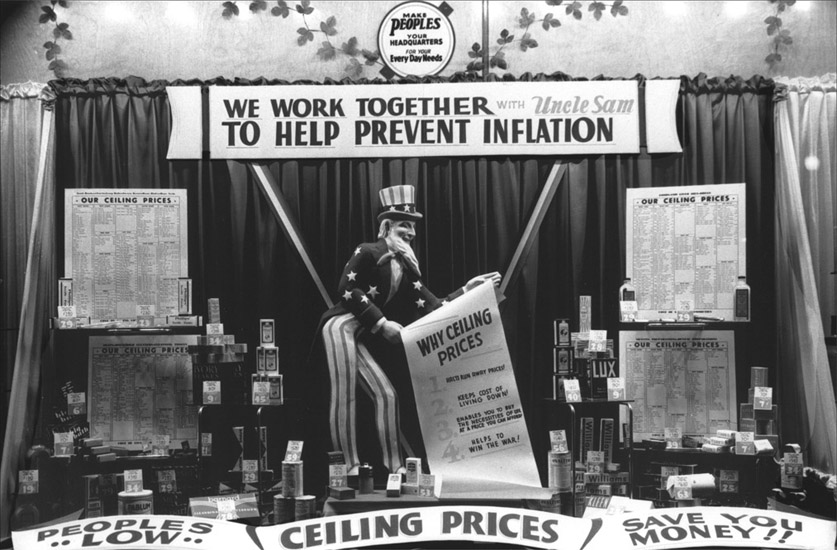

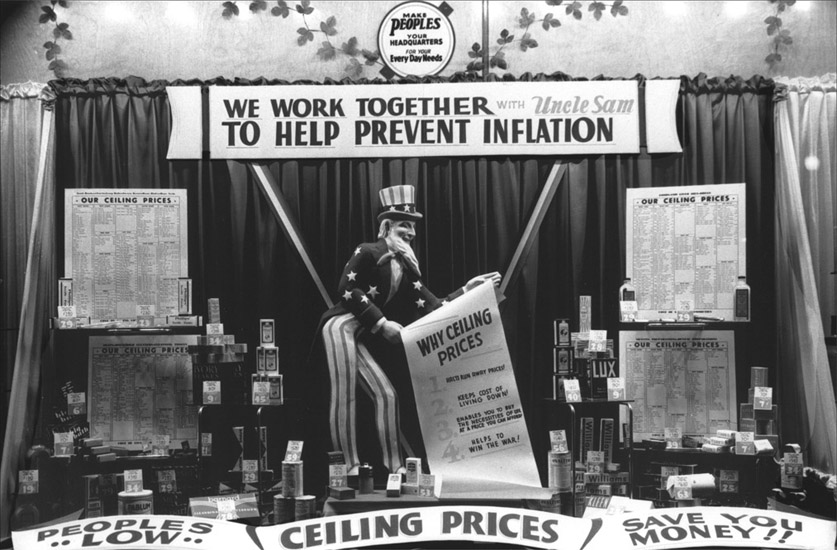

Because war creates increased demand for labor and commodities, sometimes it leads to inflation. This 1942 display was part of a U.S. government effort to fight inflation or, at least, explain it to consumers. (Library of Congress)

The rate of inflation measures the annual percentage of increase in prices.

The most common measure of inflation is that of retail prices. The government publishes the con sumer price index (CPI) each month, and the rate of inflation is the percentage of increase in that index over the previous twelve months. The CPI (or the retail price index as it is known in some countries) tends to be constructed differently from one country to another and this makes international comparison difficult. CPI measures the cost of buying a fixed basket of goods and services representative of the purchases of urban consumers. Price indices are based on consumer purchases.

The most commonly used cost-of-living indices are the Paasche and Laspeyres price indices. The Laspeyres price index answers the question: What is the amount of money at current-year prices that an individual requires to purchase the bundle of goods and services that was chosen in the base year divided by the cost of purchasing the same bundle at base-year prices? The Paasche price index shows the amount of money at current-year prices that an individual requires to purchase the bundle of goods and services chosen in the current year divided by the cost of purchasing the same bundle in the base year.

Both indices are fixed-weighted indices. The quantities of the various goods and services in each index remain unchanged. For the Laspeyres price index, however, the quantities remain unchanged at base-year levels, while for the Paasche price index they remain unchanged at current-year levels.

Fighting inflation is among the most important goals in macroeconomic policy goals. Moreover, inflation is sometimes declared public enemy number one. But why is inflation such a big problem?

Inflation redistributes incomes from the economically weak to the economically powerful, it causes uncertainty in the business community and as a result reduces investment, and it tends to lead to balance-of-payment problems and depreciation (or devaluation) of the domestic currency.

There are two different types of inflation: demand-pull inflation and cost-push inflation. Demand-pull inflation is caused by persistent rises in aggregate demand (total spending), whereas cost-push inflation is caused by the persistent rises in the cost of production. Rises in costs may originate from a number of different sources. The main types of cost-push inflation are: wage push, profit push, import price push, and tax push.

Because war creates increased demand for labor and commodities, sometimes it leads to inflation. This 1942 display was part of a U.S. government effort to fight inflation or, at least, explain it to consumers. (Library of Congress)

If inflation originates from the rise in aggregate demand (demand-pull inflation), both the general price level and national output (production) will increase. If inflation originates from the rise in the cost of inputs, the general price level will increase but national output will decrease, which in turn will cause a bigger unemployment problem. Cost-push inflation will cause more serious economic harm.

Expectations play a crucial role in determining the level of inflation. The higher people expect inflation to rise, the higher it will. There are different anti-inflation policies. To alter the level of total spending, demand-side policies, namely, monetary and fiscal policies, can be used, and to alter the total production through decreasing costs (such as tax incentives), supply-side policy can be used.

Elfi Cepni

See also: Money.

Pindyck, Robert S., and Daniel Rubinfeld. Microeconomics. New York: Prentice Hall, 2001.

Sloman, John. Economics. New York: Financial Times, 2002.