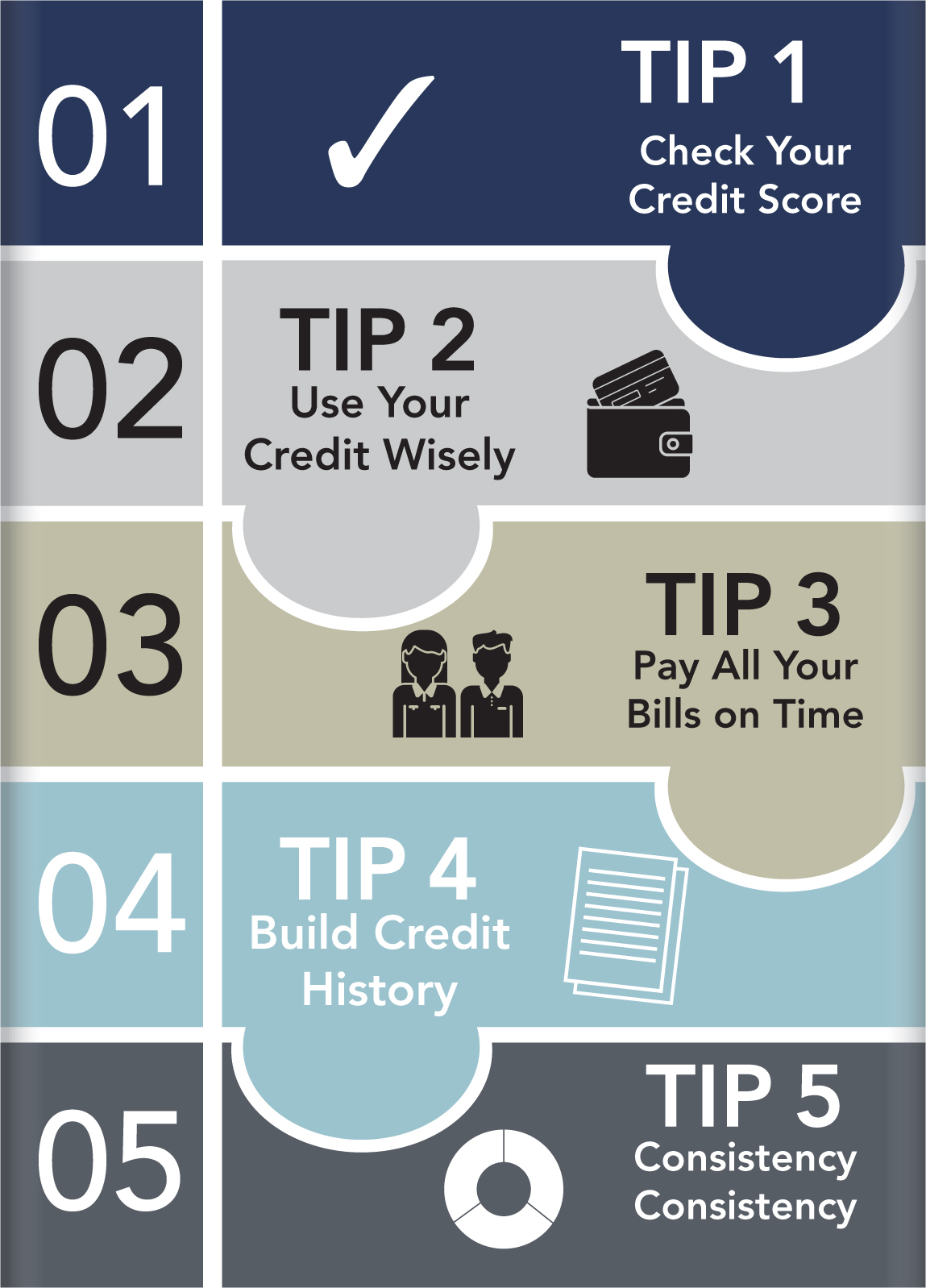

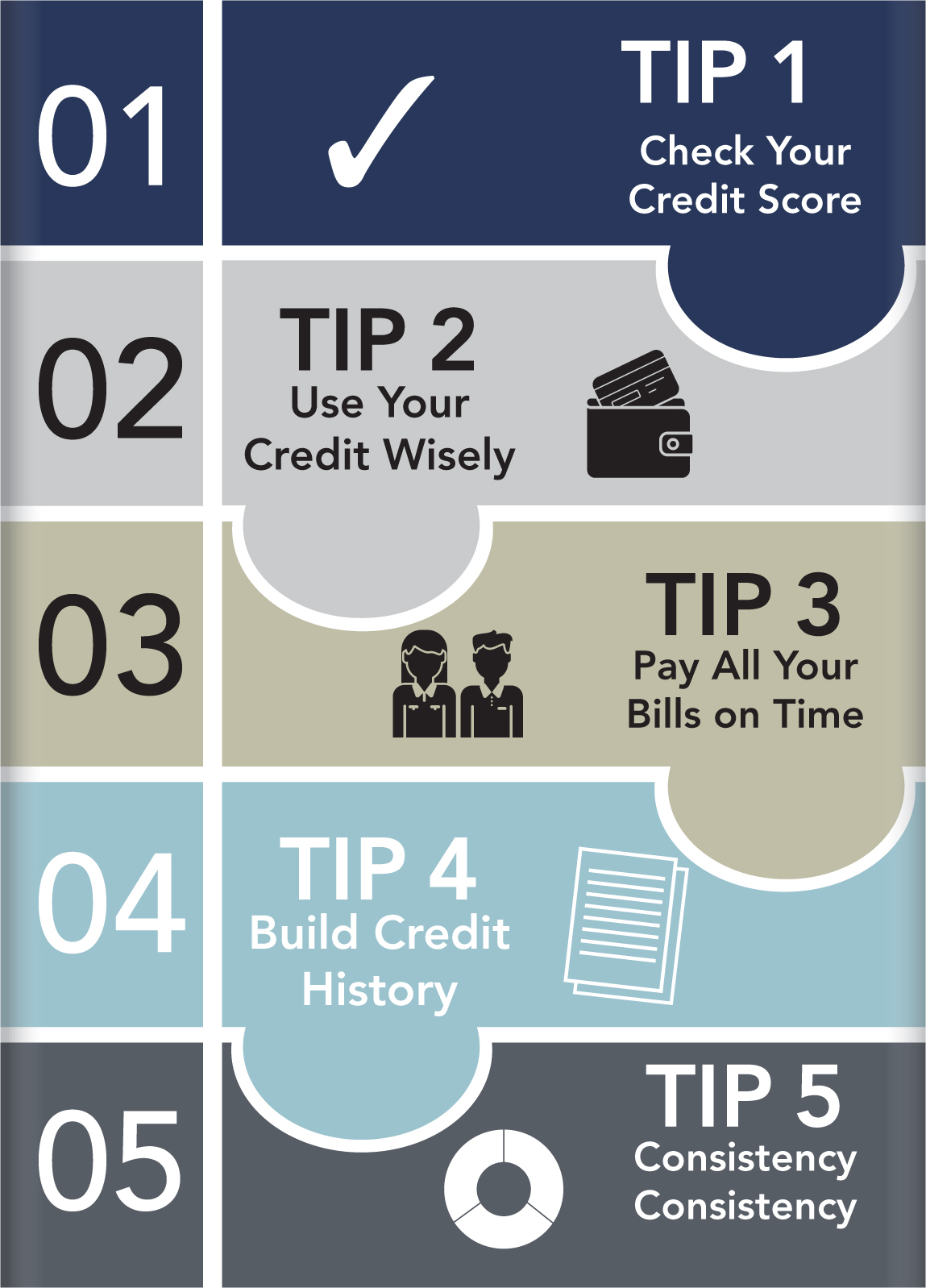

Good credit is an important element of personal finance. This chart shows five tips to building a good credit record. First, learn how to read a credit report and regularly check your score; second, know how to use credit responsibly to help strengthen your credit score; third, pay all your bills on time every month; fourth, build a strong credit history, which will then be reflected in a high score; fifth, continue this plan consistently from month to month and year to year.

