Smaller Government, Bigger Wallet

OVER the last eight years, government programs to help the poor have been cut to the bone. At the same time, taxes on the wealthy have been slashed so that mega-yacht owners can drink champagne out of ruby slippers. In fact, life in America has become remarkably simple: If your parents were rich, you will be rich. If they were poor, you are predestined by your DNA to be poor as well.

Welcome to the victimization thesis of America. It is the transcendent new creed of those who think that government is the answer to whatever ails us. It is an ideology that tells us to toss aside our ambitions, determination, grit, and sweat, and it has swiftly replaced the old code of personal responsibility and merit—a code that took America from a bunch of disgruntled British colonists to the wealthiest country the world has ever known in less than two hundred years.

The victimization thesis says that, whatever our personal failures, shortcomings, and weaknesses, our troubles are caused by anyone and everyone except ourselves. It’s not that people don’t want to succeed; it’s that they can’t succeed. The deck is always stacked against us—and if you’re poor or black or short or old or handicapped or female or gay or uncoordinated, then don’t even bother trying.

Fortunately, it’s all a fairy tale. That’s not to say we don’t stumble and fall short of our dreams—we do—but remember, Americans have never been guaranteed happiness, only the pursuit of it. There is no guarantee of equal results, only of a level field upon which the game can be played.

But now our leaders are trying to change the rules of that game. The blinding fast expansion of government is threatening to slam shut the doors of economic opportunity. The $9 trillion increase in our national debt, the $2 trillion in bailouts, the increased taxes on “the rich” (and, eventually, just about everyone who works at least 40 hours a week) are the new glass ceilings on economic advancement. Washington seems to be more preoccupied these days with making rich people poor than with making poor people rich.

Turning around our economic future requires a lot of things, but the first is a change in mind-set. Big-government, eat-the-rich policies may sound good in campaign commercials and sound bites, but history has proven that they always lead to the same disastrous place: a government that collapses under its own weight. If you learn that history and understand the signs to watch for, then you’ll also know exactly what to say the next time you hear someone make an idiotic argument, like:

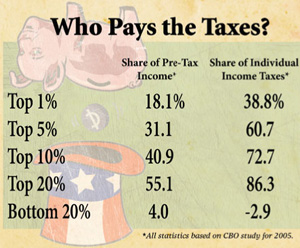

If you ask people how much of America’s total tax burden they think is shouldered by the wealthiest one percent, most would likely say it’s less than 10 percent. Some might even believe it’s less than five percent. But they would all be wrong. Very wrong.

In 2006, the most recent year that comprehensive IRS data is available, the richest one percent of Americans paid 39.9 percent of the country’s total income tax bill. The top ten percent of filers paid 71 percent of the tab.

Here’s an even more amazing showstopper that you’ll never hear mentioned by the pro-France crowd: the bottom 50 percent of earners now make 13 percent of the country’s total income yet pay less than three percent of the income taxes.

Pause. Take a deep breath. Now consider that stat again: Those in the top 50 percent pay 97 percent of the income tax.

“By adjusting the top rates and reducing windfalls paid out to some of the wealthiest individuals in the nation, we can help restore a sense of equity and fairness that is critical to the success of our voluntary tax system.”

—Charles Rangel, Chairman of the House Ways and Means Committee

I always love when politicians call our tax system “voluntary,” as though people have a choice whether or not to pay them. Ask Wesley Snipes how voluntary it is to file a 1040.

One reason why that statistic probably sounds so shocking is that it runs counter to everything we read in the popular press or hear from politicians. But that obvious spin on reality should tell you everything you need to know about their agendas.

Many people have probably heard the story that billionaire Warren Buffett likes to tell about how he pays a smaller share of his income in taxes than his secretary, who makes just $60,000 a year. If that’s really the case, then Buffett must be an expert at tax avoidance because the statistics show that the average tax rate (i.e., taxes paid as a share of income) rises steadily as people get wealthier.

Maybe the part of Buffett’s story we should be focusing on is why the richest man in the world is paying his secretary only $60,000 a year.

Maybe the part of Buffett’s story we should be focusing on is why the richest man in the world is paying his secretary only $60,000 a year.

In 2005, the effective tax rate on a person in the lowest income group was 4.3 percent. The effective rate for someone in the middle class, like Mr. Buffett’s secretary, was 14.2 percent. And for the super-duper rich, the top .01 percent of all earners, the effective federal tax burden was 31.5 percent. The truth is that our tax system does not favor the wealthy, it penalizes them. As a recent Congressional Budget Office report said, “High-income households have a disproportionate share of comprehensive income and pay a disproportionate share of federal taxes.” Those who argue that we need to have a progressive tax system are simply refusing to acknowledge the reality that we already do.

One reason why Buffett’s effective tax rate is so low (aside from the team of attorneys and accountants he likely has helping him file) is that he likely makes a lot of his money through capital gains, which are taxed at a lower rate than ordinary income. Why is the rate on capital gains lower? Because the government knows that capital investments are proven to create jobs so they want to incentivize more of them. So, sure, Warren, we can get your tax rate a little higher just for the fun of it, but how many middle-class jobs is it worth to you?

