Here’s the frustrating thing about money: As soon as you’ve earned some, the universe gangs up on you and demands that you spend it. Everywhere you turn, there’s something else to pay for.

Fortunately, for every avenue there is to spend money, there’s a loophole for spending less of it.

When to buy stuff

Prices fluctuate all the time. Supply, demand, the price of raw materials, the price of gas, location, the economy—it all affects product pricing.

You can’t do much about any of that.

What you can do, though, is control when you shop. In certain industries, the prices for products always drop at certain times of year, like clockwork.

Actually, what’s a little nonsensical is that there are usually two times for big price dips. First, there’s the time when demand is highest (sales on toys before Christmas, TVs before the Super Bowl). Second, there’s the time when demand is lowest (sales on candy after Halloween, bathing suits after swimming season).

Here’s your master cheat sheet:

• Bathing suits. What store wants shelves full of swimwear that’s no longer selling? Prices are lowest for the year in August, as the swimming season ends.

• Bicycles. New models roll out in September and October. That, therefore, is a great time to find sales on last year’s bikes.

• Cameras. New models usually debut in February, so you can count on big discounts on last year’s models on Presidents’ Day weekend.

• Camping gear. Giant price cuts arrive in August; the summer’s over, and so is demand for this stuff. Look for another rash of sales in October, too.

• Candy. Right after Halloween, every store and its brother slash prices to unload all the unsold candy.

• Car parts and service. April is National Car Care Month, so you may spot special sales that time of year.

• Cars. Many car companies roll out next year’s car models in the fall, so you can get fantastic deals on the current year’s cars around September.

• Chocolate. The fancy stuff goes on deep discount right after Valentine’s Day (shocker).

• Clothing. In general, clothing for each season goes on sale a couple of months before the next season begins. In February, for example, they put winter clothing on sale for 50 to 70 percent off, to make room for the incoming warm-weather stuff.

Similarly, spring clothing goes on sale in May, to make room for summer items; summer clothing’s price drops in August; and, of course, discounts on fall clothes emerge around November.

• Computers go on sale in September, once the back-to-school rush is over. There are more big discounts in November, on Black Friday and Cyber Monday.

• Cookware. As graduation/wedding season approaches, you can find good deals on kitchen stuff in April and May (especially Memorial Day weekend).

• Cruises. Sales on sailings usually arrive in January and February, when people are booking their spring break and summer cruises. In late October, there’s another round of sales—both for people planning holiday cruises and for the cruise lines to unload cruise cabins that aren’t selling well.

• Electronics. In late November, Black Friday and Cyber Monday have taken on mythic proportions in the gadget world. Every category of gadget goes on sale: TVs, laptops, phones, tablets, cameras, and so on. Every store and online retailer fights for headlines, and the winner is you.

• Fitness equipment. January, after the holidays and while New Year’s resolutions are still in force. Huge deals, from 30 to 70 percent off.

• Furniture. New models arrive every February and August, so the best deals (on outgoing models) are available in January and July. Also look for big sales in November, on Black Friday and Cyber Monday. Office furniture often goes on sale in May and October.

• Grills. The big rush to buy these is, of course, before July 4—so the prices drop right afterward. Prices crash again in October, as the weather gets cold.

• Gym memberships. The best deals, logically enough, sprout in June; that’s when demand is lowest, as people head outdoors for physical activity.

• Holiday decorations. As you’d guess, prices crash right after each holiday. Buy Halloween decorations right after Halloween, Christmas decorations right after Christmas, and so on.

• Home improvement. Home Depot has its own special Spring Black Friday sale every April.

• Jewelry. Scout for deals in July, when there are no gift-giving holidays for miles to boost stores’ sales.

• Laptops. Shop in June or during the back-to-school frenzy in August.

• Lawn mowers. They go on sale in August and September, when nobody needs them anymore because winter is coming.

• Linens. Look for the “white sales” in January.

• Luggage. New styles appear around March, in readiness for the summer travel season—so you can snap up great deals on last year’s suitcases. In August, another round of price cuts settles in, since people are pretty much finished with their summer travels.

• Mattresses. The entire industry blows out last year’s models over Memorial Day, so watch for crazy sales in May. More sales around the July 4 and Labor Day weekends.

• Office furniture. May.

• School supplies. August, of course. Back to school sales!

• Ski stuff. The big sales are usually in March, since nobody’s buying gear for that winter anymore.

• Sneakers. You can find delicious deals as high as 50 percent off in April, as shoe stores try to shoe you up and shoo you outdoors.

• Tools. Shop in July, since Father’s Day is now over.

• Toys. Are you kidding? January, right after the holidays. Everything’s marked down. (Then again, you may also find some big sales before the holidays, especially on Black Friday and Cyber Monday.)

• TVs. February, to make room for the new models and to accommodate the Super Bowl frenzy.

• Wedding dresses. Nobody’s buying wedding stuff in November and December, so that’s when the bridal shops mark down their wares to make room for the new year’s designs.

Savings ballpark: $855 a year

$855 = 5 percent savings on $17,100, the annual U.S. family spending on clothing, entertainment, and other consumer goods

Discounts on everything: RetailMeNot

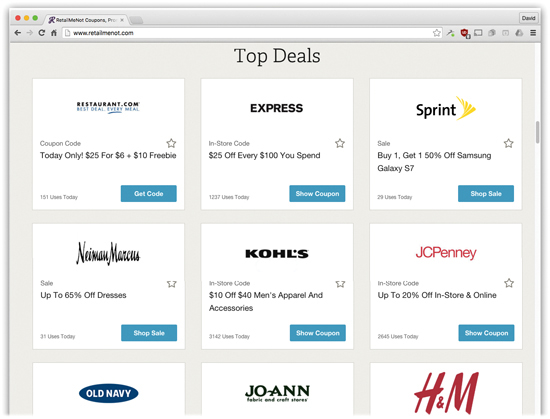

If you don’t visit RetailMeNot.com before you buy anything, you’re crazy.

This site is a massive collection of coupons—both printable ones to use at physical stores and coupon codes to use when you buy things online. (Millions of fans find these deals and submit them to the site.)

You just search for the store you’re shopping in or the thing you’re about to buy. You’d be amazed at how many times out of 100 there’s a discount waiting for you.

A huge collection of online and real-world shops, restaurants, and services offer coupons and discount codes here.

A few examples:

• Babies. Babies “R” Us, Diapers.com, Pampers.

• Clothes. Dressbarn, OshKosh B’gosh, Abercrombie & Fitch, Disney Store, Banana Republic, Ralph Lauren, Hanes, Under Armour, Forever 21, L.L.Bean, Garnet Hill, The Limited, Saks Fifth Avenue, Victoria’s Secret, Old Navy, Aéropostale, American Eagle Outfitters, H&M, Gap, Lands’ End, Sports Authority, Lane Bryant, Ashley Stewart.

• Department stores. Macy’s, Amazon, Target, Sears, Bed Bath & Beyond, Kmart, Nordstrom, Lord & Taylor, Costco.

• Drugstores/health. CVS, Drugstore.com, GNC, Walgreens.

• Electronics. Best Buy, Apple Store, Verizon, HP, Newegg, Netflix, Audible.

• Food (takeout). GrubHub, Dunkin’ Donuts, Seamless, Starbucks.

• Gifts. Edible Arrangements, FTD, 1-800-Flowers.com, ProFlowers, Teleflora.

• Home. Home Depot, Lowe’s, Pottery Barn, Ace Hardware. (Also PetSmart and Petco.)

• Office. Staples, Office Depot, OfficeMax.

• Restaurants. Pizza Hut, Subway, Ruby Tuesday, Domino’s, Olive Garden, Boston Market, Outback Steakhouse, Denny’s, Burger King, Einstein Bros. Bagels, Chili’s, Restaurant.com.

• Shoes. Payless, Foot Locker, Famous Footwear, Nike, UGG Australia, Shoes.com, Adidas, Converse.

• Tickets. Ticketmaster, Fandango.

• Travel. Airbnb, Hotels.com, Budget Car Rental, Avis, Enterprise, Hertz, SuperShuttle, Travelocity, Expedia, Priceline, Southwest, Frontier Airlines, Uber, Spirit Airlines, Hotwire, Dollar Rent a Car, CheapOair, Amtrak, Alamo Rent A Car, Park ’N Fly, Emirates airline, CheapTickets, Thrifty Car Rental.

The trick here is to remember to visit RetailMeNot whenever you’re about to buy something.

There’s an excellent free RetailMeNot app for your smartphone, too. When you’re actually out in Shopping Land, about to make a purchase, you can check the app to see if this store has coupons available. The app can also make your phone chirp and vibrate when you’re walking by a store with coupons available.

Bottom line: RetailMeNot is like free money. You should take it.

Savings ballpark: $600 a year

$600 = An average savings of 15 percent, assuming that you use RetailMeNot on half your purchases (average consumer expenditures on physical goods: $8,000 annually)

The eight great ways to get cheaper movie tickets

The movie industry got it all wrong. It predicted that if home VCRs and DVDs were allowed to proliferate, we’d all stop going out to see movies. The entire movie industry would collapse.

Instead, what happened? We go out to see movies more than ever before. Our habit of watching movies at home turned us into a nation of movie nuts.

Along the way, what was once the ultimate cheap family getaway has become an expensive family getaway. In big cities, movie tickets are $15 each, popcorn is $8, and soda is $5; add in parking, and suddenly you’re looking at over a hundred bucks for the family.

Fortunately, if you’re willing to plan ahead, it’s possible to snag discounted entry to the multiplex. Let us count the ways:

• Harness the power of the group. You can read about Groupon.com here—but one of its most attractive offerings is frequent deals on discounted Fandango tickets. (Fandango sells movie tickets to every theater near you.) A typical deal might be $16 for a pair of movie tickets, which saves you about 30 percent.

AAA and AARP memberships get you movie-ticket discounts, too (here and here).

• Sam’s Club, Costco. These membership discount stores (here) sell discounted tickets to local movie theaters. You just have to ask for them at the customer service desk. You might, for example, snag a 10-ticket book for $85, which represents a discount of 15 to 25 percent, depending on the price of movies where you live. (Movie tickets are much more expensive in big cities than in rural areas.)

And remember: If you buy your discounted tickets using a cash-back credit card (here), the deal is even sweeter.

