Managing Our Hub Economy

by Marco Iansiti and Karim R. Lakhani

THE GLOBAL ECONOMY IS COALESCING around a few digital superpowers. We see unmistakable evidence that a winner-take-all world is emerging in which a small number of “hub firms”— including Alibaba, Alphabet/Google, Amazon, Apple, Baidu, Facebook, Microsoft, and Tencent—occupy central positions. While creating real value for users, these companies are also capturing a disproportionate and expanding share of the value, and that’s shaping our collective economic future. The very same technologies that promised to democratize business are now threatening to make it more monopolistic.

Beyond dominating individual markets, hub firms create and control essential connections in the networks that pervade our economy. Google’s Android and related technologies form “competitive bottlenecks”; that is, they own access to billions of mobile consumers that other product and service providers want to reach. Google can not only exact a toll on transactions but also influence the flow of information and the data collected. Amazon’s and Alibaba’s marketplaces also connect vast numbers of users with large numbers of retailers and manufacturers. Tencent’s WeChat messaging platform aggregates a billion global users and provides a critical source of consumer access for businesses offering online banking, entertainment, transportation, and other services. The more users who join these networks, the more attractive (and even necessary) it becomes for enterprises to offer their products and services through them. By driving increasing returns to scale and controlling crucial competitive bottlenecks, these digital superpowers can become even mightier, extract disproportionate value, and tip the global competitive balance.

Hub firms don’t compete in a traditional fashion—vying with existing products or services, perhaps with improved features or lower cost. Rather, they take the network-based assets that have already reached scale in one setting and then use them to enter another industry and “re-architect” its competitive structure—transforming it from product-driven to network-driven. They plug adjacent industries into the same competitive bottlenecks they already control.

For example, the Alibaba spin-off Ant Financial does not simply offer better payment services, a better credit card, or an improved investment management service; it builds on data from Alibaba’s already vast user base to commoditize traditional financial services and reorganize a good chunk of the Chinese financial sector around the Ant Financial platform. The three-year-old service already has over half a billion users and plans to expand well beyond China. Similarly, Google’s automotive strategy does not simply entail creating an improved car; it leverages technologies and data advantages (many already at scale from billions of mobile consumers and millions of advertisers) to change the structure of the auto industry itself. (Disclosure: Both of us work or have worked with some of the firms mentioned in this article.)

If current trends continue, the hub economy will spread across more industries, further concentrating data, value, and power in the hands of a small number of firms employing a tiny fraction of the workforce. Disparity in firm valuation and individual wealth already causes widespread resentment. Over time, we can expect consumers, regulators, and even social movements to take an increasingly hostile stand against this concentration of value and economic connectivity. In a painfully ironic turn, after creating unprecedented opportunity across the global economy, digitization—and the trends it has given rise to—could exacerbate already dangerous levels of income inequality, undermine the economy, and even lead to social instability.

Can these trends be reversed? We believe not. The “hub economy,” as we will argue, is here to stay. But most companies will not become hubs, and they will need to respond astutely to the growing concentration of hub power. Digitizing operating capabilities will not be enough. Digital messaging platforms, for example, have already dealt a blow to telecom service providers; investment advisors still face threats from online financial-services companies. To remain competitive, companies will need to use their assets and capabilities differently, transform their core businesses, develop new revenue opportunities, and identify areas that can be defended from encroaching hub firms and others rushing in from previously disconnected economic sectors. Some companies have started on this path—Comcast, with its new Xfinity platform, is a notable example—but the majority, especially those in traditional sectors, still need to master the implications of network competition.

Most importantly, the very same hub firms that are transforming our economy must be part of the solution—and their leaders must step up. As Mark Zuckerberg articulated in his Harvard commencement address in May 2017, “we have a level of wealth inequality that hurts everyone.” Business as usual is not a good option. Witness the public concern about the roles that Facebook and Twitter played in the recent U.S. presidential election, Google’s challenges with global regulatory bodies, criticism of Uber’s culture and operating policies, and complaints that Airbnb’s rental practices are racially discriminatory and harmful to municipal housing stocks, rents, and pricing.