One reason why Buffett’s effective tax rate is so low (aside from the team of attorneys and accountants he likely has helping him file) is that he likely makes a lot of his money through capital gains, which are taxed at a lower rate than ordinary income. Why is the rate on capital gains lower? Because the government knows that capital investments are proven to create jobs so they want to incentivize more of them. So, sure, Warren, we can get your tax rate a little higher just for the fun of it, but how many middle-class jobs is it worth to you?

“The difference between tax avoidance and tax evasion is (a) whatever the IRS says; (b) a smart lawyer; (c) ten years in prison; (d) all the above. Being a tax lawyer’s got nothing to do with the law, it’s a game. We teach the rich how to play it so they can stay rich. The IRS keeps changing the rules so we can keep getting rich teaching it. It’s a game.”

While it’s true that the distribution of taxes changes once payroll taxes are accounted for, the change is much smaller than most progressives would like you to believe.

The Tax Policy Center, which is run by two liberal think tanks, the Urban Institute and the Brookings Institution, recently studied payroll and income taxes paid by each income group. They found that the richest one percent still pay 27.5 percent of the total tax burden, but the bottom twenty percent pays only 0.4 percent.

One good explanation for the low tax burden on the poorest fifth of Americans is that most of the people in that category (who earn income at a job) get reimbursed for at least a portion of their payroll tax through a tax-back payment called the “earned income tax credit” (EITC). In other words, we already refund taxes back to hard-working families that are struggling to make ends meet, thereby ensuring that the payroll tax, like the income tax, is progressive.

One of the reasons the EITC has been around so long and generally enjoys bipartisan support is that you can claim it only if you earn money. In other words, it incentivizes people to actually work, unlike so many other antipoverty programs which seem to reward people for not working.

One of the reasons the EITC has been around so long and generally enjoys bipartisan support is that you can claim it only if you earn money. In other words, it incentivizes people to actually work, unlike so many other antipoverty programs which seem to reward people for not working.

Not exactly.

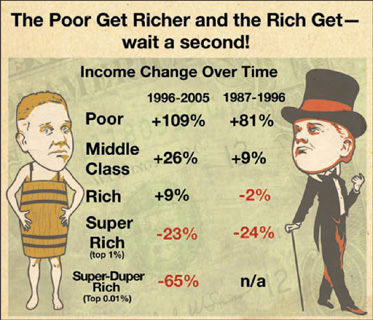

It is true that the share of the total income earned by the rich has been rising. The richest one percent now earn about 21 percent of all income, up from about nine percent in 1980. But then—

You didn’t let me finish.

Yes, the super-rich now earn a larger share of total income, but every study over the last thirty years that’s tracked real people has found that the rich lose income over time while the poor have large income gains. In other words, the poor don’t stay poor long and the rich don’t stay rich long.

A recent study by the U.S. Treasury Department found that the richest .01 percent of Americans at the time the study began experienced the largest income declines over the following ten years. And those declines were remarkable: an average reduction in median income of 65 percent compared with 24 percent income gains for the average person. Overall, only a quarter of the richy-rich people in the top 1/100th of one percent were still in that group a decade later.

There’s even worse news for the super-rich: this study was done before two major sources of upper-class wealth, real estate and stocks, basically collapsed.

There’s even worse news for the super-rich: this study was done before two major sources of upper-class wealth, real estate and stocks, basically collapsed.

Looking at the other end of the income spectrum, the study revealed that “roughly half of taxpayers who began in the bottom income quintile in 1996 moved up to a higher income group by 2005.”

Reading studies about the rich losing income must be like porn for progressives.

Reading studies about the rich losing income must be like porn for progressives.

Isn’t that exactly how the economy is supposed to work? Why do people keep trying to make us believe that the system is broken?

When the rich stumble, others are all too willing to take their place. Consider this: Of the 400 wealthiest people on the Forbes 400 list in 1982, only 32 of them are still there today. That means there are 368 newbies on that list . . . and yet we’re supposed to believe the lie that the American dream is dead?

When the rich stumble, others are all too willing to take their place. Consider this: Of the 400 wealthiest people on the Forbes 400 list in 1982, only 32 of them are still there today. That means there are 368 newbies on that list . . . and yet we’re supposed to believe the lie that the American dream is dead?

It is true that, because of huge income gains by the very wealthy over the last three decades, the gap between the jet-set crowd and the poor has widened, but even that is not as malicious as it sounds. It’s actually more of a consequence of mathematics than of economics.

Let me explain with an example. Assume there are two twin brothers and the year is 1989. One brother is making $40,000 a year as an electrician and the other earns $100,000 as an executive. Now, fast-forward twenty years to 2009. The wealthier brother is now making $110,000 a year and the electrician is now making $44,000. Both brothers increased their incomes by exactly ten percent, but the difference in salaries has widened from $60,000 to $66,000 a year.

What’s on your iPod, BARACK OBAMA?

