Simple Weekend Routine: This uses two of IBD’s most powerful screens to identify stocks that have CAN SLIM® traits and are near a potential buy point right now.

Simple Weekend Routine: This uses two of IBD’s most powerful screens to identify stocks that have CAN SLIM® traits and are near a potential buy point right now.Want Good Results? Stick to a Good Routine!

Busy During the Day? Set Automatic Trade Triggers

“We are what we repeatedly do. Excellence, therefore, is not an act but a habit.”

—ARISTOTLE

It’s impossible for me to overemphasize how important it is to have a routine that:

1. Helps you identify the best stocks before they surge.

2. Fits your schedule.

Both elements are crucial. You could have the greatest routine known to Wall Street, but if you don’t have time to use it regularly, what good does it do you?

That’s why these routines are designed for busy people with limited time to invest.

Maybe you work during the day. Maybe you’re retired. Either way, I’m sure you have family, hobbies and other interests outside of the stock market—those things we commonly refer to as “life”!

So here are two routines designed to be quick and easy for anyone to use:

Simple Weekend Routine: This uses two of IBD’s most powerful screens to identify stocks that have CAN SLIM® traits and are near a potential buy point right now.

Simple Weekend Routine: This uses two of IBD’s most powerful screens to identify stocks that have CAN SLIM® traits and are near a potential buy point right now.

10-Minute Daily Routine: Keeps you on top of the market throughout the week and makes sure your watch list and game plan stay up to date.

10-Minute Daily Routine: Keeps you on top of the market throughout the week and makes sure your watch list and game plan stay up to date.

Think of the Simple Weekend Routine as your core prep time. It’s where you update your watch list and make your game plan so you’re ready for the week ahead. Once that’s in place, use the 10-Minute Daily Routine to refresh and execute your plan as needed.

Understand that these are just two sample routines to get you started. As you become more familiar and comfortable with CAN SLIM investing and Investor’s Business Daily, you might come up with your own routine.

More Routines by Successful CAN SLIM Investors

You can learn about the investing routines of other CAN SLIM investors by reading my radio show co-host Amy Smith’s book, How to Make Money in Stocks—Success Stories. I think you’ll agree it’s a very inspiring and informative read.

You can learn about the investing routines of other CAN SLIM investors by reading my radio show co-host Amy Smith’s book, How to Make Money in Stocks—Success Stories. I think you’ll agree it’s a very inspiring and informative read.

I encourage you to jump right in and start using these routines, but with one important caveat: Don’t buy any stocks until you’ve gone through the Selling Checklist chapter. Buying stocks without having a selling game plan is like driving a car with no brakes—very exciting at first, not so pleasant at the end!

So be sure to go through the Selling Checklist and understand basic sell rules before you invest.

Have You Started Your Free Trial of IBD?

To start your free trial and get access to the tools in these routines, visit www.investors.com/GettingStartedBook. You’ll also find short videos that walk you through each step of the daily and weekend routines.

To start your free trial and get access to the tools in these routines, visit www.investors.com/GettingStartedBook. You’ll also find short videos that walk you through each step of the daily and weekend routines.

20–30 Minutes

20–30 Minutes

Step 1: Check overall market direction in The Big Picture.

Don’t ignore this step—it’s critical. Most stocks move in the same direction as the overall market, either up or down.

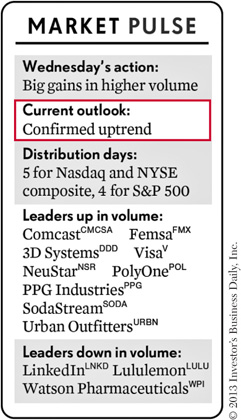

So as we noted earlier: Only buy stocks when the Current Outlook says “Confirmed uptrend.”

I strongly encourage you to read The Big Picture regularly. It gives invaluable insight into what’s happening in the market—and how to handle it.

When & Where to Find It

The Big Picture is found daily in the Making Money section of IBD and on Investors.com.

Step 2: Look for stocks near a buy point by quickly scanning the IBD 50 and Your Weekly Review.

Look at the one-line analysis below the chart for each stock. Circle or make note of any stocks said to be nearing or in a potential buying range.