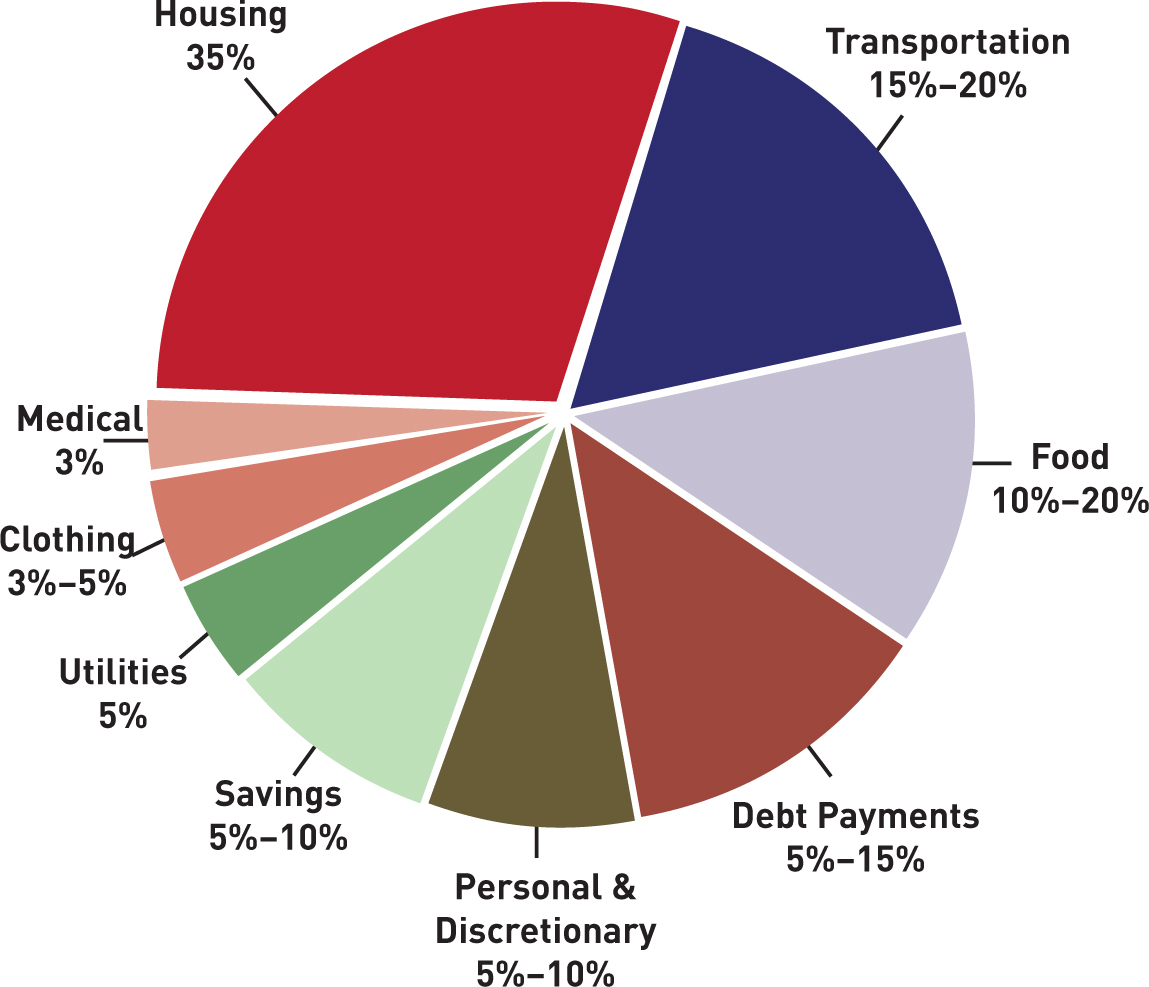

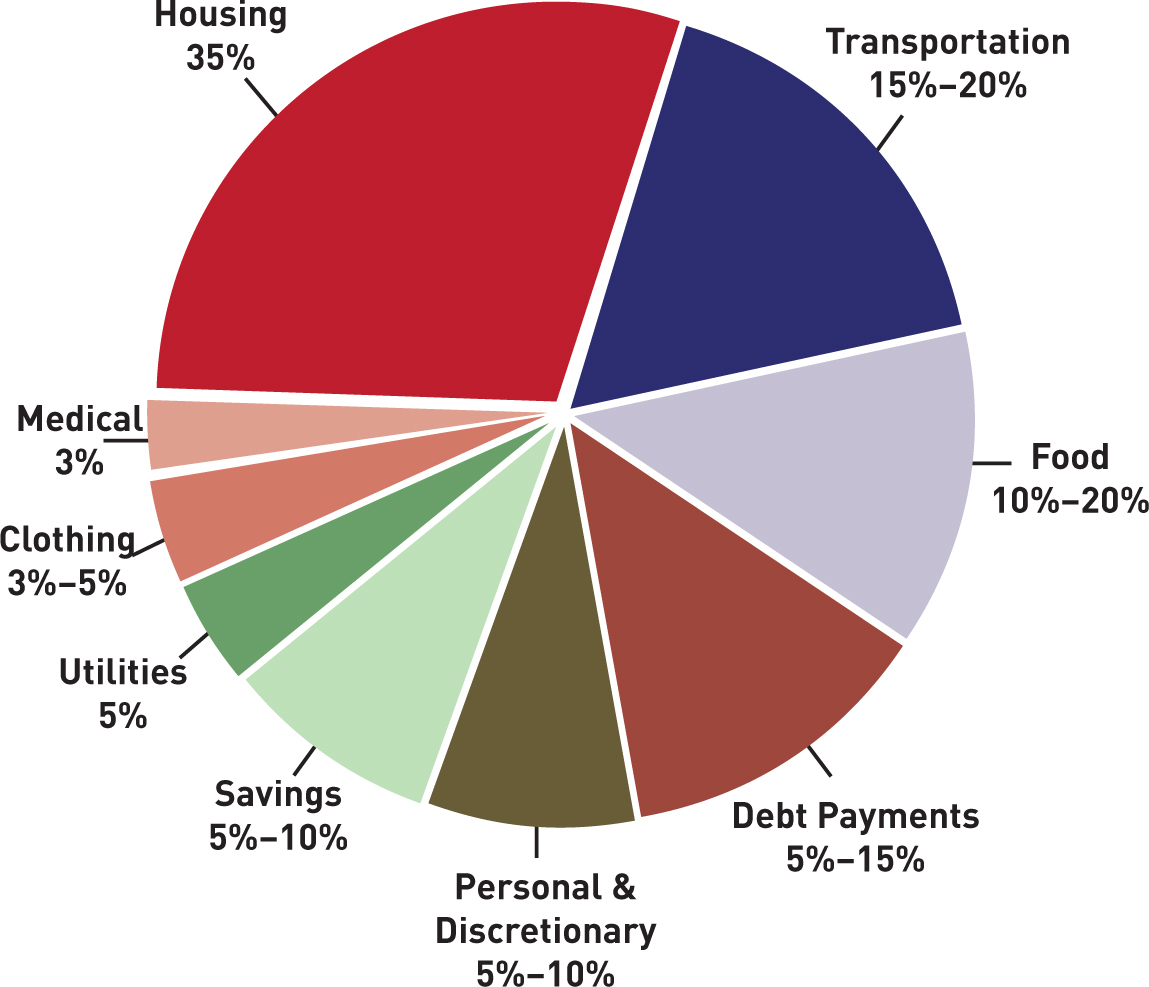

This chart shows the percentage breakdown of regular expenses in the average household budget. The biggest expense in most household budgets is housing, whether you rent or own your own home. The transportation spending, next highest, will depend on how far those in the household live from work and whether they own a vehicle or use public transportation. Other expenditures, such as food, debt payments, clothing, utilities, and healthcare, will change as the members of the household age.

Much of the information about the state of personal finance and employment is provided by the Bureau of Labor Statistics in Washington, DC. The bureau, which has existed since the nineteenth century, issues regular reports. These reports are used to shape government policy in a variety of economic areas, including employment and housing. For instance, the bureau issues reports on which job sectors are growing (and offer good employment prospects), along with which states have lower housing costs and costs of living, and could therefore be good relocation choices.

Photo credit: © Wikimedia/AgnosticPreachersKid / CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)

Veterans can qualify for loans to purchase new homes through the Department of Veterans Affairs (the seal of which is shown here). Such loans don’t require a down payment on the house and have less stringent debt-to-income requirements than regular mortgages. These loans are insured by the government.

