Chapter 10

Figuring the Pluses and Minuses of Coverdell Accounts

In This Chapter

Looking at the benefits of Coverdell accounts

Looking at the benefits of Coverdell accounts

Recognizing the drawbacks of Coverdells and working around them

Recognizing the drawbacks of Coverdells and working around them

Almost everyone agrees (which is unusual) that higher ed is where it’s at if you want your children to get the best start in their adult lives. And in a rare instance of unanimity, almost all the same people agree that you should save something to pay those eventual higher education costs. Where perfect agreement falls apart is when people discuss their “perfect” savings plan.

The truth is that there’s no one perfect savings plan. What works for one person may be totally wrong for another, and rules governing one type of account may fit perfectly into one person’s saving strategy while strangling another’s attempts. Coverdell Education Savings Accounts (ESAs) are a perfect example. Although they may be real players in your strategy to save for your student’s education, they’re not the perfect solution for everyone. To use a Coverdell account effectively, you need to understand your financial situation now and consider where you think you’ll be in the future to see if, and how, a Coverdell plan makes sense for you and your family.

In this chapter, you explore what’s really great, and what’s really not, about Coverdell ESAs. You also find out how to magnify what’s good about Coverdell while minimizing what’s bad.

Knowing the Pluses of Coverdells

Before you bog down in the minutiae of all the rules and regulations that go along with Coverdell accounts, take a couple minutes to reflect on some reasons why they can potentially be really good for you and your family.

Having total control

One of the great advantages of Coverdell ESAs (and the one that most banks and financial institutions spend a great deal of time telling you about) is that you, the responsible adult listed on the account, have total control over how the money is invested. If you want to be socially responsible and not buy into tobacco companies or companies that do business in countries that have repressive regimes, you can do that. If you only want to buy bonds, you can do that, too. You can also completely change your investment strategy on a dime. When the investments markets start to soar upwards, or conversely, begin to plunge, if you’re paying attention, you can move your investments to take advantage of a perceived benefit or limit an impending loss faster than any institutional investor can.

Keep in mind, though, that with you in control, you not only take full credit for your successes, but you also bear the responsibility for your failures. And as anyone who’s spent any time at all studying the stock and bond markets knows, some of the overall market failures have been spectacular.

Comparing Coverdell tax savings to 529 plans

Although the tax-deferred/tax-exempt provisions of Coverdell Education Savings Accounts are almost identical to those of Section 529 plans, the total tax savings in a Coverdell account may not be as great for two reasons:

No current income tax deduction: Depending on where you live, you may receive a current income tax deduction for contributions into a Section 529 plan; these don’t exist for contributions into Coverdell accounts.

No current income tax deduction: Depending on where you live, you may receive a current income tax deduction for contributions into a Section 529 plan; these don’t exist for contributions into Coverdell accounts.

Less time for money to grow: Coverdell accounts usually exist for a much shorter period of time and so have less time to earn money. Remember, there is no federally mandated final distribution date for a Section 529 plan, although individual states and plans may impose one. However, Coverdell accounts must be fully distributed by the designated beneficiary’s 30th birthday. Thirty days after that date, the money is distributed to that person, whether or not the person has any expenses for which to use that money.

Less time for money to grow: Coverdell accounts usually exist for a much shorter period of time and so have less time to earn money. Remember, there is no federally mandated final distribution date for a Section 529 plan, although individual states and plans may impose one. However, Coverdell accounts must be fully distributed by the designated beneficiary’s 30th birthday. Thirty days after that date, the money is distributed to that person, whether or not the person has any expenses for which to use that money.

Still, despite the limitations present in Coverdell accounts, they can help your money grow faster than saving that money in an ordinary investment account. The fact that all tax is, at the very least, deferred until distribution gives you a consistently larger pot of money to use in your investment strategy, which should increase your overall return on your initial investment, all other things being equal.

Benefiting from tax-deferred and tax-exempt growth

One great benefit of any tax-deferred account is that the money in it grows every time you receive interest, dividends (generally, corporate profits that are distributed to shareholders, usually in cash, but sometimes in additional shares), and capital gains (when you sell an investment for a higher price than you purchased it for, the difference between those two amounts is your capital gain ) on your investments, and no tax issues arise until the money is taken out.

