CHAPTER 13

Tax Savings for Education

THE MOST VALUABLE THING in the world is a good education. It doesn’t really matter what the education or major is, it’s all about learning; learning how to think, how to research, knowing that you must ask questions and not take everything at face value. A free college education has even become a campaign issue. Will we get that here in the United States? Not anytime soon. But hopefully we will get ever more high-quality free colleges and universities, at least those operated by the cities and states.

For example, at present, the city college system in Southern California is expensive. A student carrying a full load (twelve to sixteen units) would pay about $550–$750 per semester at the Los Angeles City College or Pierce Community College, plus the costs of books, parking, and fuel or transportation. Add it all up and the cost for nine months’ attendance, if the student lives at home, comes to a whopping $12,000 per year—more than $19,000 if they have to pay for housing (http://www.piercecollege.edu/pierce_fees.asp).

Clearly, we need some help. So where do we start? Let’s look at tax benefits.

Tip #209:

Scholarships are great, but they are not always tax-free (https://www.irs.gov/taxtopics/tc421.html). You can use scholarship funds to cover the costs of tuition, fees, books, supplies, and mandatory course equipment. But if the scholarship covers more than that, like food, housing costs, travel, or optional equipment, you now have taxable income. This applies to grants, stipends, and even funds to Fulbright scholars. What’s even worse is that if the scholarship is taxable, you will pay tax at kiddie tax rates—in other words, at your parents’ highest tax rate.

Tip #210:

Tax-free education benefits at work. All employers can pay up to $5,250 of your education costs without the benefit being taxable to you. Anything over that and you pay tax on the benefit. It will be included in your wages (https://www.irs.gov/publications/p970/ch11.html). Is there a way around that? Maybe . . .

Tip #211:

Working benefit fringe. That’s a nice little secret. When the education payments qualify as a working benefit fringe, none of the payments are taxable to you even if your employer pays out $30,000 or more. How do you get that? Well, it must be a written plan. The benefit must be available to all employees, without favoring “highly compensated employees,” and it covers practically all costs except for tools and supplies that employees get to keep after the course ends. It cannot cover the owners of the business. But even small businesses can offer this benefit, say, to family members who don’t meet the definition of “related parties” when it comes to ownership of the business. Read this information carefully and discuss it with the boss (https://www.irs.gov/publications/p15b/ar02.html). Incidentally, you cannot convert part of your wages to the education reimbursement. That would violate the provision that “the program does not allow employees to choose to receive cash or other benefits.”

Tip #212:

Don’t pay off your student loans, work them off instead. One of my all-time favorite television series was Northern Exposure. You have this clueless, newly graduated doctor, dropped into Alaska to perform, what to him, seemed like indentured servitude. Well, there really are federal and private programs that will pay off your student loans in exchange for a few years of your time (https://www.irs.gov/publications/p970/ch05.html). Now think about this and ask yourself these questions:

- • How long will it take for you to pay off all your student loans? For many people, it could take ten to twenty years.

- • During all that time, the loan is sitting on your credit, pushing down your FICO score. How do you feel about your credit?

- • A big chunk of your wages goes toward the student loan payments, which means your standard of living is reduced—unless you spend like there’s no tomorrow and just get deeper into debt. (This is dumb, but done.)

- • Do you really need all that stress?

- • How bad would it really be to go on an adventure for two or three years? Heck, you might even build up savings, meet the partner of your dreams, or at least learn more about life. And hey, think about all the great stories and pictures you will have!

Tip #213:

Let your student loans go into default. Yup. You might be able to give up and do that. Only it’s not easy. Did you know that you cannot even bankrupt student loan debt? But let’s say that you could somehow get the debt cancelled. Not only does that totally mess up your FICO score, it generates taxable income for cancellation of debt. So you are suddenly going to add $30,000, $50,000, or $200,000 to your income in the year you default on the loan. Talk about messing up your entire future. When you’re having a tough time with the student loan, call the company, like a mensch, and work out more manageable payment arrangements.

Tip #214:

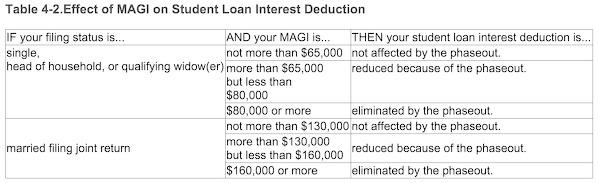

You’re paying your student loan. Deduct the interest expense (https://www.irs.gov/publications/p970/ch04.html). You may deduct up to $2,500 of your interest payment. There are lots of strings on this deduction, including a limit to the amount of MAGI you may have before your deduction is reduced or eliminated (https://www.irs.gov/publications/p970/ch04.html). In fact, suppose you felt the interest rate was too high and you were able to refinance the loan at a better interest rate. You might have just changed the nature of the loan from a student loan to a personal loan. Interest on personal loans is not deductible at all. So be very careful—run the numbers. If you can get a low enough interest rate, you might be better off without any tax benefit at all.

