DRAWING UP A budget properly will answer two important questions for you:

Do I spend more than I earn? This can lead to major problems, as continued overspending leads to serious debt. The Budget Planner will definitively answer this question and give you a realistic assessment of your finances.

Do I spend more than I earn? This can lead to major problems, as continued overspending leads to serious debt. The Budget Planner will definitively answer this question and give you a realistic assessment of your finances.

What can I afford to spend? The most important thing is to prioritise your expenditure and stick within your means. If you discover you’re overspending, by correctly budgeting using the piggybank technique (see here) it should be easy to do this.

What can I afford to spend? The most important thing is to prioritise your expenditure and stick within your means. If you discover you’re overspending, by correctly budgeting using the piggybank technique (see here) it should be easy to do this.

What’s Different about this Budgeting Technique?

Traditional budgets fail as they concentrate on one month’s expenditure, yet we don’t always spend by the month. It may be weekly or, in the case of Christmas or summer holidays, annually. This leaves most budgets missing out a chunk of expenditure – and thus not adding up.

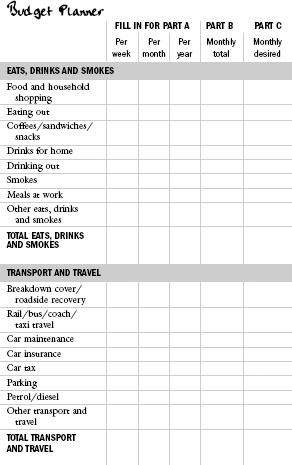

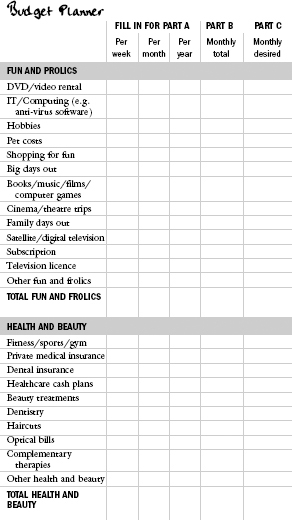

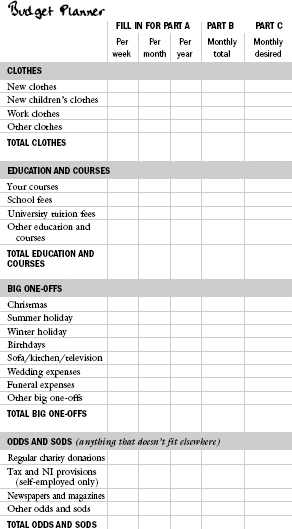

The Budget Planner is therefore designed so you can enter how often you buy certain items and, rather than the typical 20 categories of spending, has over 90 categories to ensure you don’t miss anything.

Doing the Budget Planner accurately will take over an hour. It’s best if you gather together your bank and credit card statements first, preferably the last three months’ worth. Between them, they should list all standing orders and direct debits, and give you an accurate idea of what you spend.

For example, for food shopping, gather together all your receipts for the last three months, add up all food spending listed, then divide by three to reach your average monthly spend.

If you can, also gather together your payslips to establish exactly what you earn, plus any bills or other documents if possible (though your statements should also detail this information).

Get All the Calculations Done for You

While you can do it here in the book, even easier is to use the all-singing, all-dancing Budget Planner that will do it all for you. You can find it at: www.moneysavingexpert.com/budgeting

Tips for Filling Out the Budget Planner

Are you doing it just for you or for your family? It’s very important to be consistent when budgeting. First decide who you’re filling it out for: is it just for you or is it for your partner/family too? Finances often can’t be separated, in which case you should sit down and do it together.

Are you doing it just for you or for your family? It’s very important to be consistent when budgeting. First decide who you’re filling it out for: is it just for you or is it for your partner/family too? Finances often can’t be separated, in which case you should sit down and do it together.

MoneySave while you do this. It’s always surprising to see quite how many different things you spend cash on. Worse still is how much money you truly spend on them. Yet there are always ways to save. It’s worth considering that as you write them down – are you getting the best value for your money? Can you get them cheaper elsewhere?

MoneySave while you do this. It’s always surprising to see quite how many different things you spend cash on. Worse still is how much money you truly spend on them. Yet there are always ways to save. It’s worth considering that as you write them down – are you getting the best value for your money? Can you get them cheaper elsewhere?

Ensure items go in the correct column. Choose whether you most commonly spend on something by the week, month or year and fill that in – but do ensure you have the right column.

Ensure items go in the correct column. Choose whether you most commonly spend on something by the week, month or year and fill that in – but do ensure you have the right column.

You can’t put an amount in more than one column. So if, for example, you always do a big monthly food shop and then weekly ones too, you need to calculate what you spend over a month yourself using a calculator.

You can’t put an amount in more than one column. So if, for example, you always do a big monthly food shop and then weekly ones too, you need to calculate what you spend over a month yourself using a calculator.

Overestimate, don’t underestimate. It’s tempting to try and fool yourself by underestimating your expenditure. This is a MoneySaving sin, and you will be punished. Try and be accurate and, if you’re not sure, guess larger not smaller – that way you’ll have cash left over and not be short.

