| 2 | The sophisticated Legislator meets Adam’s fallacy |

| A cultural–institutional market failure |

| |

| Samuel Bowles |

Adam’s fallacy

Adam’s fallacy, according to Duncan Foley (2006: xii), is “the idea that it is possible to separate an economic sphere of life, in which the pursuit of self interest is guided by objective laws to a socially beneficent outcome, from the rest of social life, in which the pursuit of self-interest is morally problematic.” He thus challenges “the foundation of political economy and economics as an intellectual discipline,” which, he writes, is based on the “separation of an economic sphere … from the much messier, less determinate and morally more problematic issues of politics, social conflict and values.” Here I propose to correct Adam’s fallacy by integrating the “economic sphere” with the world of “politics, social conflict, and values.”

Once Adam’s fallacy is corrected, I find that even a perfectly competitive economy falls short of what Smith’s invisible hand promised. The reason is that in addition to producing goods and services, the economy produces people — favoring some preferences and identities over others. And the amoral self interest that would proliferate in the idealized economy for which the invisible hand would do its wonders (should such an economy ever exist) would not provide the cultural underpinnings of a well working system of exchange.

The idea that incentives that appeal to the material interests may reduce the salience of ethical motives, on which the functioning of markets and other institutions depend, is hardly new. Peter Berkowitz writes “liberalism depends on virtues that it does not readily summon and which it may even stunt or stifle” (1999: xiii). A similar view was famously advanced by Daniel Bell (1976) in his Cultural Contradictions of Capitalism and earlier works (Bell, 1973: 48) “The historic justifications of bourgeois society — in the realms of religion and character — are gone … The lack of a rooted moral belief system is the cultural contradiction of the society.” Prominent exponents of related themes include Edmund Burke, Alexis de Tocqueville, Joseph Schumpeter, Frederick Hayek, and Jurgen Habermas.1

These writers advanced the idea that liberal society is dynamically unstable and hence prone to cultural–institutional collapse. I have dubbed this the thesis that liberalism is a parasite on tradition. But the parasite thesis is unconvincing (Bowles, 2011). In very brief: while recognizing the possibly deleterious cultural effects of markets, advocates of the parasite thesis have overlooked the ways in which other attributes of liberal societies — notably the rule of law and a reduction in barriers to occupational and spatial mobility — have supported a flourishing civic culture (at least by comparison with many traditional societies). But the effects of markets on culture stressed by the advocates of the parasite thesis are the basis of a quite different (static rather than dynamic) critique of markets and the one that I will advance here: namely, that the nexus of culture and institutions characteristic of a market-based society results in an inefficient allocation of economic resources.

I call this outcome a cultural–institutional market failure because it results from the effects of markets and other institutions on the cultural transmission of preferences and beliefs, and the corresponding effects of the distribution of preferences and beliefs (culture) on the kinds of contracts, forms of economic organization, and other economic institutions that economic actors will be motivated to adopt. The main conceptual challenge is thus to model the joint dynamics of individual preferences and beliefs and population-level institutions, one in which both institutions and people are endogenous. Students of the interaction of culture and institutions — advocates of the parasite thesis and others — have not used either formal modeling or sophisticated empirical methods in their work. But advances in evolutionary game theory and its application to cultural dynamics, as well as recent experiential results from behavioral economics, now allow an empirically grounded formal model of the causal processes underlying the interaction of cultures and economic institutions.

A cultural–institutional equilibrium

An adequate model must illuminate the way in which institutions affect the evolution of culture and the way culture affects the evolution of institutions. With respect to the first, the idea that institutions affect culture is commonly illustrated by the role of families and religious and educational organizations in the socialization process; but it extends to institutions less transparently associated with the evolution of norms, tastes and the like (Bowles, 1998). Supporting evidence comes from studies of parents’ child-rearing values: for example, parents value obedience more in their children and independence less if at work they take rather than give orders (Kohn, Naoi, Schoenbach, and Schooler, 1990). Using behavioral experiments, my co-authors and I have also documented the influence of cooperative production (hunting large animals, for example, or the cooperative provision of local public goods) on values supporting cooperation in other settings (Gintis, Bowles, Boyd, and Fehr, 2005). There is also extensive evidence that the explicit economic incentives on which markets rely either reduce the psychological salience or inhibit the learning of social preference such as fairmindedness, altruism, reciprocity, and intrinsic motivation to contribute to the public good (Bowles and Polania-Reyes, 2012; Bowles, 2008).

