5

When Are Contrarian Profits

Due to Stock Market Overreaction?

5.1 Introduction

SINCE THE PUBLICATION of Louis Bachelier’s thesis Theory of Speculation in 1900, the theoretical and empirical implications of the random walk hypothesis as a model for speculative prices have been subjects of considerable interest to financial economists. First developed by Bachelier from rudimentary economic considerations of “fair games,” the random walk has received broader support from the many early empirical studies confirming the unpredictability of stock-price changes.1 Of course, as Leroy (1973) and Lucas (1978) have shown, the unforecastability of asset returns is neither a necessary nor a sufficient condition of economic equilibrium. And, in view of the empirical evidence in Lo and MacKinlay (1988b), it is also apparent that historical stock market prices do not follow random walks.

This fact surprises many economists because the defining property of the random walk is the uncorrelatedness of its increments, and deviations from this hypothesis necessarily imply price changes that are forecastable to some degree. But our surprise must be tempered by the observation that forecasts of stock returns are still imperfect and may be subject to considerable forecast errors, so that “excess” profit opportunities and market inefficiencies are not necessarily consequences of forecastability. Nevertheless, several recent studies maintain the possibility of significant profits and market inefficiencies, even after controlling for risk in one way or another.

Some of these studies have attributed this forecastability to what has come to be known as the “stock market overreaction” hypothesis, the notion that investors are subject to waves of optimism and pessimism and therefore create a kind of “momentum” that causes prices to temporarily swing away from their fundamental values. (See, e.g., DeBondt and Thaler, 1985,1987; DeLong, Shleifer, Summers, and Waldmann, 1989; Lehmann, 1988; Poterba and Summers, 1988; and Shefrin and Statman, 1985.) Although such a hypothesis does imply predictability, since what goes down must come up and vice versa, a well-articulated equilibrium theory of overreaction with sharp empirical implications has yet to be developed.

But common to virtually all existing theories of overreaction is one very specific empirical implication: Price changes must be negatively autocorrelated for some holding period. For example, DeBondt and Thaler (1985) write: “If stock prices systematically overshoot, then their reversal should be predictable from past return data alone.” Therefore, the extent to which the data are consistent with stock market overreaction, broadly defined, may be distilled into an empirically decidable question: are return reversals responsible for the predictability in stock returns?

A more specific consequence of overreaction is the profitability of a contrarian portfolio strategy, a strategy that exploits negative serial dependence in asset returns in particular. The defining characteristic of a contrarian strategy is the purchase of securities that have performed poorly in the past and the sale of securities that have performed well.2 Selling the “winners” and buying the “losers” will earn positive expected profits in the presence of negative serial correlation because current losers are likely to become future winners and current winners are likely to become future losers. Therefore, one implication of stock market overreaction is positive expected profits from a contrarian investment rule. It is the apparent profitability of several contrarian strategies that has led many to conclude that stock markets do indeed overreact.

In this chapter, we question this reverse implication, namely that the profitability of contrarian investment strategies necessarily implies stock market overreaction. As an illustrative example, we construct a simple return-generating process in which each security’s return is serially independent and yet will still yield positive expected profits for a portfolio strategy that buys losers and sells winners.

This counterintuitive result is a consequence of positive cross-autocovariances across securities, from which contrarian portfolio strategies benefit. If, for example, a high return for security A today implies that security B’s return will probably be high tomorrow, then a contrarian investment strategy will be profitable even if each security’s returns are unforecastable using past returns of that security alone. To see how, suppose the market consists of only the two stocks, A and B; if A’s return is higher than the market today, a contrarian sells it and buys B. But if A and B are positively cross-autocorrelated, a higher return for A today implies a higher return for B tomorrow on average, thus the contrarian will have profited from his long position in B on average. Nowhere is it required that the stock market overreacts, that is, that individual returns are negatively autocorrelated. Therefore, the fact that some contrarian strategies have positive expected profits need not imply stock market overreaction. In fact, for the particular contrarian strategy we examine, over half of the expected profits are due to cross effects and not to negative autocorrelation in individual security returns.

Perhaps the most striking aspect of our empirical findings is that these cross effects are generally positive in sign and have a pronounced lead–lag structure: The returns of large-capitalization stocks almost always lead those of smaller stocks. This result, coupled with the observation that individual security returns are generally weakly negatively autocorrelated, indicates that the recently documented positive autocorrelation in weekly returns indexes is completely attributable to cross effects. This provides important guidance for theoretical models of equilibrium asset prices attempting to explain positive index autocorrelation via time-varying conditional expected returns. Such theories must be capable of generating lead–lag patterns, since it is the cross-autocorrelations that are the source of positive dependence in stock returns.

Of course, positive index autocorrelation and lead–lag effects are also a symptom of the so-called “nonsynchronous trading” or “thin trading” problem, in which the prices of distinct securities are mistakenly assumed to be sampled simultaneously. Perhaps the first to show that nonsynchronous sampling of prices induces autocorrelated portfolio returns was Fisher (1966), hence the nonsynchronous trading problem is also known as the “Fisher effect.”3 lead–lag effects are also a natural consequence of thin trading, as the models of Cohen et al. (1986) and Lo and MacKinlay (1990c) show. To resolve this issue, we examine the magnitudes of index autocorrelation and cross-autocorrelations generated by a simple but general model of thin trading. We find that although some of correlation observed in the data may be due to this problem, to attribute all of it to thin trading would require unrealistically thin markets.

Because we focus only on the expected profits of the contrarian investment rule and not on its risk, our results have implications for stock market efficiency only insofar as they provide restrictions on economic models that might be consistent with the empirical results. In particular, we do not assert or deny the existence of “excessive” contrarian profits. Such an issue cannot be addressed without specifying an economic paradigm within which asset prices are rationally determined in equilibrium. Nevertheless, we show that the contrarian investment strategy is still a convenient tool for exploring the autocorrelation properties of stock returns.

In Section 5.2 we provide a summary of the autocorrelation properties of weekly returns, documenting the positive autocorrelation in portfolio returns and the negative autocorrelations of individual returns. Section 5.3 presents a formal analysis of the expected profits from a specific contrarian investment strategy under several different return-generating mechanisms and shows that positive expected profits need not be related to overreaction. We also develop our model of nonsynchronous trading and calculate the impact on the time-series properties of the observed data, to be used later in our empirical analysis. In Section 5.4, we attempt to quantify empirically the proportion of contrarian profits that can be attributed to overreaction, and find that a substantial portion cannot be. We show that a systematic lead–lag relationship among returns of size-sorted portfolios is an important source of contrarian profits, and is the sole source of positive index autocorrelation. Using the nontrading model of Section 5.3, we also conclude that the lead- lag patterns cannot be completely attributed to nonsynchronous prices. In Section 5.5 we provide some discussion of our use of weekly returns in contrast to the much longer-horizon returns used in previous studies of stock market overreaction, and we conclude in Section 5.6.

5.2 A Summary of Recent Findings

In Table 5.1 we report the first four autocorrelations of weekly equal-weighted and value-weighted returns indexes for the sample period from July 6,1962, to December 31, 1987, where the indexes are constructed from the Center for Research in Security Prices (CRSP) daily returns files.4 During this period, the equal-weighted index has a first-order autocorrelation  of approximately 30 percent. Since its heteroskedasticity-consistent standard error is 0.046, this autocorrelation is statistically different from zero at all conventional significance levels. The subperiod autocorrelations show that this significance is not an artifact of any particularly influential subsample; equal-weighted returns are strongly positively autocorrelated throughout the sample. Higher-order autocorrelations are also positive although generally smaller in magnitude, and decay at a somewhat slower rate than the geometric rate of an autoregressive process of order 1 [AR( 1 ) ] (for example,

of approximately 30 percent. Since its heteroskedasticity-consistent standard error is 0.046, this autocorrelation is statistically different from zero at all conventional significance levels. The subperiod autocorrelations show that this significance is not an artifact of any particularly influential subsample; equal-weighted returns are strongly positively autocorrelated throughout the sample. Higher-order autocorrelations are also positive although generally smaller in magnitude, and decay at a somewhat slower rate than the geometric rate of an autoregressive process of order 1 [AR( 1 ) ] (for example,  is 8.8 percent whereas

is 8.8 percent whereas  is 11.6 percent).

is 11.6 percent).

