Chapter Six

Volume Price Analysis - The Next Level

I never argue with the tape.

Jesse Livermore (1877-1940)

In the last few chapters we have gradually started to build our knowledge and understanding of VPA, beginning with a very simple analysis of price and volume at the micro level, the ticker tape level if you like. From there, we moved out to consider some simple concepts of price and volume at the macro level, and finally in the last chapter, the 'global' view and the cycles of behaviour markets follow with the ebb and flow of volume as the insiders push and pull the price action, this way and that, using the media as their primary vehicle.

However, as I said at the start of this book, there is nothing new in trading, and volume has been around for over 100 years. One thing that has changed since, is the introduction of candlesticks as the 'de facto' standard for analysing price action on the chart. All the original books and articles mentioned so far have one thing in common, namely the charts use bars to describe the price action. Candlesticks have only been adopted by Western traders since the early 1990’s. Again I was fortunate in having been taught the basics by Albert, and I have used candlesticks ever since for a number of reasons.

For me, candles are so much more descriptive than any bar can ever be. VPA with candlesticks is my own methodology. By combining the power of candlesticks with VPA gives us a deeper perspective of market behaviour.

In this chapter I want to move to the next level and explain the various candle and candle patterns we build into our VPA analysis and education. I must stress, this chapter is not intended as another book on Japanese candlesticks. There are plenty of those already available, and perhaps I may write one myself in the future.

In this chapter I want to explain those candles and candle pattern combinations which are the ones to watch when analysing a chart using VPA. We're going to look at lots of examples using schematics before moving to actual annotated chart examples in subsequent chapters.

However, before moving forward I would like to explain some broad principles which apply, and which we need to keep in mind in any analysis when using candlesticks.

Principle Number One

The length of any wick, either to the top or bottom of the candle is always the first point of focus because it instantly reveals, impending strength, weakness, and indecision, and more importantly, the extent of any associated market sentiment.

Principle Number Two

If no wick is created, then this signals strong market sentiment in the direction of the closing price.

Principle Number Three

A narrow body indicates weak market sentiment. A wide body represents strong market sentiment.

Principle Number Four

A candle of the same type will have a completely different meaning depending on where it appears in a price trend. Always reference the candle to the location within the broader trend, or in the consolidation phase.

Principle Number Five

Volume validates price. Start with the candle, then look for validation or anomalies of the price action by the volume bar.

So, let me start with two of the most important candles, the shooting star and the hammer candle.

The Shooting Star Candle

Price action - weakness.

The shooting star candle is one of our three premier candles in VPA that we watch for in all time frames, and in all instruments and markets.

The price action is revealing weakness, since the price has risen and then fallen to close near the opening price, with the sellers overwhelming the buyers in the session.

Shooting star candles appear in every trend, both bullish and bearish, and at every point within the trend. Their appearance DOES NOT

signal an immediate reversal. Their appearance signals POTENTIAL WEAKNESS

at that point in the price action. The candle will ONLY

gain significance based on the associated volume.

The shooting star price action appears in every up and down trend. It is the classic signal of weakness, and it is only volume which can give a clear

signal as to the relative strength of this weakness, and consequently the extent of any reversal. The best way to understand these variants is with some examples.

In a bullish up trend any shooting star with below average volume is simply signalling a possible pause in the upwards trend, with a potential short term pull back. Following such a signal, we would then be considering the previous and subsequent price action for confirmation of a continuation of the trend.

As the trend develops further, this initial weakness may be confirmed further with additional shooting star candles, with average volumes. Once we have two candles of similar proportions in a trend, and in the same time frame, we can then compare volume between the two candles. If the first candle was an initial sign of weakness, then the second, with increased volume is confirming this weakness further. After all, if the volume on the second shooting star is higher than the first, so 'weakness' has increased as more selling is coming to the market and forcing prices lower in the session.

This brings me to an important point which I would like to introduce here. It is perhaps an obvious point, but nevertheless one which is worth making.

If we see one shooting star, this can be taken as a sign of weakness. If we see two consecutive shooting stars, or two relatively close to each other, this is increasing the bearish sentiment. If a third appears then this is adding yet more bearish sentiment. In other words, single candles are important, multiple appearances of the same candle, in the same price area, exponentially increase the level of bearish or bullish sentiment. And remember, this is just based on price action alone. Add in the volume aspect and this takes our analysis to another level, which is why I find it so strange that PAT traders don't use volume.

Fig 6.10

Shooting Star Candles And Volume

If we took this price pattern, as shown in Fig 6.10, and imagine these were in fact three simultaneous candles, each with increasing volume, then based on this combination of candle pattern and volume, do we think the market is likely to rise or fall?