In a Coverdell ESA, if the money comes out and pays for a qualified educational expense, you pay no income tax on the earnings included in that distribution. If, on the other hand, you use the money to pay a nonqualified expense, your designated beneficiary must pay income tax on the earnings portion of the distribution (using the formula shown in Chapter 6), and then, depending on the circumstances of the distribution (see Chapter 5), an additional 10 percent penalty may be tacked on to your beneficiary’s tax bill.

Paying for primary and secondary school expenses

You may have absolutely no intention of sending your child to private or parochial school (although you can pay for private and parochial school fees by using distributions from your child’s Coverdell account), and certainly many fine public school systems out there can provide your child with the very best education your tax dollars can buy. But still, there are always those extra expenses, the little things that come up year after year, such as tutoring, after-school programs, school busing costs (which are becoming more and more prevalent around the country), student athletic fees, and so on. The list seems endless, and as school budgets become tighter and tighter, this list will only continue to grow.

Dealing with Coverdell Snags

Now that you’ve looked at what’s really, really good about Coverdell ESAs, you also need to be aware of stuff that may make you think twice about investing here. Coverdell accounts don’t make sense for a lot of parents because of these negatives. Conversely, you may decide that a Coverdell account makes sense, but only in a very limited way, if you keep the amounts invested small, or if you use them only for the short term.

Whether your overall savings come up short (so you’ll need to apply for financial aid), your student actually wins some outright scholarship aid (so you have more money in your child’s Coverdell account than you need), or your child decides against any education beyond high school, you need to stay on top of how having a Coverdell account for that child will play into these scenarios, and figure out ways to minimize any negative consequences.

Minimizing a Coverdell account’s impact on financial aid awards

Hopefully, you won’t even need to read this part, because you’ve been successful in your savings ventures and you have all the money you and your student need to see him through college or any other postsecondary educational endeavor. If, however, your savings are a little short and you’re not earning quite enough to make up the gap every year, you need to pay attention. Coverdell accounts can become negative in this type of scenario. You need to carefully monitor your particular situation to avoid the minefield.

.jpg)

And it just gets worse. In addition to counting 35 percent of the value of the account as available to pay current expenses, the total amount of any distributions your student received in the prior year is also included on his current year financial aid application, even if none of the distribution was taxable. Because the folks at the Department of Education assume that the parents are responsible for supporting their child and that all the child’s income is then available for education expenses, 50 percent of that child’s income (adjusted for a small income protection allowance), whether taxable or not, is counted as available to pay educational expenses.

If you have a small Coverdell account for your student, the asset and income inclusions probably won’t impact his financial aid award too adversely. If you’re successful in making contributions and even more successful in your investments, however, the existence of that Coverdell plan may effectively prevent your student from receiving certain forms of financial aid. In addition, he may well be saddled with paying back full-cost, unsubsidized Stafford Loans at the end of his college career (see Chapter 17). Of course, if your student isn’t likely to ever qualify for need-based financial aid, you don’t need to worry about this consideration.

There are, of course, ways around this dilemma. If you choose to save inside one of these accounts for your student and your student still needs additional funds, it doesn’t mean that your saving was in vain, your student is doomed to a ten-year payback of high-cost loans, and you’re a failure. This problem has some possible solutions, but you need to be on top of the fact that you have a problem well before you ever complete that first financial aid application.

Spending down your student’s Coverdell account early

First, you may choose to use up your student’s Coverdell account before he reaches college and starts applying for financial aid. Remember, you may use Coverdell distributions to pay for all qualifying educational expenses for both primary and secondary school, as well as for postsecondary school, and the rules concerning what qualifies are far more lax for K–12 expenses than for college ones.

Rolling over your student’s Coverdell account into a Section 529 plan

If you can’t completely exhaust your student’s Coverdell account before he’s likely to start applying for financial aid, you may consider rolling the account over into a 529 plan for your student. The rollover is tax-free if you complete it within 60 days of the initial withdrawal from the Coverdell account.

In a rollover to a Section 529 plan, you need to keep in mind the following:

If you take the check you receive as a distribution from your student’s Coverdell account and use it to fund the new Section 529 plan, your student (not you) is the plan owner of the Section 529 plan. And, of course, if your student is now the plan owner, he gets to include the total amount of that Section 529 plan as a personal asset, included in the financial aid formula at a generous 35 percent. Distributions, however, are currently not includable as taxable income, so long as any deferred income inside that distribution is used to pay for qualified higher education expenses.

