Chapter Four

Volume Price Analysis - First Principles

[On the continual learning in share investing] Wherever learning curves begin in this mercurial business, they never seem to end.

John Neff (1931-)

In this chapter I want to start with some basic tenets for Volume Price Analysis VPA, but first of all, let me set out what I believe are the guiding principles in order to be consistently successful as a trader using this approach. I must stress, these are the principles I use every day, and have been developed over 20 years, since I first started using this technique based on Albert's teaching. Despite the cost and surreal experience, I am eternally grateful to Albert for setting me (and my husband David) on the right trading road. And I hope this book will do the same for you.

These are not rules, but simply guiding principles to help put the rest of what you are about to learn into context. And just as an aside, for the remainder of the book I will be referring to Volume Price Analysis as VPA – it's quicker and easier for you, and for me.

Principle No 1 : Art Not Science

The first principle to understand is that learning to read charts using VPA is an art, it is not a NOT a science. Moreover, it is not a technique that lends itself easily to automation or software. Although it does take a little while to become proficient, you will be rewarded for your effort and time. It can then be applied to any instrument in any market in any time frame. The reason software does not work with VPA, is simply because most of the analysis is subjective. You are comparing and analysing price behaviour against the associated volume, looking for confirmations or anomalies, whilst at the same time, comparing volume to judge its strength or weakness in the context of volume history.

A software program, does not have any subjectivity in its decision making. Hence it can never work.

The other advantage is that once you have learnt this technique, it is effectively free to use for life. The only cost is any data feed you may need for the live volume, and your investment in this book.

Principle No 2 : Patience

This principle took me some time to learn, so I hope I can save you a huge amount of wasted effort here.

The financial market is like a super tanker. It does not just stop and turn on a dime or sixpence. The market always has momentum and will almost always continue beyond the candle or candle pattern which is signalling a potential reversal or an anomaly. When I first started, I always became very excited whenever I saw a trading signal, and would enter a position immediately, only to see the market continue on for a while before the signal was validated with the market duly changing course.

The reason for this is very simple to understand once you begin to think about what is happening in each price bar, and in terms of the reality of the market. So, let me use an analogy here to help illustrate this point.

The analogy is of a summer shower of rain. The sun is shining, then there is a change, the clouds blow in, and in a few minutes the rain begins to fall, lightly at first, then heavier, before slowing again, and finally stopping. After a few minutes the sun comes out again, and starts drying up the rain.

This analogy gives us a visual picture of what actually happens when a price reversal occurs. Let's take an example of a down trend where the market has been selling off over a period of several down candles. At this point we begin to see signs of potential buying coming into the market. The sellers are being overwhelmed by the buyers. However, they are NOT all overwhelmed immediately within the price action of the candle. Some sellers continue to hang on, believing that the market is going to move lower. The market does move a little lower, but then starts to tick higher and some more sellers are frightened out of the market. The market then drops back lower once again, before recovering, and in doing so shakes out the more obstinate sellers. Finally, the market is ready to move higher having 'mopped up' the last remnants of selling.

The market rarely stops dead and reverses. It almost always takes time for all the sellers or all the buyers to be 'mopped up', and it is this constant whipsawing which creates the sideways congestion price zones we often see after an extended trend move, higher or lower. This is where price support and resistance become so powerful, and which are also a key element of VPA.

The moral here is not to act immediately as soon as a signal appears. Any signal is merely a warning sign of an impending change and we do have to be patient. When a shower of rain stops, it doesn't stop suddenly, it gradually peters out, then stops. When you spill something, and have to mop it up with some absorbent paper, the 'first pass' collects most of the spill, but it takes a 'second pass' to complete the job. This is the market. It is a sponge. It takes time to complete the mopping up operation, before it is ready to turn.

I hope I have made the point clearly. Please be patient and wait. The reversal will come, but not instantly from one signal on one candle. What I refer to as V shaped rallies and reversal do happen off one candle, but they are rare.

Principle No 3 : It’s All Relative

The analysis of volume is all relative and I only came to this conclusion once I stopped worrying about my volume feed. When I first started I became obsessed with trying to understand every aspect of the data. Where did it come from? How was the data collected? Was it accurate? How did it compare to other feeds? And was there something better that would give me more accurate signals, and so on. This debate continues to this day in the many trading forums with discussions centred around the provenance of the data.

After spending many months trying to compare feeds, I soon realised there was NOTHING

to be gained from worrying about minor imperfections or discrepancies. As I wrote earlier, trading and VPA is an art, not a science. Data feeds will vary from broker to broker and platform to platform thereby creating slightly different candle patterns. If you compare a chart from one broker with another of the same instrument and time frame, then the chances are you will have two different candlesticks. And the reason for this is very straightforward. It is because the close of the candle will depend on a variety of things, not least the clock speed on your computer, where you are in the world, and at what time during the session the closing price is triggered. They all vary.

Data feeds are complex in how they calculate and present the data to you on the screen. They all come from different sources, and are managed in different ways. Even those from the cash markets will vary, spot forex feeds even more so. But, it’s really not a big issue for one simple reason.

Volume is all relative, so it makes no difference as long as you are using the same feed all the time. This is what months of work proved to me.

This is why I lose patience with traders who say that tick data as a proxy for volume is only 90% accurate. So what? For all I care, it can be 70% accurate or 80% accurate. I am not interested in the 'accuracy'. All I am interested in is consistency. As long as the feed is consistent, then that's fine, because I am comparing my volume bar on my feed with previous volume bars, on my feed.