Clearly, the market is very weak and likely to fall and the reason is very straightforward. First, we have seen three consecutive candles, whose high has failed at exactly the same price level, so there is weakness in this region. Second we have three shooting stars, which we already know are signs of weakness, and finally we have volume. We have rising volume on three identical candles at the same price point on our chart. The market is really struggling at this level, and the last two could certainly be considered part of the selling climax.

Moreover, if these signals were to appear after a period of sideways price action, this gives the signals even more strength, as we are then validating our VPA analysis with another technique of price analysis, which is support and resistance.

It is very easy with hindsight to look back and identify tops and bottoms. What is far more difficult is to try and identify major turning points in real time so I have created the schematic in Fig 6.11 to explain how this action plays out on a chart. It will also allow me to introduce other broader aspects of this methodology.

Fig 6.11

Typical Price Action And Shooting Star Candles

If we take the left hand side of the schematic first. The market has been trending higher, when a shooting star candle appears on the chart, perhaps it even has above average volume. Does the appearance of this candle signify a major reversal of trend or simply a minor pause and pullback? The answer is, based on this candle, we do not know.

All we can say for sure, is that we have seen a bullish trend develop in the previous sessions, and now we have some weakness. We know the signal has some validity, as it has appeared after the market has been rising for some time, and this is one of the points I was trying to highlight earlier. We have to consider all these signals in the context of what has gone before.

In this case we had a nice bullish trend developing, when a shooting star candle appeared with above average volume. The chart now has our full attention. What do we do? Do we jump in and take a trade?

Absolutely not. As I mentioned earlier the market does not turn on a dime. It pauses, reflects, then rises, pauses once again and then falls.

We wait for the next candle to form to see if it is confirming this weakness, perhaps some narrow spread up candles, followed by another shooting star. The appearance of the first shooting star is our cue to sit up and take note. It is our cue to check the subsequent candles for confirmation of the initial weakness, and try to deduce with VPA whether this is a sign of longer term weakness or merely a temporary pause. At this point we would also be considering price congestion areas on the chart for clues. After all, if we are in a price region where the market has reversed previously, then this too is a strong signal, and in addition may also give some clues as to the likely depth of any reversal.

In addition, if the price action has only recently broken out from an accumulation phase, then it is unlikely to be the start of any reversal lower, and once again this is a key point. To always consider where we are in the context of the trend and its relation to recent consolidation phases of price action during which the insiders would have been accumulating. After all, it is very unlikely a new trend would have been started and then promptly reverse, particularly if a successful test had followed. So the context of where the candle comes in relation to the ‘bigger picture’ is important and helps to answer the question.

The next step is to check the higher and lower time frames for a broader perspective on this signal and for context, as well as applying VPA to these timeframes.

For example, if this price action had appeared on a one hour chart, and on checking the 15 minute chart we could see two shooting star candles had formed in that time frame, both with above average volume, this gives confirmation any reversal may be more significant. Furthermore, the 15 min chart may also have significant areas of price congestion which would also contribute to our analysis. All this analysis takes minutes, if not seconds while waiting for the next candle to form.

Using multiple time frames also gives us a view on the longer term trend, and may also help to answer the question of whether the appearance of this shooting start candle is merely a minor reversal or the start of a longer term change in trend. This is one of the many advantages of using multiple time frames for chart analysis. Furthermore, using multiple time frames will give a perspective on how long we are likely to be holding any position.

This makes perfect sense. After all, if the longer term trend is bullish, and we are trading short on a faster time frame chart, then it's likely we will only be holding this position for a limited period of time, as we are trading against the dominant trend for the session. Once again, this will help to answer the question of whether this is a trend reversal, or simply a minor pause and pull back.

There are a variety of techniques to help us ascertain whether the market is at ‘a top’ and these will be outlined in detail later in the book. However, I wanted to introduce some of these here. Multiple time frame analysis, VPA analysis, price congestion and candle pattern analysis can all be used to help us answer this question. Furthermore, a rising market with falling volume is also a classic sign of weakness.

The shooting star may have been preceded with a narrow spread up candle on high volume, again classic signs of weakness, but they still do not answer the question of whether this is a minor pull back or a major reversal in trend. To do this we need help, and that help comes from using VPA in other time frames, along with the techniques which you will also discover later.

One such technique is the depth and extent of any price congestion as the longer a market moves sideways at a particular level the more likely a breakout and reversal.

Moreover, VPA is an art and not a science, which is why trading software cannot do this analysis for us. The analysis we carry out on each candle, candle pattern, associated volumes, and associated price across multiple time frames to assess and determine the dominant trend, is all subjective. Initially it takes time to learn which is why I have written this book in order to short cut the learning curve for you.

The five principles mentioned at the start of this chapter apply to all candles, and all our VPA analysis, but as the shooting star and its opposite number the hammer are so important, I felt it was appropriate to introduce the basic concepts of the next levels of VPA analysis here.

