6.1 Brief Introduction to the Case Studies

A small unlisted company, PAB

Three large corporations, namely Alibaba group, Amazon and Walmart

A simplified quantitative and qualitative analysis of the companies is performed.

6.2 A Private Company in Trouble: PAB Limited

PAB is a small, unlisted retailer. The manager is a young and energetic woman with true selling expertise. She bought the company in year X − 2.

Company PAB’s balance sheet

Balance sheet PAB (in $) | Year X | Year X − 1 | Year X | Year X − 1 | |

|---|---|---|---|---|---|

Property, Plant and Equipment (PP&E) net | 105,000 | 60,000 | Equity | 250,000 | 250,000 |

Inventories | 715,000 | 580,000 | Long-term bank loans | 215,000 | 235,000 |

Accounts receivable | 120,000 | 130,000 | Loans from shareholders | 15,000 | 0 |

Prepaid expenses | 10,000 | 5000 | Accounts payable | 320,000 | 170,000 |

Marketable securities | 5000 | 0 | Wages and taxes payable | 145,000 | 95,000 |

Cash | 35,000 | 5000 | Short-term bank loans | 45,000 | 30,000 |

Total assets | 990,000 | 780,000 | Total liabilities and equity | 990,000 | 780,000 |

Company PAB’s income statement

Income statement PAB (in $) | Year X | Year X − 1 |

|---|---|---|

Sales | 1,275,000 | 1,030,000 |

Purchases | 860,000 | 670,000 |

Inventory change (beg–end) | −135,000 | −55,000 |

Selling expenses | 499,000 | 429,000 |

EBITDA | 51,000 | −14,000 |

Depreciation and amortization | 14,000 | 12,000 |

Other charges | 18,000 | 0 |

EBIT | 19,000 | −26,000 |

Interest expense | 9000 | 10,000 |

Extraordinary items | −10,000 | 12,000 |

Tax | 0 | 0 |

Net income | 0 | −24,000 |

Repayment of principal = $10,000/year ×

A negative inventory change, which is equivalent to an increase in inventory, should be deducted from the “purchases of goods” line. These purchased goods were not consumed or sold by the company during the current year and were added as an entry to ending inventory.

EBITDA with COGS

EBITDA with COGS (in $) | Year X | Year X − 1 |

|---|---|---|

Sales | 1,275,000 | 1,030,000 |

Cost of goods sold or COGS (goods consumed) | 725,000 | 615,000 |

Selling expenses | 499,000 | 429,000 |

Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) | 51,000 | −14,000 |

We will now analyze company PAB according to the different ratio families: namely efficiency, liquidity , solvency , debt and finally profitability ratios.

6.2.1 PAB’s Efficiency Ratios

We start with the working capital analysis.

Company PAB’s working capital analysis

Working capital analysis (in $) | Year X | Year X − 1 |

|---|---|---|

Working capital (long-term capital − Fixed assets) | 375,000 | 425,000 |

Non-cash working capital needs from operations | 380,000 | 450,000 |

Net cash | −5000 | −25,000 |

Working capital calculation

Working capital = long-term capital − fixed assets (equivalent to current assets − current liabilities)

=250,000 + 215,000 + 15,000 − 105,000 = $375,000

=715,000 + 120,000 + 10,000 + 5000 + 35,000 − 320,000 − 145,000 − 45,000 = $375,000

Non-Cash Working Capital (NCWC) from operations calculation

Non-cash working capital needs from operations = current assets excluding cash − current liabilities excluding short − term financing

= 715,000 + 120,000 + 10,000 − 320,000 − 145,000 = $380,000

Cash = 5000 + 35,000 = $40,000

Net cash calculation

Net cash = 375,000 − 380,000 = 5000 + 35,000 − 45,000 = − $5000

Findings

The non-cash working capital needs from operations are financed by the excess of long-term capital over fixed assets (i.e., $375,000). Non-cash working capital needs are artificially low due to oversized accounts payable (i.e., $320,000). At a reasonable level, the accounts payable would be equivalent to approximately two months of annual consumption of traded goods (or cost of goods sold , for a retailer).

= 2/12 × (Annual purchases + beginning stock − ending stock)

= 2/12 × (860,000 + 580,000 − 715,000) = 1/6 × 725,000

= approximately $120,000

Normalized accounts payable = $120,000

If we replace $320,000 with $120,000 in the formula, the normalized non-cash working capital needs look much larger than the present figure: $580,000 versus $380,000.

Normalized non-cash working capital needs:

= 715,000 + 120,000 + 10,000 − 120,000 − 145,000 = $580,000

Conclusion on Working Capital

PAB would need to find an additional $200,000 to finance its operations. This is a considerable amount. It looks like the suppliers are either willingly or unwillingly subsidizing this business by granting exceptional (i.e., abnormal) payment terms.

We continue with the calculation of the working capital days, namely the inventory, accounts receivable and accounts payable days.