- • For instance, if you’re paying 7 percent on a $60,000 loan, you’re paying $4,200 in interest, right?

- • Assuming you can save 30 percent (IRS and state tax rates) on $2,500 of that interest (or $750), your net interest expense out of pocket would be $3,450.

- • Let’s say you were able to refinance the loan to 4 percent. Your interest expense would be $2,400.

- • Even without the interest deduction, you are more than $1,000 ahead.

Tip #215:

Now we come to the education deductions and credits. The nice thing about my professional tax software is that, for decades, I have been able to enter all the education and income data and tell the computer to select the best deduction or credit available to my clients. That doesn’t mean the computer is always right. Sometimes I have to make some major adjustments and overrides to get the numbers to work because the computer isn’t taking into account some key element. (Like last year, when my taxpayer’s daughter ended up with a taxable scholarship and the software wasn’t picking it up correctly.) Most of the time it works just fine. In recent years, the major consumer software houses like TurboTax, H&R Block, Computax, and TaxAct seem to have added this feature to their systems as well. If you are going to file your own tax return, make sure your tax preparation software offers you this benefit if you have education expenses.

Tip #216:

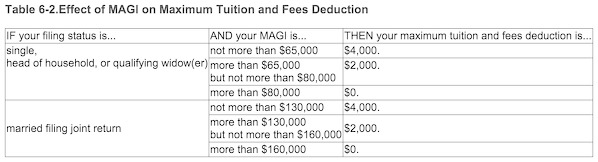

The tuition and fees deduction is worth $4,000 per tax return before it is reduced by your MAGI (https://www.irs.gov/publications/p970/ch06.html; https://www.irs.gov/publications/p970/ch06.html). I find that this deduction is often less useful than the two main tax credits. The main benefit of using the deduction instead of a credit is to reduce your AGI. By bringing the Adjusted Gross Income down, you might free up a few more deductions on Schedule A, increase some other tax credits, or even reduce the impact of the Alternative Minimum Tax (AMT). I am not sure if tax software takes all these attributes into account all by itself. So if you find yourself generating AMT, or losing deductions or credits, see what happens if you use this deduction instead of an education credit.

Note: This has been extended through December 31, 2016, as Section 153 of the PATH Act of 2015. Please see Bonus Tip #270 for more details.

Tip #217:

The American Opportunity Credit (AOC) is worth up to $2,500 per eligible student on the tax return (https://www.irs.gov/publications/p970/ch02.html). The credit is computed as 100 percent of the first $2,000 of qualified education expenses, plus 25 percent of the next $2,000. You must be working on a degree to use this credit and in school at least as a half-time student for at least one full academic period during the current year—or the first three months of the following year. This is a favorite credit because it’s partially refundable. That means even if you have no taxes due at all, you can still get back up to $1,000 per eligible student (or up to 40 percent of the total credit, if less than $2,500). This credit is only good for four tax years. They don’t need to be consecutive years. As one IRS agent explained to me, plan out in advance which four tax years will give you the highest benefit for each student in the household. Oops. A student who has a felony drug conviction is not eligible for this credit. Good news: this credit was previously extended until December 31, 2017. Better news: this was made a permanent part of the Internal Revenue Code as Section 102 of the PATH Act of 2015. Please see Bonus Tip #270 for more details.

The Lifetime Learning Credit (LLC) is worth up to $2,000 per tax return (https://www.irs.gov/publications/p970/ch03.html). It is computed as 20 percent of the first $10,000 of qualified education expenses. No need to pursue a degree to claim this credit. All types of courses will qualify. No minimum number of courses is necessary, and no worries about felonies or drug convictions. Even former criminals are encouraged to learn. Although this credit is not available per student, one of the reasons it’s worthwhile is this credit can be used to educate you in every year of your life. So if you’re taking classes each year to improve your business skills, use this credit before taking deduction for employee business expenses. Whatever part of your education expenses you cannot use here, apply them toward your job if the courses are applicable.

Alas, it’s a nonrefundable credit; if you have no tax liability, this credit is wasted. But good news: if one family member (spouse or dependent) qualifies for the AOC and another family member qualifies for the LLC, you may use them both on the same tax return—separately for each household member—up to the various limits.