Thoughtful hub strategies will create effective ways to share economic value, manage collective risks, and sustain the networks and communities we all ultimately depend on. If carmakers, major retailers, or media companies continue to go out of business, massive economic and social dislocation will ensue. And with governments and public opinion increasingly attuned to this problem, hub strategies that foster a more stable economy and united society will drive differentiation among the hub firms themselves.

We are encouraged by Facebook’s response to the public outcry over “fake news”—hiring thousands of dedicated employees, shutting down tens of thousands of phony accounts, working with news sources to identify untrue claims, and offering guides for spotting false information. Similarly, Google’s YouTube division invests in engineering, artificial intelligence, and human resources and collaborates with NGOs to ensure that videos promoting political extremists and terrorists are taken down promptly.

A real opportunity exists for hub firms to truly lead our economy. This will require hubs to fully consider the long-term societal impact of their decisions and to prioritize their ethical responsibilities to the large economic ecosystems that increasingly revolve around them. At the same time, the rest of us—whether in established enterprises or start-ups, in institutions or communities—will need to serve as checks and balances, helping to shape the hub economy by providing critical, informed input and, as needed, pushback.

The Digital Domino Effect

The emergence of economic hubs is rooted in three principles of digitization and network theory. The first is Moore’s law, which states that computer processing power will double approximately every two years. The implication is that performance improvements will continue driving the augmentation and replacement of human activity with digital tools. This affects any industry that has integrated computers into its operations—which pretty much covers the entire economy. And advances in machine learning and cloud computing have only reinforced this trend.

The second principle involves connectivity. Most computing devices today have built-in network connectivity that allows them to communicate with one another. Modern digital technology enables the sharing of information at near-zero marginal cost, and digital networks are spreading rapidly. Metcalfe’s law states that a network’s value increases with the number of nodes (connection points) or users—the dynamic we think of as network effects. This means that digital technology is enabling significant growth in value across our economy, particularly as open-network connections allow for the recombination of business offerings, such as the migration from payment tools to the broader financial services and insurance that we’ve seen at Ant Financial.

But while value is being created for everyone, value capture is getting more skewed and concentrated. This is because in networks, traffic begets more traffic, and as certain nodes become more heavily used, they attract additional attachments, which further increases their importance. This brings us to the third principle, a lesser-known dynamic originally posited by the physicist Albert-László Barabási: the notion that digital-network formation naturally leads to the emergence of positive feedback loops that create increasingly important, highly connected hubs. As digital networks carry more and more economic transactions, the economic power of network hubs, which connect consumers, firms, and even industries to one another, expands. Once a hub is highly connected (and enjoying increasing returns to scale) in one sector of the economy (such as mobile telecommunications), it will enjoy a crucial advantage as it begins to connect in a new sector (automobiles, for example). This can, in turn, drive more and more markets to tip, and the many players competing in traditionally separate industries get winnowed down to just a few hub firms that capture a growing share of the overall economic value created—a kind of digital domino effect.

This phenomenon isn’t new. But in recent years, the high degree of digital connectivity has dramatically sped up the transformation. Just a few years ago, cell phone manufacturers competed head-to-head for industry leadership in a traditional product market without appreciable network effects. Competition led to innovation and differentiation, with a business model delivering healthy profitability at scale for a dozen or so major competitors. But with the introduction of iOS and Android, the industry began to tip away from its hardware centricity to network structures centered on these multisided platforms. The platforms connected smartphones to a large number of apps and services. Each new app makes the platform it sits on more valuable, creating a powerful network effect that in turn creates a more daunting barrier to entry for new players. Today Motorola, Nokia, BlackBerry, and Palm are out of the mobile phone business, and Google and Apple are extracting the lion’s share of the sector’s value. The value captured by the large majority of complementors—the app developers and third-party manufacturers—is generally modest at best.

