Chapter Five

Volume Price Analysis - Building The Picture

Mistakes are the best teachers. One does not learn from success.

Mohnish Pabrai (1964 -)

In the previous chapter we looked at some of the basic building blocks of VPA, and how to apply our analysis first to single candles, and then to use this knowledge in relation to small groups of candles. This really took us through the first two steps of VPA in our three step process. The three step process which begins with a close up look at one candle, then gradually zooms out to step 2 which is the candles in close proximity to the latest candle. Finally, we zoom out to bring the complete chart into focus, which is what we are going to focus on in this chapter, and in doing so, I hope will also help to reinforce the basic skills we learnt in the previous chapter.

In addition in this chapter, I'm also going to introduce some new concepts which I hope will help to put everything into context, and pull the various strands of VPA together. I think this is probably the best place to start, and then we can begin to look at a variety of examples, and I can walk you through each chart as the price action unfolds.

So let me start with five concepts which lie at the heart of VPA, and these are as follows:

- Accumulation

- Distribution

- Testing

- Selling Climax

- Buying Climax

The simplest way to understand these terms, and for me to explain them to you, is to go back to our analogy of the warehouse, which was also used by Richard Ney in his books to explain this concept. This is what he said:

“To understand the specialists' practices, the investor must learn to think of specialists as merchants who want to sell an inventory of stock

at retail

price levels. When they clear their shelves

of their inventory they will seek to employ their profits

to buy more merchandise

at wholesale price levels

.”

I used the same analogy in my article for Working Money magazine many years later, which was the Parable of Uncle Joe.

The easiest way to think of volume in terms of the market price action, and this applies to all markets, is to use the wholesaling analogy. However, in order to keep things simple, let's just refer to the specialists, the market makers, the large operators, the professional money, as the insiders from now on. So, the insiders are the merchants who own the warehouses of stock and their primary goal is to make money by buying at wholesale prices and then selling at retail prices.

Remember also, in the following explanations in my VPA Principle No 2, the market always takes time to turn in a dramatic way, and this is also borne out in Wyckoff's second law of cause and effect. We are always going to see small changes up and down, as the market pulls back or reverses in a longer term trend. But, for the major changes in trend to occur, (and remember, a 'major change' can appear on a 5 minute chart or a 1 day chart) this takes time. The longer the time taken, (the cause), the greater the change (the effect). However, this does vary from market to market. Some markets may take days, weeks or even months, before they are ready to turn dramatically, whilst other markets may take just a few days. I will be covering this later in the book once we start to look at the various nuances which apply to specific markets, as they all behave slightly differently.

The key principles described here still apply. It's just the time frames and speed at which events occur that changes dramatically, and is due to the different structure of each market, the role of the insiders in that market, and the role each capital market plays as an investment or speculative vehicle.

The first term we need to understand is accumulation.

The Accumulation Phase

Before the insiders can begin to do anything, they need to make sure they have enough stock, or inventory, to meet demand. Think of this as a wholesaler about to launch a major advertising campaign for a particular product. The last thing any wholesaler would want to do is to spend time, effort and money launching a campaign, only to discover after a few days there was no more stock. This would be a disaster. Well, funnily enough, it's the same for the insiders. They don't want to go to a great deal of trouble, only to find they have run out of stock. It's all about supply and demand. If they can create the demand, then they need the supply to meet this demand.

But, how do they fill their warehouses before starting any campaign? This is where accumulation comes in, and just like a real warehouse, takes time to fill. Naturally it’s not possible to stock a large warehouse with one lorry load of goods. It may take several hundred loads to completely fill, and remember, at the same time, there are goods simultaneously leaving the warehouse. Just as filling a warehouse takes time in the real world, so it takes time in our financial world.

Accumulation then, is the term used to define an 'accumulation phase' which is the period the insiders go through to fill up their warehouse prior to launching a major marketing campaign on selling their stock. So accumulation is buying by the insiders, and depending on which market we are considering, can go on for weeks or months, depending on the instrument being acquired.

The next question, is how do the insiders 'encourage' everyone to sell? It's actually very simple, and it's called the media. The news media, in all its various forms, is manna from heaven as far as the insiders are concerned. Over the centuries they have learnt every trick in the book to manipulate each news release, every statement, natural disaster, political statement, war, famine and pestilence, and everything in between. The media is an avaricious monster and one which demands ‘new’ and fresh news items daily. The insiders simply take advantage of the constant fear and greed which is generated by this stream of news stories, to manipulate the markets, for many different reasons, but not least to shake market participants out of the market.

These are the words of Richard Wyckoff on the subject written in the 1930s

"The large operator does not, as a rule, go into a campaign unless he sees in prospect a movement of from 10 to 50 points. Livermore once told me he never touched anything unless there were at least 10 points in it according to his calculations. The preparation of an important move in the market takes a considerable time. A large operator or investor acting singly cannot often, in a single day's session, buy 25,000 to 100,000 shares of stock without putting the price up too much. Instead, he takes days, weeks or months in which to accumulate his line in one or many stocks."

The word campaign is an appropriate one. Just like a marketing campaign or a military campaign, the insiders plan each phase with military precision, with nothing left to chance. Each phase is planned and executed using the media to trigger the selling. But how does an accumulation phase play out? In practice, it goes something like this:

An item of news is released which is perceived as bad for the instrument or market. The insiders grab the opportunity to move the market lower fast, triggering a waterfall of selling, as they start their accumulation phase, buying inventory at the lowest prices possible, the wholesale price if you like.

The markets then calm as the bad news is absorbed, before starting to move higher, which is largely as a result of the buying by the insiders.

Two points here. First, the insiders cannot frighten everyone too much, or no one would ever buy. If there is too much volatility, with dramatic swings, this would frighten away many investors and traders, which would defeat the object of the exercise. Each move is carefully planned with just enough volatility to frighten holders into selling. Second, the buying by the insiders may push prices back up higher again too quickly, so they take great care in ensuring inventory is purchased in 'manageable' volumes.

Too much buying, would force prices higher quickly, so great care is taken, and is a further reason why the accumulation phase takes time to complete. It would simply not be possible to fill the warehouse with just one move lower. It would not work because the numbers are too large. Our simple examples in the previous chapter, were just to introduce the basic principles.

