Whether you run a company, a non-profit organization, or an educational institute, doing proper bookkeeping is mandatory and required by the government.

This makes the financial management the most used part of Microsoft Dynamics NAV and the least obvious place to make changes, as federal regulations do not allow much creativity in this part of the application.

The first part of this chapter is all about the look, learn, and love principle that we discussed in the previous chapter. We cannot integrate our application with financial management without knowing the basic functionality and structure of the tool.

In the second part of the chapter, we will look at some examples of how to change or expand the way financial management works.

Lastly, we will look at how to create a posting in the general ledger from a newly designed posting routine.

After reading this chapter, you should be able to set up financial management in a new database and create basic postings to the general ledger and understand how to integrate financial management with your application.

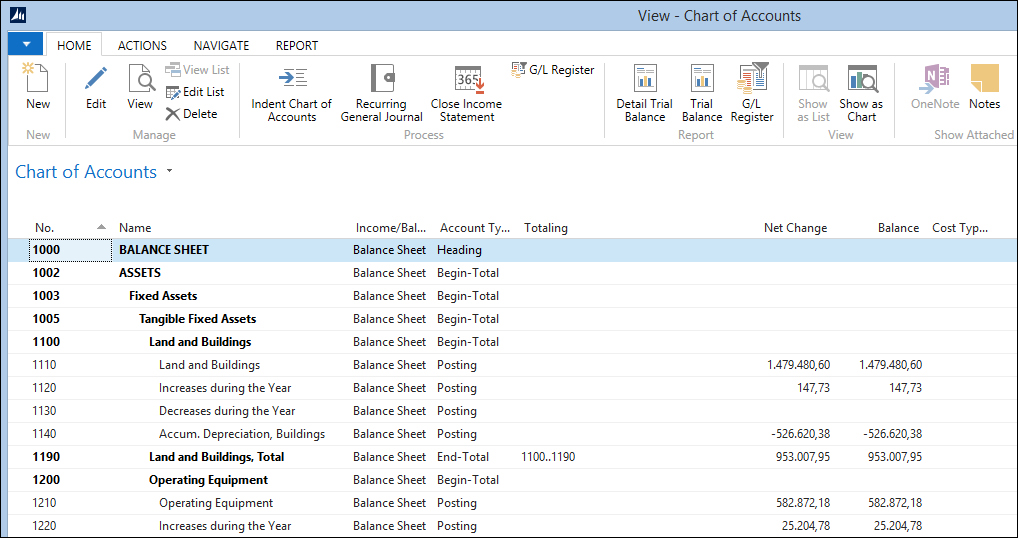

A chart of accounts (COA) is a list of the accounts used by an organization to define each class of items for which money or the equivalent is spent or received. It is used to organize the finances of the entity and to segregate expenditures, revenue, assets, and liabilities in order to give interested parties a better understanding of the financial health of the entity.

Every financial system starts with a COA and although the numbering might differ from country to country, we all have income statements and balance accounts.

Microsoft Dynamics NAV also has some other special accounts: Heading, Begin-Total, and End-Total accounts.

With these accounts, you can make the COA more readable. The accounts within the total accounts are automatically indented.

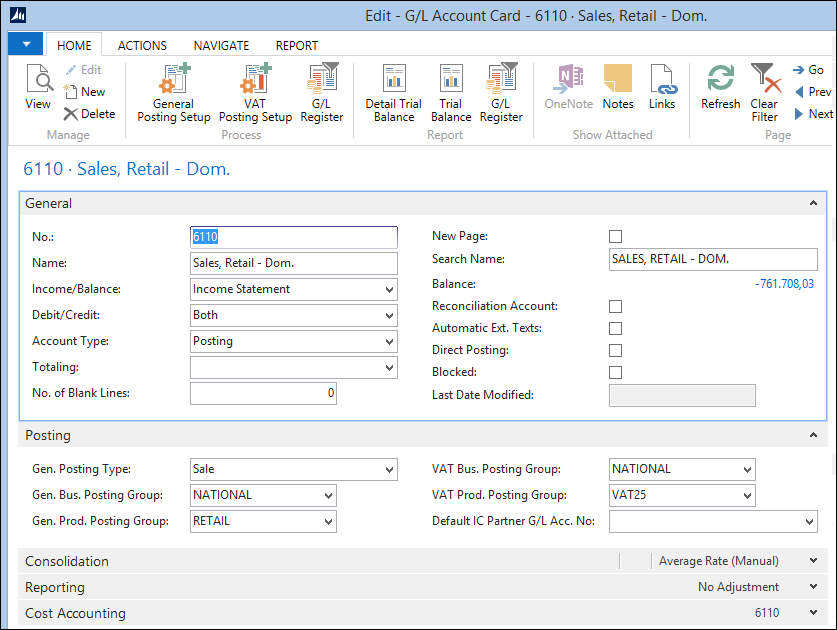

When creating a new posting account, there are several options to choose. Most of them are not mandatory but they make it easier to push the end users to using the correct account while generating entries.