Table 5.1. Sample statistics for the weekly equal-weighted and value-weighted CRSP NYSEAMEX stock returns indexes, for the period from July 6, 1962, to December 31, 1987 and subperiods. Heteroskedasticity-consistent standard errors for autocorrelation coefficients are given in parentheses.

To develop a sense of the economic importance of the autocorrelations, observe that the R2 of a regression of returns on a constant and its first lag is the square of the slope coefficient, which is simply the first-order autocorrelation. Therefore, an autocorrelation of 30 percent implies that 9 percent of weekly return variation is predictable using only the preceding week’s returns. In fact, the autocorrelation coefficients implicit in Lo and MacKinlay’s (1988) variance ratios are as high as 49 percent for a subsample of the portfolio of stocks in the smallest-size quintile, implying an R2 of about 25 percent.

It may, therefore, come as some surprise that individual returns are generally weakly negatively autocorrelated. Table 5.2 shows the cross-sectional average of autocorrelation coefficients across all stocks that have at least 52 nonmissing weekly returns during the sample period. For the entire cross section of the 4786 such stocks, the average first-order autocorrelation coefficient, denoted by  , is –3.4 percent with a cross-sectional standard deviation of 8.4 percent. Therefore, most of the individual first-order autocorrelations fall between –20 percent and 13 percent. This implies that most R2’s of regressions of individual security returns on their return last week fall between 0 and 4 percent, considerably less than the predictability of equal-weighted index returns. Average higher-order autocorrelations are also negative, though smaller in magnitude. The negativity of autocorrelations may be an indication of stock market overreaction for individual stocks, but it is also consistent with the existence of a bid–ask spread. We discuss this further in Section 5.3.

, is –3.4 percent with a cross-sectional standard deviation of 8.4 percent. Therefore, most of the individual first-order autocorrelations fall between –20 percent and 13 percent. This implies that most R2’s of regressions of individual security returns on their return last week fall between 0 and 4 percent, considerably less than the predictability of equal-weighted index returns. Average higher-order autocorrelations are also negative, though smaller in magnitude. The negativity of autocorrelations may be an indication of stock market overreaction for individual stocks, but it is also consistent with the existence of a bid–ask spread. We discuss this further in Section 5.3.

Table 5.2. Averages of autocorrelation coefficients for weekly returns on individual securities, for the period July 6, 1962, to December 31, 1987. The statistic  is the average of jth-order autocorrelation coefficients of returns on individual stocks that have at least 52 nonmissing returns. The population standard deviation (SD) is given in parentheses. Since the autocorrelation coefficients are not cross-sectionally independent, the reported standard deviations cannot be used to draw the usual inferences; they are presented merely as a measure of cross-sectional variation in the autocorrelation coefficients.

is the average of jth-order autocorrelation coefficients of returns on individual stocks that have at least 52 nonmissing returns. The population standard deviation (SD) is given in parentheses. Since the autocorrelation coefficients are not cross-sectionally independent, the reported standard deviations cannot be used to draw the usual inferences; they are presented merely as a measure of cross-sectional variation in the autocorrelation coefficients.

Table 5.2 also shows average autocorrelations within size-sorted quintiles.5 The negative autocorrelations are stronger in the smallest quintile, but even the largest quintile has a negative average autocorrelation. Compared to the 30 percent autocorrelation of the equal-weighted index, the magnitudes of the individual autocorrelations indicated by the means (and standard deviations) in Table 5.2 are generally much smaller.

To conserve space, we omit corresponding tables for daily and monthly returns, in which similar patterns are observed. Autocorrelations are strongly positive for index returns (35.5 and 14.8 percent  ’s for the equal-weighted daily and monthly indexes, respectively), and weakly negative for individual securities (–1.4 and –2.9 percent

’s for the equal-weighted daily and monthly indexes, respectively), and weakly negative for individual securities (–1.4 and –2.9 percent  ’s for daily and monthly returns, respectively).

’s for daily and monthly returns, respectively).

The importance of cross-autocorrelations is foreshadowed by the general tendency for individual security returns to be negatively autocorrelated and for portfolio returns, such as those of the equal- and value-weighted market index, to be positively autocorrelated. To see this, observe that the first-order autocovariance of an equal-weighted index may be written as the sum of the first-order own-autocovariances and cross-autocovariances of the component securities. If the own-autocovariances are generally negative, and the index autocovariance is positive, then the cross-autocovariances must be positive. Moreover, the cross-autocovariances must be large, so large as to exceed the sum of the negative own-autocovariances. Whereas virtually all contrarian strategies have focused on exploiting the negative own-autocorrelations of individual securities (see, e.g., DeBondt and Thaler, 1985, 1987, and Lehmann 1988), primarily attributed to overreaction, we show below that forecastability across securities is at least as important a source of contrarian profits both in principle and in fact.

5.3 Analysis of Contrarian Profitability

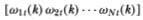

To show the relationship between contrarian profits and the cross effects that are apparent in the data, we examine the expected profits of one such strategy under various return-generating processes. Consider a collection of N securities and denote by Rt the N × l vector of their period t returns [R1t…RNt]'. For convenience, we maintain the following assumption throughout this section:

(Al) Rt is a jointly covariance-stationary stochastic process with expectation E [Rt] = µ ≡ [µ1 µ2…µN]' and autocovariance matrices  where, with no loss of generality, we take k ≥ 0 since

where, with no loss of generality, we take k ≥ 0 since  6

6

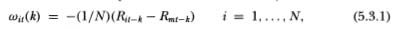

In the spirit of virtually all contrarian investment strategies, consider buying stocks at time t that were losers at time t – k and selling stocks at time t that were winners at time t – k, where winning and losing is determined with respect to the equal-weighted return on the market. More formally, if  denotes the fraction of the portfolio devoted to security i at time t, let

denotes the fraction of the portfolio devoted to security i at time t, let

where  is the equal-weighted market index.7 If, for example, k = 1, then the portfolio strategy in period t is to short the winners and buy the losers of the previous period, t – 1. By construction,

is the equal-weighted market index.7 If, for example, k = 1, then the portfolio strategy in period t is to short the winners and buy the losers of the previous period, t – 1. By construction,

' is an arbitrage portfolio since the weights sum to zero. Therefore, the total investment long (or short) at time t is given by It(k) where

' is an arbitrage portfolio since the weights sum to zero. Therefore, the total investment long (or short) at time t is given by It(k) where

Since the portfolio weights are proportional to the differences between the market index and the returns, securities that deviate more positively from the market at time t – k will have greater negative weight in the time t portfolio, and vice versa. Such a strategy is designed to take advantage of stock market overreactions as characterized, for example, by DeBondt and Thaler (1985): “(1) Extreme movements in stock prices will be followed by extreme movements in the opposite direction. (2) The more extreme the initial price movement, the greater will be the subsequent adjustment.” The profit πt(k) from such a strategy is simply

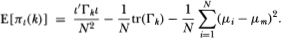

Rearranging Equation (5.3.3) and taking expectations yields the following:

