in a move which was estimated will increase the value of all Fairtrade instant and ground coffee sold in the UK supermarkets by 18%, and increase the value of Fairtrade tea by approximately 30%.

Exhibit 18.7: European Tea and Coffee Producers, Market Share by Turnover (2005)

Company namea | Market shareb (%) | Country |

|---|---|---|

Kraft Foods France | 10.65 | France |

Luigi Lavazza S.P.A. | 8.68 | Italy |

Kraft Foods Schweiz Ag | 2.31 | Switzerland |

illycaffè S.P.A. | 2.27 | Italy |

Sara Lee Coffee & Tea Belgium | 2.25 | Belgium |

Markus Kaffee Gmbh & Co. Kg | 2.24 | Germany |

Alois Dallmayr Kaffee Ohg | 2.15 | Germany |

Paulig Ab | 2.14 | Finland |

Nestlé Sverige Ab | 2.14 | Sweden |

Drie Mollen International B.V. | 2.10 | Netherlands |

Coop Industria | 1.91 | Italy |

Lipton Limited | 1.80 | United Kingdom |

Oy Gustav Paulig Ab | 1.61 | Finland |

Nevskie Porogi | 1.59 | Russian Federation |

Deutsche Extrakt-Kaffee Gesellschaft Mit Beschränkter Haftung | 1.59 | Germany |

Droga Kolinska, Zivilska Industrija, D.D. | 1.59 | Slovenia |

Nestle Kuban | 1.38 | Russian Federation |

Segafredo-Zanetti S.P.A. | 1.30 | Italy |

Gebr. Westhoff Gmbh & Co. Kg | 1.27 | Germany |

Coffein Compagnie Dr. Erich Scheele Gmbh & Co. Kg | 1.24 | Germany |

Koffie F Rombouts – Cafes F Rombouts | 1.16 | Belgium |

Kraft Foods Cr, S.R.O. | 1.14 | Czech Republic |

Cafè do Brasil S.P.A. | 1.11 | Italy |

Arvid Nordquist Handelsab | 1.04 | Sweden |

Mai | 1.01 | Russian Federation |

Othersc | 42.33 |

Exhibit 18.8: illycaffè Balance Sheet and Profit and Loss Account (€ Th)

Balance sheet | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | Average | CAGR |

Fixed assets | 66,908 | 61,416 | 50,902 | 44,664 | 40,646 | 36,780 | 29,689 | 22,997 | 44,250 | 14% |

Intangible fixed assets | 19,078 | 16,501 | 8,022 | 6774 | 6364 | 5990 | 4696 | 2682 | 8763 | 28% |

Tangible fixed assets | 44,437 | 42,587 | 37,091 | 35,337 | 32,780 | 28,750 | 21,245 | 18,117 | 32,543 | 12% |

Other fixed assets | 3393 | 2328 | 5789 | 2554 | 1502 | 2040 | 3748 | 2198 | 2944 | 6% |

Current assets | 111,928 | 87,343 | 74,660 | 74,880 | 80,617 | 90,620 | 66,834 | 53,984 | 80,108 | 10% |

Stocks | 52,320 | 38,181 | 30,973 | 31,664 | 40,969 | 46,818 | 32,247 | 26,684 | 37,482 | 9% |

Debtors | 48,323 | 38,925 | 36,796 | 34,604 | 33,427 | 32,523 | 27,622 | 23,620 | 34,480 | 9% |

Other current assets | 11,285 | 10,237 | 6891 | 8612 | 6221 | 11,279 | 6965 | 3680 | 8146 | 15% |

Cash & cash equivalent | 3577 | 4346 | 1077 | 4516 | 3091 | 3868 | 3856 | 2455 | 3348 | 5% |

Total assets | 178,836 | 148,758 | 125,562 | 119,544 | 121,263 | 127,400 | 96,523 | 76,982 | 124,359 | 11% |

Shareholders funds | 84,057 | 75,156 | 72,523 | 65,444 | 57,536 | 48,721 | 34,249 | 24,760 | 57,806 | 17% |