What happens next is anyone who survived the first wave of selling is relieved, believing the market will recover and they continue to hold. After a period of calm, more bad news arrives, and the insiders take prices lower once more, shaking further holders out of the market. As they buy again there is a consequent recovery in the price.

This price action is then repeated several times, each time the insiders accumulating more and more stock for their warehouse, until finally the last holders give up, and admit defeat. What does this look like on the price chart?

Fig 5.10

The Accumulation Phase

Whilst Fig 5.10 is a graphical representation of the price action, nevertheless I hope it gives a sense of what this looks like on a real chart. The repeated buying by the insiders is highlighted.

I have deliberately avoided using a scale on the chart, either in terms of price or time, as I believe it is the 'shape' of the price and associated volume bars which is important. This is the price action which creates the classic price congestion which we see in all time frames, and which is why this ‘shape’ is so powerful, when associated with volume. This is what gives price action the three dimensional perspective using VPA.

Once the campaign has begun, the price action then follows this typical pattern, where the market is repeatedly moved higher and lower. This whipsaw pattern is essential to 'shake' sellers out of the market. We can think of this as shaking fruit from a tree, or as we do in Italy, harvesting the olives. The tree has to be shaken repeatedly in order for all the crop to fall. Some of the crop is more firmly attached and takes effort to release. This is the same in the financial markets. Some holders will refuse to sell, despite this constant whipsaw action, but eventually they give up after several 'false dawns', generally on the point when the campaign is almost over, with the insiders preparing to take the market higher with fully stocked warehouses. So the campaign comes to an end. It's all over until the next time.

This is repeated over and over again, in all time frames and in all markets. If we take the cause and effect rule of Wyckoff, the above price action could be a 'secondary' phase in a much longer term cycle, which is something I cover in more detail once we start to look at multiple time frames.

Everything, as Einstein said, is relative.

If we took a 50 year chart of an instrument, there would be hundreds of accumulation phases within the 50 year trend. By contrast an accumulation phase in a currency pair, might last a few hours, or perhaps only a few days.

And the reason for this difference is to do with the nature and structure of market. The equity market is a very different market to bonds and commodities. In equities for example, this phase might last days, weeks or months, and I cover this in detail when we look at the characteristics of each market and its internal and external influences, which create the nuances for us as VPA traders.

The key point is this. Just recognise the price action and associated volume for what it is. This is the insiders manipulating the market in preparation for an extended price move higher. It may be a small move (cause and effect) based on a short time period, or a more significant move based on a longer phase. And if you think perhaps this is a fantasy, let me just quote from Richard Ney again, and this time from his second book, The Wall Street Gang:

“On November 22, 1963, the day President Kennedy was assassinated, specialists used the alibi provided by the tragedy to clean out their books down to wholesale price levels. After they had accumulated large inventories of stock, they closed shop for the day and walked off the floor. This prevented public buy orders from being executed at the day's lows. The specialist in Telephone, for example, dropped his stock on November 22 from $138 to $130. He opened it on the 25th at $140! Sacrificing accuracy for expediency, he admitted to making $25,000 for his trading account.”

Any news, provides the perfect excuse to manipulate the market, and nothing is exempt. In US equities it is the quarterly earnings season reports which provide the perfect opportunity. Economic data is also a rich source, whilst natural disasters can be used for longer term triggers. On an intraday basis, accumulation is made very easy with the constant round of comments from politicians, central banks, coupled with the daily stream of economic data. Life is very easy for the insiders, and to be honest, if we had the opportunity, we would probably do the same thing as well.

The Distribution Phase

The distribution phase is the exact opposite of the accumulation phase. In the accumulation phase, the insiders were filling their warehouses, in preparation for the next phase of the operation, and as I said earlier, the word campaign is perfect. This is a military campaign with nothing left to chance, as we will see shortly when I explain about testing.

With a full warehouse, the insiders now need to start moving the price higher, to encourage the somewhat nervous and jaundiced buyers back into the market. This is one reason why the insiders dare not frighten everyone too much, as they simply cannot afford to kill the goose that lays the golden egg.

Whilst the key emotional driver in 'shaking the trees' in the accumulation phase was fear, the fear of a loss, the key driver used in the distribution phase is also fear, but this time the fear of missing out on a good trade. The timing here is critical, as the insiders know most investors and speculators are nervous, and like to wait for as many confirming signals as possible, before jumping into a market, fearing they will miss out on a big move higher. This is the reason most traders and investors buy at a top and sell at a bottom.

At the top of a bullish trend, traders and investors have seen the market move higher slowly, then gather momentum, before rising fast, and it is at this point they buy, fearful of missing out on any 'quick profits'. This is precisely the point at which the insiders are preparing to pause and reverse. The same happens at the bottom of the accumulation phase. The investors and speculators can take no more pain and uncertainty, they have seen the market move lower slowly, then gather pace before dropping fast, which triggers waves of panic sales. Calm is then restored and the market starts to move into the accumulation phase. Here hope of a recovery is restored, before being dashed, then restored, then dashed again. This is the way the insiders manipulate trader fear, and in many ways we could argue it is not the markets they manipulate at all, but trader emotions which are much easier.

So what is the typical pattern for our distribution phase, and how is it managed?

First, the market breaks out from the end of the accumulation phase, moving higher steadily, with average volume. There is no rush as the insiders have bought at wholesale prices and now want to maximise profits by building bullish momentum slowly, as the bulk of the distribution phase will be done at the top of the trend, and at the highest prices possible. Again, given the chance we would do the same.

The move away from the accumulation phase is now accompanied by 'good news' stories, changing sentiment from the 'bad news' stories which accompanied the falling market.

The market continues to rise, slowly at first, with small pull backs, but nothing too scary. Gradually the market picks up speed, as the bullish momentum gathers pace, until the target price area is reached. It is at this point the distribution phase starts in earnest, with the insiders preparing to clear their warehouses, as eager traders and investors jump in, fearful of missing out. The good news stream is now constant and all encompassing as the market continues to climb.

