STAGE BASED MODEL

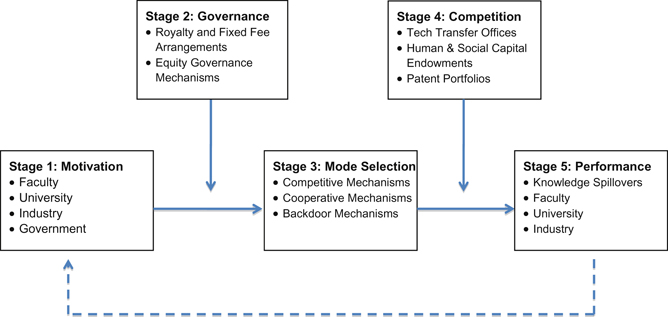

Our exploratory analysis of the literature led to emergence of a five-stage model of academic entrepreneurship with moderating and mediating effects (see Fig. 1). The five stages include: (1) motivation, (2) governance, (3) mode selection, (4) competition, and (5) performance. Each stage is described below. In order to build knowledge for future researchers, we also provide examples from the findings of prior studies as they relate to academic entrepreneurship phenomena that occur at each stage.

Fig. 1. Stage Based Model of Academic Entrepreneurship.

Motivation (Stage 1)

Recent changes to the intellectual property rights and legal systems in the United States and Europe have had the dual effects of reducing government sponsorship research and increasing the incentives to universities and faculty to generate revenue from commercial activities (Baldini, Grimaldi, & Sobrero, 2006, 2007; Geuna & Nesta, 2006). As such, the tradition of open science has become dependent on academic entrepreneurship for resources (and vice versa) at a growing number of universities (Landry, Amara, & Rherrad, 2006; Rasmussen, Moen, & Gulbrandsen, 2006; Owen-Smith, 2003). These resource dependencies, which in some cases are mutual and in other cases result in power imbalances (Casciaro & Piskorski, 2005; Pfeffer & Salancik, 1978), have direct effects on the motivation of faculty, universities, industries, and governments to engage in academic entrepreneurship.

Faculty Motivation

For faculty, the motivation to engage in entrepreneurship is derived from both the identification of a third-person opportunity and the formation of the first-person belief that the opportunity is both feasible and desirable (McMullen & Shepherd, 2006; Shepherd & Patzelt, 2011). Irrespective of differences in human capital endowments, social learning will influence whether faculty engage in academic entrepreneurship (Bercovitz & Feldman, 2008; Stuart & Ding, 2006). This is because faculty members are socially embedded in their departments, disciplines, and university environments (Kenney & Goe, 2004). They construct their personal roles to fit the normative expectations of their faculty positions (Ibarra, 1999; Jain, George, & Maltarich, 2009; Stets & Burke, 2000). For instance, industry collaborations have learning effects not just on the faculty directly involved in the collaboration but also on other faculty members in research teams, departments, and the institution as a whole (Balconi & Laboranti, 2006; Stuart & Ding, 2006).

Whether to engage in legitimacy-seeking behaviors that are geared toward traditional open science or the new commercialization mission is both a paradox and constraint of faculty motivation to engage in academic entrepreneurship (Sonpar, Pazzaglia, & Kornijenko, 2010). Resource dependencies magnify the pressure from these competing institutional logics (Reay & Hinings, 2009). While some scholars find that university policies toward faculty tenure and promotion create pressures for faculty to engage in legitimacy-seeking behaviors that run counter to what is needed for successful commercialization, other scholars researching the tension between commercialization and open science conclude that complementary synergies exist between academic freedom and industry-funded research activities.

As with other forms of entrepreneurial activities, opportunity recognition (Smilor, Gibson, & Dietrich, 1990), prior entrepreneurial exposure (Krueger, 1993), entrepreneurial self-efficacy (Prodan & Drnovsek, 2010), and risk orientation (Doutriaux, 1987) are some of the key drivers of how faculty inventors perceive the feasibility and desirability (Krueger, Reilly, & Carsrud, 2000) of academic entrepreneurship. There are, however, other important drivers that are unique to the context of academic entrepreneurship such as faculty dependencies on institutional resources such as rewards and funding for scientific research, reconciled teaching loads, and technology spin-off support (Baldini, 2009).

