There’s an old joke that goes, “What’s the definition of a boat? A hole in the water into which you pour money.”

In that case, a car is a wheeled platform into which you pour money.

The purchase price is only the beginning. Then there’s the gas, insurance, maintenance, tires, taxes, licensing, registration, finance charges, and depreciation (you know, that thing that makes a new car’s value drop by half the instant you drive it off the lot).

Trying to plug the cash leaks of your car is well worth the effort, as you’re about to find out.

The cheapest gas right now

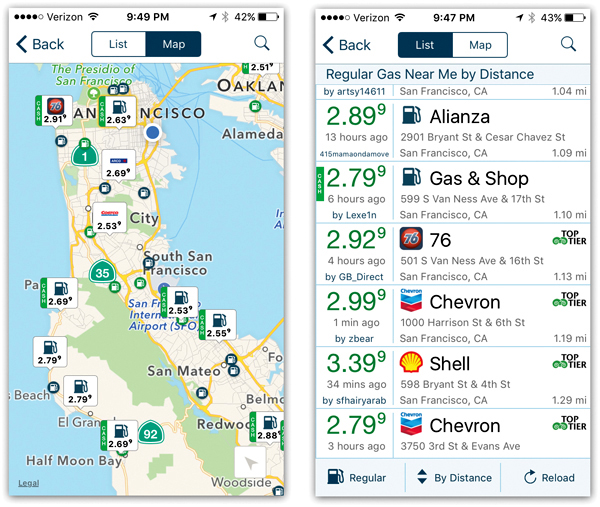

Apps—those millions of little smartphone programs—have already revolutionized shopping online, booking flights, and dating. Why shouldn’t they also put the power of gas prices in your hand?

The app is GasBuddy, and it’s free. It’s available in iPhone and Android versions. Open it up, and it shows the current gas prices at all gas stations near you (or at any location you specify). That’s it!

And how can one app somehow know the prices, at this moment, from every gas station on earth? Easy: It’s crowd-sourced. Your fellow citizens report the prices every time they stop at a gas station.

To encourage participation, Gas Buddy offers them points and a chance to win $100 in gas every day. If you want to help your fellow drivers, by all means participate by reporting prices. In the meantime, you may as well exploit their mass wisdom by driving an extra three minutes to save 15 cents a gallon.

Savings ballpark: $80 a year

$80 = Savings of 15 cents a gallon for a 25 mpg car driven the average American’s 13,200 miles a year, with gas at $3 per gallon

Fuel-conscious driving: The basics

The best way to save money on gas is to buy a fuel-efficient car in the first place—or an electric one.

But science has shown that there are plenty of ways to increase your mileage no matter what car you’re driving. Here it is: the assembled wisdom of the car-driving ages.

• Coast to a stop. Braking converts your car’s momentum, which you’ve burned gas to achieve, into wasted heat from friction. So if you know you’re going to be stopping—because you can see a stop sign or a light that’s red or yellow—take your foot off the gas as early as you can! Use less gas, brake less, and coast to stops as often as possible.

Learning to scan ahead for your next stop, and to stop gassing into it, is a change in habit for sure. But it makes great sense and adds tremendously to the efficiency of your fuel consumption.

• Drive more slowly. The U.S. government calculates that for every 5 mph you drive over 50 mph, you’re paying between 12 and 14 cents a gallon more for the gas you’re burning. (The additional fuel required at high speeds doesn’t grow proportionally. It might cost you two miles per gallon to accelerate from 40 to 60 miles an hour, but five miles per gallon to get from 60 to 80.)

Sometimes, of course, you’re in a hurry. But when you’re not, easing up saves fuel.

• Use cruise control. The cruise-control feature, if your car has it, maintains a constant speed on the highway. And since constancy = fuel efficiency, your car generally saves fuel when it’s under cruise control’s control.

• Accelerate hard. The previous two tips would suggest that a gentler, more relaxed, less anxious driving style improves fuel savings. And in cruising and stopping, that’s true.

But accelerating from a stop is different. Your engine is actually most efficient during the high-torque phase of acceleration. Furthermore, by accelerating hard, you’re guzzling gas for a shorter period. So to save a few drops of fuel, accelerate quickly to the speed you want once the light turns green—and then become a kinder, gentler driver.

• Use the AC over 40 mph. You can quit taking sides in the “open the window”/”run the air conditioner” debate. Science has spoken.

According to the Society of Automotive Engineers, once you’re driving faster than 40 miles an hour, the air conditioner uses less fuel. Driving with the windows open imposes a 20 percent gas penalty; the air conditioner only 10 percent.