Overestimate, don’t underestimate. It’s tempting to try and fool yourself by underestimating your expenditure. This is a MoneySaving sin, and you will be punished. Try and be accurate and, if you’re not sure, guess larger not smaller – that way you’ll have cash left over and not be short.

Watch out for double-counting. Some types of spending overlap into different groups; be careful not to count expenditure twice. For example, if you’ve included your car insurance in the motoring section, don’t include it again under insurance.

Watch out for double-counting. Some types of spending overlap into different groups; be careful not to count expenditure twice. For example, if you’ve included your car insurance in the motoring section, don’t include it again under insurance.

Pay special attention to credit card repayments. The credit card section is designed for you to enter the cost of repaying your existing credit card debts. Don’t confuse this with the type of spending where you simply use your credit card and pay it off in full. The best way to explain this is with an example. Say you spend £500 each month on food shopping that you pay for on your credit card but then pay off in full. This spending belongs in the food shopping column and not in the credit card column as, otherwise, you’ll be counting it twice.

Pay special attention to credit card repayments. The credit card section is designed for you to enter the cost of repaying your existing credit card debts. Don’t confuse this with the type of spending where you simply use your credit card and pay it off in full. The best way to explain this is with an example. Say you spend £500 each month on food shopping that you pay for on your credit card but then pay off in full. This spending belongs in the food shopping column and not in the credit card column as, otherwise, you’ll be counting it twice.

Don’t include company pension contributions in expenditure. Pension payments are included in the expenditure section; if you send a cheque or have a payment from your bank account each month to pay into your pension, include it there. However, if your pension comes straight from your salary as a payroll payment, don’t include it as, when you fill in the income section, you should just fill in the amount you receive after all deductions.

Don’t include company pension contributions in expenditure. Pension payments are included in the expenditure section; if you send a cheque or have a payment from your bank account each month to pay into your pension, include it there. However, if your pension comes straight from your salary as a payroll payment, don’t include it as, when you fill in the income section, you should just fill in the amount you receive after all deductions.

Treat holidays carefully. Remember that when you go on holiday, you’ll have expenditure while you’re away; but you also don’t spend on the things you normally would. So you may want to reduce the amount you put in your holiday category by a little. For example, say you normally spend £100 per week on food shopping and £30 on petrol. If you’re abroad for the week, you won’t spend this but you’ll still be adding them in. Therefore, if the holiday cost £700 and you spend £300 you may be tempted to put £1,000 in – but actually you’re saving £130 of normal expenditure so it should only be £870.

Treat holidays carefully. Remember that when you go on holiday, you’ll have expenditure while you’re away; but you also don’t spend on the things you normally would. So you may want to reduce the amount you put in your holiday category by a little. For example, say you normally spend £100 per week on food shopping and £30 on petrol. If you’re abroad for the week, you won’t spend this but you’ll still be adding them in. Therefore, if the holiday cost £700 and you spend £300 you may be tempted to put £1,000 in – but actually you’re saving £130 of normal expenditure so it should only be £870.

Use the ‘Odds and Sods’ sections. There are lots of categories in the Budget Planner, but it’s impossible to include everything. At the end of each section there’s an ‘Odds and Sods’ category. Take a minute to think if there’s anything you spend money on that is missing – and include it there.

Use the ‘Odds and Sods’ sections. There are lots of categories in the Budget Planner, but it’s impossible to include everything. At the end of each section there’s an ‘Odds and Sods’ category. Take a minute to think if there’s anything you spend money on that is missing – and include it there.

Thoroughly double-check when you finish. One small error, such as putting £1,000 annual holiday spend in the monthly column, can make an enormous difference. Before you finish the Budget Planner, double-check everything is correct and you haven’t missed anything.

Thoroughly double-check when you finish. One small error, such as putting £1,000 annual holiday spend in the monthly column, can make an enormous difference. Before you finish the Budget Planner, double-check everything is correct and you haven’t missed anything.

Okay – now fill in just Part A of the chart. Once this is completed, work out what your real monthly spending is by filling in Part B, the ‘monthly total’ column. To do this you will (probably) need a calculator (remember, at www.moneysavingexpert.com/budgeting there’s an automated version you can use):

For things in the ‘per week’ column: Multiply the amount by 4.33 (the average number of weeks in a month) and put the answer in the ‘monthly total’ column.

For things in the ‘per week’ column: Multiply the amount by 4.33 (the average number of weeks in a month) and put the answer in the ‘monthly total’ column.

For things in the ‘per month’ column: Move the answer straight over to the ‘monthly total’ column.

For things in the ‘per month’ column: Move the answer straight over to the ‘monthly total’ column.

For things in the ‘per year’ column: Divide the amount by 12 and put the answer in the ‘monthly total’ column.

For things in the ‘per year’ column: Divide the amount by 12 and put the answer in the ‘monthly total’ column.

Now total up each section and write the answer below:

Home total per month: |

______ |

Insurance total per month: |

______ |

Eats, drinks and smokes total per month: |

______ |

Transport and travel total per month: |

______ |

Debt repayments total per month: |

______ |

Savings and investments total per month: |

______ |

Family total per month: |

______ |

Fun and frolics total per month: |

______ |

Health and beauty total per month: |

______ |

Clothes total per month: |

______ |

Education and courses total per month: |

______ |

Big one-offs total per month: |

______ |

Odds and sods total per month: |

______ |

Total Monthly Expenditure: |

______ |