From “Bankster Bailout” to

“Blessed Unrest”

News We Can Use to Create a US Economy

for the 99 Percent

by Dr. Rob Williams

Vice is beneficial, found

When it’s by Justice, lop’t and bound

—Bernard Mandeville, The Fable of the Bees: Private Vices,

Publick Benefits

Sometimes the ideas we are certain are true are dead wrong.

Rich people don’t create jobs.

—Nick Hanauer, Seattle entrepreneur, Banned TED Talk

The Daily Prophet is bound to report the truth occasionally,

if only accidentally.

—Albus Dumbledore, Harry Potter and the Half-Blood Prince

Censored #5

First Federal Reserve Audit Reveals Trillions Loaned to Major Banks

Matthew Cardinale, “First Federal Reserve Audit Reveals Trillions in Secret Bailout,” Inter Press Service, Common Dreams, August 28, 2011, http://www.commondreams.org/headline/2011/08/28-3?.

Student Researcher: Nicole Trupiano (Sonoma State University)

Faculty Evaluator: Peter Phillips (Sonoma State University)

Censored #6

Small network of corporations run the Global economy

Rob Waugh, “Does One ‘Super Corporation’ Run the Global Economy? Study Claims it Could be Terrifyingly Unstable,” Daily Mail, October 20, 2011, http://www.dailymail.co.uk/sciencetech/article-2051008/Does-super-corporation-run-global-economy.html.

Stefania Vitali, James B. Glattfelder, and Stefano Battiston, “The Network of Global Corporate Control,” Public Library of Science, October 26, 2011, http://www.plosone.org/article/info%3Adoi%2F10.1371%2Fjournal.pone.0025995.

Student Researchers: Sean Lawrence (Sonoma State University) and Ivan Sidorenko (San Francisco State University)

Faculty Evaluators: Peter Phillips (Sonoma State University) and Kenn Burrows (San Francisco State University)

Censored #13

Education “Reform” a Trojan Horse for Privatization

Paul Rosenberg, “Education ‘Reform’ Vs. the 99%,” Random Lengths News, February 10–23, 2012, http://www.randomlengthsnews.com/images/IssuePDFs/2012-feb/rl_02-09-12.pdf.

Paul Thomas, “Testing and Poverty in Education,” The Daily Censored (blog), August 8, 2011, http://www.dailycensored.com/2011/08/08/poverty-and-testing-in-education-the-presentscientifico-legal-complex.

Student Researcher: Samantha George (Sonoma State University)

Faculty Evaluators: Crystal White and Peter Phillips (Sonoma State University)

Censored #21

Conservatives Attack Us Post Office to Break the Union and Privatize Postal Services

Allison Kilkenny, “Postal Workers Under Assault in Planned Demolishment Privatization Plan,” Truthout, September 8, 2011, http://www.truth-out.org/last-union/1315492298.

Matt Taibbi, “Don’t Let Business Lobbyists Kill the Post Office,” Rolling Stone, April 23, 2012, http://www.rollingstone.com/politics/blogs/taibblog/dont-let-business-lobbyists-kill-the-post-office-20120423.

Student Evaluator: Dane Steffy (Sonoma State University)

Faculty Evaluator: Peter Phillips (Sonoma State University)

“OUR ECONOMY?” SAYS WHO?

“Economy.” The Greeks had a word for it. Oikos (management of the house) is the ancient root of our modern English word that gets bandied about quite a bit during these interesting times, usually possessive, in the singular. You know. “Our economy.” Tell me if you’ve heard this one-sentence story before: More than 300 million Americans “share” an “economy” that, by all accounts, is going through a time of tremendous tumult. Sound familiar? This oft-told story about a mythical “our economy” ignores the ever-deepening socioeconomic divisions in a country more sharply divided along class lines than it has been in decades. Far from shedding light on this situation, our corporate commercial “news” media (air quotes around the word “news,” please) too often report on this fabled “our economy” in ways that obfuscate or ignore the most important economic news of our time. What should they be doing? Helping citizens connect the dots to paint a picture of how our collective house is “managed” by federal and state governments, increasingly in the pocket of large transna-tional corporations whose primary raison d’etre is profit maximization over all other social and economic values (think meaningful jobs, safe working environments, clean air and water, affordable education, and accessible health care, for starters). This troubling situation is worth exploring in more depth.

The job of journalists, one wag once noted, channeling the fearless Socialist agitator Mary Harris “Mother” Jones, is “to comfort the afflicted and afflict the comfortable.” And a truly democratic news media culture, as media critics have often noted, is one that provides a wide variety of different perspectives on important issues of our time, and continually asks hard questions that challenge the richest and most powerful among us. Alas, our national “news” media too often publish at the behest of their corporate masters, and nowhere is this more true than in how US mainstream news channels report and distort “economic” news.

As the Occupy Wall Street movement has famously proclaimed, Americans live in an economy where the 1 percent of the superrich lord over the other 99 percent—what might be best called a “kleptocracy” (“government by theft”) as described by Pulitzer Prize–winning historian Jared Diamond.1 One spring 2012 estimate of wealth (mal-)distribution in the United States’ economy concluded that 400 individuals at the top now own more assets than the bottom 160 million citizens.2 It is this 1 percent of the US population—CEOs, financial professionals (let’s call them “the banksters”), lawyers, real estate, and medical professionals—who have gobbled up the lion’s share of the nation’s wealth due to excessive deregulation, the decline of unionization, and the off-shoring and outsourcing of real work that has accompanied a complex series of economic trends simplistically dubbed “globalization” by the news media during the past several decades.