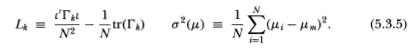

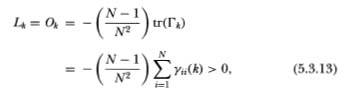

where  and tr(.) denotes the trace operator.8 The first term of (5.3.4) is simply the kth-order autocovariance of the equalweighted market index. The second term is the cross-sectional average of the kth-order autocovariances of the individual securities, and the third term is the cross-sectional variance of the mean returns. Since this last term is independent of the autocovariances

and tr(.) denotes the trace operator.8 The first term of (5.3.4) is simply the kth-order autocovariance of the equalweighted market index. The second term is the cross-sectional average of the kth-order autocovariances of the individual securities, and the third term is the cross-sectional variance of the mean returns. Since this last term is independent of the autocovariances  k and does not vary with k, we define the profitability index Lk ≡ L(

k and does not vary with k, we define the profitability index Lk ≡ L( k)and the constant σ2(µ) as

k)and the constant σ2(µ) as

Thus,

For purposes that will become evident below, we re-write Lk as

where

Hence,

Written this way, it is apparent that expected profits may be decomposed into three terms: one (Ck) depending on only the off-diagonals of the autocovariance matrix  k the second (Ok) depending on only the diagonals, and a third (σ2(µ)) that is independent of the autocovariances. This allows us to separate the fraction of expected profits due to the cross-autocovariances Ck versus the own-autocovariances Ok of returns.

k the second (Ok) depending on only the diagonals, and a third (σ2(µ)) that is independent of the autocovariances. This allows us to separate the fraction of expected profits due to the cross-autocovariances Ck versus the own-autocovariances Ok of returns.

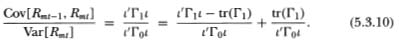

Equation (5.3.9) shows that the profitability of the contrarian strategy (5.3.1) may be perfectly consistent with a positively autocorrelated market index and negatively autocorrelated individual security returns. Positive cross-autocovariances imply that the term Ck is positive, and negative autocovariances for individual securities imply that Ok is also positive. Conversely, the empirical finding that equal-weighted indexes are strongly positively autocorrelated while individual security returns are weakly negatively autocorrelated implies that there must be significant positive cross autocorrelations across securities. To see this, observe that the first-order autocorrelation of the equal-weighted index Rmt is simply

The numerator of the second term on the right-hand side of (5.3.10) is simply the sum of the first-order autocovariances of individual securities; if this is negative, then the first term must be positive in order for the sum to be positive. Therefore, the positive autocorrelation in weekly returns may be attributed solely to the positive cross-autocorrelations across securities.

The expression for Lk also suggests that stock market overreaction need not be the reason that contrarian investment strategies are profitable. To anticipate the examples below, if returns are positively cross-autocorrelated, then a return-reversal strategy will yield positive profits on average, even if individual security returns are serially independent! The presence of stock market overreaction, that is, negatively autocorrelated individual returns, enhances the profitability of the return-reversal strategy, but it is not required for such a strategy to earn positive expected returns.

To organize our understanding of the sources and nature of contrarian profits, we provide five illustrative examples below. Although simplistic, they provide a useful taxonomy of conditions necessary for the profitability of the portfolio strategy (5.3.1).

5.3.1 The Independently and Identically Distributed Benchmark

Let returns Rt be both cross-sectionally and serially independent. In this case  k = 0 for all nonzero k, hence,

k = 0 for all nonzero k, hence,

Although returns are both serially and cross-sectionally unforecastable, the expected profits are negative as long as there is some cross-sectional variation in expected returns. In this case, our strategy reduces to shorting the higher and buying the lower mean return securities, respectively, a losing proposition even when stock market prices do follow random walks. Since σ2(µ) is generally of small magnitude and does not depend on the autocovariance structure of Rt, we will focus on Lk and ignore σ2(µ) for the remainder of Section 5.3.

5.3.2 Stock Market Overreaction and Fads

Almost any operational definition of stock market overreaction implies that individual security returns are negatively autocorrelated over some holding period, so that “what goes up must come down,” and vice versa. If we denote by Yij(k) the (i, j)th element of the autocovariance matrix  k, the overreaction hypothesis implies that the diagonal elements of

k, the overreaction hypothesis implies that the diagonal elements of  k are negative, that is, Yii(k) < 0, at least for k = 1 when the span of one period corresponds to a complete cycle of overreaction.9 Since the overreaction hypothesis generally does not restrict the cross-autocovariances, for simplicity we set them

k are negative, that is, Yii(k) < 0, at least for k = 1 when the span of one period corresponds to a complete cycle of overreaction.9 Since the overreaction hypothesis generally does not restrict the cross-autocovariances, for simplicity we set them

to zero, that is, Yij(k) = 0, i ≠ j. Hence, we have

The profitability index under these assumptions for Rt is then

where the cross-autocovariance term Ck is zero. The positivity of Lk follows from the negativity of the own-autocovariances, assuming N > 1. Not surprisingly, if stock markets do overreact, the contrarian investment strategy is profitable on average.

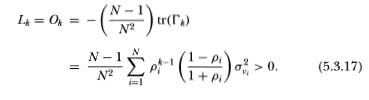

Another price process for which the return-reversal strategy will yield positive expected profits is the sum of a random walk and an AR(1), which has been recently proposed, by Summers (1986), for example, as a model of “fads” or “animal spirits.” Specifically, let the dynamics for the log-price Xit of each security i be given by

where

and the disturbances { it} and {vit} are serially, mutually, and cross-sectionally independent at all nonzero leads and lags.10 The kth-order autocovariance for the return vector Rt is then given by the following diagonal matrix:

it} and {vit} are serially, mutually, and cross-sectionally independent at all nonzero leads and lags.10 The kth-order autocovariance for the return vector Rt is then given by the following diagonal matrix:

and the profitability index follows immediately as

Since the own-autocovariances in Equation (5.3.16) are all negative, this is a special case of Equation (5.3.12) and therefore may be interpreted as an example of stock market overreaction. However, the fact that returns are negatively autocorrelated at all lags is an artifact of the first-order autoregressive process and need not be true for the sum of a random walk and a general stationary process, a model that has been proposed for both stock market fads and time-varying expected returns (e.g., see Fama and French (1988) and Summers (1986)). For example, let the “temporary” component of Equation (5.3.14) be given by the following stationary AR(2) process:

It is easily verified that the first difference of Zit is positively autocorrelated at lag 1 implying that L1 < 0. Therefore, stock market overreaction necessarily implies the profitability of the portfolio strategy (5.3.1) (in the absence of cross-autocorrelation), but stock market fads do not.

5.3.3 Trading on White Noise and Lead–Lag Relations

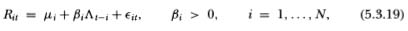

Let the return-generating process for Rt be given by

where Λt is a serially independent common factor with zero mean and variance σλ2, and the  it’s are assumed to be both cross-sectionally and serially independent. These assumptions imply that for each security i, its returns are white noise (with drift) so that future returns to i are not forecastable from its past returns. This serial independence is not consistent with either the spirit or form of the stock market overreaction hypothesis. And yet it is possible to predict i’s returns using past returns of security j, where j < i. This is an artifact of the dependence of the ith security’s return on a lagged common factor, where the lag is determined by the security’s index. Consequently, the return to security 1 leads that of securities 2, 3, etc.; the return to security 2 leads that of securities 3, 4, etc.; and so on. However, the current return to security 2 provides no information for future returns to security 1, and so on. To see that such a lead–lag relation will induce positive expected profits for the contrarian strategy (5.3.1), observe that when k < N, the autocovariance matrix

it’s are assumed to be both cross-sectionally and serially independent. These assumptions imply that for each security i, its returns are white noise (with drift) so that future returns to i are not forecastable from its past returns. This serial independence is not consistent with either the spirit or form of the stock market overreaction hypothesis. And yet it is possible to predict i’s returns using past returns of security j, where j < i. This is an artifact of the dependence of the ith security’s return on a lagged common factor, where the lag is determined by the security’s index. Consequently, the return to security 1 leads that of securities 2, 3, etc.; the return to security 2 leads that of securities 3, 4, etc.; and so on. However, the current return to security 2 provides no information for future returns to security 1, and so on. To see that such a lead–lag relation will induce positive expected profits for the contrarian strategy (5.3.1), observe that when k < N, the autocovariance matrix  k has zeros in all entries except along the kth superdiagonal, for which

k has zeros in all entries except along the kth superdiagonal, for which  . Also, observe that this lead–lag model yields an asymmetric autocovariance matrix

. Also, observe that this lead–lag model yields an asymmetric autocovariance matrix  k. The profitability index is then

k. The profitability index is then

This example highlights the importance of the cross effects—although each security is individually unpredictable, a contrarian strategy may still profit if securities are positively cross-correlated at various leads and lags. Less contrived return-generating processes will also yield positive expected profits to contrarian strategies, as long as the cross-autocovariances are sufficiently large.

