Chapter Three

The Currency Quote

Money is the sixth sense that makes it possible to enjoy the other five

Richard Ney (1916 - 2004)

In the last chapter, I introduced you to the principle currencies I believe you should be trading initially as a novice forex trader, and one of the questions you may be asking right now, is simply this - is that it? Just seven currencies. It doesn’t seem very many. Which is absolutely true. However, what we are going to cover here is how these currencies are then quoted in order to allow us to trade them, and the associated quoting conventions. This will help you to understand what you will be looking at shortly, once we move to consider the price charts in more detail.

As I said in the previous chapter, there are hundreds of currencies around the world, but these are the ones most widely traded and therefore the ones to start with, as you begin your journey as a forex trader.

The Currency See-Saw

Imagine for a moment you are American. You walk into your local bank, approach the teller, and from your pocket produce a $100 bill. You then ask the teller if you could buy some dollars. The teller would give you some strange looks. It’s simply not possible to trade a currency in that way. It simply doesn’t work. After all, as an American you are paid in US dollars and your bank account is in dollars, you cannot ‘buy’ more dollars, using dollars.

In order to overcome this problem the foreign exchange market pairs currencies together in... well pairs. You can think of this like a child’s see-saw. On one side is one currency, and on the other is a different currency. And just as on the see-saw, as one rises, the other falls, and as this falls the other rises. They are always in balance around the fulcrum of the see-saw, rising and falling every second of every day. The fulcrum point is the exchange rate being quoted at that precise time. No more, and no less.

In the previous chapter we looked at eight currencies, and you may have thought to yourself - how dull. We only have seven currencies to choose from when we are trading. In fact, in creating currency pairs, we now suddenly have 28 trading opportunities in the forex market. A much wider selection. Let’s break these down into two groups, which we refer to as the major currency pairs, and the cross currency pairs.

Major Currency Pairs

There are generally considered to be seven major currency pairs, and are those currencies which are quoted against the US dollar:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CAD

- NZD/USD

- USD/CHF

All currencies when quoted in the forex market are denoted using the three letter acronym as follows:

- USD - US dollar

- EUR - Euro

- JPY - Japanese Yen

- GBP - British pound

- AUD - Australian dollar

- CAD - Canadian dollar

- NZD - New Zealand dollar

- CHF - Swiss Franc

Cross Currency Pairs

The cross currency pairs are all those which are not quoted against the US dollar. In other words, these are all the other pairs which go to make up our 28 currencies in total, and these are as follows:

Euro cross currency pairs

- EUR/JPY

- EUR/GBP

- EUR/AUD

- EUR/CAD

- EUR/NZD

- EUR/CHF

Yen cross currency pairs

- EUR/JPY

- GBP/JPY

- AUD/JPY

- CAD/JPY

- NZD/JPY

- CHF/JPY

Pound cross currency pairs

- EUR/GBP

- GBP/JPY

- GBP/AUD

- GBP/CAD

- GBP/NZD

- GBP/CHF

Australian dollar cross currency pairs

- EUR/AUD

- AUD/JPY

- GBP/AUD

- AUD/CAD

- AUD/NZD

- AUD/CHF

Canadian dollar cross currency pairs

- EUR/CAD

- CAD/JPY

- GBP/CAD

- AUD/CAD

- NZD/CAD

- CAD/CHF

New Zealand dollar cross currency pairs

- EUR/NZD

- NZD/JPY

- GBP/NZD

- AUD/NZD

- NZD/CAD

- NZD/CHF

Swiss franc cross currency pairs

- EUR/CHF

- CHF/JPY

- GBP/CHF

- AUD/CHF

- CAD/CHF

- NZD/CHF

Currency Notation

As you can see from all the above currency pairs that we now have, there seems to be no logic to the way these are quoted, and this can be confusing for new traders. The quoting convention has really evolved over time, and what we have now is an historic system, where the first currency quoted was considered to be the stronger of the two, and the second was considered to be the weaker.

As an example, in the case of the GBP/USD, the UK pound was considered to be a stronger currency than the US dollar - ironic really.

The first currency quoted is referred to as the base

currency, so in our example above this would be the British pound, and the second currency is referred to as the counter

currency, in this case the US dollar.

The currency quotations I have listed here are the standard notations you will come across when trading in the spot forex market. However, if and when you do move to the futures market, you will find that these change. In the world of futures, all currencies are quoted against the US dollar which is the counter currency. As such, you will find that some of the popular major currency pairs will be shown reversed. In other words, in the spot market the USD/CAD is quoted in this way, but in the futures market it is quoted as the CAD/USD. Forex traders who move from the spot market to the futures market are often confused, and we do have to be careful. It’s very easy to buy or sell the wrong currency.

A buy order on the USD/CAD in the spot market is very

different to a buy order on the CAD/USD in the futures market, so please be careful. It’s an easy mistake to make and applies to all major currency pairs and others, so the USD/JPY will appear as the JPY/USD in the futures market. You have been warned.

Currency Quotes

Now we come to the whole business of how currency pairs are quoted in the market and what this all means.

Let’s start with a simple example from the MT4 trading platform which will make it much easier to explain.

Fig 3.10

- Quotation window on MT4 for EUR/USD

In this example we are looking at a quote for the EUR/USD which I've circled at the top of the image. In Fig 3.10 you can see we have two numbers quoted here, 1.30110/1.30136 - what do these numbers mean? Let me explain.

Until recently, currency pairs were quoted to four decimal places, in other words, 1.3000 or 0.5690, where the last digit was the most significant for us as forex traders (and I’ll explain why in a moment). However, in the last year, the quoting conventions have changed, and currencies are now quoted to five decimal places, as we can see here. We have one number which is 1.3011(0) and the second which is 1.3013(6), and I have added the fifth decimal place in brackets.

Whilst most

of the major currency pairs follow this new convention, there is one that is only quoted to three decimal places, and that’s currency pairs with the Japanese Yen, where the second decimal place is the most significant.

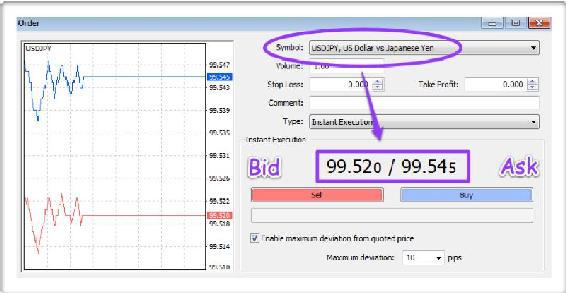

Fig 3.11

- Quotation window on MT4 for USD/JPY

If we start with the EUR/USD example, the old style of quotation was to four decimal places, and the fourth decimal place was the most significant and denoted as what we call a ‘pip’ or 1/10,000 of a movement in the exchange rate. For instance, if a rate was quoted as 1.3000 and then some time later as 1.3005, the exchange rate has changed by 5 pips having moved from 0 to 5. Equally if the exchange rate had moved from 1.3000 to 1.3020, then this has moved by 20 pips, and finally the last example, if the rate has moved from 1.3000 to 1.3100, the rate has changed by 100 pips.

Don’t worry at this stage how this is converted into profit or loss when we are trading, as I cover this in a later chapter, once we get to the mechanics of trading. For now, I am just trying to explain the basic mechanics of currency quotations.

In order to try to differentiate themselves, and to attract new customers, the forex brokers decided it would be a good marketing ploy to quote currencies to five decimal places. I have to say I find this very irritating and confusing, but this is what we are stuck with.

If we go back to our first example above, the rate will now be quoted as 1.30000 and moving to 1.30050 - this is still a 5 pip move, but looks very different. In other words, currency quotations in the major currency pairs (and in many others, excluding the Yen pairs) are now quoted in 1/10 of a pip. So for example, if the quote above was 1.30054 then this would equate to 5 full pips and 4/10 of one pip, or 5.4 of a pip.

To summarize - the number that is the most important in the forex market in terms of quotations is the fourth decimal place

, not the fifth, which to be honest you can ignore. It is a fractional pip quotation. It moves so fast anyway, as far as I am concerned it's irrelevant. Unfortunately most brokers seem to have adopted this convention in their feeds, and the MT4 and also MT5 platform does not provide an option to reduce this back to four, at the time of writing, but hopefully this may change in the future. Your broker may offer this and it is worth asking.

For now, just remember. It is the fourth decimal place which is our pip

which represents 1/10,000 of a movement in the market.

As I mentioned above, the same principle applies to the USD/JPY, but in this case, the old convention was two decimal places, whilst the new convention is three decimal places. Let’s take the example from Fig 3.11.

Here we have two numbers quoted, 99.520 and 99.545 and for Yen based pairs, the old convention was two, so in this example, if the pair had moved from 99.52 to 99.54, then this would be 2 pips. The difference here is that 1 pip is equivalent to 1/100 of a movement in the exchange rate, whereas with the EUR/USD 1 pip was equivalent to a movement of 1/10,000. I’ll explain why in a minute.

Just as with the fifth decimal place for the EUR/USD, the USD/JPY here is quoted to three decimal places, so in our Yen example, the third number represents a tenth of a pip 1/10 as before. In the case of a Japanese yen pair, if we moved from 99.550 to 99.595, we have moved 4.5 pips or four and a half pips - from 55 to 59 is four pips, and then the third decimal place is our half pip.

When trading yen pairs we only concentrate on the second decimal place which is our pip value, so a move from 99.55 to 99.85 is 30 pips, and from 99.55 to 100.25 is a move of 70 pips. I hope that's clear.

The next logical question from the above is why do most currencies quote to four decimal places (and five now) and the Yen based pairs (and other exotic currencies) only quote to two (and now three)? And the answer is simply this. Currency exchange rates between most countries are relatively close, and generally in single figures. The US dollar against the Canadian dollar for example is often around 1, so when changing currency from one to the other, they are very close in terms of exchange rates. In order to offer meaningful moves in the markets and allow traders and speculators to profit accordingly, these currency pairs are quoted to four and five decimal places. Imagine if the USD/CAD were quoted to two decimal places, as 1.01 and 1.02, this would represent a huge move in the exchange rate, and have little value other than for very long term trading. After all, a move from 1.00 to 1.01 would be 100 pips, and a long wait for a scalping trader. Hence, these currency pairs are quoted to four (and now five) decimal places.

The Japanese yen on the other hand is very different.

Whilst the US dollar and the Canadian dollar are very close in exchange rate terms, the Japanese yen is not, and often trades around 100 or more to one US dollar. Here we would have the reverse problem if the pair were quoted to four (or five) decimal places. In this case if the USD/JPY were quoted as 100.0000 then the fourth decimal place in this example would be equivalent to 1/100 of a pip, a tiny amount, and a price which would then be moving at an absurd speed. This would be impossible to trade.

If it helps to understand, think of it like this.

Most currencies have a value equivalent to a paper banknote. The yen is closer to a coin. That’s the difference.

Finally, and just to round off. The pip is our principle trading unit, and you can think of it just like a point. A stock index moves in points, as do many other instruments. For us, a pip is our trading unit. For the major currency pairs it’s either the fourth decimal point, or the second for yen pairs. And in a later chapter I’ll explain how this basic trading unit then converts into our profit or loss on each trade.

The Bid, Ask And Spread

In every currency quote, there are always two figures quoted. The first one on the left hand side is called the bid

, and the second on the right hand side is called the ask

. The difference between the two is called the spread

.

The bid, the lower of the two prices is the one at which you can sell the base currency. If we go back to our EUR/USD example in Fig 3.10, the bid price is 1.30110 and is the price we would get if we sold the euro against the US dollar. In other words the bid price, is the price at which the market will buy

.

On the other side we have the ask price, and this is the price at which the market will sell

to you which of course is higher. Why? Well the forex broker has to make a profit and their profit is generally, (although not always) in the spread, which is the difference between the two prices. In this case the spread is the difference between 1.30110 and 1.30136 or 2.6 pips.

What does this mean? As a matter of fact, several things.