I am not comparing it with someone else's feed. I admit it did take time before it dawned on me that this common sense approach was perfectly valid.

Therefore, please don't waste as much time as I did. Volume is all relative because we are constantly comparing one volume bar with another, and judging whether this is high, low or average with what has gone before. If the data is imperfect, then it makes no difference whatsoever, as I am comparing imperfect data with imperfect data.

The same argument applies to tick data in the spot forex market. I do accept it is imperfect again, but we are only comparing one bar with another, and provided it is displaying activity, that's fine. It's an imperfect world and one we have to live and trade in. The free tick volume feed on a simple MT4 platform works perfectly – trust me. I've used it for years and make money every day using it. Furthermore it is provided, for free, by the broker.

Principle No 4 : Practice Makes Perfect

It takes time to become proficient in any skill, but once learnt is never forgotten. The trading techniques you will learn in this book work in all time frames, and are equally valid, whether you are a speculator or investor. As an investor you may be looking for a buy and hold over months, so will be considering the longer term charts of days and weeks, much like Richard Ney for example. Alternatively, you may be an intraday scalping trader using VPA on tick charts or fast time charts. So, take your time and don't be impatient. It is worth the time and effort you invest, and after a few weeks or months you will be surprised at how quickly you can suddenly start to interpret and forecast every twist and turn in the market.

Principle No 5 : Technical Analysis

VPA is only part of the story. We always use a variety of other techniques to confirm the picture and provide additional validation. The most important of these are support and resistance, for the reasons I outlined in Principle No 2. This is where the market is pausing and executing its 'mopping up' operations, before reversing. Alternatively, it may simply be a pause point in a longer term trend, which will then be validated by our volume analysis. A breakout from one of these regions of consolidation, coupled with volume, is always a strong signal.

Trends are equally important, as are price pattern analysis, all part of the art form which is technical analysis.

Principle No 6 : Validation or Anomaly

In using VPA as our analytical approach, we are only ever looking for two things.

Whether the price has been validated by the volume, or whether there is an anomaly with the price. If the price is validated then that confirms a continuation of the price behaviour. By contrast if there is an anomaly, then this is sending a signal of a potential change. These are the only things we are constantly searching for in VPA.

Validation or anomaly. Nothing else. And here are some examples of validation based on single bars, before moving onto multiple bars and actual chart examples.

Examples Of Validation

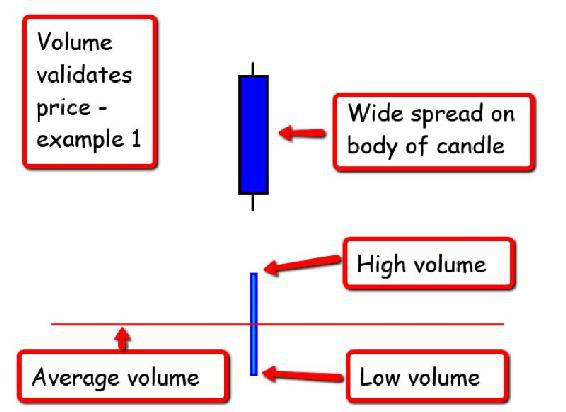

Fig 4.10

Wide Spread Candle, High Volume

In the example in Fig 4.10 of a wide spread up candle with small wicks to top and bottom, the associated volume is well above average, so the volume is validating the price action.

In this case we have a market which is bullish, and has risen strongly in the trading session closing just below the high of the session. If this is a valid move then we would expect to see the effort required to push the market higher reflected in the volume.

Remember, this is also Wyckoff's third law of effort vs result. It takes effort for the market to rise and also takes effort for the market to fall, so if there has been a large change in price in the session, then we expect to see this validated by a well above average volume bar. Which we have. Therefore, in this case the volume validates the price. And from this we can assume two things. First, the price move is genuine, and has not been manipulated by the market makers, and second, for the time being, the market is bullish, and until we see an anomaly signalled then we can continue to maintain any long position that we may have in the market.

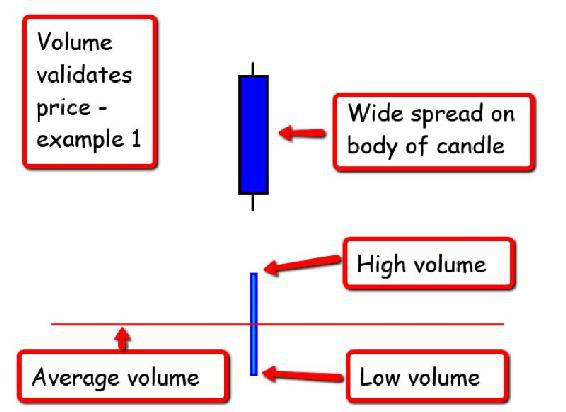

Fig 4.11

Narrow Spread Candle, Low Volume

Fig 4.11 is an example of a narrow spread candle accompanied by low volume. In this case the price has risen, but only marginally higher, and the spread of the candle is therefore very narrow. The wicks to the top and bottom are once again small. The associated volume is well below average, and again the question we have to ask ourselves is simple. Is the volume validating the price action, and the answer once again is yes? And the reason is again because of effort and result. In this case the market has only risen in price by a small amount, and therefore we would expect to see this reflected in the volume, which should also be low. After all, if effort and result validate one another, the effort required to move the market a few points higher (the result), should only warrant a small amount of effort (the volume). So once again, we have a true picture with the volume validating the price. Now let's look at these two examples again, but this time as anomalies.

