“Champions aren’t made in gyms. Champions are made

from something they have deep inside them—a desire,

a dream, a vision. They have to have the skill, and the will.

But the will must be stronger than the skill.”

—MUHAMMAD ALI

It is said that a black belt is a white belt that never quit. Only through perseverance and indomitable spirit can one achieve the highest level in martial arts. It is the same with investing. The top traders develop skills through hard work, discipline, following a daily routine, and controlling emotions. The journey is not always easy, and there will be trials along the way, but anyone can achieve this level if they are willing to put in the work.

Kevin started investing in 1985 with a very simple strategy: he bought blue chip stocks from the Dow Jones Industrial Average that had earnings growth of 20% per year.

In July 1987, Kevin noticed that the market was selling off, and so, being a risk-averse investor, he sold many of his positions. But he had no idea what was coming. Kevin turned on the TV on October 19th, the morning of the “Black Monday” crash, and saw that the Dow had dropped 500 points, more than 20%, and that the entire world market was collapsing. He immediately sold his last short-term position, which was Royal Dutch, an oil and gas company. Although Kevin had been more fortunate than many investors, he felt a bit stunned. It was a serious and devastating day for a multitude of traders, and the crash hit many Wall Street firms hard, driving some out of business altogether.

In the aftermath of the crash, Kevin realized he didn’t know how to time the market. His strategy worked in the 1980s because stocks were in a bull market. But now times were different. In 1990, he happened to come across Investor’s Business Daily and saw an ad in the paper for How to Make Money in Stocks. Kevin bought the book, and as he read through the chapters, he began to see how the markets worked historically. For Kevin, this was a watershed moment. Midway through the book, he felt as though someone had turned a light bulb on in his mind. He put the book down, and he began to pace the living room floor, thinking about what he had just read and what a difference it would make in his trading.

Kevin attended several of IBD’s advanced investment seminars and found that the CAN SLIM strategy fit his personality well, particularly the “N” in CAN SLIM, which stands for something new. He had always been intrigued by new things, whether they were related to cars, fashion, musical styles, companies, or a host of other things. Operating in the aggressive growth sector would allow him to watch firsthand the progress of many companies that were on the cutting edge. These were the names that would crank out the heaviest advances in the stock market because they had customers beating a path to their doorstep.

Kevin began subscribing to the Daily Graphs charting service that IBD offered and would drive down to the printing plant every Saturday morning to pick them up. He says, “All the hardcore stock jocks showed up on Saturday mornings at the plant to get their charts early. You felt like you were part of a secret club.”

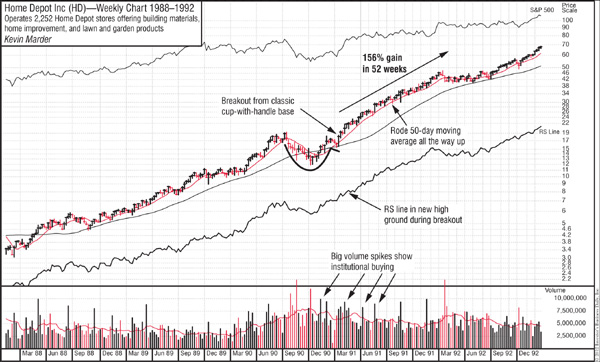

One of the biggest technical indicators that Kevin learned to pay attention to on charts was the RS (Relative Strength) line. Kevin learned that what was important was the slope of this line. If the line was upward sloping and hitting new highs, it meant that the stock was outperforming the S&P 500. Conversely, if the line was downward sloping and drifting into newer lows, the stock was underperforming the major indexes. He was looking for the truly big growth stocks that were far outperforming the major indexes, so this indicator was something he would continue to focus on as he looked at charts.

Early in 1991, Kevin recognized that a new bull market had begun. He was able to use the CAN SLIM Investing strategy in “full bloom.” Companies like Microsoft soared as people gobbled up its state-of-the-art software. Home Depot experienced blistering growth by coming out with a chain of innovative home improvement stores offering discount prices. Cisco Systems became an earnings juggernaut by developing technology used to link groups of individual computers together. In each case, these companies had carved out a whole new market.

In the spring of 1993, Kevin would learn a big lesson. He had bought Microsoft out of a base, but the breakout failed, and the stock fell 10%. Kevin didn’t sell. Microsoft dropped some more and was down 15% from where he bought it. Kevin held onto the stock and kept telling himself what a really great company Microsoft was and that it would recover. He finally sold the stock after it was down 20%. Kevin realized he had not adhered to the CAN SLIM sell rules. Since then, Kevin relies on technical analysis alone to sell a position, and he has never sold a stock with more than a 7 to 8% loss except for the rare news-related gap-down.

He also realized that there are two problems in hanging onto losers. First, you can take a potentially devastating hit to your account if you allow a small loss to grow into a big one. Second, you can tie up your money in a laggard stock instead of selling a losing stock and putting your money into a winner. This is particularly important at the beginning of a new bull market.

By 1995, it seemed obvious to Kevin that the Internet was going to change the way investors could get quotes and other information, but everything was very new. The Internet was in its infancy. Kevin began by publishing bond market commentary on the Internet, but his heart was in the stock market. He wanted to share all that he had learned about making money in stocks.

In early 1996, he cofounded DBC Online. This was among the first websites where the individual investor could find quotes and news information about what was happening in the market. In the early days, Kevin’s intraday market updates served as the site’s home page.

CBS bought half of DBC Online in 1997 and named it CBSMarketWatch. In January 1999, the company went public. The IPO was priced at 18 and opened at 80. It ran up as high as 150 during the first day. This was the second-best opening-day performance for any IPO in history.

The website became a huge hit and is now a widely recognized site for online news and market data with over one million viewers per day from 70 countries around the world.

As part of Kevin’s market commentary, he interviewed top traders. In particular, he sought out other traders of the O’Neil method. Among his favorite interviews were Bill O’Neil, David Ryan, Greg Kuhn, and Cedd Moses Through what he had learned from the “O’Neil approach,” Kevin was able to write about the market in a way that others found enlightening. Kevin’s realtime commentary was seen around the world on USAToday.com, AOL, Yahoo, and other outlets. For Kevin, this was tremendously exciting. His foundation of how the market worked was built on what he had learned from reading How to Make Money in Stocks.

Kevin learned from his interviews that the top traders “become successful by putting their personal opinions aside and listening to the market’s message. In fact, keeping one’s ego in check is one of the most important aspects of trading. This becomes particularly difficult when someone who is a success in another field—say medicine, law, business, or sports—believes his success will translate to a superb trading career.” As Bill O’Neil had often said, “The market doesn’t know who you are, doesn’t know how bright you are, and doesn’t know what great college you attended. It simply doesn’t care.” Kevin added, “The highly successful lawyer walks into the game expecting to clean up. Often, he is the one who gets cleaned.”

Kevin’s biggest lessons from interviewing Bill multiple times for MarketWatch have been about the general market trend.

“I learned from Bill that, no matter how grim the economy or the market may appear, you must always do your daily analysis of the averages and leaders,” says Kevin. “This is because a new bull phase begins when things are at their worst, and investor sentiment is quite bearish. The initial breakouts in a new bull phase often occur in the growth stocks that end up being your genuine leaders in the ensuing move up. So making sure you get in early in a new trend is important. This is especially critical because once these new leaders break out, they can run a good amount before pausing to form their next base.

