How to Exploit Group Buying Power

The goal of any business is to sell as many widgets as possible. The more widgets a company sells, the lower it can set the price.

If you’re genuinely interested in finding life’s best money hacks, sooner or later you have to consider the power of group buying. Get enough people together, amass enough buying power, and you won’t believe how the world’s merchants and vendors tremble.

Here are a few of those groups worth joining.

AAA: Places to go, things to do—at a discount

AAA once stood for American Automobile Association. But those free emergency roadside services (jump-starts, tire-changes, gas delivery, locksmiths, tow trucks) are only the tip of their deal iceberg.

AAA is actually a national federation of about 70 regional clubs: AAA Northern New England, AAA Mid-Atlantic, and so on. Each offers its own membership pricing (usually about $70 a year), and—here’s where things get interesting for people who like money—each offers an enormous, 50-page list of discount deals on just about everything in life. Here’s a sampling:

• Hotels. Discounts of 5 to 15 percent on Marriott, Renaissance, Sheraton, Ritz-Carlton, W, Westin, Best Western, Hyatt, and just about every other hotel you’ve ever heard of.

• Clothing. Discounts or free shipping from chains like American Eagle, Brooks Brothers, Calvin Klein, Eddie Bauer, Guess, Kenneth Cole, Kmart, L.L.Bean, Nautica, Nine West, The Limited.

• Movie tickets. 25 or 35 percent off tickets from Cinemark, Showcase, Bow Tie, or Regal theaters.

• Tech. 10 to 30 percent off orders from Dell, HP, FedEx, GameStop, Lenovo, Office Depot, and iRobot. Free shipping from Apple, Bose, and Best Buy.

• Food and drink. 10 to 30 percent off Perkins, Wine.com, and lots of individual, local, non-chain restaurants.

• Prescriptions. If you take medicines (or if your pet does) that insurance doesn’t cover, here’s where AAA can really shine. You get discounts averaging 24 percent at 90 percent of the pharmacies in America, including CVS, Walgreens, Rite Aid, and most supermarket drugstores.

• Activities and travel. 30 percent off Aquatica, Busch Gardens, SeaWorld, Sesame Place, Water Country USA. Discount packages on Universal theme parks, cruise ships, zoos, museums, and other travel destinations. Discounts on Hertz, Dollar, and Thrifty rental cars and SuperShuttle airport vans.

In addition to those discounts on national businesses, each regional AAA club offers its own local deals. For example, AAA Southern New England covers New York City, so it offers discounts for Yankees games, New York City museums, and Off-Broadway shows.

The bottom line: Just about everywhere you go, everything you do and see, comes with a AAA discount of at least 10 percent. The important thing, then, is to remember to ask. Every time you book anything, buy anything, order anything: “By the way, is there a triple-A discount?”

If adopting that habit doesn’t easily make back your $70 annual dues, then you really must not get out much.

Savings ballpark: $230 a year

$230 = Savings average of 10 percent on $3,000 spent on goods, services, food, and travel, minus $70 annual fee

AARP: Discounts everywhere the 50-year-old looks

At one time, AARP stood for the American Association of Retired Persons. Today, it’s just AARP. It’s a massive, 37 million-member interest group for seniors, although it defines “senior” pretty loosely: anyone over 50.

Membership costs $16 a year. Honestly, you can make that up using one of the discounts the group has negotiated. Here are a few examples:

• Car care. $18 for a complete oil change, free tire rotation, free maintenance inspection from Monro Muffler Brake and Mr. Tire. 10 percent off auto repairs (up to $50) at RepairPal.

• Car rental. 25 percent off from Avis or Budget.

• Electronics. 10 percent off Kindle ebook readers, and 50 percent off certain ebooks for it. 10 percent off AT&T cell phone plans.

• Entertainment. $9.50 for Regal movie tickets (plus $3 off popcorn/drink combos). 15 percent savings on golfing with TeeOff.com. At least 25 percent off tickets bought in groups of four with Ticketmaster/Live Nation. 15 to 30 percent off Cirque du Soleil tickets.

