.

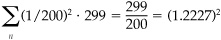

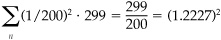

.3The active holdings are 1/200 for 100 stocks and —1/200 for another 100 stocks. The expected active return is 100 · (1/200) · (1%) + 100 · (−1/200) · (−1%) = 1%. The residual variance of each asset (conditional on knowing θn,1) is 299. The active variance of our position is  .

.

4We can go one step further with this example. In each half year, about 50 of the stocks will move from the buy list to the sell list, and another 50 will move from the sell list to the buy list. To implement the change will require about 50 percent turnover per 6 months, or 100 percent turnover per year. If round-trip transactions costs are 0.80 percent, then we lose 0.80 percent per year in transactions costs. The information ratio drops to 0.70, since the annual alpha net of costs is 1.21 percent and the annual residual risk stays at 1.729 percent.