If you take the check you receive as a distribution from your student’s Coverdell account and use it to fund the new Section 529 plan, your student (not you) is the plan owner of the Section 529 plan. And, of course, if your student is now the plan owner, he gets to include the total amount of that Section 529 plan as a personal asset, included in the financial aid formula at a generous 35 percent. Distributions, however, are currently not includable as taxable income, so long as any deferred income inside that distribution is used to pay for qualified higher education expenses.

If you choose to distribute the funds from the Coverdell account directly to your student and then you contribute that exact amount into a Section 529 plan, you retain control over the new Section 529 account. The Section 529 plan is counted as your asset (included at only 5.6 percent in the financial aid formula), and you have the ability to change the designated beneficiary (according to the relationship test described in Chapter 5).

If you choose to distribute the funds from the Coverdell account directly to your student and then you contribute that exact amount into a Section 529 plan, you retain control over the new Section 529 account. The Section 529 plan is counted as your asset (included at only 5.6 percent in the financial aid formula), and you have the ability to change the designated beneficiary (according to the relationship test described in Chapter 5).

Transferring the money to another beneficiary

The assets in the Coverdell account belong to the designated beneficiary; so when you change that beneficiary to another child or other related person (using the familial relationships stated in Chapter 8), you take these assets away from the first beneficiary, and he no longer has to count them on his financial aid application. You have, however, just made a new gift to the new beneficiary, and there may be gift tax consequences. In addition, you now need to pay careful attention to the financial aid needs of the new student. If you see financial aid applications in that child’s future, you may want to consider paying down the remaining balance in the Coverdell account as quickly as possible by making qualified withdrawals covering primary and secondary educational expenses.

.jpg)

Closing the account and completely distributing the proceeds to your student

Finally, you may choose to close the Coverdell account and hand the distribution check over to your student. Your student will owe income tax on any accumulated income in the account and also a 10 percent penalty for the privilege of receiving a nonqualified distribution. Still, if the amount of income isn’t great and your student has little or no other income to report on his tax return, the overall tax burden may be slight, and this option may be your best way out of this particular jam.

You’re handing a chunk of change to a kid, who may not have the best money management skills. Actually, though, this is what you’re hoping for in this scenario, because you really want that money to be spent.

You’re handing a chunk of change to a kid, who may not have the best money management skills. Actually, though, this is what you’re hoping for in this scenario, because you really want that money to be spent.

If your student has wonderful money management skills and promptly stashes that cash away in a savings or investment account, he still has an asset that will be subject to a 35 percent inclusion rate on his FAFSA, which was the treatment you were trying to avoid in the first place. The only income that is counted in calculating his aid award, though, is the current income earned on that money, not the amount of any withdrawals that he takes. It’s not much relief from the initial Coverdell/ financial aid dilemma, but it’s something.

If your student has wonderful money management skills and promptly stashes that cash away in a savings or investment account, he still has an asset that will be subject to a 35 percent inclusion rate on his FAFSA, which was the treatment you were trying to avoid in the first place. The only income that is counted in calculating his aid award, though, is the current income earned on that money, not the amount of any withdrawals that he takes. It’s not much relief from the initial Coverdell/ financial aid dilemma, but it’s something.

Taking the best strategy if your student receives educational assistance

I’m planning on my son receiving a four-year football scholarship (although he’s not particularly athletic). If that fails, he will, of course, be a National Merit Scholar (did I mention he’s brilliant?) and receive a four-year free ride to the college of his choice. So much for my fantasy life, and I have a rich one In real life, I’m saving for his education because I figure I’ll have to start paying tuition bills approximately ten years from now. Now, he may hit the jackpot and actually receive one of these scholarships, and if he does, I’ll be prepared.