Under 40 miles an hour, opening the windows is slightly more fuel-efficient.

• Turn off the car if you’re stopped for more than 10 seconds. Sitting still with the engine on burns through gas—from a quarter to a half-gallon per hour. Restarting the car, on the other hand, costs you about 10 seconds’ worth of gas.

Moral of the story: Shut off the car if you’ll be stopped for more than 10 seconds. Not at stoplights, where you’ll want to start up again quickly, but (for example) when waiting for your passenger to run into the drugstore.

• Get that thing off your roof. A roof-mounted storage container may let you haul a lot more stuff. But as far as your wind resistance is concerned, it’s like you’ve deployed a parachute. A rooftop capsule can kill your mileage by 8 percent in the city and 25 percent on the highway.

Take the thing off when you’re not using it. And, when possible, use a rear-mounted cargo box or tray instead; they drain only 2 percent efficiency in the city and 5 percent on the highway.

• Take cold-weather steps. The cold does a real number on gas efficiency. At 20 degrees Fahrenheit, your mileage drops by around 22 percent on short trips (as compared with what it would do at 77 degrees). Because batteries don’t like the cold, hybrid cars get hit even harder (around 33 percent)—and electric cars worst of all (up to 50 percent).

You can fight back, though. If you can park the car in a warmer spot (like, say, a garage), it won’t be as cold when you start it up.

Driving a warmed-up engine is more fuel-efficient than driving a cold one, so if you can combine trips, your engine will spend less of its time cold.

And if you have an electric or plug-in hybrid car, turn on its heater while it’s still charging. You’ll get greater range from the battery once you’re on your way.

• Keep your tires inflated. This is a big one. So big, in fact, that it gets its own write-up; read on.

Savings ballpark: $158 a year

$158 = Savings of 10 percent on 13,200 miles driven annually in a 25 mpg car, gas at $3 per gallon

Keep your tires inflated

Without even reaching for a calculator, you’d probably agree that driving on four flat tires would burn more gasoline than driving on inflated ones. Right? The flatter they are, the more rubber is touching the road, which means more friction, which requires more power to overcome.

Therefore, you can also understand why tires that are underinflated by any amount use up gas unnecessarily. And guess what? A third of all cars are driving around underinflated at this moment—and that might include yours.

According to the U.S. Department of Energy, you lose 0.4 percent in gas mileage for every 1 psi (pound per square inch) of underinflation. If you drive 500 miles a month, and gas is $3 a gallon, then you’re throwing about 20 bucks a year out the car window.

Yes, yes, new habits are hard to develop. But develop this one—not just for reasons of money, but for safety, car performance, and tire life, too.

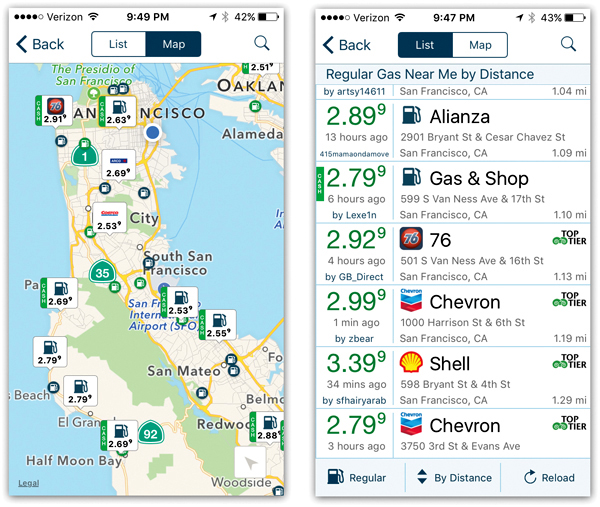

1. Find out your car’s recommended tire pressure. The number molded into the side of your car’s tires, in black rubber, isn’t it. That’s the maximum inflation pressure, not the desired pressure.

The best pressure for your tires is on a sticker on the outer frame of the driver’s-side door. It’s probably something like 30 or 35 psi. This info may also appear on a sticker in the glove compartment, and in the user’s manual.

2. Find out what the current tire pressure is. You take these measurements with a tire-pressure gauge; they’re about $3 from a hardware store, or there’s usually one on the air pump at the gas station.

Do your testing when the tires are cold—at least half an hour after their last long drive—because when you drive, they heat up, increasing the pressure.

And do this checking every week or two, or even every time you get gas. Your tires are constantly leaking slowly.