5.3.4 Lead–Lag Effects and Nonsynchronous Trading

One possible source of such cross effects is what has come to be known as the “nonsynchronous trading” or “nontrading” problem, in which the prices of distinct securities are mistakenly assumed to be sampled simultaneously. Treating nonsynchronous prices as if they were observed at the same time can create spurious autocorrelation and cross-autocorrelation, as Fisher (1966), Scholes and Williams (1977), and Cohen et al. (1986) have demonstrated. To gauge the importance of nonsynchronous trading for contrarian profits, we derive the magnitude of the spurious cross-autocorrelations using the nontrading model of Lo and MacKinlay (1990c).11

Consider a collection of N securities with unobservable “virtual” continuously compounded returns Rit at time where i = 1,…, N, and assume that they are generated by the following stochastic model:

where Λt is some zero-mean common factor and  it is zero-mean idiosyncratic noise that is temporally and cross-sectionally independent at all leads and lags. Since we wish to focus on nontrading as the sole source of autocorrelation, we also assume that the common factor Λt is independently and identically distributed and is independent of

it is zero-mean idiosyncratic noise that is temporally and cross-sectionally independent at all leads and lags. Since we wish to focus on nontrading as the sole source of autocorrelation, we also assume that the common factor Λt is independently and identically distributed and is independent of  it–k for all i, t, and k.

it–k for all i, t, and k.

In each period t there is some chance that security i does not trade, say with probability pi. If it does not trade, its observed return for period t is simply 0, although its true or virtual return Rit is still given by Equation (5.3.21). In the next period t + 1 there is again some chance that security i does not trade, also with probability pi. We assume that whether or not the security traded in period t does not influence the likelihood of its trading in period t + 1 or any other future period; hence, our nontrading mechanism is independent and identically distributed for each security i.12 If security i does trade in period t + 1 and did not trade in period t, we assume that its observed return Roit+1 at t + 1 is the sum of its virtual returns Rit+1, Rit and virtual returns for all past consecutive periods in which i has not traded. In fact, the observed return in any period is simply the sum of its virtual returns for all past consecutive periods in which it did not trade. This captures the essential feature of nontrading as a source of spurious autocorrelation: News affects those stocks that trade more frequently first and influences the returns of thinly traded securities with a lag. In this framework, the effect of news is captured by the virtual returns process (5.3.21), and the lag induced by nonsynchronous trading is therefore built into the observed returns process Roit.

More formally, the observed returns process may be written as the following weighted average of past virtual returns:

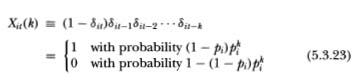

Here the (random) weights Xit(k) are defined as products of no-trade indicators:

for  and where the δit’s are independently and identically distributed Bernoulli random variables that take on the value 1 when security i does not trade at time t, and zero otherwise. The variable Xit(k) is also an indicator variable, and takes on the value 1 if security i trades at time t but not in any of the k previous periods, and takes on the value 0 otherwise. If security i does not trade at time t, then δit = 1, which implies that Xit(k) = 0 for all k, thus, Roit = 0. If i does trade at time t, then its observed return is equal to the sum of today’s virtual return Rit and its past

and where the δit’s are independently and identically distributed Bernoulli random variables that take on the value 1 when security i does not trade at time t, and zero otherwise. The variable Xit(k) is also an indicator variable, and takes on the value 1 if security i trades at time t but not in any of the k previous periods, and takes on the value 0 otherwise. If security i does not trade at time t, then δit = 1, which implies that Xit(k) = 0 for all k, thus, Roit = 0. If i does trade at time t, then its observed return is equal to the sum of today’s virtual return Rit and its past  virtual returns, where the random variable

virtual returns, where the random variable  is the number of past consecutive periods that i has not traded. We call this the duration of nontrading, and it may be expressed as

is the number of past consecutive periods that i has not traded. We call this the duration of nontrading, and it may be expressed as

To develop some intuition for the nontrading probabilities pi, observe that

If pi = ½, then the average duration of nontrading for security i is one period. However, if pi = ¾, then the average duration of nontrading increases to three periods. As expected if the security trades every period so that pi = 0, the mean (and variance) of  is zero.

is zero.

Further simplification results from grouping securities with common nontrading probabilities into portfolios. If, for example, an equal-weighted portfolio contains securities with common nontrading probability pk, then the observed return to portfolio K may be approximated as

where the approximation becomes exact as the number of securities in the portfolio approaches infinity, and where βK is the average beta of the securities in the portfolio.

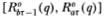

Now define RoKτ (q) as the observed return of portfolio k over q periods, that is,  . We wish to work with time-aggregated returns RoKt (q) to allow nontrading to take place at intervals finer than the sampling interval.13 Using Equation (5.3.26), we have the following moments and co-moments of observed portfolio returns:14

. We wish to work with time-aggregated returns RoKt (q) to allow nontrading to take place at intervals finer than the sampling interval.13 Using Equation (5.3.26), we have the following moments and co-moments of observed portfolio returns:14

where Roaτ (q) and Robτ (q) are the observed q-period returns of two arbitrary portfolios a and b. Using (5.3.29) and (5.3.32), the effects of nontrading on contrarian profits may be quantified explicitly. A lead–lag structure may also be deduced from (5.3.32). To see this, consider the ratio of the cross-autocorrelation coefficients:

which shows that portfolios with higher nontrading probabilities tend to lag those with lower nontrading probabilities. For example, if pb > pa so that securities in portfolio b trade less frequently than those in portfolio a, then the correlation between today’s return on a and tomorrow’s return on b exceeds the correlation between today’s return on b and tomorrow’s return on a.

To check the magnitude of the cross-correlations that can result from nonsynchronous prices, consider two portfolios a and b with daily non-trading probabilities pa = .10 and pb = .25. Using (5.3.32), with q = 5 for weekly returns and k = 1 for the first-order cross-autocorrelation, yields Corr  = . 066 and Corr

= . 066 and Corr  = .019. Although there is a pronounced lead–lag effect, the cross-autocorrelations are small. We shall return to these cross-autocorrelations in our empirical analysis below, where we show that values of .10 and .25 for nontrading probabilities are considerably larger than the data suggest. Even if we eliminate nontrading in portfolio a so that pa = 0, this yields Corr

= .019. Although there is a pronounced lead–lag effect, the cross-autocorrelations are small. We shall return to these cross-autocorrelations in our empirical analysis below, where we show that values of .10 and .25 for nontrading probabilities are considerably larger than the data suggest. Even if we eliminate nontrading in portfolio a so that pa = 0, this yields Corr  = .070 and Corr

= .070 and Corr  = .000. Therefore, the magnitude of weekly cross-autocorrelations cannot be completely attributed to the effects of non-synchronous trading.