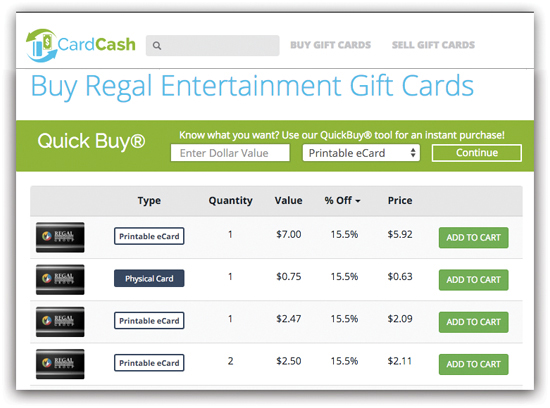

• Discounted gift cards. Gift-card exchange sites like GiftCardGranny.com and CardCash.com (here) are teeming with gift cards to the major theater chains, ready for you to buy for 15 percent off. If you’re a frequent moviegoer, you really must buy movie cards there and start paying less.

• Matinees. Movies that begin before dinnertime are often sold at “bargain matinee” prices—$6 or $8 instead of $10 or $12, for example. This offer varies; to find out, call the theater. Or pull up Fandango.com, click the movie showtime you’re eyeing, and look at the matinee price.

• The unlimited-movie plan. At MoviePass.com, you can sign up for this most unusual program: For $30 a month, you can see all the movies you want.

There are no blackout dates, and almost all theaters are included. If you see three movies a month, you start coming out ahead. If you see more than one a week, you save a lot of money. Heck, you can see a movie every day—total price, $1 a ticket!

There’s some fine print: IMAX and 3D movies aren’t included. You have to pay the $30 a month for an entire year, or else pay early-cancellation fees ($20 to $75, depending on how soon you quit).

Otherwise, though, MoviePass.com is like Netflix for going out to the movies.

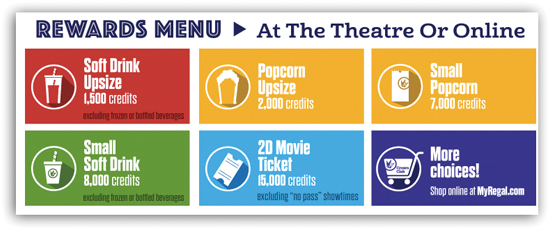

• Join the club. Every major theater chain offers its own loyalty program: Regal, AMC, Cinemark, Carmike, Showcase, Bow Tie, and so on. It’s free to join. The more movies you attend, the more points you get, and you can redeem them for free popcorn, drinks, and movie tickets.

More to the point, you also get discount offers by email, a free movie ticket on your birthday, and other goodies.

• Be old or young. Movie theaters offer student discounts and senior discounts—and their definitions of “student” and “senior” can be pretty lax. In some places, over 50 is considered old enough for the discounted senior ticket.

• See advance screenings. Most movies host free advance screenings in big cities—for critics, for bloggers, for building word of mouth. Yes, we’re talking about free movies before the public gets to go see them.

In the days of yore, the only way you’d get invited was to be on the mailing list of the PR company setting up the screenings. These days, though, you can register with Gofobo.com (or use its app). Gofobo lets you search for advance screenings near you—and you get invitations to them.

Two footnotes. First, they want to ensure a full house, so they distribute more passes than they have seats; you’ll be told to arrive an hour early. (You’ll also be told to leave your cell phone in the car, to ensure that you won’t record the movie illegally.) Second, you may be alarmed at how much junk email you get once you’ve signed up. For best results, register with Gofobo using a secondary email address, so that your primary address doesn’t get clogged up.

There are also, of course, free movie showings at schools, libraries, and town summer programs. And there are “second-run” theaters in most cities, where the movies are a few months old but also half-price.

Savings ballpark: $115 a year

$115 = 20 percent savings for a family of four, seeing one movie a month at $12 per ticket

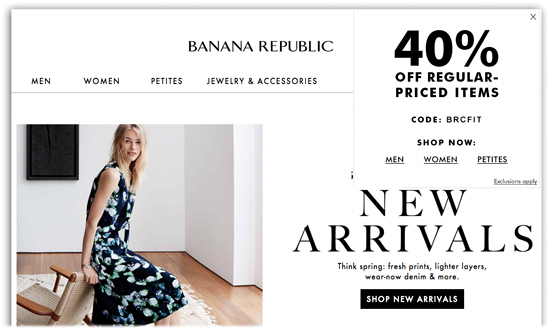

The truth about Gap, Banana Republic, and Old Navy

If you wander into one of these popular clothing stores and pay the price on the tag, you’re a sucker. Plain and simple.

You should never pay full price at Gap, Banana Republic, or Old Navy. A single mother ship (Gap Inc.) runs all three chains, and they all follow the same fascinating business model: They price the clothes higher than you might expect—but then they shower the world with sales and discounts and deals. All the time. If you time your visits, you can walk away with great clothing at much lower prices.

Here are some of the techniques. (Most of them work identically for Gap and Banana Republic. Old Navy’s savings mechanisms are similar, but the percentages may differ.)

• 40-percent-off-everything sales. Gap, Banana Republic, and Old Navy run 40-percent-off sales every couple of months, often tied to holidays. The sales usually run for several days.