Guido Tabellini (2008) provides evidence of a quite different sort: generalized (rather than familial) trust appears to thrive in countries with a long history of liberal political institutions. Tabellini shows that the reverse relationship also holds: the quality of public institutions is associated statistically with more generalized trust. The effect of culture on institutions arises because the kinds of preferences and beliefs that are prevalent in a population will influence the comparative advantage of particular institutions. By institutions I mean formal and informal rules governing social interactions, from the organization of families and firms to the structure of government. The extent to which economic activity is governed by markets as opposed to states, firms, communities, families, or other institutions differs across societies and over time, and it is subject to deliberate alteration both by states and by individual economic actors (Coase, 1937; Ben-Porath, 1980; Ostrom, 1990; Belloc and Bowles, 2012 and 2013). These choices will depend on the distribution of individual preferences and beliefs in a population — that is, on its culture.

The dependence of culture on institutions and the reverse leads one to expect a limited set of compatible matches between the two. Recently developed models of the coevolution of cultures and institutions (Bowles, 2004; Bowles and Gintis, 2011) allow a precise formalization of this thesis. I simplify by representing institutions by a measure of the extent to which markets (as opposed to other institutions) allocate resources (m), while representing preferences by a single-valued measure of civic virtue (v), where the latter represents the prevalence of norms that contribute in essential ways to the functioning of the institutions of a liberal market economy, including such things as truth telling, adherence to socially valuable norms, a strong work ethic, and generosity toward others, even strangers. To make the model concrete, in a population in which there are some people who are amoral and self interested and others who act on the basis of the social preferences just mentioned, then v could be the fraction of the population who are the latter type. In the same population there might be two allocation mechanisms — markets and collective allocation — and the extent of the market, m, could then be the fraction of an individual’s livelihood acquired through the former. The objective of the model is to represent the mutual determination of m and v so as to characterize the pair or pairs {m, v}, such that both are stationary — that is, subject to change only due to exogenous events. These stationary pairs — the compatible matches between cultures and institutions — are termed cultural–institutional equilibria.

Modeling cultural–institutional dynamics

The structure of the model captures three key ideas.

The first is that what I have just called civic virtues improve institutional functioning by reducing the transaction costs of exchange and cooperation. “No social system can work … in which everyone is … guided by nothing except his own … utilitarian ends” wrote Joseph Schumpeter (1950: 448). Kenneth Arrow (1971: 22) added:

In the absence of trust … opportunities for mutually beneficial cooperation would have to be foregone … norms of social behavior, including ethical and moral codes (may be) … reactions of society to compensate for market failures.

In the major markets of a modern economy — the markets for labor, credit, and knowledge — complete contracts are the exception, and as a result the market failures to which Arrow refers are ubiquitous. These markets as well as other economic institutions function as well as they do because social norms and other-regarding motives foster a positive work ethic, an obligation to tell the truth about the qualities of a project or a piece of information, and a commitment to keep promises.

The second key idea is that virtue is crowded out by markets. The experimental evidence for this proposition has already been mentioned. Sandra Polonia-Reyes, Sung-Ha Hwang, and I have recently explored the causal mechanisms accounting for crowding out. A possible mechanism is that markets frame action settings providing clues that the situation is one in which the pursuit of self interest is morally acceptable (Hwang and Bowles, 2012a). Another is that markets (as well as market-like incentives used by public bodies) reward self-interest and penalize those with other-regarding or ethical values, or that markets reduce the scope for or visibility of generous actions, or in other ways provide environments inimical to the learning of civic values (Hwang and Bowles, 2012b). In the second set of mechanisms, preferences are endogenous (rather than simply state dependent), and that is the case I consider here. (These processes are summarized in non-technical language and related evidence provided in Bowles and Polania-Reyes (2012).)

