“What gets measured, gets done!”

In my early career as an international consultant, I was working with Greg. He had the master rights for a brand in his country in the Caribbean. I went there with the purpose of helping him redefine his employee training program. His franchise had been struggling since it opened and he needed the support to train his trainers, define the training program itself, and roll it out to his three stores. As I was working with the team on the original project, I discovered that they were struggling with food orders. When I dug a little deeper, I found out that they did not have sales projections or weekly/monthly inventories. Two key pieces of information to make accurate food orders.

The bigger shock came when I asked Greg for his profit and loss statements, only to find out that he didn’t have any. I was flabbergasted that a company could operate without P&Ls. The reason he thought that he didn’t need any P&Ls is because this country did not have sales or income tax. He only knew that every month they had more money in the bank, and he seemed to be satisfied with that. I decided to take it upon myself to build a P&L with whatever data I could find and present to him not only the issues that he was having with fluctuating food costs, but also how much money he was leaving on the table by not knowing his numbers and closely monitoring costs. At the end of my presentation, his eyes were opened to what could be–and he liked it. Immediately, Greg made a phone call and arranged for an accountant to meet with me the very next day and work with me for the balance of my stay on the island to set up his P&Ls and reporting. From that day forward, he diligently followed through whenever he noticed any discrepancies. He gave his managers objectives and held them accountable. The result? His costs dramatically decreased and, as a result, profits skyrocketed.

A wise man taught me a long time ago that, “if you want to move anything, you must be able to measure it. If you can measure it, you can move it.” This is probably why technologies like the Fitbit are becoming more and more popular. Those little bracelets can measure more and more, and they inspire people to walk more, sleep more, and even exercise harder, producing better results for the user. Obviously, measuring it alone doesn’t do the trick. You need to get into action in order to move the numbers and make a difference – just like Greg did, above. Once he realized what his numbers were, and where he could be, he took action and his team’s efforts paid off with lots of extra money in the bank.

The next time you want to improve your numbers, determine the measurable score of what you want to move, define the end goal, make a plan on how to move it, find the necessary resources and tools, get into action, check and celebrate the progress, and accomplish your goal! That is how you move what you measure! But it all starts by knowing where you are and the acknowledgement that you want to move it.

Even though there are generally accepted accounting principles (GAAP) or accounting standards that are the guidelines for financial accounting, profit and loss statements can vary in the structure, layout, and account names, among other things. As a private company, you have more flexibility than public companies, however the result of your financial statements must be accurate and verifiable by an outside accountant to protect yourself in the event that you get audited or one day you want to sell the business.

Ideally, you will work with your accountant to build the structure of your P&L in a way that it is accurate and consistent, but also so that it’s easy to read and to identify discrepancies, opportunities, and trends. It is recommended that you have general meaningful categories that will then have subcategories in the case that you need to dig deeper on any expense. For example, you may have a category named food, but under that category you might have subcategories like food, beverage, and paper. These three subcategories will give you the complete picture of the main category, “food.”

The accounting practices that I will share in this chapter are based on the best practices that I’ve learned from reading profit and loss statements from hundreds of franchisees. You can decide which ones you want to apply and which ones you don’t.

The chart of accounts is basically the list of names and account numbers for each of the revenue and expense categories on the profit and loss statement. You can name and number the categories in whatever way you like as long as the names make sense regarding what they represent. For example, you can’t call the category that represents food “mole.” It must have a name like food, food cost, or cost of goods.

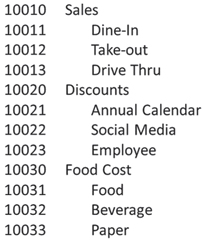

Here is a small example of what a chart of accounts might look like:

You can see how, in this example, you can look at just the main categories and get a picture, but if you look at the sub-categories you can better understand where the numbers are coming from.

P&Ls have several sections:

Revenue

Revenue

Variable Costs

Variable Costs

Fixed Costs

Fixed Costs

Other Costs

Other Costs

Between these sections, you can get a clear picture of how your business is performing.

Here is where you record your sales as well as any discounts that may reduce those sales.