When & Where to Find It

The IBD 50 is updated every Monday and Wednesday in the Making Money section of IBD and e IBD.

(The Monday print edition is delivered on Saturdays in most areas so you have it in time for your weekend routine.)

Your Weekly Review is published every Friday in the A section of IBD.

Step 3: Use IBD Stock Checkup to see if the stocks you circled pass the Buying Checklist.

In Stock Checkup, you’ll find pass, neutral or fail ratings for most items on the checklist.

And if you’re not familiar with the company and what it does, check out its website and read what IBD and others have written about it. You’ll find links to articles in Stock Checkup.

You may also find the stock was recently covered in a Daily Stock Analysis or Market Wrap video on Investors.com.

When & Where to Find It

Stock Checkup is available on Investors.com and updated daily.

Step 4: Add the strongest stocks to your watch list.

Make a game plan for each stock that has passed the Buying Checklist and is near a potential buy point:

What is the ideal buying range? (Chapter 6)

What is the ideal buying range? (Chapter 6)

How many shares will you buy if it breaks out?

How many shares will you buy if it breaks out?

Watch to see if any stocks on your list break out in the coming days and weeks. (Make sure each stock still passes the Buying Checklist and the market is in an uptrend at the time of the breakout.)

You can also set up automatic trade triggers with your broker ahead of time (see “Busy During the Day? Set Automatic Trade Triggers” later in this chapter).

Also see “How to Build and Maintain an Actionable Watch List” (Chapter 7).

Tune in to IBD’s Weekly Radio Show

Join Amy Smith and me each week for a look at the current market and how to use CAN SLIM® rules to handle it. For details on how to tune in, visit www.investors.com/radioshow.

Join Amy Smith and me each week for a look at the current market and how to use CAN SLIM® rules to handle it. For details on how to tune in, visit www.investors.com/radioshow.

• ACTION STEPS •

10 Minutes

10 Minutes

Step 1: Check overall market direction with The Big Picture.

Scan The Big Picture for answers to these questions:

Any changes in market direction (e.g., from correction to uptrend)?

Any changes in market direction (e.g., from correction to uptrend)?

Which leading stocks are moving up in big volume?

Which leading stocks are moving up in big volume?

What trends are emerging—and how should you handle them?

What trends are emerging—and how should you handle them?

You can also watch the Market Wrap video for a 3–4 minute overview of the day’s action and highlights of selected leading stocks.

When & Where to Find It

The Big Picture is found daily in the Making Money section of IBD and on Investors.com. The Market Wrap video is found daily at Investors.com/IBDtv.

Step 2: Review stocks you own or have on your watch list.

Pull up a chart to see how your stocks are faring:

Any buy or sell signals in the stocks you own?

Any buy or sell signals in the stocks you own?

Have stocks on your watch list broken out or broken down?

Have stocks on your watch list broken out or broken down?

You can also do a search for your stocks on Investors.com to see if IBD wrote about them recently.

If you take a minute to regularly check your stocks, you’ll become much better at spotting any changes in trend. The more you do it, the faster— and more profitable—it gets.

When & Where to Find It

Use Stock Checkup and IBD Charts on Investors.com.

Step 3: As your schedule allows, look for new stock ideas.

You’ll probably do most of your research on the weekend, but if you have time during the week, here are some other places to find timely stock ideas:

Sector Leaders

Sector Leaders

Stock Spotlight

Stock Spotlight

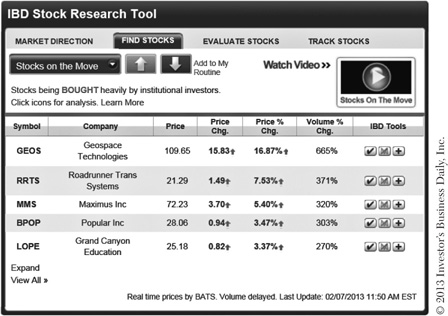

Stocks on the Move™

Stocks on the Move™

Daily Stock Analysis video

Daily Stock Analysis video

See Chapter 7, “More Tips and Tools for Getting Started Right,” for how to use these and other features to find winning stocks.

Step 4: Adjust your game plan and watch list as needed.