Censored #14: Who Are the Top 1 Percent and How Do They Earn a Living?

Mike Konczal charts jobs and income growth of the top 1 percent earners and the causes of changing income inequality. Evidence from tax returns depicts the top occupations as follows: nonfinancial executives first, then financial professionals, followed by lawyers, and then real estate and medical professions. Konczal found that 60 percent of the top percentile of income goes to these top professions. Quoting from J. W. Mason’s Slack Wire blog, Konczal noted that the way our laws structure corporations, “‘a business exists only to enrich its shareholders, including, of course, senior managers themselves,’ and this is done by paying out more in dividends that is earned in profits.” This reality about “our economy” is what upsets the people of the Occupy Wall Street movement. The top 1 percent are “cashing out wealth during the good times and then leaving workers and the rest of the real economy to deal with the aftermath.” There’s good reason to focus on the top 1 percent instead of the top 10 or 50 percent. Evidence suggests that financial pay at this elite level is correlated with deregulation and the other legal changes that brought on the crisis. High-ranking senior corporate executives’ pay has dwarfed workers’ salaries, but is only a reward for engaging in shady financial engineering practices. These problems require legal solutions, a democratic challenge, and a rethinking of how we ought to restructure “our economy.”

Who is really in the driver’s seat of “our economy”? Let two examples help answer this question, Censored stories #5 and #22.

Censored #5: First Federal Reserve Audit Reveals Trillions Loaned to Major Banks

Matthew Cardinale reported that an audit of the Federal Reserve “revealed 16 trillion dollars in secret bank bailouts.” He described how many financial institutions boasted of plenty of cash in their reserves while they were actually receiving loans. Sixteen trillion dollars is a huge figure, and Cardinale explained that “overall, the greatest borrowing was done by a small number of institutions. Over the three years, Citigroup borrowed a total of 2.5 trillion dollars, Morgan Stanley borrowed two trillion,” and “the majority of the loans were issued by the Federal Reserve Bank of New York.” Cardinale observed that lending and borrowing on this scale illustrates the weakness of the financial sector within “our economy.”

Although the banks here at home were taking out massive loans from the Fed, they were not the only ones, as Cardinale concluded. Financial institutions abroad were also taking advantage of the bailout; the United Kingdom, France, and Germany were just a few of the countries that received federal money. “The Federal Reserve has neither explained how they legally justified several of the emergency loans, nor how they decided to provide assistance to certain firms but not others,” Cardinale wrote. Without a formal justification from the Fed, Cardinale’s sources had some opinions of their own. Some said it was simply a “lack of congressional oversight” while others claimed that it was “a clear case of socialism.” The Federal Reserve clearly has some restructuring to do, and according to the audit report, all of the loans are being repaid or have already been repaid.

Censored #22: Wachovia Bank Laundered Money for Latin American Drug Cartels

Writing for AlterNet, Clarence Walker provided a second example of who sits in the driver’s seat of “our economy.” Between 2004 and 2007, Wachovia Bank handled funds totaling $378.4 billion for Mexican currency-exchange houses acting on behalf of drug cartels. Although Wachovia concedes it “didn’t do enough to spot illicit funds,” the transactions amount to the largest violation of the Bank Secrecy Act, an anti-money-laundering law, in US history. As context, between 2006 and 2010, over 22,000 people have been killed in drug-related battles that have raged mostly along the 2,000-mile (3,200-kilometer) Mexico-US border. Illegal narcotics cost the US economy $215 billion annually. Martin Woods, who directed Wachovia’s anti-money-laundering unit in London from 2006 to 2009, left the bank after Wachovia executives disregarded documentation he produced showing that drug dealers were channeling money through Wachovia’s branch network.

What’s even more troubling as we consider this example in light of “our economy”? The case of Wachovia is not exceptional. The bank is just one of many US and European banks that the drug cartels have used to launder money. Since the early 1990s, Latin American drug traffickers have gone to US banks to launder their dirty cash, according to Paul Campo, head of the US Drug Enforcement Administration’s financial crimes unit. So much for the rules ostensibly governing the “free enterprise” system, financial transparency, and political accountability when it comes to the most wealthy and powerful among us.

In sum, if we look beyond the much-fabled “our economy” jargon as proclaimed by the well-coiffed and well-paid pundits and prognosticators who inhabit the pages and airwaves of corporate commercial “news,” it becomes clear that our national economic house is on fire, the arsonists are still in the building, and the US “news” media are too often fanning the flames instead of organizing the bucket brigade.

And what of our national government? Are they working on our behalf to create a level playing field to create equality of opportunity for all? Or are they simply high-fiving with Adam Smith’s so-called “invisible hand” of the marketplace with one palm, while holding out the other for corporate checks, instead of pushing for “checks and balances” within our economic system?

Start with the Supreme Court. I’ve got two words for you: Citizens United. What of the executive branch, and President Barack Obama’s much-vaunted “hope and change” rhetoric from 2008? Time for a reality check. Congress? Read the much-hyped Dodd-Frank Wall Street Reform and Consumer Protection Act—the most complex, arcane, and toothless legislation devised by the Beltway crowd—and then weep. And what of the Democrats and Republicans in the US Congress? Let’s ask the question a different way. Why should members of Congress be too concerned about the real state of the US economy? Story #11 can explain.

Censored #11: Members of Congress Grow Wealthier Despite Recession

While average Americans’ net worth declined significantly between 2007 and 2009 (from $125,000 to $96,000) due to declining home equity and investment activity, Luke Johnson reported that the net worth of our congressional representatives continued to rise, from $1.65 billion in 2008, to over $2 billion.