“This means if you enter after the initial breakout, you are likely entering when the price is materially extended past its most recent base. And entering an extended stock is risky because there is no technical support below to cushion any normal pullback that might occur.

“I learned this lesson in the July to October 1990 bear market. Instead of doing my daily analysis, I did not look at a single chart for months. Only after everything was obvious after the mid-January 1991 lift-off did I realize a new bull market had begun three months earlier. As the saying goes, you snooze, you lose.”

Learning how a market tops proved to be as important as getting in on a new bull run. “My first triple-digit percentage month was February 2000,” says Kevin. “I did this by holding 15–17 stocks, nearly all in the explosive technology sector. As it turned out, this was the final blow-off phase of the most powerful bull market in 70 years, though of course no one knew this at the time. In early March 2000, I noticed institutions beginning to exit the stocks that I held. This showed up on price charts as distribution days (heavy selling) in the leadership names. By taking quick action, I moved my account to a 100% cash position by March 14, which was two trading days after the March 10, 2000, top. A day later, on March 15, I mentioned this in a column of mine on a major website.”

Kevin’s long-term record has outperformed the S&P 500 by a multiple of 10 (net of a management and performance fee), according to audited reports by Big Four CPA firm Ernst & Young LLP.

Kevin says that he is “grateful to Bill O’Neil for learning so much about the market early in his career, because it significantly impacted my professional journey through the market. I believe Bill has influenced more of this era’s most outstanding stock pickers than anyone else.” Kevin’s gratitude and respect for Bill can be felt more in the silences following these statements than anything else.

Kier’s first job out of college was with a large brokerage firm. He was trained to be a stock broker but didn’t really learn very much about stocks: “They teach you to be a salesman and follow the internal analysts’ recommendations.”

In 1990, Kier got to know a broker from another firm who was a very good stock picker. When Kier inquired how he found stocks for his portfolio, the broker handed Kier Investor’s Business Daily and recommended that Kier read How to Make Money in Stocks.

As Kier read through the book, he began to see how successful investing really worked. Before reading How to Make Money in Stocks, Kier was using a number of bad investing strategies. He bought when the market was trending down, didn’t cut his losses short, and had no idea how to isolate which stocks were leading in the current market. Kier was excited as he read and reread the book, because he “had found a solid framework to help him keep in sync with the market and leading stocks.”

Kier attended his first IBD Workshop in 1992 and felt empowered from the education. He began to employ the strategies and started to have success in the market both personally and professionally. Kier moved from a large investment firm to a smaller boutique company and became a manager for a team that had diversified investments. One thing that was exciting about this smaller firm was its concentration on the new economy, which included the more innovative companies focused on technology and the consumer. Many of these newer companies had CAN SLIM traits.

In 1995, Kier bought Centennial Technologies, a Massachusetts company that made PC computer cards that provided increased storage capacity.

Earnings soared 262% and sales rose 62% for the March quarter. Because of those stellar numbers, the stock broke out of an area of price consolidation and zoomed 17% on volume that was 838% above average. Kier recognized the large institutional money that was going into Centennial and began pyramiding into the stock and added to his position.

Centennial would become the number one performing stock on The New York Stock Exchange in 1996. Kier sold the stock when it went on a climax run at the end of December 1996. Centennial ran up 65% in 5 weeks and was 170% above its 200-day moving average, which is excessive. After a 21-month run, Kier locked in a gain of 475% in Centennial.

Kier personally held a sizeable position in the stock and had bought a significant amount for his investors. Kier says, “The gains from this stock had a big impact on my business, my net worth, and validated that the rules of CAN SLIM Investing, when followed correctly, do indeed work.”

After the bear market of 2000–2003, Kier realized that trading wasn’t going to be as easy as it had been in the 1990s. He decided to go to IBD’s Level 3 and Level 4 Workshops to further his market knowledge. Kier listened to the recordings from those workshops over and over and met other high level traders. He found it very helpful to exchange ideas about the market with other investors and continued to keep in touch with several of them.

In 2005, IBD was looking for a national speaker from the Boston area. Kier wanted to audition for the position because he felt it would be a tremendous learning experience. He was given a PowerPoint presentation from the IBD Education Department as the basis for his audition. Kier knows you only get one chance to make a first impression, so he spent two months writing a script and practicing before flying out to California to audition in front of an IBD speaker approval committee. The hard work paid off: Kier was unanimously approved and began teaching workshops for IBD nationally. Preparing to teach each workshop was “like spring training, where I had to go over the principles and basics for every event. Good habits became deeply imbedded and second nature.” Kier taught over 30 workshops for IBD and really enjoyed helping other investors learn and profit from the system.

Kier discovered a shoe company called Crocs in October 2006 that had an impressive 13 quarters in a row of triple-digit sales. The last two quarters had an EPS (earnings per share) growth of 330% and 120%. Sales had vaulted 232% and 309% in the last two quarters. Stocks that exhibit extraordinary earnings and sales numbers like that capture the attention of professional investors. Part of Kier’s research was to look for solid institutional sponsorship in any new position he might take.

Jeff Vinik, a successful hedge fund manager, owned 1.8 million shares at the time, which was up from 468 shares in the prior quarter. Kier knew that a top performing hedge fund manager increasing the size of his position was another strong indication that Crocs might make a major move. He bought the stock out of its IPO base and added to his position as the stock ran up. Kier was sitting on a gain of 378% when Crocs reported earnings on October 31. The stock sold off hard in after-hours trading due to disappointing guidance for the next quarter that was well below expectations. Kier saw the stock crashing (trading down sharply), called his trader, and sold his entire position immediately in after-hours trading, locking in a gain of 362% from his original purchase.

Through his studies of past big market winners, as well as his experience with Crocs, Kier has found that shoe fads can cause a stock to make an explosive move based on a new trend or style. Some examples that Kier has studied are Reebok, L.A. Gear, and Decker’s Outdoor, the maker of Uggs.

In March 2007, Kier bought First Solar, the maker of photovoltaic solar panels. The group was extremely strong at that time, as demand for alternative energy sources soared. Kier bought the stock as it bounced off the 10-week moving average line but got shaken out shortly thereafter when First Solar dropped below that line on heavy volume. He decided to sell the position at that time because earnings were coming out later that week, and one of Kier’s rules is to not hold positions going into earnings announcements if he doesn’t have a profit cushion. The stock then proceeded to double but didn’t offer a good entry point. Kier was patient and waited for First Solar to form another base, and then he bought the stock again. He sold the stock when it once again dropped below the 10-week line on heavy selling volume, locking in a gain of 83%.

In 2008, Kier formed a hedge fund and significantly outperformed the general market by being almost entirely in cash for much of that year’s bear market. The Nasdaq was down 40% that year, and Kier kept the losses in his fund to under 5%. The rules of CAN SLIM pushed Kier to seek the safety of cash during that devastating market correction.

Kier’s investment rules for his new fund would be very similar to what he had learned from his years of teaching for IBD. His top-down approach would include the health of the general market, followed by searching for dynamic companies with new products or services that were in leading industry groups. The fund would focus on top-notch earnings and sales numbers followed by technical analysis of chart patterns and price and volume as an indicator of demand for leading stocks. The overall goal of the fund was to isolate the top 1 to 2% of stocks in the market that could become true market leaders.

He made rules that the fund could hold up to 15 positions at a time, but the market exposure would increase only as previous positions showed profits. Margin would be used when the fund was fully invested and showing significant gains. The concentration level on any given security would be up to 30%.

