Food is one of life’s most sought-after commodities. You just can’t get along without it.

Knowing how to get more of it for less money, therefore, can be an essential life skill.

Some of the food-buying basics should be obvious:

• Eating at restaurants is more expensive than eating at home—three or four times as much.

• Healthful food is, unfortunately, generally more expensive than junky food.

• On the other hand, eating better food pays for itself in the long run, thanks to the medical bills you won’t wind up paying because you’re fat and heart-clogged.

Ready to read? Set the table!

Know what’s on sale at your grocery store

As with iPhones, TVs, and winter coats, the annual cycles of sales on groceries are fairly predictable. It’s a no-brainer that candy is drastically discounted right after Valentine’s Day and again after Halloween, for example.

But what about everything else? What about the 50,000 other things on the shelves of a typical supermarket? Without walking through the store once a day, how are you supposed to know what’s on sale when?

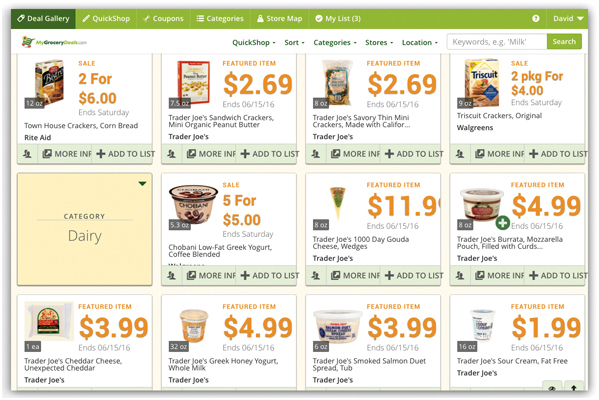

That’s easy: Visit MyGroceryDeals.com. Here you check off the grocery stores and drugstores you visit, and boom: The site instantly shows you what’s on sale right now at those stores, and for how long. To make life even easier, the site can build a shopping list for you. It even displays coupons rounded up from the big coupon sites like Coupons.com, RedPlum.com, SmartSource.com, and Cellfire.com.

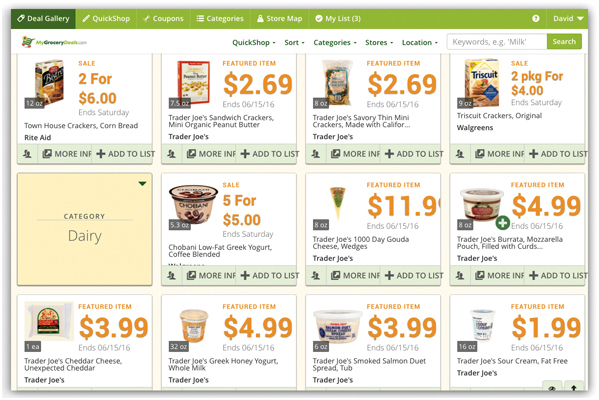

If you have a smartphone, you can get a free app called Favado Grocery Sales that fulfills the same purpose. Its database includes the specials on items in 65,000 stores. You can view the sales by store or do a search for certain products. Either way, it sure beats flipping through advertising supplements on newsprint.

Of course, you have to balance the thrill of saving money with the amount of time you put into perusing these specials. But knowing what’s on sale at your supermarket is especially valuable when you want to use coupons; as described here, the really crazy deals come your way when you use a coupon on top of something that’s already on sale.

Savings ballpark: $400 a year

$400 = 10 percent savings on the average American’s $4,000 annual grocery expenditure

Starbucks hacks

The best tip anyone ever gave for saving money at Starbucks, of course, is “Kick the habit.” The average Starbucks addict spends $1,100 a year; a Grande Caffè Latte, three times a week, will cost you $2,100 a year.

That’s a lot of beans.

If you can’t quite kick the habit, though, adopt some of these tricks:

• Bring your own cup. Save 10 cents on any drink—and keep one more chunk of Starbucks cardboard out of the landfill. (This works for any cup you bring in, even if it comes from a Starbucks rival.)

• 50-cent refills all day. After you’ve bought one Starbucks beverage, you can keep gulping all day for cheap. They’ll refill your cup with coffee or tea (hot or iced) as many times as you can stand, for 50 cents a pop, for as long as you’re still in the store. Doesn’t matter what you ordered originally or what size. Depending on the size of your original cup, that’s saving you about 85 percent per drink.

• Free birthday drink. If you’ve signed up for Starbucks’s loyalty program (free at Starbucks.com/card/rewards), you get a free beverage on your birthday. You also get emailed coupons and discounts all year long. And each time you pay for a drink with your Starbucks card or app, you earn a “star.” If you manage to collect five in a year, you get free coffee and tea refills; collect 30 in a year, and you get a couple of free beverages.