Based on what you find in Steps 2 and 3, add or remove stocks from your watch list, and adjust your buying or selling game plan as needed.

Remember: You can set up automatic trade triggers with your broker ahead of time.

The key to spotting big winners early is to have a regular routine. Whether you use these routines or something better fitted to your schedule or investing style doesn’t matter. What’s crucial is that you come up with a plan that works for you and stick to it.

As motivational speaker Brian Tracy has said, “Successful people are simply those with successful habits.”

• ACTION STEPS •

If you work during the day and can’t watch the market, you can set “conditional orders” ahead of time with your broker.

It can be a great way to catch a big breakout—even as you’re plugging away at your day job. And when you’re on vacation and can’t watch your stocks closely, you also can set conditional sell orders to lock in your gains or cut short any losses if the stock declines.

Important: Talk with your broker before placing a conditional order for the first time. Certain brokers have different ways of setting up these types of trades.

For example, some allow you to set them up based on both price and volume, so you can make sure institutional investors are buying heavily as the stock breaks out.

So before you start using trade triggers, call your brokerage service, tell them what your objective for the order is, and have them walk you through the various offerings they have to meet your needs.

Here are some basic examples.

Purpose: To buy a stock as it breaks out from a proper buy point

Use a buy stop order when you want to buy a stock, but only after it climbs higher and hits a certain price.

Let’s say you find a stock on the IBD 50 that passes the Buying Checklist and is near a potential buy point of $30. But right now, it’s trading at $29.50.

On Saturday or Sunday, after you’ve done your research and set your game plan using the Simple Weekend Routine, you could log in to your online broker’s website and set a buy stop order for $30.

If a few days or weeks later the stock hits the target $30 share price, your trade will get triggered automatically. (You can set an expiration date for your conditional order: If it doesn’t get triggered within that time frame, the order is cancelled.)

If your broker doesn’t let you use conditional orders that track both price and volume, be sure to check the volume after your trade has been triggered. You want to see a nice spike in the number of shares traded when a stock breaks out. That confirms institutional investors are buying aggressively. (More on that in Chapter 6, “Don’t Invest Blindly.”)

Purpose: To automatically cut short any losses

We’ve already touched on the cardinal rule of selling: Always sell if a stock drops 7% to 8% below what you paid for it. You can use stop-loss orders to make sure you stick to that rule, and it’s very easy to do.

Let’s say you bought a stock at $100 a share. If you set a stop-loss order at $93 (i.e., a 7% loss), then the stock will be automatically sold at the market price if it slips to that target.

If you have a hard time selling—if you’re afraid you might “freeze” when it’s time to get out—having a stop-loss order in place can put your mind at ease.

Purpose: To lock in the bulk of your profits if a stock starts to decline

Trailing stop-loss orders can be very useful but also a little tricky, since there are several different versions. So call your brokerage service and have them show you the right way to set them up.

Here’s just one way you can use a trailing stop-loss.

Let’s say you bought a stock at $100, and it’s now trading at $150. Congrats—you’re sitting on a nice 50% gain!

The last thing you want to do is let those profits disappear, so you could set up a trailing stop-loss order to make sure you automatically lock in a good portion of your gains if the stock starts to head south.

Let’s say you set a trailing stop of 10%. (You can choose a percentage or dollar amount.)

If the stock drops 10% below the current $150, the sell order would be triggered, and you’d lock in the remaining profits. (Still a nice gain of 35%.)

But let’s say the stock doesn’t decline 10% and instead shoots up to $200—giving you a 100% gain.

Your 10% trailing stop-loss order would be automatically adjusted to that new current market price. Pretty convenient, right?

So now if the stock did start to decline and dropped 10% below the $200 mark, your sell order would get triggered—locking in the bulk of that big gain.

Using automatic trade triggers can be a great way to make sure you don’t miss out on a big breakout—and safeguard your profits if a stock begins to drop.

Just make sure you use them correctly. Talk with your broker about how to set them up, and be sure to watch the market as often as you can. Conditional orders are definitely convenient and a big help to busy investors, but remember: There’s no substitute for staying engaged and keeping a close eye on your stocks.

Here are just a few examples to give you a sense of the kind of big gains you can capture using the Simple Weekend Routine as your starting point.