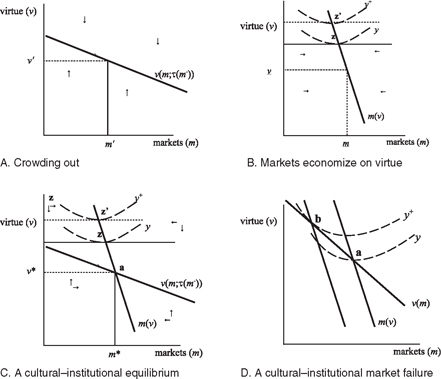

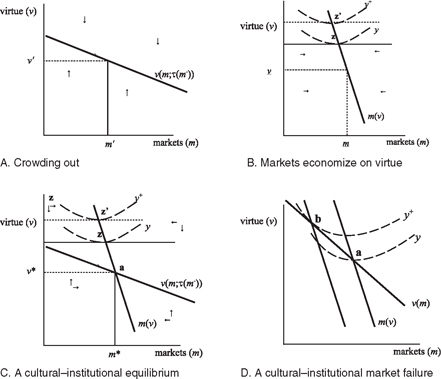

The experimental evidence suggests that crowding out of virtue occurs in markets to a greater extent than in plausible alternative non-market allocation mechanisms. Thus there is a stationary level of virtue expressed by the function v = v(m) where v(m) is termed a cultural equilibrium conditional on the given value of m. What this means is that if v > v(m) there are more “virtuous” people in the population than is consistent with the economy’s market structure, so that some of them will abandon their pro-social preferences; and conversely, if v < v(m). Thus when v = v(m) the process of cultural updating is such that the level of virtue in the population does not change (i.e. is stationary, unless m changes). Thus the v(m) function is given by the values of m and v for which dv/dt = α(m, v) = 0 where the function α(m, v) is derived from a process of cultural transmission in which an individual’s values are periodically updated taking account of the relative payoffs of bearers of different values and the frequency of types in the population, given the extent of the market (as modeled in Bowles (2004)). For example if v is substantial it may nonetheless be stationary if, for the given value of m, the payoff disadvantage of acting on one’s pro-social preferences is exactly compensated by one’s conformist desire to behave like most others do. The crowding out function v(m) is illustrated in panel A of Figure 2.1; the arrows indicate the direction of adjustment from out-of-equilibrium states (that is the values of dv/dt for values of v ≠ α(m, v)).

The basic point embodied by the v(m) function is expressed in its downward slope; a greater extent of the market is associated with fewer virtuous citizens

Figure 2.1 A cultural–institutional equilibrium. Arrows indicate the direction of adjustment. Panel A: the effect of the extent of markets on virtue. Panel B: The effect of virtue on the extent of markets. Panel C: A temporary cultural–institutional equilibrium Panel D. Point a is the cultural–institutional equilibrium, while point b is a Pareto-superior cultural–institutional configuration induced by an exogenous limitation of the market (the leftward shift of the m(v) function.)

in cultural equilibrium. This is an empirical statement, and it is not always true: in a few experiments market-like incentives appear to crowd in pro-social preferences (Galbiati and Vertova, 2010; Bowles and Polania-Reyes, 2012). An upward sloping v(m) function would capture the reasoning of the exponents of “doux commerce,” including Voltaire and Smith, who held that “where there is commerce the ways of men are gentle,” as Montesquieu (1961: 81) put it (Hirschman, 1977).

The third key proposition is that markets economize on virtue. “Market-like arrangements,” according to Schultze (1977: 18), “reduce the need for compassion, patriotism, brotherly love, and cultural solidarity.” This is important in what follows, because the extent of the market in allocating resources is determined in a decentralized way by the choices of countless economic agents, and it will vary with the cost advantages of markets relative to other institutions that may accomplish the same ends. For example, whether firms produce or purchase a particular component of the product they produce — the problem analyzed by Coase (1937) — depends on the supervision and other costs of the direct command relations that distinguish firms from markets (and that are entailed by production of the component), relative to the costs of search, bargaining over prices, and other costs of using the market. These costs will depend on the ethical, self-interested, and other motives of those involved. Marianna Belloc and I provide a model of this process, showing that where values such as reciprocity and fairness are prevalent, organizations based on partnerships may thrive, while in highly self-interested populations production may be carried out in organizations with close and punitive supervision (Belloc and Bowles, 2012 and 2013).

As a result, the level of values will influence the extent of the market; and because of the comparative advantage in governing interactions among entirely self-interested individuals enjoyed by markets (relative to bureaucracies, families, and other institutions), the relationship is inverse: higher levels of values being associated with a reduced extent of the market. The function m(v) gives the stationary values of m for given values of v based on individuals structuring their interactions with others (choosing among, say, contractual or friendship, or familial ways of interacting in some particular activity) based on the relative payoffs of these various structures. Thus for any given level of virtue (say, v) there is an equilibrium extent of the market (m) that is stationary, in the sense that no actor with the capacity to alter the extent of the market may benefit from doing so. I call m(v) an institutional equilibrium for the given level of civic values.