Examples Of Anomalies

Fig 4.12

Wide Spread Candle, Low Volume

In Fig 4.12 we have our first anomaly which can be explained as follows. It is clear we have a wide spread up candle, and if we follow Wyckoff's third rule then this result, should be matched by an equal amount of effort. What we have instead is a big result, from little effort. This is an anomaly. After all for a wide spread up candle, we would expect to see a high volume bar, but here we have a low volume bar. Immediately the alarm bells start ringing, since something is not right here.

One question to ask is why do we have low volume when we should expect to see high volume. Is this a trap up move by the markets, or the market makers? Quite possibly, and this is where you can begin to see the power of such simple analysis. In one price bar, we can immediately see that something is wrong. There is an anomaly, because if this were a genuine move higher, then the buyers would be supporting the move higher with a high volume bar. Instead there is a low volume bar.

If we were in a long position in the market and this appeared, we would immediately start to question what is happening. For example, why has this anomaly appeared? Is it an early warning of a possible trap? This is a pattern which often occurs at the start of trading in equity markets. What is happening here is that the market makers are trying to 'feel out' the sentiment in the market. The above could be from a one minute chart for example. The market opens, then the price is pushed higher to test interest in the market from the buyers. If there is little or no buying interest, as here, then the price will be marked back down, with further price testing.

Remember from earlier in the book, the futures index markets will have already been trading overnight on Globex, giving the market makers a clear idea of bullish or bearish sentiment. All that is needed is to test out the price level at which to pitch the price for the opening few minutes. Not only is this done for the main index, but also for each individual stock. It is extraordinary how easy this is to see, and is instantly visible with volume.

This is why I cannot understand the attraction of price action trading. Without volume a PAT trader would have no idea. All they would see is a wide spread up candle and assume the market was bullish.

This is very easy to prove and all we need to do is to watch a couple of charts from the opening bell. Choose the main index, and a couple of stocks. The anomaly will appear time and time again. The market makers are testing the levels of buying and selling interest, before setting the tone for the session, with an eye on any news releases due in the morning, which can always be used to further manipulate the markets, and never allowing ‘a serious crisis go to waste’ (Rahm Emanuel). After all, if they were buying into the market, then this would be reflected in a high volume bar.

The volume bar is signalling that the market is NOT joining in this price action, and there is a reason. In this case it's the market makers in equities testing the levels of buying and selling, and therefore not committing to the move until they are sure buyers will come into the market at this price level.

The same scenario could equally apply in the forex market.

A fundamental item of news is released, and the market makers see an opportunity to take stops out of the market. The price jumps on the news, but the associated volume is low. Now let’s look at another example of an anomaly.

Fig 4.13

Narrow Spread Candle, High Volume

Once again this is a clear signal of a potential trap. The move higher is NOT a genuine move but a trap move, designed to suck traders into weak positions, and also take out stops, before reversing sharply and moving in the opposite direction. This is why VPA is so powerful and once you have learnt this skill will wonder why you never discovered it before. Volume and price together reveal the truth behind market behaviour in all its glory.

In the example shown in Fig 4.13 we can see a narrow spread candle with high volume which, once again, is another anomaly.

As we saw earlier in Fig 4.11, a small increase in the price (result), should only require a small increase in volume (effort), but this is not the case here.

The small price increase has been generated by a huge amount of volume, so clearly something is wrong. Generally, we would expect to see this height of volume bar, accompany a wide spread candle with the volume driving the price higher. But, in this case the high volume has only resulted in a very small rise in the price.

There is only one conclusion we can draw. The market is starting to look weak, and is typical of a candle pattern that starts to develop at the top of a bullish trend, or the bottom of a bearish trend.

For example in an established bullish trend the market opens, and starts to rise a little, but the buyers (longs) are now starting to take their profits, as they have been in this trend for while and feel that this is the right time to close out. However, as these positions are closed out, more eager buyers come in, (as most traders and investors always buy at the top of markets), but the price never rises as the longs continue to liquidate and take their profits, before more buyers come in, and the cycle repeats throughout the session.

What is actually happening is that the market has reached a price at which further effort does not result in higher prices, as each wave of new buyers is met with longs selling out at this level and taking their profits, 'off the table'. So there is no sustained move higher in price.

In other words, what this combination of price and volume is revealing is weakness in the market. If we were to imagine a profile of the volume bar in terms of selling and buying volumes, the buyers would just outweigh the sellers, reflecting the narrow price spread.

This is akin to driving up an icy hill which is gradually increasing in steepness. At the start we can still move higher, but gradually as we try to move up the hill we have to increase the power, eventually getting to a stage where we are on full power and standing still, as the wheels spin on the ice. Perhaps not a perfect analogy, but one which I hope makes the point and cements this idea in place. In our car analogy, we are now stationary, halfway up the hill, engine on full power, wheels spinning and going nowhere. What happens next is we start sliding backwards, gaining momentum as we go and mirrors what happened in the price action described. The market reached a point where no matter how much more effort is applied, is now resistant to higher prices, and the sellers are knocking back the buying.