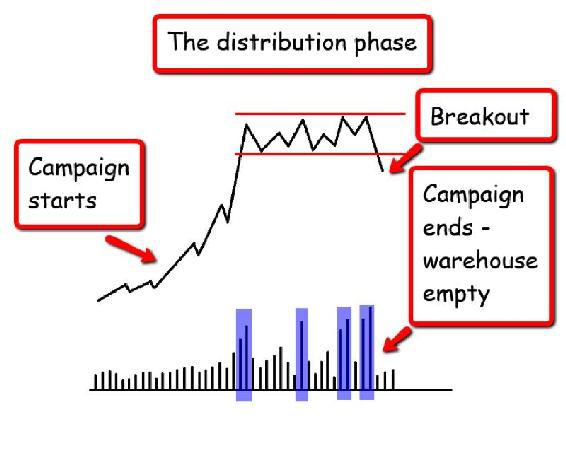

The insiders now have a willing supply of victims to whom they happily sell to in ever increasing numbers, but careful never to sell the market too hard. Prices therefore trade in a narrow range, sucking in more buyers on each dip. Finally, the warehouse is empty, and the campaign comes to an end. Fig 5.11 illustrates the typical price action and volume schematic of the distribution phase.

Fig 5.11

The Distribution Phase

The example in Fig 5.11 gives us a picture of what is happening here, and once we begin to think of this behaviour in terms of a full or empty warehouse, then it will start to make sense. It is very logical, and if we had our own warehouse of goods we wanted to sell at the highest price, we would go about this in much the same way.

First we would ensure we had enough stock and then start a marketing campaign to create interest. Next we would increase the marketing and hype the sales message – perhaps using celebrities, testimonials, PR, media, in fact anything to get the message across. A recent and classic example of marketing hype has been Acai berries (instant and massive weight loss with no effort – just eat the berries and wait for the results).

This is all the insiders are doing, they are simply playing on the emotions of the markets which are driven by just two. Fear and greed. That's it. Create enough fear and people will sell. Create enough greed and people will buy. It's all very simple and logical, and to help them, the insiders have the ultimate weapon at their disposal – the media.

This cycle of accumulation and distribution is then repeated endlessly, and across all the time frames. Some may be major moves, and others minor, but they happen every day and in every market.

Testing Supply

One of the biggest problems the insiders face when mounting any campaign is they can never be sure all the selling has been absorbed, following an accumulation phase. The worst thing that could happen is they begin to move the market higher, only to be hit by waves of selling, which would drive the market lower, undoing all the hard work of shaking the sellers out of the market. How do the insiders overcome this problem? And the answer is just as in any other market, they test.

Again, this is no different to launching a marketing campaign to sell a warehouse full of goods. Not only do the items have to be correctly priced, but also ensure the market is receptive, primed and ready if you like. Therefore a small test marketing campaign is used to confirm if we have the right product at the right price, and with the right marketing message to sell in volume.

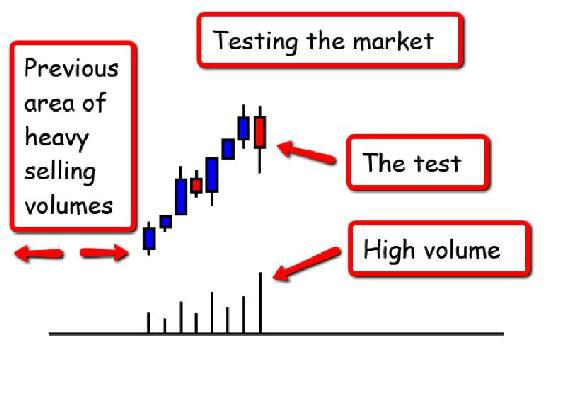

The insiders also want to test, and once they have completed the accumulation phase, they prepare to move the market higher to begin the selling process. At this stage, they are generally moving back into price regions which have only recently seen heavy selling, so they execute a test to gauge market reaction and check all the selling has been absorbed in the accumulation phase. The test is as shown in the schematic below:

Fig 5.12 is a schematic to explain this principle which is common sense when we think about it logically.

Fig 5.12

Low Volume Test – Good News!!

The phase of price action we are looking at here follows the accumulation phase, and prior to this, the insiders will have frightened everyone into selling by moving prices down fast. Panic selling follows with high volumes in this area. The insiders then begin to shake the trees for the more obstinate 'fruit' before they slowly begin to push the market out from this region and to start the gentle upwards trend, which will ultimately develop into the distribution phase at the top of the bull trend.

At this point the insiders are moving the market back through an area of recent heavy selling, and the worst thing that could happen is for this selling pressure to return, bringing the campaign to a shuddering halt. The answer is to execute a test in the rising market which is shown in the schematic in Fig 5.12.

The market is marked lower, possibly on the back of a minor item of bad news, to test to see if this is likely to flush out any remaining sellers. If the volume remains low, this instantly tells the insiders there are few sellers left, and that virtually all the selling has been absorbed in the accumulation phase of the campaign. After all, if the sellers were still in the market in any number, the candle would have closed lower on above average volume. The volume is low, as the insiders move the candle back near the opening price with a 'good news' story, before continuing higher, happy with this positive result.

These so called 'low volume' tests occur in all time frames and in all markets, and is a simple way for the insiders to gauge the balance of supply in the market. They are, after all, trying to create demand here, but if there is an over supply in the market then this will bring the bull campaign to a halt.

In this case the test was successful and confirms any selling pressure has been removed. The precise formation of the candle is not critical, but the body must be a narrow spread, with a deep lower wick. The colour of the body can be either bullish or bearish.

With the test now confirmed the insiders can move the market higher to the target distribution level, confident all the old selling has now been absorbed.

Fig 5.13

High Volume Test – Bad News !!

However, what if the test fails and instead of low volume appearing there is high volume, which is a problem. In starting to move the market away from the accumulation area, and executing the first part of the test by marking prices lower, this has resulted in sellers returning in large numbers and forcing the price lower.

Clearly on this occasion, the selling from the old trading range has not been absorbed in the accumulation phase, so any further attempt to take the market higher may struggle or fail.

