Chapter Seven

Support And Resistance Explained

Money and markets may never forget, but surely people do. And that will not be different this time, next time, or any time in your life.

Kenneth L Fisher (1950-)

So far in this book on Volume Price Analysis we have focused on the 'pure' relationship between volume and price.

In this chapter I'm going to introduce the first of our analytical techniques, which helps to give us our 'perspective' on where we are in terms of the price behaviour on the chart. More importantly, when combined with VPA, this technique also reveals when trends are about to start or end, and equally when markets are moving into congestion phases.

To use a building analogy for a moment. If volume and price can be considered the foundations, then the analytical techniques I explain in the next few chapters are the walls, floors, ceilings and the roof. In other words, they provide the framework for volume and price. VPA on it's own is extremely powerful. However, what these additional techniques will add are the markers, the signposts if you like, as to where the market is in its longer term journey on the chart.

Perhaps one of the most difficult aspects of trading is managing and exiting any position. As I said earlier, getting in is the easy part, getting out is hard, and this is where these techniques will help in 'mapping' the price action. They are milestones if you like, and understanding these milestones and the messages they convey will then help you to understand not only when a market is about to trend, but also, and perhaps more importantly, when it is coming to an end.

Let me begin with the first of these techniques which is known as support and resistance. Once again, this is a powerful concept which can be applied to any market, any instrument and in any time frame, so whether you are using VPA as a scalping intra day trader, or as a longer term investor, support and resistance is one of the key principles of price behaviour on a chart and a central plank of technical analysis.

However, the irony of support and resistance is that it is in sharp contrast to VPA itself. Volume Price Analysis focuses on the 'leading' aspects of price behaviour and tries to analyse where the market is heading next. Support and resistance does this in a different way entirely, by focusing on what has gone before. The history of price behaviour, the 'lagging' aspects of price behaviour.

Despite this irony, it is the combination of the two which gives us a perspective on where the market is in terms of its overall journey. It tells us where the market might pause, breakout, or reverse, both now and in the future, all important markers for the entry, management and exit of trading positions.

Therefore, let me recap the basics of price behaviour. In broad terms a market can only move in one of three ways, up, down or sideways. In other words, a market can only trend higher, trend lower or move sideways in a consolidating phase of price action. Of these three states, markets spend considerably more time moving sideways, than they do trending either higher or lower. As a rough rule of thumb this is generally considered to be around 70% of the time, whilst only trending for 30% of the time. Markets move sideways for all sorts of reasons, but primarily there are three.

First, is the pending release of an item of fundamental news. To see this in action simply watch the price action ahead of any major fundamental news release. Prices are likely to trade in a narrow range for several hours ahead of key economic data.

Second, markets move sideways in both the selling climax and the buying climax phases, when warehouses are either being filled or emptied by the insiders.

Third and finally, markets move sideways when they run into old areas of price, where traders have been locked into weak positions in previous moves. As the market approaches these areas, speculators and investors grab the chance to exit the market, usually grateful to be able to close out with a small loss.

Whatever the reason, areas of support and resistance will look something like Fig 7.10. This price behaviour appears on all charts, with clearly defined areas where the market has moved sideways for an extended period.

Support And Resistance

Fig 7.10

Support & Resistance

The analogy I always use to explain this type of price action is that of a house, with floors and ceilings, which I hope will help to fix this more vividly in your mind's eye. What is happening in the schematic in Fig 7.10?

To begin with the price has fallen, before reversing higher, only to fall back again, before reversing higher once more. This 'zig zag' price action is repeated over and over again, and as a result, has created the 'channel' of price action with peaks and troughs as shown on the schematic. This oscillating price action creates what we call the floor of support and the ceiling of resistance. Each time the price action comes down to the floor, it is supported by what appears to be an invisible cushion. Not only does this help to prevent the market from falling further, but also helps the price to bounce higher.

Once the price has bounced off the floor of support, it heads back towards the ceiling of resistance, where an invisible barrier appears again, this time preventing the price moving higher and pushing it back lower again. For any of you who remember the very first computer games such as ping pong with the two paddles, it is very similar, with the ball, or the market in this case, bouncing endlessly back and forth between the two price levels. At some point the price will break out from this region.