The reverse, also happens after a trend run lower. In this case, it is the selling which is absorbed by the buying, and once again signals a potential reversal point as the market runs out of steam. After all, if the selling had followed through, then we would have seen a wide spread down candle, and not a narrow spread candle.

Moving on, this candle and volume relationship also raises another much deeper question, and here we go back to the insiders, and the market makers.

If we return to our bullish example again, with the narrow spread candle and the high volume, the question we might reasonably ask, is 'who is actually selling here?' Is it the investors and speculators, exiting the market after the trend run higher, or is it another group perhaps? Maybe it is the insiders and the market makers? Who is it more likely to be? After all, we know most investors and traders tend to buy at the top when in fact they should be selling, and sell at the bottom when they should be buying. Something which the specialists and market makers are well aware of in the psychology and make up of most traders and investors.

They also know this group is easy to frighten out of the market. Generally, they get in far too late after a bullish trend has been in place for some time, and only jump in when they feel it is safe, having watched the market move higher and higher, regretting the decision not to enter much earlier. As the late Christopher Browne once said ‘The time to buy stocks is when they are on sale, and not when they are high priced because everyone wants to own them'.

This sentiment applies to any instrument or market. Buying when ‘on sale

’ is always at the bottom of a trend, and not at a top.

'Missing an opportunity' is a classic trader (and investor) fear. The trader waits and waits before finally jumping in, just at the point when the market is turning and they should be thinking of getting out. This is what the insiders, specialists, market makers and big operators bank on, trader fear. Remember, they see both sides of the market from their unique and privileged positions.

Back to the question. The specialists have driven prices higher, but the market is now struggling at this level. They are selling to the market to clear their warehouse, but the buyers are not there in sufficient numbers to move the price higher, as it is constantly knocked back by longer term traders, selling out and taking their profits off the table. The specialists continue selling into the buying, but the volume of buyers is too small, in contrast to the number of sellers, to move the price significantly higher, as each attempt to push the market higher is hit with more selling, which in turn is replenished with more buyers.

What is actually taking place here is a battle. The first sign of a real struggle, with the specialists desperate to clear their warehouse before moving the market lower, and fast. The market is not receptive to higher prices, but the specialists cannot move the market lower until they are ready, and so the battle continues. I explain this in much greater detail later in the book. They maintain the price at the current level attracting more buyers in, who are hoping to jump into the trend and take some easy profits, but the sellers keep selling, preventing any real rise in price.

This is one of the many classic relationships to look for on your charts. As I have said many times before, this could be on a fast tick chart, or a slow time chart. The signal is the same. It is an early warning that the market is weak and struggling at this level, and therefore you should either be taking any profit off the table, if you have an existing position, or, preparing to take a position on any reversal in trend.

Moreover, it is important to remember just as a candle can have a different significance, depending on where it appears in the trend, the same is true with VPA.

When an anomaly occurs, and we will start looking at actual chart examples, the first point of reference is always where we are in the trend, which will also depend on the time frame. However, this is one of the many beauties of this type of trading analysis. For example on a 5 minute chart, a trend might be considered as one lasting an hour, or perhaps even two hours. Whereas on a daily chart, a trend could last for weeks or even months. Therefore, when we talk about a trend, it is important to understand the context of a trend. A trend is always relative to the time frame we are trading. Some traders only consider a trend to be valid if it is over days, weeks and months, the super cycles if you like.

I don’t subscribe to this view. To me a trend on a 1 minute or a 5 minute chart is just as valid. It is a price trend, which may be a short term pull back in a longer term trend, or it may be confirming the longer term trend. It makes no difference. All that matters is the trend is a trend in price. The price has moved the same way for some period of time, in that particular time frame.

Just remember. VPA applied to a 5 minute chart will yield just as many profitable and low risk trades as on a longer term daily or weekly chart. The analysis is the same.

The point I am making here is this – whenever we see an anomaly which sets the alarm bell ringing, the first step is to establish where we are in any trend. In other words, we get our bearings first. For example, are we at a possible bottom, where perhaps the market has been selling off for some time, but is now looking at a major reversal?

Or perhaps we are half way up or down a trend, and we are merely observing a minor pull back or reversal in the longer term trend. Deciding where we are in the trend is where we bring in some of our other analytical tools which then help to complement VPA and gives us the 'triangulation' we need.

In judging where we are in the trend, and potential reversal points, we will always be looking at support and resistance, candle patterns, individual candles, and trend lines. All of this will help to give us our 'bearings' and help to identify where we are in the price action on the chart. A perspective if you like, and a framework against which to judge the significance of our analysis of volume and price.

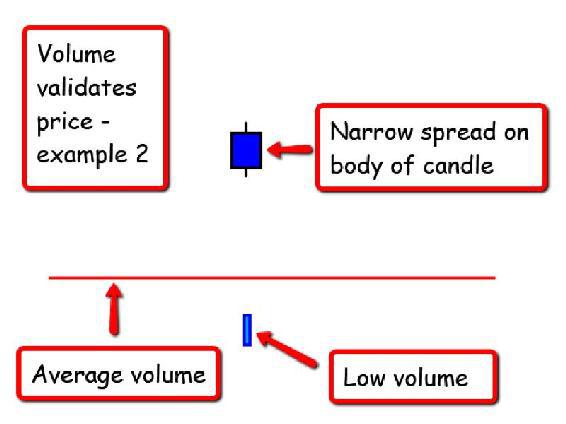

Multiple Candle Examples

Moving on, I now want to explain how we use VPA with multiple candles and volume, as opposed to single candles. The approach is identical as we are only ever looking for two things. Is the volume confirming the price action, or is this an anomaly?

