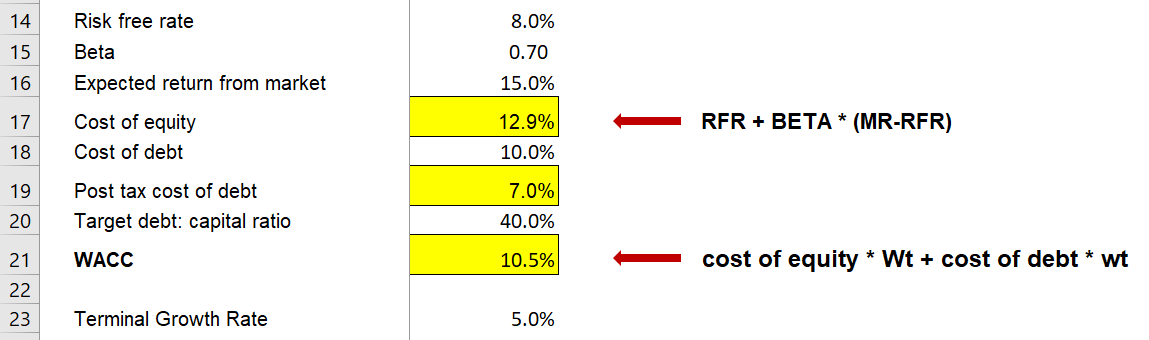

For the DCF model, the weighted average cost of capital (WACC) is r in the discount factor formula. A company typically has different sources of capital, debt, and equity, with each source having its own cost or expectation of the company. For example, the cost of debt capital would be the interest charge. This interest is a charge against the profit for the year, which, along with other allowable expenses, reduces the amount of profit subject to tax.

So, while the interest is the cost of the debt capital to be adjusted from our cash flow, there is an amount of tax saved when we charge the interest against profit. The tax saved by the interest expense is recognized by using the after-tax cost of capital, which is arrived at as follows:

WACC is the average cost of the different types of capital owned by the company. The contribution of each source of capital to the WACC is weighted to account for the fraction of the overall capital it represents.

For example, if the debt-to-equity ratio is 2:1, then the cost of debt will have double the effect on the overall capital as the cost of equity and the weight of the cost of debt in WACC will reflect this, as shown in the following formula:

This equation is widely referred to as the capital asset pricing model (CAPM). We have seen that the cost of debt is the interest due to the debt holders. Calculating the cost of equity is a more complex exercise. Equity carries more risk than debt, and equity holders therefore have a higher expectation of reward. Debt holders are assured of their interest as long as the company is a going concern. Equity holders have to rely on ordinary dividends, which may or may not be declared.

The cost of equity is arrived at as follows:

In the preceding formula, Rf is the risk-free rate. The rate for government securities is usually taken as the risk-free rate:

In the preceding formula, Rm is the premium for the entire stock market and β is the volatility or risk of the company's shares compared to the market. So, the premium can be said to be the difference between the market premium over the risk-free rate, adjusted to accommodate the specific volatility of the company's shares compared to the market.

A β value of 1.0 signifies that the shares exactly match market volatility. For every 1% movement in the market, the shares will also move by 1% in the same direction. A higher β value signifies that the shares are more volatile than the market; they carry more risk but also more reward than the market.

A lower β value signifies that the shares are less volatile than the market, while a negative β value indicates negative correlation with the market. In other words, when the market price increases, the share price will decrease, and vice versa.

The following screenshot shows the equation and the parameters required to calculate the cost of equity and the WACC: