“No matter how tall the mountain, it cannot block the sun.”

—CHINESE PROVERB

There is an ancient fable about a Zen master who was out for a walk with one of his students and pointed out a fox chasing a rabbit. The master said, “The rabbit will get away from the fox.” “Not so,” replied the student. The master insisted, “The fox is faster, but the rabbit will elude him.” When the student asked why, the master replied, “Because the fox is running for his dinner, while the rabbit is running for his life.”

Barbara had been following IBD and investing for several years when she suddenly lost her husband of 30 years to a heart attack. A year and a half later, she was laid off from a major corporation where she was an executive secretary. Barbara was nearing retirement and thought it was unlikely that she would be hired at the income level she had been receiving. She also knew Social Security would never take care of her financial needs.

Knowing she would be laid off from her job in 2004, Barbara paid off her house and car loans using the extraordinary profits she had made from trades during the booming 1990s: 1,300% in EMC, 200% in Gap, 254% in Oracle, 235% in Intel, and 44% in Cisco.

Though she went through a very difficult emotional period after losing her husband and being laid off from her job so soon afterward, Barbara has advice for investors facing similar challenges. “Have self-confidence in your own abilities,” she says, “but you must study, and you must learn to read charts. Chart reading is a visual art. What do you see? What is the chart telling you? Then act accordingly. You also have to let the overall market trend be your guide as to whether it is a good time to be in stocks or not.” Barbara modestly adds that she had no financial background whatsoever. “I sold real estate and was a secretary, so if I can become a successful investor, anyone can.”

Barbara says she learned the most from the IBD workshops, which she has attended regularly throughout the years, and always walks away having learned something new: “It is the continual process of learning that is so beneficial. And the paper is also full, every day, with educational materials to help people become better investors and better chart readers.”

Barbara follows a solid routine every morning, and this assures her that she won’t miss a market leader as it’s breaking out.

1. In the pre-market, Barbara checks The Big Picture column and the Market Pulse to see if the market is in an uptrend or a downtrend. Barbara circles leaders that are up in volume from this section and adds them to her watch list.

2. Next, she runs two MarketSmith screens.

a. The first screen that Barbara runs is the William J. O’Neil screen, which brings up stocks with the CAN SLIM criteria. Barbara clicks through the charts that appear on this list to see which ones may be setting up and nearing a potential buy point.

b. Then she runs a screen for stocks up on big volume because this tracks what the institutional investors are buying.

3. Barbara then reviews Leaderboard and finds the list saves her time because “it’s a very focused list of the market’s current leaders.”

4. Finally, Barbara looks at Stocks on the Move at Investors.com, another screen that highlights stocks that are rising or falling in heavy volume, showing where institutional money is flowing.

What Barbara is looking for are stocks that show up on several of these different lists. That might be an indication that she has found a stock that could make a big move.

Barbara says, “The key is creating a routine that works for you, something you will continue to do on a consistent basis, every day.” Part of her routine also includes a morning phone call with a trading buddy. They talk about the general market together and look through charts in search of breakouts.

Barbara does best in the market when closely following the CAN SLIM rules and takes most profits at 20 to 25% and cuts every loss at 7 to 8% from her buy point. In a more volatile market, she will cut losses at 5 to 6%.

In 2009, Barbara had profits of:

Fuqi International (FUQI). 42%

Green Mountain Coffee Roasters (GMCR). 21%

F5 Networks (FFIV). 15%

Silver Wheaton Corp. (SLW). 39%

SPDR Gold Shares (GLD). 17%

and, in 2010, profits of:

NetApp (NTAP). 21%

SanDisk Corp. (SNDK). 27%

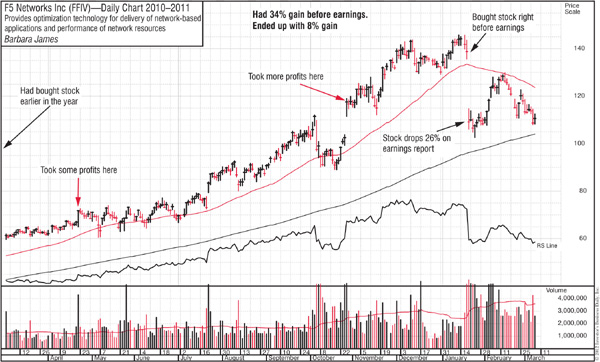

That same year, Barbara admits to having a “favorite pet stock” with F5 Networks (FFIV) and bought the stock three times. In April, she sold for a profit of 12% and in November for a profit of 22%.