Johnson’s analysis of financial disclosure forms did not include non-income-producing assets. Rep. Darrell Issa (R-CA) reported that his assets were worth at least $295 million. House Minority Leader Nancy Pelosi’s (D-CA) wealth also increased, from $21.7 million in 2009 to $35.2 million in 2010. Speaker of the House John Boehner (R-OH), Senate Majority Leader Harry Reid (D-NV), and Senate Minority Leader Mitch McConnell (R-KY) all had multimillion-dollar net worths in 2010.

To summarize our two-party system’s relationship to “our economy,” “there are no longer two political parties in the United States, each offering a constructive if differing view of how to secure the welfare, prosperity, security and liberty of the American people,” explained political analyst Mike Krauss. “Instead, there is one party,” he concluded, “the party of corporate profit and the status quo, kept in power by the ability to spend vast sums of money no political party can hope to match, and able to so dominate elections as to set up a choice for president that can only be described as one between two sides of the same bent coin.”3

Censored #6: Small Network of Corporations Run the Global Economy

The consolidation of wealth is not unique to the United States, of course, as is dramatically documented by a 2011 study showing that a small network of corporations exert global influence on the international economy. The study, completed by Stefania Vitali, James B. Glattfelder, Stefano Battiston at the Swiss Federal Institute in Zurich, is the first to look at all 43,060 transnational corporations and the web of ownership among them. They mapped the 1,318 companies at the heart of the global economy and identified 147 companies that form a “super entity” within this web, controlling 40 percent of the world’s wealth. Most of the companies comprising this super entity are banks, including, for example, Barclays and Goldman Sachs. The “super” 147 are “at least in the position to exert considerable control, either formally (e.g., voting in shareholder and board meetings) or via informal negotiations.” At the same time, their close connections mean that the network is “prone to systemic risk” and vulnerable to collapse.

Economists such as John Driffil of the University of London, a macroeconomics expert, stated that the value of its study wasn’t to determine who controlled the global economy, but, rather, to illustrate the tight connections among the world’s largest companies. Some of the assumptions underlying the study have been under criticism—such as the idea that ownership equates to control. But the Swiss researchers have simply applied mathematical models conventionally used to model natural systems to the world economy, using data from Orbis 2007, a database listing thirty-seven million companies and investors.

So, from both a national and international perspective, “our economy” looks fairly grim, a system run by banksters in collusion with compliant politicians, and an economy marked by bailouts for the superrich (the 1 percent) and shrinking economic opportunities for everyone else (us, the 99 percent). Censored 2013 offers a number of case studies regarding how the US “news” media cover and cover up our economic life. Here are three dots to connect that help us understand the true scope of our economic challenges.

Censored #13: Education “Reform” a Trojan Horse for Privatization

Begin with news coverage of US public education, one of the oldest and most democratic collective projects in the United States. The history of public education is complex and multifaceted, but the core premise is elegantly simple: to ensure virtuous citizens and a capable work force, the United States must collectively invest time, money, energy, and purpose in preparing its young people for adult life. As Paul Rosenberg of Random Lengths News, and Paul Thomas, writing for the Daily Censored, made clear, after a decade of local school districts and individual states administering federal testing mandates in the form of the George W. Bush administration’s No Child Left Behind (NCLB) policies and the Obama administration’s Race to the Top program, national educational progress has actually worsened.

In January 2012, FairTest, the National Center for Fair and Open Testing, reported that a decade of No Child Left Behind (NCLB) policies had actually slowed the rate of education progress. The report, “NCLB’s Lost Decade for Education Progress,” concluded that the law had “failed badly both in terms of its own goals and more broadly.” The FairTest findings are based on data from the National Assessment of Educational Progress (NAEP) and dozens of independent studies. One of NCLB’s most outspoken critics, Diane Ravitch, sees current corporate efforts to “reform” public education as a thinly disguised attack on it. “Public education today is the target of a well-coordinated, well-funded campaign to privatize as many schools as possible, particularly in cities. This campaign claims it wants great teachers in every classroom, but its rhetoric demoralizes teachers, and reduces the status of the education profession,” Ravitch told a Los Angeles audience in February 2012. “There is no historical comparison to [the] current movement for privatization and de-professionalization.”

These reform efforts include President Obama’s Race to the Top program, which Ravitch calls “No Child Left Behind 2.0.” Race to the Top entails more high-stakes testing, more school privatization, and the closing of schools with large numbers of low-performing students. As Ravitch noted, “A race has one winner and many losers. That’s not what we want for our children.” Instead, the core rhetoric of “reform” features testing and accountability, the very management principles that have been the status quo in American education for twenty years. The driving logic for such reform is profits. “Wall Street hedge fund managers are heavily invested in this,” Ravitch argued. “This is really an issue of the 1 percent vs. the 99 percent. . . . The more privatization, the less people will work together as communities.”