Thus, paralleling the case of the “markets crowd out virtue,” function, the m(v) function gives the values of v and m for which dm/dt = β(m, v) = 0. The function β(m, v) is derived from a process in which individuals periodically alter or reaffirm the contractual or other means by which they govern their economic interactions with others in light of the benefits and costs of the alternatives (market and non-market), given the distribution of types in the population as modeled in Belloc and Bowles (2012 and 2013). This “markets economize on virtue” function is shown in panel B of Figure 2.1, where, as in panel A, the arrows give the out-of-equilibrium adjustment process — the extent of markets shrinking when it exceeds the level indicated by the function, and expanding when the reverse is true. The downward slope of the function captures the idea that the larger is the virtuous fraction of the population, the lesser will be the extent of the market.

It will be important in what follows to say a bit more about the construction of the “markets economize on virtue” function. In the figure, the loci labeled y and y+ are output isoquants, namely loci of pairs of m and v that yield a total income (of the society in question) of y and y+, respectively, with y < y+. The position of the isoquants indicates that virtue contributes to the productivity of the society (its total income). Suppose, for illustration, that (as Coase hypothesized) the extent of the market is determined by an implicit transaction-cost-minimizing process that maximizes income net of these costs for a given level of values. Then the m(v) function is the locus of all points for which m is the solution to the problem: maximize y(v, m) for the given level of v, which will be found where the isoquant is tangent to the horizontal dotted line indicating the given level of v.

The given value of m is stationary because, conditional on the level of v, it maximizes the society’s income ex hypothesi because of the Coasean process underlying the determination of the extent of markets. (The maximization is implicit in the Coasean assumptions, rather than the deliberate choice of any individual, each of whom is seeking to minimize the transactions costs of the transactions in which they are engaged.) The idea that entirely decentralized contracting and other interactions would implement an efficient set of institutions in the Coasean sense is of course unrealistic; the key point is that markets will be used more were virtue is less. I adopt the Coasean framework simply because it makes clear that the cultural–institutional market failure thesis does not require any departures from conventional liberal economic models — other than the fact that markets have cultural consequences.

Because we want to know the conditions under which both culture and institutions will be stationary, we are interested in a state that is common to both functions, namely the intersection of the two lines representing relationships labeled “markets crowd out virtue” and “markets economize on virtue.” The joint influence of these two relationships, shown in Panel C of Figure 2.1, gives us the equilibrium values of the level of virtue and extent of the market {v*, m*), termed a cultural–institutional equilibrium. In Bowles (2011) I present a related model that differs in two ways: I take account of the long-term effects of markets on traditional institutions, such as lineage-based family structures and religious organizations, and show that there may be more than one stable cultural–institutional equilibrium. This is the case because all that we know about the m(v) and v(m) functions is that they slope downward, so were they non-linear (unlike here) they could intersect any number of times. Where there is more than a single stable equilibrium it may be that two identical societies differing only in their recent history may differ dramatically in their culture and institutions — one with extensive use of markets and limited virtue, and the other with the converse — with the possibility of precipitous transitions between the two. But to study cultural–institutional market failures — my topic here — a single stable equilibrium is sufficient, and much simpler.

The sophisticated Legislator corrects a cultural–institutional market failure

Let’s now introduce a social planner recently graduated from the New School. Having studied Adam’s fallacy, she had been motivated to venture beyond the confines of economics and had read: “Legislators make the citizen good by inculcating habits in them,” in Aristotle’s Ethics, “It is in this that a good constitution differs from a bad one.” (Aristotle, 1962: 103). Could the sophisticated Legislator — that’s what we’ll call her — improve on the Coasean “income maximizing” institutional arrangements in the cultural–institutional equilibrium, namely point a in panel C of Figure 2.1?

A tall order, but she knows where to go: room 1123, 6 East 16th Street at the New School. She draws panel C of the figure on the whiteboard and explains to her former teacher how it works. Intrigued, he suggests that she consider educational programs that might enhance the level of citizen virtue, shifting up the v(m) function (in panel C of the figure) and supporting a higher level of income in the new, more virtuous and less market oriented, cultural–institutional equilibrium. But the Legislator demurs, reminding Foley that public policies designed to change preferences would be regarded as paternalistic and in violation of the basic liberal precept that the state ought not to favor any particular conception of the good (or the good life; Goodin and Reeve (1989), Barry (1996)).