The domino effect is now spreading to other sectors and picking up speed. Music has already tipped to Apple, Google, and Spotify. E-commerce is following a similar path: Alibaba and Amazon are gaining more share and moving into traditional brick-and-mortar strongholds like groceries (witness Amazon’s acquisition of Whole Foods). We’ve already noted the growing power of WeChat in messaging and communications; along with Facebook and others, it’s challenging traditional telecom service providers. On-premise computer and software offerings are losing ground to the cloud services provided by Amazon, Microsoft, Google, and Alibaba. In financial services, the big players are Ant, Paytm, Ingenico, and the independent start-up Wealthfront; in home entertainment, Amazon, Apple, Google, and Netflix dominate.

Where are powerful hub firms likely to emerge next? Health care, industrial products, and agriculture are three contenders. But let’s examine how the digital domino effect could play out in another prime candidate, the automotive sector, which in the United States alone provides more than seven million jobs and generates close to a trillion dollars in yearly sales.

Re-architecting the Automotive Sector

As with many other products and services, cars are now connected to digital networks, essentially becoming rolling information and transaction nodes. This connectivity is reshaping the structure of the automotive industry. When cars were merely products, car sales were the main prize. But a new source of value is emerging: the connection to consumers in transit. Americans spend almost an hour, on average, getting to and from work every day, and commutes keep getting longer. Auto manufacturers, responding to consumer demand, have already given hub firms access to dashboard screens in many cars; drivers can use Apple or Google apps on the car’s built-in display instead of on their smartphones. If consumers embrace self-driving vehicles, that one hour of consumer access could be worth hundreds of billions of dollars in the U.S. alone.

Which companies will capitalize on the vast commercial potential of a new hour of free time for the world’s car commuters? Hub firms like Alphabet and Apple are first in line. They already have bottleneck assets like maps and advertising networks at scale, and both are ready to create super-relevant ads pinpointed to the car’s passengers and location. One logical add-on feature for autonomous vehicles would be a “Drive there” button that appears when an ad pops up (as already happens on Google’s Waze app); pressing it would order the car to head to the touted destination.

In a future when people are no longer behind the wheel, cars will become less about the driving experience and more about the apps and services offered by automobiles as they ferry passengers around. Apart from a minority of cars actually driven for fun, differentiation will lessen, and the vehicle itself might well become commoditized. That will threaten manufacturers’ core business: The car features that buyers will care most about—software and networks—will be largely outside the automakers’ control, and their price premiums will go down.

