Slim’s fortune has grown faster than any other in the world, according to the influential The Wall Street Journal. The magazine has followed the Mexican tycoon’s every step. The most important people in the world see him as a symbol of a new era.

There is nothing new about the interest shown by the international press. The significant fact is that Slim became the richest man in Mexico, and from Mexico has established an empire that spans more than twenty countries on various continents.

His business expansion in recent decades has bestowed onto Slim the picture of a postmodern emperor. He is powerful and as any true businessman, he is forceful in expressing his ideas. In Europe he is seen as a “conqueror.” Even though he does not know the exact number of his companies, what is clear is that after Petróleos Mexicanos, the country’s largest industry, he is the country’s biggest taxpayer. Each year, he brings around $10 billion to the Treasury. One company of his vast empire, Telmex, has a market capitalization of more than MX$15 billion and along with other companies, represents about 30 percent of the Mexican Stock Exchange.

Those who admire Slim see him as the wizard who holds the “secret” to turn everything he touches to gold, but critics have insisted that his empire is the product of speculation. For many, it is incompressible that the son of a Lebanese immigrant and a self-made multimillionaire has accumulated wealth in a country that has never been considered a land of opportunity.

Some have tried to discover how he succeeded, but the common explanation is that Slim was simply “in the right place at the right time.”

In June 1994, at the close of Salinas de Gortari’s government, Slim developed a document called The History of Grupo Carso in which he tells the origin and development of his companies:

After discussing it with my family and several friends, I collected and wrote some notes on the history of Grupo Carso. The result seems incipient to me, although it fills some of the sought-after objectives, such as establishing its chronological development and the disclosure of certain personal and family history. But beyond the story, I also wish to relate, in general terms, how it operates and how it evolved financially. I believe that this exercise of individual and collective memory may be of interest to my children, friends, family, and colleagues to businessmen, journalists, investors, and students.

It is my intention to continue these notes later to deepen and broaden the group’s history with other specific data combining subjective concepts, such as the principles and foundations on which Carso operates and develops.

Slim explains that the foundations of his empire came in 1911 when his father Julián and thirteen-year-old brother José established a corporation named after his place of origin: the Eastern Star. His capital was MX$25,000, with each of the proprietors owning fifty percent of the shares. The reason for its commercial success was simple: vocation, talent and hard work. His advice on professional issues, moral, and social responsibility was very clear. The report continues:

The gestation of Grupo Inbursa and Carso began in 1965. It was then that I acquired the bottling company Jarritos del Sur and began building several businesses like Bolsa Inversora Bursátil (Stock Market Investment), Inmobiliaria Carso (Carso Real Estate), Constructoria Carso (Carso Construction), Promotora del Hogar, S.S.G. (Housing Promotions), Mina de Agregados Pétreos el Volcán (Stone and Volcano Mining), Bienes Raíces Mexicanos (Mexican Roots) and Pedregales del Sur (Stones of the South).27 I established Inmobiliaria Carso in January 1966, three months before my marriage. The name comes from the first letters of Carlos and Soumaya.

Inmobiliaria Carso acquired some properties like the 65th Guatemala Street, corner Correo Mayor, August 19, 1970, Isabela la Católica corner of Mesones, on November 14, 1970; Palmas 1730, August 16, 1971; and also many other areas in the west and south of the city. The aforementioned acquisitions were complex negotiations involving nearly one hundred farms and constituted an area of over 1.5 million square meters (over sixteen million square feet). To purchase some of these properties, Inmobiliaria Carso mortgaged all of its property at an annual rate of eleven percent and paid interest and credit with the flow of rent.

In relation to real estate, it should be noted that some land south of the city, acquired in the early seventies, was expropriated in 1989 for ecological purposes, constituting part of the city’s green belt. These lands were only partially cleared and at a value of ten percent of its market value.

Also, Flornamex, a company established in 1981 for the cultivation and export of flowers, had to close shortly thereafter due to various errors and problems.

