18

The First Step: Launching CS in an Established Business

Many leaders at established companies look at Customer Success and think, “Yeah, that's great if you founded your company in the last few years. But how can I make this transition in an existing business when I don't have venture capital dollars to fund me?”

Chris Bates is a great example of a leader who has succeeded in threading the needle of transformation. Bates is the GVP of Customer Success at Tableau Software, a visual analytics software company. He was given the tall order of launching Customer Success in an established business. And he made it happen.

The transformation that Bates and his cross-functional team spearheaded is remarkable. Fortunately, it's achievable in other organizations, too. As B2B companies innovate in their business models, offering flexible and customer-aligned delivery models like subscription, cloud, pay-as-you-go, and outcomes-based pricing, they are realizing the increasing power that their clients have—and the increasing ROI from investing in retaining and growing their customer base. In parallel, these B2B companies have implemented myriad systems over the last decade—from CRM to Marketing Automation to Online Support to Billing—allowing them to have greater insights into their client bases than ever before. With this convergence of business need and data availability, B2B innovators are going beyond the normal organizations of Sales and Service/Support to create a new Customer Success Management (CSM) team focused on proactively driving client outcomes using data.

In this chapter, we'll guide you in launching a CSM team in your established business. We'll discuss the decisions you'll need to make, how to align departments around the launch through strong communications and journey mapping, and how to avoid common mistakes.

Empower a Leader for This Transformation

For most mature companies, this Customer Success concept requires a great deal of consideration. Where should the team live in the company? What are its responsibilities? How does it relate to other functions (e.g. Sales/Marketing/Support)? How should it be measured? Where does the budget come from? We've worked with hundreds of large companies on the journey to Customer Success and have seen what works and what doesn't in terms of launching pilot experiments in Customer Success.

Before we get into the details of the decisions you'll need to make, it's worth emphasizing that you'll need a single leader accountable for driving the transformation. That person may be you, or it may be someone you're appointing. As Catherine Blackmore, the GVP of Customer Success at Oracle, says, “The CEO needs one person to be in charge of this transformation. They have to have a direct line to the CEO. They can't be buried within a department and someplace else. They don't have an operating responsibility; they have a transformation responsibility, because there are so many pieces that are going to have to shift and change in order for this move to happen.”

The Decisions You'll Need to Make

Now that you have your mandate (or you've appointed the right person), let's dive into the 11 decisions that will make this transformation successful.

1. Define the Core Business Driver for Customer Success

Because Customer Success is such a “hot” concept, it has also become an overloaded term. Customer Success can be applied to adoption, renewals, expansion, advocacy—anything that involves getting more from your client base by driving greater results. However, in your first rollout of Customer Success, you need to think deeply about the specific goals for your business. For some businesses, a lack of Customer Success causes churn. For other, more sticky businesses, the impact is slower expansion. The table in Figure 18.1 articulates example pilot goals for different types of businesses.

2. Define the Starting Point Organization

Like most new initiatives in large organizations, innovation comes from a combination of situation (what group you sit in) and motivation (your desire to change). However, we've found some patterns in logical starting points for CSM teams (see Figure 18.1) in terms of which group might launch the CS effort. In general, the “ideal” CSM is almost like a unicorn—hard to find in real life because the job involves a blend of:

| Unique Aspect of Business | Current Situation | Customer Success Pilot | Customer Success Outcome |

| Complex onboarding | Fiction during onboarding causing downstream churn | CSM team focused on onboarding phase | Less onboarding churn leading to higher renewals |

| Seat-based pricing model | Overselling and low adoption leading to churn and downsell | CSM team focused on adoption phase (deployment and adoption of unused seats) | Increased percentage adoption leading to less churn and downsell |

| Sticky platform-style product with “land-and-expand” modules | Slow adoption hurting expansion efforts | CSM team focused on adoption phase | Faster time-to-value leading to faster next sales opportunity at customer |

| Long-term contract product or service | Poor customer satisfaction hurting advocacy and new sales | CSM team focused on satisfaction and business value | Improved client business value alignment leads to higher client satisfaction (e.g. Net Promoter Score or referenceability), yielding greater advocacy and new sales |

| Competitive product category with less client commitment | Company surprised by churns to competitors | CSM team focused on early warning to risk | Earlier action on risk leading to reduced competitive churn |

| Large enterprise targeted product | Customer satisfaction low due to low adoption and product issues | CSM team focused on product adoption and collaboration | Greater client engagement and adoption leading to higher satisfaction, yielding increased advocacy and new sales |

- Product knowledge

- Domain knowledge

- Strategic thinking

- Relationship skills

- Project orientation

- Task orientation

We most frequently see organizations with technical offerings starting with the Technical Account Management or Professional Services groups and organizations with transactional offerings starting with the Account Management group.

3. Define the Product to Start With

For many large organizations, the vision for Customer Success spans across the entire product line. But where do you start? Successful pilots involve one or a few product lines and create proof points to continue scaling. Again, there is no perfect answer, but consider what's described in Figure 18.2.

| Starting Point | Pros | Cons |

| Mature product |

|

|

| Mature product in transition (e.g. perpetual moving to subscription pricing) |

|

|

| New product |

|

|

| Recently acquired product |

|

|

Customer experience software company Genesys launched a fast-growing cloud business and started Customer Success there. They subsequently saw that the model applied to their traditional business as well. Chief Customer Success officer Lucy Norris observed, “Companies that deliver software on-premises and companies that deliver software in the cloud are starting to think about Customer Success in a unified way. What we're really learning is that customers no longer self-identify as on-premises. Modern customer customers expect a level of engagement and the level of service independent of whether they're running on-premises or SaaS.”

In general, we find CSM pilots starting with newer or acquired product lines or with product lines in transition and then expanding to the overall business over time.

4. Define the Segment to Start With

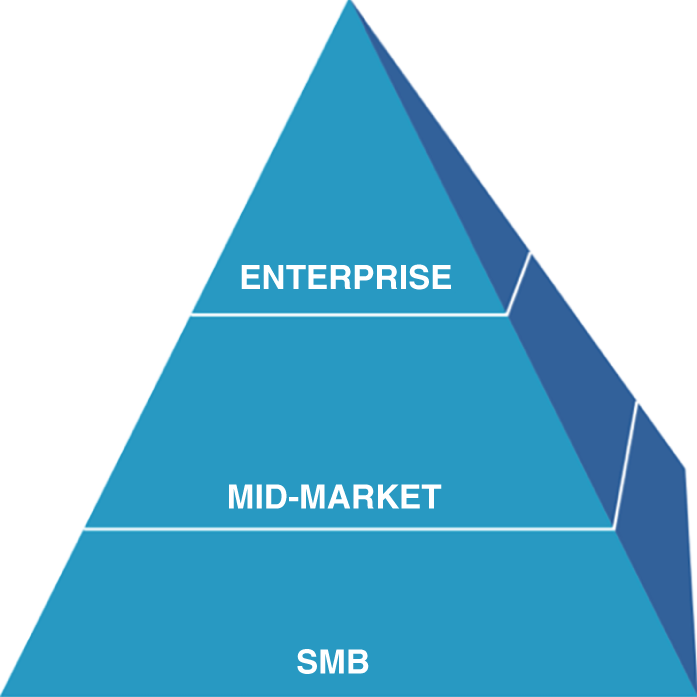

Even within a product line, you likely have multiple tiers of customers, as shown in Figure 18.3.

At Gainsight, we define three canonical models for Customer Success for these tiers:

- High-Touch Customer Success Management: Strong coordination around a client's Success Plan and client journey across CSM, Sales, Services, Support, and Product

- Mid-Touch Customer Success Management: Trigger-driven, “just in time” Customer Success based upon data (e.g. client is six months from renewal and only using one out of three modules)

- Tech-Touch Customer Success Management: Fully automated, personalized Customer Success using email and other tools

Figures 18.4 and 18.5 illustrate these models.

We most frequently see CSM Pilots starting with the mid-touch segment, given the pros and cons in Figure 18.5.

Slicing the world further, you may need to take your segment of your product line and start with a limited set of clients. If you choose a high-touch or mid-touch model, you might be gated by the size of your initial team. As a rule of thumb, high-touch CSMs often manage 1 to 25 customers while Mid-Touch CSMs range from 25 to a few hundred. As such, companies pursuing high-touch Customer Success pilots often start with a subset of their top accounts.

How do you decide which clients to pick? Some progressive CSM pilots involve picking a cohort of clients for whom the company believes there is substantial “whitespace” or expansion potential. Other pilots are focused on A/B testing—taking a uniform group and dividing into a slice (e.g. 80%) that gets a CSM and a slice that does not. Regardless, be thoughtful in your initial client selection.

| Segment | Pros | Cons |

| High-Touch | Impacts large clients |

|

| Mid-Touch | Significant dollars but usually gets limited attention | Requires process-oriented approach |

| Tech-Touch | Least amount of change management | Sometimes have to coordinate with Marketing (especially for automated one-to-many outreaches) |

Whatever segments you choose, make sure your pilot is sized to your team's capacity. Jill Sawatzky at PROS has done this many times and shares her advice: “I would start a pilot with a small group of customers. What you don't want to do is have a brand-new small CS team trying to cover an entire large customer base. Then, after you've run the pilot for a few months, start to look at leading CS indicators. For example, did you get more references from the covered customer group? Did their Net Promoter Score go up? Don't focus on your renewal rate right away because it takes some time to make a significant impact on retention.”