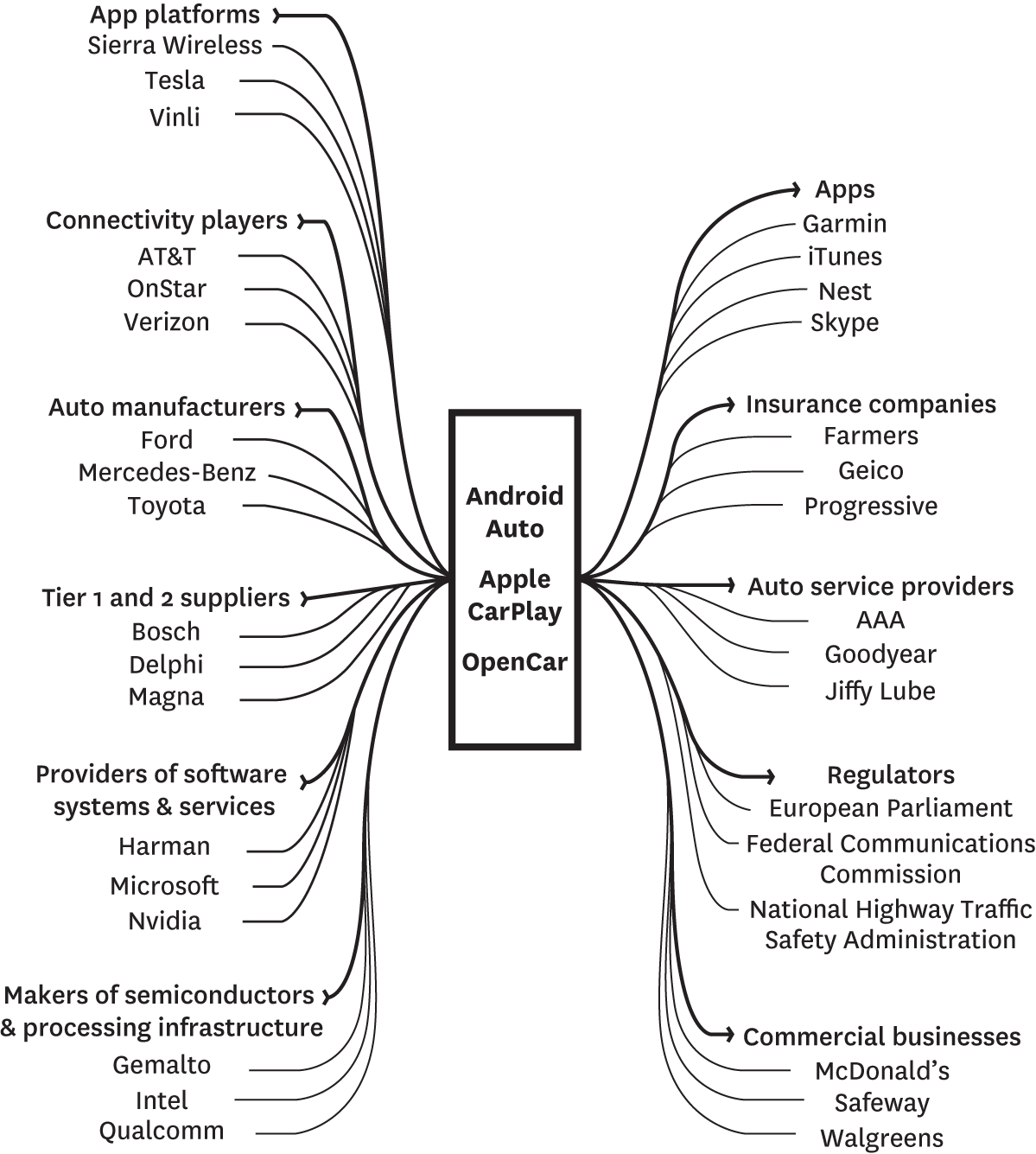

The transformation will also upend a range of connected sectors—including insurance, automotive repairs and maintenance, road construction, law enforcement, and infrastructure—as the digital dominos continue to fall. (See the exhibit “The connected-car ecosystem.”)

Three software platforms—Android Auto, Apple CarPlay, and, to a lesser extent, OpenCar—dominate the market for integrating smartphone functionality into vehicles. They constitute powerful bottleneck assets because they have scores of supply-chain partners (left) and they enable other stakeholders (right) to reach consumers. (Note: The companies, apps, and regulators listed are selected examples only.)

For existing auto manufacturers, the picture is grim but not hopeless. Some companies are exploring a pay-per-use model for their cars and are acquiring, launching, or partnering with car-as-a-service providers. GM, for one, invested $500 million in the ride-sharing service Lyft, and its luxury-car division is now offering a monthly car subscription service. Daimler launched a car-sharing business called car2go. Several manufacturers have also invested in their own research into driverless vehicles or partnered with external providers.

Beyond these business-model experiments, automakers will need to play as the hubs do, by participating in the platform competition that will determine value capture in the sector. At least for the moment, alternatives to Google and Apple are scarce. One example is OpenCar, recently acquired by Inrix, a traditional auto supplier. Unlike Apple CarPlay and Google’s Android Auto, which limit automaker-specific customization and require access to proprietary car data, the OpenCar framework is fully controlled by the car manufacturer. To take on the established giants, we believe that OpenCar and Inrix will have to develop an effective advertising or commerce platform or adopt some other indirect monetization strategy—and to do that, they’ll probably need to partner with companies that have those capabilities.