Just to complete this commentary on the shooting star candle, not only do these appear in up trends, but they also appear in down trends, and here they act as confirmation of weakness, particularly if they appear shortly after the start of the move lower. The appearance of a shooting star candle in a downtrend which follows a selling climax could be a test of demand as the market moves lower. Furthermore, if the shooting star is accompanied by low volume, and the market had been in sideways congestion for a period following the selling climax, this also confirms the insiders testing demand as the market moves away from the distribution phase. The shooting star is a sign the market has been pushed higher, but there is no demand so falls back to close, at or near the open.

Shooting star candles may also appear at minor reversals deeper in the trend, as the downwards pressure pauses and pulls back higher. Here again, if the candle is accompanied with above average volume, it is only telling us one thing, namely the market is still weak, and we have not yet reached the buying climax at the bottom of the trend.

This pattern of price action is the insiders selling back to the market some of the inventory they have collected from panicked sellers who had bailed out earlier. This inventory in the warehouse has to be sold as the market moves lower. After all, the insiders don't like to buy anywhere other than at their target price, in other words, a wholesale price.

Some buyers will come in at these pull backs, thinking the market has bottomed out, and about to turn higher, whilst others continue to sell. This price action occurs all the time in a price waterfall, as the market moves lower and fast. The insiders have to stop the fall, pause, push the market higher using the media and sell into the created demand whilst also dealing with the ongoing selling that is continuing to arrive. The volume will therefore be above average or high, showing further weakness to come.

The Hammer Candle

Price action – strength

The hammer is the second of our three 'premier' candles and another classic candle that we look out for in all markets and time frames. It is the classic candle of strength, for either temporary strength, or as a signal for longer term price reversal.

A hammer is formed when in a session, the price has fallen, only to reverse and recover to close back near the opening price. This is a sign of strength with the selling having been absorbed in sufficient strength for the buyers to overwhelm the sellers, allowing the market to recover. The hammer is so called as it is 'hammering out a bottom', and just like the shooting star, is immensely powerful when combined with VPA.

Once again, the five principles outlined at the beginning of the chapter apply to the hammer candle, and again it is very easy to become over excited as soon as you see this candle. It is so easy to jump into what we think is going to be a change in trend. If the market has been moving lower fast, which they generally do, it is unlikely any reversal will take effect immediately. What is far more likely is for the market to pause, move higher, and then continue lower once again. In other words posting a short squeeze.

As we now know, the insiders have to clear inventory which has been sold in the move lower, and the first signal of a pause is the hammer, as the insiders move in to buy, supporting the market temporarily. They may even push it higher with a shooting star candle. The hammer is signalling 'forced buying' by the insiders, and the shooting star is signalling 'forced selling' by the insiders. Whilst they do move bearish markets fast, there is always selling that has to be absorbed at higher levels, and this inventory has to be cleared before moving lower once again. After all, if this did not happen, the insiders would be left with a significant tranche of inventory bought at high prices, and not at wholesale prices.

A price waterfall will always pause, pull back higher, before continuing lower. As always, volume holds the key, and if the volumes have been rising in the price waterfall lower, then this is a strong signal of further weakness to come. Therefore, a single hammer will simply not be enough to halt the move lower, even if the volume is above average. As always, the price action which follows is key, as is the price and volume in the associated time frames along with any price congestion in the vicinity. This is the same problem as before and the question we always have to ask, whenever we see a hammer or a shooting star, is whether the price action is signalling a pause in the longer term trend, or a true reversal in trend.

The power of the hammer candle, just like the shooting star, is revealed, once we see a sequence of two or three of these candles accompanied by high or extremely high volume. It is at this point we know for sure we are in the realms of a buying climax and only have to be patient and wait for the insiders to complete their task, before they begin to take the market higher.

Furthermore, we also have to remember once the buying climax is completed, we are likely to see one or more tests using the hammer candle. These candles may be less pronounced than the true hammer, perhaps with relatively shallow wicks, but the principle will be the same. The open and close will be much the same, and there will always be a wick to the lower body.

For a successful test, the volume needs to be low too, and there is also likely to be more than one test in this phase. These tests can appear both in the price congestion area of accumulation as well as in the initial phase of any breakout, as the price action moves back into an old area of heavy selling immediately above.

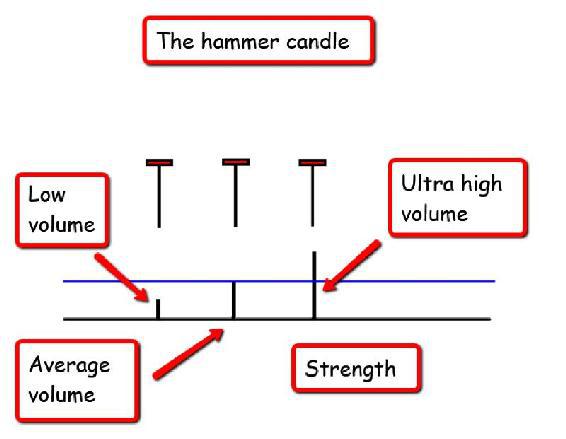

These are the two candles which are our number one priority in reading of price and volume. As I'm sure you will recall from the introduction to Volume Price Analysis, all we are looking for, on any candle or sequence of candles, is validation or anomaly. Is the volume validating the price action and what signal is this sending to us, or is it an anomaly, and therefore sending us a very different signal.