Gross Sales – The revenue received from the sale of your product. You should compare your sales against last week, but even more importantly, last year. The average healthy growth for sales is about 2-4% over last year. This accounts for keeping up with inflation.

Gross Sales – The revenue received from the sale of your product. You should compare your sales against last week, but even more importantly, last year. The average healthy growth for sales is about 2-4% over last year. This accounts for keeping up with inflation.

Discounts – Here you would record all the discounts that you give customers. Most of them will be driven by marketing, some of them for community involvement, and some of them to your employees, family, and friends. There will also be other times when you have to discount to customers due to poor customer service or product quality.

Discounts – Here you would record all the discounts that you give customers. Most of them will be driven by marketing, some of them for community involvement, and some of them to your employees, family, and friends. There will also be other times when you have to discount to customers due to poor customer service or product quality.

Net Sales – The actual sales/cash that come in after discounts. Most of the time this is the sales used to calculate your royalty payment.

Net Sales – The actual sales/cash that come in after discounts. Most of the time this is the sales used to calculate your royalty payment.

Variable costs are the costs that vary with sales. This means that the more you sell, the more you spend. These costs are usually discussed in terms of a percentage of sales. This is why whenever you hear about food cost it is as a percentage of sales and not a dollar amount.

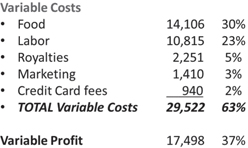

Here are the most common variable costs:

Food (Cost of goods) – What it takes to produce and deliver the product to the customer. The average food cost can run from 25–35%, depending on your menu and prices. This number includes food, beverage, and paper (for fast food and take-out packaging). To know when a number is a good number, you need to know what your ideal/theoretical food cost is. To the ideal food cost, you would add approximately 0.25–0.5% of waste to define your goal. It is impossible to prepare food and have no waste at all.

Food (Cost of goods) – What it takes to produce and deliver the product to the customer. The average food cost can run from 25–35%, depending on your menu and prices. This number includes food, beverage, and paper (for fast food and take-out packaging). To know when a number is a good number, you need to know what your ideal/theoretical food cost is. To the ideal food cost, you would add approximately 0.25–0.5% of waste to define your goal. It is impossible to prepare food and have no waste at all.

Labor – This is the hourly salaries of the staff as well as the payroll taxes and variable benefits associated with them. Your average staff labor cost would run from 20–30%, depending on the labor intensity and pricing structure of your concept. The best way to determine what a good labor number might be is to compare it with the top 10% of franchisees in your brand.

Labor – This is the hourly salaries of the staff as well as the payroll taxes and variable benefits associated with them. Your average staff labor cost would run from 20–30%, depending on the labor intensity and pricing structure of your concept. The best way to determine what a good labor number might be is to compare it with the top 10% of franchisees in your brand.

Royalties – This is the fee paid to the franchisor for the rights to operate the brand, calculated as a percentage of sales. Royalty fees can vary from 2–7% of sales, depending on the brand. Your royalty fees are negotiated when you sign your franchise agreement, and usually there is very little negotiation unless you are signing a multi-unit development agreement. Sometimes they offer incentives for new stores. This usually happens when the corporation is not meeting their growth plans or they are focusing on aggressive growth.

Royalties – This is the fee paid to the franchisor for the rights to operate the brand, calculated as a percentage of sales. Royalty fees can vary from 2–7% of sales, depending on the brand. Your royalty fees are negotiated when you sign your franchise agreement, and usually there is very little negotiation unless you are signing a multi-unit development agreement. Sometimes they offer incentives for new stores. This usually happens when the corporation is not meeting their growth plans or they are focusing on aggressive growth.

Marketing Fees – These are the fees paid to the franchisor as a contribution to the brand marketing fund. These fees may be different between brands, but their support will also change. Marketing fees may vary from 0–4%. Be sure to get clear on what you are supposed to be receiving for these marketing fees and take advantage of everything that you can. After all, you are paying for it.

Marketing Fees – These are the fees paid to the franchisor as a contribution to the brand marketing fund. These fees may be different between brands, but their support will also change. Marketing fees may vary from 0–4%. Be sure to get clear on what you are supposed to be receiving for these marketing fees and take advantage of everything that you can. After all, you are paying for it.

Credit Card Fees/Charge-backs – These are the fees that you have to pay to the credit card companies for the use of their credit card processing services. Credit card fees can vary based on volume. Charge-backs are credit card sales that are deducted from your revenue because a customer disputed the charge. These fees are becoming a larger and larger line item due to the increasing use of credit cards to pay for retail purchases.

Credit Card Fees/Charge-backs – These are the fees that you have to pay to the credit card companies for the use of their credit card processing services. Credit card fees can vary based on volume. Charge-backs are credit card sales that are deducted from your revenue because a customer disputed the charge. These fees are becoming a larger and larger line item due to the increasing use of credit cards to pay for retail purchases.

Gross or variable profit is the money left after paying all of the variable costs. This is also called the contribution margin, and is stated as a percentage of sales. For example, if the total of all of the variable costs equals 68% of sales, then it is said that the contribution margin (gross or variable profit) is 32%.

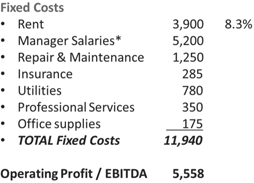

These are the expenses that may or may not be the same every month, but if they vary they don’t vary because of sales, but because of any other factors. These expenses are normally discussed in terms of dollars and not percentages (except for rent).

Rent – The rent paid, including common area maintenance. The average rent as a percentage of sales can range from 5–15%. This rent can vary greatly from location to location. This is the one number that you will be unable to change for the duration of your lease, and it will most likely go up at the end of your lease. This is a critical piece of your business, and if you are not careful with the lease that you negotiate, it can cause your business to fail before you even open. Do not accept an extremely large lease expense because no matter how amazing the location may seem, you may not be able to cover it.

Rent – The rent paid, including common area maintenance. The average rent as a percentage of sales can range from 5–15%. This rent can vary greatly from location to location. This is the one number that you will be unable to change for the duration of your lease, and it will most likely go up at the end of your lease. This is a critical piece of your business, and if you are not careful with the lease that you negotiate, it can cause your business to fail before you even open. Do not accept an extremely large lease expense because no matter how amazing the location may seem, you may not be able to cover it.

Manager salaries – If the manager(s) are paid fixed salaries, they will be accounted for among the fixed costs. This should include all payroll taxes, bonus, and benefit expenses.

Manager salaries – If the manager(s) are paid fixed salaries, they will be accounted for among the fixed costs. This should include all payroll taxes, bonus, and benefit expenses.

Repairs and maintenance – Here you will account for all the repair and maintenance costs of your equipment and building.

Repairs and maintenance – Here you will account for all the repair and maintenance costs of your equipment and building.

Insurance – This is the insurance paid to protect the business.

Insurance – This is the insurance paid to protect the business.

Utilities – All of your electricity, water, gas, internet, and telephone expenses.

Utilities – All of your electricity, water, gas, internet, and telephone expenses.

Professional Fees – This account would include payments to your accountant, lawyer, recruiter, etc.

Professional Fees – This account would include payments to your accountant, lawyer, recruiter, etc.

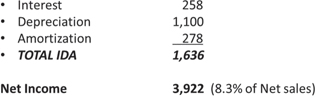

The operating profit is the profit left from the operations of the business after variable and fixed costs are paid. The expenses that follow are business expenses that do not come from the operations, but are of a banking and accounting nature.

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization

Interest – The interest paid to the bank for loans and lines of credit.

Interest – The interest paid to the bank for loans and lines of credit.

Depreciation – The amount that the law allows for any company’s tangible assets like real estate, leasehold improvements, and large equipment purchases to depreciate.

Depreciation – The amount that the law allows for any company’s tangible assets like real estate, leasehold improvements, and large equipment purchases to depreciate.

Amortization – The amount that the law allows to amortize any company’s non-tangible assets like architectural building design, contractor fees, etc.

Amortization – The amount that the law allows to amortize any company’s non-tangible assets like architectural building design, contractor fees, etc.