Fig 4.14

Multiple Bar Validation In Up Trend

In the first example in Fig 4.14 we have a bullish trend developing in a rising market, and what is obvious is that rising prices are accompanied by rising volume.

This is exactly what we would expect to see and furthermore having multiple volume bars also gives us a 'benchmark history' against which to judge future volume bars.

If we were watching this price action live, this is what we would see happening on our chart. The first candle forms, a narrow spread up candle with low volume, which is fine. The volume validates the price, no anomaly here. The second candle then begins to form, and on close inspection we note the spread of this is wider than the first, and based on Wyckoff's rule, we expect to see greater volume than on the first bar, which is indeed the case. So the up trend is valid, the volume has validated the price on both candles.

By the time the third candle starts to form, and closes with a spread which is wider than both the first and the second, we should expect a volume bar which reflects Wyckoff's third law of effort vs result. The third law which states we have increased the result (price spread is wider than before) which should be matched by increased effort (volume should be higher than on the previous candle) – and so it is. Therefore, once again, the price action on the candle has been validated by the volume. But, in addition to that simple observation, the three candles themselves are now validating the price trend.

In other words, the price over the three bars has moved higher, developed into a trend, and the volume is rising and NOW validating the trend itself. After all, just as effort vs result applies to one candle, it also applies to a 'trend' which in this case consists of three candles. Therefore, if the price is moving higher in the trend, then according to Wyckoff's third law, we should expect to see rising volume as well. And this is the case.

The point is this. Effort vs result, applies not only to the individual candles we looked at earlier, but also to the trends which start to build once we put the candles together. In other words we have two levels of validation (or anomaly).

The first level is based on the price/volume relationship on the candle itself. The second level is based on the collective price/volume relationship of a group of candles, which then start to define the trend. It is in the latter where Wyckoff's second law of ‘cause and effect’ can be applied. Here the extent of the effect (price changes in trend) will be related to the size of the cause (the volume and period over which it is applied - the time element).

In this simple example, we have a very neat picture. The price action on each candle has been validated with the associated volume, and the overall price action has been validated by the overall volume action. This can all be summed as rising prices = rising volume. If the market is rising, and we see rising volume associated with the move, then this is a valid move higher, supported by market sentiment and the specialists. In other words, the specialists and insiders are joining in the move, and we see this reflected in the volume.

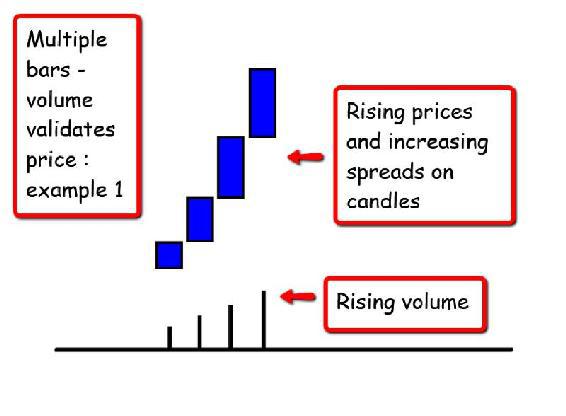

Fig 4.15

Multiple Bar Validation In Down Trend

I now want to examine the opposite, and look at an example where we have a market which is falling as shown in Fig 4.15.

In this case the market is moving lower, and perhaps this is where some of the confusion starts for new VPA students. As humans, we are all familiar with gravity and the concept that it takes effort for something to move higher. The rocket into space, a ball thrown into the air, all require effort to overcome the force of gravity. As traders, these examples of gravity are fine in principle when the market is moving higher, as in our first example. Where these examples using gravity fail, is when we look at markets which are falling, because here too we need rising effort (volume) for the market to fall.

The market requires effort to both rise AND

fall, and it is easier to think of in these terms.

If the specialists are joining in the move, whether higher or lower, then this will be reflected in the volume bars. If they are joining a move higher, then the volume will be rising, and equally

if they are joining a move lower, then the volume bars will ALSO

be rising in the same way.

This is Wyckoff's third rule again – effort vs result, and whether the price action is higher or lower, then this rule applies.

Looking at the four candles in the example in Fig 4.15, the first down candle opens and closes with a narrow spread. The associated volume is small, and therefore validates the price action. The next bar opens and closes with a wider spread, but with higher volume than on the previous candle, so once again the price action is valid.

The third candle opens and closes with higher volume, as we expect, and finally we come to our last candle which is wider still, but the associated volume is also higher than all the previous candles. Once again, not only has volume validated each individual candle, it has also validated the group of four candles as a whole.

Again we have two levels of validation. First, we check the individual candle and the associated volume for validation or anomaly. Second, we check to see a validation or anomaly in the trend itself.

One of the questions that hasn’t been answered in either of the above examples is this – is the volume buying or selling? And, this is the next question we always ask ourselves as the market moves along.

In the first example in Fig 4.14, we had a market that was rising nicely with the volume also rising to support the price action, so the volume here must all be buying volume. After all, if there were any selling volume this would be reflected somewhere in the price action.