But the third time for F5 Networks was not the charm. Barbara broke one of her rules and bought the stock right before earnings. F5’s earnings disappointed expectations, and the stock dropped 26%. She said it was a stinging reminder to never buy stocks right before earnings because anything can happen. A stock can soar on good earnings or dive precipitously on disappointments. Barbara had let a nice gain in F5 Networks evaporate. She states that because she had done well with the stock previously, it caused her to not be as diligent as she usually is in writing down earnings dates for stocks that she owns.

One of Barbara’s greatest joys is in helping newer investors. She works part time for IBD at the many Money Shows that are held throughout the year. Barbara sits down one-on-one with attendees and goes over her routine to find winning stocks as well as showing people how to use the paper more effectively. Barbara feels she is helping women and retired investors who are worried about their financial situation as they grow older. Sadly, she has heard many heartbreaking stories from people who did not have a sell rule and suffered devastating losses of 40 to 50% in their retirement savings.

Barbara relates her own story and how she overcame financial challenges and encourages them to learn the CAN SLIM strategy to help them change their lives for the better.

Barbara says, “I manage my own stock portfolio accounts, both my main trading and IRA accounts. There was a pretty big learning curve involved that went beyond studying and learning to read charts. The biggest obstacle I had to overcome was developing self-confidence in my abilities. My success in these accounts has without question proven that I am capable of managing my own money better than any stock broker or financial money manager that I had tried. This was a major breakthrough in my thinking process. Any time I handed my account over to a money manager, they did not do nearly as well as I did. I can now say no one will manage my money better than I will.”

Her stock market profits pay for annual month-long trips to exotic locations around the world. She has traveled to India, Asia, Costa Rica, Africa, Australia, New Zealand, and Eastern Europe, among other places.

Jerry had been a professional investor in the stock market for several years before coming across the CAN SLIM Investing System. After the crash of 1987, which left many investors stunned, a friend handed Jerry a copy of Investor’s Business Daily. After seeing the quality of the paper and the information that was in it, Jerry bought How to Make Money in Stocks and devoured the book. Suddenly, a lot of things made sense about the market that he had never realized before, even as a professional trader.

By the time the bull market of 1991 started, Jerry formed an investment firm with a partner and began to experience tremendous gains using the system.

Jerry had his first eye-opening experience with growth stock investing when he bought ECI Telecommunications. The stock had already tripled in price before he bought it in August 1991. Jerry sold ECI in March 1992 for a gain of nearly 200%. Before he learned CAN SLIM Investing, Jerry “thought anyone would be crazy to buy a stock that had already tripled in price before they bought it.”

In 1992, Jerry found himself in a very difficult and stressful situation. His partner had died of a heart attack, leaving him the burden of managing $10 million by himself. Jerry says he was never really the corporate type. Addressing questions or concerns from clients at all hours of the day was something he found increasingly difficult because it disrupted the trading day. Besides, it was psychologically draining. Some of his clients wanted to be in the market all the time, even if the environment wasn’t right. By 1994, Jerry made the decision to stop managing money professionally and returned all of the money to his investors. But by this point, he also had enough confidence in the system from several successful trades to begin investing his own money full time.

In October 1999, Jerry bought Qlogic (QLGC) and made 150%. He could have increased his profit even more but sold too late after the stock topped. At that time, Jerry wasn’t as experienced about how to handle a climax top. This is when a stock has a rapid price run up for one to two weeks after an advance of many months and then rolls over. This climactic activity usually occurs in the final stages of a stock’s advance.