Other rules for the fund included taking most profits at 20 to 25%, although true market leaders could be held for larger moves. Risk management rules would be strictly adhered to in order to protect against losses, such as a strict sell rule 7 to 8% below the initial cost of the equity. Cash levels could be as much as 100% to protect assets in difficult markets. These rules were time-tested by Bill O’Neil since the 1960s and have led to better results in the market.

In 2009, Kier underperformed and found that buying off the bottom was difficult. The market had gone through a very turbulent time, and most traders were cautious. He found most base patterns were badly damaged, “making it difficult to see what was setting up properly.”

In 2010, Kier was able to find leading stocks more easily that were working in conjunction with the overall market. Some of the stocks Kier was able to notch decent gains in were Priceline, Apple, and Chipotle Mexican Grill.

Kier looks for an average daily trading volume of at least 700,000 (average daily dollar volume of $70,000,000) and tends to drift toward consumer stocks that he really understands.

During the trading day, Kier runs various screens while he is watching the overall market. He also does an extensive analysis of past big market winners. He knows that the patterns of big winners from the past repeat themselves over and over: “Like Bill O’Neil always says, the more you know what past winners look like, the more likely you are to spot a new winner as it is emerging in the current market.”

In the evening, Kier reads eIBD, the digital edition of the paper, and says, “The entire paper is a resource tool that has continually evolved and improved throughout the years.” Every single day, Kier creates a spreadsheet of the Stock Spotlight feature from the paper because he’s found that the “big leaders of any market uptrend will appear in this list.”

The New America article is another IBD feature that Kier uses regularly: “The paper has many sections that help an investor isolate new emerging companies. My most profitable trades have always appeared somewhere in IBD.”

Leaderboard is another product Kier uses to “have another set of eyes and research focused on the same investment philosophy as I do. As a speculator, you should not care who comes up with the idea but rather how you can capitalize on it.”

Kier finds actionable ideas with Leaderboard that dovetail with his own research: “The annotated charts are an excellent reference tool for beginners or even professional investors like me. I also find the cut list helpful during downtrending markets to look for ideas to short.”

Kier uses the weekends for studying. He scanned and enlarged the 100 charts that appear in beginning pages of How to Make Money in Stocks and studies one or two of them each week. It’s the desire to find the next big winner that motivates and excites him.

Kier believes in giving back and likes helping others learn more about the market. For the past six years, Kier has taken on two interns from Boston University every semester and teaches them about stocks and the overall market. He also remains involved in his local IBD Meetup community, teaching lessons several times a year over the last four years.

In searching for the next big winner, Kier notes, “Big leaders take time to develop. Most big moves typically take 12 to 18 months to occur. One has to be willing to sit through intermediate corrections that are often 20 to 25% to capture the big returns. That’s why patience and discipline are, in my opinion, key characteristics of successful speculators.”

Jim is the founder and managing partner of a hedge fund in the Chicago area. When you talk to Jim, his energy and enthusiasm for the market is obvious. He notes, “Opportunities in the stock market are endless if an investor is willing to do their homework, stay disciplined, and learn to be patient.”

Shortly after graduating college, Jim began his financial career as a stock broker. At the time, his dad invested in biotech and drug companies. Jim thought he would try investing in medical stocks as well. His initial buys moved higher, however, when a stock’s price cratered due to a bad earnings report, or when a company didn’t get approval for one of their drugs, the drawdown was severe. Since Jim hadn’t yet developed sell rules, he lost a great deal of money.

For several years, Jim would struggle as a stock broker, continuing to look for a winning system, even trying value investing, but he didn’t have much success with any new strategy. He was determined to succeed, though, so he kept reading various books and publications on investing.

In 1990, Jim came across How to Make Money in Stocks at a bookstore and was immediately intrigued. He also found Investor’s Business Daily and began reading it every day. Jim became such an avid fan of the paper that he would wait till midnight for the truck to deliver the papers to a local distribution center. As part of the learning process, Jim cut out weekly charts from the newspaper and glued them to the back of copier paper box lids. Then he leaned the box lids against the wall and studied the charts over and over. (These were big names in the market like Amgen and Cisco Systems.) He also cut out the New High list from the paper. Looking at this list gave Jim an indication of the overall market health. If leading stocks were continuing to hit new price highs, the market was robust.

That same year, Jim attended his first IBD Seminar with Bill O’Neil and David Ryan. Jim started really understanding the importance of fundamental criteria as well as technical buy and sell signals. He bought every cassette tape that IBD produced and would listen to these educational tapes on the way to and from work every day.

Jim realized that one of the biggest mistakes he had been making was a lack of defined sell rules. The second major problem was that he didn’t have the proper selection criteria for picking stocks. He also hadn’t learned to get rid of the underperforming stocks in his portfolio and move more money into the stocks that were working well. Once he began to implement a few simple rules, his portfolio returns turned around almost overnight.

Jim has attended IBD Workshops once a year and sometimes three times a year since 1990. He wanted to gain a thorough understanding of the investing strategy and base pattern recognition in order to spot potential leading stocks that were breaking out of sound patterns. He knew that buying stocks just as they are coming out of those areas of price consolidation was crucial to making large gains. Jim went over and over his notes from the workshops to cement the finer points of the system. He wanted to make money, and his desire to succeed completely overshadowed his previous challenges.

In 1993, Jim observed New Bridge Networks as it went up 600% in just under a year. He saw that it was highlighted frequently in IBD and was upset that he missed a big winner. But it gave Jim complete faith in the CAN SLIM Investing System and made him ready to commit some serious capital.

In 1995, Ascend Communications appeared in the paper almost every day. This was a true market leader with triple-digit earnings and sales growth. Jim had bought the stock and was sitting on a nice gain when Ascend suddenly broke below the 50-day moving average on heavy volume in October. He sold his entire position, but by the end of the trading day, Ascend closed back above the 50-day moving average. Jim realized that he had made a mistake in selling the stock, but he didn’t go back in. The shakeout had rattled him. Ascend went on to rocket higher in the following months, and Jim missed some big gains.

After that, Jim made a rule that if he gets shaken out of a position, he must go back into a stock on the same day if the stock retakes the 50-day moving average. This benchmark line is a place where large institutional players will often come in to support a position that they hold, so it is a sign of strength if a stock retakes that line with heavy volume on the same day that it falls below it.

By 1999, Jim had made over a million dollars trading, but this was the roaring 1990s, just before the tech bubble burst. Things seemed a little too good to be true, and that was the understatement of the decade. The market avalanche was about to begin.

In 2000, Jim was running a $150 million account for Morgan Stanley. He saw that the market wasn’t acting right: Leaders were topping, many with dramatic climax runs. From January through early March, Qualcomm zoomed 42% in four days, Qlogic surged 75% in 11 days, and Yahoo rocketed up 90% in less than a month. This was abnormal activity. The number of climax runs that were occurring all at the same time was a warning sign to the seasoned investor that the market was topping. Jim went completely off margin and sold all of his holdings. He remembers being in a hotel in Arizona on St. Patrick’s Day, all in cash, celebrating his gains. Then the crash came. Jim had avoided catastrophic losses and saved his clients and his firm enormous amounts of money as a result of heeding what he had learned from How to Make Money in Stocks and what he was reading in IBD at the time about the overall trend and the action of leading stocks.