Further, counter to corporate spin-offs where the relationships with the parent organization increases over time, faculty spin-offs demonstrate initially strong funding and technology relationships to their parent universities that taper off over time (Perez & Sanchez, 2003). Indeed, access to funding has been suggested as the reason why faculty decide whether to engage in academic entrepreneurship (Hayter, 2011). In this regard, research funding from industrial firms has been shown to increase the likelihood that faculty will focus on questions that are of short-term commercial interest, not in the interests of open science (Azoulay, Ding, & Stuart, 2009).

University Motivation

Although countries are experimenting with different approaches to encourage universities to engage in academic entrepreneurship (Beath, Owen, Poyago-Theotoky, & Ulph, 2003; Park, Ryu, & Gibson, 2010), the unavailability of venture capital to finance innovation (Florida & Kenney, 1988; Lockett & Wright, 2005) and the shortfall in government support and sustainable revenues have led to the dependence of universities on funding obtained from industrial firms (Knockaert, Wright, Clarysse, & Lockett, 2010). Concerns about this dependence are reiterated throughout the academic entrepreneurship literature on the premise that industry sponsorship of university research provides industrial firms with the power to shift university motivation in a manner that conflicts with the advancement of open science (Bathelt, Kogler, & Munro, 2010).

Funding from industry sources also increases the incidences of university policies that prioritize commercialization and the reallocation of faculty resources to academic entrepreneurship (Bozeman & Gaughan, 2007). Argyres and Liebeskind (1998), for example, draw attention to emergent university policies that lift the constraints that universities traditionally place on contracts with private firms. Other sample policies cited by Argyres and Liebeskind (1998) include provisions that grant rights of first refusal to industrial resource providers and provisions that emphasize nonexclusive license agreements to firms even though exclusive property rights would have generated more revenue for the university.

Industry Motivation

Industry involvement in academic entrepreneurship can focus on new projects or the completion of existing industry projects (Cohen, Nelson, & Walsh, 2002). The reality, however, is that many firms are not motivated to collaborate with universities because of concerns about the appropriation of intellectual property (Hall, Link, & Scott, 2001; Link & Scott, 2001; Tether, 2002). That said, the growing dependence of universities on industry resources for sustainability does create a power imbalance that has motivation effects. Mansfield and Lee (1996) find, for example, that the large science-based firms in their sample were motivated to support applied research at nonelite universities with average-quality faculty because the faculty at nonelite universities are less connected to other regional sources of funding and therefore are more willing to focus on funded short-term problem-solving research.

The power imbalance in resource dependence, however, is not always in the favor of industry. Adding new capabilities or entering new markets require varying levels of trial and error (Feller, Ailes, & Roessner, 2002) that can be difficult for individual firms (Hagedoorn, Link, & Vonortas, 2000; Shapiro, 1985). Further, when there are technological interdependencies in the commercial market, industrial firms are motivated to strategically trade knowledge with universities in order to share costs and risks of accessing knowledge not presently integrated into their products (Bessy & Brousseau, 1998; Grant, 1996; Rosenberg, 1992).

Motivation of Governments

As with the other economic actors (faculty, universities, and industry) discussed previously, the motivation for governments to engage in academic entrepreneurship is also driven by resource dependencies. In countries like the United States, Europe, and Japan, the traditional university roles of teaching and research have combined into triple helix patterns that emphasize capital accumulation and technological change (Etzkowitz & Leydesdorff, 2000; Niosi, 2002). Within the last two decades, the university’s third mission of economic development through the capitalization of knowledge has gained global acceptance (Etzkowitz, 1998; Etzkowitz, Webster, Gebhardt, & Terra, 2000; Inzelt, 2004) and universities have been centrally positioned in national technology and innovation platforms (Thursby & Kemp, 2002). Japan led with significant policy shifts in the 1970s (followed by the United States and Europe in the 1980s) to inject university faculty and administration into commercial knowledge networks and technology markets (Hagedoorn et al., 2000; Motohashi, 2005). Policy shifts in countries such as China (Wu, 2010), Taiwan (Chang, Chen, & Yang, 2005), Saudi Arabia (Alshumaimri, Aldridge, & Audretsch, 2010), and Germany (Grimpe & Fier, 2010) have subsequently been shaped by early lessons, such as the outcomes of the Bayh–Dole Act in the United States.