• Take the Money and Run, Steve Miller Band

• Eat the Rich, Aerosmith

• All at Once, Whitney Houston

• Livin’ on a Prayer, Bon Jovi

Given that scenario, the headline from the media would likely be: GAP BETWEEN RICH AND POOR WIDENING! Okay, sure, that’s technically true . . . but does that really tell the whole story? Both brothers increased their incomes at the same rate and, more important, both are now richer than they were twenty years ago.

That is how badly things have been twisted in America. No longer is it good enough for a rising tide to lift all boats, the tide must lift the smaller boats more than the mega-yachts for some people to be happy.

The truth is that the bottom twenty percent of earners in 1996 saw their incomes rise by an average of 233 percent by 2006. That is a far higher gain than any other income group and it should tell us (if it were ever publicized) that Americans don’t stay poor for long. This is still the land of opportunity!

And for progressives to be happy, the tide has to lift all of the small boats and then turn into a massive tsunami that destroys only the mega-yachts.

And for progressives to be happy, the tide has to lift all of the small boats and then turn into a massive tsunami that destroys only the mega-yachts.

Other studies have verified the Treasury’s findings. The Congressional Budget Office confirmed that, from 1994 to 2004, Americans in the bottom twenty percent of income had higher increases in income than any other group. A second study by the Treasury Department found the same thing. It’s amazing but the richer a person is at any given point in time, the smaller their subsequent income gains generally are.

Why aren’t any of these facts more widely known? Because they’re buried. After all, if people understood that existing policies help the poor get richer, they wouldn’t be able to make the argument for more progressive taxes and massive increases in government power under the guise of “righting the injustices” of our system.

Those, of course, are the immortal words of America’s favorite family entertainer, Kanye West. If you don’t know (and really, how could you not?), he’s the super-talented artist behind the hit song “Gold Digger.” C’mon, you know the one, sing along with me . . .

If you ain’t no punk holla we want Prenup—WE WANT PRENUP! Yeah, it’s something that you needs to have, Cause when she leave yo a**, she gonna leave with half.

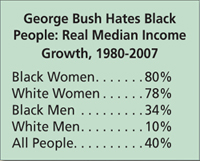

Reading those lyrics (believe me, they’re going to be in your head all day now), I can’t for the life of me think of one good reason why we wouldn’t turn to Kanye for insightful political commentary—but I bet that even he couldn’t guess which demographic group has made the largest income gains over the past twenty years. (Hint: It wasn’t white, wealthy males.)

While doing media interviews for his new book, Kanye said, “I am a proud non-reader of books.”

While doing media interviews for his new book, Kanye said, “I am a proud non-reader of books.”

It was African-American women.

Their earnings rose 80 percent versus an increase of 40 percent for everyone else. Oh, and the worst-performing group? White men. Sorry, Kanye, back to the baseless-racist-accusation drawing board.

Why not just raise the tax rate on the rich who supposedly benefited so much from the economic expansion? After all, they can afford to pay more. If we raise their rates to 40 or 50 percent, how much harm can it really do? The very rich will just have to stock fewer bottles of Dom Pérignon in their wine cellars.

Sounds like great logic except for one big, inconvenient problem. Before we drench the rich with taxes, there is something we need to know: about two-thirds of them are small-business owners and operators. They are the people who create jobs and write the paychecks that keep millions of American families going. They are also the people who will be hurt most by jacking up the top tax rates.

The Tax Foundation calculated that simply restoring the top tax brackets to the rates that were in place during the Clinton years would negatively impact 45 to 55 percent of small-business income. Do you think owners will just accept that loss of net income, or do you think that perhaps they might try to cut expenses . . . like salaries?

The question I always ask people who make this argument is a simple one: How can you create jobs by taking more money away from the people who do the hiring? I’m still waiting to hear a good, logical answer.

If New York doesn’t care about the tax revenue from Limbaugh, then someone should ask the governor why, according to Limbaugh, they’ve audited him for twelve straight years . . .

If New York doesn’t care about the tax revenue from Limbaugh, then someone should ask the governor why, according to Limbaugh, they’ve audited him for twelve straight years . . .

Finally, a good question! Unfortunately, you’ve fallen prey to the tax myth. The way this one goes is that, prior to President Obama riding into the White House on a white horse, all essential government “investments” were basically neglected. Hate-mongering conservatives spent years cutting taxes as an ugly plot to “starve the beast” of government, resulting in a severe decline of federal revenues that forced us to neglect important priorities, like caring for sick children. According to the myth, the only way out of this mess is to now “reinvest” in all the vital programs that were starved for funding from 2001 to 2008.

It’s a great story, but it’s just that, a story.

Federal spending before the Obama administration took over expanded from $1.8 trillion in 2000 to $3 trillion in 2008. That’s a 66 percent increase in just eight years. Raise your hand if you saw your income grow by 66 percent over that time.

Now, quick, put it back down before someone from the Obama administration sees you.

Now, quick, put it back down before someone from the Obama administration sees you.