Inventory Days

Company PAB’s inventory data

Inventory data (in $) | Year X | Year X − 1 |

|---|---|---|

Inventory, beginning | 580,000 | 525,000 |

Inventory, ending | 715,000 | 580,000 |

Inventory, average | 647,500 | 552,500 |

Daily sales | 3493 | 2822 |

Daily purchases | 2356 | 1836 |

Annual consumption (COGS) | 725,000 | 615,000 |

Daily consumption (daily COGS) | 1986 | 1685 |

Company PAB’s inventory days

Inventory days | Year X | Year X − 1 |

|---|---|---|

Inventory days = average Inv/daily purchases | 275 | 301 |

Inventory days = ending Inv/daily purchases | 303 | 316 |

Inventory days = average Inv/daily sales | 185 | 196 |

Inventory days = ending Inv/daily sales | 205 | 206 |

Inventory days = average Inv/daily COGS | 326 | 328 |

Inventory days = ending Inv/daily COGS | 360 | 344 |

The detailed calculation for inventory days (year X) using ending inventory and COGS is outlined below:

Inventory days = ending inventory/daily COGS

COGS = 580,000 − 715,000 + 860,000 = $725,000

Inventory days = 715, 000/[725, 000/365] = 360 days

Not only do inventories appear excessive in relation to the goods sold, which are equivalent to one selling year, but the trend is also negative here. Why were the purchases so important (at $860,000) with such a high inventory (at $580,000) at the beginning of the year? Was the existing stock saleable? This could mean that there is a massive depreciation risk (inventory write-off)!

Accounts Receivable Days

Company PAB’s accounts receivable days

Accounts receivable | Year X | Year X − 1 |

|---|---|---|

Ending accounts receivable (in $) | 120,000 | 130,000 |

Accounts receivable days | 34 | 46 |

Detailed calculation for accounts receivable days (year X)

Accounts receivable days = Accounts receivable/daily sales

Accounts receivable days = 120,000/(1, 275,000/365 days)

Accounts receivable days = 120,000/3493 = 34 days

Accounts Payable Days

Company PAB’s accounts payable days

Accounts payable | Year X | Year X − 1 |

|---|---|---|

Ending accounts payable (in $) | 320,000 | 170,000 |

Accounts payable days | 136 | 93 |

Accounts payable days = Accounts payable/daily purchases

Accounts payable days = 320,000/(860,000/365 days)

Accounts payable days (purchases) = 320,000/2356 = 136 days

Accounts payable days = Accounts payable/daily COGS

Accounts payable days = 320,000/(725,000/365 days)

Accounts payable days (COGS ) = 320,000/1986 = 161 days

Conclusion on Working Capital Days

On the positive side, customers have paid their bills more promptly, and this brings the accounts receivable ratio down from 46 to 34 days. On the negative side, the accounts payable ratio has deteriorated sharply, with the company paying its suppliers with an average delay of roughly four to five months. Thus, there is a significant risk that suppliers will stop their deliveries and start legal proceedings! Remember, they are suppliers, not bankers.

6.2.2 PAB’s Liquidity Ratios

We now undertake a liquidity analysis.

Company PAB’s liquidity ratios

Liquidity ratios | Year X | Year X − 1 |

|---|---|---|

Current ratio | 172% | 242% |

Quick ratio | 31% | 46% |

Cash ratio | 8% | 2% |

The detailed calculations for the adjusted liquidity ratios (year X) are outlined below :

Current ratio = (715,000 + 120,000 + 5000 + 35, 000)/(320,000 + 145,000 + 45,000) = 875,000/510,000 = 171.6% >> 100 % (good)

Quick ratio = (120,000 + 5000 + 35,000)/(510,000) = 160,000/510,000 = 31.4% << 100% (too low)

Cash ratio = (5000 + 35, 000)/(510,000) = 40,000/510,000 = 7.8% << 50% (too low)

Prepaid expenses can be excluded from liquidity ratios. They do not represent future cash inflows, and they cannot be converted into cash to face short-term liabilities (e.g., a prepaid insurance policy or rent).

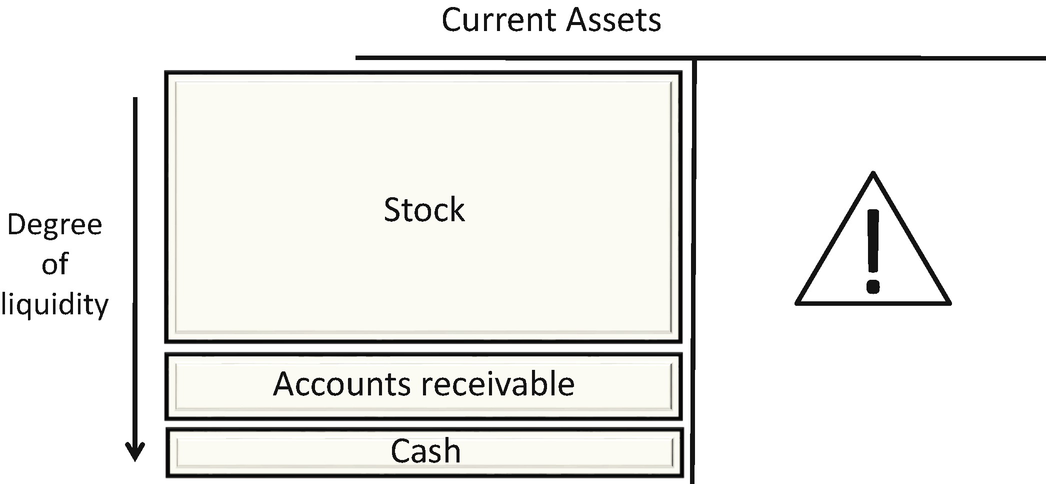

Conclusion on Liquidity

There is a huge imbalance between excessive stock and low cash on hand. Even if the cash ratio does slightly improve, the situation is still alarming with inventories reaching an astronomical level. They represent 80% of the current assets .

Company PAB’s current assets

6.2.3 PAB’s Debt and Solvency Ratios

The ratios used for the debt analysis are presented below, namely the debt to equity and debt coverage ratios.