As National Education Policy Center managing director Bill Mathis concluded, “This set of reforms has been the dominant educational philosophy for the past 20 years—and has yet to register a single sustained success across any urban district in the nation. . . . A child living in poverty with a single parent, a sketchy neighborhood, rotten teeth and bad nutrition is not going to be saved because the third grade teacher adopted Pearson Corporation’s latest national curriculum manual.”4

What’s curious about the “managed” nature of corporate news coverage on this important story is how US “news” purveyors, unlike Mathis, continually fail to ask basic questions about the efficacy of these federal “educational” programs, even as they report on what the “news makers”—Bush, Obama, their secretaries of education, and other important establishment figures—assert about them. What’s worse, US news coverage often perpetuates simplistic stereotypes about the alleged failure of the US public education system, helped along by popular documentaries like Davis Guggenheim’s 2010 film, Waiting for Superman, which functioned as masterful propaganda for the pro-privatization forces interested in co-opting public schools for private gain. The conventional wisdom, Ravitch wrote in a scathing critique of the film, now seems to go something like this:

American public education is a failed enterprise. The problem is not money. Public schools already spend too much. Test scores are low because there are so many bad teachers, whose jobs are protected by powerful unions. Students drop out because the schools fail them, but they could accomplish practically anything if they were saved from bad teachers.

They would get higher test scores if schools could fire more bad teachers and pay more to good ones. The only hope for the future of our society, especially for poor black and Hispanic children, is escape from public schools, especially to charter schools, which are mostly funded by the government but controlled by private organizations, many of them operating to make a profit.5

If this Waiting for Superman logic sounds familiar, even for Censored 2013 readers who have not seen the film, it may be because this educational tale is told and retold in our national “news” media ad nauseum, to the extent that it is commonly accepted as truth by citizens who lack direct experience with the public schools in their very own communities. What most “news” reports fail to acknowledge is this: as “our economy” continues to defund public schools, de-professionalize educators, and aggressively promote privatization as the solution to the many complexities that bedevil our public education system, it is ultimately our students who end up in a race to the bottom.

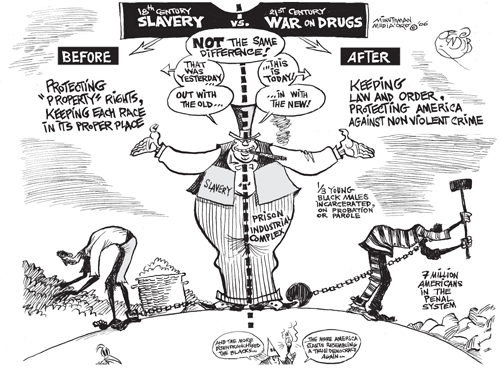

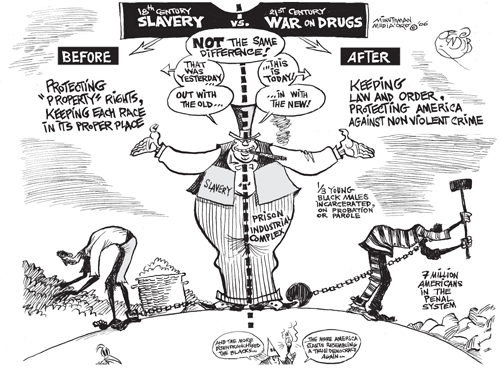

Censored #20: Stealing from Public Education to Feed the Prison-Industrial Complex

Even more insidious, as Adwoa Masozi of the Institute for Policy Studies has suggested, is the relationship between the aggressive attacks on our public school system and the rise of the private prison-industrial complex in the United States. What is the big picture behind funding cuts for our public school systems? We do not hear that some of the largest backers of the public school systems also derive lucrative profits from private prisons. “On top of cutting 4 billion dollars from their budget, Texas has also eliminated state funding for pre-K programs that serve around 100,000 mostly at-risk children,” Masozi reported. North Carolina also cut half a billion in school programs, resulting in less support for social workers and guidance counselors. Losses in the school programs such as these contribute to dropout rates of approximately 27 percent. Once again, public education is being threatened by for-profit forces operating within “our economy.”

“Public education is something more than a right, a liberty, or a privilege,” Masozi wrote, “It is a need.” At too many schools, metal detectors and police, rather than extracurricular activities, have become the norm. Charter schools offer some creative solutions, but in their current incarnation, they fail to serve all students needing an education. Increasingly, corporate entities such as Wells Fargo, Bank of America, J. P. Morgan, and Wal-Mart back both charter education and private prisons, Masozi reported. The increasing prison population is an indirect result of the school system not supporting students or giving them the proper tools for learning. A majority of the people in prisons do not have high school diplomas.

In sum, a defunded public school system that leaves children behind also promotes a more Hobbesian social milieu marked by greater poverty, misery, and lack of meaningful professional and vocational opportunities. Desperation, despair, and drugs fill the void, and prisons, when they are transformed into privatized for-profit institutions, offer investors more opportunities to maximize their return by increasing the levels of incarceration among US society’s most underserved populations. Currently six million citizens are under “correctional supervision,” a figure that surpasses Stalin’s Gulag Archipelago.6

The sinister relationship between attempts to privatize education and the rise of a for-profit prison-industrial complex is one economic story of vital significance that is effectively censored—it never makes the pages or airwaves of the United States’ corporate “news” outlets.

