CURRENT RESEARCH ON THE ENTREPRENEURIAL UNIVERSITY

Rothaermel et al. (2007) in their article “University Entrepreneurship: A Taxonomy of the Literature” identify four major research streams addressing the entrepreneurial university: (i) entrepreneurial research university, (ii) the system of innovation and entrepreneurship, (iii) productivity of technology transfer offices, and (iv) university spin-offs. Each one of these research streams has been critical to better understanding the entrepreneurial university. Our experience suggests a variety of other potential metrics that are barely touched upon that could yield a much more robust characterization.

The dominant literature relies decidedly on “output” metrics drawn from readily measureable factors such as patents and licenses. “Input” metrics, albeit less easy to capture, are less studied. Research capturing inputs typically involves descriptive accounts or close studies of the system of innovation and entrepreneurship both within the university and between the university and industry. These are primarily case studies which elucidate distinct organizational efforts usually at a single university.

The problem with technology transfer centric measures is that they miss much of the cultural complexity and embeddedness of the university within a region that enables researchers to truly understand the entirety of the entrepreneurial university including activities related to preparing students for an entrepreneurial economy; provision of advice and technical assistance to entrepreneurial enterprises; assisting the business and professional communities with formal and informal education that prepares them to support an entrepreneurial rather than a managerial economy (Audretch & Thurik, 2000).

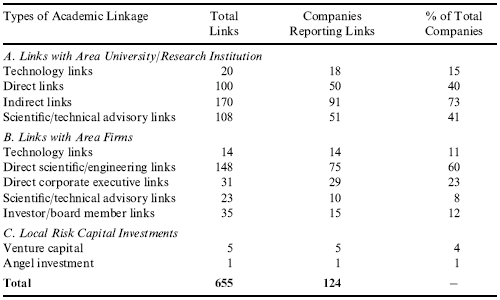

Single campus case studies elucidate how particular campuses organize and incentivize entrepreneurs but rarely allow for inter campus comparisons. A recent piece by Casper (2013) argues impressively for the power of community connections and networks of innovation which enable community and corporate “pull,” what we call inputs, not just researcher “push,” what we call outputs. Table 1 summarizes a research project we did for the California Science and Technology Council evaluating the effects of a state funded seed fund, CalTIP. It reveals that nearly three times the number of research faculty were embedded in these networks of consulting, advising, and directing entrepreneurial companies than had applied for a patent or license (Lee & Walshok, 2000).

A Taxonomy of the Literature on the Entrepreneurial University

The Entrepreneurial Research University

The research stream on the entrepreneurial university suggests entrepreneurial activity is a step in the natural evolution of a university system that emphasizes economic development in addition to the more traditional university missions of education and research (Chesbrough, 2003). Most of the articles in this research stream describe how the organizational design of specific universities inhibits or enhances the commercialization of university inventions (Rothaermel et al., 2007). Such studies cover incentive systems, university status, location, culture, intermediary agents, focus, experience, and defined role and identity (Thursby & Thursby, 2002). In addition to organizational design, studies focus on the characteristics and roles of faculty and the nature of the technology to be commercialized (Darby & Zucker, 2003). Entrepreneurial activities are measured in various ways: existence of a formal program, cooperation agreements, research support, licensing, marketing activities, quality of commercial output (licenses, patents), existence of incubators, and science parks (Rothaermel et al., 2007).

Qualitative studies in this stream describe the drivers of entrepreneurial activity among individual faculty (Owen-Smith & Powell, 2001) or at the university level (Laukkanen, 2003; Mowery, Nelson, Sampat, & Ziedonis, 2001; Powers & McDougall, 2005). Discussions of how a traditional university transitions into a more entrepreneurial organization abound (Etzkowitz, 2003; Jacob, Lundqvist, & Hellsmark, 2003) as do descriptions of the barriers to the university commercialization process (Argyres & Liebeskind, 1998; Collins & Wakoh, 2000; Feldman & Desrochers, 2003; Henrekson & Rosenberg, 2001). Work on the factors that facilitate the technology transfer process, as well as attempts to identify ways to make universities more entrepreneurial are also informative (Debackere & Veugelers, 2005; Henrekson & Rosenberg, 2001; Saragossi & van Pottelsberghe de la Potterie, 2003; Siegel, Waldman, Atwater, & Link, 2003). These qualitative studies also identify various commercialization options (Bains, 2005; Lee & Gaertner, 1994), explain why different stakeholders care about technology transfer from universities to industry (Bell, 1993), and discuss the consequences or effects of entrepreneurial activities at universities (Chrisman, Hynes, & Fraser, 1995; Etzkowitz, 1998; Freier, 1986; Powell & Owen-Smith, 1998; Wallmark, 1997). Importantly, nearly all the work in this research stream is concerned with single case studies surrounding the organization and faculty inducements of a particular university. They are focused on factors which enable technology push from universities and are somewhat fragmented due to the lack of a common language and framework among these researchers.