The crazy part is that some items are already on sale when the 40-percent-off sale rolls around. That is, you can get 40 percent off the sale price.

So how do you know when one of these sales is on? Visit the website (Gap.com, BananaRepublic.com, or OldNavy.com); you won’t be able to miss the banner advertising the sale.

Or, if you’re willing to surrender your email address, you can sign up for these stores’ email newsletters, right there on their websites. They’ll email you when the sales are on. As a bonus, the mere act of signing up for that newsletter usually gets you a coupon for 15 or 20 percent off.

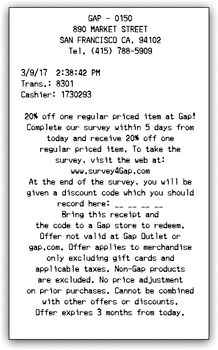

• 20 percent off anything. When you buy something at one of these three stores, along with your receipt, you generally get a little slip of paper inviting you to take an online survey. (Gap’s survey, for example, is at survey4gap.com.)

The survey takes about 15 minutes. When you finish, you’ll be given a code to write on the receipt—worth 20 percent off anything on your next Gap or Banana visit. (Old Navy’s code is worth 10 percent instead.)

• 10, 15, 40, or 50 percent off anything with the store credit card. When you buy anything at Gap/Banana/Navy, the cashier will probably invite you to sign up for the store’s credit card.

If you ever expect to shop at any of these stores again—or even if not—go right ahead. (You can use the same card for discounts at all three chains.) Card ownership works like discount magic:

First, you get 15 percent off whatever you’re about to buy right now.

Second, you get 10 percent off anything you buy in the next two months.

Third, you get 10 percent off everything you buy on any Tuesday at Gap.

Fourth, you’ll get frequent emails offering you discount offers exclusively for cardholders—usually 40 percent off everything. (In recent years, cardholders were invited to get 50 percent off during the week leading up to Black Friday in November.)

Fifth, you get $5 back on every $100 you spend.

Finally, if you spend at least $800 a year, you get Silver status: free shipping on everything you order online, with no minimum order.

Note: This store-credit-card business is a fantastic idea if you pay your whole credit card bill each month. If you don’t, you’ll be slapped with very high interest rates and late fees. You’ve been warned.

• 50 percent off anything, anytime. Work at the store. Employees get half off everything.

Savings ballpark: $270 a year per person

$270 = 30 percent off, shopping at Gap Inc. stores for half of the average American’s $1,800 in apparel spending

Meet coupons, 21st-century style

Back in the day, our moms clipped coupons from the newspaper. Depending on how serious they were about it, they wound up saving a lot of money over the years.

Eventually, many people quit clipping paper coupons. The time-money trade-off just wasn’t good enough. Sure, you could save 50 cents on a bottle of window cleaner—but the time it took to pore through newspaper supplements, clip the coupon, keep it organized, and remember to use it was probably worth more than 50 cents.

But what if the Internet could change that time-money value proposition? What if that coupon-clipping session took only a minute and involved no actual clipping? You’d check it out, right? You wouldn’t want to leave money on the table every time you went shopping, right?

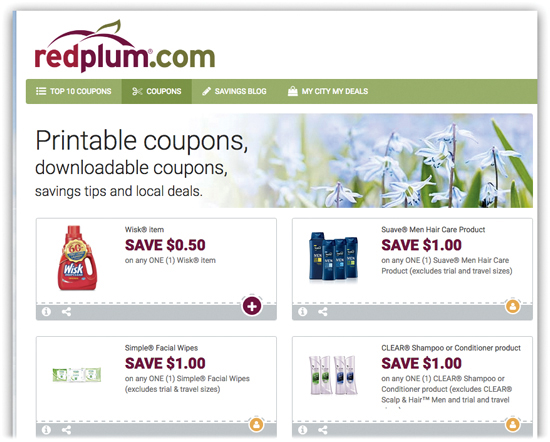

The Internet is full of sites that round up thousands of coupons in one handy, searchable place. They include Coupons.com (the biggest one), RedPlum.com, and SmartSource.com. On these sites, you scroll through the hundreds of available coupons or just do a search for specific products. When you see one that looks good, one click (on a Print or Clip button) adds that coupon to your list of printouts-in-waiting.

When you’re finished browsing, you can print all the rounded-up coupons on a few printer pages, which you then take to the store.

Savings ballpark: $312 a year

$312 = Three coupons a week, face value of $2 each

Tips from the cult of extreme couponing

It’s possible to take the concept of couponing to an almost unhealthy extreme.

There are people, perhaps even some you know, who spend hours a week playing the coupon game. They seek out deals so extreme that the couponers actually make money by buying things. They have four subscriptions to each Sunday newspaper so they’ll have four copies of the really useful coupons. They carry foot-thick binders full of carefully organized coupons to the store. They speak jargon like “BOGO” (buy one, get one free), “OYNO” (on your next order), and “Catalina” (the special printer at the checkout that spews out coupons after your sale is complete).

And they fill their pantries with $5,000 worth of supplies that, in the end, cost them only $300.

It’s called extreme couponing. These people exist. They were even the subject of a TLC TV series, Extreme Couponing.

You, of course, would never take things that far. You plan to use the information in this book only to save money on things you intend to buy anyway, and you won’t spend more than a couple of minutes doing it. Right?