The chart below compares government spending in some major areas that we are continually told need more funding. The total inflation rate over this period was 22 percent. But transportation spending was up 43 percent. Health-care spending was up 46 percent. The Department of Education budget was up more than 85 percent. Welfare spending was up 60 percent.

What’s on your iPod, TIMOTHY GEITHNER?

• Tax Man, Beatles

• Been Caught Stealing, Jane’s Addiction

• Money for Nothing, Dire Straits

• Money’s Too Tight to Mention, Simply Red

It looks to me like the people who have been the most greedy were the lobbyists, politicians, and Beltway bureaucrats who run these programs—most of which grew by four, five, or six times the rate of inflation! If that is neglect, I’d hate to see what happens when our politicians really start spending.

Have you noticed that government subsidies, giveaways, and pork projects have suddenly now become known as “investments”? Aren’t you just tickled pink that your tax dollars went to pay for such vital national investments as Old Tiger Stadium Conservancy in Detroit, Pleasure Beach water-taxi service in Connecticut, and Dance Theater Etcetera in Brooklyn?

Remember, all of these figures are from before the Obama torrent of spending began. In 2009, the average federal program saw an increase of 48 percent! That’s more than 30 times the rate of inflation. And while Bush deserves much of the blame (his last budget pegged 2009 spending at $3.1 trillion), President Obama has taken things to a whole new stratosphere. His latest estimates put 2009 spending at $4 trillion, an increase (of $900 billion) that is larger than the economies of Norway and Austria . . . combined.

Is it any wonder that we are losing jobs in manufacturing, business services, construction, wholesaling, financial services, but we are gaining jobs in government?

Since 2007, the only three sectors of the economy that have created jobs are (1) government, (2) education, and (3) health care. Of course, education and health care are practically adjuncts of government at this point anyway, but let me ask the obvious question: Somebody has to pay for these government jobs, right?

Of course—and they’re being paid for with tax dollars. But if we aren’t creating private jobs so that the overall tax base increases, then where is the money coming from? After all, we can’t have everyone sitting inside the wagon; we still need some people available to pull it.

From April 2008 to April 2009 the private sector lost 5.4 million jobs. But the public sector? They added 162,000 jobs. I guess it helps to have a blank taxpayer check available to make payroll with.

Remember the mythical Tooth Fairy that we always looked forward to? Guess what . . . she really exists. Her name is Nancy Pelosi and, while she may not look like you expected, she is just as generous. Except, she doesn’t hand out quarters, she hands out billion-dollar checks, courtesy of the U.S. government. Oh, and the money doesn’t go to good little children, but to the good little lobbyists and union leaders that leave her favors under their pillows.

Remember when President Obama somehow kept a straight face and said, “That’s why I’ve charged the Office of Management and Budget . . . with going through the budget—program by program, item by item, line by line—looking for areas where we can save taxpayer dollars”? Given their results, I’m sure glad we haven’t put those guys in charge of looking for anything we were actually hoping to find.

Remember when President Obama somehow kept a straight face and said, “That’s why I’ve charged the Office of Management and Budget . . . with going through the budget—program by program, item by item, line by line—looking for areas where we can save taxpayer dollars”? Given their results, I’m sure glad we haven’t put those guys in charge of looking for anything we were actually hoping to find.

As I flip through President Obama’s budget—which is as thick as the Manhattan phone book—and I observe the 9,000 subsidy programs that give money to Harry and take more from Louise—all I really see is more and more spending for nearly every government program imaginable.

When I hear people talk about the “multiplier effect” I feel like they believe government is the elusive perpetual economic motion machine that scientists have been trying to invent for centuries. It’s not. In fact, there is a lot of evidence to suggest that there is no multiplier effect at all; that every dollar in government spending results in less than a dollar being added to our GDP.

Noted Harvard economist Robert Barro looked at federal spending and corresponding GDP growth during World War I, World War II, Korea, and Vietnam. In each case he found the “multiplier” to be exactly the same: 0.8. In other words, for every dollar our government spent, $0.80 was added to our GDP. Even worse, Barro thinks that wartime spending probably increases the multiplier . . . it’s likely even lower when you try to spend your way out of a recession.

I’m pretty sure I know why Robert Barro isn’t on Obama’s Presidential Council of Economic Advisors.

I’m pretty sure I know why Robert Barro isn’t on Obama’s Presidential Council of Economic Advisors.

Remember the stimulus bill, with its $787 billion price tag and money for the National Education Association, unemployment insurance, windmills, new cars for federal bureaucrats, and the like? When you put that spending on top of the regular operating budget, you find that spending for the average government agency increased by about 50 percent. In other words, at a time when families were pulling back on their spending and suffering through a deep recession, Uncle Sam was living higher on the hog than ever before.

If you haven’t figured out my point by now, it’s that the answer to how we can balance the budget without burying the rich in taxes is easy: We have to balance the budget. In other words, we’ve got to bring our spending side—which I’m pretty sure I’ve proven is completely out of control—down to match our revenues, not the other way around.