Taxes – The income taxes paid to the government based on the net profit of the company.

Taxes – The income taxes paid to the government based on the net profit of the company.

This is the famous “bottom line” of the P&L. This is the actual profit that the business has produced after all business expenses are accounted for.

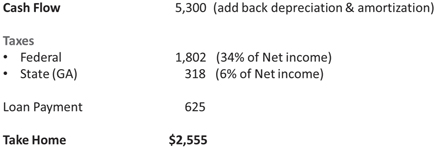

Cash flow is the actual cash that gets to the bank. Because expenses like amortization and depreciation are not a cash expense, that money makes it to the bank. Therefore, the cash flow will always be higher than the net profit, as long as there is depreciation and amortization left in the business.

Here is an example of a full P&L for one month:

In this franchise P&L, the owner would have to be an owner-operator, meaning that he would be one of the managers running the store. This way, his monthly income would be *$2,000 in manager salary plus the “take-home” business profit of $2,555.

The most important ongoing and controllable numbers in your food franchise are Sales, Food, and Labor. These are what I call the Food Service Holy Trinity, and they represent more than 50% of your total expenses. This means that for every dollar that comes in as Sales, more than 50 cents is spent in Food and Labor Cost. These three numbers can make or break you every day. If you are not looking at them, following up on them, and acting upon discrepancies from your plan literally every day, you can find yourself in financial trouble faster than you can imagine. This is why I call them the Food Service Holy Trinity and should be your daily bread. You should look at these three numbers every day.

These numbers are so important that each of the next three chapters are dedicated solely to each element of the Food Service Holy Trinity.

“Break-even” is the point at which your sales are equal to your variable and fixed costs. This means that all of your expenses are covered, but there is nothing left for you. Your sales and your expenses are even. Nothing is left for you, to pay for any loan equity payment or to invest in your business.

The formula to calculate what sales you need to have to be at the break-even point is:

In this example, the minimum amount of sales you need to have to be able to be at operating profit break-even is $32,270.

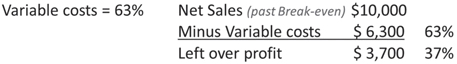

Something else that is important to understand is that past your break-even point, not all the sales that come in after that is profit. This is because while your fixed costs are covered, your variable costs continue to occur as you sell. For example, if you keep selling hamburgers you are still using burger patties and buns (food cost) and your people are making them (labor cost). Therefore, to understand how much profit you’ve accumulated past your break-even, you need to deduct your ongoing variable costs.

In this example, your total sales were $42,270. The first $32,270 went to your break-even and, from the additional $10,000 you sell, you are left with an operating profit of $3,700 after you cover your variable costs.

It is important to know this number before you even open, since this is the first threshold that you need to meet on your business journey to become successful. This is a number that you need to calculate from the time you are making your initial business plan, making sure to review it every year to understand how and why it is changing.

The balance sheet of your business is the financial report that summarizes what your business assets, liabilities, and equity are at a specific point in time. This information will give you an idea of what you owe and what you own, as well as the amount of money you have invested in the business.

I will not discuss this statement here, but it is important that you review it every six months with your accountant to make sure that it is moving in the right direction and so, if it is not, you can address the issue and do something about it.

When you applied to get the franchise, you were required to present a business plan that covered at least your first three years in business. That should be your initial roadmap for your business. It is true that things change – and there is nothing wrong with making adjustments – but if you did your due diligence and you have a good enough plan, you will create a profitable business.

These initial numbers will allow you to have a point of comparison in your early months to know if you are going in the right direction or not. That awareness will allow you to adjust as quickly as possible. That is why it is so important to have your initial business plan close and available at all times. Remember that you built that plan before you had any actual data, and as soon as data starts coming in, you need to compare it with the original plan. Eventually you should start building an alternate plan using the new data. I recommend redoing your business plan after six months of history, and again after a full year of history. After that, you should build your annual business plan with two-year projections based on your first year. In addition, you should have a five-year and ten-year strategic business plan. Those will help with any financing applications and long-term planning for growth or capital needs.

