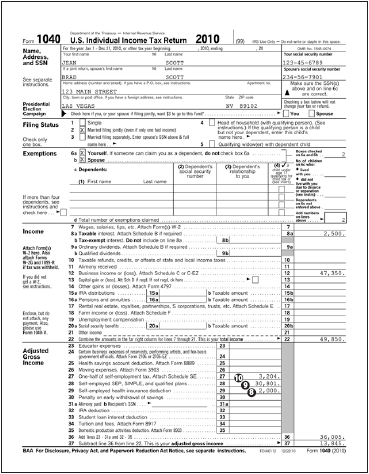

Form 1040 side 1

As a professional gambler, gambling winnings6 and losses7 are reported on Schedule C. Also note that as a professional gambler, deductions can be made for self-employed heath insurance8, self-employed retirement-plan contributions9, and one-half of self-employment tax10. Gambling-related expenses, such as automobile expenses11 can also be reported on Schedule C.

Form 1040 side 2

Schedule A

Schedule C

Schedule C side 2

Schedule SE

Note that the full amount of SE tax from line 5 above must be carried over to line 58 on page 2 of the return, but half of that figure (from line 6 above) is put on page 1 of the return as a deduction on line 27.10