Appendix B2

Recreational Gambler—Itemized

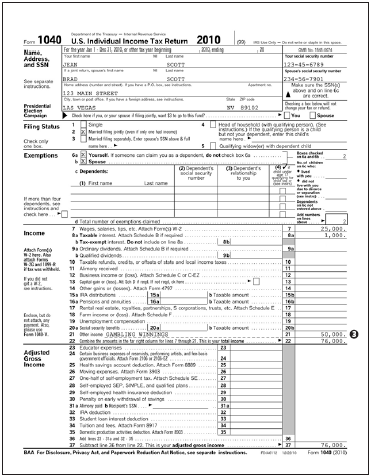

Form 1040 side 1

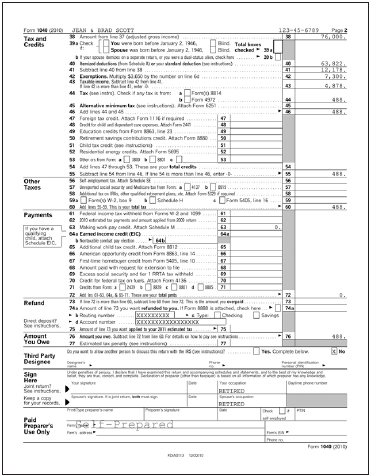

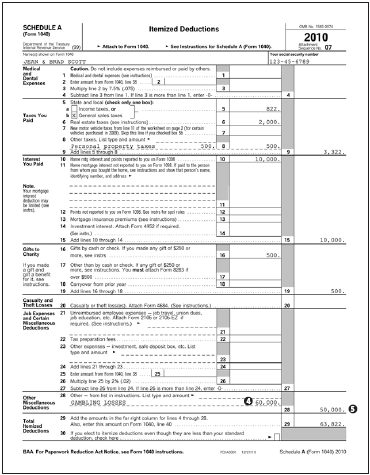

In this scenario, the taxpayers are not “penalized” for gambling. Their other itemized deductions, such as mortgage interest and real estate taxes, already put them over the standard deduction amount for a married couple. Therefore, the gross gambling winnings3 are “canceled out” by the deducted gambling losses5 and that amount is not included in their taxable income.

Form 1040 side 2

Schedule A (Itemized)

Although total gambling losses were $60,0004, you can claim only $50,0005, since you can count losses only up to the amount of the winnings.