Censored #17: Students Crushed by One Trillion Dollars in Student Loans

Turning to higher education, the story of US “news” coverage is a bit different. Remember the Servicemen’s Readjustment Act of 1944, commonly called the GI Bill? Passed by Congress in 1944, the visionary education law provided a whole host of benefits for returning World War II veterans, including cash payments to attend college or vocational school. By the time the program ended twelve years later, in 1956, more than two million veterans had gone back to college on the GI Bill, with another more than 6.5 million using the bill to seek some sort of educational training program. Observers from across the political spectrum heralded the legislation, rightly recognizing that a federal government investment in veterans’ education would be of tremendous benefit to the United States’ economic future. Even today, the GI Bill is remembered as one of the most important pieces of education legislation in US history. How do we judge? Just look at the numbers. The GI Bill produced seven dollars of economic growth for every dollar invested by Congress, making it “one of the best investments Congress ever made,” according to independent financial analyst Ellen Brown, author of the must-read history Web of Debt.7

Fast-forward to today. Talk to US college or university students and you will discover that, most likely, they have borrowed money to help pay for their higher education. What is astonishing is the staggering amount of collective debt burdening college students today. As Alex Pareene reported for AlterNet in October 2011, student loan debt was then poised to exceed one trillion dollars, surpassing even US credit card debt.8 Students have accepted debt loads that sometimes rival those of a home mortgage, before they have graduated and established regular incomes, based on phony promises. Due to a 2005 bankruptcy bill, debtors cannot discharge student loans through bankruptcy; thus, unlike corporations, students cannot declare bankruptcy. Meanwhile, as the government is shielded from the risk, and creditors are licensed to collect by almost any means they deem necessary, the student loan epidemic threatens to lead a generation into wage slavery. If students are lucky enough to find a job during our economic crisis, they will be spending much of their money paying off their student loans, and the banks will continue to see massive profits.

Prompted perhaps by independent media’s initial coverage of this story, corporate “news” outlets such as CBS and the New York Times began to report on the national student debt crisis during spring 2012. Rarely, however, did their stories highlight the enormous prof-its made by banksters in particular, or by the system as a whole. One exception? Bloomberg ran a May 2012 story on the piles of cash being raked in by taxpayer-funded student-loan debt collectors like Joshua Mandelman and his boss Richard Boyle of Minnesota-based Educational Credit Management Corporation (ECMC), who together pocketed more than $1.5 million in 2010 for chasing down and recovering student loans in a partnership agreement with the US government.9

Instead, the corporate news media’s fragmented coverage focused on “human interest” stories of indebted students and their families, and the efforts of higher education to help solve an economic problem spiraling out of control. The titles of the two-part “Degrees of Debt” New York Times feature that ran during May 2012 are illustrative— “A Generation Hobbled by the Soaring Cost of College” and “Slowly, as Student Debt Rises, Colleges Confront Costs.”10 New York Times journalist Andrew Martin portrayed Wall Street as an interested and helpful observer in the midst of this crisis, a player without any skin in the game, rather than a stakeholder making huge profits from this abysmal situation. Martin quoted an analyst from Moody’s Investors Service, saying that “tuition levels are at a tipping point” and that “we anticipate an ongoing bifurcation of student demand favoring the highest quality and most affordable higher education options.” This jargon is Wall Street shorthand acknowledging the widening gap between the 1 percent who can afford to pay for an elite college education, and the other 99 percent, who are stuck with deepening levels of debt or a difficult decision not to attend college at all because it is simply unaffordable.11

The way that corporate media frame this issue—with an exclusive focus on debt-ridden students, their families, and colleges struggling to rethink “best practices” when it comes to affordable education— ignores the most basic economic issues at the heart of the student debt crisis, including, most significantly, how Wall Street’s predatory loaning practices, in collusion with 24/7 corporate commercial marketing, promote usury that enriches banks and lenders at the expense of the hopes and ambitions of our nation’s young people. Even more troubling, corporate news seldom reports on potential solutions to the student debt crisis, such as interest-free student loans, for example, or the creation of a student debt jubilee, in which the Federal Reserve would do for students what it has done for the banksters, quantitatively easing one trillion dollars of toxic debt from the backs of students and stimulating the economy as a result.12

Censored #21: Conservatives Attack US Post Office to Break the Union and Privatize Postal Services

With the possible exception of the US Constitution and the National Park System (both under siege), the United States Postal Service (USPS) may be one of the most important sociopolitical and economic institutions birthed by the US republic, one of the United States’ great gifts to the modern world. Older than the Constitution and currently the nation’s largest union and second largest public employer, the USPS employs more than 574,000 workers and has played a central role in stimulating national commerce, promoting ideas, and making possible the low-cost democratic flow of information for all citizens across the country, rich or poor. But these days, “our economy” seems impatient with a national post office that (we are told) may have lost its relevance in the age of Federal Express, UPS, and the Internet. However, Allison Kilkenny, writing for Truthout, and Matt Taibbi, of Rolling Stone, have provided a different lens through which to view the US Postal Service’s “crisis.”

The postal service has been under constant assault for years from conservative Republicans, who view the attack on the USPS as an epic battle to take down the strongest union in the country and as a means to roll the United States ever closer toward full privatization. The postal service isn’t paid for by taxpayer dollars, but rather fully funded by postage sales. Nonetheless, Congress passed the 2006 Postal Accountability and Enhancement Act (PAEA), mandating that the postal service fully fund retiree health benefits for future retirees. The act requires that USPS pay $5.5 billion to the Treasury every September, to pre-fund future retirees’ health benefits. Thus, the USPS must fund the retirement packages of future employees who have not even been born. An audit done by the USPS Office of Inspector General came up with the figure of seventy-five billion dollars in pension overpayments. Revealingly, when the Postal Regulatory Commission, an independent agency that actually received more autonomous power under PAEA, commissioned its own independent audit, they placed the overpayment at fifty billion dollars. Taking these figures into consideration, the projected nine-billion-dollar deficit the USPS now faces seems like small change that could easily be corrected with minor accounting adjustments. This would eliminate the “crisis”— which is driving the proposals to terminate Saturday mail delivery service, close mail processing centers, and lay off 120,000 workers. (Over the last four years, the postal service’s work force has shrunk by over 100,000 employees due to attrition).