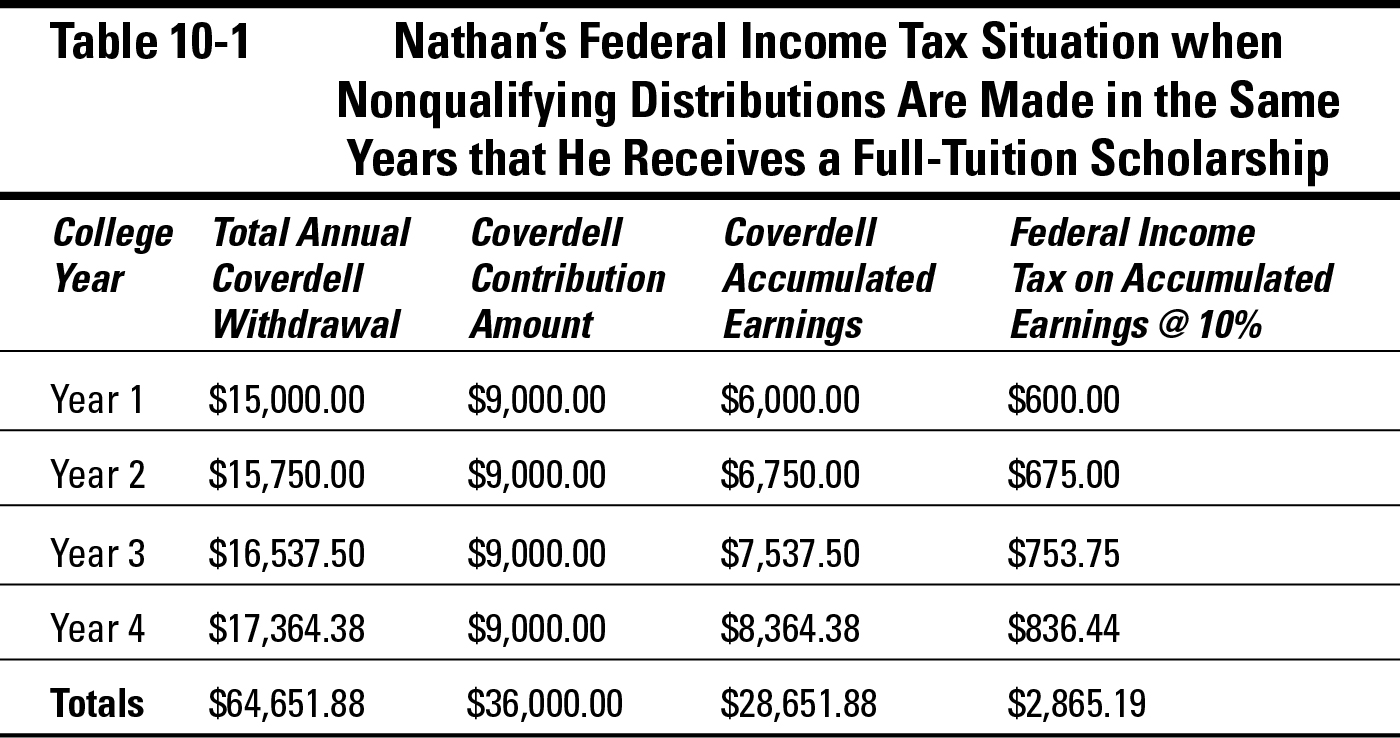

Keep in mind that tax brackets are incremental based on total income and that a student is usually in a lower bracket because he doesn’t have much income. For example, if Nathan receives a full scholarship and his parents have established a Coverdell ESA for him that has $60,000 in it on his 18th birthday ($36,000 of contributions and $24,000 of accumulated income), they may want to consider making an equal distribution of $15,000 for four years, so that an equal amount of their original contribution ($9,000 x 4 = $36,000) is paid to him in each of his four years of college.

Because Nathan is receiving all this extra money, he’s not going to have to get a summer job (probably) or do anything else to earn money for these years. If his parents are willing to make these withdrawals from his Coverdell account for nonqualified expenses, Nathan’s tax situation will look like Table 10-1 (assuming that the money left in the account continues to earn income at the rate of 5 percent per year).

Now, suppose that Nathan’s parents wait until his 30th birthday to make that distribution (at which point he is hopefully earning a reasonable sum of money), and assume that he hasn’t gone to graduate school and completely depleted the account. In this situation, his parents risk increasing the percentage that he may pay in tax. Remember, the $60,000 that was sitting in his Coverdell account on his 18th birthday has now increased significantly (using the 5 percent per year assumption, the cash in the account has grown to over $107,750), and all that money will be coming out at one time, in a lump-sum distribution. Of the $107,750 total distribution, $71,750 represents accumulated earnings on which Nathan must pay income tax. If you assume that he’s now paying in a 25 percent federal income tax bracket, his income tax on the lump sum distribution at his 30th birthday will be a princely $17,977.50. Added to that, he’ll also pay an additional $7,175 penalty, for a total federal tax liability of $25,112.50, or more than $22,000 more than he would’ve paid in taxes had his parents made distributions to him in the same tax years that he was receiving his scholarship.

