CHAPTER 35 Government Spending, Taxes, and Fiscal Policy

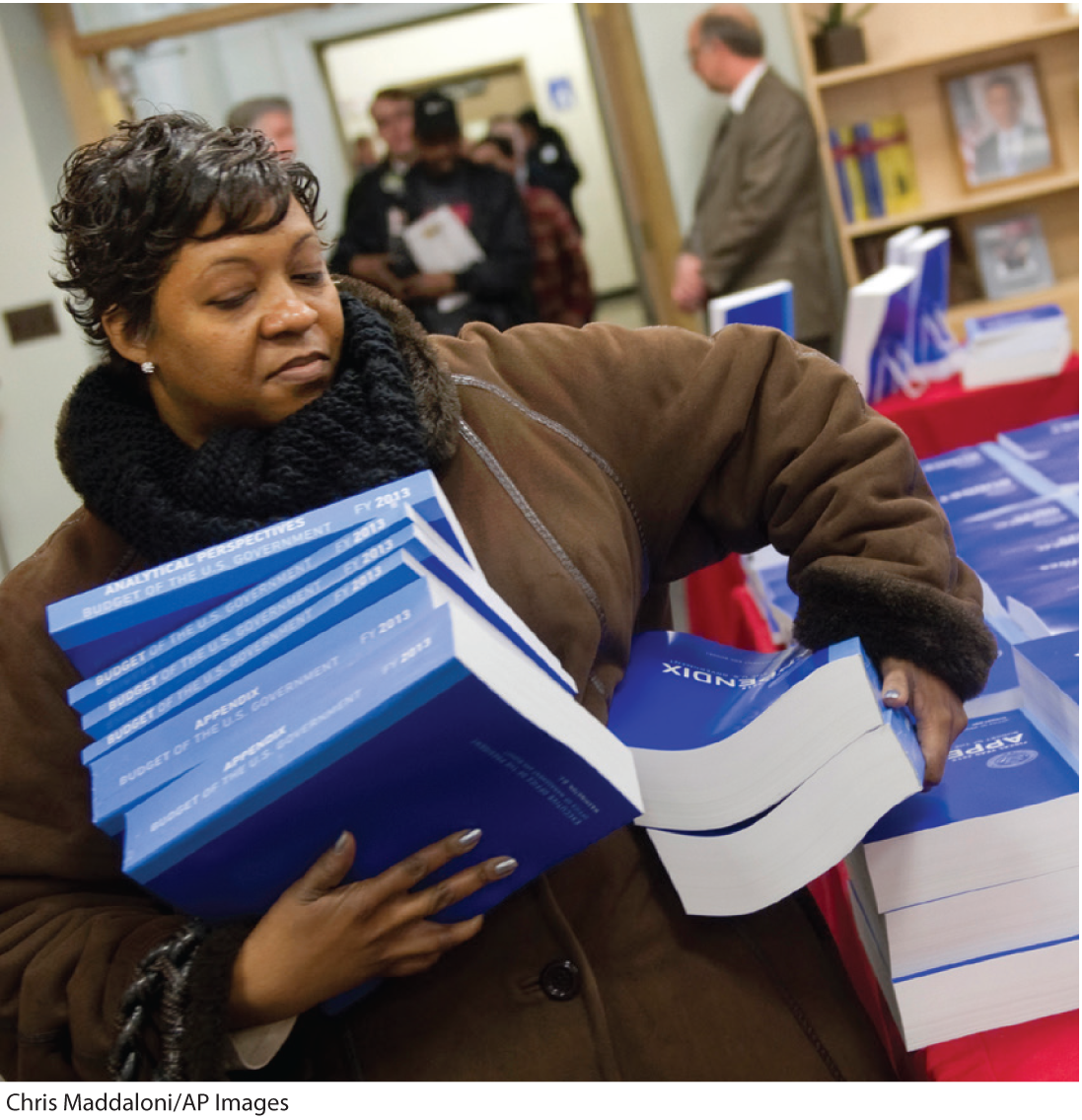

Your economics textbook is light reading compared to the multivolume federal budget.

Every year, typically in early February, the president of the United States releases a proposed budget. The printed version stands nearly as tall as a toddler. Thousands of detailed tables outline actual and proposed spending on everything that’s funded with federal government dollars.

Each agency across the federal government spends months developing spending proposals. They submit these proposals to Congress, which considers them when it authorizes spending for each year. Analysts also prepare forecasts for the trillions of dollars of government spending that is not authorized annually, but rather is predetermined by laws passed long ago. As the budget is prepared, vicious fights break out among people who are normally friends, as they struggle to get a share of the limited funding for their preferred programs.

To budget is to fight over money. And fighting over money is really about fighting over priorities. What’s most important to you: increasing funding for the military, education, or health care? Wouldn’t another aircraft carrier make us just a little bit safer? Wouldn’t more education spending to pay for more teachers, better buildings, and fresher teaching materials increase student learning? Wouldn’t spending a bit more on public health care prevent more early deaths? Deciding among these options is all about opportunity cost—if you spend a dollar on one thing, you’re not spending it on another. But your sense of the relative benefits of buying another aircraft carrier versus spending more on education or health care depends on your values, preferences, and beliefs. In other words, the slew of numbers that makes up the budget lays out a vision for society.

The president’s budget doesn’t just lay out a vision for our country; it also tells Congress what the administration thinks will happen to the U.S. economy and what role government spending and taxation will play in influencing that outcome. That means the budget is also a plan of attack for smoothing business cycles and helping the economy operate closer to its potential.

In this chapter, we’ll take a close look at what the government spends money on and how it raises revenue. You’ll see that the government regularly borrows money, and thus our national debt is growing. We’ll also examine how the government uses spending and taxation to stabilize the economy, and how its debt affects private investment and the economy. Let’s get started!