= .000. Therefore, the magnitude of weekly cross-autocorrelations cannot be completely attributed to the effects of non-synchronous trading.

5.3.5 A Positively Dependent Common Factor and the Bid–Ask Spread

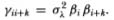

A plausible return-generating mechanism consistent with positive index autocorrelation and negative serial dependence in individual returns is to let each Rit be the sum of three components: a positively autocorrelated common factor, idiosyncratic white noise, and a bid–ask spread process.15 More formally, let

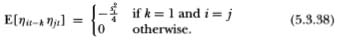

where

Implicit in Equation (5.3.38) is Roll’s (1984a) model of the bid–ask spread, in which the first-order autocorrelation of nit is the negative of one-fourth the square of the percentage bid–ask spread si, and all higher-order autocorrelations and all cross-correlations are zero. Such a return-generating process will yield a positively autocorrelated market index since averaging the white-noise and bid–ask components will trivialize them, leaving the common factor Λt. Yet if the bid–ask spread is large enough, it may dominate the common factor for each security, yielding negatively autocorrelated individual security returns.

The autocovariance matrices for Equation (5.3.34) are given by

where  In contrast to the lead–lag model of Section 5.3.4, the autocovariance matrices for this return-generating process are all symmetric. This is an important empirical implication that distinguishes the common factor model from the lead–lag process, and will be exploited in our empirical appraisal of overreaction.

In contrast to the lead–lag model of Section 5.3.4, the autocovariance matrices for this return-generating process are all symmetric. This is an important empirical implication that distinguishes the common factor model from the lead–lag process, and will be exploited in our empirical appraisal of overreaction.

Denote by ßm the cross-sectional average  Then the profitability index is given by

Then the profitability index is given by

Equation (5.3.41) shows that if the bid–ask spreads are large enough and the cross-sectional variation of the βk’s is small enough, the contrarian strategy (5.3.1) may yield positive expected profits when using only one lag (k = 1) in computing portfolio weights. However, the positivity of the profitability index is due solely to the negative autocorrelations of individual security returns induced by the bid–ask spread. Once this effect is removed, for example, when portfolio weights are computed using lags 2 or higher, relation (5.3.42) shows that the profitability index is of the opposite sign of the index autocorrelation coefficient γλ(k). Since γλ(k) > 0 by assumption, expected profits are negative for lags higher than 1. In view of the empirical results to be reported in Section 5.4, in which Lk is shown to be positive for k > 1, it seems unlikely that the return-generating process (5.3.34) can account for the weekly autocorrelation patterns in the data.

5.4 An Empirical Appraisal of Overreaction

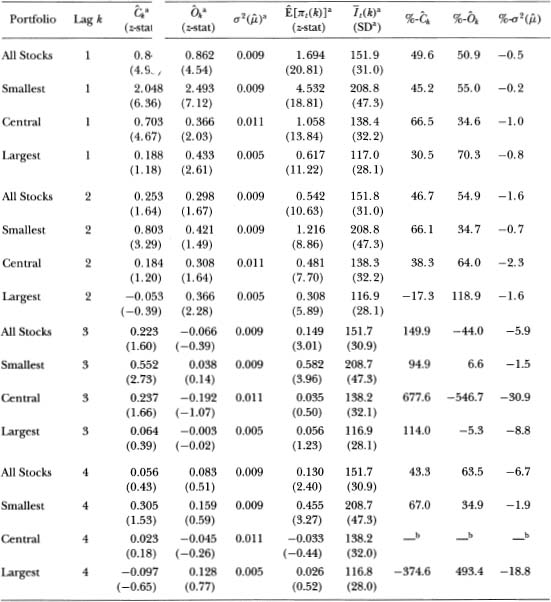

To see how much of contrarian profits is due to stock market overreaction, we estimate the expected profits from the return-reversal strategy of Section 5.3 for a sample of CRSP NYSE-AMEX securities. Recall that

where Ck depends only on the cross-autocovariances of returns and Ok depends only on the own-autocovariances. Table 5.4 shows estimates of

where Ck depends only on the cross-autocovariances of returns and Ok depends only on the own-autocovariances. Table 5.4 shows estimates of  , Ck Ok and σ2(µ) for the 551 stocks that have no missing weekly returns during the entire sample period from July 6,1962, to December 31,1987. Estimates are computed for the sample of all stocks and for three size-sorted quintiles. All size-sorted portfolios are constructed by sorting only once (using market values of equity at the middle of the sample period); hence, their composition does not change over time. We develop the appropriate sampling theory in Appendix A, in which the covariance-stationarity assumption (A1) is replaced with weaker assumptions allowing for serial dependence and heterogeneity.

, Ck Ok and σ2(µ) for the 551 stocks that have no missing weekly returns during the entire sample period from July 6,1962, to December 31,1987. Estimates are computed for the sample of all stocks and for three size-sorted quintiles. All size-sorted portfolios are constructed by sorting only once (using market values of equity at the middle of the sample period); hence, their composition does not change over time. We develop the appropriate sampling theory in Appendix A, in which the covariance-stationarity assumption (A1) is replaced with weaker assumptions allowing for serial dependence and heterogeneity.

Consider the last three columns of Table 5.4, which show the magnitudes of the three terms  and σ2

and σ2 as percentages of expected profits. At lag 1, half the expected profits from the contrarian strategy are due to positive cross autocovariances. In the central quintile, about 67 percent of the expected profits is attributable to these cross-effects. The results at lag 2 are similar: Positive cross-autocovariances account for about 50 percent of the expected profits, 66 percent for the smallest quintile.

as percentages of expected profits. At lag 1, half the expected profits from the contrarian strategy are due to positive cross autocovariances. In the central quintile, about 67 percent of the expected profits is attributable to these cross-effects. The results at lag 2 are similar: Positive cross-autocovariances account for about 50 percent of the expected profits, 66 percent for the smallest quintile.

The positive expected profits at lags 2 and higher provide direct evidence against the common component/bid–ask spread model of Section 5.3.5. If returns contained a positively autocorrelated common factor and exhibited negative autocorrelation due to “bid–ask bounce,” expected profits can be positive only at lag 1; higher lags must exhibit negative expected profits as Equation (5.3.42) shows. Table 5.4 shows that estimated expected profits are significantly positive for lags 2 through 4 in all portfolios except one.

The z-statistics for  and

and  are asymptotically standard normal under the null hypothesis that the population values corresponding to the three estimators are zero. At lag 1, they are almost all significantly different from zero at the 1 percent level. At higher lags, the own- and cross-autocovariance terms are generally insignificant. However, estimated expected profits retains its significance even at lag 4, largely due to the behavior of small stocks. The curious fact that

are asymptotically standard normal under the null hypothesis that the population values corresponding to the three estimators are zero. At lag 1, they are almost all significantly different from zero at the 1 percent level. At higher lags, the own- and cross-autocovariance terms are generally insignificant. However, estimated expected profits retains its significance even at lag 4, largely due to the behavior of small stocks. The curious fact that  is statistically different from zero whereas

is statistically different from zero whereas  and

and  are not suggests that there is important negative correlation between the two estimators

are not suggests that there is important negative correlation between the two estimators  and

and  .16 That is, although they are both noisy estimates, the variance of their sum is less than each of their variances because they co-vary negatively. Since

.16 That is, although they are both noisy estimates, the variance of their sum is less than each of their variances because they co-vary negatively. Since  and

and  are both functions of second moments and co-moments, significant correlation of the two estimators implies the importance of fourth co-moments, perhaps as a result of co-skewness or kurtosis. This is beyond the scope of this chapter, but bears further investigation.

are both functions of second moments and co-moments, significant correlation of the two estimators implies the importance of fourth co-moments, perhaps as a result of co-skewness or kurtosis. This is beyond the scope of this chapter, but bears further investigation.

