You know how banks make money from credit cards, don’t you? All month long, you use your card to buy things without actually giving up any money of your own. The bank pays the stores, restaurants, and businesses. Your money sits safely in your checking or savings account.

That system is a wonderful gift, but it’s not because the bank loves you. At the end of the month, you’re supposed to pay the bank back for everything you spent that month.

If you do, great! You got the use of that bank’s money for free. If you have the right credit card (read on), you even got paid a few percent as a cheerful bonus.

The banks, of course, hope that you won’t pay them back promptly. If you don’t pay off the full amount at the end of the month, they get to charge you an insane amount for the loan they’ve essentially made you—around 15 percent a year. (That’s known as the APR—the annual percentage rate.)

And if you don’t prove that you’re making an effort to repay what you owe, by paying a minimum amount the bank specifies, you get into serious loan-shark territory. The penalty rates hover around 28 percent.

No wonder the banks offer cash back and rewards for using their credit cards. The more people they can persuade to “charge it,” the greater the number of people who won’t pay off their bills completely.

That strategy works fantastically well—for the banks. At this moment, 40 percent of Americans don’t pay off the bill in full each month. The average American owes $9,600 to credit card companies.

If you’re interested in getting through life with the most money, then the lesson is obvious: Do everything in your power not to carry a balance (that is, not to owe the bank). Pull out every stop—psychological, financial, practical—to avoid this massive money drain.

Every one of the “use your credit card to beat the system” tips in this book, therefore, should bear a footnote in bold italics: This trick assumes that you’ll pay off your entire bill every month.

Use a credit card that pays you back

If you’re smart, you’ll get yourself a credit card that gives you cash back. The best ones credit you with, for example, 2 percent of everything you buy—and 5 percent on certain kinds of spending, like restaurants or travel.

The particulars of these deals change all the time, and there’s fine print everywhere. But here are a few examples:

• Citi Double Cash card. No annual fee. 2 percent back on everything—no limits.

• Fidelity Rewards Visa Signature card. No annual fee. 2 percent back on everything—no limits. The one footnote: Your cash back gets deposited into a Fidelity account of some kind (a brokerage account, retirement account, cash management account, and so on). From there, you can withdraw it whenever you’d like.

• Chase Freedom card. No annual fee. You get 1 percent back on everything you spend, and 5 percent back on spending in certain categories (on your first $1,500 in spending each month). Which categories? It rotates through the year: groceries, gas stations, Amazon, and so on. They also give you $150 as a thank-you for signing up.

• Blue Cash Everyday card (American Express). No annual fee. You get 1 percent back on everything; 2 percent back on gas; and 3 percent back on groceries (on your first $6,000 of grocery spending annually). You also get $100 as a sign-up bonus.

• Blue Cash Preferred card (American Express). This one has a $75 annual fee. But for that you get 1 percent back on most purchases, 3 percent back on gas, and 6 percent back on groceries (on your first $6,000 of grocery spending each year). If you’re the kind of person who eats food, you’ll earn back the $75 fee pretty quickly. Besides, there’s a $150 sign-up bonus.

If you’re not using a cash-back card, you’re making a big mistake. It’s free money. It’s 2 percent off everything you ever buy—with zero effort on your part.

Savings ballpark: $633 a year

$633 = 2 percent cash back on the average American’s annual rewards-card spending of $10,680 + 3 percent back on the average American’s $2,000 annual gas spending + 6 percent back on $6,000 worth of groceries

The argument for paying for insurance with a credit card

All major insurance companies let you pay for your insurance with a credit or debit card (Progressive, GEICO, State Farm, Allstate, Esurance, and so on).

And you know what? You should. Because if you have a rewards or cash-back credit card (as the previous tip strenuously advises), you’re getting rewards or cash back on a big expense: the thousands a year you spend on insurance. If you have a typical $900-a-year car insurance plan, your card will kick back $18 each year; if you spend $3,000 a year on homeowners insurance, your card will refund $60 every year.

You’ve got several kinds of insurance to pay. You’ve got utility bills, too—same trick. It adds up handsomely.

As a handy bonus, you can set up a recurring automatic charge to your card each month. That way you never forget to pay your premium (and never have to bother).