The reason Jerry was able to buy Qlogic is because of his experience with ECI Telecommunications. He bought Qlogic after it had already tripled in price, which is almost exactly what ECI had done. This taught him a very valuable lesson: winning stocks repeat themselves with similar patterns and behaviors.

Jerry learned another valuable lesson with EMC in 1999. He bought the stock at $68 but got shaken out and took a loss. He sold at $61. But the stock went on to build a cup-with-handle base. Jerry learned to keep watching stocks that didn’t work the first time he tried to buy them, because big winners often give you another chance.

In November, he bought EMC again as it came out of a base at $75 and sold it at $112 in 2000 for a 49% gain.

Then, in 2003, Jerry bought J2 Global Communications (JCOM) in March and sold it in October after a two-for-one split for a 198% gain.

He learned that it was important to bag gains early in a bull market cycle. That’s when market leaders really pop and the big money will be made.

Then a hard blow came for Jerry due to several factors, including what he feels was overconfidence in his trading abilities. He lost half his money in a drawdown. For a serious trader, losing a large amount of money can be the darkest moment, filled with self-doubt and disillusionment.

Over the years, Jerry had attended IBD workshops multiple times, so he went back and studied the workshop books. The first egregious error was in not cutting losses sooner. As Jerry examined his trading mistakes, he learned that the emotions of euphoria when he was doing well in the market as well as being too distraught when a trade went against him were damaging to his trading. He studied and worked hard with a trading coach that specialized in psychological barriers and learned to keep a more even keel and be calmer in his everyday approach to the market.

He found out that the most dangerous time is when you’re doing really well in the market, because you get sloppy: “The market will prove to you that you’re getting cocky.”

Jerry has been very successful in the market since adjusting his trading. He mentions with a chuckle, “If things are going well and I’m really excited, it’s a good indication the market may be topping.”

Now when he is doing well, Jerry calmly takes some gains off the table and takes his family on a vacation. He found that it is important to reward yourself at least in some small way when you’ve had some success. This keeps overconfidence in control.

One of the biggest lessons Jerry has learned is that you can make a lot of money in a rally only to give it back in a correction. This can be extremely frustrating. “One of the hardest things is to stay out of a correcting market,” he says. “Although you can get some of the biggest up days in a bear market, and this makes it tempting to go back in, you buy some stocks and take small losses, then buy a few more stocks, and then take a few more losses. Pretty soon, if you do that enough times, even if you are cutting your losses, you’ll often lose a decent amount of money.”

To keep from giving back gains that he made during an uptrend, Jerry refuses to buy stocks if there are only three or four stocks that are making decent gains in the market. He is looking for true confirmation in the market, and that means that 10 to 15 or more stocks must be setting up and looking good. “If the market doesn’t look strong, you have no business getting in.”

To help him determine if the market was in a good phase or a so-so phase, Jerry set up what he calls his “leaders index,” which is a mixture of 20 to 25 stocks from 15 different industry groups. Jerry does this early in every new uptrend. He creates the list by searching for stocks that look strong as a new uptrend is beginning.

Many of these are stocks that have already broken out. Stocks that are a bit extended are great candidates, because Jerry knows from market history that these are the stocks that are most likely to go higher. Stocks making new highs tend to go higher.

Jerry looks for stocks with strong fundamentals, big earnings and sales, and a great new product or service that is in demand.

He follows this “leaders index” as a gauge of the general market and updates its performance on a daily basis. Jerry e-mails the daily results of the index to several IBD Meetup Groups. He says that sharing the results helps him stay “honest about what the market is actually doing.” Jerry also helps teach at several IBD Meetup Groups and always enjoys the exchange of ideas.

He says, “I can wear Hawaiian shirts and shorts to work, come and go as I please, take a vacation when I want, have the luxury of spending more time with my family, and I don’t have a boss telling me what to do. It suits my personality well.”

Mike first became interested in stocks through business courses taken in college. His first job was at a CPA firm that had a library and a couple of books on equities. After reading a few books, he decided to dabble in the market.