However, before moving on there are several points I would like to examine and the first, and perhaps most obvious is, why is this price action so important. Therefore let me try to address this issue here.

Suppose for a moment that the price action in Fig 7.10 is taking place following a long bullish trend higher, but that this is not a selling climax. What is actually happening in this scenario?

First the market has moved higher, buyers are still buying into the trend, but then the price reverses, and moves lower. The buyers are trapped at this higher level, and are now regretting their decision. They are trapped in a weak position. The market moves lower, but then starts to move higher again, as buyers come in at this lower level, fearful they may miss out on another leg higher in the trend. As the market approaches the first reversal point, those buyers in a weak position, sell, glad to exit with a small loss or at break-even. This selling pressure sends the market lower, away from the ceiling level, but with a second wave of buyers now trapped in weak positions at this higher level.

The market then approaches the floor again, where buyers enter, seeing an opportunity to join the bullish trend, and take the market back to the ceiling again, where the second wave of weak traders sell out, and exit with either a small loss or marginal profits. This oscillating price action is then repeated.

At the top of each wave, buyers are left in weak positions, and then sell out on the next wave, to be replaced by more buyers at the top of the wave, who then sell out at the top of the subsequent wave. It is this constant buying and then selling at similar price levels, which creates the 'invisible' bands, which are made visible by joining the highs and lows on the price chart.

The buyers who bought at the floor of the price action, are happy to hold on, expecting higher prices. They have bought at the lower level as the market has pulled back, seen the market rise, and then reverse back to the original entry level. Unlike those buyers who bought at the ceiling level, their positions have never been in loss. So far, all that has happened, is that a potential profit has been reduced back to zero, or close to zero, so these buyers are still hopeful of making a profit from their position. Fear is not yet driving their decision making.

In fact, there is nothing magical about these price levels of the floor and the ceiling. They simply represent the 'extreme' psychological levels of fear and greed in that particular price region and time. We must always remember, price action is fuelled by these two basic emotions, and it is in the price congestion phase of market behaviour we see these emotions in their most basic form. At the top of the first wave, greed is the over riding emotion. By the time the market returns on the second wave, fear and relief are the over riding emotion for these traders.

Fear And Greed Riding The Wave – Top Of Bull Trend

Fig 7.11

Fear & Greed - Bull Trend

As we can see in the schematic in Fig 7.11 it is all very logical once we begin to think of it in terms of emotional buying and selling. The over riding emotion as the market hits the top of the first wave is greed, combined with the emotion of fear – the fear of missing out on a good trading opportunity. Remember, these traders are weak anyway. Why? Because they have been waiting and waiting, watching the market continue higher, frightened to get in, as they are nervous and emotional traders, but at the same time, frightened of missing a 'golden opportunity' to make some money. After all they have seen the market rise and are now wishing they had entered earlier. They eventually buy at the top of the first wave.

The market then promptly reverses, and they immediately become fearful of a loss. The market moves lower then bounces. At the bottom of the first wave, buyers come in, entering on the pull back and pleased to be getting into the market at a 'good price'. The market moves back higher towards the top of the first wave.

The buyers at this level cannot wait to exit, as the fear drains away and they get out with a small loss. Remember, throughout this phase of price action, they have NEVER seen a profit, only an increasing loss, which has then reduced back to close to zero. Their emotional level of fear, a fear indicator if we had one, would have been rising steadily on the downwards leg, and then falling on the upwards leg, but at no time was their position in any sort of 'potential profit' so this group is simply pleased to exit with just a small loss.

After all, at one point the potential loss could have been much worse, so this group considers it has done well in closing with just a small loss. Remember also, that this group always trades on emotion anyway, so is almost always in a weak position when they open any trade, and therefore very easy to manipulate using emotional price swings.

The group that has bought at the bottom of the first wave lower are a completely different proposition. They have been prepared to wait, and buy on a pullback in price, they are not chasing the market, and are prepared to be patient. In general, they are more experienced.