In a sense, there is never an anomaly with a shooting star candle, since the price action is sending a clear message on it's own. As any price action trader will tell you, this candle is a signal of weakness, in itself. There is no other interpretation. The market has risen and then fallen in the session, therefore the market must be weak. What volume does is put this weakness into context, which is why I have shown the schematic with the three volume bars, low, average and high (or even ultra high). A shooting star with low volume is a sign of weakness, but probably not significant, unless it is a test of demand following a selling climax as we start the downwards move lower.

A shooting star with average volume is telling us there is weakness, it is a relatively strong signal, and the pull back may be more significant than in the first example on low volume. Finally, we have the shooting star with high or ultra high volume and this is where the professional money is now selling out. Whether it's the market makers in stocks and indices, or the big operators in futures, or the market makers in forex, or the big operators in bonds, it doesn't matter. The insiders are selling out, and we need to prepare and take note, as a big move is on the way.

The point is this. There is never an anomaly with a shooting star, only ever a validation of the strength of the signal. The volume always confirms the price action with a shooting star, and all we have to do is consider whether it is low, average or high to ultra high, and frame this in terms of the preceding price action across our time frames, and track the subsequent candles as they unfold on the chart.

The same points apply to the hammer candle. Once again, there is never an anomaly with a hammer candle. The price action tells us all we need to know. In the session, for whatever reason, the price has moved lower and then recovered to close near or at the open. It is therefore a sign of strength, and the volume bar then reveals the extent of this strength.

Once again, I have shown three hammer candles with three volume bars, low, average and ultra high as we can see in Fig 6.12.

A hammer with a low volume candle is indicating minor weakness, average volume suggests stronger signs of a possible reversal, whilst ultra high signals the insiders buying heavily, as part of the buying climax. The volume is giving us clues on how far the market is likely to travel. An average volume bar with a hammer candle, may well give us an intra day scalping opportunity. And there is nothing wrong with that. A low volume hammer is simply telling us any reversal is likely to be minor, as there is clearly little interest to the upside at this price level.

Fig 6.12

Hammer Candles And Volume

This raises another point which I feel I should also mention here.

VPA not only helps us get into low risk trading positions, it also helps to keep us in those positions, which is often one of the hardest things to do in trading. Holding a position and staying in a trend can be very difficult, and I believe is one of the hardest skills to master. It is also a primary reason why so many traders fail. After all, it is staying in a trend where we maximise any profit, and a trend can be from a few minutes or hours, to several days and weeks.

We all know as traders the market only goes up in steps and down in steps, never in a straight line, and we have to stay in positions through these minor pull backs and reversals. This is one of the many great powers of VPA as it will help to keep you in an existing position, and give you the confidence using your own analysis, to truly see inside the market.

For example, the market may be moving lower, we are short the market, and we see a hammer formed. Is this a reversal in trend and time to exit, or merely a short term reversal in a longer term trend lower? If the volume is low, then clearly the insiders are not buying at this level. Perhaps the hammer is followed by a shooting star on average to high volume, a sign of weakness in the down trend, and confirming the analysis of the hammer candle. The market is weak and our analysis using VPA has given us the confidence to hold the position in the market through this pullback. Without volume, we would have little idea of the strength or weakness of this price activity. With volume, it is all revealed, and we can base our decisions accordingly.

This is the power of VPA. Not only does it get us into trades, but it helps keep us in, and finally gets us out.

Taking the above example again in Fig 6.12, and the hammer which arrives with high or ultra high volume. This is an early warning signal of a potential reversal. The big money is moving in, and as a short seller it is potentially time to exit the market, take some or all of our profits off the table, and prepare for a long position when the break out occurs.

Getting into a trade is the easy part, staying in and then getting out at the right time is very difficult. And this is where VPA is such a powerful technique in giving us the insight we need into market behaviour. Once you begin to interpret and understand what the price and volume relationship is signalling, then you have arrived at trading Nirvana.

Now finally, if we do see the hammer candle at the top of a bullish trend, it has a different name, and a completely different interpretation. This will be covered later in this chapter when we consider other candles and candle patterns, as we continue to build on our knowledge.

This is what I meant by Principle 4 – a candle can have a very different meaning depending on where it appears in the overall trend. At the top of a trend the hammer is called a ‘hanging man’ and when it appears in a candle pattern with a shooting star is signalling weakness.