Let’s unwrap this special delivery. The ways that corporate media report on the USPS’s current performance is a classic example of misframing, drawing narrative lines around a story to emphasize certain elements while completely ignoring other vital contexts that provide a more complete understanding. We are told ad nauseum that the USPS is in crisis because the lightning-fast Internet Age reveals how the Postal Service has become bloated, inefficient, and overly bureaucratic. In this view, competing private carriers deliver packages faster (though more expensively, we might remember). This assertion ignores the fact that 2006 marked the USPS’s single biggest mail-carrying volume year in its entire 237-year history, not to mention what a remarkably democratic and accessible national service the USPS provides. “The Postal Service isn’t paid for by taxpayer dollars, but rather fully funded by the sale of stamps,” noted Truthout’s Allison Kilkenny. “It’s easy to forget what a marvel this is—that today, in 2011, one can still mail a letter clear across the country for less than 50 cents. And if the impressiveness of that feat still hasn’t sunk in, attempt this brain exercise: consider what else you can buy for $0.44.”13

One of the only US journalists to report on the “crisis” surrounding the USPS in meaningful political terms, Kilkenny went on to interview New York Metro Area Postal Union political director Chuck Zlatkin, who provided a counter to US corporate “news” reporting on the controversy surrounding the USPS. “It’s part of the class war and it’s against the poor and it’s a class war against working people,” explained Zlatkin.

Any time a post office is rumored to be closing, it’s devastating to the neighborhood that it’s in. . . . What happens when we get involved with elected officials and community people to try and keep a post office open, it’s always the same people who turn out: elderly people, disabled people, poor people, and small business owners. They’re the people who are the ones that depend on the postal service that they can’t really afford or have access to alternatives.

The United States Postal Service “caters primarily to the economically disadvantaged and employs over 574,000 union members,” Kilkenny concluded, reframing the issue in new political and economic terms. “No wonder it has become such a mouth-watering target for the GOP,” she wrote, whose goal may be “to take out one of the largest unions in the country and simultaneously give the US a nudge in the direction of total privatization by crippling one of the last great public services.”14 Whether or not the USPS will survive in “our economy” remains to be seen, but understanding the larger political context of the USPS “crisis” is one message that our corporate media’s “managed” news coverage simply does not deliver (unlike your mail, which arrives faithfully most every day of the week).

THE “BLESSED UNREST”: RESTORING GRACE, JUSTICE, AND BEAUTY TO “OUR ECONOMY”

“Poor Americans are urged to hate themselves” and “glorify their bet-ters,” wrote Kurt Vonnegut in his masterful dystopian novel Slaughterhouse-Five.15 Vonnegut’s fictional observation resonates every day in the pages and on the airwaves of our national corporate “news.” In the real world, where infotainment, propaganda, and public relations all substitute for in-depth investigative reporting, we desperately need real news to reclaim “our economy” for everyone, and not just the 1 percent who currently reap its benefits. Indeed, given how h

igh the stakes are for “our economy,” the 99 percent best get busy challenging the 1 percent’s dominance. The good news, as Project Censored reminds us, is that help is on the way, in the form of the millions of citizens who are doing the hard work of reclaiming “our economy” from the banksters.

In 2007, entrepreneur and Ecology of Commerce author Paul Hawken published Blessed Unrest, in which he described “how the largest social movement in history is restoring grace, justice, and beauty to the world.” He observed, “If you look at the science that describes what is happening on earth today and aren’t pessimistic, you don’t have the current data.” “If you meet the people in this unnamed movement and aren’t optimistic, you haven’t got a heart.”16 Thus Hawken reminds us of Project Censored’s importance, prov

iding global citizens with “current data” to better inform themselves and join the fray over “our economy” and a host of other vital issues. To put it another way, as imprisoned Italian philosopher Antonio Gramsci famously did, we must all practice “pessimism of the intellect, optimism of the will.”

17

The hopeful news is this: the “blessed unrest” Hawken describes is all around us, even if you won’t read much about it in the corporate media. For starters, the Occupy Wall Street movement, which burst onto the international scene in fall 2011, has succeeded in reframing the debate over “our economy” by continually reminding all of us, through street heat, guerrilla action, and a potpourri of new media messaging strategies, that “our economy” is currently managed by and for the rich as a national kleptocracy that robs from the 99 percent to enrich the 1 percent.

While Occupy continues to agitate, US citizens—and people around the world—are moving to reclaim economic and political power and reinvent how economies function at local, state, and regional levels.

Censored #7: 2012: The International Year of Cooperatives

The return of cooperatives is one encouraging example. The United Nations named 2012 the “International Year of the Cooperatives.” As Jessica Reeder (Yes! Magazine) and Monique Hairston (Rebuild the Dream) reported, fully one billion people around the world—one in five adults over the age of fifteen—participate in co-ops as “one person, one vote” member-owners. “Cooperatives, in their various forms, promote the fullest possible participation in the economic and social development of all people, including women, youth, older persons, persons with disabilities and indigenous peoples,” explains the UN. They “are becoming a major factor of economic and social development and contribute to the eradication of poverty.”18

Co-ops are collaboratively owned and operated by their members. The cooperative business model puts money and power back into the hands of people, strengthening communities in the process. Decisions are balanced between pursuit of profit and needs of members and their communities. Co-ops have proven to be just as profitable as their corporate counterparts, yet their profits go back to the community of worker-owners, rather than to investors or high-priced management. Examples include the Evergreen Cooperative Laundry in Cleveland, Ohio, and the Mondragon Corporation founded in the Basque region of Spain, one of the world’s largest corporations and a cooperative. Founded in 1965, Mondragon is considered the most successful example of worker-owned enterprise in the world. According to the UN, the co-op is expected to be the world’s fastest growing business model by 2025.