Capital | 6,300 | 6,300 | 6,300 | 6,300 | 6,300 | 5,423 | 5,423 | 1,085 | 5,429 | 25% |

Other shareholders funds | 77,757 | 68,856 | 66,223 | 59,144 | 51,236 | 43,298 | 28,826 | 23,675 | 52,377 | 16% |

Non current liabilities | 39,716 | 32,500 | 18,395 | 20,327 | 46,276 | 35,072 | 24,976 | 21,375 | 29,830 | 8% |

Long term debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | n.a. |

Other non-current liab. | 39,716 | 32,500 | 18,395 | 20,327 | 46,276 | 35,072 | 24,976 | 21,375 | 29,830 | 8% |

Current liabilities | 55,062 | 41,103 | 34,645 | 33,772 | 17,452 | 43,656 | 37,297 | 30,846 | 36,729 | 8% |

Loans | 15,094 | 9357 | 8480 | 6328 | 12,676 | 18,050 | 9585 | 13,505 | 11,634 | 1% |

Creditors | 25,727 | 21,653 | 17,311 | 19,448 | 0 | 17,467 | 16,578 | 10,113 | 16,037 | 12% |

Other current liabilities | 14,241 | 10,093 | 8854 | 7996 | 4776 | 8139 | 11,134 | 7,228 | 9058 | 9% |

Total shareh. funds and liab. | 178,836 | 148,758 | 125,562 | 119,544 | 121,263 | 127,400 | 96,523 | 76,982 | 124,359 | 11% |

Working capital | 74,916 | 55,453 | 50,458 | 46,820 | 74,396 | 61,874 | 43,291 | 40,191 | 55,925 | 8% |

Net current assets | 56,866 | 46,240 | 40,015 | 41,108 | 63,165 | 46,964 | 29,537 | 23,138 | 43,379 | 12% |

Number of employees | 647 | 590 | 537 | 731 | 678 | 996 | 417 | 385 | 623 | 7% |

Profit and loss account | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | Average | CAGR |

Operat. revenue/turnover | 228,737 | 208,188 | 190,314 | 193,818 | 193,845 | 179,709 | 154,766 | 130,596 | 184,997 | 7% |

Sales | 226,907 | 204,997 | 189,930 | 193,113 | 190,309 | 175,913 | 152,584 | 131,075 | 183,104 | 7% |

Costs of goods sold | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

Gross profit | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

Other operat. expenses | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

Operating P/L | 22,856 | 17,608 | 20,357 | 22,555 | 19,810 | 21,081 | 15,972 | 12,188 | 19,053 | 8% |

Financial revenue | 1,162 | 433 | 1997 | 1588 | 2508 | 2203 | 1920 | 2131 | 1743 | −7% |

Financial expenses | 3554 | 1815 | 3444 | 3611 | 4736 | 5318 | 2925 | 5547 | 3869 | −5% |

Financial P/L | −1,377 | −2,127 | −1,447 | −2,023 | −2,227 | −3,115 | −1,005 | −3,416 | −2,092 | −11% |

P/L before tax | 21,480 | 15,480 | 18,911 | 20,532 | 17,583 | 17,967 | 14,967 | 8,772 | 16,962 | 12% |

Taxation | 9268 | 7676 | 8121 | 8335 | 7135 | 7932 | 6596 | 4492 | 7444 | 9% |

P/L after tax | 12,212 | 7804 | 10,789 | 12,197 | 10,447 | 10,035 | 8371 | 4281 | 9517 | 14% |

Extr. and other revenue | 879 | 967 | 621 | 385 | 804 | 716 | 819 | 417 | 701 | 10% |

Extr. and other expenses | 2487 | 847 | 607 | 1567 | 1,160 | 328 | 285 | 299 | 948 | 30% |

Extr. and other P/L | −1,609 | 121 | 13 | −1,182 | −356 | 387 | 535 | 118 | −247 | n.a. |