To recap, resource dependencies have moderating and mediating effects on the motivations of faculty, university, industry, and governments to engage in academic entrepreneurship. We propose the following as Stage 1 of the model:

Proposition 1. Power imbalances and mutual dependencies on resources have a direct effect on the motivation of faculty, university, industry, and governments to engage in academic entrepreneurship.

Governance (Stage 2)

Firms that license technology from universities are often concerned about their constrained access to the human assets within the university. This concern is one of the reasons that sponsored research is often negotiated into license agreements for early-stage technologies (Thursby, Jensen, & Thursby, 2001). Sponsored research cannot in itself resolve the moral hazards of academic entrepreneurship without governance mechanisms such as royalties or equity arrangements.

Royalty and Fixed-Fee Arrangements

Royalties “generate the lion’s share of revenues generated by university licensing” (Baldini, 2010, p. 59). Royalties govern the moral hazard that codified knowledge will be transferred but that some of the faculty’s tacit knowledge will not (Macho-Stadler, Martinez-Giralt, & Perez-Castrillo, 1996). In some countries, such as Italy and France, royalties supplement faculty pay schedules (Baldini, 2010) and can also substitute for the prestige and reputation that may come from the pursuit of open science research interests (Baldini et al., 2007). Alternatives to royalty payments are fixed-fee or milestone payments. Such fixed-fee arrangements are common mechanisms for addressing the moral hazard that faculty inventors will shirk in their commitment to transfer their tacit knowledge over time. Fixed-fee arrangements that call for annual payments to the university also address the problem of licensee firms acquiring and then shelving university patents as a strategic tactic (Dechenaux, Thursby, & Thursby, 2009).

Royalty and fixed-fee arrangements reduce transaction costs that arise from uncertainty and opportunism (Bousquet, Cremer, Ivaldi, & Wolkowiz, 1998). Importantly, the length of time that licensors and licenses expect their relationship to last at the time of signing the agreement influences whether license agreements contain, on the one hand, variable royalty payments that are adaptable to uncertainty in the commercialization environment or, on the other hand, fixed-fee arrangements (Mendi, 2005).

Equity Governance Mechanisms

Equity arrangements provide an alternative governance mechanism to royalty and fixed-fee governance mechanisms. Royalties provide an incentive for faculty to select the licensing mode of academic entrepreneurship and can be a disincentive to the selection of new venture creation as a commercialization route (Di Gregorio & Shane, 2003). Equity arrangements however also come with different transaction costs and exposure to market uncertainty (Feldman, Feller, Bercovitz, & Burton, 2002). University equity positions have the advantage of providing options for claiming future income streams; aligning the commercialization goals of the university to the spin-off company; and sending signals to external stakeholders about the value of the company (Feldman et al., 2002). Nonetheless, by taking equity, the university’s return on its investment in academic entrepreneurship is exposed to more market uncertainties in the commercialization environment.

To recap, the actors engaged in academic entrepreneurship are exposed to varying levels of moral hazards, transaction costs, and market risks. Accordingly, governance mechanisms are important considerations for motivated economic actors when selecting a mode of academic entrepreneurship activity. We propose the following as Stage 2 of the model:

Proposition 2. The mechanisms that govern the commercialization of university knowledge moderate the mode selected by economic actors who are motivated to engage in academic entrepreneurship.

Mode Selection (Stage 3)

Economic actors, whether internal or external to universities, can serve in one or more roles implicated in the planning and disclosure of the commercialization of university knowledge: technology originator, entrepreneur, parent, or investor (Carayannis et al., 1998). Ideally, planning should occur through an organized effort among the actors in each of those roles. There is high moral hazard, however, that some actors will not completely disclose the information that other actors need to plan effectively and achieve their economic returns (Knockaert et al., 2010). These planning and disclosure problems are important indicators of whether academic entrepreneurship will occur via (competitive mechanisms) such as new start-up ventures; (cooperative mechanisms) such as patent license agreements or the transfer of university intellectual property to established firms; or (backdoor mechanisms) such as faculty engagement in academic entrepreneurship without disclosure to the university (Klemperer, 1990; Pries & Guild, 2011; Scotchmer & Green, 1990).