• Eyes and ears. An average of 38 percent off all prescriptions not covered by insurance. 60 percent off eye exams, and 30 percent off prescription glasses, at Target Optical, LensCrafters, Pearle Vision, Sears Optical, JCPenney Optical, and thousands of private shops. 25 percent off from Glasses.com. 15 percent off hearing aids from HearUSA.

• Food and drink. 15 percent off at Denny’s, Outback Steakhouse, and others.

• Hotels. Up to 15 percent off at Starwood Hotels (Sheraton, W, Westin, and others). 20 percent off at 7,000 Wyndham hotels (Days Inn, Howard Johnson, Ramada, and so on). 10 percent off at 1,100 other hotels.

• Insurance. AARP offers discounted insurance in every category: health, dental, property, life, homeowners, boat, car, and so on.

• National parks. 10 percent off lodging and gift shops at Yellowstone, Grand Canyon, Death Valley, Zion, and other national parks (as well as state and county parks).

• Rail and tours. Discounts on train trips and tours from Collette, Grand Canyon Railway, Vacations By Rail. No service fees for European rail passes and tickets.

• Shopping. 20 percent off 1-800-Baskets.com, The Popcorn Factory, and Rockport Outlet Stores. Free coupon book with over $1,000 in savings at designer outlet stores from Tanger Factory Outlet Centers. 5 percent off UPS shipping at The UPS Store. 50 Balance Rewards points for every $1 spent on Walgreens health products.

• Travel. 10 percent discount at certain hotels, 25 percent off Avis and Budget car rentals, extra onboard credits on select cruises. Discounted travel packages put together by AARP Travel Center. $100 off per couple (and reduced deposit) from Liberty Travel agencies. $65 to $400 off round-trip tickets from British Airways. 10 percent discount on offsite airport parking through Park Ride Fly USA.

Of course, claiming an AARP discount is a sure way to make you feel old.

On the other hand, you’ve lived this long. Why not enjoy some of the perks?

Savings ballpark: $434 a year

$434 = Average savings of 15 percent on $3,000 worth of spending on goods, services, food, and travel, minus $16 annual fee

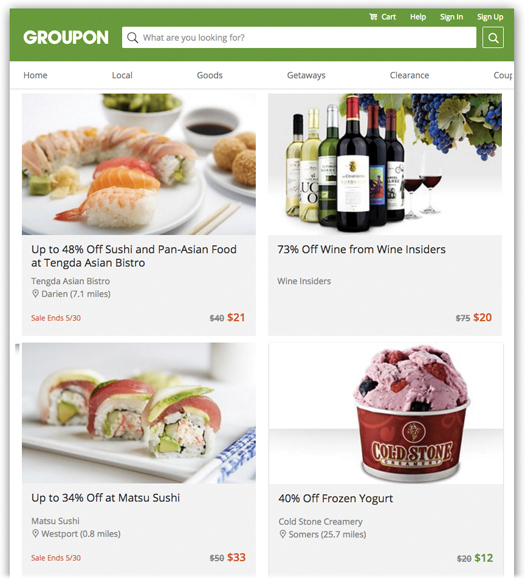

Groupon: Not your father’s crowd-purchasing site

Groupon is a big, big deal. It’s a crazy new business model that’s making national headlines—assuming you’re reading this in 2011.

Truth is, Groupon doesn’t make as much news as it once did. And it’s expanded into selling physical goods and offering RetailMeNot-style coupons.

But the central concept is still alive and well: harnessing group buying power to negotiate huge discounts on local restaurants, classes, activities, and tickets.

Most of the discounts are at least 40 percent off, but deals for 50 or 75 percent off aren’t uncommon. You might see a coupon for $25 that buys you a $50 massage, or a $35 coupon for $50 worth of sushi, or a $99 coupon for $1,100 worth of dental care.

And are you ready for this? The Groupon membership fee is nothing. You lose absolutely nothing by getting into Groupon. You just look over the offers each week and click if—and only if—you see one that you know you’ll use.