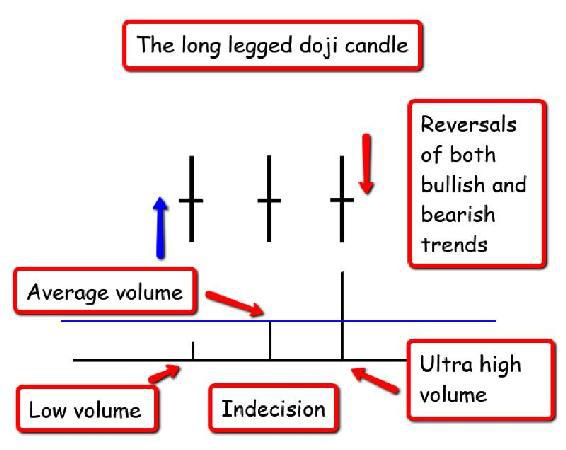

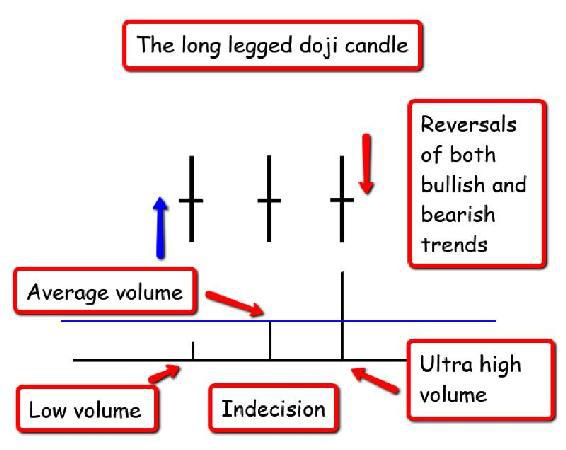

The final candle in our trio of premier candles is the doji, but not just any doji candle, it is the long legged doji.

The Long Legged Doji Candle

Price action – indecision

There are many variants of the doji candle, and you will see them continuously in every chart. They are all characterised in the same way with the open and close being the same or very close, and with a wick to the upper and lower body.

This is the price action which creates the unique pattern of the doji candle, or doji cross. Whilst there are many different sizes and types of doji candle, there is only one which I believe is significant in the context of VPA, and that's the long legged doji.

In itself the doji candle signifies indecision. The market is reaching a point at which bullish and bearish sentiment is equally balanced. In the context of what actually take place in the session, it is something like this. The market opens, and sentiment takes the price action in one direction. This is promptly reversed and taken in the opposite direction, before the opening market sentiment regains control and brings the market back to the opening price once more. In other words, there have been some wild swings in price action within the session, but the fulcrum of price has remained somewhere in the middle.

The key point about this type of doji candle is both the upper and lower wicks are long in comparison to the body, and should resemble what I used to call, a 'daddy long legs' – a small flying insect with very long legs.

The power of the candle lies in it's predictive power as a potential signal of a reversal in trend. Just like the hammer and the shooting star, the price action alone gives us a firm signal, but when combined with volume, it becomes immensely powerful. The price action in the candle is sufficient, in itself, to tell us visually that there is indecision. After all, if this were not the case, then the candle would be very different in construction.

Once again, the price action reveals the sentiment, which in this case is indecision and therefore a possible reversal. The long legged doji can signal a reversal from bearish to bullish, or bullish to bearish, and the change in direction depends on the preceding price action. If we have been in an up trend for some time, and the long legged doji appears, then this may be the first sign of a reversal in trend to bearish. Conversely, if we see this candle after the market has been falling for some time, then this may be signalling a reversal to bullish.

However, unlike the shooting star and the hammer candle, with the long legged doji candle we can have an anomaly in volume. Once again as we can see in Fig 6.13 I have shown the candle with three volume bars beneath, and the one which is an anomaly is the first one on low volume.

Let me explain why this is an anomaly, and also introduce another concept here which fits neatly into this section.

Fig 6.13

Fig 6.13

The Long Legged Doji

Why is low volume on such a candle an anomaly? Well, let's think about this logically. The market has moved sharply in both directions and finally closed back or near the opening price. This price action is a sign of volatility in the market, as the market has swung back and forth in the session. If the market were not volatile, then we would see a very different type of candle. Therefore, if the market is volatile, why is there low volume.

Volatile markets require effort and as we know effort and result go hand in hand. However, in this instance we have no effort (low volume) and a big result (wide price action). Clearly this is an anomaly, and the only logical answer is the price is being moved by the insiders, who are simply not joining in at the moment. The most common reason for this is stop hunting, where the market makers and insiders are moving prices violently, first one way and then the other, to shake traders out, and to take out stop and limit orders in the process. They are not buying or selling themselves, but simply 'racking' the price around, generally using a news release as the catalyst, and this brings me to an important point in the VPA story.