Mike thought cheap stocks looked interesting, so he bought Ramada Inn when it was under $5. He made a 13% gain, which seemed pretty good for his first stock pick. But he quickly learned that duplicating that success was going to be difficult.

Through the years, he was confused by all the information that was out there and didn’t understand which methodology he should be following.

Mike had continually tried to be a bottom fisher because he never had the confidence to buy a stock that was so far up from what he thought was a low-risk entry price. As a result of continually buying cheap, low-quality stocks that weren’t showing earnings growth, he frequently lost huge percentages on his individual stocks as well as having a meager overall portfolio performance.

In 1989, an architect friend introduced him to IBD. Mike stared for a few moments at the paper and all of its detailed information. “I was so absolutely amazed that I almost had to sit in a chair,” he says. “This is what I had been looking for all my life.” He made a plan in the back of his head that investing would be his retirement career.

Mike continued to be a subscriber to IBD, but time was in short supply because he was busy with his own CPA firm. So although Mike bought stocks here and there, he didn’t get serious about investing until 2002.

Mike began focusing on stocks that showed a rare combination of traits: strong volume demand and stellar fundamentals. These are the market leaders that exhibit earnings and sales that are far outperforming the market averages, which is why they kept showing up in various features in IBD week after week during their massive runs.

Garmin (GRMN) was one of the first successful stocks Mike bought in December 2002, using the CAN SLIM Investing System. He bought the stock as it was coming out of a cup-with-handle base and logged a 74% gain.

After a particularly grueling tax season in 2003 and buoyed by his success with Garmin, Mike decided to really study the CAN SLIM System intensely. He sat in his office for an entire weekend and printed out a huge amount of educational pieces from Investors.com. As he read through the material, he had an epiphany. Mike was beginning to put all the pieces together: he needed to focus on stocks that had great fundamentals combined with the right chart action. These were stocks that had at least double-digit earnings numbers and were breaking out of areas of price consolidation on big volume.

Mike also began to read all of the books Bill O’Neil had on his recommended reading list: How I Made $2 Million in the Market by Nicolas Darvas, The Battle for Investment Survival by Gerald Loeb, My Own Story by Bernard Baruch, and Reminiscences of a Stock Operator by Edwin Lefevre.

In May 2003, Mike was reading an IBD New America article and learned about a stun gun called Taser. He realized that this could be a big winner because of the development of a nonlethal weapon that would improve a police officer’s options to capture and detain suspects. He bought Taser (TASR) in September 2003 and sold it in October for a 105% gain in 30 days. This was a very exciting moment for Mike; he had done well with Garmin and now had a triple digit gain with Taser. His confidence was soaring.

But Mike was frustrated as Taser continued to rocket higher—another couple hundred percentage points—and he realized he had sold too early, though IBD analysis hadn’t indicated this. His heart sank, but, realizing his mistake, he started looking for a proper new entry point. In December 2009, the stock formed a series of rare high tight flags. This is when a stock has a fast advance of 100 to 200% in 4 to 8 weeks. Then a stock moves sideways for 3 to 5 weeks before making another run. High tight flags are very rare and only seen in the market’s biggest winners. After this formation, stocks usually make a massive move upward.

Mike bought the stock back again. His position was significant as he pyramided into the stock and added to his position. Then Mike did something that is hard to do: he sat tight with a volatile stock. When a stock gyrates and is a bit of a wild thing in daily price swings, it can be difficult to sit with. This will test your nerves, but it’s where a set of rules comes into play. You sit with a stock that has proven itself to be a true market leader. Taser never went below its buy point, so Mike held onto it, despite some wild price fluctuations.

Then he saw some climax activity in the chart. The stock had gone up a tremendous amount, and Mike realized that this might be a dangerous time. He knew from his studies that all stocks top out at some point. On April 19, Taser was due to report earnings after the close. Lawsuits and bad news were beginning to creep up, and there were other yellow flags, such as excessive stock splits. Mike made note of this and called his broker that afternoon. He took his entire gains off the table. After Taser released earnings and disappointed analysts’ expectations, the stock cratered 29%.