P/L for period | 10,603 | 7925 | 10,802 | 11,015 | 10,091 | 10,422 | 8906 | 4399 | 9270 | 12% |

Export turnover | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. | n.a. |

Material costs | 88,820 | 73,189 | 66,113 | 63,612 | 76,586 | 76,242 | 60,654 | 56,478 | 70,212 | 6% |

Costs of employees | 39,922 | 36,734 | 32,204 | 30,253 | 28,067 | 25,727 | 23,182 | 19,671 | 29,470 | 9% |

Depreciation | 14,213 | 11,620 | 9153 | 8703 | 8533 | 8887 | 6383 | 4220 | 8964 | 16% |

Interest paid | 2594 | 1813 | 3116 | 3167 | 3925 | 4532 | 2915 | 5395 | 3432 | −9% |

Cash flow | 24,816 | 19,545 | 19,955 | 19,718 | 18,624 | 19,309 | 15,289 | 8619 | 18,234 | 14% |

Added value | 76,600 | 65,768 | 63,396 | 61,473 | 57,751 | 57,500 | 47,982 | 38,177 | 58,581 | 9% |

EBIT | 22,856 | 17,608 | 20,357 | 22,555 | 19,810 | 21,081 | 15,972 | 12,188 | 19,053 | 8% |

EBITDA | 37,069 | 29,228 | 29,510 | 31,258 | 28,343 | 29,968 | 22,355 | 16,408 | 28,017 | 11% |

Exhibit 18.9: illycaffè Ratios

Ratio | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | Average | CAGR |

|---|---|---|---|---|---|---|---|---|---|---|

Current ratio | 2.03 | 2.12 | 2.16 | 2.22 | 4.62 | 2.08 | 1.79 | 1.75 | 2.35 | 2% |

Liquidity ratio (%) | 1.08 | 1.2 | 1.26 | 1.28 | 2.27 | 1 | 0.93 | 0.89 | 1.24 | 2% |

Shareholders liquidity ratio (%) | 2.12 | 2.31 | 3.94 | 3.22 | 1.24 | 1.39 | 1.37 | 1.16 | 2.09 | 8% |

Solvency ratio (%) | 47 | 50.5 | 57.8 | 54.7 | 47.45 | 38.24 | 35.48 | 32.16 | 45.42 | 5% |

Gearing (%) | 65.2 | 55.7 | 37.1 | 40.7 | 102.5 | 109 | 100.9 | 140.9 | 81.5 | −9% |

Share funds per employee (€ Th) | 130 | 127 | 135 | 90 | 85 | 49 | 82 | 64 | 95 | 9% |

Work. capital per employee(€ Th) | 116 | 94 | 94 | 64 | 110 | 62 | 104 | 104 | 93 | 1% |

Total assets per employee (€ Th) | 276 | 252 | 234 | 164 | 179 | 128 | 231 | 200 | 208 | 4% |

Profit margin (%) | 9.39 | 7.44 | 9.94 | 10.6 | 9.07 | 10 | 9.67 | 6.72 | 9.1 | 4% |

Return on shareholders funds (%) | 25.6 | 20.6 | 26.1 | 31.4 | 30.56 | 36.88 | 43.7 | 35.43 | 31.27 | −4% |

Return on capital employed (%) | 19.5 | 16.1 | 24.2 | 27.6 | 20.72 | 26.85 | 30.19 | 30.71 | 24.48 | −6% |

Return on total assets (%) | 12 | 10.4 | 15.1 | 17.2 | 14.5 | 14.1 | 15.51 | 11.39 | 13.77 | 1% |

Interest cover | 8.81 | 9.71 | 6.53 | 7.12 | 5.05 | 4.65 | 5.48 | 2.26 | 6.2 | 19% |

Stock turnover | 4.37 | 5.45 | 6.14 | 6.12 | 4.73 | 3.84 | 4.8 | 4.89 | 5.04 | −1% |