Nonetheless, there’s no shame in knowing some of the extreme couponers’ tricks. They include these:

• Stacking. Stacking coupons is applying two coupons to the same item so that it winds up costing nearly nothing. Now, you’re not allowed to use two manufacturer’s coupons on the same item—two Crest toothpaste coupons, for example. But most stores permit you to use a store coupon and a manufacturer’s coupon on the same item.

• Competitor coupons. Many stores accept coupons issued by other stores. For example, you might be able to use a Target coupon for some pain reliever at your ShopRite. (Not all stores will do this—you have to ask.)

• Buy by the sale, not by your need. You may not need deodorant right now. But hard-core couponers realize that, sooner or later, they’ll always have to buy certain staples—paper towels, toilet paper, favorite cereal, ketchup, and of course what they call HBA (health and beauty aids like shaving cream, soap, dental floss, toothpaste, and shampoo).

So when the deals come, take them, whether you’re currently running low on those items or not. Buy five or six of something if the deal is good. Stuff them in your pantry or under-sink bathroom cabinet, and enjoy the rosy glow of knowing that you’ve planned ahead.

Local shops vs. the Internet

It’s a classic dilemma. Should you buy something in a physical store, where you’ll support a local business, boost the local economy, and get your purchase immediately?

Or should you buy it online, where you can save money?

Often, the decision boils down to how much lower the online price is. If that blender on the shelf in front of you costs $90 less online, then it might be worth ordering it instead of bringing it home with you.

That’s the beauty of smartphone apps like RedLaser and ShopSavvy. You aim your phone’s camera at the bar code on the package—and instantly, the app tells you how much that identical product would cost if you bought it from an online retailer.

Information is power—so, so much power.

Savings ballpark: $300 a year

$300 = 10 percent savings on $3,000 worth of consumer goods a year

Best Buy vs. the entire Internet

When it comes to electronics, the “Buy it online, or buy in the store?” debate isn’t nearly so difficult.

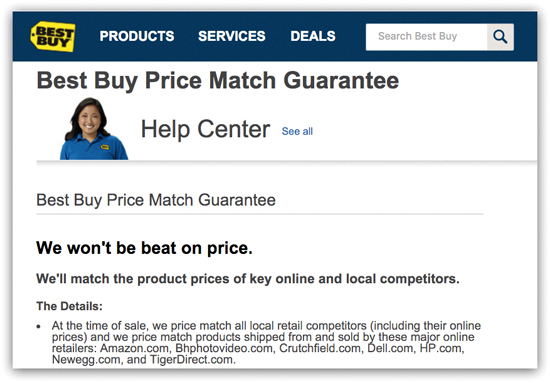

Best Buy, the national electronics chain, has a price-match guarantee. It promises to match the price of any product at any rival store within 25 miles.

But who cares about store prices? What you really want is for them to match the prices of online stores, like Amazon.com or TigerDirect.com!

In fact they will. It’s called the Best Buy Price Match Guarantee, and you’ve got it in writing—on the Best Buy website.

It works like this:

Find what you want to buy at a local Best Buy. Whip out your smartphone. Search for that item on all the usual discount online retailers: Amazon.com, Dell.com, HP.com, Newegg.com, TigerDirect.com, BHPhotoVideo.com (photo and video supplies), or Crutchfield.com (audio and video for cars, home theaters, and professionals).

Show the lower online price at the store’s customer service desk. Boom: They give you the online price at the physical store without even blinking.

Savings ballpark: $25 per purchase

$25 = 5 percent savings on a typical $500 appliance

The shameful truth about extended warranties

For many years, Consumer Reports has been tracking product failure rates and extended-warranty programs. Want to know what they’ve discovered about extended warranties?

They’re a rip-off.

Often, when you buy a new car, phone, microwave, camera, or whatever, you’ll be asked—with tremendous salesperson encouragement—to pay extra for a longer warranty period. (Why the enthusiasm? Because the salesperson gets a commission on every extended warranty sold.)

An amazing number of us give in. For example, 40 percent of new-fridge buyers pony up for the extra warranty. They worry that if something does go wrong, they’ll kick themselves for not having gotten the warranty when they had the chance.

The truth is, though, that an extended warranty is insurance. Or, rather, it’s a bet—that your appliance will break outside the original warranty (say 90 days or a year) but inside the extended warranty period.

But the statistics show that they almost never do. If a new product fails, it’s almost always soon after purchase, well within the original warranty period.

There are a few situations when the extra coverage is more likely to pay off: when you buy a used car, or a laptop, or a cell phone—as long as the policy covers everything, including loss and dropping.

Remember, though, that your credit card may offer extended-warranty coverage automatically. It’s a common perk for credit cards.

In general, extended warranties are a waste of money.

Savings ballpark: $160 a year

$160 = Extended warranty prices for one major and one minor appliance

An Amazon Prime primer

No book about money would be complete without mentioning Amazon Prime. For better or worse, there’s nothing quite like it in the world.

When the service began in 2005, Prime membership cost $80 a year. For that, you got free two-day shipping on anything. You broke even if you bought at least 25 things a year.

(Not everything is eligible for Prime delivery, but most things are. A Prime logo lets you know.)