Mike had sold exactly at the right time and had bagged a 294% gain in a stock on top of earlier gains of 105%. This was a very emotional moment for Mike. He closed the door to his office and sat in his chair as tears welled up in his eyes. It was a life-changing moment. Mike had made a six-figure profit in a stock, and he could now pursue his retirement dream of selling his CPA firm and turning to investing full time.

Having a huge gain was both a blessing and a curse, however. After the success Mike found with Taser, he felt every stock would be a huge winner and, as a result, has had a tendency to be a home run hitter since then. The problem he found is that not all market environments produce giant gains like Taser.

Mike has since learned to take profits at 20 to 25% instead of giving back hard-earned profits.

One thing that helps him stay in step regularly with the market and reduce his mistakes is teaching. In October 2003, after Mike’s first big gain in Taser (TASR) of 105%, he formed an IBD Meetup Group in his hometown of Clearwater, Florida. He said this was one of the best decisions he has made in his stock market career. He has found other people who are passionate about the market and who invest the same way. Mike has also enjoyed helping a number of newer investors get started and enjoys watching their success.

Ed was raised in a middle class family in the suburbs of Long Island, New York. Throughout his childhood, his exposure to the stock market consisted of watching his father buy stocks on “hot tips.” Every stock that his dad bought was supposedly going to be a ten bagger and make him a multimillionaire. However, the reality was that his father would lose a small fortune in the stock market by listening to whatever stocks were being pumped by his broker. Ed’s experience of watching this completely turned him off to the markets.

Ed borrowed $100,000 in loans to pay for law school and quickly came to the realization that in order to pay off the loans, he would need to land a job with a firm that could afford to pay a six-figure salary to starting associates.

As he entered law school, it became quickly apparent that he was surrounded by extremely talented and intelligent people. Ed figured that several had IQs that dwarfed his and that if he was going to obtain the grades necessary to land a job with one of those large firms, he’d have to outwork them. He spent the first year of law school either in the classroom or pulling all nighters in the library. That work ethic paid off: Ed finished his first year near the top of his class and was recruited to work for a highly ranked law firm in its New York office for the summer.

Ed never paid much attention to the stock market during law school and completely missed the tech bubble and explosion in Internet stocks in 2000. But after he graduated and began working, Ed decided it might be prudent to invest some of the money he was making. He knew that he needed to learn a thing or two about stocks before committing capital, so he read a few books about value investing and other stock market strategies. None of it made much sense to him, especially after seeing people buy cheap stocks only to lose most of their money.

A few months later, Ed was in a bookstore and noticed a copy of How to Make Money in Stocks sitting on a table. He picked up the book, browsed through it, and decided to purchase it. Little did he know at the time that this decision would forever change his life.

The key principles all made sense. Shortly thereafter, he purchased The Successful Investor, which really resonated with him. He realized that his friends and family could have kept the small fortunes they made in the late 1990s if they had followed some simple sell rules.

Throughout the rest of 2002 and 2003, Ed read Bill O’Neil’s books multiple times: How to Make Money in Stocks, The Successful Investor, and 24 Essential Lessons for Investment Success. These books were intended to make the rules and guidelines register with investors in a deeper way.

In March 2003, a new bull market began, and Ed started trading stocks. He quickly turned $50,000 into nearly $300,000 until the market corrected in early 2004. Reading and understanding CAN SLIM Investing, however, was entirely different than its application. By the end of the correction, because he didn’t stay out of the market while it was heading lower, Ed lost every penny that he’d made. When he did his post analysis, he realized that he did not follow the CAN SLIM sell rules he had studied.

Ed spent the next three years of his life immersed in mastering CAN SLIM and learning every detail he could about the system and how to use it effectively. Besides studying, Ed also traded his own account and made “almost every mistake that a trader can possibly make. The market can evoke emotions in everyone, causing one to break rules, overreact, and make mistakes.” Because Ed had no mentors, he had to learn everything by trial and error and experience. Instead of becoming disenchanted when he would lose money on a stock, however, he would mark up a chart to see the reason for his mistake. And he constantly reviewed them so he wouldn’t make the same mistakes again.

