5

Reason #2: Customer Success Is a Growth Engine—If You Move from Defense to Offense

When Mark Roberge started teaching a class on sales at Harvard Business School, he was dumbfounded. “We did not have Customer Success in our syllabus—in a course focused on growth!”

For Roberge, the former chief revenue officer at HubSpot, it was inconceivable to not talk about Customer Success in the context of sales. Roberge helped take HubSpot public as a leading multi-product growth platform. Along that journey, he saw how important CS was for growth.

The first year I was at HubSpot, we were very sales- and marketing-driven. We went from 100 to 1,000 customers and 1 million to 3 million in revenue in seven months. We had amazing growth. But churn went from an already terrible five percent a month to eight percent a month.

So we became obsessed with Customer Success. We hired a leader who built the team. We studied the customer segments that we were retaining and churning. We stopped selling to segments that churned at too high a rate. We started tracking early indicators of success. We knew that if clients used five of the 20 features in the first 60 days, then they'd be a customer for life. If they didn't, they'd churn.

From there, it was extremely easy to operationalize everything from the definition of Marketing Qualified Lead (MQL) on the marketing side, to how account executives were compensated on the sales side, to our goals for customers during onboarding, to how we evolve the roadmap and reduce friction in the product. We set up the entire company around the customer's adoption in the first 60 days.

Let's pause for a moment. Roberge was the sales leader who grew HubSpot from $0 to $100 million in revenue, before heading up HubSpot's sales division as CRO. His biography screams “sales!” But he believes as much as anyone in the power of Customer Success.

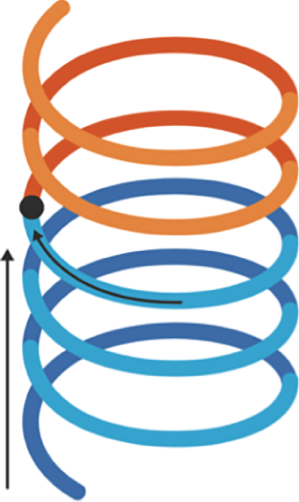

Why are revenue leaders like Roberge touting the benefits of customer-centricity? They're embracing a new framework for revenue growth that we like to call the Helix.

The New Framework: The Helix Model of Revenue Growth

Throughout the history of business, CEOs and heads of Sales have woken up every morning thinking about how to grow faster. That hasn't changed. But as their companies shift to recurring revenue business models, they're realizing that the way they grow must change.

Ten years ago, revenue leaders were thinking about the pipeline of hand-offs: how to manage hand-offs from Marketing to Sales, and transitions from Stage A to Stage B in the sales process. Today, the best revenue leaders know that strong revenue growth doesn't come from a straight-and-narrow pipe. It comes from the Helix (see Figure 5.1).

Let's step back. Where does revenue come from in a recurring revenue business model? Check out Figure 5.2.

What revenue leaders have realized is that in the modern business world, successful customers are the start and end of the pipe. When you make a customer successful, you've created at least three new leads:

- A lead for a renewal event: This customer is prime to be renewed.

- A lead for an expansion deal: This customer will be amenable to get even more value from their partnership with you. In fact there may be multiple expansion opportunities.

- A lead for a new logo: This customer, depicted in Figure 5.3, will be happy to speak to a prospective customer about the value they've achieved. In fact, they'll be willing to speak to multiple prospects.

If you make your customers successful, you can turn one new lead into 3+ leads. And in turn those 3 incremental leads result in 3 × 3 = 9+ new leads. And those 9+ leads result in 9 × 3 = 27+ new leads. That's exponential growth.

You're not just looping around. You're looping around and moving on up, as shown in Figure 5.4.

The growth pattern of successful recurring revenue companies resembles an expanding helix: The successful customer brings you back to your starting point (leads), but your company is increasingly better off than it was before.

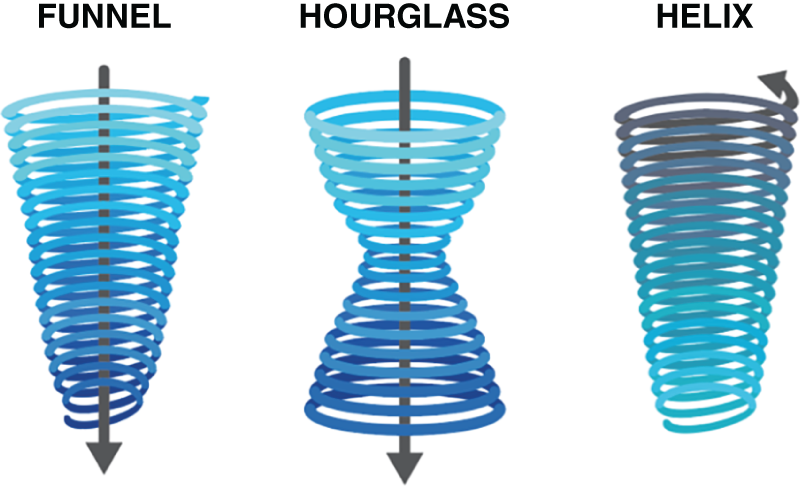

This phenomenon is causing revenue leaders to believe that their old framework of the “funnel” (representing a linear progression of leads to closed deals, without a view to the customer) is insufficient. That's why the Helix model is growing in popularity.

Whereas the Sales Funnel captured one lever for revenue growth (new logos), and the Land & Expand Hourglass model captured two levers (new logos + expansion), the Helix model captures all three (new logo, expansion, and renewal) and explains the causal relationship between successful customers and new logo growth.

In the previous chapter, we dove into the impact of Customer Success on one of those three growth levers, renewals. Now let's double-click into the impact of CS on each of the other two levers: expansion and then new logo growth through advocacy.

Double-Click #1: Customer Success Drives Expansion

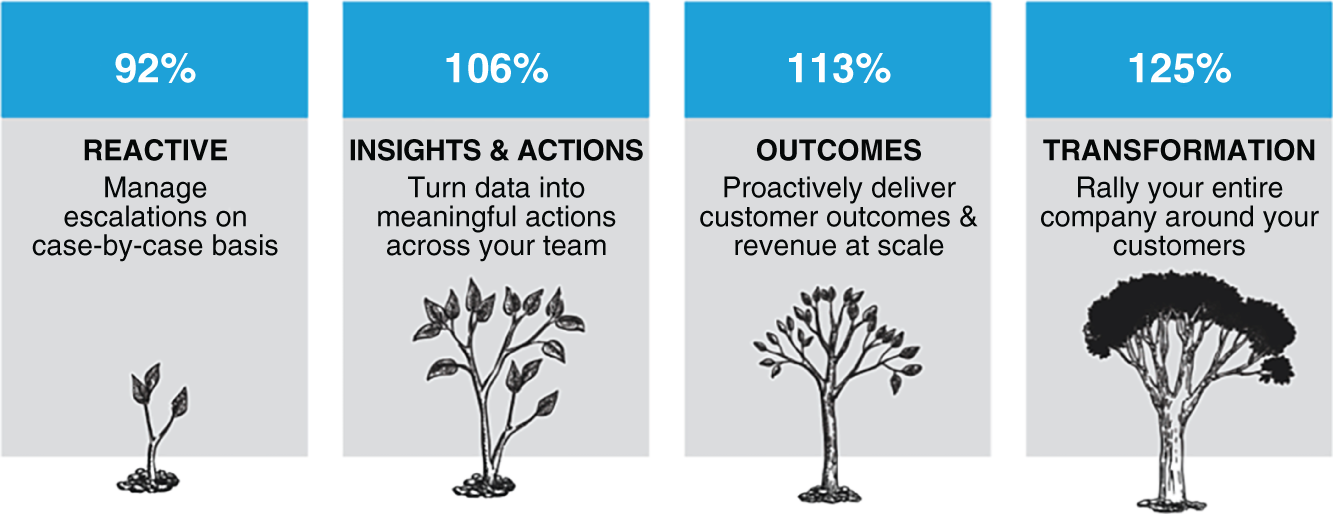

In 2018 we surveyed chief customer officers at about 100 tech companies and asked them many questions to assess their “maturity” in Customer Success practices, as well as their Net Retention Rate. Then we grouped those companies into four stages of maturity (shown in Figure 5.5):

- Reactive: These companies are in fire-fighting mode, managing escalations on a case-by-case basis.