Tip #219:

No double benefits are allowed for the same dollars spent. IRS Publication 970 repeats this concept over and over again, separately for each educational benefit (https://www.irs.gov/publications/p970). In essence, the IRS walks you through the order in which tax attributes reduce the tuition. Before you may claim any expenses or credits, you must first reduce the tuition by scholarships and grants, draws from Coverdell ESAs and Sec 529 plans, refunds of the tuition, and other credits. Use Form 8863 for both these credits (https://www.irs.gov/pub/irs-pdf/f8863.pdf). Use a separate Part III (on page 2) for each student entitled to credits. To see how each credit is separately affected and limited, let’s just pull the links directly from the index of Publication 970:

- American opportunity credit—No Double Benefit Allowed (https://www.irs.gov/publications/p970/ch02.html)

- Lifetime learning credit—No Double Benefit Allowed (https://www.irs.gov/publications/p970/ch03.html)

- Student loan interest deduction—No Double Benefit Allowed (https://www.irs.gov/publications/p970/ch04.html)

- Tuition and fees deduction—No Double Benefit Allowed (https://www.irs.gov/publications/p970/ch06.html)

- Work-related education—No Double Benefit Allowed (https://www.irs.gov/publications/p970/ch12.html)

Tip #220:

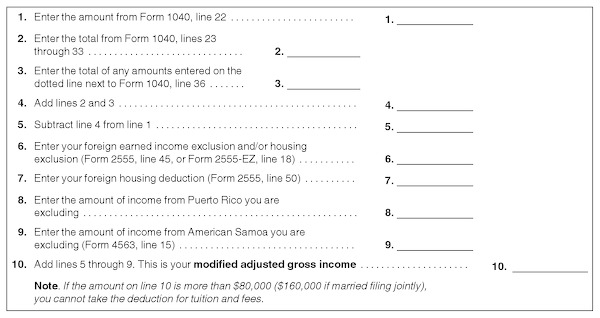

For the purpose of education, how do we adjust the Adjusted Gross Income (AGI) to arrive at the Modified Adjusted Gross Income (MAGI)? Here is an overview of the computation. It shows the items that are added back into income (mostly foreign income and housing exclusions) to arrive at the MAGI to be used for education deduction and credit purposes.

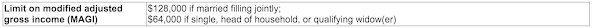

We mention MAGI (Modified Adjusted Gross Income) in several places in this chapter (and elsewhere). However, please be aware that, thanks to the brilliant minds in Congress, MAGI has a completely different phaseout level of MAGI for each and every tax deduction, credit, and attribute.

- • MAGI student loan interest—https://www.irs.gov/publications/p970/ch04.html

- • Tuition and fees deduction MAGI—https://www.irs.gov/publications/p970/ch06.html

- • American Opportunity Credit MAGI—https://www.irs.gov/publications/p970/ch02.html

- • Lifetime Learning Credit MAGI—https://www.irs.gov/publications/p970/ch03.html

Unreimbursed work-related education expenses. While you may not generally deduct the cost of a degree, if you can prove that specific expenses are job related, do claim them on your Form 2106 as employee business expenses. Read this Tax Court case, Lori Singleton v. Commissioner, from 2009 (http://www.ustaxcourt.gov/InOpHistoric/singleton-clarke.sum.WPD.pdf). It’s quite interesting to read the story of this nurse who took a $14,787 deduction for the cost of her MBA/HCM (Health Care Administrator) on her 2005 tax return. She was able to prove that the new degree did not necessarily prepare her for a new job. It helped her maintain her skills for the job she already had. Singleton handled her own case and fought her own battle. She did a great job. That’s why I am including her story. Generally, I would not have been so aggressive as to deduct the actual cost of the degree. But I would have taken the deduction for each individual course that helped a taxpayer maintain your skills for your present job or business. Keep your mind open to the possibilities (that are available within the law). And keep excellent records, as Singleton did.

Tip #223:

Need a summary? Due to the complexity and inconsistency of the laws related to the variety of tax credits and deductions related to education, it really helps to have a scorecard. Actually, in a way, the IRS does have such a thing. It’s called Appendix B, “Highlights of Education Tax Benefits for Tax Year 20XX.” This appendix is updated in each new year’s edition of Publication 970. Alas, it’s not available as we write this. But that doesn’t mean you can’t pull up the PDF version of this publication and click on Appendix B in the table of contents when you are working on your tax return (https://www.irs.gov/pub/irs-pdf/p970.pdf). Really, seeing the overview of the various benefits, rules, and limits side by side will help you understand which ones you can use for yourself and your family.

Tip #224:

While we’re talking about education, let’s take a quick look at homeschooling to see if there are any tax benefits at all. For families who prefer to homeschool your children, consider getting a group of families together to share the responsibilities. If you can get state accreditation for the parents and for the school, it will be recognized as a school by the state. As a result, the IRS won’t consider the teachers, principals, counselors, or aides to be homeschoolers. All accredited teachers may deduct their unreimbursed, class-related costs on line 23 (up to $250; see Tip #259) and the rest of the balance of costs on Form 2106 as itemized deductions. Remember, each “teacher” still has to meet the nine-hundred-hour test. For a ten-month teaching cycle, that’s about twenty-one hours per week—or about three hours per day of a seven-day week. This wouldn’t be easy to accomplish. A lot depends on why you are homeschooling. If it’s to preserve security and your particular ideology, and you share it with others in the community, this may work for you.