The long legged doji is seen most often during a fundamental news release, and the classic one for the US markets is the monthly Non Farm Payroll data, released on the first Friday of every month. On the release, price behaviour becomes extremely volatile, where this candle is created repeatedly when economic data such as this is released. The market swings violently one way, then the other, and then perhaps back again. It is the ideal opportunity for the insiders to whipsaw traders in and out of positions fast, taking out stops and other orders in the market at the same time.

And the reason we know this is happening is volume, or rather the lack of it. If the volume is low, then this is not a genuine move, but an anomaly. For the price to behave in this way takes effort, and we are seeing this with no effort, as shown with low volume. The insiders are simply manipulating prices, and in this case, the long legged doji is not signalling a reversal, but something very different. Insider manipulation on a grand scale at this price level. It may well be the market does reverse later, but at this stage, we stay out, and wait for further candles to unfold.

The next point which leads on from this is the interaction between volume and the news. Whenever we have an economic release, a statement, a rate decision, or any other item of fundamental news, then the associated volume reaction will instantly tell us whether the market is validating the news or ignoring it. In other words, here too volume validates the news release, and tells us immediately whether the market insiders are joining in any subsequent price action or waiting on the sidelines and staying out.

If the insiders are joining in, then we can too, and if not, then we stay out, just like them.

For example, when a 'big number' is released, say NFP, which is seen as positive for risk assets such as equities, commodities and risk currencies, and perhaps we are trading a currency. Then we should see these assets rise strongly on the news, supported by strong and rising volume. If this is the case, then we know the markets have validated the news and the insiders and big money are joining in. We might see a wide spread up candle, with high volume. The news has been validated and confirmed by the price action and associated volume.

I would urge you to study volume whenever news is released, as it is one of the quickest ways to learn the basics of VPA. Here you will see it at work. Surges in volume accompanying large price moves, large price moves on low volume, and trap moves, such as low volume on a long legged doji. It will all be there for you. However, the key point is this. When news is released, it is often the first place where we see volume surges in the market, and they are excellent places to start our analysis. If the volume surge has validated the price move, then we can be sure the insiders are joining in the move higher or lower. If the price action has moved on the news, but has NOT been validated by supportive volumes, then it is an anomaly and other forces are at work. This is telling us to be cautious.

Volume and the news should go hand in hand. After all, the markets generally react to the major news releases which occur throughout the trading day, and this is the easiest, quickest and simplest way, to begin to read the market, and also gain a perspective on what is low, medium, high or ultra high volume, for all the various instruments and markets you may be trading.

A long legged doji candle, should always be validated by a minimum of average volume, and preferably high or ultra high. If it is low, then it is an anomaly and therefore a trap set by the insiders. If the volume is high, we must be patient and wait for the subsequent price action to unfold. We may see further doji candles before the trend is established, so as always patience is required following their appearance. Wait for direction to be confirmed and established.

Those then are our trio of 'premier candles' we watch for in all time frames. They are our cue to pay attention and start our VPA analysis. If we are not in a position, we are looking for confirmation of an entry, and if we are already in the market, we are looking for signals either to stay in, or exit.

Now let's move on to some of the other key individual candles, and then on to consider some candle patterns.

Wide Spread Candles

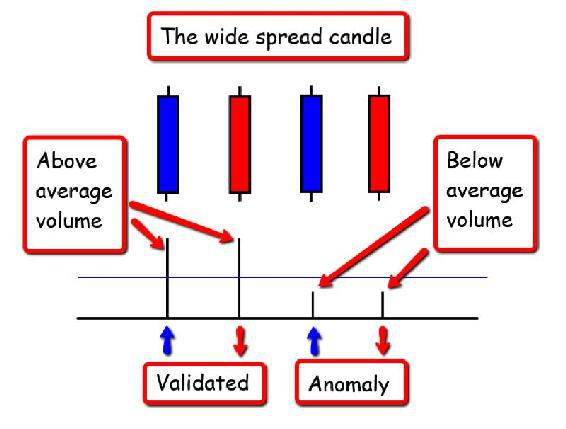

Fig 6.14

Wide Spread Candle

Price action – strong market sentiment

The price action of the wide spread candle is sending a clear signal with only one message. Sentiment for the session is strong. It is either strongly bullish or strongly bearish, but the word is strong. The price action has risen sharply higher or lower in the session and closed at or near the high of an up candle, or at or near the low of a down candle. The associated volume should therefore reflect this strong sentiment with 'strong' volume.

As we can see in the example in Fig 6.14, if the volume is above average, then this is what we should expect to see as it validates the price. The insiders are joining the move higher and everything is as it should be.

However, if the volume is below average or low, this is a warning signal and an anomaly. The price is being marked higher, but with little effort. The warning bells are now ringing. Many retail traders will be rushing to join the move higher or lower thinking this is a valid move by the market and therefore strong. But the volume reveals a very different story. If we are in a position, we look to exit. If we are not in a position we stay out, and wait for the next signal to see when and where the insiders are now taking this market.