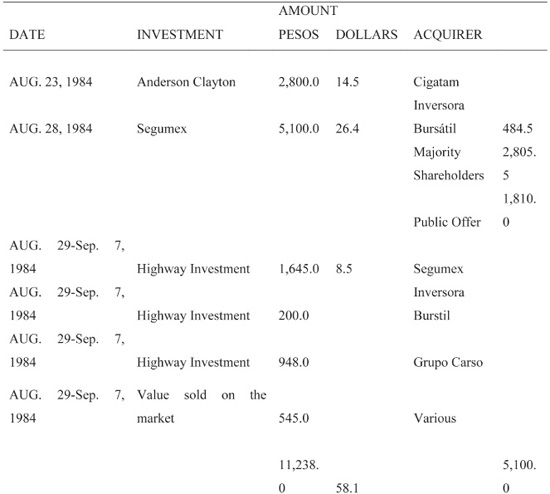

The chart on the next page shows Slim’s first investments:

Under the principle, “Don’t act now thinking that what once happened will happen again,” Slim continued with the business evolution of Carso and Inbursa:

During the four years of 1981 to 1984, we made many large investments and acquisitions including the purchase in 1984 of bank stock shares, originating in the repurchase of significant bank assets.

In June 1976, we acquired sixty percent of Galas de México in the sum of MX$10 million through a capital increase of said society, and in 1980, we formally established the company that is currently Grupo Carso with the aim of acquiring Cigatam (Cigar Tabacalera Mexicana). Grupo Carso was then the Group Galas. Having bought about ten percent of Cigatam for approximately MX$30 million during 1981, on August 11 we acquired Cigatam for 39.6 percent with an additional MX$214 million. The acquisition of this company turned out to be of enormous importance to the group as the significant cash flow enabled us to engage in other investments. Since the introduction of Cigatam to Grupo Carso, it became a company with the lowest cost of production and operation in the world and was the lever and the motor that helped develop Grupo Carso. The group spent about MX$20 million over the course of twenty-five years. Its market share increased in this period, from twenty-eight to sixty-three percent.

In those years, and considering the fact that many major domestic and foreign investors did not want to keep their investments, it was feasible to acquire several companies at prices far below their real value, including “Mexicanizing” some of them. Among these companies were Reynolds Aluminum, Sanborns, Nacobre and its subsidiaries. Later, we Mexicanized and operated Luxus, Euzkadi, General Tire, Aluminum and thirty percent of Condumex. Another way in which we Mexicanized companies was by selling them to other Mexican companies like the case of Penwalt Chemistry in 1983 and the Moderna in 1985.

During the second half of 1982 and the beginning 1983, the value of companies was even more irrational than people’s pessimism. In those years, some companies were worth less than five percent of their book value. Currently, several companies are trading at more than five times their revalued equity. Although a product of our own environment, these two situations are not alien to the international environment. Indeed, in the early eighties the interest rate in international markets was greater than twenty percent and US inflation was in the double digits. At the end of the eighties, with an inflation rate of three to four percent, the interest rate was reduced substantially to levels of two percent (negative return in real terms). For that reason, they revalued fixed assets in the United States. By converting US investment funds to the Mexican stock market since 1991, Mexican companies gained more than ten times the value by the applied US investment parameters (multiples, performance, growth). This reassessment has led several Mexican companies to turn to these markets to capitalize in an important way and in favorable conditions.

THE MARKET VALUE OF SEVERAL COMPANIES IN THE MEXICAN STOCK MARKET

The eighties marked a milestone in our history. Grupo Carso established itself as a group of large companies, a conglomerate. This was a critical stage in the history of Mexico in which most lost confidence in their own future. While others refused to invest, we decided to do it. The reason for this decision was a mixture of trust in ourselves, trust in the country, and trust in common sense. Any rational or emotional analysis told us that to do anything that was not an investment in Mexico would be an outrage. You can’t educate and train our teenage children (or anyone at any age) with fear, mistrust and bribery. The conditions of those years remind me of the decision my father made in March of 1914: during the time the country was in the midst of a revolution, he bought his brother’s fifty percent of the business, risking all their capital and their future.

Between 1982 and 1984 we made several investments in various companies, as was the case of Firestone with twenty-three percent, 3.5 percent of Anderson Clayton and 21.6 percent of Sanborns. In the same year we acquired seventeen percent of Reynolds Aluminum, and significant stakes in several other companies.

In 1984, we concentrated on various controls. We acquired the “Group 2 Package” of Bancomer, in August of 1984 at MX$11,238 million (US$58 million), including one hundred percent Seguros de México (Insurance of Mexico), before Seguros Bancomer (Bancomer Insurance), plus thirty percent of Anderson Clayton and several other important investments.