A failed test means only one thing. The insiders will have to take the market back lower once again, and quickly, to shake these sellers out. The market is not ready to rise further, and the insiders therefore have more work to do, before the campaign can be re-started. This is equivalent to a failed test in an advertising campaign. Perhaps the pricing of the product is not quite right, or the marketing message is not clear. Either way, the test has shown something isn’t right and needs to be addressed. For the insiders it's the presence of too many sellers remaining in the market.

The original 'mopping up' campaign needs to be restarted, to absorb these old positions. The insiders will then relaunch their campaign again, and re-test the supply as the market begins to rise. On a failed test we can expect to see the insiders take the market back into the congestion area once again, to flush out this selling pressure before preparing to breakout again, with a further test. Any subsequent test on low volume will then confirm selling pressure has now been removed.

Testing is one of the key tools the insiders use, in all markets. Like everything else in VPA, it is a simple concept, based on simple logic, and once we understand the concept of accumulation and the structure on the chart, we will begin to see tests occurring in all time frames and in all markets. It is one of the most powerful signals you will see, as it is the insiders sending a clear message that the market is about to break out and move higher.

In the example in Fig 5.13 the insiders were testing for any residual selling pressure, often referred to as 'supply', following the accumulation phase. With a full warehouse they were all set to roll out the campaign and the last step was to check that all the selling in the price levels immediately ahead had all been absorbed. In this case it hadn’t. However, once the test has been repeated and confirmed with low volume, the market will move higher.

Testing Demand

But what of the reverse scenario, where we are coming to the end of a distribution phase? The last thing the insiders want is to start a campaign to begin filling their warehouses again, move back into an area which has seen high demand (buying pressure) only for the buyers to take the market in the opposite direction.

Once again a test is employed to make sure all the buying (demand) pressure has been absorbed in the distribution phase, and this is done with a test of demand as the campaign gets under way.

In this case the distribution campaign has been in progress for some time. The insiders have moved the market from the wholesale price level, to their target level for retail prices, and are now happily selling on waves of bullish news. The investors and speculators are rushing in and buying, fearing they are missing out on a golden opportunity, and motivated by greed. The insiders pull in more demand by whip sawing the prices and gradually emptying their warehouses of all the inventory of stock.

Finally, when the campaign is complete, it's time to start the next phase of moving the market lower, and as the trend starts to develop, the price action moves back into areas which only recently had seen high volume buying. Once again a test is required, this time to test demand. If the demand is low, then all the buying has been absorbed in the distribution phase as we can see in the schematic in Fig. 5.14.

Fig 5.14

Low Volume Test – Good News

Here we have the end of the distribution phase. The warehouses are virtually empty, and the next stage is a sharp move lower, to repeat the process and move into an accumulation phase once again.

As the distribution phase ends, the insiders want to make sure there is no demand still remaining in price areas which, until recently, had seen strong buying during the entry into the distribution phase. Once again, they test. The market is marked higher using some news, and if there is no demand, closes back near the open, with very low volume. This is what the insiders want to see. No demand, as shown by the low volume. They are now safe to start moving the market lower, and fast, as they now need to replenish their warehouses again.

Fig 5.15 is definitely not what the insiders want to see as they prepare to move away from the distribution price region. The market is marked higher and buyers flood in, thinking the bullish trend is set to continue and move higher still. As before, a failed test stops the campaign in its tracks, and the insiders have to move back into the distribution price area, and clear these buyers out of the market, using the same processes as before. Once complete, then a further test is made, and if on low volume, then the trend lower will gather pace and move quickly away from the distribution region, trapping traders into weak positions at this level.

Fig 5.15

High Volume Test – Bad News

Now we know what to look for, you will see testing occurring all the time, once this has been preceded by an accumulation or a distribution phase. We may even see a series of tests, perhaps the first has low volume, followed by a second or third which have lower volume still. This is simply confirming the insiders are preparing the next phase of a campaign, and the key is simple. Once prices break away from the congestion areas created during these two phases, we can be assured the next stage is then under way.

Before moving on to consider the selling climax and the buying climax, at this point I think it's appropriate to answer a couple of questions which sometimes puzzles both traders and investors.

The first question is – why do markets take longer to rise than to fall, and is this something to do with the insiders?

The second question is – over what time frames do these cycles of filling and emptying the warehouse typically last?

Let me answer the first, which also leads into the second. Market insiders only have two objectives. The first is make us fearful and the second is to make us greedy. They have no purpose in life other than to create emotional responses which will ensure we always do the wrong thing at the wrong time, but they always do the right thing at the right time.

A quote from the late great John Templeton who wrote:

“Heed the words of the great pioneer of stock analysis Benjamin Graham: ‘Buy when most people…including experts…are pessimistic, and sell when they are actively optimistic.’”

Let's think about this logically and try to answer the first question. The markets have been in free fall, with panic selling by investors and traders. Then comes a period of calm as the market moves sideways into the accumulation phase, as the warehouses are stocked up ready for the move higher.

Now at this stage, remember from an insiders point of view, they have just frightened everyone to death, and the last thing they want to do is to suddenly send the market soaring in the opposite direction. This would soon drive every investor and speculator away. After all, there is only so much emotion traders can take, and too much too soon would quickly kill the goose that lays the golden egg. A calm approach is required. The tactic now is to quietly start to build confidence back up, moving prices higher steadily, without frightening anyone out of the market, and gradually drawing the buyers back in.

Soon, the panic selling is forgotten as the markets recover and confidence is slowly restored. This also suits the insiders, as they have a full inventory to sell, and want to take their time, and certainly don't want to see large volume buying as they move the market higher. At this stage, it is is about maximising profits, and the biggest profits are to be made once the distribution target price levels are reached at the retail level. It would be madness to suddenly mark up the market to the retail level, as many investors would then feel they had missed out on the move, and not join in later.

The strategy here is one of confidence building by taking the market higher slowly, and then gradually to move faster, generating the belief in the investor or speculator's mind this is a market with momentum, which is gathering pace all the time, and is an opportunity not to be missed to make some easy money.