- Insights and Actions: These companies are leveraging data to determine what actions to take to help those clients.

- Outcomes: These companies are systematically delivering outcomes for their clients and revenue growth for their own companies.

- Transformation: In these companies, every department is aligned around the success of clients. These companies are truly customer-centric.

We found that companies that had made it to the Transformation stage had Net Retention Rates that were on average 33 percentage points higher than those of their peers in the Reactive stage. (They also had 13 percentage points higher Gross Retention.) That's a huge difference, reinforcing the growing belief across industries that investing in Customer Success results in stronger revenue growth through expansion.

Why exactly does Net Retention increase when companies invest more in Customer Success? There are a few reasons:

- Positive client outcomes and experiences: When a company is further along on the maturity curve above, CSMs are guiding clients to achieve a return on investment from their purchase of your product or service, and ensuring that they have a positive experience along the way. Successful customers are more likely to buy more of your product or service.

- More retained customers to expand: When CSMs are effective in retaining clients (through the practices underlying the maturity curve above), they ensure that these clients are “still around” to be upsold or cross-sold.

- Leads for expansion: Many CSM teams are specifically chartered to generate leads from within existing customers. Those leads are often known as CSQLs, or Customer Success Qualified Leads. CSMs pass along those leads to Sales, who close them. An investment in Customer Success therefore implies an investment in expansion.

- Faster expansion: CSM is, in a sense, all about “time to value.” Frequently, customers won't buy more until they have already seen value. So CSMs can accelerate the pace of expansion.

- Evidence of value: Finally, when an executive at a client is looking at buying more, they often skeptically ask, “What value have you delivered for me so far?” CSMs are key here in terms of being able to demonstrate the value delivered to-date.

Double-Click #2: Customer Success Drives New Logo Growth

It used to be that sales teams would bring in new business by cold-calling customers. Persistence was the name of the game, embodied in the mantra “ABC—Always Be Closing” by the character played by Alec Baldwin in the 1992 movie Glengarry Glen Ross. You can see this “hunting” mindset in the cold emails shown in Figures 5.6 and 5.7, which are real ones that we have received—and we're sure, not too different from the ones that you have received.

That second email cracks us up every time! We love the persistence that these sales development reps are demonstrating. But we want to point to a problem with this cold-emailing approach, which is that it doesn't meet the prospective client where they are.

In the modern business world, when your prospects are “in the market” for a product or service like the one that you offer, they're rarely a “cold” prospect in the traditional sense. They've already done an online search to learn more about their challenge and how to solve it. They've searched through the abundance of public reviews on websites such as TrustRadius or G2, and then read reports written by Gartner or Forrester. They've gone to a business conference where they asked another attendee, “How have you solved this problem before?” “Have you used XYZ product? What was it like?” and “Which vendor would you recommend I work with to solve my problem?” So by the time this cold-calling sales representative gets this buyer on the phone, the buyer has already been educated about the product through word of mouth. The cold pitch doesn't land well.

In general, buyers trust word of mouth more than any other source when considering whether to buy a product. Analyst firm Forrester Research has reported that peers and colleagues are the number-one source for gathering information during the discovery stage of a purchase decision.3 Researcher eMarketer found that referrals have the highest conversion rate from Lead to Deal compared to any other type of lead, about four times the rate for sales-generated leads.4

Companies realize that generating positive word of mouth about their products or services is crucial to their revenue growth. That goal to proactively create advocates—who will speak on stage at a conference, write positive testimonials online, serve as a reference for an uncertain prospective buyer, and speak positively at cocktail parties—has been a primary factor leading to companies increasing their investment in Customer Success.