Photo credit: © United States Department of Veterans Affairs [Public domain]

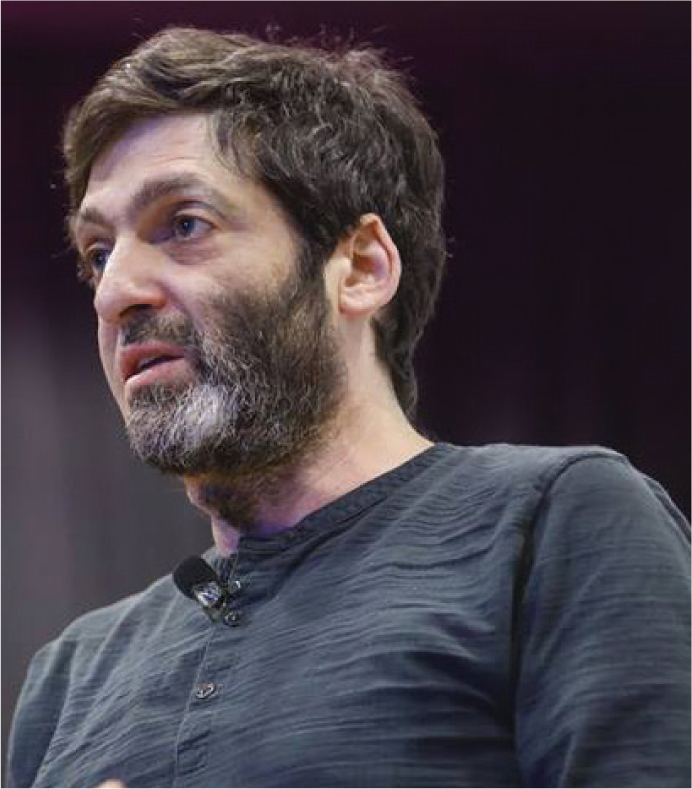

Dan Ariely is one of the pioneers in studying modern consumer behavior and its implications for personal finance. Ariely’s books focus on irrational economic behavior, which he believes governs the financial decisions people make. This sort of study is at the heart of the growing field of behavioral economics, which has an important impact on the study of personal finance. Behavioral economics studies the effect economics has on human behavior and shows that the economic decisions humans make are not always rational.

Photo credit: © Wikimedia/Yael Zur, for Tel Aviv University Alumni Organization /CC BY-SA (https://creativecommons.org/licenses/by-sa/4.0)

The US House Committee on Financial Services, shown here meeting, is also known as the House Banking Committee. It oversees the US’s financial services, including banks, investing, insurance, and housing. As a result, its decisions have an important impact on personal finance, including mortgage rates, how banks will interact with their customers, and other areas that affect consumer spending and borrowing.

Photo credit: © Wikimedia [Public domain]

