Another method of calculating depreciation is called the reducing balance method. This method is based on the assumption that an asset loses value more quickly in earlier years. It is therefore constructed to allocate more depreciation in the early years and less in the later years of an asset's useful life. In the first year of depreciation, the depreciation rate is applied to the cost of the asset. In subsequent years, the depreciation rate is applied to the net book value brought forward from the previous year.

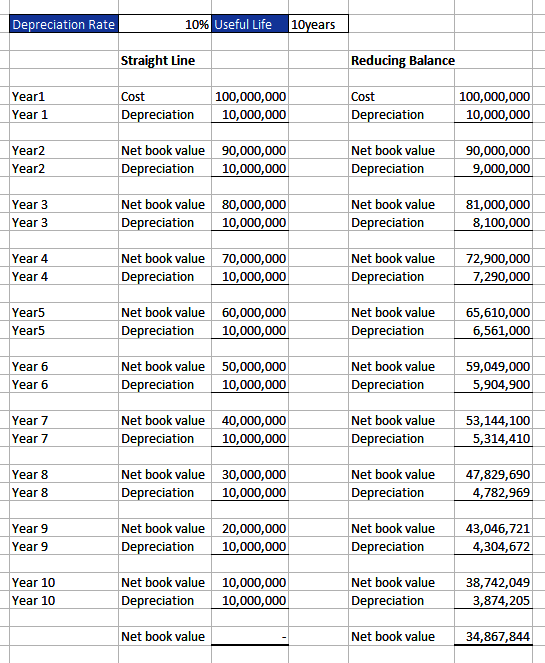

Since the net book value of the asset reduces from year to year, the depreciation will also reduce because the depreciation rate is being applied to a progressively lower figure. The following screenshot shows the difference between the straight line and

reducing balance methods:

From the preceding screenshot, we can observe the following:

- Both methods begin with the same charge for depreciation—10,000,000 (100,000,000 x 10%)

- From the second year on, the depreciation for the year using the reducing balance method begins to drop from 10,000,000 to 9,000,000 in the second year, to 8,100,000 in the third year, and so on

- By the tenth year, the depreciation charge has dropped to 3,874,205

- With the SLM, the annual depreciation charge for the year remains constant at 10,000,000, up until the tenth year

- The net book value at the end of the tenth year with the SLM is zero, compared to 34,867,844 with the reducing balance method

The following is a graphical representation of the effect of the two depreciation methods on depreciation and net book value:

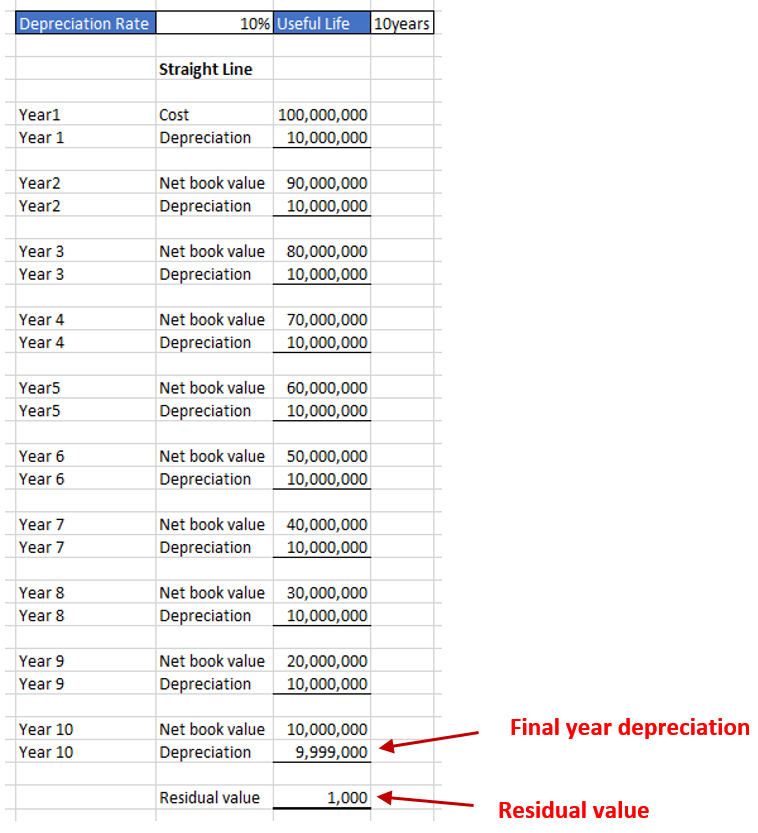

You should recognize that, no matter how old or utilized an asset becomes, it will always have a residual or scrap value. The residual value is an estimate of how much the asset would fetch if it were sold for scrap. With this in mind, you should ensure that you don’t depreciate any assets down to zero, but rather down to their residual value, so that in the final year of depreciation, the depreciation charge will be the net book value minus the residual value. The following screenshot shows the annual depreciation for an asset with a Residual value of 1,000:

Apart from being more realistic, an asset with a residual value as net book value is less likely to disappear than one with a residual value of nil. Although the SLM and reducing balance method are the two most common methods of depreciation, there are other methods, such as sum-of-years digits and units of production.