“What about the other function,” she asks? Already at the whiteboard, Foley writes

maxm = y(m, v) subject to v = v(m) or maxm = y(m, v(m))

but he then recalls that the Legislator was never much of a whiz in math, and it had been a few years since she had seen something like this. “Because of your liberal biases,” Foley patiently explains, “we have to take the v(m) function as inviolate, so we’re going to find the level of m along the v(m) function that maximizes income.” “And ..?”, she wonders where this is going. “And then find some policies that will shift the m(v) function so that the income-maximizing m is part of a cultural–institutional equilibrium.” It’s all coming back to her now: “OK, we find the point on the v(m) function that is tangent to one of the isoquant things, right?” Foley writes

v′(m) = −ym/yv

“Or, the …” he begins. She takes over, jumping to the whiteboard, tapping her finger on point b “… the marginal rate of transformation of markets into (degraded) values must be equal to the marginal rate of substitution of markets and values as influences on income.” “Brava!”, and Foley returns to his desk:

“How you implement this is your department; you’re the Legislator.” “No problem,” she’s happy to be back on more familiar ground, “there is no shortage of ways to make market transactions more expensive. The Tobin tax, named after one of your former teachers, is just an example.”

She opens her computer without looking at Foley: “Sorry, but let me get this down” and starts typing:

From the Coasean allegedly income maximizing cultural–institutional equilibrium a [she smiles when she adds the italics], there must exist an exogenous restriction of market extent that would displace the market extent function to the left (given by the dashed line) and therefore shift the cultural institutional equilibrium to point b, resulting in a larger aggregate income. The income-maximizing level of restricted market use balances the income losses entailed by the use of non-market institutions (in cases for which, conditional on a given v, markets would do better) against the cultural benefits made possible by attenuating the deleterious market effects on culture. This cultural–institutional market failure arises because pro-social values facilitate exchange by reducing transaction costs, and in adopting contractual and other institutional choices, economic actors do not take account of the endogenous nature of preferences and hence do not internalize the negative externalities associated with market incentives.

She smiles again and looks up from her keyboard.

“Let me see” Foley says. She pushes her PC to the other side of the desk.

After a minute or two, beaming, he says “Bravissima!”

Acknowledgments

This chapter aims to celebrate the life and work (so far) of Duncan Foley. Thanks to the Behavioral Sciences Program of the Santa Fe Institute for support of this research. The model presented here draws on Bowles and Polania-Reyes (2012), Hwang and Bowles (2012 and 2013), Belloc and Bowles (2012 and 2013), and Bowles and Hwang (2008), and will be extended in Bowles (2013). I thank my just-mentioned co-authors as well as Lance Taylor, Elisabeth Wood, and two anonymous referees for their contributions.

Note

1 Burke (1791: 64); Burke (1890[1790]: 4–86); Tocqueville (1945: I 12; II 208, 334–337, 339); Hayek (1948); Polanyi (1957: 76–77, 177); Habermas (1975: 77,79); Hirsch (1976: 117–118); Schumpeter (1950). Some of the relevant passages appear in the appendix to Bowles (2011) that is available on my web page: http://www.santafe.edu/∼bowles

References

Aristotle (1962) Nicomachean ethics. Indianapolis: Bobbs-Merrill.

Arrow, Kenneth J. (1971) ‘Political and economic evaluation of social effects and externalities,’ in Frontiers of quantitative economics M. D. Intriligator (Ed.). Amsterdam: North Holland 3–23.

Barry, Brian (1996) Justice as Impartiality. Oxford: Clarendon Press.

Bell, Daniel (1973) The coming of post-industrial society: a venture in social forecasting. New York: Basic Books, Inc.

Bell, Daniel (1976) The cultural contradictions of capitalism. New York: Basic Books.

Belloc, Marianna, and Samuel Bowles (2012) ‘International trade and the persistence of cultural–;institutional diversity.’ Santa Fe Institute Working Paper 09–03–005

Belloc, Marianna, and Samuel Bowles (2013) ‘The persistence of inferior cultural-institutional persistence conventions.’ American Economic Association, Papers and Proceedings.