Collection period (days) | 76 | 67 | 70 | 64 | 62 | 65 | 64 | 65 | 67 | 2% |

Credit period (days) | 40 | 37 | 33 | 36 | n.a. | 35 | 39 | 28 | 35 | 5% |

Net assets turnover | 1.85 | 1.93 | 2.09 | 2.26 | 1.87 | 2.14 | 2.61 | 2.83 | 2.2 | −5% |

Costs of employees/oper. rev.(%) | 17.5 | 17.6 | 16.9 | 15.6 | 14.48 | 14.32 | 14.98 | 15.06 | 15.81 | 2% |

Operat. rev. per employee (€ Th) | 354 | 353 | 354 | 265 | 286 | 180 | 371 | 339 | 313 | 1% |

Aver. cost of empl./year (€ Th) | 62 | 62 | 60 | 41 | 41 | 26 | 56 | 51 | 50 | 2% |

Profit per employee (€ Th) | 33 | 26 | 35 | 28 | 26 | 18 | 36 | 23 | 28 | 5% |

Cash flow/turnover (%) | 10.9 | 9.39 | 10.5 | 10.2 | 9.61 | 10.74 | 9.88 | 6.6 | 9.72 | 6% |

Exhibit 18.10: illycaffè’s Guiding Principles Based on Quality

Consumer: the client comes first. The main object of illycaffè’s passion for quality is to provide complete satisfaction to clients and consumers. Besides being responsible for the unfinished product that leaves the plant, the company also feels jointly responsible for the finished product – an espresso must always be perfect throughout the world. Toward this goal, illycaffè adheres to and attempts to improve every aspect of the standards of quality, in production, the processes, and in customer services.

Team spirit: care for collaborators. The policy of collaborator growth reaches toward the self-fulfilment and happiness of these people, based on respecting the dignity of others, on professional and personal growth, on their involvement in their work, their sense of responsibility, and a system of rewarding commendable work. Indeed, the company’s success depends on the skill and contribution of all the collaborators. illycaffè aims at developing the competencies of the collaborators through technical training in each sector and at providing for the necessary resources and a pleasant, stimulating, and safe working environment.

Partnership with the supplier. In the area of business ethics, the company policy emphasizes mutual benefits with its suppliers by both selecting and leading them with its values. It fosters long-term collaborations convinced that only a relationship based on mutual interest and growth can guarantee quality and, at the same time, improve the value of the product. In particular, illycaffè provides the producers of green coffee with its acquired know-how and expertise in ways to obtain better-quality coffee, for which it offers a sustainable, above-market price.

Social commitment. illycaffè deeply respects the environment and communities where it works. It undertakes not only to comply with the regulations, but also to implement policies of sustainable development for both the environment and society, by contributing to the development of the territory and the community living there.

illycaffè’s commitment with financers. illycaffè’s commitment to and its passion for quality and the protection of the shareholders’ and financiers’ legitimate interests, constantly work toward improving economic performance, aimed at self-financing and the growth of the company’s value.

Source: illycaffè Web site 2005

Exhibit 18.11: Sustainability in illycaffè

Sustainable development and quality: an inseparable pair. To make the best coffee, you need to use the best coffee beans, i.e., the highest-quality Arabica purchased by illycaffè, mainly in Brazil but also in Central America, India, and Africa. illy quality begins at its origin, with its cooperative relationship with the cultivators, based on principles of mutual respect and listening to each other’s requirements and needs. This company philosophy is consistent with its own strategy and has led illycaffè to work on sustainable development since the end of the 1980s.

One hundred percent of illy coffee is purchased directly from the producers. We know each and every one of our suppliers; we educate and train them to produce quality, while protecting the environment; we purchase the high quality our suppliers produce, always paying a price that ensures them a profit: this is at the core of the relationship illy has created and maintained with the growers who supply its raw material. It is a relationship based primarily on trust.