As the market moves higher to the top of the third wave, their position has a potential profit, before it reverses lower, back to the level at which they entered the market. However, at no point during this journey have they suffered the emotion of a potential loss. They may be regretting the decision not to close at the top of the wave, but are likely to continue to hold on the expectation of a bounce back higher.

Their emotional response is therefore very different. Unlike the weak group at the top of each wave, this group has less emotional stress pressure to deal with on each wave. All they have to deal with is the emotional pressure of seeing a potential profit drain away, not the emotional pressure of recovering from a potential loss. The buyers at the top of each wave can be considered to be weak, but the buyers at the bottom of each wave can be considered to be strong. Naturally I accept this is a very simplistic way of looking at market price action in these regions, nevertheless it is typical of what happens when markets consolidate.

It is this constant flow of buyers and sellers entering the market in these contained areas, that creates the invisible barriers of price, which then become barriers and platforms in the future, since within these price regions we have dense populations of buyers and sellers, both weak and strong.

So do we see the same at the bottom of a trend lower? And the answer is, yes. We have exactly the same principles at work here.

Fear And Greed Riding The Wave – Bottom Of Bear Trend

Fig 7.12

: Fear & Greed - Bear Trend

The principles here are exactly the same as for the bullish trend we looked at earlier. As we can see in our schematic in Fig 7.12 the market has been in a down trend for some time, and once again, the weak emotional traders are drawn into the market, just as it is about to reverse. They have seen other traders making nice profits from the move lower, and finally overcome their fear of trading, and make an emotional decision to join the market.

The market immediately reverses against them and bounces higher locking them instantly into a losing position, which then worsens. Fear mounts as the losses increase.

Finally the market reverses back to where they first entered their position, and they exit, relieved to have been able to close out with just a small loss.

The strong traders are selling into the market at the tops of the waves, and their positions are generally positive throughout as the market moves back and forth in the trading range.

As before, the price consolidation creates the invisible barriers which are then densely populated with both weak and strong groups of traders, and which become defined levels, either of support or resistance during future market activity.

I hope the above explanation has at least given you an insight into why these levels are important. What this constant price action creates is invisible barriers and platforms all over our charts, which we then 'see' by joining up the price action at the top and bottom of each wave with horizontal lines. These give us the visual perspective on where these regions are on the charts. Each time future price action approaches these regions, because of the dense population of buyers and sellers marooned in these zones, we can expect the market to at least pause and 'test' these areas in the manner I will be covering shortly.

Of equal importance is when the market pauses in one of these areas, but then continues on its journey in the same direction as the original trend. Both of these have important consequences and send us key signals, all validated with volume, which we will look at shortly. But first, let me set out some general principles when using this analytical technique.

First Principle

The lines we draw on our charts to define the ceiling and the floor of these price regions are not rods of steel. Consider them more as rubber bands with some flexibility. Remember, technical analysis and VPA is an art, and not a science. Whilst these levels do constitute barriers and platforms, they are not solid walls, and on occasion you will see them broken, only for the market to then move back into the channel once again. Consider them to be 'elastic' with a little bit of 'give'.

Second Principle

Always remember Wyckoff's second law, the law of cause and effect. If the cause is large, this will be reflected in the effect, which applies to support and resistance. The longer a market consolidates in a narrow range, the more dramatic the resulting price action once the market moves away from this region. Naturally this is all relative, not least because a market that has been consolidating on a daily chart for several weeks is likely to trend for a similar period, whilst any breakout from a consolidation phase on a 5 minute chart may only be for an hour or so – it is all relative. Remember, the law of cause effect introduces the concept of time

Third Principle

The third principle is perhaps the one which perplexes most new traders and it is this – how do I know when the market is in congestion? After all, it's easy to look back in hindsight and see where the price action has been consolidating for some time, but when the market action is live, it is only 'after the event' any consolidation phase becomes self evident.