Green worker co-ops promise to build strong local economies and to help break the cycle of poverty by keeping community money within the community. Since banks and credit unions typically do not lend money to co-ops, some groups are finding innovative ways to raise money without bank loans. The Alchemy Co-op in Melrose, Massachusetts, raised over $10,000 to start their organic food co-op through online crowd funding. Crowd funding and other forms of collective financing are allowing local co-ops to get off the ground and empower their communities.

At least two other projects within the “blessed unrest” deserve mention here. One is the Move Your Money project, a national grass-roots campaign that “aims to empower individuals and institutions to divest from the nation’s largest Wall Street banks and move to local financial institutions.”19 The direct language used by Move Your Money cuts to the heart of the national debate about “our economy”:

It has been almost three years since the Wall Street banks, through gross corruption and greed, caused the greatest economic crisis since the Great Depression that caused millions to lose their homes, jobs and livelihoods. And while the Wall Street banks have quickly returned to making record-breaking profits and bonuses, helped in large part by the $700 billion bailout by the American taxpayer, little has changed to prevent the types of abuses that created this mess.

Move Your Money has received corporate commercial news coverage on CNN and CBS, and in the Wall Street Journal, in part because their call to action is simple, direct, and powerful; it doesn’t directly put Wall Street in the line of legislative or regulatory fire, instead relying on the individual decisions of individual citizens to “move their money.” To wit:

We give individuals and institutions the tools and resources they need to divest from “Too Big to Fail” banks and invest in community banks and credit unions. No longer will we stand idle as banks take extraordinary risk with our financial system for their short-term profits; rather we will vote with our dollars and no longer contribute financially to the abusive practices of Wall Street. If Congress is unable to enact meaningful financial reform that will prevent another financial disaster, then we must take action into our own hands and hit the banks where it hurts them the most: their bottom line.20

Another national effort taking the long-term view on “our economy” is the Transition Town movement, as reported by Rachel Trachten Fall and Frances Beinecke.21 First developed in 2005–06 by Rob Hopkins and Naresh Giangrande in Totnes, England, the Transition Town idea has grown into an international network of people committed to socioeconomic re-localization in the face of peak oil, climate change, and international economic instability. Daily news highlights the environmental and health costs citizens are paying, and the unstable future we face. The choice before thoughtful citizens seems clear: stand by old habits and suffer, or find new ways to adapt and thrive. Transition organizations and towns provide such a choice—giving citizens chances to collaborate with others to begin the shift toward a stable, sustainable world. A Transition Town is a place infused with a community-led process that helps the town/village/neighborhood/ organization become independent and sustainable.

This process begins when a small group of motivated individuals within a community comes together with a shared concern: How do we sustain ourselves and thrive as a community in these changing times? How do we significantly increase resilience (in response to peak oil), drastically reduce carbon emissions (in response to climate change), and greatly strengthen our local economy (in response to economic instability)? These core concerns lead to homegrown, citizen-led education, multi-stakeholder planning, and eventually to grassroots community initiatives that seek to mobilize the larger community and build shared resilience in the face of these modern-day concerns. Transition initiatives work to create a fulfilling and inspiring local way of life that can withstand the shocks of rapidly shifting global systems. It’s happening in over a thousand highly diverse communities across the world—from towns in Australia to neighborhoods in Portugal, from cities in Brazil to rural communities in Slovenia, from urban locations in Britain to islands off the coast of Canada.

As we consider what’s ahead for “our economy,” the signs of “blessed unrest” in response to the “bankster bailout” are all around us. Despite corporate media chatter and diversion, an engaged public will not sit idly by, awaiting further victimization by a kleptocratic US national economy that enriches the few at the expense of the many. In May 2012, Gar Alperovitz coined a term called the New Economy Movement to serve as an umbrella phrase for a host of creative and forward-thinking initiatives. Citing a laundry list of meetings, networks, and actions already underway, Alperovitz reported:

Just beneath the surface of traditional media attention, something vital has been gathering force and is about to explode into public consciousness. The “New Economy Movement” is a far-ranging coming together of organizations, projects, activists, theorists and ordinary citizens committed to rebuilding the American political-economic system from the ground up.22

Consider just April to June 2012: The Social Venture Network held its annual gathering in Stevenson, Washington. The Public Banking Institute gathered in Philadelphia. The National Center for Employee Ownership met in Minneapolis, with record-breaking attendance. And the Business Alliance for Local Living Economies (BALLE) held a major conference in Grand Rapids, Michigan. The Consumer Cooperative Management Association met in Philadelphia. The US Federation of Worker Cooperatives gathered in Boston. Other events planned for 2012 include a Farmer Cooperatives conference organized by the University of Wisconsin Center for Cooperatives, and meetings of the National Community Land Trust Network and the Bioneers. The American Sustainable Business Council, a network of 100,000 businesses and 300,000 individuals, has been holding ongoing events and activities throughout 2012.23

The rise of the new economy movement, the emergence of a blessed unrest, the call to action embedded in the Move Your Money campaign, the resurgence of member-owned cooperatives, the long-term planning of the Transition Town effort, and the hundreds of other communities carrying out thousands of economic projects with the participation of millions of our fellow citizens ought to serve as a potent reminder that, indeed, another world is not only possible, but emerging full flower before us. Let us not cultivate a false sense of Panglossian optimism about “our economy” based on censored news and information. Instead, let us connect the dots in the midst of these turbulent economic times, and then, like any good gardener, get our hands dirty growing something new. As Martin Luther King Jr. famously observed, “the time is always right to do what is right,” and nowhere are his words more important than in the turbulent twentyfirst–century life of “our economy.”