The upwards trend then starts to gather pace, moving higher in steps, pausing, reversing a little, drawing in buyers, tempting others, then moving higher still, until close to the distribution area, the market picks up speed as buyers crack under the emotional pressure of missing out, and jump in.

Throughout the upwards journey, the inventory is gradually reduced, but topped up in minor reversals with sellers taking their profits, and helping to maintain levels for the final phase of the campaign.

This is the emotional journey the insiders have mastered. It is the reason markets move higher in a series of higher highs and higher lows, with pauses and minor reversals along the way. It is a confidence building exercise, designed to restore confidence after the fear, and replace it with another emotion – greed. These are the two levers that the insiders have, and they are used to devastating effect, and the only weapon you have in your armoury is VPA.

After greed comes fear – again.

With their warehouses now empty, the insiders need to get back to the 'bottom' and fill them up as quickly as possible. Again, we would do exactly the same thing in their position.

However, the insiders have nothing to sell now, and the only way to make money fast is to refill the warehouse again and begin another campaign. The market crashes lower, panic selling ensues, fear is triggered and the warehouses are filled once more. And so the cycle repeats, time and time and time again. The best analogy I can think of here is of an old fashioned helter skelter we might see at a fair ground. It takes effort to get to the top, walking up all the steps, but the slide down on a mat is very quick. That's how the markets work. Up in stairs and down in elevators. The old fashioned board game of ‘snakes and ladders’ expresses this effect perfectly, it’s slowly up the ladders, and then a very quick ride down on the snakes.

It is only once we start to think of the markets in these terms we begin to realise how anyone, other than the insiders, ever makes money. The insiders have to be careful, for the simple reason if the price action was continually and unrelentingly volatile, traders and investors would look elsewhere for investing and speculating opportunities.

Just like Goldilocks and her porridge, the motto here is 'not too hot and not too cold'. The insiders have learnt their craft and honed their skills over decades. Most investors and speculators lose. You are lucky. By the end of this book you will become a VPA expert and be able to see and recognise all the tricks they play. They are there in plain sight and all we have to do is interpret the signals and then follow the insiders. It really is that simple.

Moving to the second question which was how often is this cycle repeated? And here I will let you into a secret. This was a question I wanted to ask Albert Labos all those years ago as we sat in a rusty cabin on the President learning all about the market makers (as he referred to them) and their tricks. I actually wrote down the question and asked my neighbour in the class, but he didn't know the answer either.

What I thought at the time was this. I understood about the accumulation and distribution phases which made perfect sense to me, but then I started to think. Also, remember at the time we were really looking at trading indices, so essentially long cycles. I thought to myself if the cycle was perhaps 10, 15, or 20 years, then this was a long time for a market maker to wait to make a profit from his (or her) buying and selling. Perhaps it was longer, and from one big market crash to another. Perhaps it was decades? I didn't dare ask the question at the time, and now I wish I had.

The answer to the question is these cycles occur in all time frames from tick charts to 1 minute charts, to 15 minute and hourly charts, and to daily, weekly and monthly charts. The best way to think of this is to imagine a set of nested Russian dolls.

The smallest doll, fits inside a slightly larger doll, which fits inside a larger doll, and so on. In the context of these cycles, we can imagine the same thing with a chart. An accumulation and distribution cycle on a one minute chart, may last a few hours, and be part of a larger cycle on a slower time frame chart, which in turn itself will be part of a larger cycle and so on. This is an important concept to grasp, as it brings in two important aspects of market behaviour.

First, these cycles happen in all time frames, and second by watching price action across multiple time frames you will start to see these cycles developing and unfolding and confirming one another as a result. A cycle that has already started on a one minute chart, will be setting up on 5 minute chart, and possibly just developing on the 15 minute chart.

Let me quote from Richard Ney again and his book The Wall Street Gang, books every trader and investor should try to read. They contain a wealth of information, and they give us a broad perspective on volume and price, along with an excellent view on how the specialists manipulate the markets. Whilst the books primarily focus on stocks, the principles are identical and relevant to all markets. In equities it's the specialists, insiders or market markets, in futures it's the large operators, and in spot forex it's the market makers again.

This is what he says about time frames:

“The specialist's objectives can be classified in terms of the short, intermediate and long term. Thus we can see that there are three broad classifications into which we can place the market's price movements.

He then goes on to say.......

“The short term trend. This can last from two days to two months. Within this trend there can be even shorter term trends lasting no more than several hours. The importance of the short term trend is that it is within this context that the specialist resolves his day to day inventory problems with his intermediate and long term objectives always in view. It is as though the short term trend is the spade with which the specialist digs the investor's intermediate and long term grave.”

“The ticker tape provides us with a microscopic view of the techniques of big block distribution at the top and big block accumulation at the bottom on behalf of the specialist's inventory.”

“It is impossible to look solely at the tape as it passes in review and hope to determine longer term trends in the market. One can understand the tape and decipher its code of communication only when experience is shaped through memory – or through the use of charts. In a manner of speaking short and long term charts provide both a microscopic and a telescopic view of what has happened. In the final analysis, we need both in order to make financially rational decisions.”

The reason I have quoted this section from his book here, is it neatly sums up the points I am trying to convey in this chapter.

Remember, this book was published in 1974, when the ticker tape was still in use, but we can replace the ticker tape with an electronic chart, on a short time scale. The concepts and principles are the same. We use the fast or ultra fast time frame as our microscopic view on the market, and then zoom out to our longer term time frames to provide the broader perspective on the volume and price relationship.

This is all relative, so for a scalping trader, this might be a 1 minute, 5 minute and 15 minute chart. A swing trader may consider a 30 minute, 60 minute and perhaps a 240 minute chart. A trend investor may utilise a daily, weekly and monthly chart.

Therefore, regardless of the trading strategy and market, equities, commodities, bonds or forex, the point is that to succeed as a speculative trader or as an investor, the VPA relationships should be used in conjunction with multiple time frames. On a single chart VPA is immensely powerful, but when the analysis is ‘triangulated’ using slower time frames, this will give you a three dimensional approach to the market.

There is nothing wrong with focusing on one chart, but remembering the analogy of our three lane highway, where we are sitting in the middle lane with our wing mirrors on either side giving us a view on the fast and slow lanes, this will help to build confidence levels, while learning, and more importantly once you start to trade live.