But everyone gets a free birthday drink.

• The 22-percent-off Starbucks card. Remember the amazing gift-card exchange-site tip here? You’ll find a lot of Starbucks gift cards on those sites, usually available for around 22 percent off. If you’re a Starbucks regular, you’d have to be nutty not to buy those cards and use them on your S’bux visits.

• The free water. Starbucks sells bottled water. But it also gives away its own delicious, triple-filtered water. Just ask for it in a to-go cup, and boom: You’ve saved a couple of bucks.

• Light ice. If you order your iced beverage with “light ice,” they’ll give you less ice. Your drink is less diluted, and you get more drink for your money. (A few truly brazen Starbuckians actually ask for the ice on the side, taking this principle to a shameless extreme.)

• The secret short drink. The smallest size on the Starbucks menu is called the Tall. But an even smaller one doesn’t appear on the menu: the Short. It’s less expensive, of course, and great when you need just a little zap of something. Besides: The Short does as well as the Tall if you’re just looking for a caffeine hit. It contains the same amount of espresso.

• Free whipped cream for Rover. Starbucks wants your dog to be happy, too, by providing a free cup of whipped cream. (To get it, order a puppycino or puppy latte.)

And while we’re talking about Starbucks hacks: Feel free to order your hot beverage at “kids’ temperature.” It won’t be so hot that it scalds you; you’ll be able to start sipping right away.

Savings ballpark: $290 a year

$290 = Savings by bringing your own cup (five days a week, 50 weeks a year) + getting a 50-cent coffee refill twice a week + enjoying a free birthday Venti Skinny Vanilla Latte + using 22 percent discounted gift cards on a coffee each day ($2)

A free doughnut in June

There is, believe it or not, a National Doughnut Day. It’s on the first Friday in June each year.

And why should you care? Because the big chains hand out free doughnuts that day. Stop by a doughnut shop (Dunkin’ Donuts, Krispy Kreme, Tim Hortons, Shipley Do-Nuts, Fractured Prune Doughnuts, LaMar’s Donuts, many others). Choose your free doughnut (sometimes it’s “with purchase of a drink,” sometimes with a coupon from the chain’s Facebook page, sometimes with no fine print at all). And thank this paragraph in your heart.

Savings ballpark: $1 every year

Free samples of anything at Whole Foods

Whole Foods is an expensive place to get beautiful, wholesome groceries; people haven’t nicknamed it “Whole Paycheck” for nothing. But you gotta say this for them: During prime daytime hours, there are always a few free-sample tables around the store. Breads, dips, cookies, pie, orange juice, meats, and the most amazing cheeses.

But wait, there’s more. It’s Whole Foods’ policy to let you sample anything in the store. Literally anything on the shelf—even if the salesperson has to open the package to get you a taste!

Just ask. (Sometimes, having opened a box of something, they’ll just hand it to you to keep.)

Whatever happened to grocery coupons?

Here, you can read about the modern culture of Internet couponing. All around you, probably in your very town, certain people save insane amounts of money by exploiting the cult of online coupon collecting.

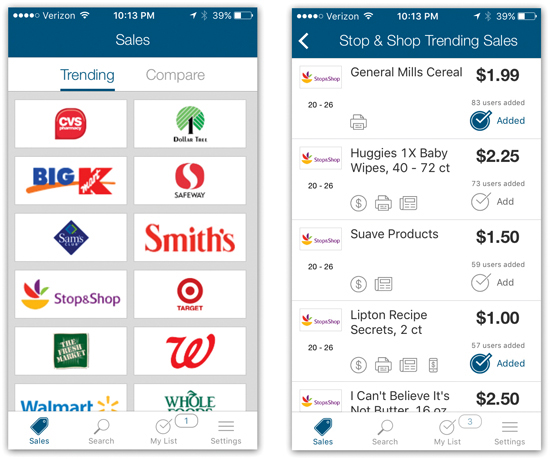

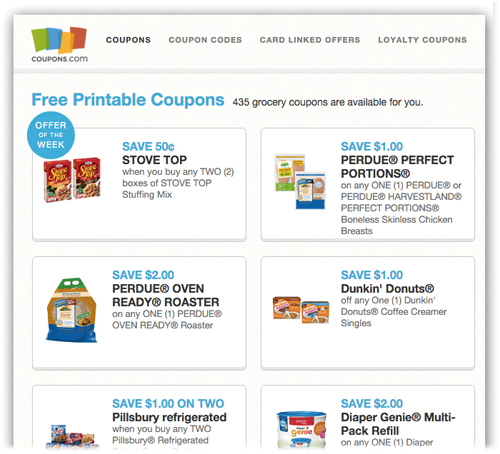

When it comes to supermarkets, the headquarters for manufacturer and store coupons are websites like Coupons.com and GrocerySmarts.com. These are like gigantic, searchable newspaper ad supplements online, without the paper cuts. To “cut one out,” you just click it. All the clicked coupons wind up on a single printout, ready to take to the store.