Table 5.3. Analysis of the profitability of the return-reversal strategy applied to weekly returns, for the sample of 551 CRSP NYSE-AMEX stocks with nonmissing weekly returns from July 6, 1962, to 31 December 1987 (1330 weeks). Expected profits is given by  where Ck depends only on cross-autocovariances and Ok depends only on own-autocovariances. All z-statistics are asymptotically N(0,1) under the null hypothesis that the relevant population value is zero, and are robust to heteroskedasticity and autocorrelation. The average long position

where Ck depends only on cross-autocovariances and Ok depends only on own-autocovariances. All z-statistics are asymptotically N(0,1) under the null hypothesis that the relevant population value is zero, and are robust to heteroskedasticity and autocorrelation. The average long position  (k) is also reported, with its sample standard deviation in parentheses underneath. The analysis is conducted for all stocks as well as for the five size-sorted quintiles; to conserve space, results for the second and fourth quintiles have been omitted.

(k) is also reported, with its sample standard deviation in parentheses underneath. The analysis is conducted for all stocks as well as for the five size-sorted quintiles; to conserve space, results for the second and fourth quintiles have been omitted.

aMultiplied by 10,000.

bNot computed when expected profits are negative.

Table 5.4 also reports the average long (and hence short) positions generated by the return-reversal strategy over the 1330-week sample period. For all stocks, the average weekly long-short position is $152 and the average weekly profit is $1.69. In contrast, applying the same strategy to a portfolio of small stocks yields an expected profit of $4.53 per week, but requires only $209 long and short each week on average. The ratio of expected profits to average long investment is 1.1 percent for all stocks, and 2.2 percent for stocks in the smallest quintile. Of course, in the absence of market frictions such comparisons are irrelevant, since an arbitrage portfolio strategy may be scaled arbitrarily. However, if the size of one’s long-short position is constrained, as is sometimes the case in practice, then the average investment figures reported in Table 5.4 suggest that applying the contrarian strategy to small firms would be more profitable on average.

Using stocks with continuous listing for over 20 years obviously induces a survivorship bias that is difficult to evaluate. To reduce this bias we have performed similar analyses for two subsamples: stocks with continuous listing for the first and second halves of the 1330-week sample respectively. In both subperiods positive cross effects account for at least 50 percent of expected profits at lag 1, and generally more at higher lags. Since the patterns are virtually identical to those in Table 5.4, to conserve space we omit these additional tables.

To develop further intuition for the pattern of these cross effects, we report in Table 5.4 cross-autocorrelation matrices  for the vector of returns on the five size-sorted quintiles and the equal-weighted index using the sample of551 stocks. Let Zt denote the vector

for the vector of returns on the five size-sorted quintiles and the equal-weighted index using the sample of551 stocks. Let Zt denote the vector  , where Rit is the return on the equal-weighted portfolio of stocks in the ith quintile, and Rmt is the return on the equal-weighted portfolio of all stocks. Then the kth-order autocorrelation matrix of Zt is given by

, where Rit is the return on the equal-weighted portfolio of stocks in the ith quintile, and Rmt is the return on the equal-weighted portfolio of all stocks. Then the kth-order autocorrelation matrix of Zt is given by

where D ≡ diag

where D ≡ diag By this convention, the (i,j)th element of

By this convention, the (i,j)th element of  k is the correlation of Rit–k with Rjt. The estimator

k is the correlation of Rit–k with Rjt. The estimator  k is the usual sample autocorrelation matrix. Note that it is only the upper left 5 x 5 submatrix of

k is the usual sample autocorrelation matrix. Note that it is only the upper left 5 x 5 submatrix of  k that is related to

k that is related to  k, since the full matrix

k, since the full matrix  k also contains autocorrelations between portfolio returns and the equal-weighted market index Rmt.17

k also contains autocorrelations between portfolio returns and the equal-weighted market index Rmt.17

Table 5.4. Autocorrelation matrices of the vector  where Rit is the return on the portfolio of stocks in the ith quintik, i = 1,…, 5 (quintile 1 contains the smallest stocks) and Rmt is the return on the equal-weighted index, for the sample of 551 stocks with nonmissing weekly returns from July 6, 1962, to December31, 1987 (1330 observations). Note that

where Rit is the return on the portfolio of stocks in the ith quintik, i = 1,…, 5 (quintile 1 contains the smallest stocks) and Rmt is the return on the equal-weighted index, for the sample of 551 stocks with nonmissing weekly returns from July 6, 1962, to December31, 1987 (1330 observations). Note that where D ≡

where D ≡ , thus the (i,j)th element is the correlation between Rit-k and Rjt. Asymptotic standard errors for the autocorrelations under an ID null hypothesis are given by

, thus the (i,j)th element is the correlation between Rit-k and Rjt. Asymptotic standard errors for the autocorrelations under an ID null hypothesis are given by  .

.

An interesting pattern emerges from Table 5.4: The entries below the diagonals of  k are almost always larger than those above the diagonals (excluding the last row and column, which are the autocovariances between portfolio returns and the market). This implies that current returns of smaller stocks are correlated with past returns of larger stocks, but not vice versa, a distinct lead-lag relation based on size. For example, the first-order autocorrelation between last week’s return on large stocks (R5t–1) with this week’s return on small stocks (R1t) is 27.6 percent, whereas the first-order autocorrelation between last week’s return on small stocks (R1t–1) with this week’s return on large stocks (R5t) is only 2.0 percent! Similar patterns may be seen in the higher-order autocorrelation matrices, although the magnitudes are smaller since the higher-order cross-autocorrelations decay. The asymmetry of the

k are almost always larger than those above the diagonals (excluding the last row and column, which are the autocovariances between portfolio returns and the market). This implies that current returns of smaller stocks are correlated with past returns of larger stocks, but not vice versa, a distinct lead-lag relation based on size. For example, the first-order autocorrelation between last week’s return on large stocks (R5t–1) with this week’s return on small stocks (R1t) is 27.6 percent, whereas the first-order autocorrelation between last week’s return on small stocks (R1t–1) with this week’s return on large stocks (R5t) is only 2.0 percent! Similar patterns may be seen in the higher-order autocorrelation matrices, although the magnitudes are smaller since the higher-order cross-autocorrelations decay. The asymmetry of the  k matrices implies that the autocovariance matrix estimators

k matrices implies that the autocovariance matrix estimators  k are also asymmetric. This provides further evidence against the sum of the positively autocorrelated factor and the bid-ask spread as the true return-generating process, since Equation (5.3.34) implies symmetric autocovariance (and hence autocorrelation) matrices.

k are also asymmetric. This provides further evidence against the sum of the positively autocorrelated factor and the bid-ask spread as the true return-generating process, since Equation (5.3.34) implies symmetric autocovariance (and hence autocorrelation) matrices.

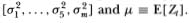

Of course, the nontrading model of Section 5.3.4 also yields an asymmetric autocorrelation matrix. However, it is easy to see that unrealistically high probabilities of nontrading are required to generate cross-autocorrelations of the magnitude reported in Table 5.4. For example, consider the firstorder cross-autocorrelation between R2t-1 (the return of the second-smallest quintile portfolio) and Rlt (the return of the smallest quintile portfolio) which is 33.4 percent. Using Equation (5.3.28) and (5.3.32) with k = 1 and q = 5 days, we may compute the set of daily nontrading probabilities (p1, p2) of portfolios 1 and 2, respectively, that yield such a weekly cross-autocorrelation. For example, the combinations (.010, .616), (.100, .622), (.500, .659), (.750, .700), and (.990, .887) all yield a cross-autocorrelation of 33.4 percent. But none of these combinations are empirically plausible nontrading probabilities—the first pair implies an average duration of nontrading of 1.6 days for securities in the second smallest quintile, and the implications of the other pairs are even more extreme! Figure 5.1 plots the iso-autocorrelation loci for various levels of cross-autocorrelations, from which it is apparent that nontrading cannot be the sole source of cross-autocorrelation in stock market returns.18

Figure 5.1. Loci of nontrading probability pairs (pa, pb) that imply a constant cross- autocorrelation ρqab(k), for ρqab(k) = .05, .10, .15, .20, .25, k = 1, q = 5. If the probabilities are interpreted as daily probabilities of nontrading, then pqab(k) represents the first-order weekly cross-autocorrelation between this week’s return to portfolio a and next week’s return to portfolio b when q – 5 and k = 1.