If your designated beneficiary also lives in a state with a so-called piggybacked income tax (where your state income tax is calculated by using a percentage of your federal income tax), he will pay a higher percentage of the total accumulated income in his Coverdell account not only in federal income tax but also in his state income tax. You should note, though, that state income tax numbers are piggybacked only on the actual federal income tax piece; if a penalty is applied, there should be no additional tax on the penalty portion. If you have another kid you’re going to sending to college, you may also consider transferring the account to that beneficiary (see Chapter 8).

Limiting the blow if your beneficiary decides against going to college

Despite your high hopes and careful planning, you may be paying into a Coverdell account that your student will never use. What can you do then with all that money?

Probably your best bet is to transfer the account to a new beneficiary (see Chapter 8). But if you have no one who can step up to the plate and replace him as beneficiary or if you feel like that money belongs to the person, you can just hand it over. The tax consequences of doing so can be fairly dramatic, as shown by Nathan’s example when his plan is distributed to him at his 30th birthday in one lump sum, but they don’t have to be quite as drastic. Some careful planning and the ability to remove the rose-colored glasses can minimize the tax bite for your designated beneficiary.

Although putting money into the hands of someone who’s failed to live up to your expectations may cause you to grind your teeth, you really don’t have a choice. That money belongs to that beneficiary, and your only control over the matter is when he actually receives it. You need to remember, though, that the longer you keep it in the account, the more income will accumulate there, and the higher the eventual tax bill. The sooner you start paying and the more payments that you make, the lower the total tax bill will be over time.