The government had so much money to spend in 2009 that it actually contemplated allocating $5 million for the care of cats and dogs . . . in foreign countries. No one in Washington seems to care though, because $5 million is nothing but a rounding error in the $108 billion that President Obama wants to give to the International Monetary Fund (IMF) in foreign aid this year. (In fact, he wanted the IMF to have the money so bad that he was willing to compromise the security of our troops by agreeing to release torture photos in exchange for votes). Maybe those in the Capitol haven’t received the memo yet, but we should be on the receiving end of that foreign aid.

“This nation must come to grips with the repercussions of recent fiscal irresponsibility.”

—Charlie Rangel, 2007

“When it comes to deficits, this president owns all the records. The three largest deficits in our nation’s history have all occurred under this administration’s watch.”

—Harry Reid, 2006

“After years of historic deficits, this 110th Congress will commit itself to a higher standard: pay-as-you-go, no new deficit spending. Our new America will provide unlimited opportunity for future generations, not burden them with mountains of debt.”

—Nancy Pelosi, 2007

• Impulsive, Wilson Phillips

• Let’s Go Crazy, Prince & The Revolution

• Shakedown, Bob Seger

• All I Need Is a Miracle, Mike & The Mechanics

We now know that a major trigger point for the recession was too much spending that we couldn’t afford. Households accumulated too much credit-card and mortgage debt. Businesses took on too much leverage (think of Bear Stearns with its debt-to-asset ratio of more than 35-to-1). And the federal government took on more debt than any other institution in the history of the world.

Here’s a dirty little secret you won’t hear from Nancy Pelosi or Barack Obama, who in June 2009 renewed Nancy Pelosi’s 2007 call for “pay-as-you-go” budgeting to be used in Congress: It applies only to new entitlement programs or expansion of current ones. In other words, programs like Medicare are exempt, along with all discretionary spending. But the saddest part of all is that, even with all of those exceptions, our politicians still can’t stick to it.

We also know that most of this debt was used to finance absurdly wasteful spending: Individuals bought televisions, vacations, cars, and granite countertops; the government bought entitlement expansion, wars, and federal bailouts.

Maybe I need some advanced degree in economics from the People’s Republic of Harvard or a Nobel Prize to understand this, but if excessive debt caused the economic crisis, then how is more debt supposed to get us out of it? Is the idea to borrow more and more money to pay off all the people we borrowed money from over the last twenty years? If so, then isn’t that exactly what got Bernie Madoff thrown into prison for 150 years?

It’s ironic that when individuals rob Peter to pay Paul they end up having to be careful in the shower, yet when the government runs the same kind of Ponzi scheme, we call it an “economic stimulus.” No wonder Washington is called “America’s only work-free drug zone.”

Sorry, no. As Burt Folsom has proven in his book New Deal or Raw Deal, FDR’s economic-recovery plan was an absolute bust. Federal spending as a share of GDP more than doubled in the 1930s, but the unemployment rate stayed high throughout the decade. Shouldn’t all of that money have created lots of new (non-government) jobs?

By 1940, eight years after the New Deal was launched, the U.S. unemployment rate was still hovering around 15 percent. Wow, that is some success story! To put that into perspective, it would be like the United States having a 15-percent unemployment rate in 2016 and everyone celebrating the success of Obamanomics.

Even Henry Morgenthau, FDR’s own Treasury secretary, acknowledged that the blizzard of government spending didn’t create new American jobs. Testifying in front of the House Ways and Means Committee in 1939, Morgenthau said, “We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest, and now if I am wrong . . . somebody else can have my job. I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. We have never made good on our promises . . . I say after eight years of this administration, we have just as much unemployment as when we started . . . And enormous debt to boot.”

I guess Tim Geithner was too busy not paying his taxes to heed Morgenthau’s advice.

Believe it or not, during the New Deal, the federal government actually burned fields of crops in order to reduce the supply of food and keep prices high so that farmers’ incomes would also stay high. (No, I’m not making this up.) Meanwhile, as the government was destroying crops, cities were filled with tens of thousands of Americans who were going to bed hungry each night thanks to a lack of jobs and cheap food.

Japan tried eight—yes, eight fiscal-stimulus plans in the 1990s and early 2000s to end their nearly two-decade-long depression that began in 1991. They basically paved over the whole island with public-works programs and then started paving over the ocean (literally) to build “the world’s most expensive airport” once they got done with that.

What was the result of all that borrowing and “broken- window” (i.e., you break all of the windows in a house and then pay someone to fix them) stimulus spending? In 1991, the Japanese Nikkei stock index stood at 30,000. By 2007, after spending the equivalent of at least $1.4 trillion (in today’s U.S. dollars) on stimulus packages, the Nikkei was at 12,000. After 16 years of government pump priming, sixty percent of the country’s financial wealth had disappeared.

• Smooth Operator, Sade

• F**k It, Eamon

• Money Changes Everything, Cyndi Lauper

• The Real Slim Shady, Eminem

But, sure, by all means, why wouldn’t we want to emulate that model?

The modern-day equivalent of “broken-window” stimulus is “green jobs.” We invent a crisis and then spend billions on finding a way to solve it.