5. Define What Data Your Team Needs

Data is at once the greatest opportunity and greatest challenge for most large companies. Businesses are awash in data but often struggle to leverage it. For the CSM pilot, you need to define a practical and achievable list:

- CRM

- Customer name: This is sometimes complex with customer “hierarchies” (e.g. parent and subsidiary businesses)

- CSM: Where do you track the CSM assigned per customer? Is it a field in the CRM?

- Spend: Where do you track the spend per client for the product in question? Is it accurate? Does it need to be 100% right or just directional?

- Renewal date: If you have contracted businesses, where is this information stored?

- Tier: If you want to focus on a specific client segment, how will you filter the data?

- Entitlements: Products/services under contract.

- Support: You may want access to support ticket history for the client.

- Community: If you have an online community, can you track how active a given client is?

- Surveys: Client satisfaction surveys are often essential for CSMs.

- Professional services: How can you see which client projects are on time versus running over?

- Learning: How can you track which clients have been trained versus not?

- Marketing: Can you see which clients are engaging in events, webinars, and emails?

- Billing: Can you view Accounts Receivable for a client to determine early satisfaction issues?

- Telemetry: If you have an online product or service, what can you see about client usage?

In our experience, CRM data is a must and organizations pick two or three other data sources (most commonly support and survey data).

6. Define What Systems Your Team Will Use

Depending on the scope of the pilot, you may want a formal system or you may start with a spreadsheet. Consider a formal system if you want:

- Sharing across the team and with other stakeholders

- Trackability and historical trending

- Process implementation and consistency

- Automation

7. Define IT Involvement

As we discussed in Chapter 16, depending on the data and systems needs, you might need IT help. In most companies, IT is a precious resource, so be sure to make your case early. Or you can consider third-party managed service providers that can run CSM platforms and data architectures on your behalf.

8. Define What's Out of Scope

By definition, a pilot is just a starting point. As such, make sure to clarify what you don't plan to accomplish in the pilot. We already covered focusing on product lines, tiers, and customers. But even within this, define what to “punt” for later. As an example, unless you have tremendous volume of client data, you probably want to punt “machine learning” and “predictive analytics” to a secondary phase once you understand your processes. Similarly, you might define the minimum viable product (MVP) for the pilot to be focused on the actions of the CSM team versus visibility to the rest of the organization. Finally, you may want to restrict the pilot to one region or geographical area.

9. Define How You Will Communicate

Brian Kaminski is the chief customer officer at Conversica, a leading provider of Intelligent Virtual Assistants for business. Brian has launched CS programs many times and points to the importance of communication.

Speaking of the rest of the organization, successful CSM pilots require powerful and consistent communication. Define a communication program for each of your stakeholders:

- Team: How often will you meet with your pilot CSM Team? Many pilots involve daily “scrum” meetings to ensure rapid progress. How will you coach each CSM in one-on-ones? How prescriptive will you be on processes? You may also want a weekly forum to recognize successes and share learnings.

- Cross-functional: How will you update the rest of the organization on your pilot progress? We'd suggest a weekly newsletter on highs, lows, and learnings from the pilot, along with a few formal review meetings.

- Clients: What expectation are you setting for clients? How do you introduce the CSM program? What's in it for them? Even in the MVP, it's important to have polished client-facing materials on the CSM program.

10. Define Success Criteria

Going back to the business goals, make sure to set expectations upfront of achievable metrics that can be used to measure the success of the pilot. At Gainsight, we try to distinguish lagging indicators—the financial outcomes of Customer Success like renewals, retention, and upsell—from leading indicators that can be moved more quickly. Leading indicators can include:

- A score measuring client adoption volume (e.g. Daily Active Users)

- A score measuring client sophistication (how well they use your product or service)

- A customer satisfaction metric like C-SAT or Net Promoter Score

- The percentage of clients that are referenceable

- The number of upsell leads sent to sales

- The number of at-risk accounts that were moved back to health

- A health score that aggregates several of the above into an overall indicator

Consider aggregating these into a scorecard for the overall health of the CSM pilot.