Selection of Competitive Modes

Competitive modes of engaging in academic entrepreneurship include new venture creation and the outright sale of university technology to incumbent firms (Cockburn & Stern, 2010). Such modes are advantageous when the university technology is not radical but rather incrementally reinforce the market power of established firms (i.e., pharmaceutical industry). The advantage of selecting competitive modes, however, is not limited to non-radical innovations. When there are low barriers to entry and weak appropriation rights in the market, competitive commercialization modes for radical innovations such as new venture creation are more likely to occur (Gans & Stern, 2003). In particular, ineffective patents (which increase the likelihood that cooperative licensing mechanisms will fail) are more likely to be commercialized directly by the faculty inventor through new venture creation to reduce the adverse selection, moral hazard, and hold-ups that would otherwise arise (Shane, 2002).

Selection of Cooperative Modes

Cooperative modes of academic entrepreneurship are more common options when low levels of faculty tacit knowledge are required for commercialization (Lowe, 2006; Pries & Guild, 2011). University faculty engaging in academic entrepreneurship generally select cooperative modes (D’Este & Perkmann, 2011) such as patent licensing, consulting activities, scientific publications, teaching, and network exchanges. Lowe (2006) suggests that faculty inventors consider the opportunity costs of starting new ventures; where the costs are too high, faculty will be more willing to forgo the monopoly rights to their inventions and attempt commercialize through cooperative license agreements. Further, star scientists with the tacit knowledge to produce more valuable commercial spin-offs are often tenured at their institutions and are more risk-adverse.

Further, cooperative modes of academic entrepreneurship are also more common when incumbent firms have slack resources (Agrawal, 2006) or hold specialized complementary assets (Macho-Stadler & Perez-Castrillo, 2010; Shane, 2002). For instance, when there is a fragmentation of upstream property rights that results in firms having to license from multiple incumbents to enter the market, incumbent firms with slack resources are encouraged to ramp up their patent portfolios using cooperative arrangements with universities (Cockburn, MacGarvie, & Muller, 2010).

Selection of Backdoor Modes

Faculty can start new ventures without disclosing their intellectual property to university technology transfer offices (TTOs) or to administration (Aldridge & Audretsch, 2010). Such backdoor academic entrepreneurship activities are less discussed in the literature (Fini, Lactera, & Shane, 2010). Faculty motivations to use the backdoor mode are shaped by a number of factors including their subjective perceptions of the commercial value of inventions, commercial uncertainty, tacit knowledge embodied in the invention, patent protection, and institutional support for commercial activity and tenure (Bathelt et al., 2010; Lowe, 2006; Owen-Smith & Powell, 2001). University TTOs play a major role in shaping these perceptions (Aldridge & Audretsch, 2010).

University policies to address backdoor academic entrepreneurship range from top-down policies that constrain or restrict the entrepreneurial activities of faculty to policies that encourage experimentation, that is, giving faculty inventors the ownership of intellectual property rights (Argyres & Liebeskind, 1998). Not all of the restrictive or experimental policies have had positive effects on discouraging backdoor academic entrepreneurship (Bekkers & Freitas, 2008; Goldfarb & Henrekson, 2003; Markman, Gianiodis, Phan, & Balkin, 2004; Rasmussen, 2008). Nonetheless, while all faculty inventions are not disclosed, there may be only marginal gains from backdoor academic entrepreneurship left off the table if university TTOs are effective at commercializing the significant portion of high-value technologies (Thursby et al., 2001).

In summary, incomplete disclosures and incentive misalignments affect how actors that are internal and external to universities engage each other. As discussed above, universities and governments may promote academic entrepreneurship while the faculty advocate for the academic freedom to engage in traditional academic roles. Additionally, there can be uncertainty about the viability of university knowledge and the appropriation of returns in commercial markets that play roles in mode selection. We propose the following as Stage 3 of the model:

Proposition 3. Incentive misalignments that arise from incomplete planning and disclosures influence whether motivated actors select competitive, cooperative, or backdoor modes of academic entrepreneurship.

Competition (Stage 4)

As with other forms of entrepreneurship activity, human, financial, and social capital are valuable resources that can provide competitive advantages which ultimately lead to the superior performance of academic entrepreneurship (Alvarez & Busenitz, 2001; Barney, 1991; Powers & McDougall, 2005). Resources that are often discussed in the academic entrepreneurship literature are technology transfer offices, human and social capital endowments of faculty, and university patent portfolios. We will next discuss some of the competitive advantages and challenges of these resources.

Technology Transfer Office

TTOs manage university licensing contracts and coordinate the necessary involvement of faculty in academic entrepreneurship (Macho-Stadler & Perez-Castrillo, 2010). There are scholarly insights emerging in the literature as to how the characteristics of TTOs benefit or harm academic entrepreneurship (Siegel, Waldman, & Link, 2003). Macho-Stadler, Pérez-Castrillo, and Veugelers (2007) suggest that because larger TTOs have more projects to choose from, they can develop a reputation for selecting more valuable innovations that achieve greater returns. Also, Markman, Phan, Balkin, and Gianiodis (2005) suggest that nonprofit TTOs are less likely than for-profit TTOs to result in wealth creation through venture creation.

With respect to country comparisons, the empirical evidence suggests that European universities with TTOs lag behind US universities in the commercialization of academic research (Huggins, Johnston, & Steffenson, 2008). Using evidence from Italian universities, Muscio (2010) suggests that the quality of faculty research drives the differences in the contribution of TTO offices to the commercialization missions of universities. Other scholars question the suggestion that US TTOs conclude more technology licenses than Europe. Conti and Gaule (2011) show, for instance, that US TTOs had higher revenue elasticity on concluded licenses and not necessarily a greater quantity of licenses. The scholars attribute this difference in elasticity to the human capital endowments of the TTOs in the United States.

Human Capital Endowments

Human capital endowments drive new value creation (Crossan, Lane, & White, 1999) and as such have significant impacts on the success or failure of academic entrepreneurship activities. The impacts of human capital endowments are significant because faculty and their research teams are often called to assist in the early phases of the commercialization process (Agrawal, 2006; Franklin, Wright, & Lockett, 2001; Lockett, Wright, & Franklin, 2003; Macho-Stadler & Perez-Castrillo, 2010). Findings of prior studies suggest that faculty who are involved in successful university spin-offs are likely to have prior industry or commercialization experience that contribute to their human or social capital endowments (Boardman & Ponomariov, 2009; Dietz & Bozeman, 2005; Hoye & Pries, 2009; Lubango & Pouris, 2007; Mosey & Wright, 2007; Nicolaou & Birley, 2003; Stuart & Ding, 2006; Walter, Auer, & Ritter, 2006).

Further, there are other correlations that have been observed between the human capital endowments of faculty and their academic entrepreneurship activities. Klofsen and Jones-Evans (2000) found positive correlations between the entrepreneurial experience of academic faculty in Sweden and Ireland and their consulting and contract research spin-off activities. Extending this thought, Prodan and Drnovsek (2010) found that the positive correlation between human capital endowments and academic entrepreneurship are more likely to decrease with the faculty tenure. Importantly, human capital endowments do not have to originate from within the university setting. In fact, universities often engage surrogate entrepreneurs to lead the academic entrepreneurship process (Franklin et al., 2001) because faculty scientists often lack industry experience or entrepreneurial knowledge (Wennberg, Wiklund, & Wright, 2011).

Social Capital Endowments

Social capital is another important resource endowment (Shane & Stuart, 2002) because academic entrepreneurship often originates through network relationships and not through formal search channels (Harmon et al., 1997). The problem however is that faculty with entrepreneurial interests are less open to sharing knowledge about innovations within the university (Campbell, Weissman, Causino, & Blumenthal, 2000; Louis, Jones, Anderson, Blumenthal, & Campbell, 2001). Further, differences exist in the ability of nascent, novice, and habitual faculty entrepreneurs to develop social capital through relationships with corporate partners and equity investors (Bozeman & Gaughan, 2011; Dietz & Bozeman, 2005; Murray, 2004). Prior studies report for instance that numerical minorities, as in the case of female scientists, may suffer from social isolation (Murray & Graham, 2007; Settles, 2004; Stephan & El-Ganainy, 2007). This social isolation can have a negative impact on the success of faculty interactions with industry to commercialize their tacit knowledge (Boardman & Ponomariov, 2009; Bozeman & Corley, 2004; Ding, Murray, & Stuart, 2006; Thursby & Thursby, 2005).