After the top, people were sending Jim large amounts of money to invest, thinking that it was a great time to enter the market, but Jim let the money sit in cash, because he knew the trend was down: “When it is obvious to the masses and they begin to jump into the market with both feet, you know you’ve reached a major market top.” Clients would call, begging him to buy Cisco Systems after it was down 40%, thinking it was a bargain, but Jim knew that buying a stock that was doing a nosedive was like trying to catch a falling knife. Cisco ended up losing 85% of its value. IBD’s research shows that former leaders correct 72% on average. That is why a buy and hold strategy is very dangerous.

The next three years were very difficult as the ensuing bear market wore on from 2000–2003, although there were a few tradable rallies. A professional trying to make money in the market found this a most challenging time.

Although Jim knew from looking at market history that things would get better eventually, the prolonged bear almost wore him out. It was so bad that people who worked in his office couldn’t wait till Friday. Watching the market week by week was excruciating and often depressing.

About the time that Jim started to seriously worry that if things didn’t turn around soon, he’d be “selling donuts at the local coffee shop,” the market direction changed, and a new uptrend began. It really hit home to Jim that it is often during the darkest hour that the market will bottom and begin to turn up. Since then, he has welcomed bear markets, knowing they clear the decks for new leadership and powerful bull markets. New winners are born, and Jim knows he’ll be there to profit from their enormous moves.

In December 2003, he bought Research in Motion, the maker of the Blackberry. Jim was excited about the stock because of the new technology. People could leave their office and keep up with work and e-mails. The stock’s earnings soared as a result. Research in Motion is a stock that Jim would profit from a few years down the line also.

Jim bought Google in 2005. The company had the “big stock criteria” that Jim always looks for: something completely new and innovative. Google’s search engine would transform the way people searched for information on the Internet.

Jim also saw something very unusual with Google’s up/down volume ratio, which was 2.9. This ratio tracks the trading volume when a stock is rising in price and compares it to the volume when the stock is falling in price. A ratio greater than 1.2 shows positive demand for a stock. At 2.9, the demand for Google’s shares was off the charts. Jim had found while doing research on the biggest winners from the past that they might have an up/down ratio of 1.9 or higher, but 2.9 was the highest he had ever seen (up/down volume can be found in Stock Checkup at Investors.com).

Baidu, which is the Google of China, first came to Jim’s attention after it came public in February 2005. He didn’t buy the stock because its initial base looked faulty, but he kept following it because of the unique story and because many of the market’s biggest winners will have come public within the prior eight years of their big price moves.

By 2007, Baidu had more quarters of earnings and sales data, so Jim could do a better analysis of the company. As Jim did his research, he thought that Baidu looked too good to be true. “It just seemed too perfect.”

Starting in the June 2007 quarter, Baidu had earnings growth of 100% and sales growth of 120%. These were massive earnings and sales numbers, and that is why Jim was able to have conviction in the stock and why he bought shares aggressively. Earnings in the following quarters were 75%, 61%, 100%, and 114%. Sales rose 118%, 125%, 130%, 122%, and 103%.

With more than 1.6 billion people in China and only a small number on the Internet at that time, Jim knew that the stock had enormous potential. Baidu also had government protection and virtually no competition. Several mutual funds, banks, and other institutional investors like Fidelity were taking large positions in Baidu, and this gave Jim greater confidence in the company.

Jim thought that Baidu was likely to have the same success that Google had as an Internet search engine. There was an exploding environment in China with a whole new group of people using the Internet. Barriers were beginning to break down in the Communist regime, and Baidu would go on to become a truly giant market leader.

Even so, as the market turned south late in 2007, Baidu was hit along with several other market leaders. Jim sold his entire position in Baidu, knowing that even the best stocks correct when the market heads lower.

The market went down dramatically from late 2007 until March 2009. The Nasdaq suffered a loss of over 50% due to the banking and housing debacles. But Jim had been through a period like this before with the 2000–2003 bear market, and he knew that eventually the economy would pick up and that new innovative companies would emerge.

Starting in February 2009, Jim noticed that Baidu was beginning to move up again. The stock advanced 13 weeks in a row, which indicated that institutional money was accumulating shares. He also noted that the RS line (relative strength line) was heading into new high ground, something that is often seen in the biggest market leaders. This meant that Baidu was outperforming the S&P 500. Subsequently, on March 12, 2009, the general market began a new uptrend. With the market acting well, Jim reestablished a position in Baidu.

On October 26, 2009, Baidu announced that it was going to change to an advertising platform called Phoenix Nest. The stock sold off heavily on the news because analysts thought earnings were going to be affected by the switch to a different platform. The next day, the stock gapped down 18% and fell below the 50-day moving average. Jim owned a large number of shares and was down several million dollars in his account. He sold a sizeable amount of his position down to the “being able to sleep at night level” and waited to see how Baidu would do in the following weeks.

Baidu traded sideways for 10 weeks but bounced off the 50-day line with heavy volume. Baidu said that the Phoenix platform would solve problems they were having with advertisers, which turned out to be good news. Institutional money went back into Baidu, and so did Jim Roppel.

Baidu had a 10-for-1 stock split in June 2010. Jim reduced his position, knowing that oversize splits can sometimes make a company more lethargic by creating a substantially larger number of shares. He sold another part of his position as the stock broke the 50-day line in June and the final portion in June 2011 after the stock again pulled below the 50-day line. Jim has a sell rule that if a stock has a severe break of the 50-day moving average on heavy volume after a long run, then it must be sold.

Jim ended up making just under $30 million with his trades in Baidu. This illustrates the importance of handling a big winner correctly once you find it. Many people might discover a winning stock but end up selling it too soon or make the mistake of not going back into the stock after being shaken out of it. But this is necessary if you’re going to capture the market’s biggest leaders. And these stocks are the ones that can really change your life if you handle them correctly.

Jim’s overall strategy is to hold a stock for a year, though this isn’t cast in stone. He knows that a big winner may have four pullbacks to the 50-day line along its massive run. He is mentally prepared for a pullback of 20 to 26% with a truly big winner but notes that “you have to literally sit on your hands and stay disciplined as a stock pulls back.” He knows that the equity curve in his hedge fund can come down 20% or more, but this is where the professional investor must have the confidence to sit through pullbacks in order to get the big monster moves. Jim does a lot of research on a company before he buys shares, and this allows him to have the conviction to hold through periods of pullbacks.

Jim is looking for the rare stocks that will make enormous moves. When he is establishing a position in a stock, he could be investing $15 million or more, making liquidity extremely important. Ideally, the average daily dollar volume should be two hundred million or higher (calculated by multiplying the number of shares a stock trades by the stock’s price per share). These are also stocks that are more likely to have institutional support from mutual funds, banks, and pension funds. Jim says part of the “magic sauce for finding the market’s biggest winners is high liquidity combined with soaring earnings growth.”

Baidu went on to make a move of 1,000% from March 2009 to July 2011. This only occurs when the stock is a complete game changer and dominates in its field. The biggest winners have something—a product or service that no one else has. Apple had the iPod, iPhone, and the iPad. Hansen launched the Monster Energy Drink. eBay became a multibillion dollar company with its online auction site, which offers a variety of goods and services. The exciting thing is these innovative companies show up in every new bull market cycle.

Jim found another game changer with Netflix in 2010. Netflix knocked Blockbuster out of business. The United States was in a recession, but people could order movies from Netflix, stay home, and watch them without any late fees. Noting the company’s exceptional fundamentals and innovative business model, Jim bought Netflix in August 2010 and held for the big run, selling his final shares in April 2011 and netting an $8.9 million profit.