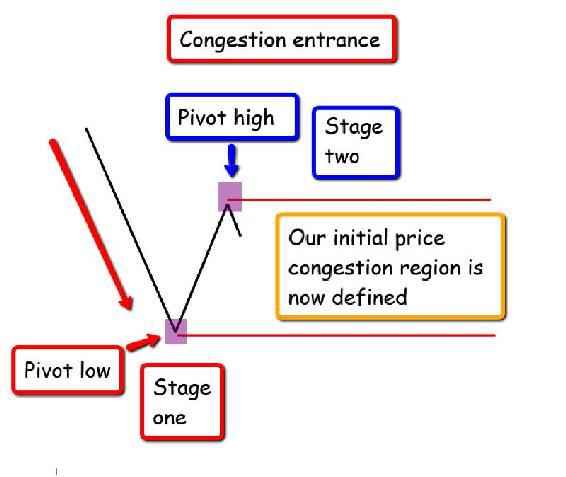

This is where the concept of an isolated pivot high and an isolated pivot low become key signals, and whilst there are indicators available to create these automatically, they are simple to spot visually.

Isolated Pivots

Fig 7.13

Isolated Pivots

These are the defining points for the start of any congestion phase. And the easiest way to understand pivots is to suppose the market is moving higher in an up trend, and we see an isolated pivot high formed on the chart. We have now seen the first sign of possible weakness in the market. These pivots are created by a three bar/candle reversal and as shown in Fig 7.13 above. To qualify as a three bar/candle reversal the candle in the centre has to post a higher high and a higher low, creating the pivot high pattern. The appearance of one pivot does not mean we are moving into a congestion phase at this point. All we can say at this stage is we have a possible short term reversal in prospect.

Now we are waiting for our equivalent isolated pivot low to be created. This occurs when we have a three bar/candle pattern where the centre candle has a lower low and a lower high than those on either side. Again we have an example in Fig 7.13.

Once this candle pattern appears on our chart, we can now draw the first two lines to define the ceiling and the floor of our congestion zone. The pivot high is the ceiling and the pivot low is the floor. These simple candle patterns not only define the start of any congestion phase, they also define the upper and lower levels as the market moves into a period of sideways price action. This is referred to as congestion entrance as we can see in Fig 7.14.

Fig 7.14

Congestion Entrance - Bullish Trend

The same applies when a market has been falling and enters a congestion phase. Here we are looking for the reverse, with an initial pivot low, followed by a pivot high which we can see in Fig 7.15.

Fig 7.15

Congestion Entrance - Bearish Trend

At this point we now have our ceilings and floors clearly defined, and as the market moves further into congestion, we see further pivot points to the upper and lower price levels, which adds further reinforcement to these areas. What happens next?

At some point of course, the market finally breaks out from these regions, and this is the trigger we have been waiting for, either to confirm the continuation of a current trend, or to signal a reversal.

However, throughout the price congestion phase we are constantly looking for clues and signals using our VPA knowledge to confirm weakness or strength as the market moves sideways. Moreover, if the congestion phase has been created as a result of a buying or selling climax, then the signals will be very clear.

But, the signal we are constantly watching for now, once we are in a congestion phase, is the volume associated with any breakout and consequent strong move away from this region. As we have already seen, congestion areas are densely populated regions, with traders locked in a variety of weak positions, and therefore any break away from these areas requires volume, and generally lots of it. A break out from such a price area on low volume, is a classic trap move by the insiders, and is often referred to as a 'fake out'.

The insiders are trying to trap traders on the wrong side of the market once again, and a break out from recent congestion is another classic strategy. Only VPA traders will be aware of such a false move, since the volume associated with any move higher or lower will be clearly visible. This is why these price regions are so important and they are important for three reasons:

First, if we have a current position in the market, and we see a breakout validated in our direction, this is a very clear signal of a continuation of the move, and therefore gives us confidence to hold the position.

Second, if we do not have a current position, this gives us an excellent entry signal once the move away has been validated with volume.

Third, if we have an existing position and the trend reverses against us, we have been given a clear signal to exit.