The acquisition was carried out as follows:

With these acquisitions, we formed the Inbursa Financial Group, comprising of Bolsa Inversora Bursátil, Seguros de México, and Fianzas la Guardiana (Guardian Financial). In 1981, we founded the fund, which in the last thirteen years has yielded approximately thirty-one percent in dollars annually and in which we invested proceeds from the sale of Venustiano Carranza.

By 1983, the equity of the Bolsa Inversora Bursátil was MX$3,000 million and had paid MX$57 million in dividends.

In 1985, Grupo Carso acquired control of Artes Gráficas Unidas (United Graphic Arts) and Loreto y Peña Pobre, Porcelanite, and most of Sanborns, and its subsidiary, Denny’s.

In 1986, we acquired Minera Frisco, Nacobre and their subsidiaries, and we still maintain an important role in Euzkadi.

From these acquisitions, we sold various minority purchases that we had previously acquired without corporate interests, including forty percent of the company Empresas de Moderna, already mentioned above.

All companies above-mentioned constitute part of Grupo Carso from the referred-to dates and until 1986. We didn’t acquire the majority of the company until 1992.

In its statutes, Grupo Carso maintains exclusion clauses to foreigners that prohibit them from becoming shareholders. Excepted are the investors who, since 1991, participated through the trusteeship Nafinsa with exclusive patrimonial fines.

As of June 18, 1990, we made Grupo Carso a public company through a primary share offering to those who followed the fusion with other companies within the group, an augment in capital, and with two other primary international public offers. Before the offer in June 1990, Carso was a private company with few partners, all working together in collaboration with the group even though several controlled companies were public and had numerous investors.

In late 1990, Grupo Carso with Southwestern Bell, France Telecom and several Mexican investors won the bid to privatize Teléfonos de México. They acquired 5.17 percent of the company through the purchase of Class AA shares at a price twenty percent higher than the stock value of Classes A and L. Despite the group’s solid financial structure, the important companies that formed it, the viable accelerated investments, and the use of the resources generated in the operation of its subsidiaries, to maintain a sound financial and operational position and address this important payment, they achieved diverse public offers in order to finance the acquisition. The first was in June 1990, after registering on the Mexican Stock Exchange. They made a public offer for an amount equivalent to US$100 million; a bond issued in June 1991 of MX$500 billion and two other subsidiaries with MX$550 billion in May and July to consolidate liabilities. We conducted a second public offering of shares of Grupo Carso and gave MX$140 billion to the Mexican Stock Exchange and US$214 million in international capital markets. Investment in the purchase of our interest in Telmex was US$442.8 million, our public offerings were about US$360 million of capital and US$165 million in liabilities. This is to say, we captured through these offers US$100 million dollars more than the investment of Telmex. It is noteworthy that our Mexican partners (including Segumex) acquired the remaining five percent of the Class AA shares of Telmex, even though they were forced to maintain their long-term investment to pay above the market and buy shares of the control (Class AA) that they cannot sell.

Given the importance of the company, its lag, and the enormous changes and investments in the sector on worldwide level, it was necessary to establish an aggressive investment plan to grow and modernize a program to accelerate the training and begin a process of cultural change and reconstruction outside the old network to improve services. It was also necessary to perform the painful removal of cross subsidies, greatly increasing the local services to reduce that of long distance services.

In February 1993, and to continue their development plans, Grupo Carso made a third public offering—also primary—for approximately US$352 million in order to remain a healthy and strong group of companies capable of competing with powerful international companies.

Following the acquisition of Class AA shares of Telmex, the band continued its policy of total reinvestment of profits, mainly in the sectors of construction, auto parts, consumer products, communications and commerce.

From 1992 to date, we have acquired foreign companies such as Pirello, Alcoa, Continental, Condumex enterprise, Aluminum and General Tire, of which we were key partners with thirty, forty-eight and ninety-nine percent, respectively. With the latter two cases, we were responsible for the operation. With Continental, we maintain a technical assistance and marketing agreement.

Despite the great achievements in almost three decades of work, we have had numerous difficulties. During these twenty-nine years of business, we have had problems from others’ brands (Jarritos, Hershey’s, Reynolds, Goodrich, Sugus, Toblerone) that we have had to develop to the point of expropriation (1989), free trade, illegal entry of products passing through operating permits, denied land use, land invasions, unaffordable prices of mining products, depletion of mines, monopoly problems, labor problems, dissociation (Constructora Carso, Minera Real Ángeles), unexpected changes in technical assistance, obsolete facilities, pollution or consumption of too much water (Planta de Celulosa de Peña Pobre, Loreto, Euzkadi in the Federal District) and bad business (Flornamex). Negotiations have been swift and cordial, like that of Frisco and Condumex, or long and difficult.