The modern-day equivalent of “broken-window” stimulus is “green jobs.” We invent a crisis and then spend billions on finding a way to solve it.

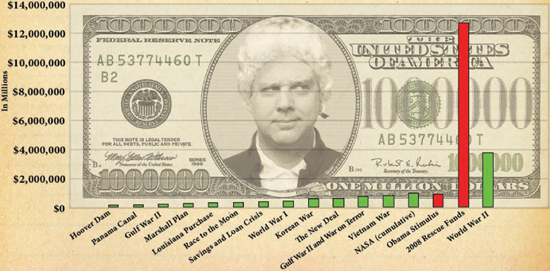

Given the obvious failure of big-spending programs in the past, we have good reason to be worried about the current one. This chart shows the “stimulus plan” in comparison to other major spending initiatives throughout American history—adjusted for inflation. The stimulus is number one. By far. It is larger than the Marshall Plan, the Apollo plan to put a man on the moon, the Louisiana Purchase, the Civil War, Reconstruction, or World War I. In fact, we’ve spent more money to fight this recession than America spent to defeat the Nazis and Japanese in World War II.

Over the next ten years the Obama budget chains America to a future of $15 to $16 trillion of debt. That is obviously unsustainable and will unquestionably lead to inflation and a declining U.S. dollar. No nation in history has ever devalued its way to prosperity, but U.S. policymakers are giving it their best effort. During the Bush years, the dollar fell relative to virtually every other major currency and, in late 2007, it reached a new symbolic and ignominious low, falling below the Canadian dollar in value for the first time ever.

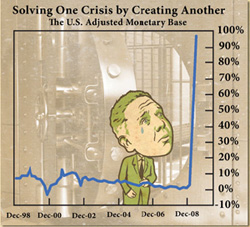

If you think I’m exaggerating the crisis (I know, I have that reputation for some reason . . . ) then look at how our government is financing all of its debt: The chart below (Solving One Crisis by Creating Another) shows the money supply over the past ten years. It was consistently stable . . . until about the summer of 2008 . . . and then all hell broke loose.

You don’t have to have a Ph.D. in Obamanomics to understand what the inevitable consequence of this will be: Say hello to my little friend inflation.

After World War I, Germany’s inflation got so bad because of their debt that people had to fill wheelbarrows with cash just to have enough money to buy groceries. Here’s a tip: Invest in wheelbarrows now, while they’re still affordable!

No one knows for sure how much the government has spent so far to “stimulate” the economy—after all, who can count that high?—but if you add up the cost of all the bailout plans, stimulus measures, debt measures, and all the spending by the Federal Reserve Bank to buy up bad assets, the figure is near $3 trillion.

President George W. Bush and his Treasury secretary, Hank Paulson, said that if we didn’t bail out the banks and big investment houses, like Bear Stearns and AIG, the economy would collapse like a house of cards. So, they asked for about $1 trillion in new spending and our Congress—frightened, confused, or both—agreed.

When Barack Obama was elected, the economy was still headed south and we were told that another trillion in spending and bailouts was essential. In addition, the Federal Reserve Bank—made up of unelected officials who helped usher in the crisis, through policies that encouraged excessive money creation—decided to intervene on their own and spend another trillion.

Saying that we had to unleash all of that debt to prevent the economy from collapsing is a little like what the barbarians used to say when they ransacked Europe: “We had to burn the cities—in order to save them!” It’s a great line for another reason as well: There’s no way to disprove it.

We can, however, look at specific spending programs and measure their effectiveness. The federal government has already committed over $80 billion to bailing out GM, Chrysler, and GMAC. That’s $80 billion to save roughly 320,000 jobs.

To put that into perspective, we could have given every worker at these companies a $250,000 check and it would have been cheaper than all these bailouts. And that’s assuming that $100 billion is the end of it—which is probably a bad assumption unless you think that Uncle Sam and the United Auto Workers are somehow going to produce profitable cars.

My point is that we are wasting money on such a massive scale that we’ve lost any sense of reality. The $787 billion we spent on the “stimulus” plan is supposed to create three and a half million jobs. Good luck, but if that does somehow happen it would mean a cost to taxpayers of about $225,000 per job. Again,

I know it’s a rhetorical question, but couldn’t we have just given three million unemployed people that money and called it a “stimulus”?

As part of the “stimulus” we also earmarked tens of billions of dollars for increased unemployment insurance. How, exactly, does paying people not to work create more jobs?

As part of the “stimulus” we also earmarked tens of billions of dollars for increased unemployment insurance. How, exactly, does paying people not to work create more jobs?

So why hasn’t the economy roared back to life in response to all of this vital spending? Simple . . . because government money doesn’t appear out of thin air, it has to come from one of three places:

• Little Lies, Fleetwood Mac

• Out of Touch, Hall & Oates

• We Didn’t Start the Fire, Billy Joel

• Burning Down the House, Talking Heads

1. Taxes. The government can take the money right out of your wallet and magnanimously give it to someone else. But redistribution is not stimulus . . . the net effect on the economy is basically zero.