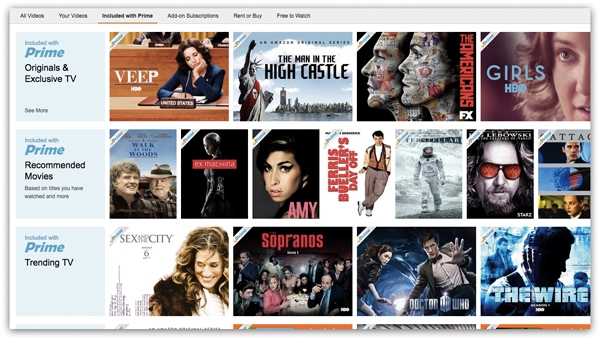

Since that time, Amazon has raised the price to $100 a year (or $11 per month), but has quietly added a weird, random, but valuable list of perks to membership. Now Prime also gets you all of this:

• Prime Video is an unlimited streaming movies-and-TV-shows service, almost exactly like Netflix. They’ve got thousands of movies in the catalog, lots of entire seasons of TV shows, and a few original shows (produced by Amazon). None of it is quite as good or quite as copious as what Netflix offers, but it’s getting closer. (You can subscribe to Prime Video alone—without all the other Prime benefits—for $9 a month. Of course, that makes no sense, since that’s $108 a year—more than a full annual Prime membership.)

• Prime Music is like Spotify, in that you can listen to all the music you want at no extra charge. The catalog is far smaller, though—“only” 1 million songs are available at any time.

• Unlimited photo storage. You can set up your phone to auto–back up your pictures to Amazon Photos.

• Kindle Lending Library. If you own a Kindle (Amazon’s ebook reader), a Prime membership lets you read its 800,000 Kindle ebooks for free. They’re often brand-name, worth-reading books. You can “check out” one free book a month.

• 20 percent off diapers. Prime members have access to the Amazon Family club, which is basically a bunch of discounts, coupons, and sales on things you might need for raising kids. If you subscribe to one of the automatic diapers-by-mail plans, for example, you get 20 percent off. And if you make a list of goodies you’d like your friends to buy for you on Amazon’s Baby Registry, and you wind up not getting everything on it, Amazon will let you buy the rest of the stuff for 15 percent off.

• Early access to special deals and sales. You can get at them 30 minutes before the rest of the world.

• Free same-day shipping in big cities. The fine print: You have to order before noon (seven days a week), live in a big U.S. city where same-day operates (27 and counting), and spend at least $35. (If your order total is smaller, you can pay $6 for the delivery.) And about a million Amazon items are available for same-day shipping—not everything they sell.

Some stuff, like groceries and essentials, arrives within two hours; everything else arrives by 9 p.m.

(The same shipping services are available if you’re not a Prime customer; you just pay more.)

Overall, Prime is an excellent deal. If you place more than a few orders a year from Amazon and watch just a few of the free movies, you’ll make your money back.

Prime is, however, what’s known as velvet handcuffs: Studies show that Prime members tend to wind up buying more stuff from Amazon, and more often, than they otherwise would have.

Savings ballpark: $732

$732 = $20 saved on shipping two orders a month + $3 saved watching a movie a week + $8 saved on one Kindle book a month, minus $100 price of Prime membership

Sharing your Prime account

There are two ways to spread out the value of your $100 Prime membership by sharing it with other people:

• Share your Prime membership. The cost of a Prime membership goes down easier when you realize that two different people, even in different places, can both enjoy its benefits. That includes free two-day shipping (even if it’s to two different addresses), Prime Video streaming movies, Prime Music music, unlimited photo storage (two separate “lockers” for photos), Kindle Owners’ Lending Library, and so on.

The one catch: To show how much you love and trust each other, you also have to share your credit card information with each other. (That’s to prevent you from sharing your account with strangers across the Internet with the goal of abusing the system.)

• Family Library is a related feature. It lets you link two Amazon accounts, merging their collections of Kindle ebooks, audiobooks, and Kindle apps. You and your spouse, friend, or co-worker can share all your stuff with each other, for example, thereby not having to buy all those best-sellers twice.

You can also share your Kindle books and apps with up to four children.

Once again, the two consenting adults must be willing to share their credit card info to prove just how close they are.

Savings ballpark: $300 a year

$300 = $100 a year savings on a second Prime subscription plus $200 savings on books and apps that would have had to be purchased twice

More free months of Amazon Prime

OK, you’re paying $100 a year for free two-day shipping. What happens if you order something from Amazon that doesn’t arrive by the second day?

You just contact Amazon’s customer service. (Visit Amazon.com/help; you’ll find options to make this report by email, web, or phone.)

For breaking its promise, Amazon cheerfully gives you a free extra month of Prime membership or credits you $5 or $10.

Savings ballpark: $8.33

$8.33 = $100 annual Prime cost divided by 12

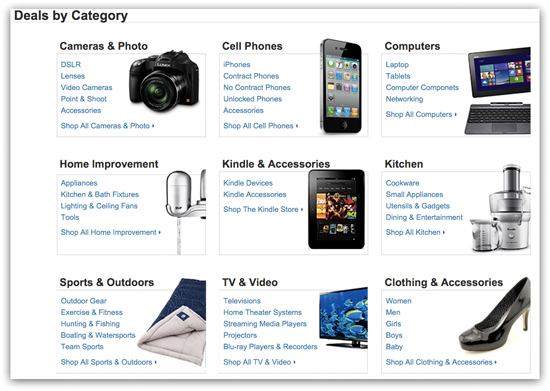

Eight obscure Amazon discount programs that shouldn’t be obscure

Amazon.com, as you may have heard (over and over and over again), is the “everything store.” You can find and order just about anything from this gigantic website, from clothes to medicine to farm implements.