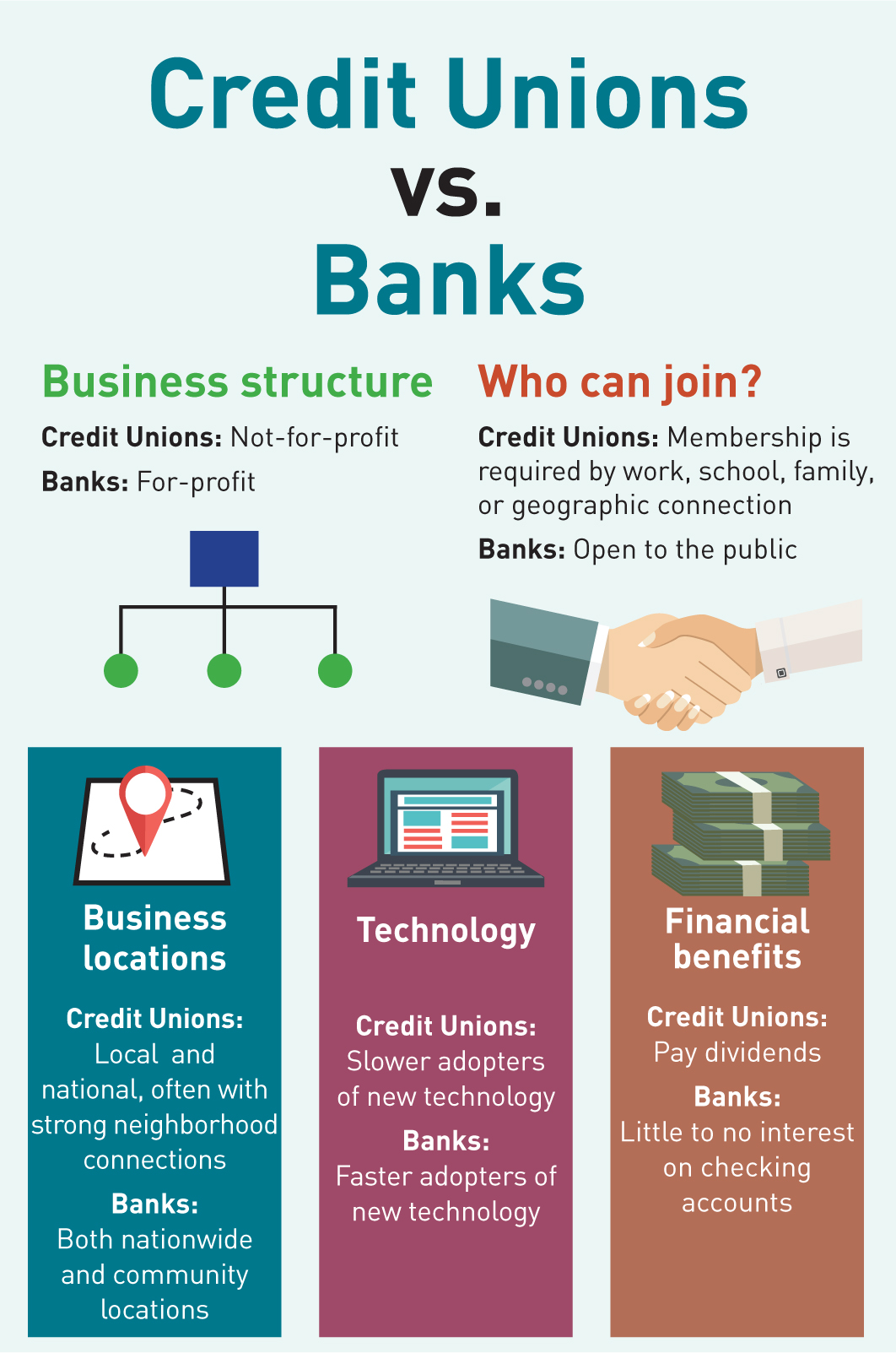

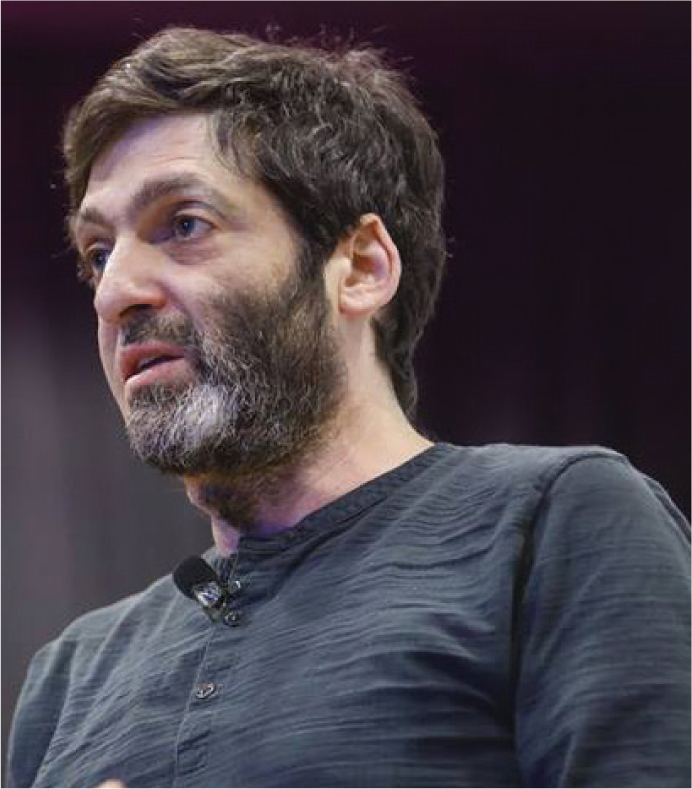

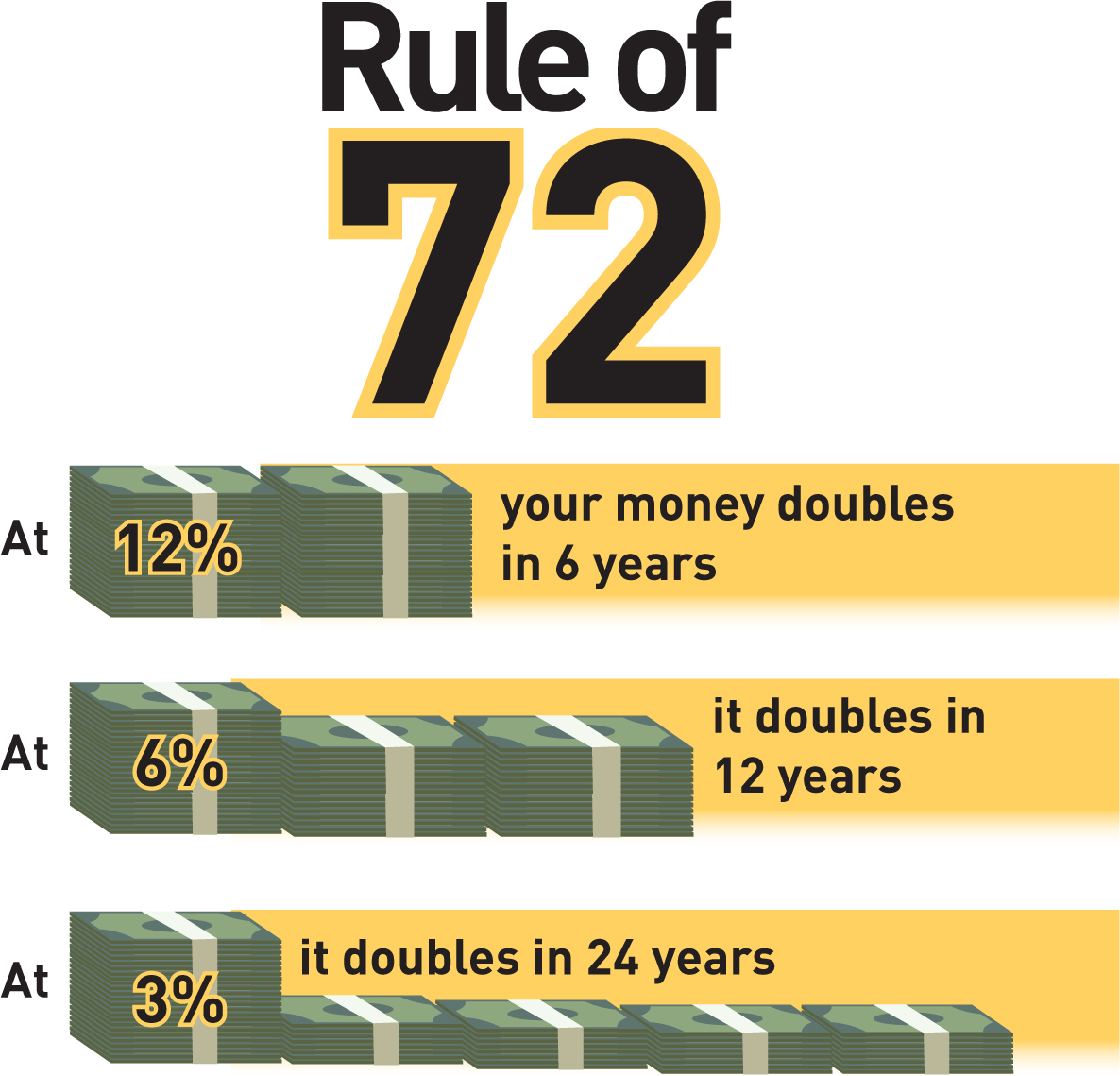

A credit union and a bank are both possible sources of lending, and both have advantages and disadvantages as far as personal finance is concerned. A credit union is essentially a cooperative enterprise owned by its members, while a bank is a private institution. Although banks are the dominant lending institutions, credit unions have been growing in the volume of lending they do, particularly to small businesses and individuals. When considering a lending institution, many people look at both alternatives.