Patent Portfolios

Some of the patents that originate from within university settings are more valuable to academic entrepreneurship than others (Balasubramanian & Sivadasan, 2011; Coupe, 2003) in competitive markets for products and ideas. To prevent the misappropriation of valuable patents, universities are likely to incur significant litigation and social costs that reduce the overall value of their patent portfolios (Gambardella, 2005). Nonetheless, as Cockburn et al. (2010) suggest, the value of a university’s patent portfolio bears a positive correlation to the performance of their academic entrepreneurship activities. In particular, valuable university patents have a positive correlation to performance in markets with fragmented intellectual property protection because without the property rights afforded by patent stocks, universities would have reduced bargaining power in markets for ideas (Gambardella, 2005).

In summary, bundling resources that provide competitive advantages plays an important role in the performance of academic entrepreneurship (Alvarez & Busenitz, 2001; Barney, 1991; Powers & McDougall, 2005). We propose the following as Stage 4 of the model:

Proposition 4. TTOs, capital endowments, and patents are resources that economic actors involved in academic entrepreneurship can combine to obtain competitive advantages that ultimately lead to the superior performance.

Performance (Stage 5)

The last stage of our model focuses on the performance of academic entrepreneurship. Knowledge spillovers are the core measures of performance in the context of academic entrepreneurship. Outside of the anti-commons debate, there is evidence that direct and indirect knowledge spillovers (through the codification of university intellectual property in patents and other spin-off mechanisms) enhance the explorative and exploitative learning capabilities of internal and external actors to the university (Bishop, D’Este, & Neely, 2011; Lucas, Cooper, Ward, & Cave, 2009). In addition to knowledge spillovers, other performance measures are important to specific economic actors. Tenure and promotion rank high in importance for faculty, while revenue generation from university intellectual property ranks high in importance for universities. For industry, returns on investment and cost savings from outsourcing innovation are important performance measures; and for governments, the development of economies and the productivity of the workforce matter as well.

Knowledge Spillovers

The benefits of knowledge spillovers from academic entrepreneurship are path-dependent on the absorptive capacity (Cohen & Levinthal, 1990) and on the proximity (Audretsch, Lehmann, & Warning, 2005) of the individual, firm, and regional actors. Knowledge spillovers impact the problem-solving ability of industries (Bishop et al., 2011; Zucker, Darby, & Brewer, 1998) and the effectiveness of regional public policy (Audretsch & Erdem, 2004). Understanding the path dependencies of knowledge spillovers from academic entrepreneurship becomes especially important when the region lacks the appropriate rewards and incentives to promote research on radical innovations (Carayol & Dalle, 2007). In Europe, for instance, universities and faculty face increasing pressure to engage in academic entrepreneurship in regions with low absorptive capacity (Azagra-Caro, Archontakis, Guitierrez-Gracia, & Fernandez-de-Lucio, 2006). For the same reasons in the United States, only some states (such as California) have significantly benefitted from regional knowledge spillovers (Mukherji & Silberman, 2011).

Faculty

Faculty who engage in academic entrepreneurship may or may not achieve synergistic benefits from the duality of their commercial and traditional roles (Behrens & Gray, 2001; Boardman & Ponomariov, 2009; Jacobsson, 2002; Owen-Smith & Powell, 2003). Different forms of formal and informal knowledge exchanges have complementary, substitution, or independent effects on the productivity of faculty (Feller et al., 2002). There is evidence that patenting, spin-off creation, and consulting are complementary to each other (Landry et al., 2006). The evidence is mixed, however, as to the relationship between these commercial activities and the research productivity of faculty. For instance, D’Este and Perkmann (2011) suggest that faculty research productivity increases from academic entrepreneurship because faculty are more research-driven in their commercial interactions with industry. Other scholars agree and suggest that faculty who engage in research to solve commercial problems publish more than colleagues in their discipline (Carayol & Matt, 2004; Fabrizio & Di Minin, 2008; Van Looy, Ranga, Callaert, Debackere, & Zimmermann, 2004).

