This is where the rules get complicated. Married couples have choices with their Social Security benefits that singles don’t have. Studies show these choices are not well understood.

In a 2008 study titled When Should Married Men Claim Social Security[15], authors conclude,

“Most married men claim Social Security benefits at age 62 or 63, well short of the age that maximizes the expected present value of the average household’s benefits. That many married men “leave money on the table” is surprising. It is also problematic. It results in much lower benefits for surviving spouses and the low incomes of elderly widows are a major social problem. If married men delayed claiming Social Security benefits, retirement income security would significantly improve.”

Technically the last sentence of the prior quote should be changed to “If the higher earner of the two delayed claiming Social Security benefits, retirement income security would significantly improve.”

The higher earner, whether that is the husband or the wife, has the ability to make choices that leave the couple in a more secure financial situation whether both should be long-lived or only one should be long-lived. It is not about being male or female; it is about developing a plan to get more as a couple.

Claiming strategies for married couples offer many possibilities because of two features of Social Security benefits that apply only to married couples:

Spousal benefits - As a spouse, you are eligible for a spousal benefit that is equal to 50% of what your spouse will get at their FRA, or your own benefit amount – whichever is higher. For those born on or after January 2, 1954, when you file you will be deemed to be filing for all benefits you are eligible for, and you will automatically be given the higher of either your own benefit, or if eligible, a spousal benefit. (In order to be eligible for a spousal benefit your spouse must have filed for their own benefit already.)

For those who reach age 62 on or before January 1, 1954, depending on the relative ages of you and your spouse, you may be able to claim a spousal benefit for a few years, while letting your own benefit amount accumulate delayed retirement credits, and then switch to your own benefit at age 70.

For example, when Sara reaches her FRA of 66, she could collect a spousal benefit of $1,086 (assuming 2% inflation by the time Sara reaches age 66 this will be $1,176) which is half of Sam’s Full Retirement Age benefit of $2,173 as shown in Table 1-4, or she could collect a benefit of $1,313 based on her own earnings record. Initially, because her own benefit is larger, Sara thinks that is what she should take. In Sara’s case, however, if she collects the monthly inflated spousal benefit of $1,176 at age 66, then when she reaches age 70 she can switch to her own age 70 benefit amount of $1,876.

Widow/Widowers benefits – Once you are both claiming Social Security when one spouse dies, it is the higher of the two Social Security benefit amounts that the surviving spouse continues to receive. The lower amount goes away. By planning to get the most out the highest earner’s benefits, you can provide a significant survivor benefit to a spouse.

In Sam and Sara’s case, if Sam waits until age 70, he gets $3,104 per month. This higher monthly amount is then locked in as the survivor benefit for either spouse. If Sam collects at age 66, the lower $2,173 becomes the survivor benefit, and would represent a permanent life-long reduction for either spouse, or both, who may be long-lived.

Note: The maximum spousal benefit payable is 50% of the earner’s benefit at the earner’s FRA. Spousal benefits do not participate in delayed retirement credits. If you are not eligible for your own benefit, but only for a spousal benefit, there is no benefit to waiting beyond your FRA to apply for your spousal benefit.

In order to use Social Security rules around spousal and widow/widower’s benefits you have to learn about your ability to:

File and suspend or request a voluntary suspension of benefits - which due to new Social Security rules will only work for the purpose of spousal benefit eligibility if you were born on or before 5/1/1950[16] and suspend benefits on or before 4/29/2016 (which is a Friday[17]). If you know people who fit this description pass the word along!

File a restricted application – due to new laws signed Nov. 2, 2015, the restricted application option is only available to those born on or before 1/1/1954. Those born 1/2/1954 or later will not be able to restrict their application unless they are a widow/widower.

Up until and including the day of April 29th 2016 filing and suspending will allow your spouse to collect a spousal benefit while your own benefit continues to accumulate delayed retirement credits.

After April 29th, 2016 if you suspend your own benefits, then all benefits associated with your earnings record will also be suspended. (Note: You can only file and suspend once you are FRA or older – to be FRA by the end of April 2016 you had to be born on or before 5/1/1950.)

For example, suppose you and your spouse are both age 65 and your Full Retirement Age is 66, at which point you will receive $1,000 a month. After doing your homework you have decided you do not want to start benefits until 70.