We know this because there are no wicks on the candles, as the price moves steadily higher, with the volume rising to support the price action and validating the price. It can only be buying volume and a genuine move. Therefore, we can happily join in, knowing that this is a genuine move in the market for the time being. We join the insiders and buy.

But perhaps much more importantly – it is also a low risk trading opportunity. We can enter the market with confidence. We have completed our own analysis, based on volume and price. No indicators, no EAs, just price and volume analysis. It's simple, powerful and effective, and reveals the true activity within the market. Market sentiment is revealed, market tricks are revealed and the extent of market moves are also revealed.

Remember, there are only two risks in trading. The financial risk on the trade itself. This is easy to quantify and manage using simple money management rules, such as the 1% rule. The second risk is far more difficult to quantify, and this is the risk on the trade itself. This is what VPA is all about. It allows you to quantify the risk on the trade using this analytical technique, and when combined with all the other techniques you will learn in this book, is immensely powerful, and even more so when combined with analysis in multiple time frames.

As a result, you will become much more confident as a trader. Your trading decisions will be based on your own analysis, using common sense and logic, based on two leading indicators, namely price and volume.

To return to our second example in Fig 4.15 and the questions we ask ourselves here. Is the volume buying or selling, and should we join the move?

Here we have a market which is moving firmly lower, with the volume validating the candles and the overall price action. We have no wicks to any candles, and the market is falling with rising volume. Therefore, this must be a valid move and all the volume must be selling volume, as the specialists are joining in the move and selling. Market sentiment is firmly bearish.

Again, another low risk opportunity to enter the market, based on common sense, logic and an understanding of the price and volume relationship.

I now want to round off this chapter on the first principles of VPA by considering multiple candles with an anomaly. In the examples that follow, there is more than one anomaly, as we are considering the concept of VPA on two levels. The first level is that applied to each candle, the second level is to the overall trend.

Fig 4.16

Multiple Bar Anomalies In An Uptrend

Fig 4.16 is the first example, and here we have what appears to be a bullish trend, with the first narrow spread up candle accompanied by relatively low volume. This is fine as the volume is validating the price and is in agreement. The second candle then forms and on the close we have a slightly wider spread candle than the first, but with high volume.

From experience and looking back at previous bars, this appears to be an anomaly. With high volume we would expect to see a wide spread candle. Instead, we only have a candle which is marginally wider in price spread than the previous candle, so something is wrong here. An alarm bell is now ringing.

Remember Wyckoff's third law, effort vs result? Here the effort (the volume) has not resulted in the correct result (the price), so we have an anomaly on one candle, which could be an early warning signal, and we should be paying attention.

The third candle then forms, and closes as a wide spread up candle, but with volume which is lower than on the previous candle. Given the spread of the bar, it should be higher, not lower. Another warning signal.

The fourth candle then forms and closes as a very wide price spread up, but the volume is even lower. We now have several anomalies here, on candles two three and four.

Candle 2 Anomaly

This is an anomaly. We have a modest spread in price, but high volume. The market should have risen much further given the effort contained in the volume bar. This is signalling potential weakness, after all the close of the bar should have been much higher given the effort. The market makers are selling out at this level. It is the first sign of a move by the insiders.

Candle 3 Two Anomalies

This is two anomalies in one. The price spread is wider than the previous candle, but the volume is lower. The buying pressure is draining away. Second, we have a market that is rising, but the volume has fallen on this candle. Rising markets should be associated with rising volume not falling volume. This is also signalling clearly that the previous volume is also an anomaly, if any further evidence were required.

Candle 4 Two Anomalies Again

Again, we have two anomalies in one, and is adding further confirmation the volume and price on this trend are no longer in agreement. Here we have a wide spread up candle and even lower volume than on previous candles in the trend. Following the effort vs result rule, we would expect to see significantly higher volume, but instead we have low volume.

Second, the falling volume is confirming that we have an anomaly on the trend, as we expect to see rising volume with a rising trend, whereas here we have falling volumes on a rising trend. The alarm bells would be ringing loud and clear now.

What are the conclusions we can draw from these four candles? The problems start with candle two. Here we have effort, but not an equivalent result in terms of the associated price action. This is therefore the first sign of possible weakness. The market is what is known as 'over bought'. The market makers and specialists are starting to struggle here. The sellers are moving into the market sensing an opportunity to short the market. This creates the resistance to higher prices at this level, which is then confirmed on the third and fourth candles, where volume is falling away.

The specialists and market makers have seen this weakness, and are selling out themselves at this level, preparing for a move lower, but continue to mark prices higher, to give the appearance of a market that is still bullish. It is not. This may only be a temporary pause, and not a major change in trend, but nevertheless, it is a warning of potential weakness in the market.

The high volume is as a result of an increasing number of sellers closing out their positions, and taking their profits, whilst the remaining buyers do not have sufficient momentum to take the market higher. The specialists and market makers are also selling out at this level adding to the volumes, as they have seen the weakness in the market. This is the reason volumes fall on the next two candles, as they continue to mark the market higher, but are no longer involved in the move themselves. They have withdrawn and are trapping traders into weak positions.

The initial weakness appeared on candle two, which was then further confirmed by candles three and four. This is often the sequence of events which unfolds.

Initially we see an anomaly appear using the single candle analysis. We then wait for subsequent candles to appear, and analyse them against the initial anomaly. In this case, the anomaly was confirmed, with prices continuing to rise on falling volumes.