Bank deposit variances (cash over and short) – In Chapter 10, Follow the Money, I will review how to handle deposits in such a way that you can easily compare the deposits with what should have been deposited. If you find any variances, you should act immediately. The more days that you let this go, the lower your chances of finding out what happened and who is responsible.

Bank deposit variances (cash over and short) – In Chapter 10, Follow the Money, I will review how to handle deposits in such a way that you can easily compare the deposits with what should have been deposited. If you find any variances, you should act immediately. The more days that you let this go, the lower your chances of finding out what happened and who is responsible.

Customer Surveys – Most brands have some sort of way for customers to complete a survey for feedback. This is one of the operational reports used by the brands to make sure that your franchise is meeting their minimum standards. These surveys give you and the brand valuable information of where you are and where you need to improve. It also saves you time, because you can then focus your efforts on improving the areas that your customers want you to improve.

Customer Surveys – Most brands have some sort of way for customers to complete a survey for feedback. This is one of the operational reports used by the brands to make sure that your franchise is meeting their minimum standards. These surveys give you and the brand valuable information of where you are and where you need to improve. It also saves you time, because you can then focus your efforts on improving the areas that your customers want you to improve.

Reviews – In the age of information, online reviews can make or break your business. You will be on food service review sites, as well as your own Facebook page. It will serve you well to look at those often (at least once per day) and check that you don’t have an online reputation problem, making sure to respond to your customer feedback on a timely basis. More on this in Chapter 11.

Reviews – In the age of information, online reviews can make or break your business. You will be on food service review sites, as well as your own Facebook page. It will serve you well to look at those often (at least once per day) and check that you don’t have an online reputation problem, making sure to respond to your customer feedback on a timely basis. More on this in Chapter 11.

Speed of service is a huge part of the customer experience, and these numbers will allow you to understand if you are meeting the customers’ and your brand’s expectations.

Order-taking time – Most registers do not keep track of this time, but you can do it with a stop watch. I recommend that you record the times and share it with the team. The time goal for most Fast Food or Quick Service Restaurants (QSRs) is one minute. This measure changes for casual dining because the expected experience is different, but speed is still important. No one wants to sit at the table and keep waiting for the waiter to show up.

Order-taking time – Most registers do not keep track of this time, but you can do it with a stop watch. I recommend that you record the times and share it with the team. The time goal for most Fast Food or Quick Service Restaurants (QSRs) is one minute. This measure changes for casual dining because the expected experience is different, but speed is still important. No one wants to sit at the table and keep waiting for the waiter to show up.

Fulfillment time – This is the time between when the order is taken and the customer receives it, whether at the counter or at the table. This varies greatly from brand to brand, but for QSRs the goal is 180 seconds or less. In fast casual and casual dining this is different since the time to prepare the product is longer and cooked-to-order, however the speed in which you do this still matters…a lot!

Fulfillment time – This is the time between when the order is taken and the customer receives it, whether at the counter or at the table. This varies greatly from brand to brand, but for QSRs the goal is 180 seconds or less. In fast casual and casual dining this is different since the time to prepare the product is longer and cooked-to-order, however the speed in which you do this still matters…a lot!

Drive-thru time – This is the same as the fulfillment time for QSRs. Whether you are receiving your order in the drive-thru or at the front counter, the speed of service expected is the same: 180 seconds from order.

Drive-thru time – This is the same as the fulfillment time for QSRs. Whether you are receiving your order in the drive-thru or at the front counter, the speed of service expected is the same: 180 seconds from order.

Table-turning time – This is the time between customers, the time it takes to notice that the customers have left the table, the table is cleaned and is made ready for the next customers. Computers cannot record this, but you can do it using your stop watch. You can monitor the time it takes for table turnover. Customers will not sit at your tables if they are dirty, and if no one is actively cleaning them, they will leave and you will lose the sale.

Table-turning time – This is the time between customers, the time it takes to notice that the customers have left the table, the table is cleaned and is made ready for the next customers. Computers cannot record this, but you can do it using your stop watch. You can monitor the time it takes for table turnover. Customers will not sit at your tables if they are dirty, and if no one is actively cleaning them, they will leave and you will lose the sale.