To reach the scale required to be competitive, automotive companies that were once fierce rivals may need to join together. Here Technologies, which provides precision mapping data and location services, is an interesting example. Here has its roots in Navteq, one of the early online mapping companies, which was first bought by Nokia and later acquired by a consortium of Volkswagen, BMW, and Daimler (the multibillion-dollar price tag may have been too high for any single carmaker to stomach). Here provides third-party developers with sophisticated tools and APIs for creating location-based ads and other services. The company represents an attempt by auto manufacturers to assemble a “federated” platform and, in doing so, neutralize the threat of a potential competitive bottleneck controlled by Google and Apple. The consortium could play a significant role in preventing automotive value capture from tipping completely toward existing hub firms.

Of course, successful collaboration depends on a common, strongly felt commitment. So as traditional enterprises position themselves for a fight, they must understand how the competitive dynamics in their industries have shifted.

Increasing Returns to Scale Are Hard to Beat

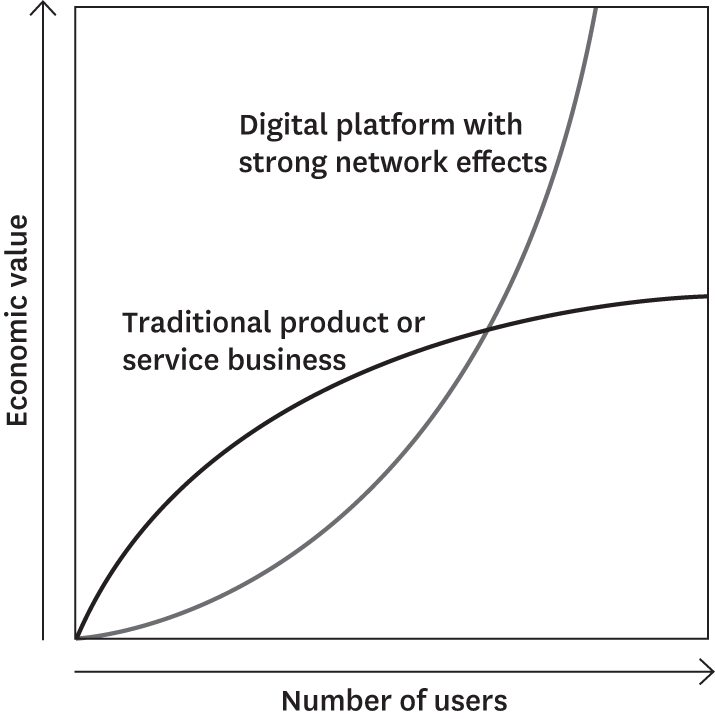

Competitive advantage in many industries is moderated by decreasing returns to scale. In traditional product and service businesses, the value creation curve typically flattens out as the number of consumers increases, as we see in the exhibit “Profiting from a growing customer base.” A firm gains no particular advantage as its user base continues to increase beyond already efficient levels, which enables multiple competitors to coexist.

Profiting from a growing customer base

For traditional product and service businesses, gaining additional customers does not continue adding commensurate value after a certain point. However, many platform businesses (Amazon, Facebook, and the like) become more and more valuable as more people and companies use them, connect with one another, and create network effects.

Some digital technologies, however, exhibit increasing returns to scale. A local advertising platform gets better and better as more and more users attract more and more ads. And as the number of ads increases, so does the ability to target the ads to the users, making individual ads more valuable. An advertising platform is thus similar to software platforms such as Windows, Linux, Android, and iOS, which exhibit increasing returns to scale—their growing value to consumers increases the number of available apps, while the value to app developers rises as the number of consumers rises. The more consumers, the greater the incentive for developers to build apps, and the more apps there are, the more motivated consumers are to use their digital devices.