Debt to Equity Ratios (Static Approach)

Company PAB’s debt ratios

Financial leverage | Year X | Year X − 1 | Limits |

|---|---|---|---|

Net financial debt to equity ratio | 94% | 104% | < 100% |

Net banking debt to quasi equity ratio | 83% | 104% | < 100% |

The calculations for the debt to equity ratios (year X) are outlined below :

Net financial debt = 215,000 + 15,000 + 45,000 − 5000 − 35,000 = $235,000

Net banking debt = 215,000 + 45,000 − 5000 − 35,000 = $220,000

“Quasi” equity = capital + loans from shareholders = 250,000 + 15,000 = $265,000

Net banking debt to quasi equity ratio (year X) = 220,000/265,000 = 83 % (104 % in year X − 1)

Debt Coverage Ratios (Dynamic Approach)

Company PAB’s debt coverage ratios

Debt coverage ratios | Year X | Year X − 1 | Limits X |

|---|---|---|---|

Debt servicing coverage ratio (EBITDA/debt service) | 2.7 | −0.7 | >> 2 OK |

Interest coverage ratio (EBITDA/int exp) | 5.7 | −1.4 | >> 5 OK |

Interest coverage ratio (EBIT/int exp) | 2.1 | −2.6 | >> 3 not OK |

Net debt to EBITDA ratio | 4.6 | −18.6 | << 5 OK |

Detailed calculations for the Debt Service Coverage Ratio (DSCR) (year X)

Debt service = 10,000 (principal) + 9000 (interest) = $19,000

DSCR = EBITDA/debt service = 51,000/19,000 = 2.7 > 2

Detailed calculations for the Interest Coverage Ratio (ICR) (year X)

Interest expense = 9000

ICR = EBIT/interest expense = 19,000/9000 = 2.1 << 3

Detailed calculations for the debt to EBITDA ratio (year X)

Net financial debt/EBITDA = 235,000/51,000 = 4.6 < 5

Net banking debt/EBITDA = 220,000/51,000 = 4.3 < 5

The amount of debt seems slightly out of proportion.

Cost of PAB’s Debt

The formula used for calculating PAB’s cost of debt is the following:

Detailed calculations for the cost of debt (year X)

Financial debt = long + short-term loans + loans from shareholders

Financial debt Year X − 1 = 235,000 + 30,000 + 0 = $265,000

Financial debt Year X = 215,000 + 45,000 + 15,000 = $275,000

Average financial debt = $270,000

Apparent interest rate on debt = 9000/270,000 = 3.3%

Solvency Metrics

The formula used for calculating PAB’s solvency ratio is the following:

Detailed calculations

Solvency ratio = equity/total assets

Solvency ratio (year X) = 250,000/990,000 = 25.25% > 20%

Solvency ratio (year X − 1) = 250,000/780,000 = 32%

Net tangible worth (book value) = $250,000 >> 0

Equity finances 25% of the assets of the company, a satisfactory level. The trend is negative.

Conclusion on Debt and Solvency

PAB’s debt remains important even if the overall debt ratios have slightly improved.

The company is not in a position to raise additional funds or borrow from a bank, this is a serious concern.

It is worth mentioning that the apparent cost of debt is greater than either net return on capital employed (ROCE) or normalized Return on Equity (ROE). This is a very negative sign for a company!

6.2.4 PAB’s Profitability Ratios

The ratios used for the profitability analysis are listed and presented below, namely performance margins, ROCE and ROE .

EBITDA Margin

The formula used for calculating PAB’s EBITDA margin is the following:

Detailed calculations

The EBITDA margin stands at 4%.

Operating Margin

The formula used for calculating PAB’s operating margin is the following :

Detailed calculations

The Earnings before Interest and Taxes (EBIT ) margin stands at 1.5%.

Profit Margin

The formula used for calculating PAB’s profit margin is the following:

Detailed calculations

Normalized net income = adjusted net income before tax × (1 − tax rate)

Normalized net income = (0 + 10,000) × (1 − 0.25) = $7500

Profit margin = 7500/1,275,000 = 0.6%

The extraordinary item, by definition non-recurring, of −$10,000 is eliminated, and a tax rate of 25% is then applied.

The profit margin stands at 0.6%.

Return on Capital Employed (ROCE, Net After Tax)

The formula used for calculating PAB’s ROCE after tax is the following :

Detailed calculations

EBIT − tax = EBIT × (1 − tax rate) = 19,000 × 0.75 = $14,250

Net operating assets = fixed assets + operating non-cash working capital

Net operating assets = 105,000 + 380,000 = $485,000

Capital employed = long-term capital − cash

Capital employed = equity + interest-bearing debt − cash

Capital employed = 250,000 + 215,000 + 15,000 + 45,000 − 5000 − 35,000 = $485,000

Net ROCE = 14,250/485,000 = 2.94%

The net ROCE stands at 2.94%.

EV Multiple

A standard enterprise value (EV) multiple for a retail company is around eight times.

If we take the assumption that the book value of capital employed (or net operating assets) is close to market value, that is to say $485,000, the EV to EBITDA multiple would be as follows:

Detailed calculations

The ratio is above the industry specific ratio, which indicates a lower operating efficiency than an average firm in the sector.

Return on Equity

The formula used for calculating PAB’s ROE is the following:

Detailed calculations

Normalized net income = (0 + 10,000) × (1 − 0.75) = $7500

The extraordinary item, by definition non-recurring, of –$10,000 is eliminated, and a tax rate of 25% is then applied.

Normalized ROE = 7500/250,000 = 3%

The normalized ROE stands at 3%.