Delivery time – Because of the standard set by Domino’s and their original guarantee of 30 minutes, this is now the customer expectation and the measure of success and efficiency for any business that delivers. If you can safely beat it because your product doesn’t take eight minutes to prepare, the customers will pay you with loyalty. If you take a lot longer than that, customers will probably call someone else next time.

Delivery time – Because of the standard set by Domino’s and their original guarantee of 30 minutes, this is now the customer expectation and the measure of success and efficiency for any business that delivers. If you can safely beat it because your product doesn’t take eight minutes to prepare, the customers will pay you with loyalty. If you take a lot longer than that, customers will probably call someone else next time.

If you have a fast food brand, and especially a drive-thru brand, accuracy is one of the top three issues that customers care about and have the most problems with. This is one of those items where the slogan “slow is fast” applies. Sometimes the team is in such a hurry that mistakes happen. These mistakes can cost you not only in the form of food cost by re-doing your customer’s order, but also in sales when customers decide that they can’t trust you and go somewhere else next time.

How many times have you gone through a drive-thru and received an order that was 100% correct? In my case, it is less than half the time. The biggest concern is that take-out and drive-thru customers usually don’t realize the mistake until they are home, and at that point they are not going back. They will simply be disappointed, mad and may not come back next time.

The food service industry is all about people. In our world, the business with the best people always wins. Think of Chick-fil-A. They are selling chicken sandwiches, similar to many other places. However, their reputation precedes them. They are known for service, and customers flock to their stores because of it. We know that they can do this because they have great people and they keep them longer. As I write this book my daughter works at one of their stores. She gets paid minimum wage, which is less that some of her friends in other jobs, but she will not leave because she enjoys the work environment there. For her, that is more important than 75 cents more per hour. She has shared with me that she will probably stay there until she graduates from high school next year.

Staff – The average staff turnover in the food industry is 100–150% annually. The reason for this high number is partially due to the transient nature of the food service industry. The food service industry is usually the first job to many, one they land in between school and their first career job. However, another reason for this high turnover is because very little time and attention is given to ensure that the staff that could and should be retained, is retained. This is one of the things top franchisees and top brands focus on, and that is why they win.

Staff – The average staff turnover in the food industry is 100–150% annually. The reason for this high number is partially due to the transient nature of the food service industry. The food service industry is usually the first job to many, one they land in between school and their first career job. However, another reason for this high turnover is because very little time and attention is given to ensure that the staff that could and should be retained, is retained. This is one of the things top franchisees and top brands focus on, and that is why they win.

Assistant Managers – The average manager turnover in the food industry is between 40–60%. If your employee has reached this level, they are less likely to leave if your place of business nurtures and develops them. If they are a manager, they have goals and ambition. They will stay with you if you provide an environment where they can grow.

Assistant Managers – The average manager turnover in the food industry is between 40–60%. If your employee has reached this level, they are less likely to leave if your place of business nurtures and develops them. If they are a manager, they have goals and ambition. They will stay with you if you provide an environment where they can grow.

General Manager – It is proven that the top indicator of a food franchise success is general manager tenure. Everything that you can do to keep your general manager (if it’s not you) will be worth your time and a very significant amount of dollars, as long as they are the right manager.

General Manager – It is proven that the top indicator of a food franchise success is general manager tenure. Everything that you can do to keep your general manager (if it’s not you) will be worth your time and a very significant amount of dollars, as long as they are the right manager.

Brand Evaluation – These scores not only determine how well you are doing at executing the brand, but they also, if you do poorly, can put your franchise rights and your investment at risk. Your franchise consultant will tell you how are you doing and what areas can be improved. You will be well-served by paying attention and acting upon their guidance. It will have a positive impact on your operations and your profitability.

Brand Evaluation – These scores not only determine how well you are doing at executing the brand, but they also, if you do poorly, can put your franchise rights and your investment at risk. Your franchise consultant will tell you how are you doing and what areas can be improved. You will be well-served by paying attention and acting upon their guidance. It will have a positive impact on your operations and your profitability.