Finally, once the market has broken away from these regions, we then have clearly defined platforms of future price regions, which come into play as both support and resistance. These are immensely powerful and helpful in giving us simple targets for managing and exiting positions, based on the price action on our charts. If you remember back to something I wrote earlier; getting in is easy, it's getting out that is always the hardest part, and this is where these areas can help, in providing a visual map of likely places where the market may struggle, reverse or find support. This helps us as traders to manage our positions more effectively.

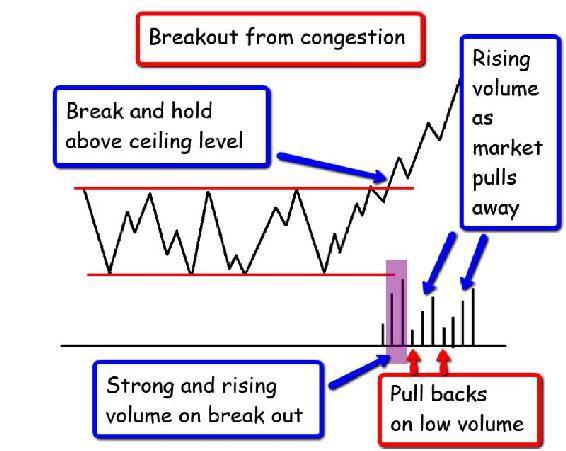

Let's start with breakouts and volume and what we should expect to see as the market pulls away from these congestion zones.

Fig 7.16 is an ideal schematic of what we should expect to see, and in this case we are seeing a bullish breakout. This could either be a continuation of a recent bullish trend higher, where the market has paused, before moving on once more, or this could be a reversal in trend. It doesn't really matter. The key points are the same, and are these.

Fig 7.16

Breakout From Congestion : Bullish Trend

First, for any break and hold out of congestion to be valid we need to see 'clear water' above the ceiling of price action. Remember what I said earlier. These lines are not rods of steel, they are pliable, rubber bands and we have to treat then as such, so if the market ticks a few points above or below, this is not in itself a signal of a breakout. We need to see a clearly defined close above the ceiling. And one question I am often asked is how much is ‘clear water’? Unfortunately, there is no hard and fast rule. It all comes down to judgement, experience, and the market or instrument as each will have its own unique price behaviour and risk profile. But there needs to be a 'clearly visible' gap in terms of the closing price of the candle which finally breaches the ceiling. This is the first signal a breakout is in progress. The second is volume.

As we can see in Fig 7.16 the initial move higher up and through the ceiling, has to be accompanied by strong and rising volume. It takes effort for the market to move away, rather like dragging someone out of quicksand or a bog. The same applies here, and you should see this reflected in the associated volume of the next few bars. If you don't, then you know it is either a trap up move by the insiders, or there is simply no interest from market participants to take the market higher at this stage.

If it is a valid move, the volumes on the initial break will be well above average and rising, as the market finally starts to build a trend. At this stage, do not be surprised to see the market pull back to test the old ceiling (which is now a floor) as it moves higher, but this should be accompanied with low or falling volume, since we are now developing a bullish trend higher and so expect to see a rising market with rising volume, if this is a true move higher. Once clear, VPA then takes over and we are back to a candle by candle analysis of the price action as the trend unfolds.

Exactly the same principles apply when the breakout is into a bearish trend (See Fig 7.17). Once again, it makes no difference whether this is a continuation of a bearish trend, or a reversal from bullish to bearish. The only difference this time is we are breaking through the floor of price congestion, and not the ceiling.

As before, this breakout should be clean and developed, and accompanied by well above average volume to reflect the effort required to break away. Again, do not be surprised to see the market move back higher to test the old floor area (which is now a ceiling), but this should be on low volume, and as the market pulls away rising volume should reflect the downwards move. Remember, falling markets should also see rising volume reflecting a genuine move lower.

Fig 7.17

Breakout From Congestion : Bearish Trend

I cannot stress too strongly the importance of price congestion regions. They are one of the foundations stones of price action, as they reveal so much, and give us so many trading opportunities. There are many traders around the world who only trade on breakouts, and nothing else.