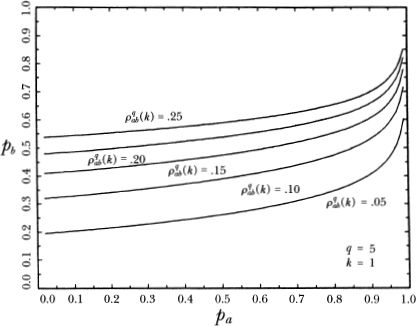

Figure 5.2. Cross-autocorrelation ρqab(k) as a function of p(a) and p(b), for q = 5, k = 1.(a)Front view; (b)rear view

Further evidence against nontrading comes from the pattern of cross autocorrelations within each column of the first-order autocorrelation matrix  1.19 For example, consider the first column of

1.19 For example, consider the first column of  1 whose first element is .333 and fifth element is .276. These values show that the correlation between the returns of portolio a this week and those of portfolio b next week do not change significantly as portfolio a varies from the smallest firms to the largest. However, if cross-autocorrelations on the order of 30 percent are truly due to nontrading effects, Equation (5.3.32) implies an inverted U-shaped pattern for the cross-autocorrelation as portfolio a is varied. This is most easily seen in Figure 5.2a and b, in which an inverted U-shape is obtained by considering the intersection of the cross-autocorrelation surface with a vertical plane parallel to the pa axis and perpendicular to the pb axis, where the intersection occurs in the region where the surface rises to a level around 30 percent. The resulting curve is the nontrading-induced cross-autocorrelation for various values of pa, holding pb fixed at some value. These figures show that the empirical cross-autocorrelations are simply not consistent with nontrading, either in pattern or in the implied nontrading probabilities.

1 whose first element is .333 and fifth element is .276. These values show that the correlation between the returns of portolio a this week and those of portfolio b next week do not change significantly as portfolio a varies from the smallest firms to the largest. However, if cross-autocorrelations on the order of 30 percent are truly due to nontrading effects, Equation (5.3.32) implies an inverted U-shaped pattern for the cross-autocorrelation as portfolio a is varied. This is most easily seen in Figure 5.2a and b, in which an inverted U-shape is obtained by considering the intersection of the cross-autocorrelation surface with a vertical plane parallel to the pa axis and perpendicular to the pb axis, where the intersection occurs in the region where the surface rises to a level around 30 percent. The resulting curve is the nontrading-induced cross-autocorrelation for various values of pa, holding pb fixed at some value. These figures show that the empirical cross-autocorrelations are simply not consistent with nontrading, either in pattern or in the implied nontrading probabilities.

The results in Tables 5.3 and 5.4 point to the complex patterns of cross effects among securities as significant sources of positive index autocorrelation, as well as expected profits for contrarian investment rules. The presence of these cross effects has important implications, irrespective of the nature of contrarian profits. For example, if such profits are genuine, the fact that at least half may be attributed to cross-autocovariances suggests further investigation of mechanisms by which aggregate shocks to the economy are transmitted from large capitalization companies to small ones.

5.5 Long Horizons Versus Short Horizons

Since several recent studies have employed longer-horizon returns in examining contrarian strategies and the predictability of stock returns, we provide some discussion here of our decision to focus on weekly returns. Distinguishing between short-and long-return horizons is important, as it is now well known that weekly fluctuations in stock returns differ in many ways from movements in three- to five-year returns. Therefore, inferences concerning the performance of the long-horizon strategies cannot be drawn directly from results such as ours. Because our analysis of the contrarian investment strategy (5.3.1) uses only weekly returns, we have little to say about the behavior of long-horizon returns. Nevertheless, some suggestive comparisons are possible.

Statistically, the predictability of short-horizon returns, especially weekly and monthly, is stronger and more consistent through time. For example, Blume and Friend (1978) have estimated a time series of cross-sectional correlation coefficients of returns in adjacent months using monthly NYSE data from 1926 to 1975, and found that in 422 of the 598 months the sample correlation was negative. This proportion of negative correlations is considerably higher than expected if returns are unforecastable. But in their framework, a negative correlation coefficient implies positive expected profits in our Equation (5.3.4) with k = 1. Jegadeesh (1990) provides further analysis of monthly data and reaches similar conclusions. The results are even more striking for weekly stock returns, as we have seen. For example, Lo and MacKinlay (1988b) show evidence of strong predictability for portfolio returns using New York and American Stock Exchange data from 1962 to 1985. Using the same data, Lehmann (1990) shows that a contrarian strategy similar to (5.3.1) is almost always profitable.20 Together these two observations imply the importance of cross-effects, a fact we established directly in Section 5.4.

Evidence regarding the predictability of long-horizon returns is more mixed. Perhaps the most well-known studies of a contrarian strategy using long-horizon returns are those of DeBondt and Thaler (1985,1987) in which winners are sold and losers are purchased, but where the holding period over which winning and losing is determined is three years. Based on data from 1926 through 1981 they conclude that the market overreacts since the losers outperform the winners. However, since the difference in performance is due largely to the January seasonal in small firms, it seems inappropriate to attribute this to long-run overreaction.21

Fama and French (1988) and Poterba and Summers (1988) have also examined the predictability of long-horizon portfolio returns and find negative serial correlation, a result consistent with those of DeBondt and Thaler. However, this negative serial dependence is quite sensitive to the sample period employed, and may be largely due to the first 10 years of the 1926 to 1987 sample (see Kim, Nelson, and Startz, 1991). Furthermore, the statistical inference on which the long-horizon predictability is based has been questioned by Richardson (1993), who shows that properly adjusting for the fact that multiple time horizons (and test statistics) are considered simultaneously yields serial correlation estimates that are statistically indistinguishable from zero.

These considerations point to short-horizon returns as the more immediate source from which evidence of predictability and stock market over-reaction might be culled. This is not to say that a careful investigation of returns over longer time spans will be uninformative. Indeed, it may be only at these lower frequencies that the effect of economic factors, such as the business cycle, is detectable. Moreover, to the extent that transaction costs are greater for strategies exploiting short-horizon predictability, long-horizon predictability may be a more genuine form of unexploited profit opportunity.

5.6 Conclusion

Traditional tests of the random walk hypothesis for stock market prices have generally focused on the returns either to individual securities or to portfolios of securities. In this chapter, we show that the cross-sectional interaction of security returns over time is an important aspect of stock-price dynamics. We document the fact that stock returns are often positively cross-autocorrelated, which reconciles the negative serial dependence in individual security returns with the positive autocorrelation in market indexes. This also implies that stock market overreaction need not be the sole explanation for the profitability in contrarian portfolio strategies. Indeed, the empirical evidence suggests that less than 50 percent of the expected profits from a contrarian investment rule may be attributed to overreaction; the majority of such profits is due to the cross effects among the securities. We have also shown that these cross effects have a very specific pattern for size-sorted portfolios: They display a lead-lag relation, with the returns of larger stocks generally leading those of smaller ones. But a tantalizing question remains to be investigated: What are the economic sources of positive cross-autocorrelations across securities?

