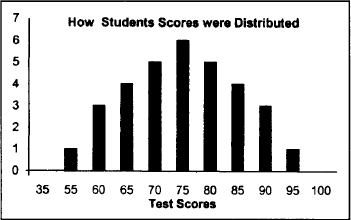

The purpose of this writing is to illustrate what Market Profile is and to define its underlying principles. Before the early 1980s, the only technical tools available were the bar chart and the point and figure chart. Since then Market Profile® 1 was introduced to expand the arsenal of technical tools. Market Profile is essentially a statistical approach to the analysis of price data. 2 For those without a statistics background, a familiar example may be helpful. Consider a group of students taking an exam. Typically, some score very high (say 90 or higher), some score very low (say 60 or lower), but most scores tend to be clustered around the average score (say 75). A histogram can be used to depict the frequency distribution of these test scores in a “statistical picture” (Figure B.1).

Figure B.1

As can be seen, the most frequent score, or modal score, is 75 (6 students) while the range of scores is defined by the lowest and highest scores (55 and 95). Note how the scores distribute evenly around the modal score. For a perfectly symmetric distribution, the modal score will be equal to the mean, or average score. Next observe that the distribution is “bell-shaped,” the telltale sign of a normal distribution. For a perfect normal distribution, specific standard deviation intervals correlate to specific numbers of observations. For example, if the test scores are, in fact, perfectly normally distributed, then 68.3% of these scores will fall within one (1) standard deviation of the mean. While actual data is unlikely to form a perfect normal distribution, it is often close enough that these relationships can be employed.

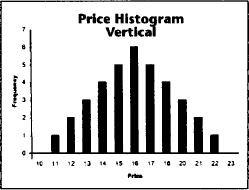

Prices, like other physical measurements (e.g., school test grades, population heights, etc.), distribute around a mean price level as well. What is the Market Profile graphic? Visualize it as simply, a frequency distribution of prices displayed as a price histogram turned on its side (see Figures B.2a and B.2b).

Figure B.2a Traditional.

Figure B.2b Flipped on its side.

The centerpiece of the Market Profile graphic is the (bell-shaped) normal curve used to display the evolving price distribution. Once the normal curve assumption is acknowledged, a modal or average price can be identified, a price dispersion (standard derivation) can be computed and probability statements can be made regarding the price distribution. For example, virtually all values fall within three (3) standard deviations of the average while about 70% (68.3% to be exact) fall within one (1) standard deviation of the average (see Figure B.3).

Market Profile provides a picture of what’s happening here and now in the marketplace. In its pursuit of promoting trade, the market is either in equilibrium or moving toward it. The profile’s natural tendency toward symmetry defines, in a simple way, the degree of balance (equilibrium) or imbalance (disequilibrium) that exists between buyers and sellers. As the market is dynamic, the profile graphic portrays equilibrium as periods of market balance—when price distributions are symmetric, and represents disequilibrium as periods of market imbalance—when price distributions are not symmetric or are skewed.

Figure B.3 The profile graphic reveals that market activity is regularly normally distributed.

Market Profile is not a trading system nor does it provide trade recommendations. The aim of the profile graphic is to allow the user to witness a market’s developing value on price reoccurrence over time. As such, Market Profile is a decision support tool requiring the user to exercise personal judgment in the trading process.

The Market Profile format organizes price and time into a visual representation of what happens over the course of a single session. It provides a logical framework for observing market behavior in the present tense displaying price distributions over a period of time. The price range evolves both vertically and horizontally throughout the session. How is a profile graphic constructed?

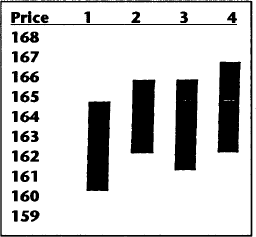

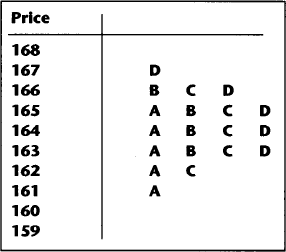

Consider a 4 period bar chart (see Figure B.3a). This traditional bar chart can be converted to a profile graphic as follows: (1) assign a letter for each price within each period’s price range, letter A for the 1 stperiod, B for the 2 nd, and so on (see Figure B.3b) and then (2) collapse each price range to the leftmost or first column (see Figure B.3c). The completed profile graphic reflects prices on the left and period frequency of price occurrence on the right, represented by the letters A through D.