At the end of 2005, Ed had his first “big stock experience.” Ed missed out on Google’s first two base breakouts, but when the stock gapped out of a base on October 21, 2005, he bought what was a rather large position for him at the time. He had studied models of past breakaway gaps of former leaders, and he knew this was a high probability play, despite many pundits saying the stock was overvalued. He spotted volume accumulation on a weekly chart and saw the continued demand as it ran up. On January 20, 2006, Ed locked in a large profit by implementing one of his sell rules, which is to sell a stock if it breaks its 50-day moving average on heavy volume.

Ed noted, “Holding onto a big winner is sometimes hard, and that’s why you have to know everything about a stock and a company, because if you don’t know much about the product, its useful place in the market, why sales may increase, or why its product or services may be in demand, the more likely you are to get shaken out of it. Conviction is definitely key to holding onto a big winner. You have to ask yourself, ‘Why is this company likely to be successful in the future? Does it have a remarkable product or service that is revolutionary in its industry?”’

Another important factor that Ed looks for is liquidity. He wants a stock that big funds would buy, and more thinly traded stocks don’t capture the attention of the big institutional investor.

By 2006, Ed had made enough money with CAN SLIM Investing that he decided to follow his new passion, the stock market. He had always dreamed of owning his own business and was further motivated by reading about all the successful entrepreneurs in the Leaders and Success column in IBD.

Although he had virtually no clients and no experience managing professional money, he felt that if he followed his passion, continued to work hard, and stayed true to the principles of CAN SLIM Investing, he could make it a full-time career.

At the end of 2007, Ed said good-bye to the law firm where he had begun his career and launched his own money management firm. He slowly built his client base, and when the market crashed in 2008, he had his clients’ money safely in cash. Although he didn’t know how severe the crash would be, he recognized the breakdown of leading stocks and the large amount of selling in the financial stocks. That made him realize cash was the safest place to be.

A new bull market began in March 2009, and during that year, Ed’s firm did so well that he decided to launch a hedge fund in January 2010. The fund did well in 2010, but in 2011, Ed faced a more difficult period. For the first time since he started managing money, he wasn’t performing up to peak. After he went back and analyzed the entire year, he realized that portfolio concentration was the problem, and he needed a new set of management rules for choppy, difficult markets.

He made a “threshold rule”: if the market issued a follow-through day, he would go in no more than 20% invested, unless the stocks in his portfolio made a gain of 2%, then he could go in a little deeper. Even if he was tempted to buy more than he should, having portfolio management rules would keep him out of a choppy market.

Even though 2012 was an easier environment to trade in, having the 20% threshold rule helped Ed outperform the S&P by nearly double through September 2012. Ed seeks to “constantly learn through post analysis and make new rules that will help him as a trader.”

Ed also noted that no matter how good you get at investing, you’re going to have a bad year at some point, so it’s important to fix mistakes. He said that he learned a lot more in the difficult 2011 period than in easier up years. “Don’t be afraid of your mistakes, but make rules to fix them.”

He continues to be a student of the market, studying and learning. Ed also likes to go to a local mall and see what people are buying. He was able to make a nice profit from Chipotle Mexican Grill when he noticed one open near his old law firm and saw lines 45 minutes long for healthy fast food.

Ed says that had he not read How to Make Money in Stocks nine years ago, he might still be a lawyer, working long hours and being unhappy with his profession. Instead, now, not only does he have his own hedge fund where others trust him to manage their money, but when he wakes up in the morning to go to work, he is excited and passionate about every waking hour he spends analyzing the market and trading. “My life is much more fulfilling than I could imagine as I have much more free time to spend with my family and three-year-old son. Mr. O’Neil, I thank you for making this all possible.”

Google. 25% gain 2005

Vmware. 80% gain 2007

Dryships. 91% gain 2007

Michael Kors. 80% gain 2012

LinkedIn. 100% gain 2012

Priceline. 50% gain 2012

Apple. 28% gain 2012