Although all companies involved required a great individual and collective effort, we have had very difficult professional and financial challenges, which are, from a professional point of view, Galas and Telmex. Galas, upon purchase, presented very difficult conditions in 1976: a strike, too many products, obsolete equipment, high debt, customers inconvenienced by the strike, suppliers that did not work for non-payment, outstanding debts with banks, leasing companies and suppliers, as well as conventions of taxes, with more limited industrial social insurance. Fifteen years later, in 1991, Teléfonos de México, with its large gaps in service, an outdated equipment plant, a deteriorated exterior, a large unmet demand, and cross-subsidies of painful adjustments, had significant impact on the social and economic life of the country.

Integrating the Mexican group was difficult for the amount and timing of the investment (five to ten years) and the negotiation was especially arduous with our technology partner, Southwestern Bell and France Telecom. However, after reaching agreements, we have had no problem for nearly four years.

No doubt, the more you discuss and define the conditions of an association, the fewer problems the company will have later on. The Grupo Carso investment, although very large, was funded with relative ease through chirographic obligations of MX$500 billion, a public/private offering of MX$307 billion, an increase in capital of MX$500 billion, and an international public offer of MX$794 billion. Subsequently, we made a second international public offer of MX$1,094 billion in January 1993.

On top of the large capitalization of Grupo Carso, thanks to the three primary offerings, we continued to reinvest the profits of the group and divesting minority stakes, allowing Carso to have very healthy finances to continue its development.

The following is a summary of the business history of Grupo Carso and Inbursa after four decades of having laid the first foundations of the empire.

Companies

Slim spent more than half his life building and running Grupo Carso. Although he has left the majority of his companies to his board of advisors, he still plays many roles within his company. He is head of the Board of Directors of Impulsora del Desarrollo y el Empleo en América Latina (Fostering Development and Employment in Latin America OR IDEAL). He is also head of the Board for Carso Infraestructura y Construcción (Carso Infrastructure and Construction or CICSA), a company the size of ICA, which Slim took two years to develop while its competition took half a century. Slim is president of the Telmex Foundation and the Fundación Slim (The Slim Foundation). He is the acting chair of the Executive Advisory Council for the Restoration of the Historic Centre and of the Historic Centre of Mexico City Foundation.

He remains actively involved in his businesses although his main focus now is on education, health and employment in Mexico and throughout Latin America through his foundations. His three sons, Carlos, Marco Antonio and Patricio Slim Domit run his businesses.

His leadership style is very practical. Grupo Carso doesn’t have corporate “staff.” Rather, each company has its own structure.

His first company was founded in 1965 with the acquisition of the bottling company Jarritos South and the establishment of several companies such as Casa de Bolsa Inversora Bursátil (Stock Exchange and brokerage Firm), Inmobiliaria Carso (Carso Real Estate), Carso Construcción (Carso Construction), Promotora del Hogar (Housing Promotion), S.S.G., Mina de Agregados Pétreos el Volcán (Stone and Volcano Mining), Raíces Mexicanos (Mexican Roots) and Pedregales del Sur (Stones from the South), as well as a company that buys, sells and leases construction equipment.28 Inmobiliaria Carso was established in January 1996.

In the late sixties, he bought about two million square meters (twenty-two million square feet) of land south of Mexico City, which was expropriated in 1989.

In June 1976, he acquired Galas de México. In 1980, the conglomerate that is now known as Grupo Carso was formally established with the purpose of acquiring the majority of Cigatam, a partner of Philip Morris, who owned twenty-nine percent.

The beginning of the eighties marked a milestone in the history of Grupo Carso. In 1982, the same year that Mexico was in a debt crisis and the banks were increasingly becoming nationalized, Carso began investing in an intense and active way.

Between 1981 and 1986, Slim succeeded in several investments and acquisitions of businesses small and large, among them Citagam, which was the first and most important for their cash flow. In twenty-five years, they gained an average of 1.5 percent of market shares each year. Other companies that he acquired were Hulera el Centenario (Firestone) with twenty-three percent, and also Bimex. During this period he also attained Reynolds Aluminum and Aluminum, Inc.