Savings ballpark: $120 a year

$120 = 2 percent back on the average annual car insurance premium of $907 per car + homeowners insurance of $1,750 + household utilities of $3,360

The argument for paying your taxes with a credit card

The IRS doesn’t accept credit card payments. That’s too bad, really; your tax payments are generally some of the largest expenditures you’ll make all year. And if you have a credit card that gives you cash back, frequent-flier points, or some other reward, you could really enjoy April 16.

Fortunately, the IRS says it’s OK for other companies to pay your taxes on your behalf—companies that do accept credit cards. You can pay your federal taxes through, for example, Pay1040.com or PayUSATax.com. (Your ability to pay state taxes this way varies by state.)

You knew there’d be a catch, didn’t you? And there is: These services charge a fee. It’s 1.87 percent for Pay1040.com and 1.99 percent for PayUSATax.com.

Suppose you made $150,000 in taxable income this year, and you’re filing your taxes as the head of your household. You’ll owe $32,434.50 in federal taxes.

The best cash-back cards (here) give you 2 percent back on all your spending. So if you pay your federal tax with such a card (and your credit limit is high enough to cover that payment), you’ll get $649 cash back. Of course, you’ll have spent $607 in Pay1040 fees, so your profit will be $42.

But it gets better: The Pay1040 fee is tax-deductible! That fee lowers your taxable income by $607, which saves you another $170 on your taxes. When the dust settles, by paying your taxes with your cash-back card, you’ll have saved $212.

Saving money is only part of the point here, though. There may be other good reasons to pay taxes by credit card. Sometimes you want to rack up expenditures in order to get a sign-up bonus from a certain card, or a spending-threshold bonus. Maybe you have a card that gives you frequent-flier points or hotel points for every dollar spent; paying your taxes this way would be a very quick way to earn a couple of free flights.

Note: Do not use your credit card to finance your tax payments; you’ll wind up getting hosed in fees and interest. (If you need to pay your taxes on an installment plan, the government’s own financing programs are much more reasonable.) Use these techniques only if you can pay off the card in full at the end of the month.

Savings ballpark: $212 a year, plus free flights

$212 = 2 percent cash back on the federal taxes on a $150,000 annual income, minus the Pay1040 fee of 1.87 percent + the tax savings from deducting the Pay1040 fee

The two smartest ways to kill your credit card debt

If you’re among the millions who owe money on their credit cards, the first financial step in your life should be this: Pay off the darned card.

Of course, that’s usually impossible at the moment; if you had the money available, you’d have paid it already. So the second financial step is this: Pay less for that debt.

Use one of these strategies:

• Take out a loan. Visit a bank, or do some comparisons online, to explore taking out an unsecured personal loan (also called a “signature loan”) or a home-equity loan. The interest rate might be in the range of 6 to 10 percent, depending on your credit score. Since your credit card interest rate is much higher, it makes sense to use the loan money to pay off your card debt.

Boom: You’ve just replaced a 28 percent interest rate with a 10 percent rate (for example). And you’ve got yourself only a single, fixed monthly payment to make.

To make this tactic work, you should then stop racking up new debt on your card. Otherwise, you’ll defeat the whole purpose.

• Pay off the card with a balance-transfer card. It might sound deranged to pay off one credit card with another credit card, but that’s exactly the idea here. The trick: You get a new card that offers a starter period, maybe 15 or 18 months, when the interest rate is zero. You’ll have that time to pay off what you owe on the first card—without racking up interest charges that make the debt even bigger.

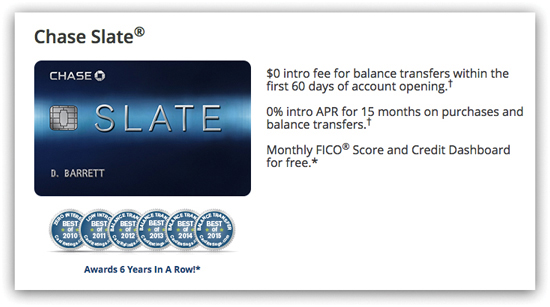

This trick isn’t some big sneaky shenanigan; the banks actually encourage it. At this writing, for example, the Chase Slate card (no annual fee) gives you 15 months of zero interest rate—and, unlike most balance-transfer cards, it doesn’t charge you a “transfer fee” to switch over your debt.

Another example: the BankAmericard gives you 18 months with zero interest. There’s a balance-transfer fee of 3 percent, but that’s still much better than the 15 percent you’re probably paying now.