President Gerald Ford signed into law the Employment Retirement Income Security Act of 1974. This act strengthened existing pension plans and also made it easier for employers and employees to set up retirement plans. These plans eventually evolved into today’s 401(k) plans, one of the most common ways to save for retirement.

Photo credit: © Globalcuts

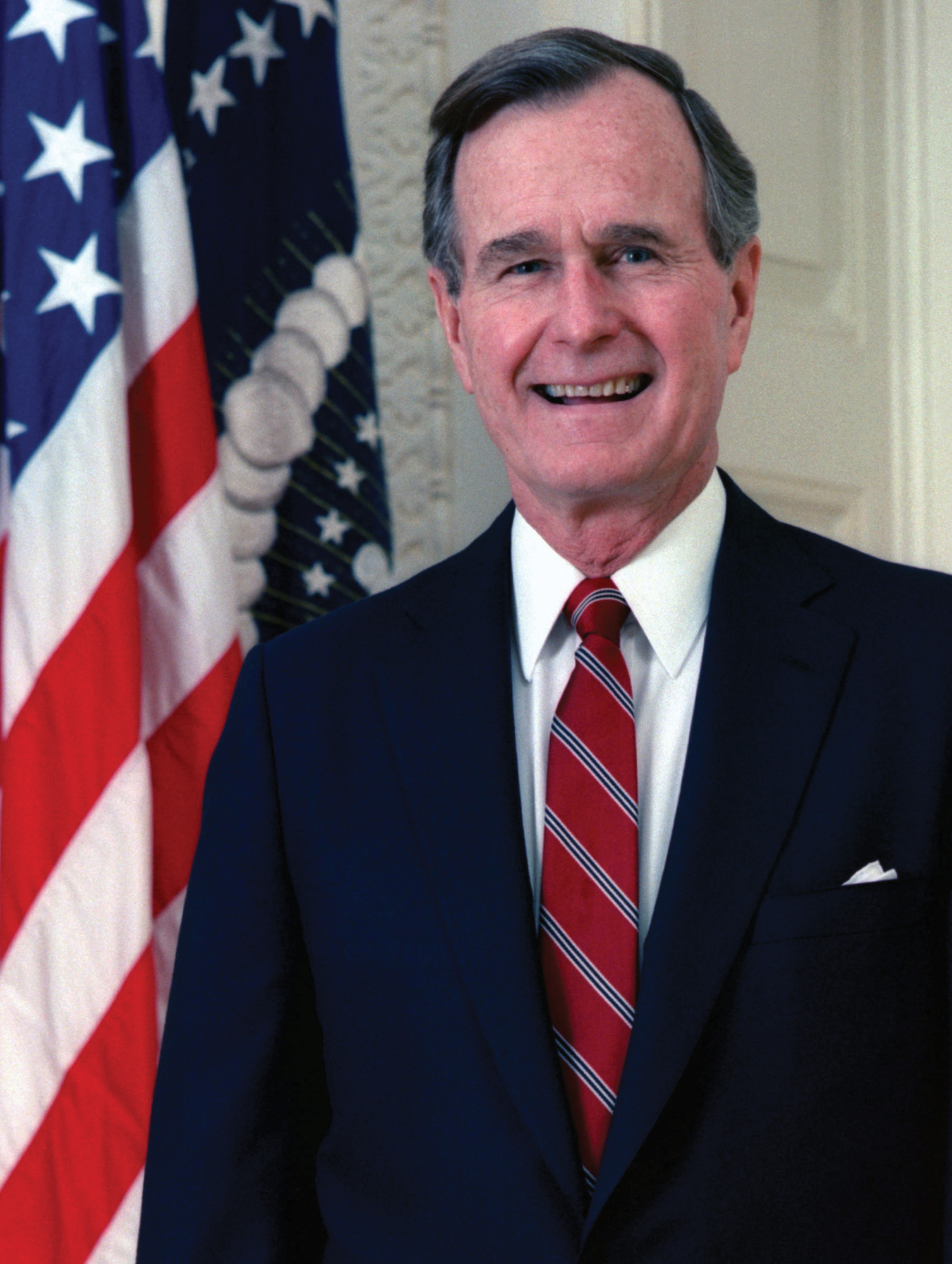

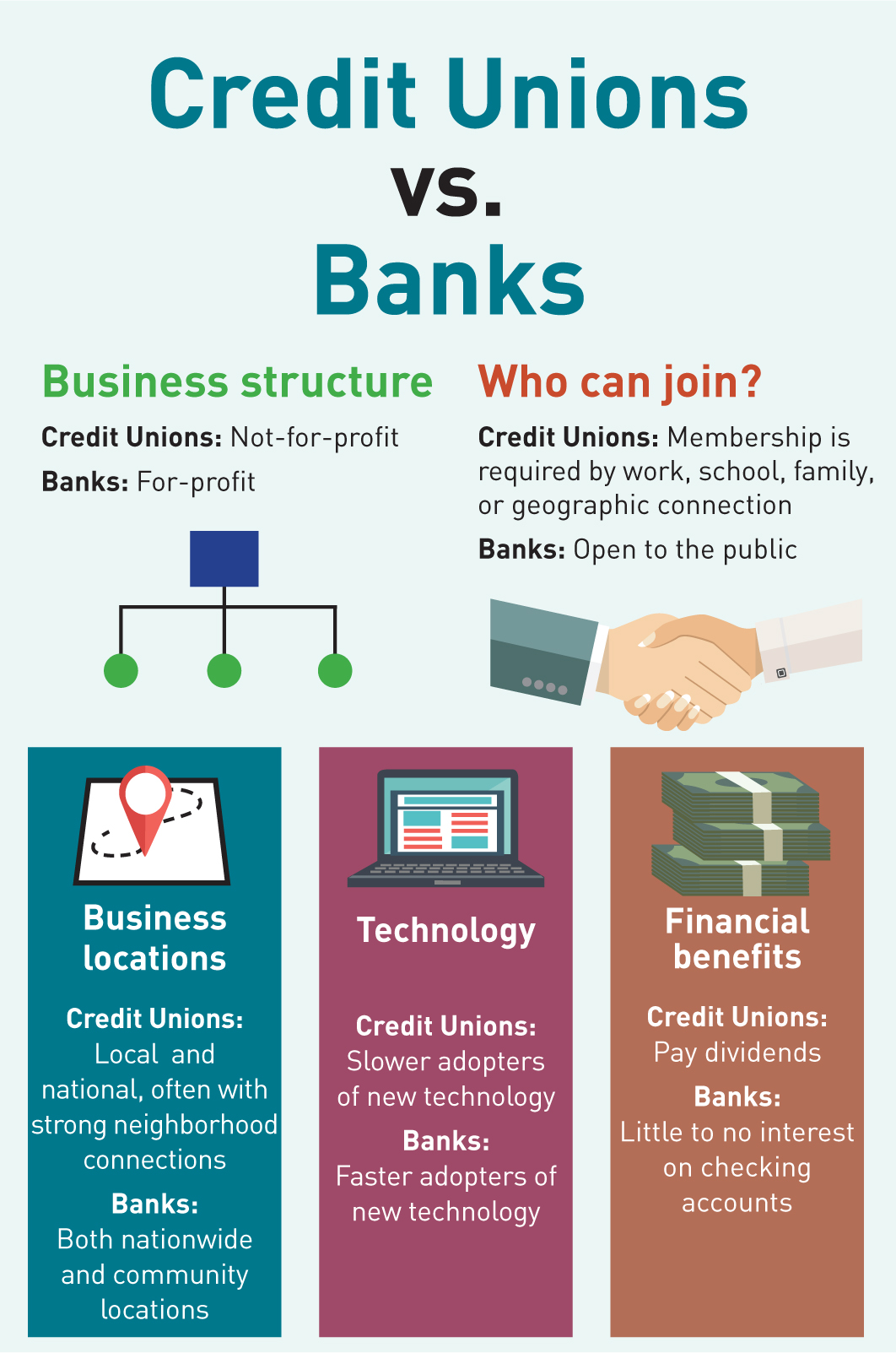

President George H.W. Bush began the Federal Direct Student Loan Program in 1992. This program, run through the Department of Education, offers student loans directly from the federal government, rather than private lenders. It is the single biggest source of student loans. There are many advantages to federal student loans: For example, the borrower does not have to begin payments on the loan until after graduation; the interest rate is fixed and often lower than private loans; and the borrower does not need a credit check to qualify for a federal loan.

Photo credit: © Globalcuts

Bank fees can be a significant drain on finances, since they add up over time. Here are six steps to avoid them. When considering setting up a bank account, request information about the various fees the bank charges and whether there are ways of eliminating them.

