Create Value for Your Customer and Your Business

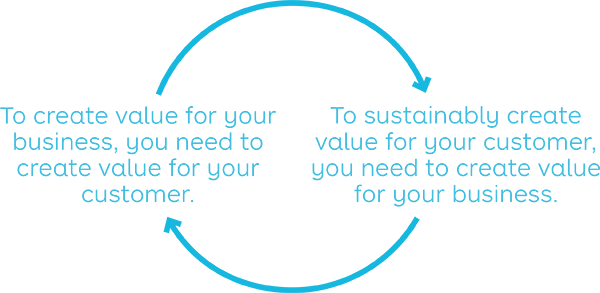

A business that generates fewer revenues than it incurs costs will inevitably disappear, even with the most successful value proposition. This section shows how getting both the business model and the value proposition right is a process of back and forth until you nail it.

Azuri (Eight 19): Turning a Solar Technology into a Viable Business

1.6 billion people in the world still live without electricity. Could innovative value propositions and business models around new technology offer answers?

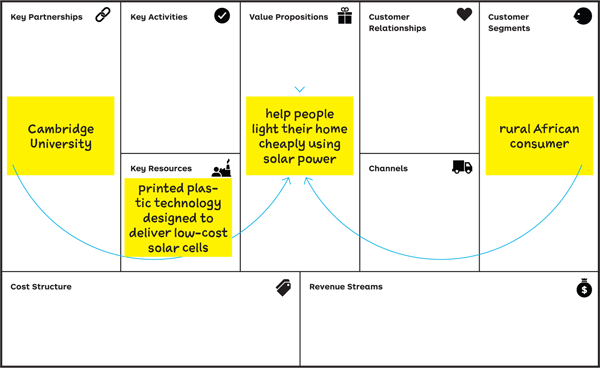

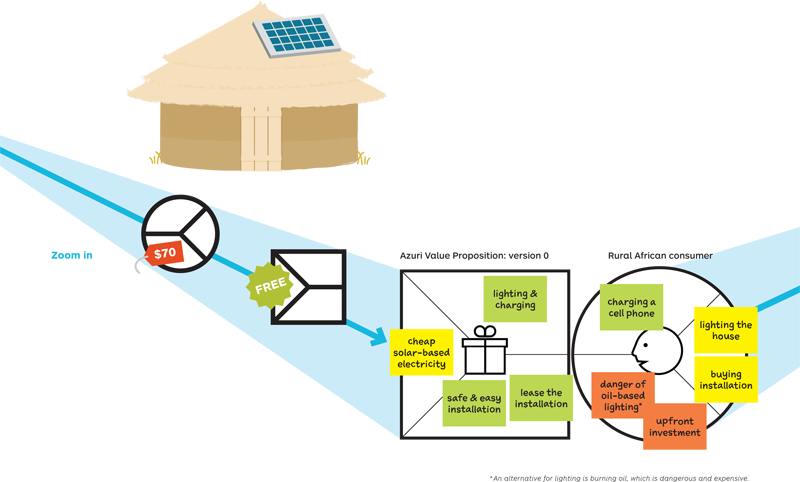

Simon Bransfield-Garth founded Eight19 based on a printed plastic technology originating from Cambridge University. The technology is designed to deliver low-cost solar cells. In 2012 Eight19 launched Azuri to commercialize the technology and bring electricity to off-grid customers in rural emerging markets.

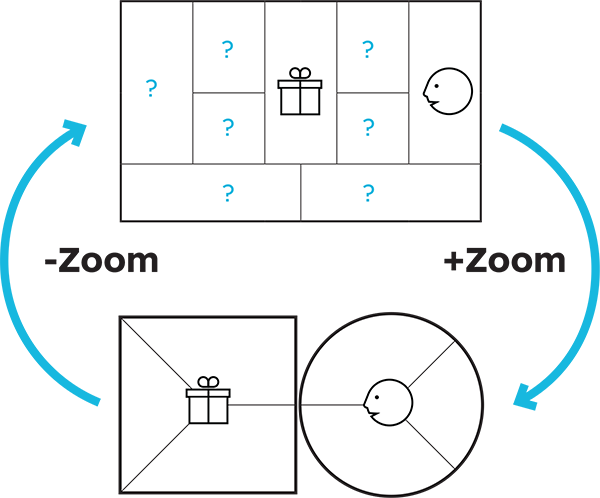

Finding the right value propositions and business models in such a context is not easy. We illustrate how it is a continuous back and forth between both on the following pages.

Azuri Business Model: version 0

Azuri Business Model: version 1

So…

How does the Indigo value proposition look for a customer?

Buy the indigo kit (solar panel, lamps, charger).

Buy scratch cards, use SMS from a mobile phone, enter the resulting passcode into the Indigo unit, and use the installation for a period of time (typically a week).

Own your box after 80 scratch cards, or….

Escalate to a larger system and access more energy; continue to buy scratch cards.

EXERCISE

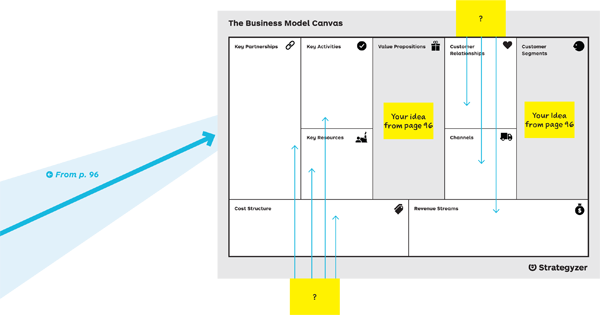

From Value Proposition to Business Model…

Stress Testing with Numbers: A MedTech Illustration

A great value proposition without a financially sound business model is not going to get you very far. In the worst case you will fail because your business model incurs more costs than it produces revenues. But even business models that work can produce substantially different results.

Play with different business models and financial assumptions to find the best one. We illustrate this with the medical technology illustration on this spread. We sketched out two models both starting from the same technology that enables building a cheap diagnostic device.

Prototype 1 generates $5.5 million in revenues and a profit of $0.5 million. Prototype 2 starts from the same technology but produces more than $30 million in revenues and a profit of $23 million with a different value proposition and business model. Only the market can judge if either model could work, but you certainly want to explore and test the best options.

EXERCISE

Seven Questions to Assess Your Business Model Design

Download “Seven Questions to Assess Your Business Model”

Download “Seven Questions to Assess Your Business Model”