If you reach age 66 on or before 5/1/2016 you can file and suspend your benefits, which then allows your spouse at their FRA to begin collecting a benefit of $500 a month (50% of your age 66 benefit amount). Since you have suspended your benefits they will continue to accumulate delayed retirement credits. When you reach age 70 you can begin your age 70 benefit amount of $1,320 (from Table 2-1,which in reality will have increased a bit more due to inflation adjustments.)

However this strategy will not work after April 29th, 2016. After April 29th, 2016 the only reason to suspend your benefit would be because you realize you claimed too soon; by suspending your benefit it will then continue to accumulate delayed retirement credits so you can start again later and get a higher monthly amount.

Filing a restricted application continues to be allowed for widows/widowers. However, for married couples, in order to file a restricted application you must reach age 62 on or before January 1, 2016.

If married and you qualify for the restricted application it allows you to collect only your spousal benefit while your own benefit continues to accumulate delayed retirement credits.

(If widowed, regardless of your age you will be able to restrict the scope of your application to preserve your ability to switch benefit strategies later. The new law did not change this option for widows/widowers.)

For example, in Sara’s case if she wants to collect a spousal benefit at her age 66, she will need to file a restricted application so she can collect the spousal benefit based on Sam’s earnings record. As Sara attains the age of 62 before 1/2/1954 she can do this.

If she does not file a restricted application she will be deemed to be filing for both her own and a spousal benefit and will automatically be given the larger of the two.

If she does file a restricted application (after she reaches her FRA) she can choose which one to apply for, thus preserving her ability to later switch and apply for the other option.

Sara would choose the restricted application because then at age 70 she can file for her own benefit amount which will be higher based on her delayed start date.

Sara’s sister Sally, who is a year younger, will not have the same options as Sara. When Sally goes to file, regardless of her age at time of filing she will be deemed to be filing for all benefits available and will be given the larger of either her own benefit, or, if married, a spousal benefit.

Note: regardless of your date of birth you do not have the option to file this type of restricted application before you reach your FRA unless you are a widow/widower.

Factoring all of this in is challenging. Larry Kotlikoff, Professor of Economics at Boston University, had this to say about it in his column on Forbes[18]:

“Suppose the couple are the same age. The husband can apply for his spousal benefit in any of 48 months between 62 and 66. Same with the wife. They can both apply for their retirement benefits in any of 96 months between 62 and 70. But in all 48 months between 66 and 70 each spouse can suspend his/her retirement benefit collection and then restart it again later. This gives us 48 x 48 x 96 x 96 x 48 x 48 x 48 x 48 = 112.7 trillion combinations to consider…. …my point is that we have a system that not only redefines complexity, but also defies understanding.”

The rules are quite complex and Larry and several other industry experts have designed software to calculate your claiming options for you. If I were married, or eligible for a benefit on an ex-spouse’s record, I would not even think about starting benefits without first running an analysis using such software.

It is impossible for this text to provide a comprehensive analysis of the different methods that online Social Security calculators use. Some tools use different methodologies than others, which can change the advice.

In addition, online tools are continuously being improved so at different times in the software development cycle, one tool may have more advanced capabilities than another, but that can change rapidly. I have provided a brief list of online resources below, listing the tools I am most familiar with for each category at the time of writing this.

From the Social Security Office

You can download a detailed Social Security calculator from the Social Security website; however, it will not evaluate claiming options for you and a spouse. You may find it useful for understanding the factors that affect your own benefit.

For Free

SSAnalyze

There are several free online calculators that can help illustrate your benefit options, however the best one I have found is by Bedrock Capital Management. It is easy to use and lays out a recommended claiming plan for you.

When I input Sam and Sara’s numbers, other than some minor differences related to rounding rules and the timing of the very first check, the numbers were in line with the projections I have used in this book.

For a Fee

Maximize My Social Security

Maximize My Social Security was developed by Boston University economics professor Laurence Kotlikoff, software engineer Richard Munroe, and other professionals at Economic Security Planning, Inc., which markets personal financial planning programs.

This calculator covers all the Social Security claiming scenarios one might encounter: retiree, spousal, survivor, divorcee, disabled, parent, and child benefits as well as calculations for the windfall elimination provision and government pension offset (which will affect you if you receive a pension from an employer who did not withhold Social Security tax from your earnings - such as a state employee.)