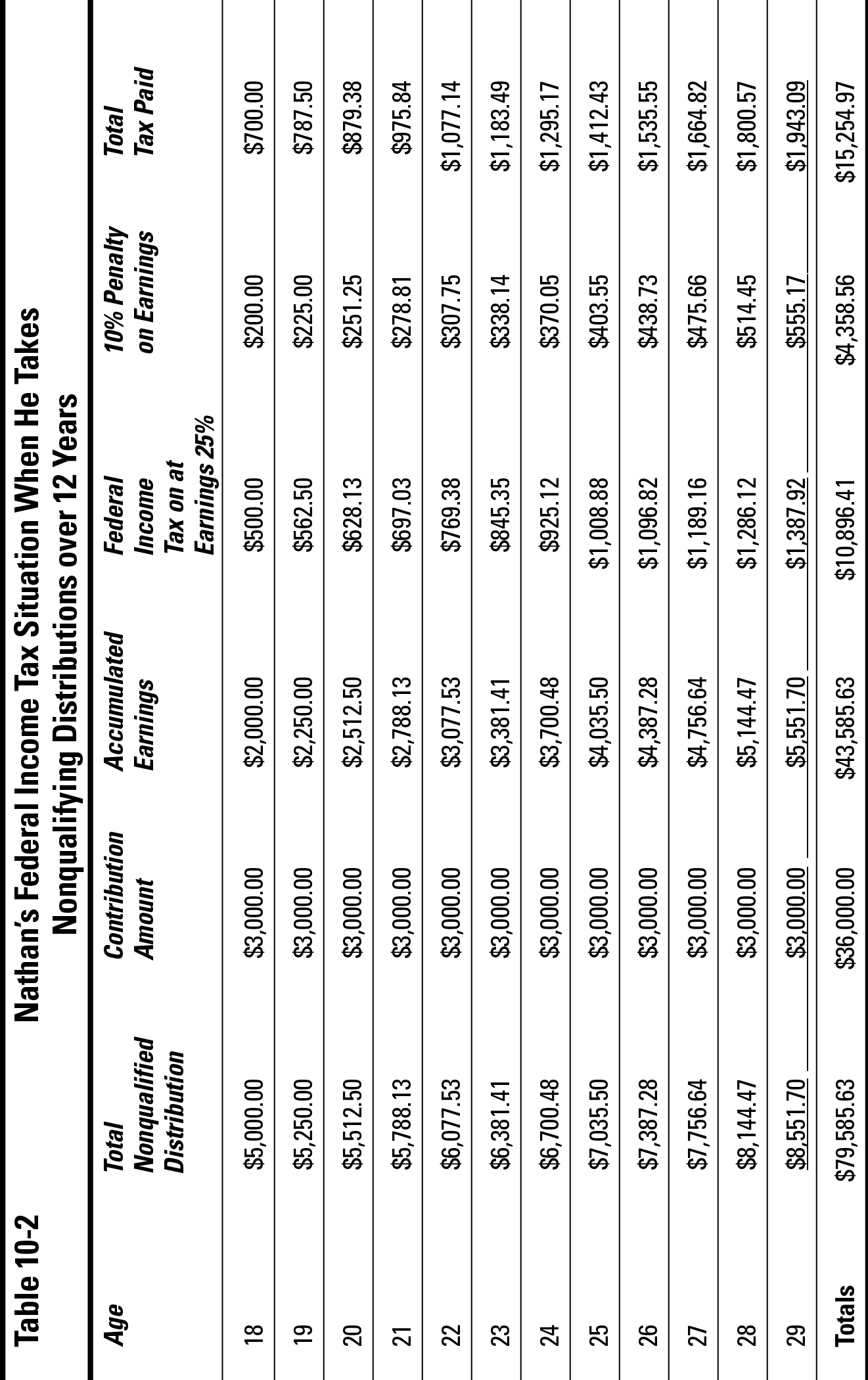

If, for example, Nathan doesn’t receive that full scholarship but instead attends a three-week bartending school (which isn’t an eligible educational institution) when he turns 21, the money that his parents have saved in his Coverdell account will need to be distributed to him at some point either before or immediately after his 30th birthday. If all the other factors in the earlier example remain the same, the damage incurred by the lump sum distribution at his 30th birthday remains the same. Suppose, however, that his parents choose to distribute the account to him beginning when he’s 18 and make equal distributions of their contributions over the 12 remaining years the account may remain open. In that situation, Nathan’s overall tax liability is decreased, even if he pays federal income tax on the accumulated earnings at a 25 percent marginal rate (remember, Nathan is now a bartender and earning reasonable money).

Table 10-2 shows how spreading the account distributions out over time minimize the income taxes and penalties Nathan will pay.

Because Nathan’s parents have chosen to pay down his Coverdell account over the period of time from when they first realize that Nathan won’t need this money for qualified educational expenses until the time that the account needs to be completely distributed, they help him save almost $10,000 in taxes. Paying tax and penalties on the earnings accumulated in a Coverdell account is never the outcome your dreams when you first open the account. If that does happen, however, careful planning can help you minimize the damage, as Table 10-2 shows.

Investing in tax-deferred accounts as tax rates drop

A great deal of hoopla accompanied the passage of the Jobs and Growth Tax Relief Reconciliation Act of 2003, which lowers the tax rate on corporate dividends and long-term capital gains (on investments held for longer than one year) to a maximum of 15 percent and which also lowers income tax brackets for all taxpayers. Not so much has been written about how these tax changes will affect your tax-deferred accounts, probably because they’re not pretty, and no one really wants you to think about them.

Although the Jobs and Growth Tax Relief Reconciliation Act of 2003 never set out to gut the tax-deferred savings markets, it has, in essence, done just that. The huge reduction in tax rates on dividends and capital gains affects only dividends and capital gains earned and taxed currently, not those earned now and taxed later. When you take a taxable distribution from a tax-deferred account, you receive the income portion of that withdrawal as so-called ordinary income, and you’re taxed at “ordinary income” rates, regardless of how that income was earned. By comparison, if you earn that money by buying, keeping, and then selling stocks (thus earning dividends and capital gains), and paying the tax in the year in which your money was earned, you’d pay a maximum income tax of 15 percent on that money. Now that the tax rates on ordinary income are considerably higher than those on corporate dividends and long-term capital gains, saving in a tax-deferred account isn’t quite as sweet as it once was.

Tax-deferred accounts still have benefits, though. Remember, the longer your money isn’t taxed within the account, the longer it has to grow. In addition, you have every reason to believe that the income earned in your Coverdell account or Section 529 plan will eventually be distributed to your student tax-free to pay for qualified educational expenses. And even if your student takes nonqualified distributions from these accounts, the odds are in his favor that he’ll be in a lower tax bracket than you are currently (even with the reduced rates on these forms of income).

Note that the reductions in income tax rates on long-term capital gains and corporate dividends are only temporary and are due to expire in 2009. If budget deficits and the national debt continue to grow, you have every reason to believe that they won’t be extended.