Conclusion on PAB’s Profitability

These returns are considered too weak for a retail company. A normalized ROE for a leveraged company such as PAB should be 10% at a minimum.

6.2.5 Summary and Final Thoughts on Company PAB

Company PAB’s key ratios

PAB key ratios | Year X | Year X − 1 | “OK if” |

|---|---|---|---|

Working capital days | |||

Inventory days | 360 | 344 | << 60 days |

Accounts receivable days | 34 | 46 | << 60 days |

Accounts payable days | 136 | 93 | 30/60 days |

Liquidity ratios | |||

Current ratio | 172% | 242% | >> 100% |

Quick ratio | 31% | 46% | →100% |

Cash ratio | 8% | 2% | > 50% |

Debt and solvency ratios | |||

Net debt to equity | 94% | 104% | < 100% |

Equity/assets | 25% | 32% | > 20% |

Debt coverage ratios | |||

DSCR (EBITDA/debt service) | 2.7 | −0.7 | >> 2 |

ICR (EBIT/interest) | 2.1 | −2.6 | >> 3 |

Profitability ratio | |||

Operating margin | 1.5% | −2.5% | |

Net ROCE (after tax) | 3% | −5.1% | |

ROE | 3% | −10% | > 10% |

The PAB business model does not seem sustainable over the long run. Its financial profitability is not satisfactory for a leveraged company, and it urgently needs both an infusion of cash and massive destocking. With a trade debt of $320,000, the suppliers hold the fate of the company in their hands.

Note: A real-life company with the same metrics as the fictitious company PAB went bust one year after its balance sheet was initially published, due to its lack of cash and to the delivery limitations imposed by its suppliers!

6.3 Comparison Between Alibaba, Amazon and Walmart

Alibaba group, Amazon and Walmart are three giant retail companies with distinct core business models that fiercely compete against each other on the world stage. They have expanded their historic business models to become more diversified players on world markets. True omni-channel retailing may be the holy grail they are pursuing. Even the word “retail” may no longer suffice since Amazon Prime Video and the video streaming platform Youku are more services than “pure” retail units.

This comparison cannot however be oversimplified and limited to an “old versus new” economic paradigm. As we know, reality proves to be more complex than a simplistic vision.

Just a word of warning: The comparison between these three prestigious companies is for educational purposes only. It does not constitute a recommendation to buy or sell stock in these corporations, nor should it be considered investment advice. Moreover, it does not constitute in any way a value judgment on the businesses presented in this section.

Furthermore, readers should not place undue reliance on the calculated projections. They were made as of the date of publication and are not guaranteed to be error or bias free. Any investment remains risky and should respect the investor’s risk profile and objectives. Remember, past performance is no guarantee of future performance !

6.3.1 Alibaba Group

Alibaba has created one of the most profitable internet business models in the world. Its Business-to-Business (B2B) marketplace connects over two million merchants online. It is also present in the Business-to-Consumer (B2C) arena with Taobao and AliExpress. Most of its activity takes place in China but the situation is constantly evolving.

Alibaba Group’s balance sheet, RMB (Yuan), in millions, year ended March 31, 2019

Alibaba Group (RMB, in millions) | March 2019 | March 2019 | |

|---|---|---|---|

Cash and cash equivalents | 189,976 | Accrued exp., payables and other liabilities | 117,711 |

Short-term investments and investment securities | 13,189 | Short-term debt | 22,466 |

Prepayments, receivables and other assets | 58,590 | Other current liabilities | 67,492 |

Inventory | 0 | Total current liabilities | 207,669 |

Restricted cash and escrow receivables | 8518 | Long-term debt | 111,834 |

Total current assets | 270,273 | Other liabilities | 6187 |

Long-term investments | 241,544 | Deferred liability charge | 23,984 |

Fixed assets | 92,030 | Total liabilities | 349,674 |

Goodwill | 264,935 | Mezzanine equity | 6819 |

Intangible assets | 68,276 | Non-controlling interest | 116,326 |

Prepayments, receivables and other assets | 28,018 | Shareholders’ equity | 492,257 |

Total non-current assets | 694,803 | Total equity | 608,583 |

Total assets | 965,076 | Total liabilities and equity | 965,076 |

Alibaba Group’s adjusted balance sheet, $, in millions, year ended March 31, 2019

Alibaba Group ($, in millions) | March 2019 | 1 RMB = 0.15 USD | March 2019 |

|---|---|---|---|

Cash and cash equivalents | 29,774 | Accrued exp., payables and other liabilities | 17,657 |

Short-term investments & inv. Securities | 1978 | Short-term financial debt/Current Portion of Long-Term Debt (CPLTD) | 3370 |

Prepayments, receivables and other assets | 8789 | Other current liabilities | 10,124 |

Inventory | 0 | Total current liabilities | 31,150 |

Other current assets | 0 | Long-term debt | 16,775 |

Total current assets | 40,541 | Other liabilities | 928 |

Long-term investments | 36,232 | Deferred liability charge | 3598 |

Fixed assets | 13,805 | Total liabilities | 52,451 |

Goodwill | 39,740 | Mezzanine equity | 1023 |

Intangible assets | 10,241 | Non-controlling interest | 17,449 |

Prepayments, receivables and other assets | 4203 | Shareholders’ equity | 73,839 |

Total non-current assets | 104,220 | Total equity | 91,287 |

Total assets | 144,761 | Total liabilities and equity | 144,761 |

Alibaba Group’s original income statement , RMB, $ US, in millions, year ended March 31, 2019