In the report provided by this software they do not project inflated benefit amounts; instead they show nominal amounts and discount them back to today’s dollars using a real rate of return (the rate of return you expect to earn in excess of inflation).

For Financial Advisors

Social Security Timing®

This is the software I use in my practice. It was also used to calculate or double check most of the claiming options I have used in this book.

Social Security Timing® was developed by Joe Elsasser, CFP®, RHU, REBC, an Omaha-based financial planner. Joe is also the Director of Advisory Services for Senior Market Sales, Inc.

In his work as a financial advisor, Joe began testing a variety of Social Security calculator tools in search of a solution that would help his clients make the best decision about when to elect Social Security benefits. What he found was that every tool he tested, including the government's, was woefully incapable of providing a thorough analysis that took all of the election strategies for married couples into account.

For consumers this calculator provides a free look as to what is at stake between a poor claiming choice and a planned claiming choice. It will list three strategies you may want to consider. To see the full strategy and the full report you will have to agree to be contacted by an advisor who subscribes to the full version of the software.

All three calculators provided a present value comparison of Sam and Sara’s claiming options. Although each software program calculates present value in a slightly different way all three showed that for Sam and Sara, following a claiming plan as outlined in this book was worth more to them than claiming at their ages 66 and 62.

Even when using software it still helps to understand the rules so you know why one option might be preferable to another. Let’s examine spousal benefits and widow/widowers benefits in greater detail and see how these items affect the total amount of income you and your spouse may receive.

This is one area where I see misinformation coming out of the Social Security office on a regular basis. The rules are complex. Your average Social Security office worker may not know all of them. They are trained to deal with the most common situations.

If you have been married for at least one year (or if you have a previous marriage that was at least ten years in length and you have not re-married), you are eligible for a spousal benefit (assuming your spouse or ex-spouse is eligible for their own Social Security benefit).

Length of Marriage Rules

• 9 months – to be eligible for a survivor’s benefit on your spouse’s record

• 1 year – to be eligible for a spousal benefit

• 2 years – if your divorced spouse is 62, but has not yet filed, you must be divorced two years before you are eligible for a spousal benefit based on their record. If they have already filed for benefits there is no two year requirement to be eligible for the spousal benefit on an ex-spouse’s record.

• 10 years – must have been married to claim on a spousal benefit on an ex-spouse’s record

Even if you have your own earnings history, and your own projected Social Security benefit, some of you still have the ability to collect a benefit based on your spouse’s (or ex-spouse’s) record, and later switch to your own benefit, or vice versa. In a few pages in Table 3-1 you’ll see how this works in Sam and Sara’s situation.

The rules you need to know are:

If you were born on or before 1/1/1954 and you file for benefits before you reach your FRA, you will forgo your ability to switch between spousal and your own benefits. Why? When you file early you are deemed to be filing for both your own benefits and a spousal benefit and Social Security will automatically give you the larger of the two. You cannot choose which to take.

If you were born on or before 1/1/1954, and you wait until your FRA to file, you now have choices. You can file a restricted application and just collect a spousal benefit for a few years. This may be advantageous if your age 70 benefit amount would be higher, as you could switch over from a spousal benefit to your own at that point.

If you were born on or after 1/2/1954 regardless of what age you file you will be deemed to be filing for your own benefit and a spousal and will be given the larger of the two. You will not have the option to restrict your application.

You can increase your benefits by using these complex rules but you may need to go into the Social Security office armed with printouts from their own website to implement some of the choices available to you[19].

Let’s put some of these rules in action by looking at Sam and Sara’s choices.

Sam and Sara, whose inflation-adjusted benefit amounts are in Table 1-4, provide a good example of how both spousal rules and widow/widower rules can be leveraged to your benefit.

Sam was born April 10, 1949, which makes him 66 in 2015. Sara was born January 2, 1953, which makes her 62 in 2015. They both have a Full Retirement Age of 66.

Sara did her own benefit calculations without considering spousal or survivor benefits. She now has a better understanding of how both spousal and survivor benefits work. She decides to redo her calculations one more time before sharing her numbers with Sam.

In Table 3-1 you see Sam and Sara’s benefit amount based on Sam claiming at 66 and Sara at 62. In Table 3-2 you see an alternate choice they could make.