We can trade breakouts by defining congestion zones using pivots, then charting the price action using VPA, and finally when the breakout is validated by volume, enter any positions.

At this point I cannot reiterate too strongly support and resistance is one of the foundation stones of price analysis. Every full time trader I have ever spoken to, uses this concept in one way or another, and as you will see, now that we understand price congestion, it is a powerful and simple concept which can be applied in several ways.

It can be used to identify entry positions; it can be used in managing positions, and finally it can also be used as a target for closing out positions. In simple terms, it is one of the most powerful techniques you can apply, and when combined with an understanding of VPA, will give you an insight into market behaviour few traders or investors ever achieve. It is also the phase of price action where trends are borne. Many traders and investors become frustrated when markets move into a congestion phase, but in reality this is one of the most exciting phases of market behaviour, as it is just a question of being patient and waiting. When the market is ready, it will break out, and a new trend will then be established. And the extent of any trend will be dictated by the cause and effect rule.

To round off this chapter, let me summarise the concept of support and resistance which builds on the knowledge we already have of price congestion, and the analogy I always use here, is of a house. Which is why I have used the terms floor and ceiling to describe the upper and lower levels of price congestion.

Support And Resistance – The House

Fig 7.18

Support & Resistance : The House

Imagine you are looking at a vertical cross section of a house which is shown in the schematic in Fig 7.18. In other words, what we are looking at here is a house with the front removed, rather like an old fashioned dolls house with the door open. Now you can see all the floors and ceilings in the house, and as you can see here we have a ground floor, first floor, second floor and roof.

The zig zag line represents the market which has moved from the ground floor to the roof and back again. Let me explain the price action on the schematic as it moves through the house, to better visualise the concept of support and resistance.

The market moves higher from the ground floor, and eventually reaches the ceiling, where it moves into sideways price congestion. At this point, the ceiling is providing an area of price resistance to any further move higher for the market. However, at some point the ceiling is breached and the market climbs through to the first floor level. What was the ceiling of the ground floor, has now become the floor of the first floor. In other words, an area of price resistance has now become an area of price support.

The market continues higher until it reaches the ceiling of the first floor, where once again the price moves into a consolidation phase. Eventually it breaks out into the second floor level. Again, price resistance as represented by the ceiling of the first floor, is now support as represented by the floor of the second floor.

Finally the market continues higher until it reaches the ceiling of the second floor, where the price resistance proves to be too strong, and the market reverses at this level. The ceiling has remained firm and the barrier of price activity has prevented the market continuing further.

The market then moves lower, having reversed, back to the floor, where it consolidates, before breaking through and back down through the floor and past the ceiling of the first floor level. Here we see the reverse in action. What was price support in terms of the floor, has now become price resistance in terms of the ceiling.

This is repeated at the first floor level, before the market breaks lower with the floor of price support now becoming price resistance in the ceiling, and we are back to square one again.

But, why is this concept so important?

Support and resistance is important for a number of reasons. First, as we have already seen, a breakout from a consolidation phase can be validated with volume, and if confirmed, provides excellent trading opportunities. The so called 'breakout trades'.

Second, and perhaps just as important, the reason this trading approach is so popular is it embraces in its strategy, the whole concept of support and resistance which is this – that in creating these regions, and using them as part of the trading strategy, you are in effect, using the markets own price behaviour to provide you with protection on your positions. By this I mean in trading using a breakout, the market has created its own natural barriers to protect you against any sudden changes in market direction as the trend develops.

Returning to the price action in our ‘house’. As we approach the ceiling of the first floor we move into price congestion, pause, and then break through into the first floor room above. We now have a 'natural floor' of price support in place, which is giving us protection in the event the market pauses and perhaps moves back to test the price in this area. This floor is our natural protection, defined by the market for us. After all, we know from our VPA studies to move back and through this area would take effort and volume, so we therefore have a natural area of support now working in our favour. Not only does the floor offer us protection should the market pull back, it also offers the market support to the continued move higher.