The System of Innovation and Entrepreneurship

The research stream on the system of innovation and entrepreneurship emphasizes that university entrepreneurship is not simply a result of internal factors but also is heavily influenced by external factors (Etzkowitz, 2003), most notably federal laws and policies like the Bayh–Dole Act in the United States (Jacob et al., 2003; Mowery et al., 2001), the surrounding industry (Gulbrandsen & Smeby, 2005), and regional conditions (Friedman & Silberman, 2003). One of the main factors discussed in this literature is the importance of being embedded in networks of innovation, which in turn are influenced by the regional context (Rothaermel et al., 2007) outside the university.

Research on innovation networks highlights the benefits of such networks to technology-based firms. Scholars have produced evidence that innovation networks are beneficial for overall firm productivity, R&D capability, and R&D output (Adams, Chiang, & Starkey, 2001; Lofsten & Lindelof, 2002; Medda, Piga, & Siegel, 2005; Murray, 2004; Zucker & Darby, 2001; Zucker, Darby, & Armstrong, 2002). In addition, involvement in innovation networks enhances a firm’s embeddedness in social networks and increases its survival (Lockett, Wright, & Franklin, 2003; Murray, 2004). Scholars have also identified various means to develop innovation networks, ranging from informal to formal collaborations, from facility sharing to deep and reciprocal knowledge sharing (e.g., joint projects and recruitment of scientists) (Lofsten & Lindelof, 2002; Murray, 2004; Perez Perez & Sanchez, 2003; Zucker & Darby, 2001; Zucker et al., 2002). However, while extraordinarily important much of the literature in this space once again deals with single case studies. This line of inquiry has yet to lend itself to cross university comparisons, because it lacks a larger framework or typology of activities that allow for a more systematic approach to studying and comparing the entrepreneurial university. Nonetheless, we have found this sort of “input” literature highly useful to thinking about a more robust way of characterizing the entrepreneurial university.

Productivity of Technology Transfer Offices

The great majority of the literature, in part because it represents readily available quantitative data coming directly from university TTOs is comparative analyses of patents, licenses, and spin-outs. With the increasing entrepreneurial activities at universities, TTOs have been in the spotlight of research, because they typically function as the key transactional gateway between the university and industry. This research stream suggests university entrepreneurship is a function of the productivity of their TTOs. Most measures of entrepreneurial activities are focused around commercial output, including university licensing (number of licenses, licensing revenue), equity positions, coordination capacity (number of shared clients), information processing capacity (invention disclosures, sponsored research), royalties, and patents (number of patents, efficiency in generating new patents) (Rothaermel et al., 2007). Factors that have been identified to be important in explaining the productivity of TTOs include technology transfer offices’ systems, structure, and staffing, as well as the different mechanisms of technology transfer, nature and stage of technology, faculty, university system, and environmental factors.

In examining the implications of TTO structure, scholars have found that the choice of organizational structure influences TTO performance through the shaping of the flow of resources, reporting relationships, degree of autonomy, incentives, and commercialization strategy (e.g., Bercovitz, Feldman, Feller, & Burton, 2001; Feldman, Feller, Bercovitz, & Burton, 2002; Markman, Phan, Balkin, & Gianiodis, 2005). Besides the organization and management of TTOs, scholars have also explored external factors that contribute to relative TTO performance. For example, the stage of technology (e.g., embryonic) is related to the rate of invention disclosures and commercialization strategy (Markman et al., 2005; Thursby et al., 2001). Moreover, both tangible and intangible resources from the university and locality, such as research support and R&D activities, have been understood as input factors of TTO productivity (Chapple, Lockett, Siegel, & Wright, 2005; Jones-Evans & Klofsten, 1999; Siegel, Waldman, & Link, 2003b). The literature describing the TTO space does an excellent job of comparing metrics across universities and provides excellent quantitative data. It does not provide insight into the processes and complexity of a university’s embeddedness in a regional context where capital, business, and managerial know how, partnerships and global regulatory development, marketing and distribution of a technology make the difference to whether a patent “matters” to a regional economy. It provides a window into the output of the university without addressing whether that output travels through an entrepreneurial development process, which increases its probabilities of success. Multiple university mechanisms increasingly are in place at universities to facilitate that, but output research rarely addresses them.