About the time Sam reaches 81 and Sara reaches 77 you can see the cumulative numbers in the far right column of Table 3-2 exceed the cumulative numbers at the same ages in Table 3-1. For each year they live past their ages 81/77 the Table 3-2 claiming plan becomes more attractive.

Table 3-2 shows Sam and Sara doing the following:

Sam files and suspends his benefits at age 66, near his 4/10/16 birthday. He will begin his own benefit at age 70.

Sara files for a restricted application for a spousal benefit based on Sam’s earning’s record at her Full Retirement Age (which is a few months before Sam’s 70th birthday).

Sara switches to her own benefit at her age 70.

Sara decides to see how fast they would spend down their savings with each of these alternate claiming choices.

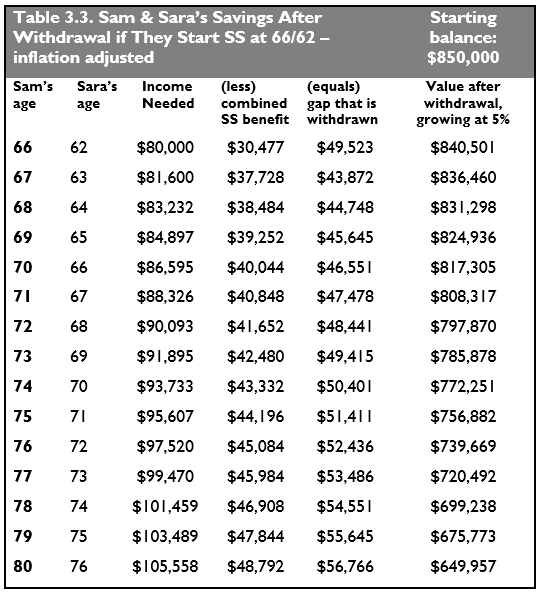

She adds up the amount of savings and investments that she and Sam have. It totals to $850,000. She assumes the investments earn 5% a year. She adds up their expenses including health care costs, property taxes, income taxes and everything else she can think of and determines they need about $80,000 a year to live on.

She runs some additional calculations to see how long their funds last (results shown in Table 3-3 and Table 3-4). She is shocked to see that if they begin Social Security at ages 66/62 then the year she reaches 88 they will run out of money. If they claim Social Security according to her alternate plan, then their funds last into the year she reaches 90.

In Sara’s second set of calculations shown in Table 3-4 she can see that if they wait until a later age to start benefits they will spend down a fairly large portion of their portfolio in the next four years.

She decides to see what happens if their investments earn a higher rate of return.

She determines that in order for them to have more funds remaining at her age 90, with the age 66/62 Social Security claiming choice their savings and investments would have to earn an annual rate of return after all fees and expenses of just over 8% a year.

While Sara has been researching Social Security options she has also been learning about investing. She attended an online class hosted by retirement researcher Wade Pfau. During that class she remembers that Wade showed that based on past market history approximately 1 in 3 retirees would not have earned a compound rate of return in retirement higher than 6% a year. (You can follow Wade online at retirementresearcher.com)

It was an eye opener for her to see that two investors could behave the same way and build the same diversified portfolios, but have very different outcomes depending on the time period that they live through.

She knows it is important to make decisions that put them in the most secure position regardless of what market conditions come along, and she knows earning a higher rate of return is not something that she and Sam can count on.

That’s why one of the things Sara likes about claiming Social Security later is what things will look like at her age 75 - if they claim at 66/62 they will have $47,844 of guaranteed income; with the later claiming plan they will have $69,360 of guaranteed income at her age 75.

That is $21,516 more guaranteed income per year.

She looks at the inflation adjusted amount they’ll need to live on at her age 75, which is $103,489. If they claim Social Security later a large portion (67%) of their expenses will be covered by their Social Security income. The thought of this makes her feel safer.

She realizes that following this plan can increase the amount of guaranteed income available to them later in life, without buying an annuity or any other investment product.

Sara is about to share her analysis with Sam when one other thought crosses her mind… what if Sam passes early? Before he reaches age 70? What happens then?

The short answer is that the decision will still benefit Sara as a survivor. The long answer is addressed by looking into how widow/widowers benefits work.