(In the olden days, you didn’t actually get the coupon until a critical mass of people—50, for example—had clicked “Buy.” That’s why merchants were tempted by Groupon: In exchange for offering those steep discounts, they could count on enormous masses of new customers. That minimum-group-size requirement is gone now. You just buy the deals you want to buy, when you want to buy them.)

There’s a Groupon phone app that makes it easy to see what the latest deals are, and to show your waiter or salesperson your coupon.

Here’s a final word of advice: Groupon is a gigantic home run when you buy coupons for things you would have bought anyway. It’s discount city.

Just don’t be swayed by amazing deals for things you might not actually cash in on. You don’t want to pay for 50 percent of something and then never get it.

(Note: The deals are good only for a limited time, usually six months. After that, though, don’t forget about them. A Groupon still has value—the amount you paid for it. If you paid $25 for $50 worth of sushi, your Groupon is still good for $25 worth of sushi.)

Savings ballpark: $240 a year

$240 = 40 percent off spending of $600 a year

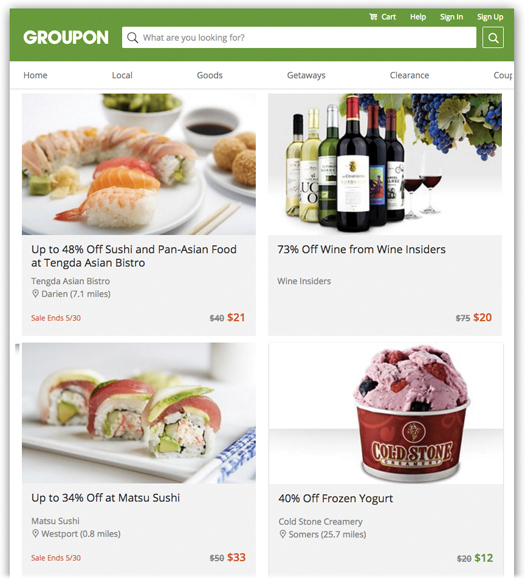

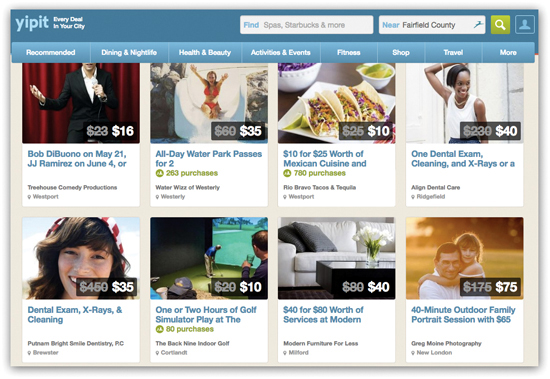

Meet the deal rounder-uppers

Groupon is the most famous group-buying deal site, but it’s not the only one. It has very similar rivals in LivingSocial, Gilt, and others.

But who on earth has the time to open up every one of these sites every day to see if there are any worthwhile deals?

Fortunately, you don’t have to. Yipit.com is a deal aggregator. It rounds up all the local deals from Groupon.com, LivingSocial.com, and other sites. Better yet, when you sign up, Yipit asks you to choose which kinds of deals you’d like to be shown. You might say you’re up for Travel, Massage, and Restaurants but you don’t want to be bothered by offers for Botox, Golf, and Bridal.

After that, you’ve got only one site to visit every day, prefiltered and organized for your money-saving pleasure.

Every time you buy a deal, Yipit gets a kickback from the originating site (Groupon or whatever). As a handy bonus, Yipit will split that commission with you, in the form of what it calls Yipit Cash Back.

Savings ballpark: 15 minutes every day

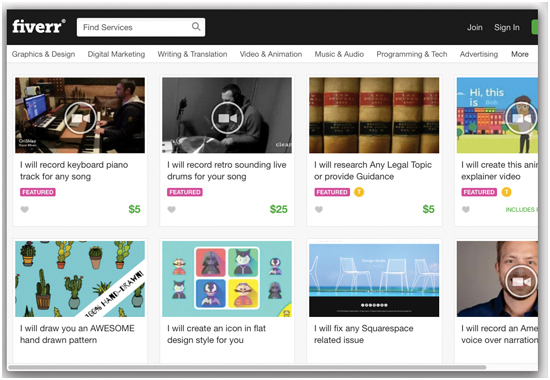

Hire a starving artist to make a custom gift for $5

You should know about Fiverr.com.