Keep in mind: Big winners like the ones below emerge in every strong uptrend, and you can find them if you just regularly follow that basic game plan.

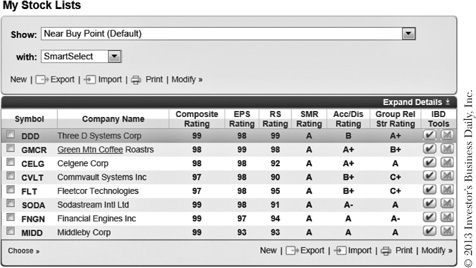

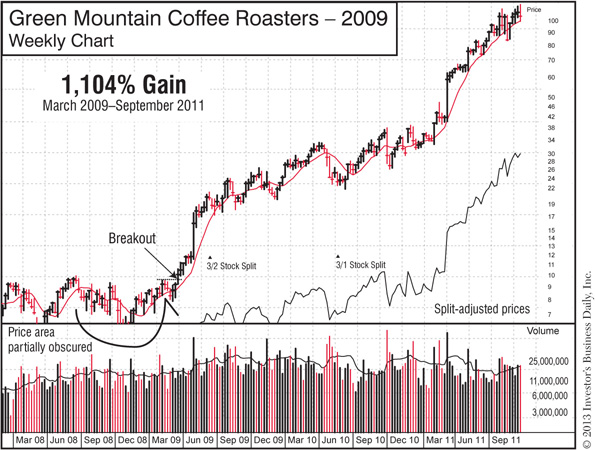

Here’s a day-by-day look at how you could have found Green Mountain Coffee Roasters before it broke out and soared over 1,000% from March 2009 to September 2011. The information below is what you would have found if you were doing the routine on the weekend of March 13–15, 2009.

Step 1: Check overall market direction with The Big Picture.

On March 12, 2009, the Market Pulse outlook changed from “Market in correction” to “Confirmed uptrend” (called a “rally” at the time).

That told you a new uptrend was just beginning, following the 2008 bear market.

Follow the market, not the news!

Despite investor fears and bad economic news after the housing and financial crisis, the market action showed it was time to buy.

Step 2: Look for stocks near a buy point by quickly scanning the IBD 50 and Your Weekly Review.

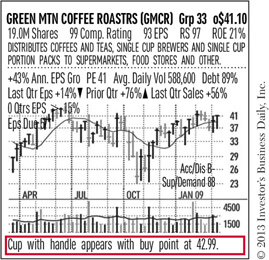

The same day the market direction changed to “Confirmed uptrend,” the analysis for Green Mountain Coffee Roasters in Your Weekly Review said: “Cup with handle appears with buy point at 42.99.”

Green Mountain was also featured in that day’s Daily Stock Analysis video.

With the general market in an uptrend and Green Mountain near a potential buying area, it definitely merited further review.

New to charts? Note how Your Weekly Review identified the chart pattern and buy point. That’s a huge help if you’re new to chart-reading.

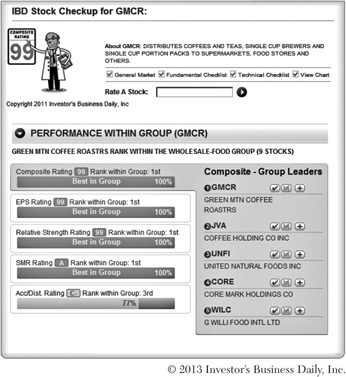

Step 3: Use IBD Stock Checkup to see if the stocks you circled pass the Buying Checklist.

A quick look at Stock Checkup showed Green Mountain passed the Buying Checklist:

Composite Rating: 99

Composite Rating: 99

EPS Rating: 93

EPS Rating: 93

RS Rating: 97

RS Rating: 97

Return on Equity: 21%

Return on Equity: 21%

Last Quarter Sales Growth: 56%

Last Quarter Sales Growth: 56%

Last Quarter EPS Growth: 14%*

Last Quarter EPS Growth: 14%*

3-Year Annual EPS Growth: 43%

3-Year Annual EPS Growth: 43%

*Green Mountain’s earnings growth slipped to 14% in the most recent quarter, but annual EPS growth was 43%, and the previous quarter’s gain was 76%.