2. Borrowing. “Please, China, can we have some more?” When we borrow, we put one dollar into the economy, but we also add a dollar, plus interest, to our liabilities. That’s a net decrease in future growth.

3. Printing. The government can always call up the Treasury and tell them to keep printing those $100 bills, 24/7. But when the government prints an additional dollar, every dollar that you and I have in our wallet or our savings account is worth a tiny bit less. Supply and demand, right? So printing money is just a way of taxing people without their permission and it results in no positive economic growth.

The point is that government spending as an economic stimulus is an illusion. We don’t create any new wealth or jobs, we just redistribute money from people who pay taxes or hold dollars to people who helped our politicians get elected.

Among the biggest donors to the Democratic Party in the 2006 and 2008 election cycles were the unions. Guess who wound up getting most of the money from the stimulus plan? Guess who gets the Chrysler bailout money? Guess who gets all that education money that is supposed to be “for the kids”? Yep, the unions, the unions, and the unions.

Should that be called “stimulus,” or “payback”?

First of all, there have been no real “Republican” economic policies in place for a long, long time (unless you think that massively expanding entitlement programs is right out of the Reagan playbook). Yes, President Bush cut taxes, and yes, cutting taxes is what Republicans generally want—but Bush missed a key part of the equation: cutting spending as well. Cutting taxes while increasing spending is not a Republican economic theory . . . because it simply doesn’t work.

If President Obama, Tim Geithner, Ben Bernanke, and Hank Paulson were the people I was relying on to help me get sober, I’d probably still be a raging alcoholic. On my first day of recovery, as I walked in smelling like Jack Daniels, they’d probably each hand me a fifth and tell me that drinking more is the only way I’ll ever feel better.

Second, I will never defend a party, because I don’t believe in them anymore . . . but when someone tries to convince you that the answer to excessive spending and debt is obscene levels of spending and debt, I think you have a responsibility to say, “No . . . enough is enough.”

But let’s suspend our disbelief for a moment and accept the notion that the government had to do something. Here is an amazing but true statistic: Instead of spending $3 trillion on bailouts to homeowners, banks, insurance companies, Wall Street executives, and car companies, what if we had simply suspended the personal- and corporate-income taxes for a year until the economy got better? In 2008, the personal- and corporate-income tax raised about $1.45 trillion.

In other words, we could have told every business and every worker in America: You don’t have to pay income tax this year if you work, if you invest, if you earn a profit, if you expand your business and hiring. You keep it all. Can you imagine how fast our economy would have grown under that scenario? We would have had more jobs than people to fill them!

So why didn’t we suspend the tax . . . even for a few months as a “stimulus”? Simple, because cutting taxes for everyone doesn’t allow you to do special favors or properly “redistribute” income. That’s why we have rebate checks that are skewed toward the poor. They tell us it’s because the poor are more likely to spend them . . . but the truth is that we do it that way because it fits the progressive Robin Hood agenda.

When Ronald Reagan entered the White House in 1980, his message to voters was plain and simple: Big government is the problem, not the solution.

At the time, federal spending was at just over $500 billion. Now the budget is $4 trillion—a sevenfold increase. Even after adjusting for inflation, federal outlays have increased over 250 percent since 1980.

But let me be very clear, this isn’t about the donkey or the elephant, both parties are to blame for the situation we now find ourselves in. In fact, I think you can make a good case that the Republicans deserve your anger more than the Democrats. At least most Democrats have been fairly honest about their progressive agenda—Republicans have shredded our Constitution while smiling and pretending that they actually care about the principles our Founders stood for.

It’s not just the federal government that was spending like Keith Olber-mann at a Shakespeare festival—state and local governments were as well. Since 1960, state and local spending is up 495 percent (after inflation)! Spending totaled about $367 billion back then (in 2008 dollars) . . . it’s $2.2 trillion now.

The thing that’s unleashed the federal leviathan the most since our founding is the concept of entitlements. In 1933, the modern entitlement state was born in the form of the federal government’s first and most expensive income transfer program: Social Security. In the 1960s, LBJ launched the Great Society, creating a whole new menu of entitlement programs, chief among them Medicare, Medicaid, food stamps, public housing, and Aid to Families with Dependent Children (AFDC).

Once created, these redistribution programs were virtually impossible to restrain. It wasn’t long before people began to feel like they were in the minority if they weren’t taking advantage of some free government program. It got so bad that, twenty years ago, author Matthew Lesko (aka “the guy who wears the question-mark suits”) started writing bestselling books chronicling the thousands of federal programs and agencies that gave out “free” money.

When Medicare was created it was estimated to cost about $12 billion by 1990. The actual cost? $107 billion—proving once again that government cost estimates are about as accurate as Iranian vote counts.

There are a lot of ways you can be known in life, but it’s hard to pick one worse than “the guy who wears the question-mark suits.”

There is a lot of truth to the adage that a system that robs Peter to pay Paul can always count on Paul’s support. Unfortunately, if Peter ever decides that he’s sick of being robbed and leaves the country, the whole scam falls apart.