It is a 'win win'. You have the comfort of knowing once the market has broken through a ceiling of price resistance, not only does this become a floor of price support, it has also become a barrier of price protection in the event of any short term re-test of this area. Any stop loss for example could then be placed in the lower regions of the price congestion. This is why breakout trading is so popular, and when backed with VPA validation becomes even more powerful.

The same principles apply when markets are moving lower. In our ‘house’ example we were in an up trend, but if we take the down trend example, this works in identical fashion.

Picking up the price action where the market has reversed at the roof level, we are approaching the second floor, floor level. The market moves into congestion and then breaks through the ceiling of the first floor room below. What was the floor of price support has now become the ceiling of price resistance, and once again offers two things. Price resistance to any short term reversal, adding pressure to any downwards move lower, and secondly, a natural barrier of price protection in the event of any short term pullback.

Once again, it is a 'win win' situation for the breakout trader, this time to the short side of the market.

This is using this concept in taking trading positions as the market action develops, but its power also lies in the price action and history the market leaves behind. The market leaves its own DNA, buried in the charts. These areas of price congestion remain on the charts forever. The price moves on, but these areas remain, and at some point in the future, price behaviour moves back into these regions, and at this stage these areas, often dormant for long periods, then become powerful once again. This begs the question as to whether the market has a memory?

Or is it because, as traders we are all looking at the same charts, and therefore these areas of price become self fulfilling prophecies? Perhaps it’s because these areas are densely populated with weak traders, still holding on and waiting for a reversal so they can exit with small losses or small profits.

It may well be a combination of all of these. Whatever the reasons, these areas can and do play a significant role in price behaviour as they are visited by the market repeatedly. Once again, where there are extensive areas of congestion, then the more significant will be their impact.

Let's go back to our house schematic again, and in particular the failure to break the ceiling of resistance on the second floor. The reason for this failure may well have been as a result of sustained areas of old price congestion in the same region, and failures at this level in the past. If the market has failed at this level previously, which as a trader you will see on your price chart with areas of price congestion on the longer time frames, then there is every chance it will fail at this level again. After all, there was a reason. This could have been a selling climax, occurring years previously and what was once considered overbought at this level is now considered fair value.

Nevertheless, as traders, this is a key level, and volume will give us all the clues we need to validate the subsequent price action. If this is in fact an old area of price congestion, at which level the market failed and reversed previously, then if it does succeed in breaching the ceiling on this occasion, this adds greater significance to the move higher, and a strong platform of support would then be in place. Equally a failure would suggest an extremely weak market, and something we will look at when considering key price patterns.

This is the power of support and resistance. It is the market signalling all those areas of price congestion which come into play constantly. They are the DNA of the market. Its history and life story rolled into one, and as you would expect works exactly the same way regardless of whether markets are falling or rising. In the example just outlined above, the market reversed from resistance, but equally powerful is the concept of old support regions when a market is falling. These areas then provide natural platforms of support, to stop any further decline in the market, and just as in a rising market, if these areas are deep and wide, then they take on increased significance, which is further enhanced if there has been any major reversal at this level in the past.

Naturally, price congestion areas come in all shapes and sizes, and in all time frames. A stock index may trade in a narrow range for days or even weeks. A currency pair may move sideways for months. Bonds often trade in very narrow ranges, particularly in the current financial crisis. Stocks may remain waterlogged for months.

Conversely, areas of price congestion may last for a few minutes or a few hours. The underlying concepts remain the same, because as VPA traders all we have to remember is cause and effect go hand in hand. An area of price congestion on a 5 minute chart will still offer support and resistance to the intraday trader, along with any breakout trading opportunities, but in the context of the longer term will have little effect. However, move to the same instrument on the daily chart, and if we see a deep area of price congestion, then any move through the ceiling or floor will be significant.

This is yet another reason for trading using multiple charts and time frames. Price congestion on a 5 minute chart will have less significance than on a 15 minute, than an hourly chart. In other words the longer the time frame the greater the significance, all other things being equal. Cause and effect and the concept of time once more.

Support and resistance is a powerful concept in its own right. Match it with VPA, and it will become another of the cornerstones of your trading methodology, based on volume and price.