Quality as a tool for enhancing the living conditions of growers over time. The suppliers need to be very carefully selected. This is accomplished through a system of quality-incentive awards established in 1991 in Brazil with the Prêmio Brasil de Qualidade do Café para Espresso directed at the best growers in the country. The transfer of know-how begins once the cultivators have been selected. illycaffè agronomists make every effort to transfer knowledge and techniques of cultivation, harvesting, and processing. The growers are thus enabled to meet the high standards of quality required by illycaffè. Each year the company team of agronomists dedicate an average of 300 days of training to the growers. Moreover, illycaffè, in conjunction with the University of São Paolo, has created the University of Coffee in Brazil, which offers both practical and theoretical courses for producers.

Fair price. illycaffè calculates a minimum price, below which it never goes, under any circumstances. This price is based on variables such as the country of origin, the type of market, the quality of the product, and the cost of production. This minimum price is based on the international market quotations (NYC) and on the cost of production to which a fair margin is added: a margin to reward the producer for the greater care he has taken with his crops and to guarantee him a profit. illycaffè’s price policy is based on an empirical approach, built partly through the long-term relationships the company maintains with its producers.

Source: illycaffè Web site 2007: In Principio Project

Exhibit 18.12: Clube illy Do Café Benefits

Card | Benefits |

|---|---|

Cartão Vermelho | Supplying illycaffè for 1 year allows producers to become members of the Clube illy do Cafè. Members: |

1. Receive the Cartão Vermelho and the membership certificate; | |

2. Preferred access to the Clube illy do Cafè Web site; | |

3. Special offers among illycaffè’s products (e.g. coffee, ‘espresso’ coffee machine, etc.); | |

4. Periodic information about the Clube illy do Café; | |

5. Access to the relevant references about coffee; | |

6. Copy of the movie ‘Como Fazer do Café uma Obra de Arte’ (How to make coffee a work of art); | |

7. Opportunity to buy products and participate, as a special benefit, in seminars organized by the Clube with other organizations; | |

8. Participation in technical workshops with experts identified by illycaffè | |

Cartão Prata | Supplying illycaffè for a 3-year period allows members to receive the Cartão Prata, which provides additional benefits: |

1. Status and reward for receiving a higher-level card; | |

2. Free participation in courses and workshops at the Universidade illy do Cafè; | |

3. Free logo identifying the authorization by illycaffè to analyze the coffee; | |

4. Reserved Internet channel to exchange information with Dr. Illy, researchers, and coffee experts; | |

5. Annual participation in a holiday in Italy with the full organization | |

Cartão Ouro | Supplying illycaffè for more than three consecutive years allows members to receive the Cartão Ouro, which provides additional benefits: |

1. High status and rewards for receiving the highest-level card; | |

2. Free participation in courses and workshops at the Universidade illy do Cafè; | |

3. Free logo identifying the authorization by illycaffè to analyze coffee; | |

4. Reserved Internet channel to exchange information with Dr. Illy, researchers, and coffee experts; | |

5. Technical support with direct visits by illycaffè experts; | |

6. Free copy of the book by Andrea Illy Espresso Coffee: The Science of Quality; | |

7. Participation as special guest in the illycaffè Brazil Quality Espresso Coffee Award Ceremony; | |

8. Annual participation in a holiday in Italy with the full organization | |

Award ‘Supplier of the year’ | Each year, members of the Clube illy do Cafè with Cartão Ouro and Cartão Prata can participate in a cultural trip to Italy |

Members of the committee are illycaffè, Assicafè (Organization providing quality certification for illycaffè), Porto de Santos (official retailer for illycaffè), and ADS (Assessoria de Comunicaçoes, official communication agency for illycaffè) | |

Requirements to participate in the award are: | |

Loyalty in supplying illycaffè; | |

Efficiency in production; | |

Reliability; | |

Outstanding coffee; | |

Correspondence of the lot with the original sample; | |

Perfect balance sheet; | |

Processing of supplied quantity and subsequent high quality; | |

Relationships: efficiency and reliability in the bargaining process; | |

Participation in the illycaffè Brazil Quality Espresso Coffee Award Ceremony |

Acknowledgements

The development of this case and the overall project has been made possible due to the generous financial support of EABIS’ founding corporate partners: IBM, Johnson & Johnson, Microsoft, Shell and Unilever.