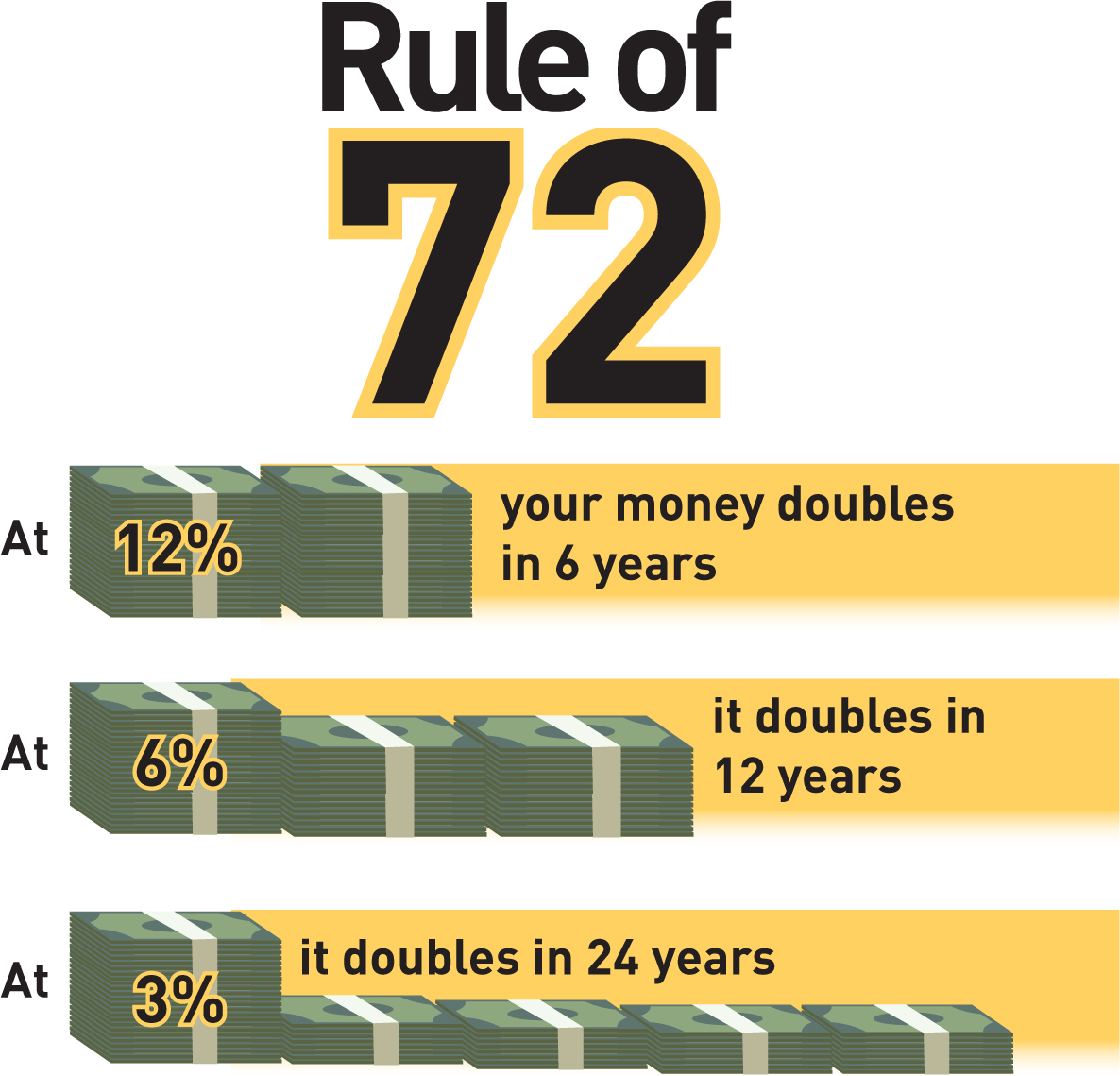

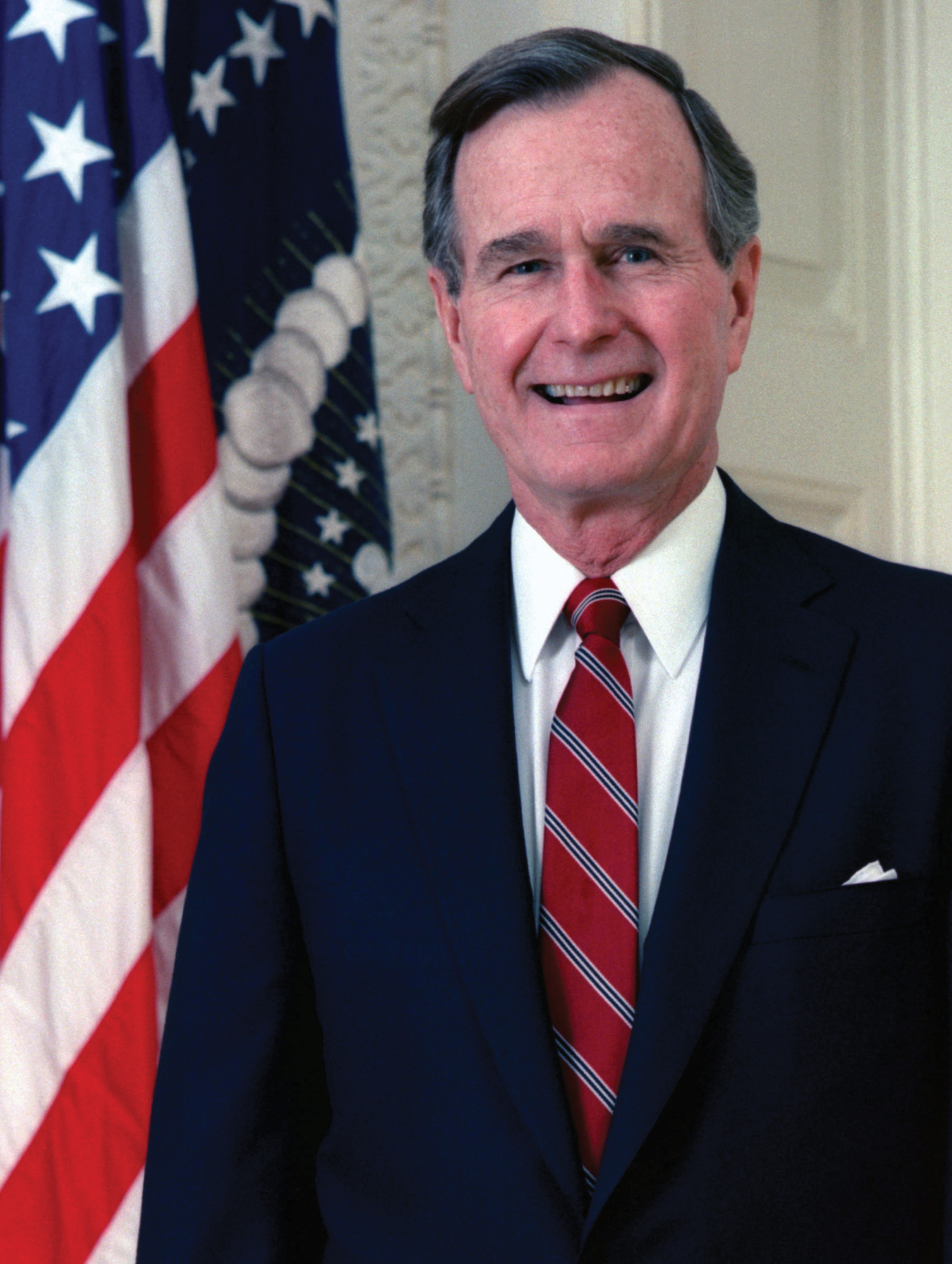

In personal finance, the Rule of 72 is a method for determining how fast a sum of money in an interest-granting institution will double, thus giving consumers a clearer idea of their financial situation in the future. The rule number (72) is divided by the interest percentage per year. This gives, approximately, the number of years needed to double the money. (The answer assumes that interest rates remain constant over time.) For example, if the interest rate remained at 6 percent, a depositor’s money would double in twelve years.

Amadeo Giannini (1870–1949) founded the Bank of Italy (US), which in turn became the Bank of America, one of the first banks to offer services to middle-class Americans. The Bank of America was established in 1923 and remains to this day a central banking institution for consumers, whether for lending, saving, or other personal financial activities.

Photo credit: © Agence Rol. Agence photographique / Public domain