Narrow Spread Candles

Price action – weak market sentiment

You may be wondering why we should be interested in a narrow spread candle, which tells us when market sentiment is weak. After all, shouldn’t we simply be interested when the insiders are in the market, to which the answer is, yes, of course. Narrow spread candles can be found everywhere and in quantity. But the reason we need to consider them is that, in general, markets move higher slowly. Markets pause, consolidate and reverse, often on narrow spread candles. Therefore, the interesting ones are not those validated by volume, but the anomalies.

Fig

6.15

Narrow Spread Candles

A narrow spread candle should have low volume – again effort vs result. These are of little interest to us. However, the ones that are of great interest are the anomalies, where we see above average, or high volume, on a narrow spread candle. This should instantly alert us, and we should ask ourselves why?

The reason is very simple and can be seen in Fig 6.15. If we have an up candle with a narrow spread and relatively high volume, then the market is showing some signs of weakness. As we know high volume should result in a wide spread candle, not a narrow spread. Effort vs result again. The insiders are starting to struggle at this price level. The market is resistant to higher prices, and although it has moved a little way higher, is now proving resistant to any further progress, and the next candle could be a shooting star, which would then confirm this weakness further.

Equally, if we see high volume on a down candle then the reverse applies. Here the insiders are starting to see signs of bullish sentiment enter the market. The price is narrow, with buyers (insiders) coming in, and supporting the market at this level. Again, this is the first sign of a potential reversal from bearish to bullish. Subsequent candles may confirm this and we would now be waiting for a hammer, or possibly a long legged doji to add further weight to the analysis. These narrow spread candles on high volume will often be seen following the start of any accumulation or distribution phase and signal further buying or further selling by the insiders.

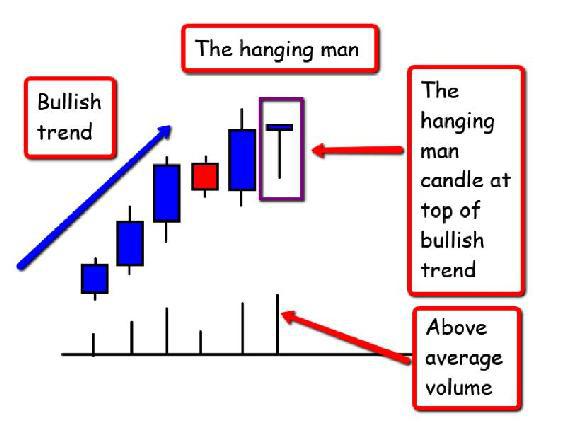

The Hanging Man Candle

Price action – potential weakness after bullish trend

When I first started using VPA and candles, I always used to assume a hanging man appearing in a bullish trend was a sign of strength, and continuation of the trend, since to me this was the same action as the hammer candle. It isn't. It is in fact the opposite, and is a sign of weakness, provided it is associated with above average volume as shown in Fig 6.16.

Fig 6.16

Hanging Man

And the question is, why is it a sign of weakness? The answer is very simple. The market has been rising steadily on rising volume, when at some point in the bullish trend, the market sells off sharply, with the price moving lower in the session, only to recover and close at, or near the high of the session, creating the familiar 'hammer candle price action'. Except here we now refer to this candle as the hanging man candle, as it is now at the top of a bullish trend.

The reason this candle is considered to be bearish is this is the first sign of selling pressure in the market. The insiders have been tested, and the buyers have supported the market, but this candle is sending a signal the market is moving towards an over bought area. The body of the candle can be either colour, but the price needs to close at, or near the open.

The price action is confirming the appearance of sustained selling pressure, which on this occasion has been supported by the buyers and repulsed, but it is an early warning of a possible change. It is an early warning signal, and now we need to watch our charts for confirming signals.

The insiders will have seen this weakness appearing too, and be starting to plan their next move.

The hanging man is validated if it is followed by the appearance of a shooting star in the next few candles, particularly if associated with above average or high volume. The key here is validation. On its own it is not a strong signal, but merely gives us early warning of a possible change.

For this candle to be validated and confirmed we need to see further signs of weakness at this level, or close to this level, which would then increase the significance of the candle. For example, a hanging man, immediately followed by a shooting star is an excellent combination and adds considerably to the strength of the initial signal. Even if the shooting star appears later in the candle sequence, this is still a strong confirming signal, provided it is associated with high volume.

Stopping Volume

Price action - strength

This is what the price action looks like as the brakes are applied by the insiders, and is generally referred to as stopping volume. As I have said many times before, the market is like an oil tanker. It never reverses on a dime for many reasons, not least because just like a supertanker it has momentum, and therefore takes time to respond, once the brakes are applied.