• Tiny Bubbles, Don Ho

• Saved by Zero, The Fixx

• Don’t Dream It’s Over, Crowded House

• No One Is to Blame, Howard Jones

40 percent of American households now not only don’t pay any federal income tax, but actually get money back from the government every year. That makes it awfully hard to pass fiscally responsibly policies. But what happens when that number gets to 50 percent? At that point, the only way you’d ever convince the country to lower taxes and cut government programs would be to convince the 50 percent of people who don’t pay taxes to stay home on Election Day. Or, since we’re shredding the Constitution anyway, why not just restrict voting to those who pay income tax? I’m just thinking out loud here . . .

40 percent of American households now not only don’t pay any federal income tax, but actually get money back from the government every year. That makes it awfully hard to pass fiscally responsibly policies. But what happens when that number gets to 50 percent? At that point, the only way you’d ever convince the country to lower taxes and cut government programs would be to convince the 50 percent of people who don’t pay taxes to stay home on Election Day. Or, since we’re shredding the Constitution anyway, why not just restrict voting to those who pay income tax? I’m just thinking out loud here . . .

How much of a welfare state have we become? One of every six dollars of Americans’ income is now a federal or state check or voucher. In 2009, the government will spend an average of $17,000 on each U.S. household, meaning that the government is funding more of Americans’ income that any time since we started keeping records in 1929.

For an even more stark illustration of government creep, consider that, in 1900, total federal, state, and local expenditures were $33 billion. Now? Americans support a nearly $3 trillion government, an increase of almost 10,000 percent!

Fair point! So instead of looking at it in dollar terms, let’s look at the size of government relative to the size of the economy. Would that be okay with you?

In 1900, the federal government consumed less than 5 percent of total economic output.

In 1900, the federal government consumed less than 5 percent of total economic output.

In 1950, the federal government consumed roughly 15 percent of total output.

In 1950, the federal government consumed roughly 15 percent of total output.

In 1999, the federal government consumed roughly 19 percent of total output.

In 1999, the federal government consumed roughly 19 percent of total output.

In 2009, the federal government will spend 28.1 percent of total output . . . and climbing.

In 2009, the federal government will spend 28.1 percent of total output . . . and climbing.

Happy now?

It’s really pretty simple: More government means less personal freedom. As economist Walter Williams of George Mason University has noted, if the government can lay claim to half of the fruits of our labor, then we are truly at most only half-free.

But now, even after allocating $10.5 trillion on direct and indirect stimulus ideas over the last two years, we still have a $6 trillion national debt (climbing to $16 trillion with the new ten-year budget) and we face another $50 trillion in unfunded liabilities for entitlement programs like Social Security and Medicare. Are we even really “half-free” or is that just wishful thinking?

There are only two problems with the Social Security trust fund. First, there’s no trust. And second, there’s no fund. In 2009, the outflow for Social Security was $675 billion and the inflow was $655 billion. That’s a negative $20 billion cash flow. Oops. Thanks to the recession, payroll tax receipts are way down because fewer people are working. We’ve sunk into red ink almost ten years ahead of schedule.

So now, Social Security appears to be contributing to the massive $1.8 trillion deficit, rather than helping to reduce it. That means we now have two deficits: the operating budget and Social Security budget. Add in Medicare and we’ve got our third . . . though it’s definitely not the charm.

In other words, the government has cost us our freedom by putting us into financial shackles. If you have a job now, that’s great—but that shouldn’t make you feel confident about the future. After all, it’s that kind of short-term-pleasure-over-pain thinking that got us here.

We’ve got a lot of work to do to rebuild our economy and regain our freedom, but here are a few steps:

Get the government out of the way.

Get the government out of the way.

Make the dollar as good as gold again.

Make the dollar as good as gold again.

Pay your bills.

Pay your bills.

Balance your budget.

Balance your budget.

Audit every federal agency and find all the waste that can be cut.

Audit every federal agency and find all the waste that can be cut.

Make sure our taxes pay for only the essentials of government, not the frivolous and extravagant.

Make sure our taxes pay for only the essentials of government, not the frivolous and extravagant.

Don’t allow those who are beneficiaries of the “frivolous and extravagant” to decide what the definition of “essential” is.

Don’t allow those who are beneficiaries of the “frivolous and extravagant” to decide what the definition of “essential” is.

Ensure our politicians put America’s future over their own by instititing term limits at all levels.

Ensure our politicians put America’s future over their own by instititing term limits at all levels.

Government is, in the memorable words of President George Washington, “a fearsome master.” So how have we permitted it to grow so far beyond its constitutional boundaries? Easy: We’ve let Congress rewrite the Constitution virtually every day it is in session without an ounce of oversight from the fourth, and most important branch of government: “We the People.”

Members of Congress are sworn to uphold the Constitution, but most seem to be as familiar with its contents as they are with the thousand-page bills they vote for in the middle of the night. Shame on them for trampling the vision of our Founding Fathers for their own selfish gain.

Shame on us, for letting them.