Jim’s fund was heavily margined on May 3 going into an earnings report for OpenTable. When the company reported earnings, the stock gapped down significantly on huge volume. Other leading stocks began to break down on heavy volume, signaling some potential trouble for the market. Jim reduced his market exposure by 50% and was able to preserve the gains in his account by moving entirely to cash within a couple of days.

For the rest of 2011, the market was choppy and difficult to trade. Jim allowed himself to get swayed by all the problems in Europe, so in December 2011, when the trend of the market changed and began to head up again, he was late to the game.

Jim notes that identifying the market trend is the trickiest yet most critical part of investing. “You have to stay in sync with the market and not argue when leading stocks begin breaking out and heading higher, because it is then and only then that you are positioned to make a lot of money in the market.”

Despite mistakes, Jim has complete confidence that he will capture a piece of several new leaders in every cycle: “There are huge winners in every bull cycle, and the more you use the CAN SLIM Investing System, the more your confidence builds that you’ll be able to find and profit from a big winner.”

Jim is modest and self-effacing in discussing his successful career, reminding investors that he loses money on at least half the stocks that he buys, but he keeps his losses small and says that “it only takes a few big winners, if you handle them correctly, to significantly improve your life financially.”

In 1995, Eve was browsing through a bookstore looking for stock investing ideas and happened to pick up a copy of How to Make Money in Stocks. She had always found the complexity and speed of change in the markets fascinating and was immediately hooked by growth stock investing possibilities.

Later that year, Eve attended her first advanced IBD Seminar and was excited to meet Bill O’Neil in person. She took her copy of How to Make Money in Stocks up to Bill after the workshop and asked for his autograph. He signed, “Buy the best companies with great earnings, coming out of bases.” It’s something Eve has never forgotten and often reads to remind herself of what to look for in the very best stocks.

Over the years, Eve has attended dozens of IBD Workshops. She says they “reinforce everything that is in Bill’s book.” From them, she has learned what to look for in the technical patterns and key fundamental factors in leading stocks.

In early 1996, Eve bought Whole Foods Market after the stock followed through on a high-volume breakout from a cup-with-handle base and made some nice gains. At the time, Whole Foods had only 35 stores, with plenty of opportunities to expand. Some of the key fundamental numbers included: latest quarter earnings +41%; latest quarter sales +24%; and Accumulation/Distribution Rating A. (This rating measures whether a stock is under institutional accumulation or buying. The rating goes from A to E, with A being the highest.) Whole Foods was one of Eve’s earlier successes, and it’s a stock that she would profit from more than once. Eve admits to being a bit of a health food nut, so she was familiar with the store long before it became a household name. It helped her have conviction in the company and its possibilities.

This success taught Eve a valuable lesson: whenever possible, she visits the store of a company that she is evaluating, or buys a product to see what she thinks of it. She admits to having a closet full of various products purchased for market research, such as the K-Cup coffee makers that Green Mountain Coffee Roasters sells, Lululemon athletic gear, and Michael Kors accessories.

Jim Roppel met Eve through mutual friends and recruited Eve to assist with a new small cap growth fund that he started in 2011.

Eve is very methodical in her approach to the market and investing. She is structured and analytical while following a relatively straightforward routine. She has streamlined the process to what is most essential.

Eve checks the global markets, futures, and pre-market prices and news on stocks in the portfolio as well as watch list stocks to see how they are doing before the market opens.

After the market opens, Eve watches the major indexes and the action of market leaders. Throughout the day, she monitors the 100 or so stocks that she feels might have the potential to become leaders and runs screens to find stocks with exceptional fundamentals that are rising on unusual volume.

An hour and a half before the market close, Eve closely monitors the action of the indexes, market leaders, and stocks on her watch list. Key reversals can happen late in the trading day, so she pays close attention during this critical time.

After the close, Eve takes a break and works out. She runs or does Pilates and feels this is a healthy way to recharge after the market action. Eve also enjoys spending time with her family and friends; this helps put everything into perspective.

In the evening, Eve reads through eIBD and does more online research. She is always looking for new trends and future leading stocks.

If the market has started a new uptrend, Eve tracks the stocks that broke out after the most recent follow-through day. The stocks that break out early and perform the best a few weeks after a new uptrend begins are the ones that may lead the new rally. Eve also monitors how the breakouts act to determine the health of the rally. If a number of breakouts stall or begin to fall below their pivot points, it may lead to a failed rally attempt.

To help assess the health of the market, Eve also monitors distribution and accumulation days on the major indexes as well as price performance and duration of the current rally relative to other market cycles.

Eve conducts a post analysis of her trades and has found that one of the worst mistakes is to take a small profit in a big market leader. These are the stocks that should be held for the bigger run. Eve bought eBay out of its IPO base but was shaken out and never went back in, missing out on the stock’s big move.

Once you have found a market leader, it’s important to put enough capital into it to make substantial profits. Your best-performing stock should be your largest holding. eBay taught Eve a lesson.

As a result, she has learned to always be prepared to buy a stock back if it subsequently turns around and starts to make another move.

In order to control possible emotional trades made in the heat of the market action, Eve has her rules written out and nearby. When she makes a trade, she asks herself what rule is making her buy, sell, or hold onto a stock.

One way to remove emotional trading is to buy on the daily charts and sell on the weekly. The daily action tells you when a stock is breaking out, but the weekly shows the big picture that is valuable in assessing how a stock is acting. To capture the significant moves, it’s important not to be shaken out by the day-to-day market gyrations, instead focusing on the intermediate trend. A weekly stock chart helps put this into perspective.

Eve feels it’s important when entering a position to write out some hold rules and have sell points established ahead of time. This takes possible indecision about when to sell, out of the equation.

Eve also trades in increments to avoid overreacting. She does follow-up buys on positions that are doing well.

She is currently doing a study of the 1998 market and the characteristics of the leaders at that time. Eve studies past markets to help her identify future market leaders. She examines the technical action that all big leaders have in common. One thing that she has noticed is that many of them have breakaway gap-ups early in their run. These big gap-up moves in price can make investors nervous, but they are often characteristic of true market leaders.

Buyable gap-ups should only be entered in stocks exhibiting strong fundamental strength in an uptrending market. The model stock book of stocks that IBD has researched for over 130 years has many examples of stocks with gap-ups that went on to make big moves in the market, but these companies were also leaders in their industry and had strong earnings and sales along with other key fundamental criteria. A more successful buyable gap-up play occurs in a market leader that has already proven itself but is rocketing higher due to a positive earnings report.

When large institutional money goes into a stock, it is a good indication that they have faith in the company and its products or services and see the likelihood of success in the future.

David’s first introduction to the stock market was from his dad, who saw investing as a way to pay for a college education. Since David was pretty young at the time, his dad would talk about companies like Disney so David could relate to them better. When David was 13 years old, he bought his first stock, 10 shares of Hershey’s, the maker of Chunky candy bars. David followed his stock and others in the market, wondering why some stocks would go up and others would go down.

His fascination with the market continued through high school and college. After hearing Bill speak at an investment seminar in Century City, David took a trial of Daily Graphs. When he went down to pick up the chart book each Saturday, Bill O’Neil was often there answering people’s questions. David listened to these conversations, riveted.