Ben-Porath, Yoram (1980) ‘The F-connection: families, friends, and firms and the organization of exchange.’ Population and Development Review, 6:1, 1–30.

Berkowitz, Peter (1999) Virtue and the making of modern liberalism. Princeton: Princeton University Press.

Bowles, Samuel (1998) ‘Endogenous preferences: the cultural consequences of markets and other economic institutions.’ Journal of Economic Literature, 36:1, 75–111.

Bowles, Samuel (2004) Microeconomics: behavior, institutions, and evolution. Princeton: Princeton University Press.

Bowles, Samuel (2008) ‘Policies designed for self interested citizens may undermine “the moral sentiments:” evidence from experiments.’ Science, 320:5883 (June 20).

Bowles, Samuel (2011) ‘Is liberal society a parasite on tradition?’ Philosophy and Public Affairs, 39:1, 47–81.

Bowles, Samuel (2013) Machiavelli’s mistake: why good laws are no substitute for good citizens. New Haven: Yale University Press (forthcoming).

Bowles, Samuel, and Herbert Gintis (2011) A cooperative species: human reciprocity and its evolution. Princeton: Princeton University Press.

Bowles, Samuel, and Sung-Ha Hwang (2008) ‘Social preferences and public economics: mechanism design when preferences depend on incentives.’ Journal of Public Economics, 92:8–9, 1811–;1820.

Bowles, Samuel, and Sandra Polania-Reyes (2012) ‘Economic incentives and social preferences: substitutes or complements?’ Journal of Economic Literature, 50:2, 368–425.

Burke, Edmund (1791) A letter from Mr. Burke to a member of the National Assembly in answer to some objections to his book on French affairs. London: Dodsley,

Pall-Mall. Burke, Edmund (1890)[1790] Reflections on the revolution in France. New York: Macmillian.

Coase, R. H. (1937) ‘The nature of the firm.’ Economica, 4, 386–405.

Foley, Duncan (2006) Adam’s fallacy: a guide to economic theology. Cambridge, MA: Harvard University Press.

Galbiati, Roberto, and Pietro Vertova (2010) ‘How laws affect behaviour: obligations, incentives and cooperative behavior.’ Universita Bocconi.

Gintis, Herbert, Samuel Bowles, Robert Boyd, and Ernst Fehr (Eds.) (2005) Moral sentiments and material interests: the foundations of cooperation in economic life. Cambridge, MA: MIT Press.

Goodin, Robert E., and Andrew Reeve (Eds.) (1989) Liberal Neutrality. London: Routledge.

Habermas, Jurgen (1975) Legitimation crisis. Boston: Beacon Press.

Hayek, Friedrich (1948) Individualism and economic order. Chicago: University of Chicago Press.

Hirsch, Fred (1976) Social limits to growth. Cambridge, MA: Harvard University Press.

Hirschman, Albert O (1977) The passions and the interests: political arguments for capitalism before its triumph. Princeton: Princeton University Press.

Hwang, Sung Ha, and Samuel Bowles (2012a) ‘Optimal incentives with state-dependent preferences.’ Journal of Public Economic Theory, in press.

Hwang, Sung-Ha, and Samuel Bowles (2012b) ‘The sophisticated planner’s dilemma: optimal incentives with endogenous preferences.’ Santa Fe Institute.

Kohn, Melvin, Atsushi Naoi, Carrie Schoenbach, Carmi Schooler, et al. (1990) ‘Position in the class structure and psychological functioning in the U.S., Japan, and Poland.’ American Journal of Sociology, 95:4, 964–1008.

Montesquieu, Charles de Secondat (1961) L’esprit des lois. Paris: Garnier.

Ostrom, Elinor (1990) Governing the commons: the evolution of institutions for collective action. Cambridge, UK: Cambridge University Press.

Polanyi, Karl (1957) The great transformation: the political and economic origins of our time. Beacon Hill: Beacon Press.

Schultze, Charles L. (1977) The public use of private interest. Washington, D.C: Brookings Institution.

Schumpeter, Joseph (1950) ‘The march into socialism.’ American Economic Review, 40:2, 446–456.

Tabellini, Guido (2008) ‘Institutions and culture.’ Journal of the European Economic Association, 6:2, 255–294.

Tocqueville, Alexis de (1945) Democracy in America. New York: Vintage.