There are corresponding phone apps, too. For example, the Coupons.com app knows where you are, so it can show you offers from nearby stores.

Finding the good ones is easy. But you can’t just show your phone to the cashier. Instead, you have to print them (by emailing them to yourself or, if you have an iPhone, sending them directly to AirPrint-compatible printers). Or, if you have a store loyalty card from ShopRite, Giant Eagle, Winn-Dixie, or a couple of other chains, you can have the coupon electronically added to it, so that you get the discount when checking out.

Coupons.com also owns the Grocery iQ app, which is a super-smart shopping-list app. It remembers stuff you’ve ordered in the past, it can scan bar codes on food packages to save you typing in their product names, and it organizes your list by area of the grocery store to save you time. But best of all, it’s integrated with Coupons.com, so that when you add something to your grocery list, any matching coupons are added automatically.

The beauty of it is that you don’t even have to think ahead or print anything out; you can look for coupons right there in the store, on your phone, while you’re out and about.

Savings ballpark: $400 a year

$400 = 10 percent savings on the average American’s $4,000 annual grocery bill

Grocery-store meat for 50 percent off

OK, you’re a butcher. You stock all kinds of meat and fish. You know you can’t sell it after a certain date. What are you going to do?

On the last sellable day, you’re going to sell it at half price, that’s what.

OK, now suppose you’re a smart consumer. You know about this sizzling deal. So you go to your grocery store early in the morning. You go to the meats counter and look for some specially marked, deeply discounted prime cuts of beef. It won’t be labeled “Today’s the last day of sale,” but the price will tell you that you’ve found gold.

You get the meat for half price. You cook it that day, or freeze it until you want it. You smile, knowing that you’ve beaten the system.

(The “sell by” date isn’t a “goes bad” date. In other words, the beef is perfectly safe to cook or freeze on its last “sell by” date.) —Tim Muehl

Savings ballpark: $250 a year

$250 = Buying half-price meat half the time, assuming that 20 percent of the average American’s $4,000 grocery bill is meat

Store brands: Subtract the marketing costs of groceries

What is Skippy peanut butter, anyway? It’s peanuts, vegetable oil, sugar, and salt.

Well, what is Great Value peanut butter (Walmart’s store brand)? Same ingredients.

So why does a jar of Great Value cost 22 percent less than Skippy?

Or why is Tropicana orange juice $3.50 a carton, when Publix OJ costs $3? It’s the same juice, right?

The answer, of course, is marketing. National brands have to advertise. Store brands don’t. On average, according to Consumer Reports, store brands cost around 30 percent less than national brands.

Fans of store-brand shopping are fond of pointing out that frequently the store brand is manufactured by the national brand, using the same ingredients, factory, and workers! Hormel (meat products), Marcal (paper products), and Reynolds (foil, plastic wrap) all make and package both their own brands and store brands. Same products, different labels.

That doesn’t mean that the products are always identical, though. They might use different formulas, or ingredients held to different standards.

Still, store brands are almost always a great deal. In a Consumer Reports poll of 24,000 shoppers, 78 percent described the store brands’ quality as identical to the national brands. (They may not taste identical to the national brands—just not any worse.)

If you’re really hesitant to try a store brand, you can Google that particular example to see how good it is. Search for bumblebee tuna vs nature’s promise, for example.

But generally you can’t go wrong with the store brands—and you can shave one-third off your annual grocery bill.

Savings ballpark: $600 a year

$600 = 30 percent off by buying store brands, assuming they’re available for half the things you buy, based on the average American’s $4,000 annual grocery spending

Store brands, drugstore edition

When it comes to drugstores, you can take everything you read in the previous tip and underline it three times.

The store brands for medicines (cough syrup, pain relief, allergy meds, and so on) differ from store brands for groceries in one key aspect: By law, store-brand drugs must include exactly the same active ingredients in the same quantities, and they must be manufactured according to the same strict FDA regulations.

They cost an average of 36 percent less than national brands, but they are exactly as effective.

(The inactive ingredients—colors, flavorings, fillers—are usually different. In fact, trademark law prevents the pills or syrups from looking exactly like national brands. But, again, the actual medicine inside is identical.)

Typical examples:

• Advil, 40 liquid gels, $7.39. CareOne, the CVS store brand sitting right next to it: $5.69 for the same amount. Savings: 23 percent.

• Listerine, 8.5 ounces, $3.79. The CVS brand is $2.67—a savings of 30 percent.