Once he graduated from UCLA, David showed up at the O’Neil offices and offered to work for free. He met with Kathy Sherman, Bill’s executive assistant at the time, who recognized David’s energy and enthusiasm for stocks and the market. David left thinking nothing might come of his visit to the O’Neil office, but by the time he got home, there was a message on his phone machine saying that Bill O’Neil wanted to interview him. A few days later, when Bill was interviewing David, he asked him what he wanted to do in five years. David wasn’t really sure, but replied, “I know you’ve been successful. I just want to learn all that I can.”

David started in the institutional area of the firm doing research and learning everything about the CAN SLIM Investing strategy. A new bull market began in August 1982, and David started investing, using what he had learned since joining O’Neil + Company®. He says, “I did pretty well for about a year and a half but was making lots of mistakes and gave back most of my gains.” David went back and studied his trades and came to the conclusion that he was buying stocks that were too extended. He decided to become extremely disciplined and from then on, “My performance really started to take off.”

David rose to national attention by winning the U.S. Investing Championship three times between 1985 and 1990. This competition was sponsored by a former Stanford professor and involved real money in real accounts. Each year, approximately 300 contestants, including portfolio managers, market letter writers, and individual investors competed to see who could achieve the best returns.

David says, “The CAN SLIM principles are all laid out for you, but it’s your job to adapt it to your comfort level and make it work. It will require some studying, but to be successful in anything, you have to be willing to put in the time.”

From 1982 to 1985, one of David’s primary responsibilities was working closely with Bill to advise the firm’s 500 institutional clients on individual stock selection. David also managed several investment portfolios for William O’Neil + Company.

David worked with Bill for nearly 17 years, and though he respected Bill enormously and had learned an incredible amount from working with him, he felt it was time to “stretch his wings,” so he started his own hedge fund in July 1998.

David feels his longevity as a professional investor stems from the fact that he controls risk as much as possible and doesn’t let losses get out of hand, noting that “if it is your own account, you might be able to take more risks, but not when you’re dealing with people’s retirement money and their family wealth.”

He likes investing in retailers because “you can go into a store or restaurant and get a good feel for them.” David usually trades around a core position in a stock, so if he owns 20,000 shares, he may cut that down to 10,000 if the stock is basing or the market is pulling back and then “ramp shares back up as the stock begins to take off again.”

In recent years, he’s had success with stocks like Chipotle Mexican Grill, Apple, and Caterpillar.

The key factor that will help you stick with a winning stock is to make sure you know its underlying story. What is making the company successful? What are the key concepts that will keep it highly profitable? Will the company go from having 250 stores to over 500 in the next few years? Are they producing a product that is in big demand?

David feels that even if someone has another job, it’s important to have a trading account of some kind: “Try to put in a half hour of study each day and begin to put the CAN SLIM principles to work. IBD does a great job of highlighting the best stocks in the best groups. All you need are one or two great stocks in a year, and you can achieve some outstanding results.”

He says that “CAN SLIM Investing is the fastest way to make money in the stock market, but the key is to have discipline. There are some straightforward rules that you must follow.”

David is passionate about the market and investing, “and this has taken me through some difficult, challenging markets.”

He also adds that while it’s great to make money, there are other things that are more important: “Faith, family, and friends are the most valuable. Keep it all in perspective.”

“Fast as the wind, quiet as a forest, aggressive as fire,

and immovable as a mountain.”

—SAMURAI BATTLE BANNER

This saying mirrors the quiet but swift decisions that a professional must make while trading. Mike and Charles have been portfolio managers for O’Neil Data Systems, Inc., for over a decade. They are hard-working and passionate about the market, and both are polite and unassuming despite the tremendous amount of success they have had in their trading accounts, both professionally and personally.

Mike had been interested in investing since he was very young.

“When I was 24 years old,” Mike says, “I read Peter Lynch’s One Up on Wall Street, which had a profound impact on how I looked at a company’s products and services. Lynch was a buy-what-you-know guy, and that just made sense to me, so I was on the lookout for that great next product to give me an edge. Around that time, I took a tour of the Robert Mondavi Winery up in Napa Valley, and I was blown away. I couldn’t believe the amount of detail that went into every aspect of the business, from how they avoided diseases that would kill the grape vines down to inventing new nonspill wine bottles. I went home and ordered all of their annual reports and read them cover to cover. Though I was too new to investing to really understand the data, I was absolutely convinced that this was going to be a great stock. The only problem was, I didn’t have any money. I was just a couple of years out of college and living paycheck to paycheck. I wanted to buy a round lot of 100 shares but didn’t have enough money, so I started saving and scrounging up whatever I could. Meanwhile, the stock didn’t wait for me; it ran up from $7 to $14. I realized I was going to miss the stock’s move if I didn’t act fast, so with all the money I had, $540, I bought my odd lots. As I saved more money, I continued buying more shares, and the stock more than doubled by the time I finally sold. I learned a great deal from that experience. Always be on the lookout for new products; they are what drive a stock’s move up.”

For Christmas that year, Mike’s parents bought him How to Make Money in Stocks. “Little did I know this book was going to change my life,” After he read Bill’s book, he recalls saying to himself, “I’ve just got to work for this guy.”

Mike remembers thinking he had won the lottery after he was hired by William O’Neil + Company to work in the research department. Not long after being hired by the firm, he was in an accident, and his car was totaled. As he sat on the curb waiting for his wife to pick him up, he says, “I felt like I was given a second chance in life and didn’t want to waste it. Right then I wrote down my short- to long-term goals. The key goal was to become a portfolio manager for Bill. I looked at that sheet every day, and it kept me highly motivated, working long hours every day.”

Soon after that, Bill gave an inspirational speech to the research department. Mike approached Bill afterwards and told him he wanted to be a portfolio manager. Bill said he wasn’t really looking for a portfolio manager but said, “Put some of your trades together, and come talk to me.”

Mike assembled several past trades and current stock ideas and nervously entered Bill’s office. He says, “I’ve never been so nervous in my whole life. Bill was pretty tough on me.” Mike felt “devastated and demoralized” after the meeting but realized that the charts he had given Bill were stretched and not properly sized, so Bill thought a lot of stocks Mike was investing in had charts that were very wide and loose (volatile price movements) when in fact they were not.

A longtime employee asked Mike, “How much time did Bill spend with you?” When Mike responded an hour and a half, she said, “Bill wouldn’t have spent that much time unless he saw something promising in you. Hang in there.”

Mike kept plugging away and had more meetings with Bill regarding his trades. Bill saw improvements in how Mike was handling stocks and that he had listened to his feedback. In late December 1999, after reviewing several of Mike’s trades that were well executed using the CAN SLIM Investing System, Bill offered Mike a job as a portfolio manager, making Mike’s dream come true. The following year, Mike was lucky enough to start working in Bill’s office, where he stayed for a few years. He says, “That was such a special learning experience and very motivational. No one works harder and is more positive than Bill. He is a great role model and mentor.”

After working with Bill for awhile, Mike realized that Bill lives in the moment as a trader: “One week Bill could dislike a stock and then a couple of weeks later turn around and start buying it. That flexibility has kept him in phase with the market for over 50 years. He doesn’t care what he said in the past. When the facts change, he changes with them.” He recalls a lesson Bill taught him when reviewing a mistake that he had made. Mike round-tripped (letting a gain fall back to the purchase price) a big position, letting a large gain evaporate. Bill said, “You always need to be flexible, bending like a tree in the wind. Don’t freeze up. If a stock starts acting poorly, start selling at least some of it, then reassess and sell more if warranted.”