To round off this chapter, I want to focus on the the last two concepts of insider behaviour, namely the selling climax and the buying climax, before putting the whole cycle together in some simple schematics to help fix the broad principles.

The Selling Climax

As I outlined earlier, there is a degree of confusion about these two concepts. In the past, most people who have written about this subject, have done so from a personal perspective. In other words, when we buy or when we sell in the market. However, in the context of the insiders it is what they want us to do. Their sole objective is to get us to buy in the distribution phase, and to sell in the accumulation phase.

In terms of 'who is doing what' during these two phases, in the accumulation phase, the 'public' are selling and the insiders are buying, and conversely in the distribution phase the 'public' are buying and the insiders are selling.

This book is written from the perspective of the insiders, the specialists, the big operators and the market makers, and hopefully like me, you want to follow them. This is the underlying principle of VPA. As Albert used to say, we want to buy when they are buying, and sell when they are selling. Simple.

When I describe and write about a selling climax, to me, this is when the insiders are selling and occurs during the distribution phase of the campaign. A buying climax is when the insiders are buying during the accumulation phase. To me, this just makes more sense. It may be a question of semantics, but it is important, and I would like to clarify it here, as many people refer to these events the other way round.

Just to be clear, a selling climax appears at the top of the bullish trend, whilst the buying climax appears at the bottom of a bearish trend, and reflects the actions of the insiders, and not the public.

The selling climax is the 'last hurrah' before the insiders take the market lower. It is the culmination of all their efforts, and is the point at which the warehouse is almost empty and requires one last big effort to force the market higher, drawing in those nervous traders and speculators who have been waiting and waiting for the right time to jump in, and can finally wait no longer. They give in to the fear of missing out, and buy.

This happens two or three times on high volume with the market closing back at the open, and at the end of the distribution phase. Following the selling climax, the market then breaks lower, and fast. This tranche of buyers, along with all the others, is then trapped at this price level, as the insiders move the market away from this region and back down the helter skelter to begin the process again.

Let's look at a typical example of what we might see as the selling climax marks the end of the distribution phase, and we can think of it in terms of fireworks – this is a firework display which marks the end of the event.

Once again, Fig 5.16 is simply a schematic of what to expect in the selling climax. Here the insiders have taken the market to their target level, at which they are selling inventory at retail prices, to happy buyers who believe this market is going to the moon.

Fig 5.16

The Selling Climax – Firework Show

The insiders are happy to oblige, selling into the demand, moving the market lower, then back higher drawing in more demand, until they are close to clearing their inventory.

At this stage the price action becomes more volatile with surges higher followed by a close back to the open price, with increasing volumes of buyers flooding into the market, fearing they will miss out on the next leg up in the bullish trend. The next leg is in the opposite direction.

Finally, the inventory is cleared and the market sells off, moving lower and back out of the distribution phase. The clues for us, as VPA experts, are there to see.

Here we will see high volume coupled with a candlestick which has a deep upper wick and narrow body, and is one of the most powerful combinations of price action and volume we will ever see on a chart. Naturally, I will be covering this in detail later in the book.

These are the 'upper wick' candles we looked at in chapter 3, and as I explained there, they are immensely powerful and reveal so much, particularly when combined with volume. The insiders are having one last effort to clear their inventory and mark prices higher early in the session. Buyers flood in, taking the market higher, fearful of missing out, with high or ultra high volumes, before the insiders take the market lower to lock these traders into weak positions, helped lower by profit taking. Some traders will sense the market is 'over bought' at this level.

This price action is repeated several times, with the insiders selling into the demand, each time the price is pushed higher, before closing the candle lower at or near the opening price, helped by profit takers closing out.

The colour of the body of the candle is unimportant. What is important, is the height of the wick, the repeated nature of this price action, and the associated high volumes. This is sending a clear signal that the market is ready to move fast, and as the warehouses are all empty, the reaction will be quick. The insiders are now jumping on their mats, and heading off down the helter skelter, back to 'square one' to begin the process once again with an accumulation phase. When we see this price action, following a distribution phase, it's best to be in front of your screen – ready and waiting. Now let's look at the opposite of the selling climax, which is the buying climax. This is the firework party that marks the end of the accumulation phase, and signals the start of the bullish trend higher.

Fig 5.17

The Buying Climax – Firework Show ( Again!)

The buying climax is simply a selling climax in reverse. The insiders have taken the market lower, panic has been triggered and fearful sellers are closing positions. See Fig 5.17.

The insiders then move into the accumulation phase to restock the warehouse, and move prices back and forth in a tight range, to shake out any last remaining tenacious sellers.

Towards the end of this phase, the insiders than mark prices down rapidly, flushing out more sellers, before moving the price higher later in the session to close somewhere near the opening price, helped higher by their own buying in the market, with bargain hunters also sensing the market is 'over sold' at this level.

This is repeated several times, with panic selling continuing as frightened investors and speculators can take no more. They capitulate and throw in the towel. This is the last hurrah.

The insiders are now ready, their warehouses over flowing with stock, to start the march North, and begin the bullish trend higher in nice easy steps towards the target price for distribution.

Once we accept the fact all markets are manipulated in one way or another, the rest of the story simply fits into place.

The above is very logical, and common sense, but don't be misled into thinking this is simply not possible with the current legislative authorities now in place. Nothing much has changed since the days of Wyckoff and Ney, and here let me quote from 'Making it in the Market' published in 1975.

This was a telephone conversation Richard Ney had with an SEC (Securities and Exchange Commission) official. The SEC is supposed to regulate the financial world in the US.

Remember, this is 1975, and this it what was said on the telephone call, when the official was asked about checks on specialists and how they are regulated:

“specialists are under the Exchange. We don't get too concerned with them. They're not directly regulated by the Commission. They all operate under self regulation. They make their own rules – the Commission just O.K's them. Only if the Commission feels there is something not proper does it take exception. We check broker-dealers but we never go onto the Exchange to check out specialists.”

So has anything changed?

In reality very little, except to say trading is now largely electronic, and one of the many problems faced today by the SEC is HFT or High Frequency Trading.