University Spin-offs

Another strong area of research focuses on entrepreneurial activity is new firm creation (e.g., university spin-offs). Indicators of university entrepreneurship revolve around the quantity of new firms created by the university, their performance (VC funding, IPO, survival/failure, revenues, growth), and their attributes (i.e., timing and location, rate of establishment, types, founding team characteristics) (Rothaermel et al., 2007).

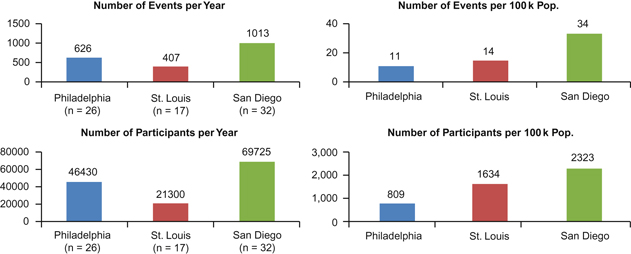

Research in this area has explored the various types of spin-outs. Based on the transferee, spin-offs are classified into “technology only,” “technology and personnel,” and “personnel only” (Carayannis, Rogers, Kurihara, & Allbritton, 1998; Nicolaou & Birley, 2003a, 2003b). Based on their business activities and resource requirements, spin-offs are categorized as “consultancy,” “intellectual property licensing,” “software,” “product,” and “infrastructure creation” (Druilhe & Garnsey, 2004). Scholars have also sought to account for the variety of antecedents to spin-offs. For instance, some argue that a university spin-off is mainly the result of development-oriented technology and the personality of the scientists involved (Roberts, 1991). Others argue that the structure of spin-offs is determined by the scientist’s business network. Other characteristics of university spin-offs concern the stage of their development (Nicolaou & Birley, 2003a, 2003b). Development stages have been defined with reference to start-up date (Clarysse & Moray, 2004), main business activities (Ndonzuau, Pirnay, & Surlemont, 2002), and critical resources needed (Sine, Shane, & Di Gregorio, 2003; Wright, Vohora, & Lockett, 2004). Scholars find that the dynamics of development stages in a university spin-off is related to the dynamics of its founding team (Clarysse & Moray, 2004). This final category captures a disproportionate amount of attention very likely because the data is readily available. While university spin-offs represent an important metric in understanding university entrepreneurship it is again concerned with an institution’s output and fails to recognize the importance of the numerous inputs that make successful spin-offs possible, much less the ways universities support other start-up enterprises which are not university spin-outs. In a dynamic innovation region such as San Diego, university patenting and licensing represents less than 10% of the annual regional totals and spin-outs less than 5% of the annual technology start-ups in the region. Nonetheless, UC San Diego is perceived as the entrepreneurial hub in the region in no small part because of the diversity of its numerous collaborative basic research initiatives and its support of regional commercialization and entrepreneurship efforts.

Taken together, research on university entrepreneurship can clearly benefit from a more holistic systems perspective across different levels of analysis rather than its current focus on distinct subsystems in order to better represent which universities are truly entrepreneurial. According to Rothaermel et al. (2007), current research lacks the complexity of models or richness in data to understand the interdependent processes across many different actors, agents, and institutions involved in university entrepreneurship. Our basic thrust throughout the remainder of this chapter will be to challenge what, among academics at least, are the conventional markers of an entrepreneurial university by presenting a framework for capturing the understudied metrics we keep referring to. Taken together, they might provide a more robust picture of the entrepreneurial ecosystem. We’re especially interested in documenting through the work we have done, a framework of metrics that can be useful to comparisons across universities and regions.