Use the balance-transfer trick only if you’re confident that you can pay off the debt within the starter period. Because if not, at the end of that period, you’ll be slapped with an even higher interest rate than what you’ve got now.

Savings ballpark: $2,826 a year

$2,826 = 18 percent annual interest saved with a bank loan (vs. credit card interest) on $15,700 (the average credit card balance among Americans who owe on their cards)

Debt-consolidation services: the angels and the devils

If you’re stuck with a bunch of credit card debts, you may hear, on the radio or in the locker room, about debt consolidation services. They promise to roll up all your debts into a single, more manageable monthly payment. They negotiate lower interest rates from the people you owe, giving you the chance to dig your way out.

In fact, though, there are two categories of debt-help services—and one of them is extremely risky.

• For-profit debt-relief companies. These companies (the ones you’ve probably heard advertised) say they’ll negotiate with the people you owe, resulting in a single, lower monthly payment that lets you dig out of debt.

Three problems, though. First, these firms charge for their services; they become another group you owe. Second, they often advise you to stop paying any bills until they’ve finished their negotiations, but that suggestion means that you’ll rack up huge penalties and interest while the process is going on. You may wind up deeper in debt than when you started.

Finally, that “stop paying your bills” business can do real damage to your credit score (here).

According to the CFPB (the Consumer Finance Protection Bureau—your government at work), you should avoid these for-profit debt-relief companies at all costs. Especially ones that (a) charge you up-front, (b) mention “a new government program” to bail out credit card debt, or (c) guarantee that they can make your debt go away.

• Nonprofit credit counseling services. Nonprofit services are a different story. You meet with a trained debt expert who studies your situation, gives you advice, and comes up with a debt-management plan. Instead of dealing with a mess of bills and creditors, you’ll write only one steady check each month: to the counseling agency. The counselor does the work of paying the people you owe.

The debt plan is usually calculated to eliminate your debt within three to five years. Overall, you’ll pay less each month, because the counselors work directly with your creditors. You can expect to get penalty fees forgiven, interest rates lowered (or even eliminated), and repayment deadlines relaxed. The creditors also agree to quit harassing you with late fees and collection-company calls.

For your part, you’re generally required to cancel your credit cards. That may be a tough pill to swallow, but it forces you to avoid making the problem worse.

The counseling outfit may take a small fee out of your monthly payments for its services, but it’s nothing like the gouging you’ll get from the commercial companies.

To find a good counseling service, you can start at the websites of the National Foundation for Credit Counseling (NFCC.org) or the Financial Counseling Association of America (FCAA.org).

The easiest way to get a lower interest rate: Ask for it

As you read about credit counseling services, a voice deep in your brain might be saying: “Wait a minute. These counselors negotiate lower interest rates on my credit cards? How do they do that?”

Easy: They ask for it.

And here’s the crazy thing: You can do that, too.

In the end, these companies don’t want you to go bankrupt; they would much rather get paid. That’s why they’re usually willing to work with you—to lower your interest rate, lower the minimum monthly payment, or waive some fees. You just have to ask. People do it all the time.

Before you call, figure out exactly what you’ll be able to pay and when. You’ll tell the agent, “My statement says the minimum payment is $215. I can’t do that right now, but I could definitely pay $45 a month for the next four months. I expect to have a job by September” (or whatever the case may be).

Call the customer service number. Ask for someone who can change your interest rate. Once you’ve got that person on the phone, explain how much you think you’ll be able to pay during your own personal economic downturn. Let them know you’ll follow up by sending some documentation, like the budget you’ve worked up. Be calm and polite; you’re asking for a favor here.

All of this works best if you contact the credit card company early in your crunch, when you’re still anticipating the tough times. It works best if you have a good credit score, a good history of paying on time, and a plan for getting back on your feet.

Everybody has temporary setbacks. Maybe you’re between jobs or your kid got sick. As long as the bank thinks it’s just helping you through a slump, you’ll get good results.

The Target REDcard

If you shop at Target, you should apply for this card. It’s available as a debit card or a credit card.

It gives you 5 percent off everything you buy at Target, free shipping from Target.com, and 30 extra days to return something.

All for free.

Now that’s right on target. —Abdulla Al Dabbagh

Savings ballpark: $120 a year

$120 = 5 percent back on $200 a month spent at Target