In August 1984, Slim concentrated on the purchase of Seguros de México (Insurance of Mexico) with a thirty-three percent equity stake worth MX$55 million. Inbursa Financial Group was composed of Casa de Bolsa Inversora Bursátil (Investment Securities Brokerage Firm), Seguros de México (Insurance of Mexico) and La Guardiana.

In 1985, Grupo Carso acquired control of Artes Gráficas Unidas (United Graphic Arts), Papel Loreto y Peña Pobre (Paper mills), and most of Sanborns and its subsidiaries, including Denny’s.

In 1986, they acquired the company Minera Frisco and Nacobre Enterprises and its subsidiaries and the control of Euzkadi tire company, a leader in the market, and later in 1993, most of General Tire. In 1991, he acquired the Hotel Calinda (now Ostar Hotel Group), headed by his nephew Roberto Slim Seade.

In 1990, Grupo Carso joined Southwestern Bell, France Telecom and several other Mexican investors, and he won the bid to privatize Teléfonos de México. Grupo Carso bought into the privatization of Telmex with 5.8 percent of the company, which had a twenty-five year run of successful business experience; Southwestern Bell acquired five percent and an option for another five percent, France Telecom bought five percent, and a group of Mexican investors had 4.6 percent stake. Since 1981, along with Cigatam, all companies that are part of Grupo Carso were made public. Consequently, its history can be accessed, as it is now public information.

Grupo Carso has sold several companies in part or in their entirety, such as tissue paper manufacturers, tire companies, several hotels, printing and packaging business, parts of Cigatam, El Globo, Química Flour (Chemical Flour) and Porcelanite, among others. The companies in the group generate more than 220,000 jobs.

Carso’s growth has been possible thanks to Slim’s philosophy of constantly reinvesting the profits of the companies to continue producing goods and services while creating jobs for Mexicans. Grupo Carso re-invests their profits s into the most dynamic sectors, in medium- and long-term vehicles as well as maintaining flexibility and speed in decision-making.

Grupo Carso is purely a Mexican-based and Mexican-owned company that has demonstrated the ability to successfully manage all the companies under its umbrella, which operate in highly competitive markets, both nationally and internationally.

Telmex

In 1990, Grupo Carso and other Mexican investors acquired 10.4 percent of Telmex shares, five percent of those associated with SBC along with the option of another five percent, and five percent of France Telecom. Since 1990, Telmex has fostered a culture of work where training, modernization, quality and customer service are priorities. Over the last nineteen years, Telmex has developed a world-class technology platform that has not only enabled the optimization of processing, but has strengthened the corporate culture, which has greatly improved service levels and commitment.

In 1991, Telmex operated with obsolete infrastructure such as electromechanical, analog, and many other forms of outdated technology. Telmex has since been upgraded and now boasts a fiber optic network of more than 68,000 miles across the country.

Telmex operates with the belief that all people should have access to telecommunications, even if there are no profit margins or subsidies available. The company has the most extensive industry network in the country.

Public telecommunications has been an important part in facilitating the access to the population. In December 1990 there were 69,025 public telephones (payphones). By December 2007 there were 715,000.

Since its privatization, Telmex worked to meet all the telecommunication needs of its customers by offering the most advanced products and services with the highest standards of quality and the best prices. Telmex is the leading telecommunications company in Mexico.

Telmex is a conglomerate formed by Teléfonos de México, S.A.B. de C.V., its subsidiaries and affiliates. It was created to provide telecommunication services in Mexico. Coverage of services includes, among others, the operation of the most comprehensive network of local and long distance telecommunications. It also offers services such as connectivity, Internet access, collocation, hosting and interconnection services to other telecommunications operators.

Competition

Telmex is the only telecommunications company in Mexico that has invested time and money to ensure that the communication needs of all socioeconomic sectors of the population are met. Their focus is to give a boost to rural telecommunications and provide Internet access in hard-to-reach areas across the country.

Telmex, in the business of landlines in Mexico, competes with operators who are focused primarily on high-income segments, A and B. Telmex’s commitment to provide telecommunications services has led them to be the only land-line operators with a presence in the homes of socioeconomic segments C, D, E and the prepaid segment of the country, with one hundred percent market share. In a market of approximately 19.6 million fixed lines, Telmex has a market share of between sixty-three and seventy-eight percent of public, prepaid and landlines. As of June 2008, the overall market share (landline and mobile) of Telmex was nineteen percent.