In cool weather, they leak a pound or two every month. And the pressure difference from summer to winter can be enormous—as much as 25 percent. (Air gets smaller when it’s cold.)

3. Fill up. Many gas stations have free tire-filling air pumps right on the building, ready for you to pull up and use. Use your hardware-store tire-pressure gauge, if you like, or the one right there on the air pump.

Now, overfilling your tires will save you even more gas, but that doesn’t mean you should. Too much air pressure increases the wear on the tires. In the end, you’ll lose money by having to replace the tires sooner.

Bottom line: Keep the tires inflated to the pressure indicated on the yellow sticker.

Savings ballpark: $32 a year

$32 = 0.4 percent lost mileage on the average American’s 13,200 miles driven a year in a 25 mpg car with 5 pounds underinflation, with gas at $3 a gallon

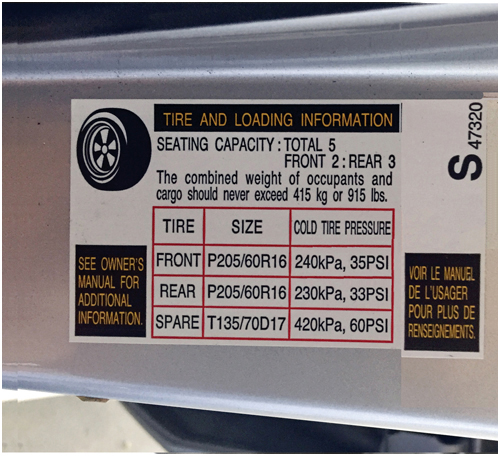

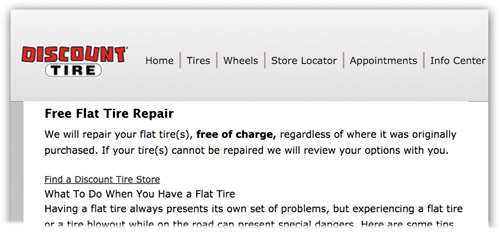

Where to get free flat-tire repairs

If you have a flat or leaky tire, you have two choices. You can take it to a gas station and pay $25 to get it fixed—or pay nothing to get it fixed at a tire shop, no matter who originally sold you the tires.

Chains like Goodyear, Discount Tire Centers, Mr. Tire, and Town Fair Tire cheerfully fix flats at no charge. They take the tire off, patch it, and put it back on for you. They hope that when you someday need to buy new tires, you’ll remember the favor they did you. (Discount Tire will also rotate your tires for free.)

These tire stores generally don’t advertise this service, but now you know. To find one near you, Google it (discount tire center locator, for example). —Steven Suwatanapongched

Savings ballpark: $25 per flat tire

How to buy a car

When you were growing up, car dealers had an informational advantage. They knew the invoice price of the car you wanted (how much they’d paid for it), and you didn’t. So you had no sense of how to negotiate.

Today it’s different. You can find out the dealer’s invoice price online, and you can use this information to your advantage with both of these tactics:

• Find out the invoice price for the car you want. Free sites like Edmunds.com and TrueCar.com offer this information.

Then, when you’re negotiating with the dealer, you know exactly how far from the invoice price you are.

The dealer is entitled to make some profit, so don’t expect to buy the car for the invoice price; the lowest you’ll get is a few hundred dollars more.

Then again, car manufacturers frequently offer the dealerships incentive payments—which you won’t know about. That’s why some people walk away thinking that they’ve paid the invoice price for the car or even less. Nope; the dealership still made money.

• Pit the dealerships against each other. Call the Internet sales manager at each of several car dealerships. Ask for their email addresses. In your emails, make it clear that you’re comparison shopping, and inquire how much over or under the invoice price they’re willing to offer you. Also ask what the out-the-door, final price will be.

Once that’s done, contact the dealership with the worst offer. Tell them the best offer you got, and give them a chance to beat it. Work through the other offers this way.

By the end of the process, you’ll have put together a killer deal, without any of the pressure and awkwardness of an in-person visit. You can drop by that dealership, sign the papers, and drive away.

Finally, don’t use your current car as a trade-in when you’re buying the new one. That’s convenient, yes, but you’ll get a lot more for it if you sell it yourself, online. (How do you know what your used car is worth? Look it up in the Kelley Blue Book at KBB.com.)

Savings ballpark: $900

$900 = 3 percent negotiated discount on a $30,000 car price

When to buy a car

A lot of people really hate the car-buying process. The sales pitches! The pressure! The sense that you’re getting ripped off!