To some extent, the effects of commercial interactions with industry on research performance are predicated on the personal, income, and entrepreneurial motivations of faculty (Larsen, 2011; Perkmann, & Walsh, 2008; Yang & Chang, 2010). Interviews of 1,000 academic faculty at US institutions conducted by Lee (1996) reveal that while a majority of the faculty support university commercial activity, they were concerned that the dependence of their university on industry funding would interfere with their academic freedom. Where such tensions arise, life cycle models developed by Thursby, Thursby, and Gupta-Mukherjee (2007) show that faculty would rather respond to the tension by giving up leisure time than either publishing or pursuing commercial activity.

Universities

University policies that impact the performance of academic entrepreneurship differ in their level of selectivity and investment in academic entrepreneurship (Roberts & Malone, 1996). Although there are some success stories, universities across the board are still experimenting to determine which policies impede or contribute to university missions of achieving a productive balance of teaching, research, and commercialization (Fini et al., 2010). Generally, the universities that were early initiators of technology transfer programs generate greater licensing revenue than universities with new commercialization missions (Heisey & Adelman, 2011). Contributing to their success are clearer strategies that have been developed from prior experiences for mobilizing resources (i.e., industry funding, quality faculty and patent portfolios, technology transfer office attributes, and venture capital munificence). Otherwise, universities run the risk of over- or under-investment in academic entrepreneurship. Clearer strategies, however, allow faculty to focus on their expert roles in the academy and for outside members to focus on their roles as expert entrepreneurs (Lockett & Wright, 2005). Example strategies include engaging the support surrogate entrepreneurs, reducing the university’s control over spin-off firms; facilitating the transfer of the tacit knowledge of the faculty inventor; and engaging in joint ventures with industry (Lockett et al., 2003; Wright et al., 2004b).

A common argument in the literature is that universities should engage in academic entrepreneurship using cooperative mechanisms such as patent licensing, as opposed to the competitive spin-offs of new ventures, which can be more costly and time-consuming (Macho-Stadler & Perez-Castrillo, 2010; Meyer, 2006). An exploratory analysis of equity sales in 11 universities in the United States and Canada, conducted by Bray and Lee (2000), makes an interesting contribution to this argument. The study concluded that taking an equity position in a start-up maximizes the financial returns from university intellectual property when used in concert with traditional license agreements. Such findings provide insights that can increase the effectiveness of university policies aimed at maximizing the returns from academic entrepreneurship. To date, however, the revenues that universities earn from their equity in new ventures and the licensing of university technology have not been an adequate substitute for the diminished government support of open science (Geuna & Nesta, 2006; Lerner, 2005).

Industrial Firms

Knowledge spillovers from universities are important drivers of economic development and wealth creation (Di Gregorio & Shane, 2003; Klofsten, Jones-Evans, & Scharberg, 1999; Mueller, 2006). As such, it is important for industrial firms to connect to universities (Huggins et al., 2008) because they increase their access to tacit and codified knowledge that can be used to solve problems and explore new markets (Salter & Martin, 2001). Some firms, however, lack explorative learning capabilities and their connections to universities may not translate into competitive advantages (Cassiman, Perez-Castrillo, & Veugelers, 2002).

Nonetheless, empirical studies in the United Kingdom and United States suggest that increased interactions with universities can build the explorative learning capabilities of firms (Bishop et al., 2011; Feller et al., 2002; Meyer, 2006). In this regard, one measure that firms can take to increase their academic entrepreneurship performance is to relocate within geographic proximity of universities so that the tacit knowledge of faculty can be vertically integrated via equity agreements. Another measure that firms can take is to restrict the access of other firms to the tacit knowledge of the university faculty. This restriction can be accomplished via excludability agreements and industry-sponsored research (Zucker et al., 1998). We propose the following as Stage 5 of the model:

Proposition 5. The performance of academic entrepreneurship is influenced by the motivation and resources of economic actors and by the mode and governance mechanisms the actors select to commercialize knowledge developed within university settings.