There are the usual cases, where individuals and firms are taken to task to prove the SEC and others have some sort of control and to assuage the public, that the markets are regulated in a fair and open way.

Sadly, as I hope the above shows, and in using VPA live will quickly prove to you, this is most certainly not the case. The insiders are far too experienced and wily to allow their golden goose to be killed off. They simply devise new and more elegant ways to manipulate prices for their own ends.

Let me quote from a recent release from the SEC in response to the issue of HFT:

“There are a number of different types of HFT techniques, and an SEC Concept Release [6] broke them down to four main types of strategies:

Market making: like traditional market making, this strategy attempts to make money by providing liquidity on both sides of the book and earning the spread.

Arbitrage: Trading when arbitrage opportunities arise ( e.g. from mispricing between Indices, ETF's or ADRs and their underlying constituents.

Structural: These strategies seek to take advantage of any structural vulnerabilities of the market or certain participants, and include latency arbitrage or quote stuffing.

Directional: These strategies attempt to get ahead of – or trigger – a price move, and include order anticipation and momentum ignition.”

And the date of this report? - late 2012.

I don't wish to labor the point, but I am conscious some people reading this book may still consider me to be a 'conspiracy theorist'. I can assure you, I am not.

As Ney himself points out :

“ most of those in government doing the investigating are beholden to the Stock Exchange in one way or another (via campaign contributions or through their law firms), or hope (if they are commissioners and chairmen of the SEC) to be employed in the securities industry at some not too distant date, nothing ever comes of these investigations.”

Let me round off this chapter by creating a simple schematic, which I hope will help to put all of this into perspective.

Here it is, the complete market cycle, or as I like to call it – ‘another day at the office’ for the insiders, and this should hold no surprises. See Fig 5.18

The first campaign is the accumulation phase. The insiders start to fill their warehouses, which are empty following the sharp move lower, at wholesale prices.

Once the warehouses are almost full, the buying climax then begins, with some volatile price action to draw in more stock, but once complete, they then exit from the price region and test for supply. If all the selling has been absorbed, the insiders can start marking the market higher in steps, building confidence back into shell shocked investors and speculators who are still recovering.

As confidence returns, so the trend starts to gather momentum, drawing in buyers who now believe the market will 'go to the moon'. Even cautious investors succumb and buy, just as the price is reaching the target area for retail prices.

With the market now at the retail level, more buyers are sucked in as the distribution phase starts in earnest, with prices moved higher to draw in more buyers, then lower to lock them in to weak positions. Finally the selling climax begins, with volatile price action, and the remaining inventory is cleared from the warehouses. Once empty, the market breaks lower, through this price area, and once again a test is executed, this time of demand. If the test confirms buying in this region has been absorbed then the campaign is complete, and the market is moved lower fast.

The cycle is complete, and it only remains for the insiders to count their profits and repeat the exercise, again, and again, and again and … well I'm sure you get the picture.

Fig 5.18

The Market Cycle – Another Day At The Office!

The important point to remember here, is that this cycle could be in any time frame and in any market. The above could be on a 5 minute chart for example of a currency pair, and perhaps over a few hours. It could equally be on a daily chart of a stock, and perhaps last weeks or even months. It could be on an hourly chart for a futures contract, and in this case the insiders would be the large operators, with the cycle perhaps lasting a few days or a week. The time scale is unimportant, other than in remembering Wyckoff's rule of 'cause and effect'.

Once we begin to study charts in detail we start to see this cycle occurring repeatedly, and armed just with the information in these early chapters, is enough to help traders and investors truly understand how the markets work and trade with confidence as a result.

However, for a VPA trader it is just the starting point.

Before moving on to the next chapter let me try to 'frame' the context of what I have covered so far, not least because it is something that took me some time to absorb when I first started studying Volume Price Analysis.

Therefore, what I want to do here is to summarise what has been covered so far, starting with the concept of market manipulation, and try to explain what we mean by this phrase. Do we mean the insiders are free to simply move prices higher and lower at random and whenever it suits them to do so. The answer is emphatically no. What I mean by market manipulation, which is perhaps different to other peoples view, is that this simply means using every available resource, to either trigger fear or greed in the retail traders mind. This means using every piece of news in the media to influence the buying and selling, and to move the market in the direction the insiders require, either higher to a distribution phase, or lower to an accumulation range.

This is what I consider to be market manipulation. It is the creation of an environment, which in turn creates either fear or greed in the mind of the investor or the speculator. As I said earlier, market manipulation is not so much about manipulating the price, but manipulation of the twin emotions of fear and greed. Fear triggers selling and greed triggers buying, and the media in all its forms, is the perfect tool to create both.

Next, whilst the insiders all work together, this is not a cartel. There are many hundreds of specialists and market makers, and this simply would not be feasible. What does happen however, is the insiders will all see strength and weakness at the same time. They have the advantage of seeing both sides of the market, all the buy orders and all the sell orders, and therefore true market sentiment.

What they cannot hide is volume, which is why it is so powerful. It is the only way we have of seeing when the insiders are involved in the price action, and if they are, whether they are buying or whether they are selling. When they are buying in the buying climax, we see it, because we have high volumes. When they are selling in the selling climax, we see it, because the volumes are high, and this is what you have to understand. It is the volume which is important not the manipulation element of the VPA, which brings me to another point.

I am often asked how the insiders decide on the target levels for accumulation and distribution, and this was something I struggled with myself. Are these just arbitrary levels decided in advance, or is there some logic that can help us to make sense of this aspect of price behaviour. Well the 'make sense' element is really this, which also helps us to understand the price behaviour we see at these levels.

On any price chart, there are levels of price congestion that create the natural levels at which markets could be considered to be 'over sold' or 'over bought', terms which I introduced earlier in the chapter. These price levels are absolutely fundamental to the principles of VPA for two reasons. First, they represent areas where the market is either likely to find support, or is equally likely to struggle. They define barriers, areas where the market has paused in the past, and either moved on or reversed from these regions. I will explain these in more detail shortly, but for the time being accept the fact they exist, and are created during the phases of accumulation and distribution, as the market moves into sideways consolidation.