These considerations are important to the nature of hub competition. The economics of traditional decreasing returns make it possible for several competitors to coexist and provide differentiated value to attract users. That’s the dynamic in the auto industry today, with many car manufacturers competing with one another to offer a variety of differentiated products. But the increasing returns in digital assets like ad platforms (or possibly driverless-car technology) will heighten the advantage of the competitor with the largest scale, the largest network of users, or the most data. And this is where the hub firms will most likely leverage their large and growing lead—and cause value to concentrate around them.

In contrast with traditional product and service businesses, network-based markets exhibiting increasing returns to scale will, over time, tip toward a narrow set of players. This implies that if a conventional decreasing-returns business (say, telecom or media) is threatened by a new type of competitor whose business model experiences increasing returns, the conventional player is in for a rough ride. With increasing returns to scale, a digital technology can provide a bottleneck to an entire industrial sector. And left alone, competitive bottlenecks dramatically skew value capture away from traditional firms.

Pushing Back

Hub firms often compete against one another. Microsoft has made substantial investments in augmented reality in an effort to create a new hub and counterbalance the power that Google and Apple wield in the mobile space. Facebook acquired Oculus to force a similar structural shift in the emerging field of virtual reality. And a battle is looming in the smart-home arena, as Google, Apple, Microsoft, and Samsung attempt to reduce Amazon’s early lead in voice-activated home technology.

But how does the rest of the economy deal with the increasing returns to scale of hub firms? With enough foresight and investment, traditional firms can resist by becoming hubs themselves, as we are seeing especially in the internet of things (IoT) space. GE is the classic example of this approach, with its investment in the Predix platform and the creation of GE Digital. [See the article “How I Remade GE,” HBR, September–October 2017.] Other companies are following suit in different settings—for example, Verizon and Vodafone with their IoT platforms.

Firms can also shape competition by investing to ensure that there are multiple hubs in each sector—and even influencing which ones win. They can organize to support less-established platforms, thus making a particular hub more viable and an industry sector more competitive in the long term. Deutsche Telekom, for instance, is partnering with Microsoft Azure (rather than Amazon Web Services) for cloud computing in Central Europe.

Most importantly, the value generated by networks will change as firms compete, innovate, and respond to community and regulatory pressure. Multihoming—a practice enabling participants on one hub’s ecosystem to easily join another—can significantly mitigate the rise of hub power. For example, drivers and passengers routinely multihome across different ride-sharing platforms, often checking prices on Uber, Lyft, and Fasten to see which is offering the best deal. Retailers are starting to multihome across payment systems, supporting multiple solutions (such as Apple Pay, Google Wallet, and Samsung Pay). If multihoming is common, the market is less likely to tip to a single player, preserving competition and diffusing value capture. Indeed, companies will need to make their products and services available on multiple hubs and encourage the formation of new hubs to avoid being held hostage by one dominant player. Take the wireless-speaker manufacturer Sonos: It has ensured that its music system seamlessly integrates with as many music services as possible, including Apple Music, Amazon Music Unlimited, Google Play Music, Pandora, Spotify, and Tidal.

Collective action can also restructure economic networks, shape value creation and capture, and ease competitive bottlenecks. In the 1990s the open-source community organized to compete against Microsoft Windows with the Linux operating system. That effort was actively supported by traditional players such as IBM and Hewlett-Packard and reinforced later by Google and Facebook. Today Linux (and Linux-related products) are firmly established in enterprises, consumer devices, and cloud computing. Similarly, the Mozilla open-source community and its Firefox browser broke Microsoft’s grip on navigating the internet. Even Apple, notorious for its proprietary approach, relies on open-source software for its core operating systems and web services, and the infamous iPhone jailbreaking craze demonstrated both the extraordinary demand for third-party apps and the burgeoning supply of them.

