Financial Planning Reference Sheet

Name: John Robertson

Prepared: April 27, 2014 (age 34)

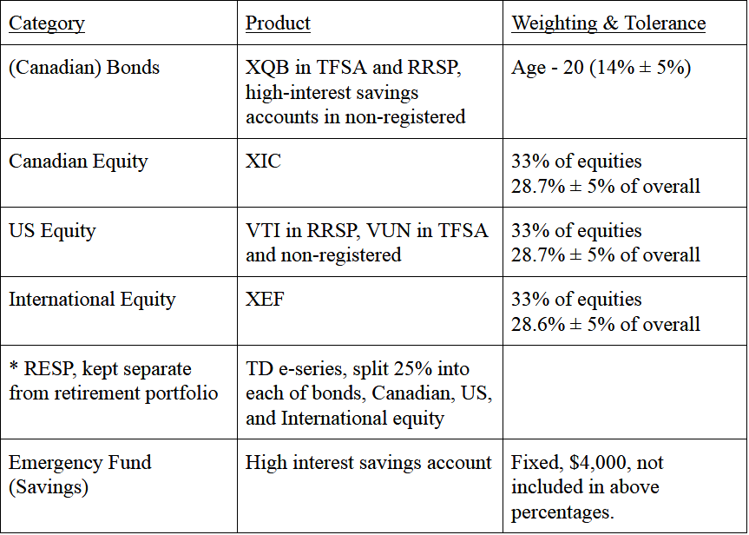

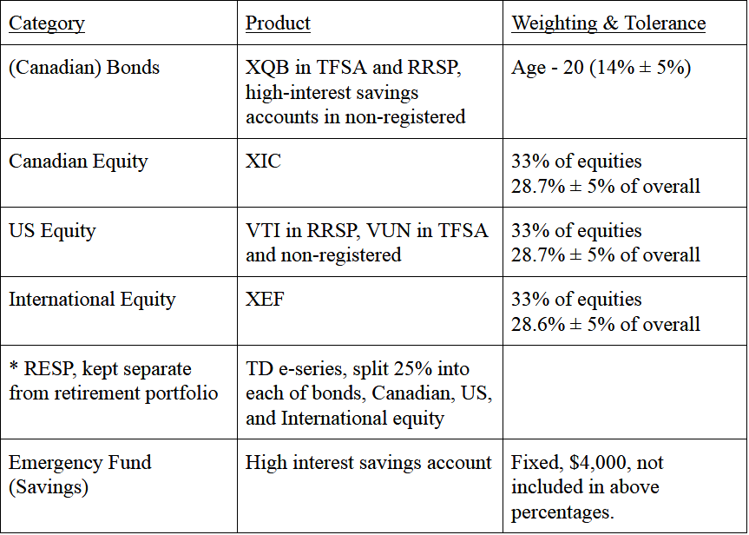

Asset Allocation

My target asset allocation is:

Also see spreadsheet at https://docs.google.com/spreadsheet/ccc?key=0AktN0CUf4uaVdFBLb09DVklHRm5fUVFYeWxObGlxSVE

[link or refer to your own rebalancing spreadsheet]

The reasons I chose this:

I am young with many years before retirement, and have a few years of service in a defined benefit pension plan. I have no upcoming major expenses, and am comfortable deferring any or reducing my budget if stock markets perform poorly. I have lived through the 2008/2009 stock crash, and know that though it caused some emotional stress, I was able to stick to my plan and stay invested. I have high confidence in my ability to stick to the plan if/when there is future market volatility and/or a crash.

Plan: I will review my allocation every year in March. As I make new contributions I will adjust my purchases to bring my portfolio back in line. If any component is off by more than 5% I will sell and repurchase other assets as needed.

If stock markets crash by more than 25%, I will view that as an opportunity and attempt to increase my savings rate, and am open to even investing my emergency fund. I will not adjust my plan for any other fluctuations in market prices, and even then will not make extreme deviations from my plan.

My allocation will become slightly more conservative over time, in accordance with the age-based rule above.

Rebalancing:

I will rebalance: a little with each purchase, with a pause to evaluate and rebalance once per year (March). I will rebalance ad hoc whenever my target allocations are off by more than 5%.

Account Allocation:

I will contribute my savings in this priority:

Because of my pension adjustment at my current job, and many years of university where I did not build RRSP room, my available tax shelter is smaller than the average Canadian my age. I will have to use my non-registered accounts and track capital gains accordingly.

I will use US-listed ETFs within my RRSP to maximize the tax benefit, however, I am most comfortable seeing each account as a fractal miniature of my overall, so I will maintain the same allocation balance in each, even if that may not be the most optimal configuration.

Savings Plan:

I project that I will need to save: $10,000 per year in 2014 dollars. I will increase my savings rate each year by 2% to keep pace with inflation, until my 5-year review.

This is based on the assumption that I will need $45,000 in annual retirement income (in 2014 dollars). I used a spreadsheet calculator tool at http://www.holypotato.net/?p=1243 to come up with these estimates. My assumptions include:

Inflation 2%, bond return 2.5%, stock return 8.5%; that I will get 80% of the maximum CPP, and full OAS at age 67; that I will have $9,000 in annual pension income; that I will retire at age 65 and need my savings to support me until age 95; that I will skip savings for 2 years on the assumption that I will have another child.

I will review my actual savings versus planned savings each year, and review my planned savings and assumptions versus reality every 5 years, with entries in my Google calendar for 2019, 2024 already set up.