As it turns out, the dealer doesn’t hold all the cards. (The car dealer, that is.) You have some power, too. For example, you control when you make your offer to buy a car. Car dealerships have their own pressures, like monthly quotas that earn them more money or more desirable cars to sell. So, if you’re smart, you’ll wait to make your offer until:

• Saturday or Sunday night, an hour before closing. The dealer might be eager to make one more deal before the week’s end, especially if they’ve had a bad week.

• The last day of the month. Car dealerships earn bonuses if they meet certain sales goals each month. Your offer might be the one that pushes them into bonus territory.

• Lousy weather. Snow and rain keep potential customers away from car dealerships. Salespeople might be especially eager to talk to you on days like this.

Savings ballpark: $450

$450 = 1.5 percent additional discount on a $30,000 car

How to buy oil changes

Oil changes usually cost about $30, but the service station isn’t making money on it. For most, oil changes are a loss leader—a way to get you into the shop so they can upsell you. You bring the car in for an oil change, but you walk out having been talked into buying new air filters, replacing your coolant, getting your engine flushed, and so on.

(Air filters generally don’t need changing more often than every 30,000 miles; coolant, every 100,000 miles; and engine flushing, never.)

If you’re smart, then, you’ll get your oil changed on schedule and resist unnecessary upsell. If you’re even smarter, you won’t pay $30 per oil change. Sears’s chain of car-care departments has a perpetual oil-change special available at SearsAuto.com, usually $15 or $20. And there are always oil-change discount coupons available on RetailMeNot.com—for Jiffy Lube, Pep Boys, Valvoline, and others.

Savings ballpark: $310 a year

$310 = Savings of $15 each on two oil changes a year + unnecessary $20 air-filter change + unnecessary $110 coolant change + unnecessary $150 engine flush

The 3,000-mile oil-change lie

The oil in your car’s engine eliminates the friction of engine parts rubbing against one another. Oil gives you better mileage and prevents expensive repair bills. But over time, it begins to break down from the heat, gets gunked up with dust and water, and needs replacing.

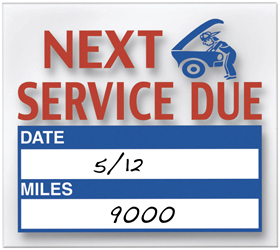

The old guideline was “Change your oil once every 3,000 miles.” That’s what oil-change outlets and service stations tell you, too. They may even put a sticker on your windshield that reminds you to come in again after 3,000 miles for another change.

Guess what? That’s 100 percent, grade-A baloney.

It’s a guideline designed to benefit the lube-station industry, not you or your car. It’s a myth that needs to die. Better oil formulations (and synthetic oil), better engines, and oil-monitoring systems have changed the game completely.

“The 3,000-mile oil change is a marketing tactic that dealers use to get you into the service bay on a regular basis. Unless you go to the drag strip on weekends, you don’t need it,” former service adviser David Langness told the oracle of all car wisdom, Edmunds.com.

You should change your car’s oil when the dashboard Change Oil light comes on. It’s part of your car’s oil-monitoring system, which takes into account how you drive your car and the conditions where you drive it (hot, cold, dusty, whatever).

If you have an older car without such a light, then change the oil at the intervals specified by your car’s manufacturer and user manual—every 7,500 or 10,000 miles. (On Jaguars, it’s every 15,000 miles. You lucky duck.)

But every 3,000 miles is way too often.

Savings ballpark: $120 a year

$120 = Savings by changing the oil twice a year instead of four times (every 10,000 miles instead of 3,000) at $30 per oil change and 50 miles driven per day

15 seconds could save you 15 percent or more on your car insurance

To pay less for car insurance, all the usual rules apply. Choose a higher deductible and pay yourself to make up the difference (here). Compare insurance rates online (TheZebra.com or InsuranceQuotes.com). Move your car insurance to the same company that’s providing your home insurance; usually you get a break by bundling.

If you can afford it, pay your entire year’s premium up-front; you’ll save about 8 percent on the total you would have paid for monthly installments.

But here’s the more unexpected advice: Revisit your car insurance when you change jobs or move. Your insurance rate is pegged to how much you drive. So if you suddenly wind up using carpools or public transport, your mileage drops—and so should your car insurance.

Savings ballpark: $200 a year

$200 = Savings of $125 on the average driver’s $907 car insurance by accepting a higher deductible + $75 by paying a year in advance