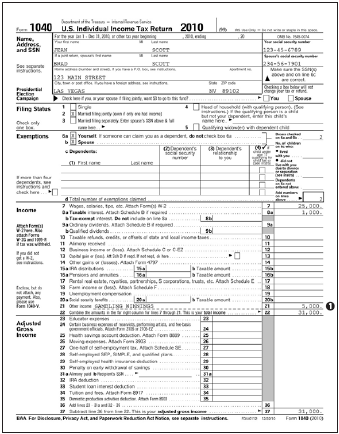

Form 1040 side 1

Gambling gross win total for the year was $5,0001. Gambling gross loss total was $6,000. The standard deduction is $11,400. Since gambling losses have to be claimed as an itemized deduction and taxpayers have only a few small other deductions, it is better to take the standard deduction2 than to itemize. This results in paying tax on gross wins even though taxpayers have an actual net gambling loss of $1,000 for the year.

Form 1040 side 2