Appendix A5

Derivation of Equation (5.3.4)

Sampling Theory for

To derive the sampling theory for the estimators Ck,  , we reexpress them as averages of artificial time series and then apply standard asymptotic theory to those averages. We require the following assumptions:

, we reexpress them as averages of artificial time series and then apply standard asymptotic theory to those averages. We require the following assumptions:

(Al) For all t, i, j, and k the following condition is satisfied for finite constants K > 0, δ > 0, and r ≥ 0:

(A2) The vector of returns Rt is either α-mixing with coefficients of size 2r/(r – 1) or ø-mixing with coefficients of size 2r/(2r – 1).

These assumptions specify the trade-off between dependence and heterogeneity in Rt that is admissible while still permitting some form of the central limit theorem to obtain. The weaker is the moment condition (Assumption (A2)), the quicker the dependence in Rt must decay, and vice versa.22 Observe that the covariance-stationarity of Rt is not required. Denote by Ckt and Okt the following two time series:

where  are the usual sample means of the returns to security i and the equal-weighted market index, respectively. Then the estimators

are the usual sample means of the returns to security i and the equal-weighted market index, respectively. Then the estimators  and

and  are given by

are given by

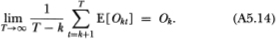

Because we have not assumed covariance-stationarity, the population quantities Ck and Ok obviously need not be interpretable according to Equation(5.3.8) since the autocovariance matrix of Rt may now be time dependent. However, we do wish to interpret Ck and Ok as some fixed quantities that are time independent; thus, we require:

(A3) The following limits exist and are finite:

Although the expectations E(Ckt) and E(Okt) may be time dependent, Assumption (A3) asserts that their averages converge to well-defined limits; hence, the quantities Ck and Ok may be viewed as “average” cross-and own-autocovariance contributions to expected profits. Consistent estimators of the asymptotic variance of the estimators  may then be obtained along the lines of Newey and West (1987), and are given by

may then be obtained along the lines of Newey and West (1987), and are given by  , respectively, where

, respectively, where

and  (j) and

(j) and  (j) are the sample jth order autocovariances of the time series Ckt and Okt, respectively, that is,

(j) are the sample jth order autocovariances of the time series Ckt and Okt, respectively, that is,

Assuming that q ~ 0(T¼), Newey and West (1987) show the consistency (A1)–(A3).23 Observe that these asymptotic variance estimators are robust to general forms of heteroskedasticity and autocorrelation in the Ckt and Okt time series. Since the derivation of heteroskedasticity-and autocorrelation-consistent standard errors for the estimated expected profits  is virtually identical, we leave this to the reader.

is virtually identical, we leave this to the reader.

1 See, for example, the papers in Cootner (1964), and Farna (1965,Fama (1970). Our usage of the term “random walk” differs slightl,y fr om the classical definition of a process with independently and identically distributed increments. Since historically the property of primary economic interest has been the uncorrelatedness of increments, we also consider processes with uncorrelated but heterogeneously distributed dependent increments to be random walks.

2 Decisions about how performance is defined and for what length of time generates as many different kinds of contrarian strategies as there are theories of overreaction.

3 We refrain from this usage since the more common usage of the “Fisher effect” is the one-for-one change in nominal interest rates with changes in expected inflation, due to Irving Fisher.

4 Unless stated otherwise, we take returns to be simple returns and not continuouslycompounded. The weekly return of each security is computed as the return from Wednesday’s closing price to the following Wednesday’s closing price. If the following Wednesday’s price is missing, then Thursday’s price (or Tuesday’s if Thursday’s is also missing) is used. If both Tuesday’s and Thursday’s prices are missing, the return for that week is reported as missing; this occurs only rarely. To compute weekly returns on size-sorted portfolios, for each week all stocks with nonmissing returns that week are assigned to portfolios based on which quintile their market value of equity lies in. The sorting is done only once, using mid-sample equity values, hence the compositions of the portfolios do not change over time.

5 Securities are allocated to quintiles by sorting only once (using market values of their sample periods); hence, their composition of quintiles does not change over time.

6 Assumption (Al) is made for notational simplicity, since joint covariance-stationaritya llows us to eliminate time-indexes from population moments such as µ and  k; the qualitative features of our results will not change under the weaker assumptions of weakly dependent heterogeneously distributed vectors Rt. This would merely require replacing expectations with corresponding probability limits of suitably defined time-averages. The empirical results of Section 5.4 are based on these weaker assumptions; interested readers may refer to conditions 1-3 in Appendix A.,

k; the qualitative features of our results will not change under the weaker assumptions of weakly dependent heterogeneously distributed vectors Rt. This would merely require replacing expectations with corresponding probability limits of suitably defined time-averages. The empirical results of Section 5.4 are based on these weaker assumptions; interested readers may refer to conditions 1-3 in Appendix A.,

7 This is perhaps the simplest portfolio strategy that captures the essence of the contrarian principle. Lehmann (1990) also considers this strategy, although he employs a more complicated strategy in his empirical analysis in which the portfolio weights (Equation (5.3.1)) are re-normalized each period by a random factor of proportionality, so that the investment is always $1 long and short. This portfolio strategy is also similar to that of DeBondt and Thaler (1985,1987), although in contrast to our use of weekly returns, they consider holding periods of three years. See Section 5.5 for further discussion.

8 The derivation of (5.3.4) is included in Appendix A for completeness. This is the population counterpart of Lehmann’s (1988) sample moment equation (5) divided by N.

9 See Section 5.5 for further discussion of the importance of the return horizon.

10 This last assumption requires only that εit–k, is independent of εjt for k ≠ 0; hence, the disturbances may be contemporaneously cross-sectionally dependent without loss of generality.

11 The empirical relevance of other nontrading effects, such as the negative autocorrelation of individual returns, is beyond the scope of this study and is explored in depth by Atkinsonet al. (1987) and Lo and MacKinlay (1990c).

12 This assumption may be relaxed to allow for state-dependent probabilities, that is, autocorrelated nontrading (see Lo and MacKinlay (1990c) for further details).

13 SO, for example, although we use weekly returns in our empirical analysis below, the implications of nontrading that we are about to derive still obtain for securities that may not trade on some days within the week.

14 See Lo and MacKinlay (1990c) for the derivations.

15 This is suggested in Lo and MacKinlay (1988b). Conrad, Kaul, and Nimalendran (1988) investigate a similar specification.

16 We have investigated the unlikely possibility that σ2 is responsible for this anomaly; it is not.

is responsible for this anomaly; it is not.

17 We include the market return in our autocovariance matrices so that those who wish to may compute portfolio betas and market volatilities from our tables.

18 Moreover, the implications for nontrading probabilities are even more extreme if we consider hourly instead of daily nontrading, that is, ifwe set q = 35 hours (roughly the number of trading hours in a week). Also, relaxing the restrictive assumptions of the nontrading model of Section 5.3.4 does not affect the order of magnitude of the above calculations. See Lo and MacKinlay (1990c) for further details.

19 We are grateful to Michael Brennan for suggesting this analysis.

20 Incseu ch profits are sensitive to the size of the transactions costs (for some cases a oneway transactions cost of 0.40 percent is sufficient to render them positive half the time and negative the other half), the importance of Lehmann’s findings hinges on the relevant costs of turning over securities frequently. The fact that our Table 5.4 shows the smallest finns to be the most profitable on average (as measured by the ratio of expected profits to the dollar amount long) may indicate that a round-trip transaction cost of 0.80 percent is low. In addition - . to the bid-ask spread, which is generally $0.125 or Larger and will be a larger percentage of the price for smaller stocks, the price effect of trades on these relatively thinly traded securities may become significant.

21 See Zarowin (1990) for further discussion.

22 See Phillips (1987) and White (1984) for further discussion of this trade-off.

23 In our empirical work we choose q = 8.