Now we have a market which is apparently weak, and confirmed as such. The next step is to move to the final level in our analysis which is to consider the analysis in the broader context of the chart. This will determine whether what we are seeing is a minor pull back, or the pre-cursor to a change in trend.

This is where Wyckoff's second rule comes into effect, the law of cause and effect. If this is simply a minor pull back or reversal, then the cause will be small, and the effect will be small.

In point of fact, the anomaly we have seen here, might be enough to result in minor short term weakness, a pull back due to one weak candle. The cause is weak, so the effect is weak. Before expanding further on this later in the book, let's look at one more example of multiple bar anomalies.

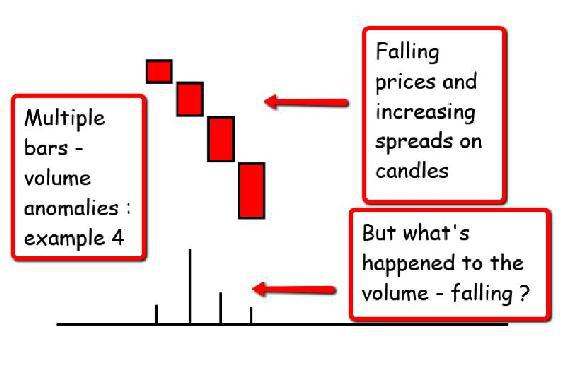

Fig 4.17

Multiple Bar Anomalies In A Downtrend

In the example in Fig 4.17 we have what is known as a price waterfall, where the market sells off sharply.

The first candle opens and closes, and is associated with low or relatively low volume, which is as we expect. We then start to see the anomalies beginning with the second price bar in the waterfall.

Candle 2 Anomaly

The candle has closed with a marginally wider spread than the previous bar, but the volume is high or very high. What this is signalling is the market is clearly resistant to any move lower. After all, if this was not the case the price spread would he been much wider to reflect the high volume. But, this is not the case, and is therefore an anomaly. And, just as in the previous example, the alarm bells are now ringing. What is happening here is bearish sentiment is draining away with the sellers now being met with buyers at this level. The market makers and specialists have seen the change in sentiment with the buyers coming in, and are moving in themselves, buying the market at this price point.

Candle 3 Two Anomalies

Here we have two anomalies, similar to the example in Fig 4.16. First, we have a wide spread candle, but with only average to low volume. Second, the volume is lower than on the previous bar – in a falling market we expect to see rising volume not falling volume. With falling volume the selling pressure is draining away, something that was signalled in the previous bar.

Candle 4 Two Anomalies Again!

Once again we have two anomalies here. First, we have a wide spread down candle, accompanied by low volume. The volume should be high, not low. Second, we now have falling volume over three candles in a market that is falling. Again, this is an anomaly as we should expect to see rising volume in a falling market.

As with the example in Fig 4.16, the first candle too in Fig 4.17 closes, and the volume validates the price. All is well. However, it is on candle 2 the first alarm bells rings. Once again we have effort (volume), but not an equivalent result in terms of the associated price action. This is therefore the first sign of possible weakness. The market is what is known as 'over sold'. The market makers and specialists are starting to struggle here. The buyers are moving into the market in increasing numbers, sensing an opportunity to buy the market. This creates the resistance to lower prices at this level, which is then confirmed on the third and fourth candle, where volume is falling away.

The specialists and market makers have seen this weakness on candle 2 and moved in, but continue to mark prices lower, to give the appearance of a market that is still bearish. Once again, it isn't. This may only be a temporary pause, and not a major change in trend, but nevertheless, it is a potential warning of strength coming into the market.

The high volume is as a result of an increasing number of sellers closing out their positions, and taking their profits, whilst the remaining sellers do not have sufficient momentum to take the market lower. The specialists and market makers are now buying at this level adding to the volumes, as they have seen the strength coming into the market, and are happily absorbing the selling pressure. This is the reason that volumes fall on the next two candles, as they continue to mark the market lower, but are no longer involved in the move themselves. They have bought their stock on candle 2, and are now simply trapping additional traders into weak short positions in candles 3 and 4.

The initial signal appeared on candle two, as in the previous example, which was then further confirmed in candles three and four. The insiders have shown their hand on candle two in both of the above examples, and all from the volume and associated price action.

In both of these examples we would now be ready and waiting for any further signals, to give us clues as to the likely extent of any reversal in trend, or whether this might simply be a minor pull back. Even if it were merely a minor change in a longer term trend, this would still offer a low risk trade we could enter in the knowledge the position would only be open for a short time.

This brings me neatly to the point I mentioned earlier, namely the framework of Wyckoff's second law, the law of cause and effect.

In learning to base our trading decisions using VPA, the analytical process that we go through on each chart is identical. The description of this process may sound complicated, but in reality once mastered only takes a few minutes to execute. In fact, it becomes second nature. It took me around 6 months to reach this level by chart watching every day. You may be quicker or a little slower – it doesn't matter, as long as you follow the principles explained in the book. The process can be broken down into three simple steps:

Step 1 - Micro

Analyse each price candle as it arrives, and look for validation or anomaly using volume. You will quickly develop a view on what is low, average, high or very high volume, just by considering the current bar against previous bars in the same time frame.

Step 2 - Macro

Analyse each price candle as it arrives against the context of the last few candles, and look for validation of minor trends or possible minor reversals.