• Tums, 160 tablets, $8.99. CVS antacid tablets, same number, $7.29. A 19 percent savings.

(And that’s just over-the-counter drugs. Generic prescription drugs bring you an even bigger savings—on average, 80 percent off. Generic prescription medicines, however, are no big secret; your doctor or pharmacist may even steer you to them. 86 percent of all prescriptions prepared by pharmacies are now generics.)

Savings ballpark: $85 a year

$85 = 25 percent off the average American’s annual $340 spending on over-the-counter medicines

The free movie-popcorn distribution channel

Movie-theater popcorn follows some of the strangest rules in all of economics.

First of all, the profit margin is truly impressive. You pay $8 for popcorn that costs the movie theater perhaps 45 cents to buy—a 1,700 percent markup. Per ounce, that popcorn costs more than filet mignon. Much more.

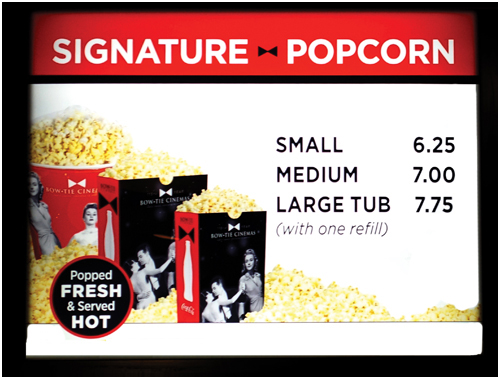

Second, most theaters offer popcorn in small, medium, and large sizes—but the prices aren’t at all proportional to the amount you get. They’re heavily slanted to encourage you to buy a large. For example, you might pay $6.50 for a small, $7.50 for a medium, and $8 for a large. (You may even have been asked: “Would you like to upgrade to a large for 50 cents more?”)

So here’s the tip. Suppose you’ve gone out to see a movie with friends.

Instead of ordering three small popcorns, order a large bucket—and then ask, “And could I also have some empty cups to share the popcorn?” That way, you get the relatively huge value of the large popcorn, but you can share it without having to keep passing the bucket back and forth.

You’ll discover that the concessions staff is perfectly happy to accommodate you.

(Incidentally, don’t get steamed up about the insane prices of popcorn and candy at the movies. The theater has to hand over as much as 70 percent of your ticket price to the movie studios—but it keeps 100 percent of snack profits. The result, according to a Stanford study, is that the sales of those tasty snacks keep your ticket price lower than it would be without them.)

Savings ballpark: $11 per movie

$11 = Savings by buying one large $8.50 popcorn instead of three small $6.50 popcorns

The most level-headed discussion of bottled water ever written

Bottled water is a hot, live-wire topic. Show up with a bottle of water in front of the wrong friend or co-worker, and you’ve got some unpleasantness on your hands. A dirty look, a disgusted lecture, maybe even a reevaluation of the whole relationship.

The arguments against bottled water are pretty standard: Making all those plastic bottles, and shipping all that water to the stores, is an environmental disaster (true). You’re paying $3 for what’s nothing more than purified tap water (often true). You’re a hopeless sucker, a mindless consumer rat, manipulated by the corporate behemoths for their own profit (possibly).

Let’s face it: Most people who buy water in bottles do it for convenience. Drinking fountains are becoming increasingly rare, and our food is becoming increasingly salty. We could buy soda or fruit juice, of course, but water is a healthier, zero-calorie drink.

So what are we going to do—carry around our own water bottles?

Well, actually, yes. Becoming one of those water-bottle-carrying people may be a habit change for you, but it has tremendous benefits:

• It’s good for you. There’s scarcely a doctor alive who doesn’t recommend drinking more water. It’s good for your skin, kidneys, digestion, brain function, and energy levels. It helps prevent kidney stones, hangovers, constipation, and headaches.

So what does all that have to do with having a water bottle? Simply put, you’ll drink more water if there’s always some handy. Convenience = consumption.

• It’s less caloric. When you’re out and about and grabbing a bite somewhere, what are you going to drink? You could buy soda or fruit juice—but both are loaded with sugar and calories. A can of Coke has 127 calories; apple juice, 155. It takes 47 minutes of jogging to burn off two of those. You up for that? Or would you rather just switch to water?

• It saves money. This, of course, is the big point here. A soda costs between $1.30 for a can (bought as part of a 12-pack at the grocery store) and $4.75 for a cup (at a movie theater or amusement park). Bottom line: A soda habit is probably costing you $500 or $600 a year.

If you carry a water bottle with you, you spend nothing. (And lose weight. And live longer.)

Savings ballpark: $550 a year

$550 = $1.50 per soda × 365 days per year