Plus, it had the “N” in CAN SLIM®: An innovative new product—single-serving K-Cup gourmet coffees—that was revolutionizing the industry.

Step 4: Add the strongest stocks to your watch list.

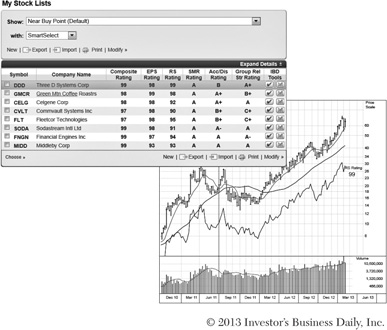

Over the weekend, you could have added Green Mountain to your watch list, with a game plan to buy if it broke past the 42.99 buy point. And you could have set a trade trigger with your broker before the market reopened on Monday.

You would have been glad you did: On Monday, March 16, 2009, Green Mountain Coffee Roasters broke out and ran up more than 1,000% over the next 2½ years.

Green Mountain Coffee Roasters is just one example of why it pays to do the Simple Weekend Routine regularly.

What if You Missed the First Breakout?

Don’t fret. The IBD 50 and Your Weekly Review highlighted Green Mountain as being near a potential buy point over 20 more times during its 1,000%+ gain.

Never give up—and keep doing the Simple Weekend Routine. The best stocks will give you multiple buying opportunities, and you’ll profit from them if you do the routine regularly.

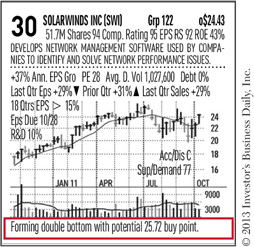

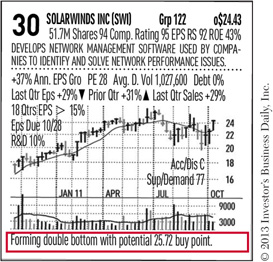

SolarWinds (SWI)

You could have also used the Simple Weekend Routine to spot cloud computing leader SolarWinds before it broke out.

On October 17, 2011, the IBD 50 noted that SolarWinds was “forming double bottom with potential 25.72 buy point.”

The stock broke out 10 days later—giving you plenty of time to have it on your watch list and set up your buying game plan. SolarWinds soared over 130% in just the next 11 months.

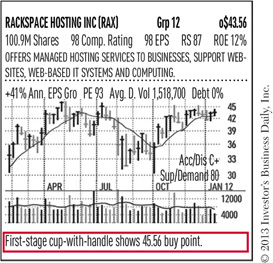

Rackspace Hosting (RAX)

Rackspace Hosting is another cloud computing company you could have found with the Simple Weekend Routine.

On January 20, 2012, Your Weekly Review highlighted Rackspace Hosting, saying its “first-stage cup-with-handle shows 45.56 buy point.”

Two weeks later, Rackspace broke out and quickly rose 30% in only 9 weeks.

Now that you know how powerful this simple routine can be, the next step is to start using it!

If you haven’t already, take the Action Steps I’ve included at the end of the Simple Weekend Routine. Once you’ve done that, it’s time to take a little challenge and find out what a big difference you can see in your investing skills in just a couple of weeks.

You’ve now seen the kind of money-making opportunities you’ll find in every strong market uptrend. And you have a basic routine that shows you, step by step, how to identify them.

So what’s next?

Let’s turn that new routine into an old—and healthy—habit! And you can do that by taking the IBD 2-Week Challenge.

It’s simple: Try the Simple Weekend Routine and 10-Minute Daily Routine for the next 2 weeks.

I think you’ll be pleasantly surprised at how quickly your confidence grows and the quality of your watch list improves. You’ll also find that once you do these routines a few times, you really can go through them in just a matter of minutes. And by combining these routines with the buying and selling checklists, you’ll have a clear road map for making money in stocks.

You can do it. You just have to take the first step and start using these routines regularly.

To get going with the 2-Week Challenge and start building your watch list, visit www.investors.com/GettingStartedBook.

And while you’re there, why not also sign up for free online training and check out the IBD Meetup group near you? Those are two great ways to kick-start your investing skills and start putting these routines and checklists into action—the right and profitable way.