“Bill isn’t afraid to make mistakes and doesn’t really care what anybody thinks. He doesn’t have an ego but has more confidence than anyone I’ve ever met. If Bill makes a mistake, he’ll correct it quickly, but if the stock turns and sets back up, Bill will go back in and buy the stock back, only with slightly more money than the first time around, putting him in the offensive position.”

“Bill has the ability to truly capitalize on the market leader. Once he has a profit cushion with a stock, he will sit with it and add at logical points as the stock rises in price. He spreads his purchases over several weeks and months. This great stock-picking skill and patience completely separates him from all other traders.”

Another thing Mike learned from working with Bill is to always be looking for new ideas. Bill looks at hundreds of charts over the weekend, and so does Mike.

Mike says, “Studying hundreds of charts on a regular basis gives you an edge. You start to notice that stocks have different characteristics, just like people do: some are slow and steady, others are erratic, and there is everything in between. Once you can key into the stock’s character, you can know what to expect, when is it acting normal, and, more importantly, when it breaks character. This is a skill that anyone can learn if you study enough charts.”

“The only time I said no to Bill as a portfolio manager was when he asked me to teach the IBD advanced workshops,” says Mike. “I was absolutely terrified of public speaking.” Bill didn’t understand Mike’s fear but encouraged him by saying, “You know everything about the system backwards and forwards.”

Mike continued to struggle with his fear of public speaking but began teaching the advanced workshops with Bill and really saw value in the seminars from the feedback he received from the attendees. Bill always said to everyone who helped out with the workshops, “We are getting as much out of the seminars as other people because of all the tremendous work we put in before we teach. It forces us to really follow the system.”

Mike thinks the workshop animations have helped him the most as a trader: “At the Chart School Seminar that I teach with Charles Harris, we go over animations taking stocks day by day through their move. We stop at various points, letting people know what we would do with the stock. When I’m conflicted with a decision in a real trade, I imagine I’m going over it at a seminar, and it gives me clarity.”

For a newer investor, Mike cautions, “Don’t try to make a lot of money right off the bat. Making money shouldn’t be the primary goal. Learning the system should be, then the money will come. The worst thing that could happen is that by a fluke, you make a lot of money with bad habits in a more forgiving market.” He suggests, “At first just trade with 10% of what you were planning on investing. Learn to make mistakes and how to correct them before investing a larger portion of your capital.”

The study of bull and bear markets helps illuminate the larger up and down trends that the market goes through and repeats decade after decade. Helping investors understand the overall market trend has been one of Bill O’Neil’s goals since before the inception of the newspaper in 1984. Having historical data to help interpret the market’s trends over the years is enormously helpful.

“If you enjoy studying the market and past winning stocks, eventually you’ll find a perfect precedent for a current time period. In early 2003, I realized that a chart of the Dow from 1929 to 1932 looked just like a chart of the 2000 to 2002 period on the Nasdaq; in fact, they were almost identical. I also found a precedent from the bull market that started in March of 1933, in which the Dow looked just like the Nasdaq in March of 2003. So I used that precedent as a roadmap to trade aggressively during that time frame. That is why Bill has us studying past stocks and markets because nothing ever changes.”

Over the years, Mike has created many products used for the company. His first was Stock Checkup for Investors.com. He also created the IBD Composite Rating because Bill wanted a way for investors to quickly evaluate the overall strength of a stock fundamentally. The Composite Rating combines key characteristics like earnings growth, profit margins, the level of institutional buying over the last 12 weeks, and other fundamental data designed to help investors find the best stocks faster. Stocks are given a numerical rating from 1 to 99, with 99 being the best.

Mike also helped develop the MarketSmith 250 Growth Screen. He admits to being a “screen junkie,” so this product was created to save people time with just one comprehensive list of stocks worth researching rather than building countless screens. This list has over 30 different themed screens that are combined into one list that filters for technical and fundamental stock data like price performance, earnings, liquidity, return on equity, and pre-tax margins, among other criteria. Mike says, “Learning how to screen properly takes years, and we wanted to speed up everyone’s learning curve. The product was really created to save people time. I use it every week.”

Pattern Recognition, another product that Mike helped develop for MarketSmith, uses algorithms to create chart base patterns and to identify buy points. Through a lot of hard work, Mike was able to get the computer to identify and draw the base. If an investor is newer to chart reading, this helps locate the stocks that are consolidating and getting ready to break out. For the more seasoned trader who already knows how to read charts, it’s a time saver: “Having the percent from the pivot, depth, and stage of the base is great—it’s like using a calculator instead of doing the math by hand.”

Market School is a new seminar that Mike teaches with Charles Harris. Mike says, “Charles and I worked with Justin Nielsen to come up with several buy and sell rules based on the market’s price and volume action to give us a guideline for how deep to be invested. We knew that a follow-through day would get us in the market. And a lot of distribution days would signal a top. But the problem was the period of time in between a market bottom and a market top. Bill has a great sense for how deep to be invested based on his decades of experience, but we aren’t Bill. So with countless hours of back-testing, we came up with a set of rules that work extremely well. Our goal was to be in line with how Bill trades and looks at the market.”

A product that Mike didn’t work on but that he really likes is Chart Arcade. He said his 10-year-old daughter got him hooked on it. It’s a stock market game created by the MarketSmith team, where investors can buy or sell historical charts based on price and volume action. Mike says, “You get immediate feedback whether a stock you bought or sold was the right decision, and this can really speed up your learning curve.”

(Investors can practice their skills for free at Chartarcade.com.)

Mike’s overall advice is, “Read How to Make Money in Stocks, and stick to the CAN SLIM Investing System. Put in a few hours of study each week, and you will be able to have that extra spending money or a larger amount of money to retire on. But if you want to truly change your life, it’s like everything else: it takes a lot of time and hard work, but it pays off.”

Charles was a commercial real estate appraiser working toward his MAI designation (Member of Appraisal Institute), but he was very unhappy with the work and wanted to find a new career. He had always been interested in the stock market, so when he saw a posting on the UCLA jobs board for William O’Neil + Company, he decided to apply. Charles got a rejection letter that thanked him for his application but said he wasn’t quite right for the job. A few years later, William O’Neil + Company was looking for an MBA to work as an analyst in the research department. Although Charles did not have an MBA, he applied for the position anyway, and this time he prevailed. At the time he was hired, Charles was primarily a value investor and was “dabbling in the market and investing in low P/E stocks without much success. I didn’t even know who Bill O’Neil was back then.”

Charles’ initial plan was to get his foot in the door, spend a year or two getting some valuable work experience in the financial industry, and then move on to a job as a securities analyst. Toward that end, he began pursuing his CFA designation.

His responsibilities in the Research Department gave him access to stock data and detailed reports of individual stocks prepared by securities analysts from all of the major investment firms. Charles figured that with access to these reports, he would be able to pick the very best stocks and make a killing in the market: “When I read these reports that were so well researched and so persuasive, I called my wife and told her, ‘We’re going to be rich!’ Instead, I lost half of my money in about three months. I was very naïve, but it taught me a very important lesson: Don’t rely on the opinions of others. Do your own research, and come to your own conclusions.”

From September 1995 through the end of 1996, Charles didn’t have much overall success with investing, despite trying to learn all that he could about the CAN SLIM Investing System. Although he was able to pick some winning stocks, he had a tendency to hold onto his losers far too long, and as a result he lost money on a net basis.