Step 3 - Global

Analyse the complete chart. Have a picture of where the price action is in terms of any longer term trend. Is the price action at the possible top or bottom of a longer term trend, or just in the middle? This is where support and resistance, trend lines, candle patterns, and chart patterns all come into play, and which we will cover in more detail shortly.

In other words, we focus on one candle first, followed by the adjacent candles close by, and finally the entire chart. It's rather like the zoom lens on a camera in reverse – we start close in on our subject, and then gradually zoom out for the complete picture.

I now want to put this into the context of Wyckoff's second law, namely the law of cause and effect, as this is where the elements of time come into our VPA analysis.

As I mentioned in the introduction, one of the classic mistakes I made repeatedly when first starting all those years ago was to assume as soon as I saw a signal, then the market would turn. I was caught out time and again, getting in too early, and being stopped out. The market is like the proverbial oil tanker – it takes time to turn and for all the buying or selling to be absorbed before the insiders, specialists and market makers are ready. Remember, they want to be sure that when they make their move the market will not be resistant. In the simple examples above, we just looked at four candles, with the insiders moving in on just one. In reality, and as you will see shortly, there is a great deal more to it than this, but this sets the basic principle in place, which is what this chapter is all about.

Therefore, on a daily chart this ‘mopping up’ phase could go on for days, weeks and sometimes even months, with the market continuing to move sideways. Several consecutive signals of a reversal could appear, and whilst it is clear that the market will turn, it is not clear when this will occur. The longer this period of consolidation, the more extended any reversal in trend is likely to be. And, this is the point Wyckoff was making in his second law, the law of cause and effect. If the cause is large, in other words the period over which the market is preparing to reverse, then the more dramatic and long lasting will be the consequent trend.

Let's try to put this concept into context as this will also explain the power of using VPA combined with multiple time frames.

If we take one of the simple examples above, where we were looking at four candles, and the associated volume bars. This is really step two in our three step process. Here we are at the macro level, and this could be on any chart from a tick chart to a daily chart. All we know is over this four bar period there is a possible change being signalled. However, given the fact this is only over a handful of candles, any reversal is unlikely to last long as any potential change is only based on a few candles. In other words, what we are probably looking at here in the micro stage, is a minor pull back or reversal. Nothing wrong with that, and perfectly acceptable as a low risk trading opportunity.

However, step back to the global view on the same chart, and we see this in the context of the overall trend, and immediately see this four bar price action is in fact being replicated time and time again at this level, as the market prepares to reverse. In other words, the cause is actually much greater than a simple reversal and we are therefore likely to see a much greater effect as a result. Therefore, patience is now required and we must wait. But, wait for what? Well, this is where the power of support and resistance comes into play, and which I cover in detail in a later chapter.

Returning to Wyckoff’s second law of cause and effect and how this principle can be applied to multiple time frames, the strategy I would like to share with you is one I use in my own trading when trading intraday. It is based on a typical set of charts and uses the 5, 15 and 30 minute timeframes. This trio of charts is typical for scalping forex and trades are taken on the 15 minute chart. It could apply equally well to index trading or day trading any market, and is only one example to explain the concept. The 5 minute chart gives me a perspective closer to the market, whilst the 30 minute chart, gives me a longer term view on a slower chart. The analogy I always use in my trading rooms is of a three lane highway. The 5 minute chart is in the middle while the two charts either side act as 'wing mirrors' on the market. The faster time frame, the 5 minute chart, tells us what is happening in the 'fast lane', whilst the 30 minute reveals what is happening in the 'slow lane', the slower time frame.

As the sentiment in the fast time frame changes, if it ripples through to the slower time frames, then this will develop into a longer term trend. For example, if a change occurs on the 5 minute chart, which then ripples through to the 15 minute chart, and ultimately through to the 30 minute chart, this change has now developed into a longer term trend.

Returning to our VPA analysis. Imagine on the 5 minute chart we see an anomaly of a possible change in trend which is then confirmed. This change in trend is also reflected in the 15 minute chart. If we take a trade on the analysis seen here, and the trend ultimately ripples through to the 30 minute chart, this reversal is likely to be more developed as a result, as it has taken longer to build, and is therefore likely to have further to run. The analogy I use here is of a clockwork model car.

If we only wind the mechanism by a few turns which takes a few seconds, the car only runs a small distance before stopping. If we spend a little longer and add a few more turns to the mechanism the car travels further. Finally, if we take a few minutes and wind the mechanism to the maximum, the car will now run the farthest distance possible. In other words, the time and effort we put in to define the strength of the cause, will be output in terms of the strength of the effect.

This is the power of VPA when used in multiple time frames and in conjunction with Wyckoff's second rule. It is immensely powerful, and combines two of the most dynamic analytical techniques into a unified single approach. It is an approach that can be applied to any combination of time frames from fast tick charts to higher time frame charts. It does not differentiate as to whether you are a speculator or an investor.

The approach is simple and straightforward, and is like the ripples in a pond when a stone is thrown. As the stone lands in the centre of the pond the ripples move outwards. This is like the ripples of market sentiment which move across time frames outwards from the fastest to the slowest. Once the ripples appear in the slowest time frame, then this is likely to have the greatest longer term impact as the move has taken the longest time to build, giving additional momentum to the move. To return to our clockwork car, when fully wound the car will travel further and a perfect expression of cause and effect.

In the following chapters, I would now like to build on these first principles and extend them out into actual examples, using real charts from a variety of markets.