Figure B.3a

Figure B.3b

Each letter represents a Time Price Opportunity or TPO to identify a specific price at which the market traded during a specific time period (e.g., in B period prices traded between 163 and 166). These TPOs are the basic units of analysis for the day’s activity. In other words, each TPO is an opportunity created by the market at a certain time and certain price. Market Profile distributions are constructed of TPOs. The Chicago Board of Trade (CBOT) assigns a letter to each half-hour trading period on a 24 hour basis; uppercase letters A through X represent the half-hour periods from midnight to noon while lowercase letters from a through x represent the half-hour periods from noon to midnight. 3

When you visit a commodities trading pit on a busy day, you observe what is best described as “controlled chaos.” Beneath the screaming and gesturing locals and other traders, there is a describable process. Think of the market as a place where participants with differing price needs and time constraints compete with each other to get business done. Emotions can run high as anxiety levels soar.

The Market Profile concept was introduced by Mr. Steidlmayer in an attempt to help describe this process. As a CBOT floor trader (local) and student of market behavior, he observed recurring patterns of market activity, which ultimately lay the foundation for his understanding of the market. Since the CBOT trading floor conducts trade in an auction-like manner, he defined Market Profile principles in auction terms. For example, an off-the-floor trader would describe an advancing market as one that is rallying or trading up, whereas Mr. Steidlmayer would instead say something like, “the market continues to auction up, advertising for sellers to appear in order to shut off buying.”

Figure B.3c

To explain why a trading pit auction process works the way it does, he invented some new terms unfamiliar to off-the-floor traders. He began with a definition of a market’s purpose, which is to facilitate trade. Next, he defined some operational procedures, namely that the market operates in a dual auction mode as prices rotate around a fair or mean price area (i.e., similar to the way school grades were distributed). Lastly, he defined the behavior characteristics of market participants, namely that traders with a short term time frame seek a fair price, while traders with a longer term time frame seek an advantageous price.

Auction Setting: The purpose of the marketplace is to facilitate or promote trade. All market activity occurs within this auction setting. Initially, as price moves higher, more buying comes in, as price moves lower, more selling comes in. The market moves up to shut off buying (i.e., auctioning up until the last buyer buys) and moves down to shut off selling (i.e., auctioning down until the last seller sells). The market actually operates through a dual auction process. When price moves up and more buying comes in, the up-move advertises for an opposite response (i.e., selling) to stop the directional move. The opposite is true when price moves down.

Continuous Negotiation: When a market moves directionally it establishes price parameters, an unfair high and an unfair low, and then trades between them to establish a fair value area. All trade takes place through this negotiating process and remains within these parameters until one side or the other side is eventually taken out (i.e., a new high or new low is formed). (see Figure B.4.)

Market Balance and Imbalance: The market is either in equilibrium or working toward equilibrium between buyers and sellers. To facilitate trade, the market moves from a state of balance (equilibrium) to one of imbalance (disequilibrium) and back to balance again. This pattern of market behavior occurs in all times frames, from intraday session activity to single session activity to aggregated or consolidated sessions activity which form the longer term auction.

Time Frames and Trader Behavior: The concept of different time frames was introduced to help explain the behavioral patterns of market participants. Market activity is divided into two timeframe categories, short term and longer term. The short term activity is defined as day time frame activity where traders are forced to trade today (e.g., locals, day traders and options traders on expiration day fall into this category). With limited time to act, the short term trader is seeking a fair price. Short term buyers and sellers do trade with each other at the same time and at the same price. Longer term activity is defined by all other timeframe activity (e.g., commercials, swing traders, and all other position traders fall into this category). Not forced to trade today and with time as an ally, these traders can seek a more advantageous price. In pursuit of their interests, longer term buyers seek lower prices while longer term sellers seek higher prices. As their price objectives differ, longer term buyers and sellers generally do not trade with each other at the same price and at the same time. It is the behavioral interaction between these two distinct timeframe types of activity that causes the profile to develop as it does.

Figure B.4

The Short Term Trader and Longer Term Trader Play Different Roles: Short term and longer term traders play key, but different, roles in facilitating trade. A market’s initial balance (i.e., a place where two-sided trade can occur) is usually established in the first hour of trade by short term buyers and sellers (day timeframe activity) in their pursuit of a fair price. Most of the day’s activity occurs in the fair price or value area. Prices above and below this developed fair value area offer opportunity and are advantageous to longer term traders. With time on their side, longer term traders can either accept or reject prices away from fair value. By entering the market with large enough volume, longer term buyers and sellers can upset the initial balance, thereby extending the price range higher or lower. The longer term trader is responsible for the way the day’s range develops and for the duration of the longer term auction. In other words, the role of the longer term trader is to move the market directionally.