Investment

Since its privatization, Telmex has invested more than US$30,000 million alone in Mexico while the total investments in the telecommunications sector between 1990 and 2007 was US$45,818 million. Telmex’s investment accounted for more than sixty-five percent of this.

Eighty-two percent of the investments in landlines during this period came from Telmex.

América Móvil

In September 2000, Telmex split their business between their cellular phones and the majority of their international investments to create the new company América Móvil.

The decision to make this split was, among other things, motivated by the advantage of making them independent companies that competed. They focused on business and financial flexibility in order to cope with different strategies of Telmex and América Móvil.

Since February 7, 2001, when it first began trading shares on the Mexican Stock Exchange, New York and Madrid, América Móvil has grown to become the largest cellular company in Latin America and one of the largest in the world.

In June 2008, the mobile company had 165.3 million mobile subscribers and 3.9 million landlines in the Americas. By the end of March 2011, it had 231 million wireless subscribers, 13.6 million broadband accesses, 28.7 million landlines and 10.8 million PayTV clients, for a total of 284 million accesses.

Today, América Móvil has a presence in the following countries: Argentina, Brazil, Chile, Colombia, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Nicaragua, Paraguay, Peru, Puerto Rico, Uruguay, the United States and Mexico.

América Móvil is a very good example of creating value for investors. Slim pioneered the prepaid system in 1996 and accelerated the development of another scheme that he was already working on. The “Hot Bill” service, which gave rise to the prepaid system Amigo de Telcel in April 1996, a solution that revolutionized the Mexican, Latin American and world market.

Telmex Internacional

The year 2007 was a milestone in the history of Telmex. On December 21, the General Assembly of Shareholders approved the strategic initiative to reorganize the corporate structure of Telmex into two independent companies. Telmex spun off its operations in Latin America and the Yellow Pages business. The new company was named Telmex Internacional.

With the split, it is expected:

1. To give each company in Mexico and abroad more efficient operation and adequate size, so that each operates autonomously in its administrative, commercial and financial sphere;

2. To improve the competitive position of each of the companies;

3. To expand the Telmex operation even more in the Mexican market of telecommunications, making the difference clear between their operations in the markets of medium and high income, where there is competition in low-income and rural areas, and where there is no competition; and,

4. Telmex International will operate in Argentina, Brazil, Chile, Colombia, Ecuador, Peru and Uruguay, offering a complete support structure for local and regional opportunity and responds efficiently to customer requirements. It also operates in the United States and Mexico through the Yellow Pages.

5.

On June 10, 2008, the price of Telmex Internacional was initiated on the International Stock Exchange in New York, Madrid and Mexico.

IDEAL

One of today’s challenges is to encourage the development of Latin America and fight against its lag through the training and development of human and physical capital. This can be accomplished through a company like Impulsora del Desarrollo y el Empleo en América Latina (IDEAL), which is engaged in the development of physical capital, acting primarily toward cost-effective investments as well as supporting training and development of human capital not-for-profit.

Currently, Grupo Carso is divided into the following holdings:

1. Carso Global Telecom holds the majority of the share control of Telmex and Telmex Internacional.

2. América Móvil, a leading provider of wireless services in Latin America and abroad.

3. Grupo Carso has operations in commercial areas of industrial services and consumer goods through CICSA, Condumex, Nacobre, Frisco, Sears, Sanborns, Ostar Grupo Hotelero, and Promotora Musical.

4. Grupo Financiero Inbursa includes Inbursa Bank, Seguros Inbursa, Casa de Bolsa Inversora Bursátil, Afore Inbursa and Operadora Inbursa, among others.

Fostering Development and Employment in Latin America (IDEAL) is a company focused on identification, feasibility studies, financial structuring of projects, and the implementation and operation of long-term infrastructure. IDEAL does not take construction risks and is organized to generate physical and human capital through the development of roads, ports, generation and distribution of energy, processing, collection and distribution of water, among others activities. The infrastructure firm is also working on a project to develop a shopping center, schools and a hospital in Mexico City. Many of these large projects are carried out through Carso Infrastructure and Construction.

Carlos Slim with Brazil ex president Luiz Inácio «Lula» da Silva