Alibaba Group, March 2019 (RMB, $, in millions) | RMB | US$ |

|---|---|---|

Sales | 376,844 | 56,527 |

Cost of revenue | 206,929 | 31,039 |

Product development expenses | 37,435 | 5615 |

Sales, marketing, general and admin expenses | 64,669 | 9700 |

Amortization of intangible assets | 10,727 | 1609 |

Impairment of goodwill | 0 | 0 |

Income from operations | 57,084 | 8563 |

Interest and investment income, net | 44,106 | 6616 |

Interest expense | 5190 | 779 |

Other income, net | 221 | 33 |

Income before income tax | 96,221 | 14,433 |

Income tax expenses | 16,553 | 2483 |

Share of results of equity investees | 566 | 85 |

Net income | 80,234 | 12,035 |

Net loss attributable to non-controlling interests | 7652 | 1148 |

Accretion of mezzanine equity (−) | 286 | 43 |

Net income applicable to common shareholders | 87,600 RMB | $13,140 |

Original RMB figures were converted into USD at an exchange rate of 1 RMB(CNY) = $ US 0.15

Alibaba’s adjusted income statement, $, in millions, year ended March 31, 2019

Alibaba Group ($, in millions) | March 2019 |

|---|---|

Sales | 56,527 |

Cost of revenue | 31,039 |

Gross profit | 25,488 |

Research and development | 5615 |

Sales, marketing, general and admin expenses | 9700 |

Amortization of intangible assets | 1609 |

Interest and investment income, net | 6616 |

EBIT | 15,180 |

Interest expense | 779 |

Other income | 33 |

Extraordinary items | 42 |

Net income before tax | 14,476 |

Income tax | 2483 |

Net loss attributable to non-controlling interests | 1148 |

Income available to common shareholders | 13,140 |

Additional useful data on Alibaba Group

Maggie Wu, Chief Financial Officer of Alibaba Group, made the following comment: “Looking ahead to fiscal year 2020, we expect revenue to be over RMB500 billion.”

Adjusted EBITDA 2019 = 121,943 million RMB or 18,291 million USD

Total of 101,958 employees as of March 2019

Softbank, Yahoo and Mr. Jack Ma are major shareholders of the company.

Alibaba has acquired Koala for $2 billion in September 2019, the Chinese e-commerce platform is specialized in luxury goods.

6.3.2 Amazon

Amazon is one of the mightiest brand names in the world and is famous for its Business-to-Consumer (B2C) activities. Once an internet bookseller, it is now a leading e-commerce retailer with a capitalization that touched the $1 trillion mark in July 2019. Amazon is also very active in cloud computing (Amazon Web Services or AWS), and nearly 60% of its operating income comes from this segment.

Amazon’s balance sheet, $, in millions, year ended December 31, 2018

Amazon ($, in millions) | Dec 2018 | Dec 2018 | |

|---|---|---|---|

Cash and cash equivalents | 31,750 | Accounts payable | 38,192 |

Short-term investments and inv. securities | 9500 | Accrued expenses and other | 23,663 |

Net receivables | 16,677 | Unearned revenue | 6536 |

Inventory | 17,174 | Total current liabilities | 68,391 |

Other current assets | 0 | Long-term debt | 23,495 |

Total current assets | 75,101 | Other liabilities | 27,213 |

Long-term investments | 0 | Deferred liability charge | 0 |

Fixed assets | 61,797 | Total liabilities | 119,099 |

Goodwill | 14,548 | Minority interest | 0 |

Intangible assets | 0 | Equity | 43,549 |

Other assets | 11,202 | Total equity | 43,549 |

Total assets | 162,648 | Total liabilities and equity | 162,648 |

Amazon’s income statement, $, in millions, year ended December 31, 2018

Amazon ($, in millions) | Dec 2018 |

|---|---|

Sales | 232,887 |

Cost of revenue | 139,156 |

Gross profit | 93,731 |

Fulfillment, technology and other exp | 63,160 |

Sales, marketing, general and admin expenses | 18,150 |

Interest income and other | 257 |

EBIT | 12,678 |

Interest expense, net | 1417 |

Income tax | 1197 |

Minority interest (Non-Controlling Interest or NCI) | 0 |

Net income | 10,073 |

Additional useful data on Amazon

Total of 647,500 employees, as of December 2018

Mr. Jeff Bezos owned 57.6 million Amazon shares, more than 11% of the company, in August 2019 (Securities and Exchange Commission filling, 08/02/2019).

6.3.3 Walmart

Walmart is a company of superlatives: It is the largest retailer, the largest employer and the largest holder of retail space in the USA. It faces formidable competitors but does not remain inactive on the world stage (the reader may refer here to Sainsbury/Asda’s merger proposal, Flipkart’s acquisition). Walmart is also pushing its digital shopping and omni-channel retailing called Sam’s Club.