11. Define the Roadmap

While we emphasize focus, it's likely that Customer Success will become big in your company—if it hasn't already. As such, you may end up with multiple, overlapping, and confusing Customer Success initiatives across many product lines and departments. Consider a Customer Success Steering Committee or Center of Excellence to bring these initiatives together to ensure internal efficiency and a smooth external client experience.

Articulating the Benefits to Other Departments

Throughout the process of launching a pilot and translating it into a large organization from there, you'll need to be over-communicating internally. Catherine Blackmore, the GVP Customer Success at Oracle, emphasizes this:

Given the magnitude and breadth of the impact that this CS transformation will have on a company, senior folks have to understand the why behind it and be able to explain it to their organizations.

It's especially important to articulate the specific benefits of a CS transformation to the leaders of other functional areas. The following is a cheat-sheet on talking points by department.

Product Management

- Prioritize customers' requests for enhancements: Product teams are often overwhelmed by client feedback. CSMs can help them figure out which enhancements would benefit clients most.

- Set up focus groups: CSMs can advise on which clients would be most helpful in Product Advisory Councils and other groups that the Product team relies on for feedback.

- Announce product releases: CSMs can promote the Product team's latest releases.

Marketing

- Proactively identify advocates: You often spend a lot of time hunting down happy clients who can speak in favor of the product. With CSMs as your partners, you'll find it easier to identify clients willing to speak at an event, give a testimonial, or participate in a case study.

- Capture the narrative about how we drove an Outcome for a customer: Even if you're able to get a client to agree to advocate, you often find it difficult to document in detail how the client got value. The CSM can be a partner in explaining the history of the client: how they got from point A to point B, and how we helped.

Sales

- Get visibility: It's utterly painful when you call a customer and get blindsided by an issue that's troubling them. Having a CSM as your partner can help you have a 360-degree understanding of client health.

- Learn about new opportunities: When an executive sponsor at your client leaves the company, it's a risk to the relationship. On the bright side, the new company that the sponsor joins is now a prospective customer. With a CS effort to identify these departures you can now track your “alumni network” and find advocates whom you can sell to at a new company.

- Learn where to focus prospecting efforts: A CS initiative can make it clear what types of clients—by industry, location, or other attribute—are successful and which are not, which can help you with territory planning.

- Manage at-risk renewals: Spend less time on escalations. That's the CSM team's job.

- Find more upsell opportunities: Instead of hunting for upsell opportunities by crunching the data in a silo without customer context, collaborate with your CSM team to find them. The CSM team may even have a target for upsell leads that they pass over to you.

Professional Services

- Identify opportunities for selling new services: CSM teams know what gaps in value the client is experiencing. So they can advise Services on which clients may be prime for purchasing education, managed services, advisory services, or other offerings.

- Scope projects more effectively: The CSM is an ongoing point of contact with the customer, so they can help you identify the client's strategic goals and map the project plan to those.

Support

- Avoid being blindsided: Get knowledge of the customer context from the CSM so you can resolve tickets more effectively, faster.

- Prioritize tickets: Focus on the right tickets based on the CSM's advice on which tickets are more relevant to a client's success so as to maximize C-SAT.

Finance

- Drive collections: When the Accounts Receivable team isn't getting a response from the customer, get help from the CSM, who likely knows someone who can push the payment along. The CSM can also inform you as to when it's better to hold off on the collection, or else risk a major escalation from a client who has refused to pay because they aren't getting value.

- Get visibility into cash flow: CSM teams know more about the predictability of your revenue and cash than any other function in the business besides Finance, because they forecast retention rates based on an intimate understanding of the client base.

Bottom line: Think carefully about the WIIFM (“What's in It for Me?”) for each department when you're pitching Customer Success at your company and you'll build a strong alliance that ultimately benefits your company and your clients.

The Value of Journey Mapping

Besides explaining the benefit to each department individually, consider how to help them see their role in the bigger picture of the transformation. A great way to bring all functions together around Customer Success is through a journey-mapping exercise.

Here's how Chris Bates from Tableau described his company's experience in creating a cohesive journey for the client with participation across departments:

When every function is aligned around a methodology—Blueprint in this case—for helping clients achieve their Outcome over a prescribed journey of steps, it ensures that the CS transformation is sticky.

We've discussed some best practices that can help you get CS off the ground at your large company. But there's a lot that can go wrong. We hope we can help you avoid those potholes in the next section.