First, the spread that is quoted will vary from broker to broker and also throughout the trading day. It is not

fixed and will change according to market conditions. If the market is volatile and moving quickly the spread will widen, possibly to several pips or more, and then gradually move closer again once the volatility has passed. The reason for this is your broker has to cover all his or her customers positions, and in a fast moving market the risks are much higher. Some brokers do offer fixed spreads in all markets, and while this may seem attractive when other brokers are widening their spreads during a news release, there are always pros and cons. After all, major news releases are relatively infrequent during the day, and for the rest of the period, a fixed spread broker is likely to be less competitive than a variable spread broker. As always, it is swings and roundabouts, and there is no such thing as a free lunch. But I digress.

The spreads are also widened during volatile trading sessions for a very different reason, and that’s to stop you taking advantage of a fast moving market. Many brokers actively discourage scalping trading (taking short term trades for a handful of pips) during these periods when markets are fast moving, and one of the ways brokers do this is to widen the spread to such an extent it is impossible to get into a strong position. You will hear this promoted as a trading strategy, often referred to as ‘trading the news’. It generally does not work I’m afraid. You are welcome to try. It sounds good in theory, but in practice fails with the broker making sure for good measure.

Which leads me to the second point. Whenever we open a new trading position, we automatically start with a small loss. This reflects the fact we have entered at one price, and now have to wait for the the spread to be absorbed by any market move, before we can move into profit in due course.

Imagine this as though we are starting a race, but giving everyone else a 2.6 pip start, taking our earlier example from Fig 3.10. Before we can catch up and move into profit, we have to recover the spread first. It’s the cost of the trade if you like, and is the profit for the broker that has to be recovered. Imagine trading stocks. Here you pay a commission when you buy or sell. This is just the same. In the forex market the commission just happens to be in the spread with most brokers. There are some, where you pay a commission instead, just as in buying and selling stocks, and I explain this in the chapter on the types of brokers. In return, you get a tighter spread quoted. But again, it’s swings and roundabouts.

Finally, spreads reflect the liquidity of the currency pair, and by liquidity I mean how heavily the pair is traded, which is why as novice traders, the best pairs to start with are the major currency pairs. First they are heavily traded throughout the trading session, with the EUR/USD the most widely traded of all, particularly through the European and US sessions. This will be reflected in the spread which will generally be quoted at somewhere between 1 and 2 pips. Other major currency pairs will have slightly wider spreads, generally averaging somewhere between 2 and 3 pips. However, move into the cross currency pairs, or exotic currency pairs, and the spreads will jump much higher, so 6, 7, 8 pips or more and into double figures. Everything of course is relative.

If you are trading over days and weeks, then a few pips here or there on a spread are irrelevant. However, if you are looking to take a few pips from the forex market as a scalping trader, the spread becomes very important, and a significant percentage of any gains or losses. Consider this for a moment.

Suppose you are trying to take just five pips from a price move, but the spread on the pair is 2.5 pips. That’s equivalent to 33% of the total move, and to put this into context, is the same as giving someone a 33m start in a 100m race. The chances are you would lose, and lose easily. This is one of the many reasons it is so difficult to be consistent using this approach, as the maths is heavily weighted against you. Move to something a little longer term where perhaps we are looking for 20 or 30 pips, and the spread becomes far less significant, and is simply the ‘cost of trading’.

The other point about the spread is this. Those currency pairs with tighter spreads will also signal a pair which will move continuously and smoothly throughout the day, simply because there are so many buyers and sellers in the market. This will be reflected in the price chart, which we will cover in a later chapter. Exotic currency pairs will stop and pause, sometimes for minutes or longer, before jumping in price one way or the other. This is simply because there are insufficient trading volumes to move the market in a continuous way. As a result, the market stops and pauses before moving on, making these pairs very difficult to trade on an intra day basis.

What we are looking for when we start trading is those pairs which move smoothly, and this is always the case with the major currencies, and most of the cross currency pairs. There will be periods of volatility, but never periods where the market just stops. Where you will see this however, is in the futures market, particularly on some of the less liquid contracts which are relatively new. For example, a micro futures contract on the EUR/USD will not move smoothly, even though it is derived from a major currency pair. The volume of trades in this contract is relatively low at present, and this will be reflected in the associated price action.

Having covered the basics of how foreign exchange rates are quoted and what they mean, in the next chapter we’re going to look at some of the forces which drive the forex markets, and are then reflected in the constant ebb and flow of these rates.