Here over a million creative and freelance types offer their services for $5 and up. “I’ll compose a song with your lyrics for $5,” you might read. “I’ll draw a caricature from your photo for $5.” “I will create a résumé or LinkedIn profile for $5.” “I will translate up to 500 words from Russian to English for $5.” “I will write you a ukulele jingle for $5.” “I will design a simple five-page website for $5.”

Lots of those creative jobs are posted by starving artists or talented people overseas, who can afford to do very inexpensive work. But don’t feel guilty about exploiting their offers. If they’re advertising, they want to work, even at these rates.

Not all the offers are for $5. Many of them charge extra for rush service, longer documents, and so on. And some are more elaborate but still dirt cheap: “I will create a whiteboard explainer animation video for $50,” for example.

But in the great global scheme of things, what you can find on Fiverr represents one stunning deal after another. And because these items are so creative and so personalized—a caricature, a song, a dramatic performance, a portrait—they make amazing, unforgettable, ridiculously inexpensive gifts.

Savings ballpark: $50 per gift

$50 = About how much more it would cost to buy some massproduced commercial thing that would provide anywhere near as much surprise and joy as a custom-made $5 work of art

The economics—and psychology—of Costco

Costco is a “warehouse club”—a chain of 700 enormous, airplane hangar–sized stores that specialize in selling stuff at huge discounts. If there’s a Costco near you (or a Sam’s Club or a BJ’s, which are very similar), you should investigate.

Warehouse clubs attain the lower prices through a bunch of systems:

• They sell memberships. It’s $55 a year for Costco. Without the card, you can’t shop there.

• Bulk packaging. Most of the stuff at warehouse clubs comes in giant packages—enough to last you months. That means less packaging and lower pricing per item. Costco is therefore great for “stocking up” on stuff like pet food, human food, toilet paper, shampoo, contact lens solution, cleaning supplies, lightbulbs, inkjet cartridges, alcohol, and so on.

But these stores also offer deals on tires, gasoline, prescription meds, movie tickets, suitcases, travel packages, office supplies, camping gear, electronics, and TVs.

• Limited brands. Costco doesn’t stock multiple brands of something if they’re basically all the same; you won’t find 35 varieties of Italian dressing. (A typical supermarket stocks 50,000 items. The average Costco stocks 4,000.)

• Store brands. Costco’s store brand, Kirkland, gets high marks for quality but costs much less than national brands (see here).

• Limited packaging. You’re supposed to bring your own shopping bags, if you want them.

• Limited employees. It’s hard to find a salesperson to ask for help.

• Power savings. Most Costco stores are illuminated by skylights during the day, so they spend a lot less on electricity.

Before you dive in, keep in mind that a warehouse-club membership can save you an insane amount of money every year—if you’ll use those huge quantities. $9 for 10 pounds of ground beef isn’t a deal if you wind up throwing a lot of it away. For that reason, warehouse clubs work best for families or roommates who go through a lot of food and supplies.

Second, the psychology of warehouse clubs is easy to spot: You’re so thrilled by the discounts that you wind up going nuts.

As a Family Circle article put it: “Outside of a Costco, I would never remotely entertain the thought of buying a trash-bag-size package of Cheez Doodles. However, roaming the aisles, drunk on value, it seems ludicrous to pass up the opportunity to own this giant sack of starch and orange food coloring for just $8.99. I mean, look. It’s the price of nine regular bags of Cheez Doodles at the deli, only there’s probably a hundred bags’ worth inside this one. Why not toss it in the cart?”

Therefore, the magic rule is: Go to a warehouse store equipped with a shopping list. Do not be swayed by insanely low prices on things you really don’t need.

Only then can you reap the benefit of a Costco without succumbing to its evil psychological charms.

Savings ballpark: $695 a year

$695 = 10 percent average savings on the average American’s $4,000 worth of spending on food + $3,500 on other supplies, minus $55 annual fee