Five Lessons from Failed Customer Success Programs

Customer Success Management is hot. But it's also new. So with the tremendous growth in the CSM world come some organizations that have failed in their quest toward success. While most companies are radically increasing investment in CSM, a few have pulled back. As the old saying goes, “last in, first out”; since many CSM programs are relatively new, they are sometimes cut when times get tough.

From our experience at Gainsight, here are five common ways that CSM programs can fail.

1. Wrong Leader

This might be the most common reason why anything fails in business. But to be specific, we're not talking about hiring a leader that's wrong for any company—we're talking about the wrong leader for a specific company. CSM is a broad job and the leadership need varies dramatically based upon the stage, scope, and the nature of your solution. Common patterns of failed hires include:

- A leader who's skilled at large-scale management in a job that needs someone to work as a “player-coach”

- A leader who's good with clients in a job (e.g. a low-priced offering) that demands time spent in the office with data

- A leader who's strong with data in a job (e.g. a high-priced offering) that demands time spent in the field with clients

- A leader who's great with experienced team members taking over a team of low-paid, entry-level CSMs

Gainsight Best Practice: Companies and candidate CSM leaders are mutually demanding practical exercises and projects in the interview process to get to know each other's styles better. For example, a company could have the CSM candidate analyze historical churn data or present a sample Executive Business Review.

2. No Goals or Unrealistic Goals

We've written about approaching “pilots” for CSM. Whether they are labeled that way or not, most CSM initiatives are experiments at this stage. As such, CSM leaders need to clearly specify how the results should be measured.

If you have a multiyear-contract business, it's unlikely that your renewal rate will change dramatically 90 days after starting the CSM pilot, so you might need to measure a leading indicator like Net Promoter Score or adoption. Similarly, if your pilot is focused on a specific part of your customer base, zoom in on the success criteria in that segment (versus looking at overall metrics). If you don't talk about goals and achievement, it's easy for management to start imagining they can live without the CSM initiative.

Gainsight Best Practice: Create a scoreboard of CSM metrics and share it weekly with your company.

3. Unscalable Model

It's great to start small in CSM. You can run a pilot and learn a great deal. But make sure you are building a CSM model that can eventually impact your entire business. As an example, we've seen companies run an uneconomical pilot (e.g. one CSM managing $100K of revenue) and have no plan on how to scale beyond that.

Gainsight Best Practice: Choose the appropriate touch model (high-touch, mid-touch, or tech-touch) for your average selling price. Don't design a pilot that will forever be a pilot.

4. What Does the CSM Team Do Again?

Because CSM is new for most companies, it's also foreign. Many CSM teams fail because other key organizations (most notably Sales and Product) don't understand the value proposition of CSM. This means that when budgets get tight, those other orgs often fight for resources from the CSM group.

Make sure you are educating your peers in other leadership roles in your organization's charter, goals, and successes. We're big believers in following the data at Gainsight. You should be able to prove the value CSM is driving for the company as a whole and across the various departments (as we described earlier in this chapter). To do this, you can build out ROI dashboards for your CSM team based on criteria relevant to each role.

Bates at Tableau emphasizes the importance of clarifying what the CSM does in contrast with other roles, both for the sake of other departments and for the sake of your clients. “Sometimes clients can feel like they're watching a bunch of six-year-old kids playing soccer, where everybody's just chasing the ball rather than sticking to their own role on the team. Define clear roles and responsibilities among the account team. It will be powerful to talk with the client about how each person will support them.”

Gainsight Best Practice: Create a “strategy deck” showing the charter and structure of Customer Success internally and dashboards per the above to show results. Create a client-facing deck to communicate roles externally.

5. No Sustainable Funding Model

Even if you manage to get a CSM team chartered and maintained, how do you grow it? It's critical that you have a clearly defined funding model so you can budget for the group. Think about how other groups are funded:

- Support: Case volume or a percentage of revenue

- Sales: Sales targets and sales quota/productivity

- Engineering: Percentage of revenue

The worst situation to be in is to have to argue with your CFO for every incremental headcount. A related question to ask your CFO is whether CSM is a cost of Sales and Marketing or a Cost of Goods Sold. We see an increasing trend toward CSM being a part of Sales and Marketing.

Gainsight Best Practice: We've seen three common funding models:

- Percentage of revenue

- Fixed ratio of accounts or dollars managed per CSM

- Self-funding P&L where you charge for Customer Success

Summary

The road to Customer Success is paved with good intentions. Hopefully, this chapter helps you avoid the potholes along the way. We discussed frameworks for making decisions, suggestions for gaining buy-in from other functions, and reasons why transformations fail. In the next chapter we'll discuss an important aspect of that transformation: What kind of CS leader do you need?