Fig 6.17

Stopping Volume

In Fig 6.17 we are in a strong down trend, the price waterfall has been in action and the market has been moving lower fast. However, the insiders now want to start slowing the rate of descent, so move in and begin the buying process. This buying is then seen in subsequent candles with deep lower wicks, but generally with relatively deep bodies. However, for additional strength in the signal, the close of the candle should be in the upper half of the open and close price. This is not a hard and fast rule, but generally describes the candles as shown in Fig 6.17.

What is happening, is the weight of the selling pressure has become so great at this point, even the insiders moving into the market have insufficient muscle to stop the market falling in one session. It takes two or three sessions for the brakes to be applied and is like our tanker. Switch off the engines and the ship will continue for several miles. It's the same with the markets, particularly when you remember markets fall faster than they rise. In a market that is being driven by panic selling, the pressure is enormous.

The insiders move in and manage to absorb some of this pressure with prices recovering in the session, to close well off the lows of session thereby creating the deep lower wick. The selling then continues into the next session, and the insiders come in again with higher volumes, driving the price back higher off the lows, and perhaps with a narrower body on the candle, signalling the buying is now starting to absorb the selling to a greater extent. Next, we see another candle with a narrower body and a deep wick. Finally, we see our first hammer candle.

The sequence of candles in Fig 6.17 is an almost perfect example, and if we do see this combination following a sharp move lower, then we would be on full alert for the forthcoming move higher.

Stopping volume is exactly as it sounds. It is the volume of the insiders and professional money coming into the market and stopping it falling further. It is a great signal of impending strength, and a potential reversal in the bearish trend to a bullish trend. It is the precursor to the buying climax which should follow as the last remnants of selling pressure are mopped up, the warehouses are filled to over flowing, and the insiders are ready to go. You should be ready to move too.

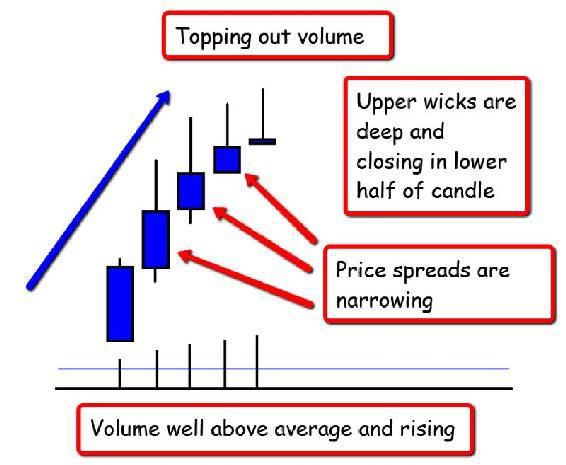

Topping Out Volume

Price action - weakness

Once again the clue is in the name. Just as stopping volume was stopping the market from falling further, so topping out volume is the market topping out after a bullish run higher.

In just the same way, the market does not simply stop and reverse, it has momentum, both in up trends and in down trends. The down trend pressure is certainly more intense as the market is generally moving faster. Nevertheless, in an up trend we still have momentum generated by the insiders driving demand. Traders and investors are jumping into the market, driven by greed and fear of missing out on easy profits. The volumes are high and rising, and the insiders are now selling into this demand, driving the market higher into selling pressure which is building. This is the price action we are seeing reflected in the deep upper wicks to each subsequent candle.

At this point it is becoming increasingly difficult for the insiders to keep the market momentum going, as they continue to sell at this level, with the candles creating the ‘arcing pattern’ as the spreads narrow and the price rise slows. Volumes are well above average and probably high or ultra high.

Fig 6.18

Topping Out Volume

In Fig 6.18 the last candle in this 'perfect' schematic is our old friend, the shooting star. We are now looking at the distribution phase which then culminates in the selling climax, before moving off to the next phase of the market cycle.

These then are the candles, candle patterns and associated volume, you will be looking for in all markets, in all instruments and all time frames. They are the major signals which are the wake up call to you as a VPA trader. They may be on a tick chart, they may be on a time chart. It makes no difference. The analysis of volume and price makes no distinction. Once you have practiced using the basic principles we have covered in the last few chapters, and further techniques you will learn in the following chapters, you will be ready to apply your new found knowledge and skills to any market. VPA is simple, powerful and it works, and once learnt is never forgotten.

There are many other candles and candle patterns in candlestick analysis, but as I said earlier, this is not a book about Japanese candlesticks. The ones I have illustrated here, are those I look for all the time. They are the 'king pins' around which VPA revolves. Understand and recognise these instantly, and you will be amazed how quickly you will become confident and assured in your trading decisions. More importantly, if you have a position in the market you will have the confidence to stay in that position, and exit when your VPA analysis signals tell you to close out.

In the next few chapters we are going to build on our knowledge, and add further techniques, before finally putting it all together with annotated examples from live charts.

Fig 6.13

The Long Legged Doji

Fig 6.13

The Long Legged Doji