Health Department – These scores are prominently displayed in your business, and every one of your customers will see them. These scores reflect the care that you are putting into the handling of the food, and they will determine whether your customers will buy from you again.

Health Department – These scores are prominently displayed in your business, and every one of your customers will see them. These scores reflect the care that you are putting into the handling of the food, and they will determine whether your customers will buy from you again.

Self-Evaluations – If you want to make sure to perform well when the brand or the health department visits you, you should conduct your own evaluations on a monthly basis so that you can determine where you are and where you need to improve. This way, your business will always operate at a high level and the next time the health department comes calling, you will be ready. This is a great learning opportunity for Assistant Managers.

Self-Evaluations – If you want to make sure to perform well when the brand or the health department visits you, you should conduct your own evaluations on a monthly basis so that you can determine where you are and where you need to improve. This way, your business will always operate at a high level and the next time the health department comes calling, you will be ready. This is a great learning opportunity for Assistant Managers.

There are a few ways to measure general employee satisfaction. One of the ways is to look at your turnover rates. You can also look at your customer surveys. It is a well-known fact that your customers’ experience will never be higher that your team members’ experience. This means that the better that you take care of your team, the happier they will be and the better that they will take care of your customers.

If you want to have clear, actionable data about the areas in which you could be doing better for your employees then … ask them. Conducting anonymous employee surveys every six months with the same questions in every survey will allow you to know where you stand, where you can do better, and how you are moving the needle with what you are doing.

You can set objectives in just about every line in the P&L and every aspect of your operations. My recommendation is that you choose the highest profit and business impact numbers and not only have specific measurable goals for each of them but also define clear incentive programs for the team and you toward those goals. Don’t choose too many, because you will not be able to focus.

These are the eight most common numbers that top franchisees focus on:

Sales growth (ticket and transactions)

Sales growth (ticket and transactions)

Food Cost

Food Cost

Labor Cost

Labor Cost

Profits (Net Income)

Profits (Net Income)

Employee Turnover (Managers and Staff)

Employee Turnover (Managers and Staff)

One speed of service measure

One speed of service measure

One customer service measure

One customer service measure

Brand Evaluation

Brand Evaluation

There are different schools of thought on how much to share with your managers and your team regarding your business numbers. Some franchisees share full P&Ls and empower the managers to take ownership of every line item that they can control. In this scenario, the manager bonus is some sort of percentage of the store profits. Other franchisees only share the Holy Trinity because they assume that this is the only thing that they can control.

It has been my observation that the franchisees with the most success are those who share more, but also train their team in such a way as to understand the entire business. In this situation, business training and education is crucial. A secondary benefit from those that share more and train their managers, is that they experience a higher rate of retention because of the knowledge that their employees are receiving. That value of personal development and growth is what makes people stay.

That is why I stayed and decided to grow with the organization I started with. Because when I was only a delivery driver I saw a manager development program poster called The Pyramid of Success that outlined every class and training program that the Managers-In-Training went through to prepare them to be General Managers and on the other side of the door was posted the store’s complete Profit & Loss Statement for the store showing the revenue and every single line item of expenses. I was fascinated and I was hooked! I wanted to do more and learn more and that is when I decided to become a Manager. Because I knew that they will teach me all of that and more. I was so excited!

Leverage Your Franchisor

One of the great benefits of belonging to a large network of business owners with your same brand is the fact that you can learn their numbers and compare them to yours to have an idea of where you are. Because you are not competitors, the level of sharing and support is very high. There are very successful franchisees in your brand. If you are not as successful as them, you need to find out what they are doing that you are not. Some brands go so far as to share cumulative franchisee P&L results to make it easier for franchisees to measure where they are in comparison and understand where opportunities are. This is only possible in the brands that collect full P&Ls from everyone, and the quality of those P&Ls is good. If your brand does not do that, then your best option is to befriend franchisees and ask for their business numbers.

My goal with The Franchise Fix is to give you the roadmap of what those top 10% franchisees in each brand do to excel. The next step for you is to find out what their numbers are within your brand so that you can start defining the goal that you want to reach, make a plan, and measure your progress until you accomplish it.