7Suppose manager n has information ratio IRn and active risk ωn. The sponsor’s utility is

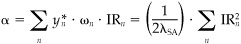

assuming independent active risks and a sponsor’s active risk aversion of λSA. The optimal allocation to manager n is

The overall alpha will be

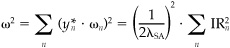

The active variance will be

and so the ratio of the alpha to the standard deviation will be