Open source has grown beyond all expectations to create an increasingly essential legacy of common intellectual property, capabilities, and methodologies. Now collective action is going well beyond code sharing to include coordination on data aggregation, the use of common infrastructure, and the standardization of practices to further equilibrate the power of hubs. Efforts like OpenStreetMap are leading the way in maps, and Mozilla’s Common Voice project is crowdsourcing global voice data to open up the speech-recognition bottleneck.

Collective action will be increasingly crucial to sustaining balance in the digital economy. As economic sectors coalesce into networks and as powerful hubs continue to form, other stakeholders will need to work together to ensure that hubs look after the interests of all network members. Cooperation will become more important for the rivals that orbit hubs; indeed, strategic joint action by companies that are not hubs may be the best competitive antidote to the rising power of hub firms.

The public is also raising concerns about privacy, online tracking, cybersecurity, and data aggregation. Solutions being suggested include requirements for social network and data portability similar to the requirements for phone number portability that telecommunications regulators instituted to increase competition among phone service providers.

The Ethics of Network Leadership

The responsibility for sustaining our (digital) economy rests partly with the same leaders who are poised to control it. By developing such central positions of power and influence, hub firms have become de facto stewards of the long-term health of our economy. Leaders of hub companies need to realize that their organizations are analogous to “keystone” species in biological ecosystems—playing a critical role in maintaining their surroundings. Apple, Alibaba, Alphabet/Google, Amazon, and others that benefit disproportionately from the ecosystems they dominate have rational and ethical reasons to support the economic vitality of not just their direct participants but also the broader industries they serve. In particular, we argue that hub companies need to incorporate value sharing into their business models, along with value creation and value capture.

Building and maintaining a healthy ecosystem is in the best interests of hub companies. Amazon and Alibaba claim millions of marketplace sellers, and they profit from every transaction those merchants make. Similarly, Google and Apple earn billions in revenue from the third-party apps that run on their platforms. Both companies already invest heavily in the developer community, providing programming frameworks, software tools, and opportunities and business models that enable developers to grow their businesses. But such efforts will need to be scaled up and refined as hub firms find themselves at the center of—and relying on—much larger and more-complex ecosystems. Preserving the strength and productivity of complementary communities should be a fundamental part of any hub firm’s strategy.

Uber provides an interesting example of the repercussions of getting this wrong. Uber’s viability depends on its relations with its drivers and riders, who have often criticized the company’s practices. Under pressure from those communities—and from competitors that offer drivers the potential to earn more—Uber is making improvements. Still, its challenges suggest that no hub will maintain an advantage over the long term if it neglects the well-being of its ecosystem partners. Microsoft learned a hard lesson when it failed to maintain the health of its PC software ecosystem, losing out to the Linux community in cloud services.

But network ethics are not just about financial considerations; social concerns are equally important. Centralized platforms, such as Kiva for charitable impact investing and Airbnb for accommodation bookings, have been found to be susceptible to racial discrimination. In Airbnb’s case, external researchers convincingly demonstrated that African-American guests were especially likely to have their reservation requests rejected. The pressure is now on Airbnb to fight bias both by educating its proprietors and by modifying certain platform features. Additionally, as Airbnb continues to grow, it must work to ensure that its hosts heed municipal regulations, lest they face a potentially devastating regulatory backlash.

Indeed, if hubs do not promote the health and sustainability of the many firms and individuals in their networks, other forces will undoubtedly step in. Governments and regulators will increasingly act to encourage competition, protect consumer welfare, and foster economic stability. Consider the challenges Google faces in Europe, where regulators are concerned about the dominance of both its search advertising business and its Android platform.

The centralizing forces of digitization are not going to slow down anytime soon. The emergence of powerful hub firms is well under way, and the threats to global economic well-being are unmistakable. All actors in the economy—but particularly the hub firms themselves—should work to sustain the entire ecosystem and observe new principles, for both strategic and ethical reasons. Otherwise, we are all in serious trouble.

Originally published in September–October 2017. Reprint R1705F