Amazon realizes that it’s at a disadvantage: It has no huge chain of physical stores for you to browse. You have to buy everything by mail order, sight unseen.

Yet Amazon dearly wants you to think of Amazon every time you need anything. So it’s willing to give you absurdly low prices on things through about a dozen discount programs. Hardly anyone knows about them, but you should. Some are so favorable to you that you may wonder about Amazon’s sanity.

• Amazon Prime Store Card. If you’re a member of Amazon Prime (here), you should pay attention. Amazon offers its own “credit card,” which works only for Amazon.com purchases. It gives you 5 percent off everything, every time. If you shop on Amazon, it’s like free money.

(As usual, this amazing deal is useful only if you religiously pay off the entire bill every month. If you don’t, you’ll be slapped with a nosebleedy 26 percent interest rate. You’ll rue the day you signed up, and you’ll use this book as kindling in your fireplace.)

• Amazon Warehouse Deals offers some incredible “open-box” specials. That’s where somebody bought a product, opened it, and returned it without using it. Or maybe the corner of the product’s cardboard box got dented in shipping, so Amazon can’t really sell it as new.

You’ll find Warehouse Deals offers in every category: computers, cameras, phones, TVs, video games, shoes, sporting goods, and on and on. Every single item has been inspected by hand and given a condition rating: New, Like New, Very Good, and so on.

(The quickest way to find Amazon Warehouse is to type amazon warehouse into Google.)

• Amazon Subscribe & Save. This plan is designed to give you two advantages. First, there’s convenience: On a schedule that you choose, Amazon automatically sends you stuff that you consume all year long, like batteries, razor cartridges, baby food, toilet paper, makeup, cereal, shaving cream, pet food, laundry detergent, and so on. You don’t have to remember, shop for, or carry anything.

Second, there are rather huge savings. Each thing you order comes with instant 10 to 25 percent savings. There’s also a coupon section of the Subscribe & Save page, which takes even more off certain products. And shipping on everything is free.

But wait, there’s more: If you schedule five or more items to arrive on the same day each month, Amazon gives you another 15 percent discount.

What you wind up with are some very low prices indeed.

(Easiest way to find this deal: Type amazon subscribe & save into Google. Or look for the Subscribe & Save logo on Amazon’s pages for things you might need to reorder periodically.)

• Student Discounts. If you have an email address that ends in .edu (meaning a school, college, or university), Amazon will give you what amounts to a six-month Amazon Prime membership—for free. You get free two-day shipping, special offers and promotions, unlimited storage for digital photos, and free access to Prime Video (unlimited streaming of 40,000 movies and TV shows) and Prime Music (1 million songs).

After the free six months, you can become a regular Amazon Prime member for $50 a year—half price. You get that half-price deal for up to four years, as long as you’re still a student.

You sign up for all this at Amazon.com/joinstudent.

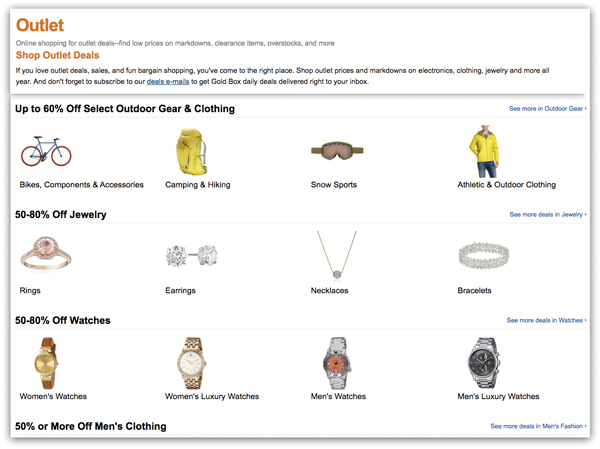

• Amazon Outlet. You know what an outlet store is, right? It’s a deep-discount store where retail stores dump stuff they can’t sell: clearance items (out-of-season clothes), overstock (they ordered too much of something), and things with teeny imperfections (missing washing-instructions tag).

Amazon has its own outlet store, too, at Amazon.com/outlet. What you find here changes all the time, but it’s usually clothing, electronics, and jewelry. Everything is brand-new, but the discounts are gigantic. Clothing, watches, and jewelry are usually priced from 50 to 80 percent off; electronics go from 20 to 70 percent off.