Walmart’s balance sheet, $, in millions, year ended January 31, 2019

Walmart (in millions) | Jan 2019 | Jan 2019 | |

|---|---|---|---|

Cash and cash equivalents | 7722 | Accounts payable | 47,060 |

Net receivables | 6283 | Short-term debt/CPLTD | 7830 |

Inventory | 44,269 | Accrued liabilities | 22,587 |

Prepaid exp. and other | 3623 | Total current liabilities | 77,477 |

Total current assets | 61,897 | Long-term debt | 50,203 |

Long-term assets | 126,217 | Deferred income taxes and other | 11,981 |

Goodwill | 31,181 | Total liabilities | 139,661 |

Total assets | 219,295 | Minority interest | 7138 |

Equity | 72,496 | ||

Total equity | 79,634 | ||

Total liability and equity | 219,295 |

Walmart’s income statement, $, in millions, year ended January 31, 2019

Walmart (in millions) | Jan 2019 |

|---|---|

Sales | 514,405 |

Cost of revenue | 385,301 |

Gross profit | 129,104 |

Sales, marketing, general and admin expenses | 107,147 |

Interest income and other losses | −8151 |

EBIT | 13,806 |

Interest exp | 2129 |

Income tax | 4281 |

Minority interest | −509 |

Income available to common shareholders | 6670 |

Additional useful data on Walmart

11,300 stores

Everyday low price (EDLP) and everyday low cost (EDLC)

2,200,000 employees or associates (including 700,000 internationally)

The Walton’s family owns around 50% of the company.

Exceptional items include $8.4 billion in losses: $4.8 billion pre-tax loss (sale of Walmart Brazil) + $3.5 billion pre-tax decrease in JD.com. This should explain why the forecasted EBITDA increases on a large scale in the following years, in comparison with 2018.

US sales represent 65% of the total sales

Walmart has launched a major e-commerce offensive in Asia (e.g., JD.com in China, Flipkart in India, Rakuten in Japan)

Walmart’s acquisition of Flipkart in India costed $16 billion

6.3.4 Liquidity and Efficiency

Liquidity and non-cash working capital metrics, Dec. 2018 to Mar. 2019

Liquidity and working capital | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

Current ratio | 0.80 | 1.10 | 1.30 |

Quick ratio | 0.23 | 0.85 | 1.30 |

Cash ratio | 0.10 | 0.60 | 1.02 |

One day of sales ($, in millions) | 1409 | 638 | 155 |

Inventory days | 31 | 27 | 0 |

Accounts receivable days | 4 | 26 | |

Accounts payable days | 33 | 60 | |

NCWC needs from operations (days) | 2 | −7 | |

NCWC needs (days) | −17 | −54 | −144 |

Cash as a % of current assets | 12% | 55% | 78% |

Receivables as a % of current assets | 10% | 22% | |

Inventory as a % of current assets | 72% | 23% |

“Dec. 2018 to Mar. 2019” means December 31, 2018 for Amazon, January 31, 2019 for Walmart and March 31, 2019 for Alibaba.

Formula Used in the Cash Ratio Calculation

The liquidity ratio calculations are outlined below

Cash ratio for Walmart = 7722/77,477 = 10%

Cash ratio for Amazon = (31,750 + 9500)/68,391 = 60%

Cash ratio for Alibaba = (29,774 + 1978)/31,150 = 102 %

Formulas and Definitions Used in the Working Capital Calculations

Non-cash working capital needs = NCWC needs = current assets − cash − cash equivalents − current liabilities

1 day of sales = sales/365 days

Working capital days = NCWC needs/(sales/day)

Working capital days from operations = inventories/(sales/day) + accounts receivable/(sales/day) − accounts payable/(sales/day)

The working capital calculations for Walmart are outlined below:

NCWC needs = 61,897 − 7722 − 77,477 = − $23,302

Sales/day = 514,405/365 days = $1409/day

Working capital days = −23,302/1409 = − 17 days

Working capital days from operations = 44,269/1409 + 6283/1409 − 47,060/1409 = 31 days + 4 days − 33 days = + 2 days

The working capital calculations for Amazon are outlined below:

NCWC needs = 75,101 − 31,750 − 9500 − 68,391 = − 34,540

Sales/day = 232,887/365 days = $638/day

Working capital days = −34,540/638 = − 54 days

Working capital days from operations = 17,174/638 + 16,677/638 − 38,192/638 = 27 days + 26 days − 60 days = − 7 days

The working capital calculations for Alibaba are outlined below:

NCWC needs = 40,541 − 29,774 − 1978 − 31,150 = − $22,361

Sales/day = 56,527/365 days = $155/day

Working capital days = −22,361/155 = − 144 days

For Alibaba Group: The amounts of accounts payable and accounts receivable cannot be determined with the account headings provided.

Findings on Working Capital

These ratios are the perfect illustrations of the three different business models, namely a brick and mortar retail company with a complex supply chain (with 11,300 stores!), an internet Business-to-Consumer (B2C) company with large fulfillment centers, an internet B2B company with no necessary stock to invest (i.e., intermediary business).

The three companies generate large working capital deficits, which is the rule in the retail industry.

It is worth noting that Alibaba generates a non-cash working capital of –$22 billion, which is equivalent to 144 days’ worth of sales. It is a major source of financing for its operations.

By contrast, Walmart and Amazon have comparable non-cash working capital from operations days but different methods for financing. Walmart has practically no funding tied up in accounts receivable, while Amazon has 26 days’ worth of sales in receivables. Walmart also pay its suppliers more promptly than Amazon.

Amazon benefits from having a “treasure,” its unearned revenue, which represents the equivalent of ten days (6536/638) of sales (i.e., subscription services paid in advance and memberships).

Another Meaningful Comparison

Walmart against Carrefour’ liquidity ratios, Dec. 2018 to Mar. 2019

Liquidity and working capital | Walmart | Carrefour |

|---|---|---|

Current ratio | 0.80 | 0.57 |

Quick ratio | 0.23 | 0.30 |

Cash ratio | 0.10 | 0.19 |

One day of sales ($, in millions) | 1409 | 208 |

Inventory days | 31 | 29 |

Accounts receivable days | 4 | 12 |

Accounts payable days | 33 | 68 |

NCWC needs from operations (days) | 2 | −26 |

NCWC needs (days) | −17 | −43 |

Cash as a % of current assets | 12% | 24% |

Receivables as a % of current assets | 10% | 14% |

Inventory as a % of current assets | 72% | 33% |

These amounts are approximations as a more accurate calculation would imply using daily COGS instead of daily sales.