And we're not the only ones talking about this. Marketing technology company HubSpot has advocated a similar analogy to our Helix—the “flywheel.” Alison Elworthy is the SVP of Customer Success at the Boston-based publicly traded SaaS company and shared her perspective on advocacy: “The whole idea is that a flywheel runs on its own momentum. When you attract new prospects, you want to engage them and convert them, but you also want to delight them. Our whole business has been focused on how to create a really great customer experience so we can generate that flywheel.”

As a result, CS teams often track the number of advocacy activities that they generate. They sometimes use the metric, Customer Success Qualified Advocacy (CSQA). Examples of a CSQA include:

- A client collaborates on a case study that captures a new use case for your product or service.

- A client offers a written testimonial for use on your website or in your sales material.

- A client speaks at an event that your prospective customers attend.

In all three cases, the client shares the benefits of your product or service with prospects.

The CSM may have generated these advocacy activities by making the client so successful that they naturally volunteer to advocate for the company. Further, the CSM may have officially asked the client to participate in these advocacy activities.

Another type of advocacy is repeat repurchasing. Repeat purchasers involve a client of your product moving to a new company, where they choose to buy your product again, or otherwise advocate within their new company for the purchase. A CSM made the client so successful the first time that they wanted to come back to you.

For the more strategic segments of your customer base, your CSMs may be involved in a kind of “advocacy through surrogate.” In this case, the CSM is directly engaged in the sales cycle, side by side with the sales representative, to share stories of successful customers. This is yet another way that CSMs can contribute to new logo growth.

***

Now that we've explored the impact of CS on expansion and new logo revenue—the two levers for growth that have been most broadly accepted among sales leaders and CEOs—let's return to growth lever #3, renewals. The fact is, companies have found that plugging the leaky bucket of churn in itself results in stronger revenue growth.

Double-Click #3: Gross Retention Drives Revenue Growth

In McKinsey's whitepaper, “Grow Fast or Die Slow: Focusing on Customer Success to Drive Growth” in October 2016, they gathered data from 200 high-growth SaaS companies with ARR between $100 and $200 million, then identified the “top-quartile” performers by quarterly revenue growth. They found that the top-quartile growers had gross retention rates of 88% on average, whereas the mean growers averaged 76%—a 12-percentage-point difference.

We think there are several reasons for this:

- Churn results in a leaky bucket: It's hard to grow fast when you have to compensate for a revenue leak, as we discussed in the previous chapter.

- Lost renewals result in lost expansion opportunities: If you're losing customers, there will be fewer customers to upsell or cross-sell, so your expansion revenue takes a hit.

- More churn leads to more detractors: If you're losing customers and they're talking to their friends and colleagues about their failed partnership with you, that negative word of mouth can impact your close rate for new business.

- Companies with high churn rates raise less money: It's harder to claim that your company is a great investment opportunity if you have a high churn rate. And if you raise less money, you can't invest as much in growth.

- Companies with high churn rates are less profitable: If your churn is high and you have to plug the gap with new business, you'll be less profitable, because it typically costs more to acquire a new customer than renew an existing one. Less profit means less to invest in the future growth of your business.

- A “learning” organization: Companies that succeed in generating high Gross Retention Rates have likely developed a culture and processes for learning from clients and their market. That learning mindset can help in all aspects of a company, including revenue growth.

Bottom line: Plugging the leaky bucket matters for your overall revenue growth. To amp up the velocity of your Helix, we recommend pulling all three levers: expansion, advocacy through new logo growth, and retention.

Summary

In this chapter we discussed a new concept for describing how B2B recurring revenue companies grow: the Helix. It's not enough to Always Be Closing. The businesses of the future have to Always Be Renewing, Always Be Expanding, and Always Be Advocating. Companies have realized that those three growth levers create a virtuous cycle of growth—the B2B version of viral growth that's well known in the B2C world—and that aspiration is motivating them to investing in Customer Success.

In the next chapter, we'll explore the third reason why companies are investing in CS: Their customers expect it.