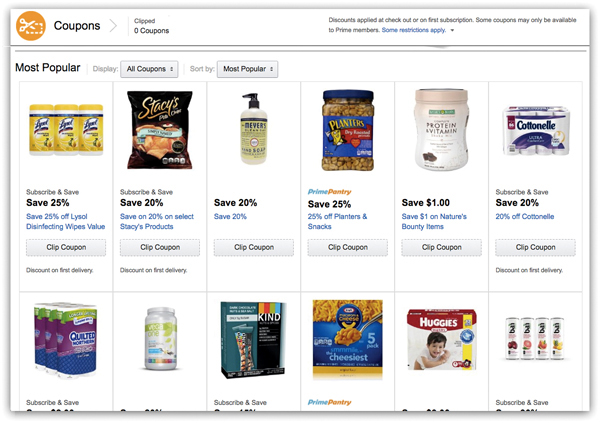

• Coupons. It might seem strange that Amazon has a page listing coupons that give you additional discounts on Amazon products, but it’s true. At Amazon.com/coupons, you see a huge spread of coupons for familiar grocery-store brands: Planters, Heinz, Kleenex, Pop-Tarts, Keebler, Scott paper products, and so on. They’re decent savings: 20 percent off or $2 off, for example.

You “clip” one by clicking the Clip Coupon button. Now you click the little photo of the product to see all of that brand’s eligible products carried by Amazon: all the different varieties of Planters’ nuts, or Heinz’s condiments, and so on. When you click to buy, Amazon applies the discount automatically.

• Gold Box (Deals of the Day). Here’s yet another page of Amazon specials. The rules are simple: crazy deep discounts (say 75 percent off)—and a totally random selection of things to buy. It’s whatever Amazon wants to get rid of. A $37 Fisher-Price kiddie toy for $16. A $40 rotating iPad holder for $10.

You can sign up on the Gold Box page (Amazon.com/goldbox) to get email listings of what’s new, so you won’t have to remember to check there every day.

• AmazonSmile. You can think of Smile as Amazon.com in a parallel universe, where half of 1 percent of everything you buy goes to a charity of your choice instead of into Amazon’s coffers.

All you have to do is start at Smile.Amazon.com instead of Amazon.com. From there, everything else works the same as it always has—but at the moment of purchase, you’re offered the chance to choose which charity you want to benefit. (At least a million charities participate, so you shouldn’t have trouble finding a worthy cause.)

Of course, AmazonSmile doesn’t save you any money on your purchase. But it helps to improve the world without costing you a penny.

Savings ballpark: $480 a year

$480 = 5 percent off the average Prime member’s $1,500 worth of Amazon expenditures with the Prime Store Card + 20 percent off $500 worth of Amazon Warehouse goods + 5 percent savings on $500 worth of Subscribe & Save items + 35 percent savings on $500 worth of Amazon Outlet purchases + 15 percent savings on $200 worth of couponed goods + 75 percent off one $100 Gold Box purchase

Price checks that go back in time with CamelCamelCamel.com

It might seem weird that a website exists to do nothing but track prices of things sold by Amazon.com.

But that’s exactly the purpose of CamelCamelCamel.com (and, yes, that’s really its name).

Amazon employs dynamic pricing, meaning that its prices constantly fluctuate based on all kinds of factors (time of year, popular demand, competitors’ prices, and so on). Obviously, you want to do your buying when the prices of things are lowest, right?

CamelCamelCamel is how you find out. It has two key features:

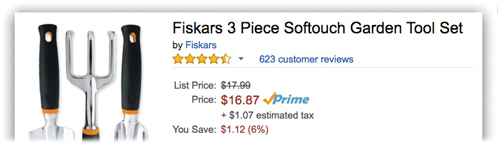

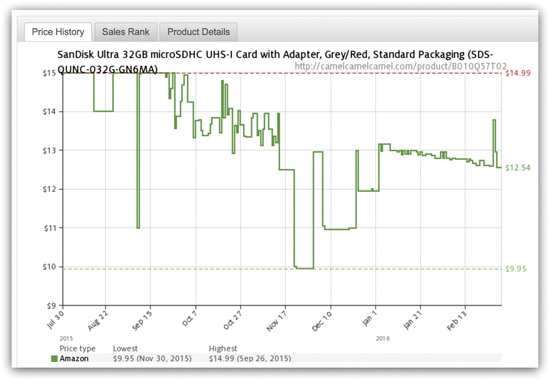

• It lets you know when a price drops. There’s a search box. You type into it whatever kind of product you’re eyeing, either generally (memory card) or specifically (sandisk ultra 32gb).

Click the one that looks good, and then type in a price where you’d bite. If the price ever drops to that level, CamelCamelCamel will email you to let you know.

• It shows the price history for any item. CamelCamelCamel tracks the price fluctuations of 18 million products sold on Amazon. The idea here is that if you’re about to buy something, you can see if you’re buying it at a good time. You don’t want to buy that toaster oven during a price spike, for example.

So how does all of this save you money? For years, Amazon offered a price-protection guarantee. If the price for something you’d bought dropped within a week after delivery, you were entitled to a refund for the difference.

Sadly, the growing popularity of CamelCamelCamel and other price-trackers eventually began to annoy Amazon. In summer 2016, as a result, Amazon ended its price-match guarantee program (except on TV sets).

But CamelCamelCamel can still save you money. It lets you wait to pounce until the site lets you know about a price drop.

If you’re patient, therefore, you gain both savings—and a deep, deep feeling of satisfaction from having beaten the system.

Savings ballpark: $70 a year

$70 = 10 percent savings on the average consumer’s $3,500 worth of purchases on consumer goods, assuming that CamelCamelCamel succeeds in finding deals 20 percent of the time