Now these 'phases' of price action appear all over our charts and in every time frame, and the insiders will be well aware of where these are and whether they are well developed areas, or simply minor areas where price in the past has perhaps paused before moving on. In preparing any campaign, the insiders therefore target these regions, as potential natural points for accumulation and distribution. This also explains the price action once we finally arrive at these areas.

Let's start with the distribution phase and consider what is actually happening during the selling climax?

The market has risen higher and accelerated on bullish news, and has arrived at the target area, which is potentially one where the market can be considered to be 'over sold', in other words, potentially weak and/or exhausted. We know this because these are the areas insiders target before a campaign starts. Following the bullish trend higher, which has been supported with positive news, and increasing numbers of buyers entering the market, the insiders now pause at this level, and begin the job of distribution.

The initial phase of the distribution is executed purely from the momentum already driven into the market by the insiders, so the volume here will be high but not excessive. On any 'up' candles the volumes here will represent 'natural' buying by investors and speculators. In other words the insiders are not having to 'force' the market higher at this stage. They are simply selling into demand that has been created during the trend higher, and buyers are now in the 'greed' mindset. Any selling at this level, at this stage is again, 'natural' selling, as holders who have bought into the trend earlier, perceive that the market is perhaps struggling at this level, and decide to take their profits. The key point here is the associated volumes during this phase are likely to be well above average but not excessive.

There will certainly be signals of weakness as we will see shortly, once we start to study the charts in detail, but this first phase of distribution is what I call the 'natural' phase. This is the insiders simply meeting demand from greedy investors and speculators. Any selling is absorbed back into their inventory, and resold. The news is then used to move the market higher and lower in this range as the warehouse stock continues to dwindle.

The final phase is the selling climax, and this is where effort is required by the insiders. Now the market is very weak at this level. Perhaps the news is not quite so bullish as before, and the insiders are having to 'force' the price higher, using whatever news they can to pull in more buyers.

But with a weak market the buyers are now becoming overwhelmed with the sellers, which is why we see the price action reflected in the candles during the selling climax. The insiders now have a real struggle on their hands, desperately trying to keep the market propped up, forcing it higher, desperately selling in large volume to buyers, but as the volumes of selling increase, this in turn leads to falling prices, adding downwards pressure on the market.

This is the problem all campaigns have eventually. The problem is simple. Sell in large enough volumes and ultimately the price will fall, working against you. It is this battle to keep the price high, but also to move inventory in volume we are seeing played out in this final dramatic scene. It is the battle the insiders have to face at this stage.

The problem is one of moving large volumes fast, without moving the price down fast, undoing all the good work of earlier in the campaign. It is a fine balance, and this is the balance you see in those last few candles at the end of the selling climax. The insiders are battling to force prices higher, supply the demand in ever increasing volumes without letting the price collapse, which is why we see the price behaviour in these candles. Let's take another look.

The Selling Climax

Fig 5.19

Selling Climax

What is happening here in Fig 5.19 is that in trying to meet demand by selling in large volumes, the selling by the insiders, is forcing the price back down again. We really only have to equate this to some real life examples. Scarcity in a product increases its value. Think of designer goods, branded items, luxury goods. If we want to increase the value of something then we make a 'limited edition'. This allows us to sell the item at a higher price, as there are fewer available and they are therefore more desirable. By contrast the price of a mass market product will be much lower by virtue of the numbers made, and the market unlikely to stand any increase in price.

Whenever large institutions have to sell large blocks of stock at the top of the market, they don’t just place one order for the entire block. This would drive the price down and reduce the profit on the sale, so in order to overcome this problem there is a facility which many large companies use called 'dark pools'.

I did say at the start of this book volume was the only activity that could not be hidden. Well this is not strictly true. Large institutions use dark pools to hide large transactions, and the details are not made public until after the trade has been completed.

There is no transparency, and once again, is something few traders or investors are ever aware of. It's not a huge issue for us, and anyway, there is little than can be done about it.

However, this does reinforce the point. When a large block has to be sold, executing this in one order would drive the price down too far, so the alternative is to either break the order into smaller blocks and sell in smaller volume, or to use the dark pool to hide it completely.

The same problem occurs in the buying climax, where the insiders are buying in large volume, which in turn starts to raise the market as a result. Nick Leeson, the rogue trader who bankrupted Barings Bank had the same problem. His positions were so large, it was impossible to unwind them without moving the market against his own buying and selling.

Finally, another example is when trading an illiquid stock, or currency. Buying in volume will very quickly put the price up against you. Sell in volume and the price will move lower. This is the problem the insiders face when they are selling or buying in large volume. The price will always move against them as a result, which is why they cannot simply complete all their selling or buying in one session.

It has to be done over two, three or four, and is another reason why the distribution process, the selling climax and the buying climax have to be spread over a period. This was one of the issues I struggled with for some time when I first started, but I soon learnt we simply have to be patient, and wait for the climax to complete. Remember it takes time to sell large volumes quickly.

The Buying Climax

It's the same problem with the buying climax. It is the sheer scale of their own buying which results in the market price rising, coupled with short holders closing positions. But, the predominant effect, once the insiders enter the market is the volume effect on price. If we go back to our buying climax example once more :

Fig 5.20

Buying Climax

The market is still bearish, and the insiders are forcing the market lower with negative news, and then buying in volume to fill the warehouses which in turn is moving the market higher against them. The action is stopped and the market moves sideways, temporarily.

More bad news is then used to send the market lower, where large volumes are bought once again, with the market rising on the insider buying. This is repeated until the warehouses are full.

In many ways, it doesn't really matter whether we believe the market manipulation aspect of price behaviour or not. What is extremely important, is that you do believe in the relationship between price and volume in these phases of market behaviour.

The ultra high volumes are showing us, more clearly than anything else, the market is preparing for a reversal in trend. When we see the price action and high volumes associated with a selling climax, we know there is a trend reversal lower in prospect. When we see the price action and high volumes of a buying climax, then we know we are likely to see a bullish trend starting soon. It’s guaranteed.

This is what high volume and the associated price action is telling us. It really couldn't be any clearer.