Notes

1. Jared Diamond, Guns, Germs, and Steel: The Fates of Human Societies (New York: W. W. Norton, 1997).

2. Gar Alperovitz, “The Rise of the New Economy Movement,” AlterNet, May 20, 2012, http://www.alternet.org/economy/155452/the_rise_of_the_new_economy_movement.

3. Mike Krauss, “The State Budget Shell Game,” May 31, 2012, http://mikekrauss.blogspot.com. Given this dysfunctional symbiotic relationship between our corporate commercial “news” media, our national government, and the transnational corporations that own them both, discriminating citizens are learning to seek out news about the way US economic life truly works, not from corporate sources, but from a variety of independent alternatives: faux TeeVee news programs (thanks, Messrs Stewart and Colbert), popular music magazines (gracias, Rolling Stone, for publishing Matt “Goldman Sachs = vampire squid” Taibbi), and young adult dystopian fiction which sounds more familiar by the week (read or see Suzanne Collins’ “The Hunger Games,” in which a pampered oligopolistic elite deploy an annual terrifying teen-warrior media spectacle to live parasitically off of the resources, energy, and work of the economically-deprived masses).

4. William J. Mathis, “Romney’s Education Rhetoric More Of The Same,” National Education Policy Center, May 25, 2012, http://nepc.colorado.edu/blog/romney’s-education-speech-more-same.

5. Diane Ravitch, “The Myth of Charter Schools,” New York Review of Books, November 11, 2010, http://www.nybooks.com/articles/archives/2010/nov/11/myth-charter-schools.

6. See, for example, Adam Gopnik, “The Caging of America,” New Yorker, January 30, 2012, http://www.newyorker.com/arts/critics/atlarge/2012/01/30/120130crat_atlarge_gopnik.

7. Ellen Brown, “A Jubilee for Student Debt?” Yes! Magazine, October 20, 2011, http://www.yesmagazine.org/new-economy/a-jubilee-for-student-debt.

8. Dubbed by advocates of debt forgiveness as “1T Day,” the corporate media dutifully covered this milestone in April 2012, though their “news” coverage focused on candidate Mitt Romney’s and President Obama’s competing reform proposals for student loan interests rates, rather than the possibility of a student loan debt jubilee, as reported by Ellen Brown and others independent journalists. See, for example, Ylan Q. Mui and Felicia Sonmez, “Obama, Romney Focus on Student Debt as Campaign Issue,” Washington Post, April 23, 2012, http://www.washingtonpost.com/business/economy/obama-romney-focus-on-student-debt-as-campaignissue/2012/04/23/gIQAnEz6cT_story.html.

9. John Hechinger, “Taxpayers Fund $454,000 Pay for Collector Chasing Student Loans,” Bloomberg, May 15, 2012, http://finance.yahoo.com/news/taxpayers-fund-454-000-pay-040100808.html.

10. Andrew Martin and Andrew W. Lehren, “A Generation Hobbled by the Soaring Cost of College,” New York Times, May 12, 2012, http://www.nytimes.com/2012/05/13/business/studentloans-weighing-down-a-generation-with-heavy-debt.html?_r=2&hp=&adxnnl=1&pagewanted= 1&adxnnlx=1336882757-ZNJcHqg5VVwBWw6alouETg.

11. Andrew Martin, “Degrees of Debt,” New York Times, May 14, 2012, http://www.nytimes. com/2012/05/15/business/colleges-begin-to-confront-higher-costs-and-students-debt. html?pagewanted=all.

12. Brown, “A Jubilee.”

13. Allison Kilkenny, “Postal Workers: The Last Union,” Truthout, September 11, 2011, http://truth-out.org/index.php?option=com_k2&view=item&id=3190:postal-workers-the-last-union.

14. Ibid.

15. As quoted in William Deresiewicz, “Capitalists and Other Psychopaths,” New York Times, May 14, 2012, http://www.nytimes.com/2012/05/13/opinion/sunday/fables-of-wealth.html.

16. Paul Hawken, Blessed Unrest (New York: Penguin, 2007), 4.

17. Antonio Gramsci, Letters from Prison, ed. Frank Rosengarten (New York: Columbia University Press, 2011 [1929]), 299.

18. Jessica Reeder, “2012: The Year of the Cooperative,” Yes! Magazine, February 1, 2012, http://www.yesmagazine.org/new-economy/2012-the-year-of-the-cooperative.

19. Find out more at http://moveyourmoneyproject.org.

20. Ibid.

21. Rachel Trachten Fall, “Local Visionaries: Transition Groups Plant the Seeds for a Homegrown Future,” Edible East Bay, Winter 2012, http://www.ediblecommunities.com/eastbay/harvest-2011/transition-groups.htm and Frances Beinecke, “International Energy Crises Make the Case for Change: Towns Lead Transition,” Shareable, March 24, 2011, http://www.shareable.net/blog/international-energy-crises-make-the-case-for-change-towns-lead-transition.

22. Alperovitz, “Rise of the New Economy Movement.”

23. Ibid.