Today, Carrefour faces a number of major challenges. It is repositioning itself toward sustainable growth while pushing organic (or green) high margin products.

Workforce Productivity

Workforce performance , $, Dec. 2018 to Mar. 2019

Workforce performance in $ | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

Employees | 2,200,000 | 647,500 | 101,958 |

Sales/employee | 233,820 | 359,671 | 554,415 |

Profit/employee | 3032 | 15,557 | 128,877 |

Alibaba’s employees are extremely productive, and its B2B business model and effective e-commerce platforms contribute to its financial success.

It is worth noting that full-time and part-time employees are agglomerated in the total number of employees, and thus the ratio is inaccurate but remains meaningful as the differences are significant.

6.3.5 The Debt and Solvency Situation

Debt and coverage ratios, $, in millions, Dec. 2018 to Mar. 2019

Company | Net debt/equity | Net debt | ICR (EBITDA/Int) | ICR (EBIT/Int) | ICR (EBITDA) & ICR (EBIT) |

|---|---|---|---|---|---|

Walmart | 63% | 50,311 | 11.5 | 6.5 | >> 5 OK; >>3 OK |

Amazon | Net debt < 0 | −17,755 | 20 | 9 | >> 5 OK; >>3 OK |

Alibaba group | Net debt < 0 | −11,607 | 23.5 | 19.5 | >> 5 OK; >>3 OK |

Detailed calculations of the Walmart’s debt ratios

Debt to equity ratio (Walmart) = [short + long-term debt (lease obligations incl.) − total cash]/(total equity, NCI included) = (7830 + 50,203 − 7722)/79,634 = 63% (as of January 2019)

Carrefour’s debt to equity ratio stands at 34%, target’s debt to equity ratio at 86%.

Debt service coverage ratio (Walmart) = EBITDA /(payment of long-term capital + interest expense) = 24,484/(3784 + 2129) = 4.1 >> 2

Net debt/EBITDA = 50,311/24,484 = 2 << 5

$3784 million represent the amount of repayments of long-term debt for the current fiscal year.

Findings on the Debt and Solvency Situation

Walmart’s debt is significant but not excessive , as the company generates enough operating cash to service its debt.

It is worth noting that if long-term operating lease obligations were added to capital lease obligations and debt, the debt to equity ratio would reach 82% as of July 31, 2019. If only capital and finance lease obligations are included, the debt to equity ratio reaches 62% as of July 31, 2019.

Long-term debt was issued in 2018 to finance the Flipkart’s acquisition in India. This will have to be monitored as the legal environment becomes more restrictive in India. Debt to equity ratio stood at 49% one year before.

Solvency metrics, $, in millions, Dec. 2018 to Mar. 2019

Solvency | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

Net tangible assets | 79,634 | 43,549 | 82,069 |

Net tangible assets, excl. Goodwill | 48,453 | 29,001 | 42,329 |

All three companies are significantly solvent, well beyond the prudential limits.

6.3.6 The Compared Profitability

The enterprise value of the three companies has to be first calculated:

EV calculations, $, in millions, August 16, 2019

EV calculation | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

Market cap | 322,560 | 886,710 | 454,580 |

Minority interest | 7138 | 0 | 17,449 |

Net debt | 50,311 | −17,755 | −11,607 |

Enterprise Value (EV) | 380,009 | 868,955 | 460,422 |

For the net debt, it would preferable to use the latest quarterly publications to update net debt as equity and debt valuation should be measured at approximately the same time. For educational purposes, we keep the same net debt as measured previously.

EV multiples and operating margins

Current EV multiples | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

EV/sales | 0.74 | 3.73 | 8.15 |

EBIT margin | 2.68% | 5.44% | 26.85% |

EV/EBIT | 27.52 | 68.54 | 30.33 |

The EV /sales multiple cannot be properly analyzed without considering the associated operating margin. Alibaba appears expensive in view of its high EV to sales multiple, but its operating margin is ten times higher than Walmart’s.

Projected EBITDA , $, in millions

Forward EBITDA | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

EBITDA 2018 | 24,484 | 28,019 | 18,291 |

EBITDA 2019 (projected) | 32,500 | 42,000 | 23,000 |

EBITDA 2020 (projected) | 33,000 | 52,500 | 29,000 |

Growth in EBITDA | 35% | 87% | 59% |

Projected earnings, $, in millions

Forward earnings | Walmart | Amazon | Alibaba Group |

|---|---|---|---|

Earnings 2018 | 6670 | 10,073 | 13,140 |

Earnings 2019 (projected) | 15,000 | 15,000 | 15,000 |

Earnings 2020 (projected) | 15,500 | 19,000 | 17,500 |

Growth in earnings 2020/2018 | 132% | 89% | 33% |

Walmart’s growth in earnings = +8400 in 2019 and 2% in 2020 (exceptional items in 2018 = −$8.4 billion)

Amazon’s growth in EBITDA = +50%/year in 2019 and +25% in 2020 (real growth in operating income achieved for the six months ended June 30, 2019 = +52.8%)

Amazon’s growth in earnings = +50%/year in 2019 and +25% in 2020 (real growth achieved for the six months ended June 30, 2019 = +48.6%)

Alibaba’s growth in EBITDA = +25%/year in 2019 and 2020 (real growth achieved in the quarter ended June 30, 2019, +25%)

Alibaba’s growth in earnings = +15%/year in 2019 and 2020

Forward Earnings Methodology

The reader can either estimate the forward earnings independently by using earnings guidance provided by the firm, or can consult excellent internet sites providing low, consensus or high analyst earnings estimates. We can improve forecast quality by computing conservative (low) and aggressive (high) multiples. Here is a non-exhaustive list of prestigious institutions providing financial data and forward earnings estimates: Boursorama, the Financial Times, Handelsblatt, Morningstar, Nasdaq and the Wall Street Journal.

