CHAPTER 7

The Capitalization Table

Now that we've worked through all of the specific clauses in the term sheet, let's go through how a typical capitalization table (cap table) works. A term sheet will almost always contain a summary cap table, which we describe in this chapter. You, your prospective investors, or occasionally your lawyers will generate a more detailed cap table.

The cap table summarizes who owns what part of the company before and after the financing. This is one area that some founders, especially those who have not been exposed in the past to cap table math, are often uncomfortable with. It's extremely important for founders to understand exactly who owns what part of a company and what the implications are in a potential funding round.

Normally when you initially set up the company, 100 percent will be allocated to the founders and employees, with a specific number of shares allocated to each individual. The question “What will I own if a VC invests X in my company at a Y valuation?” is rarely simple. To answer it, you need to be able to generate a cap table to truly analyze the deal presented by a particular term sheet. Following is a model to work from with a typical example.

Let's assume the following:

2,000,000 shares held by founders before the VC invests

$10 million premoney valuation

$5 million investment by the VC

In this example, the postmoney valuation is $15 million ($10 million premoney + $5 million investment). Consequently, the VCs own 33.33 percent of the company after the financing ($5 million investment/$15 million postmoney valuation). This should be pretty straightforward so far.

Now, assume the term sheet includes a new employee option pool of 20 percent on a postmoney basis. Remember that this means that after the financing, there will be an unallocated option pool equal to 20 percent of the company.

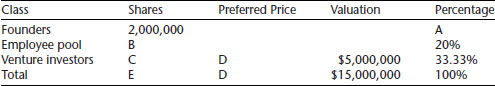

Although the postmoney valuation remains the same ($15 million), the requirement for a 20 percent option pool will have a significant impact on the ownership of the founders. Per the cap table, you can see how we calculate the percentage ownership for each class of owner, along with the price per share of the preferred stock. To start, we've filled in the known numbers and now have to solve for the unknowns (A, B, C, D, and E).

Example Capitalization Table

First, let's solve for A, the founders’ ownership percentage: A = 100 percent minus the VC percentage minus the employee pool percentage, or 100% – 33.33% – 20% = 46.67%. Given that we know that the 2,000,000 founders’ shares represent 46.67 percent of the company, we can determine that the total shares outstanding (E = 2,000,000/0.4667) are 4,285,408. Now, if there are 4,285,408 shares outstanding, determining the number of shares in the employee pool becomes B = E * 0.20 or 857,081.

The same math applies for C, the number of shares of preferred stock the VCs have. C = E * 0.3333 or 1,428,326. Since $5 million bought 1,428,326 shares of preferred stock, then the price per share of preferred stock (D = $5,000,000/1,428,326) is $3.50 per share.

Finally, always check your calculation. Since we know we have a $10 million premoney valuation, then the shares prior to the financing (2,000,000 founders’ shares plus the 20 percent option pool) times the price per share should equal $10 million. If you do this math, you'll see that (2,000,000 + 857,081) * $3.50 = $9,999,783.50. Oops, we are off by $216.50, which represents 62 shares (well, 61.857 shares).

While this is close enough for an example, it's not close enough for most VCs, or for most lawyers for that matter. And it shouldn't be close enough for you. That's why most cap tables have two additional significant digits (or fractional shares)—the rounding to the nearest share doesn't happen during intermediate steps, but only at the very end.

As the entrepreneur, you shouldn't blindly rely on legal counsel to generate these documents. There are a lot of good lawyers out there with poor math skills, and the cap table can get messed up when left in the hands of the lawyers. Although some get it right, it's your responsibility as the entrepreneur to make sure you understand your cap table. This will be especially helpful at times when you want to expand the employee option pool and you are eloquent in front of your board of directors explaining the ramifications.