Let's have a look at the options by opening a G/L Account Card:

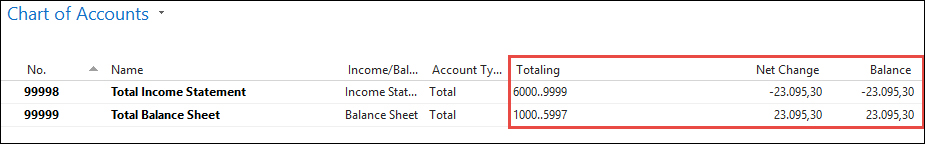

The first and most important decision to make is the type of account to be created. It can be either Income Statement or Balance Sheet. Income statement accounts are reset to zero every new fiscal year, while balance sheet accounts continue indefinitely. The total of the balance sheet accounts should always match the total of the income statement accounts.

You can also force an account to only accept debit or credit postings. The No. Of Blank Lines and New Page fields are used when printing reports and have no effect on the system. Reconciliation Account is hardly used anymore unless, you do not use sub accounting.

Automatic Ext. Texts creates the extra texts discussed in Chapter 1, Introduction to Microsoft Dynamics NAV, automatically when you use this account in a sales or purchasing document.

Direct Posting is a very important option. It is highly recommended to disable this option when an account is used in one of the posting setups. When Direct Posting is enabled, an end user can create entries in this account, disrupting the balance between the general ledger and the sub administration. We'll discuss this in more detail later in this chapter.

When you do allow Direct Posting, the fields on the Posting tab are very important.

Gen. Posting Type determines whether the account is used for purchase and/or sales for the VAT calculation and filtering in the VAT statements. A more detailed VAT specification is determined by the VAT business and product posting group. The general business and product posting groups can be used to automatically populate these fields, when this account is used.

In the Consolidation tab, you can populate the consolidation accounts used when consolidating two or more companies. We'll discuss consolidation later in this chapter.

Microsoft Dynamics NAV allows an additional reporting currency to be used. This is an inheritance from the days before the Euro in Europe and was very popular in the years of Euro introduction. Today, it is used by international companies, for example, a company based in the USA with a Dutch Parent company. In the Reporting tab, you can determine how you want to handle exchange rate adjustments when using this functionality.

Microsoft Dynamics NAV allows the calculation of both European VAT and North American Sales Tax. The examples in this book are based on European VAT.

For sales tax, the Tax Area Code and Tax Group Code fields are used instead of the VAT Business Posting Group and the VAT Product Posting Group.

As discussed in Chapter 1, Introduction to Microsoft Dynamics NAV, the entries for the general ledger are created in the general journals when you post a sales or purchase document. So, let's have a closer look at this functionality and see what we can do with it.

In theory, you could run Microsoft Dynamics NAV with just the G/L Entry table, but in accounting, we have invented sub administrations.

Sub administrations are very old. Before computers were invented, people would have cards for all customers and vendors to keep track of their balance. Updating these cards was a manual and time-consuming process with a high probability of making mistakes.

In Microsoft Dynamics NAV, this is taken care of automatically. In the general ledger, we have four sub administrations:

- Bank: For every transaction on a bank account, a bank ledger entry is created. The total of all bank ledger entries should match your bank account's balance. It allows you to quickly find payments.

- Customer: Whenever you sell something to a customer or a customer pays a customer ledger, an entry is created. It allows you to analyze payment history and send out reminders.

- Vendor: When you buy something using a vendor, the system creates a vendor ledger entry. We can use the vendor ledger entries to determine which invoice needs to be paid. The vendor ledger entries are the opposite of the customer ledger entries.

- VAT/TAX: These entries help us to easily create clear VAT/TAX statements.

As discussed earlier, it is very important that the total of the sub administration matches the general ledger. For example, when your bank account balance is 2.846,54, the G/L Account should also have that amount.

For this, you can disable the Direct Posting option we discussed earlier.