Main profitability ratios

Walmart | Amazon | Alibaba Group | |

|---|---|---|---|

Current profitability | |||

Capital employed ($, in millions) | 129,945 | 53,007 | 80,703 |

ROCE 2018 (before tax) | 10.6% | 23.9% | 18.8% |

Adj ROE 2018 | 9.2% | 23.1% | 17.8% |

EV/EBITDA 2018 | 15.52 | 31.01 | 25.17 |

P/E 2018 | 48.36 | 88.03 | 34.60 |

Forward profitability | |||

EV/EBITDA 2020 | 12 | 17 | 16 |

P/E 2020 | 21 | 47 | 26 |

Formula used: Adjusted ROE = net income attributable to the parent company (common shareholders of the parent company)/(total equity − minority interest or non-controlling interest).

Formulas Used in the Forward Profitability Calculations

Forward EV /EBITDA = current EV /forward EBITDA 2020

Forward P/E = current share price/forward earnings 2020

Detailed calculations for Walmart

Forward EV /EBITDA 2020 = 380,009/33,000 = 11.52

Forward P/E 2020 = 322,560/15,500 = 20.81

Detailed calculations for Amazon

Forward EV /EBITDA 2020 = 868,955/52,500 = 16.55

Forward P/E 2020 = 886,710/19,000 = 46.67

Detailed calculations for Alibaba

Forward EV /EBITDA 2020 = 460,422/29,000 = 15.88

Forward P/E 2020 = 454,580/17,500 = 25.98

Profitability Findings

Amazon appears to be a very profitable company when book value ratios are applied (ROCE and ROE ) but less attractive when a market ratio like the P/E ratio is applied. Indeed, its equity valuation seems to be very high. However, Amazon’s growth in EBITDA and earnings may justify such a high equity valuation.

Alibaba is well-positioned both on a current and forward perspective.

Walmart has the lowest valuation but also the lowest growth in EBITDA and recurring earnings.

6.3.7 Summary and Final Thoughts

Selected ratios underlining key differences

Walmart | Amazon | Alibaba Group | |

|---|---|---|---|

Liquidity & working capital | |||

Cash ratio | 0,1 | 0.60 | 1.02 |

NCWC needs (in days) | −17 | −54 | −144 |

Debt to equity | |||

Net debt | 63% | Net debt < 0 | Net debt < 0 |

Workforce performance | |||

Profit per employee in US$ | 3032 | 15,557 | 128,877 |

Current profitability | |||

EV/EBIT | 27.52 | 68.54 | 30.33 |

Forward profitability | |||

EV/EBITDA 2020 | 12 | 17 | 16 |

P/E 2020 | 21 | 47 | 26 |

Quantitative and Qualitative Comments

Amazon seems to be priced for perfection, even if it’s forward EV to EBITDA multiple looks reasonable. The company must continue to grow sales at an exponential rate in its diversified segments (i.e., AWS) and the company should continue to invest heavily in Artificial Intelligence (AI) and in “Phygital” marketing (e.g., amazon go stores).

Alibaba seems to have potential and could turn out to be Amazon’s number one competitor. Its home market is China, and the “Middle Kingdom” has established a highly competitive e-commerce ecosystem; companies such as JD.com or Pinduoduo may threaten and at the same time force Alibaba to be even more competitive. Questions remain as to where and how the company will be listed in the future (New York Stock Exchange and/or Hong Kong Stock Exchange, following the November 2019 IPO), on the consequences of the US trade war on China and the fate of the company without Jack Ma, its charismatic co-founder?

Walmart looks inexpensive relative to Amazon, but the company carries some debt and is less diversified than the other two digital giants. Walmart may however succeed in the convergence of its offline and online retail services.

Final Thoughts

A value or defensive investor would most likely choose Walmart, while a growth investor would likely have some hesitation between Amazon and its challenger Alibaba. Geopolitics may provide proper guidance for the future, perhaps even more than business models.

Europe and key emerging countries such as India and Russia represent future battlefields for the three giants. Attacking the Chinese or US market head on is an immense task with high barriers to entry.

In the meantime, the US “delivery battle” has started: Amazon Prime’s one day shipping versus free NextDay delivery at Walmart. In the meantime, the US “video streaming battle” has also started: Amazon, Apple and Disney may prove to be formidable Netflix’s competitors. The huge investments required will affect Amazon’s profitability as in Q3, 2019.

Case Study Limitations: Alibaba, Amazon and Walmart

This purpose of this comparison is not so much the opinions of the author regarding these companies at the time of writing (market capitalization as of August 16, 2019), but the way ratios were implemented and the methodology used. Many positive or negative events such as changes in technology, a rising competitor, a new legal framework, even a recession may upend the present situation. Ratios are powerful tools at your disposal, and an up-to-date analysis in the current environment will be the foundation of your personal investment thesis.

In the next chapter, we will define an investment thesis and examine its implementation at the three companies.