So in December 1996, he sat down and had a serious discussion with himself. He contemplated, “Who am I as a trader? What are my strengths and weaknesses? What are the basic rules that I must follow if I am to be successful?” Charles wrote down a whole set of trading rules based on a post analysis of his actual trades over the prior year, as well as the teachings of some of the great trading legends, including Bill O’Neil, Nicholas Darvas, and Jesse Livermore. This became his “Trading Manifesto,” which detailed his personal strategy to take advantage of his inherent strengths and laid out the trading rules that he would be bound to from that day forward. Immediately after that, Charles began to have “big success” in the market, running his personal account up over 1,500% over the next 18 months.

Unfortunately, Charles learned the hard way that great success often results in an inflated ego, and during the brief bear market that took hold from July 1998 through early October 1998, Charles lost three-quarters of his money: “My failure was brought on by my own hubris, and I continued to trade stocks despite the fact that the environment was treacherous, and the odds were against me. I had lost my discipline and self-confidence and almost gave up trading altogether, figuring that my earlier success was just beginner’s luck.” Having earned his CFA designation several months earlier, he applied for an analyst position at a money management firm.

Thankfully, Charles did not receive an offer, because as the market turned in October 1998 to begin the last leg of the great bull market, he went back to the rules that led to his earlier success and reclaimed both his discipline and confidence. In 1999, Charles had a huge year in his personal account and was up over 1,000%. Upon hearing of his success in the market, he remembers Bill saying to him, “Just remember, we all put our pants on one leg at a time.” Based on his own successes over the years and having worked with dozens of traders, Bill knew that successful traders often get a “swelled head. Maybe he was trying to warn me not to get too carried away with myself. I wish I would have listened.”

Toward the end of 1999, Charles approached senior management and expressed his desire to be a portfolio manager for Bill. A couple of weeks later, after his trading results were reviewed, Bill took Charles to lunch and explained that he didn’t need a portfolio manager but was looking for someone to support the current portfolio managers as a research analyst. Bill added, “Maybe in the future, you’ll get some money to run.”

In January 2000, Bill moved Charles to a cubicle just outside his office and had him research stocks that he and the portfolio managers were interested in. During the first eight months of 2000, Charles was up over 800% in his personal account. After observing his trades, Bill gave Charles money to manage in June 2000, which coincided with the beginning of a brief, yet incredibly strong countertrend rally. After just six weeks of managing money for Bill, Charles’ account was up more than 50%. “I was on top of the world,” he said. Little did Charles know, that was the beginning of a long, dry period.

“My hubris had once again raised its ugly head. I had become overconfident and loose with the rules. When the market broke badly in September 2000, I ignored the fact that the bear market trend had resumed and kept trading anyway. I had done so well up to that point that my ego was totally out of control. I had lost all my discipline. I was like an addict.”

Charles ended up giving back the bulk of his profits in his firm account and lamented that his personal account took a huge hit as well. “There is no substitute for experience, and until you’ve been in the investing battlefield, it’s hard to understand this,” he says. “The market was cracking wide open. The Nasdaq dropped over 45% in just four months. I started losing huge amounts of money. The only thing that saved me was my experience from the 1998 bear market, when I had nearly blown up my account. I knew I was out of control, so I just started wiring funds out of my personal account so I couldn’t trade. I ended up preserving about two-thirds of my capital. The rest of the money…gone. This was demoralizing and left a big impact on me.”

Charles went back to his trading plan and, with a little time and a few “good” trades, recovered his discipline and confidence. He has learned the hard way to “always maintain your discipline and keep your ego in check, because breaking rules in the market will cost you a lot of money.” He added, “I’ve really learned the importance of trading in line with the trend of the market, and to not draw down too much because it’s so hard to come back psychologically after you’ve dug a deep hole. It can take years just to get back to even…what a waste.”

When Charles and Mike Webster first became Portfolio Managers for Bill, they worked side by side in his office for two years. Each day they would compare their trading results. “I guess it was an ego thing, a way of measuring yourself. But in truth, comparing my progress with Mike put an enormous amount of pressure on me. Even if I was trading well, I’d feel crummy if he was doing better than me. But if I was beating him, I’d feel just fine, even if I wasn’t really trading that well. It made absolutely no sense.

“I learned to go into a cocoon and stay isolated, like the legendary trader Nicolas Darvas, or the ‘lone wolf’ Jesse Livermore, so that I wouldn’t compare my trades or my results to anyone else’s. You don’t have to be a genius to do well in the market, but you do have to keep your ego under control so you won’t break the rules and make careless mistakes.” To his credit, Bill isolates all of his Portfolio Managers and doesn’t let them know where they stand in performance relative to each other. He knows that doing so would only put additional pressure on them.

The many years of teaching investing workshops have made Charles realize that every trader has their own inherent strengths and weaknesses: “For some, it’s very difficult to cut losses. Other investors may not have the patience or fortitude to hold on for the big move. They satisfy their ego by locking in their profits early and miss out on the big money.”

“To overcome weaknesses, Bill has taught me to

1. Admit that you have some shortcomings. Some investors refuse to take responsibility for their own results, and they end up never succeeding.

2. Do a post analysis of your trades; your weaknesses will pop right out.

3. Write down rules to help you overcome your trading flaws.”

“In writing down my own rules and strategy, I really defined what style of trading comes most naturally to me. I am more of a swing trader. I am most comfortable taking profits into strength when my analysis of the stock’s action tells me that a pullback is in store, and I tend to buy on pullbacks to the major moving averages or other support levels in stocks that have proven that they are market leaders. I am a much better singles hitter than a homerun hitter. That style is consistent with my personality, so I don’t fight it. Bill has proven over the years that he is a great homerun hitter, so he may trade a little differently than I do. That’s okay. Bill said to me a long time ago, ‘If what you’re doing is working, don’t change it.’”

“Bill has been an inspiration in many ways. For one thing, his work ethic is unparalleled. There is nobody at the firm who works harder than he does. He is very flexible when it comes to the market and individual stocks. He can change his mind on a dime, and yet he has conviction when it’s appropriate. One of the things that I admire most is the fact that he has never blown up his account, which is rare among traders. He will never hesitate to cut a loss if his stock starts acting poorly, no matter what he thinks of the company or how much he likes the stock. He is one of the few investors who made a fortune trading his own money. Most of the wealth in the financial field is based on trading other people’s money. Bill is proof that making a fortune in the market can be done … it’s just a matter of stringing together a few big winners and handling them properly. Of course, that’s easier said than done.”

“Bill’s genius is that he truly has a knack for finding that special stock in a bull cycle that turns out to be a gigantic winner, and he has the ability to capitalize on it and make the big money. He doesn’t always find every great stock; he misses some. I remember him telling me once that ‘you can’t kiss all the babies.’ But you only need a few big ones over your lifetime to make a fortune. Look for the game changing stock, a company that has something really new and unique. Bill devised CAN SLIM to help investors identify these types of stocks.

“I’m up over 40 times my original principal since 2001 in a non-margined personal account. This is during a period when the broad market indexes have been relatively flat on a net basis. To achieve gains like this, you need to trade the windows of opportunity that present themselves and not give it all back in a correction.

“The stock market has changed my entire life. Everything I own and have been able to provide for my family has been the result of trading successfully. Anyone can do it, but you have to really want it and work hard at it. It’s not easy, and it doesn’t happen overnight. There are no shortcuts. You have to believe in yourself, and you have to believe in your trading strategy. With patience, hard work, and discipline, you will be successful.”