Price and Value: The distinction between price and value defines a market-generated opportunity. There are two kinds of prices: 1) those that are accepted—defined as a price area where the market trades over time and 2) those that are rejected—defined as a price area where the market spends very little time. A rejected price is considered excessive in the market—defined as an unfair high or unfair low. Price and value are all but synonymous for short term traders as they ordinarily trade in the fair value area. For longer term traders, however, the concept that price equals value is often inaccurate. Price is observable and objective while value is perceived and subjective, depending upon the particular needs of longer term traders. For example, a price at the top of today’s range, while excessive or unfair for today, is cheap to the longer term trader who believes that prices next week will be much higher (i.e., today’s price is below next week’s anticipated value).

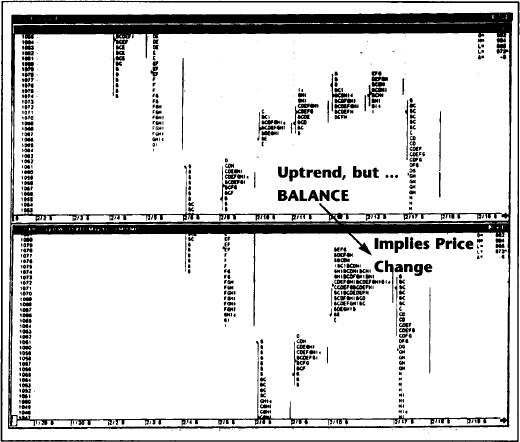

Figure B.5 By combining daily consecutive profile graphics (upper) into a larger cumulative profile graphic (lower), an evolving picture of long term balance or imbalance emerges. (See explanation on page 489.)

The longer term trader distinguishes between price and value by accepting or rejecting current prices away from his perception of fair value. Recall that rising prices advertise for sellers while falling prices advertise for buyers. When the longer term trader responds to an advertised price, this behavior is expected and is referred to as responsive. On the other hand, if the longer term trader did the opposite (i.e., buy after prices rose or sell after prices declined), then this unexpected activity is referred to as initiating. Classifying longer term activity as responsive or initiating relative to yesterday’s or today’s evolving value area provides anecdotal evidence of longer term trader confidence. The more confident the trader becomes, the more likely he is to take initiating action.

Since market activity is not arbitrary, it’s not surprising that over time recognizable price patterns reveal themselves. A skillful trader able to anticipate such pattern development in its early stage may be able to capitalize. Mr. Steidlmayer loosely identifies the following daily range development patterns:

Figure B.6

With the exception of option sellers who profit when prices remain static, the profit strategy of most traders requires directional price movement. The trader wins when he gets the direction right and loses when he is incorrect. Because the longer term trader is responsible for determining the market’s directional movement, we monitor this activity to help detect evidence of a price trend. After identifying and evaluating longer term trader activity, an educated conclusion regarding price direction can be reached. We begin the process by identifying the longer term trader’s influence in today’s session and then considering how that influence extends into the future.

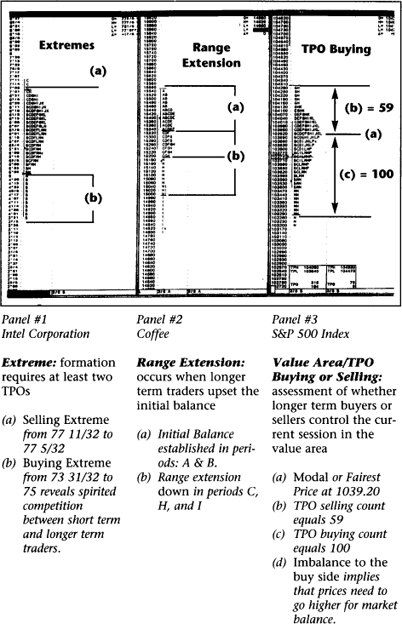

1. Extremes are formed when the longer term trader competes with the short term trader for opportunities at a particular price level (which later becomes either the session high or low). A minimum of two single prints is required to establish an extreme. The more eager the longer term trader is in this price competition, the more the single prints and the longer the single print extreme. Anything less than two prints suggests that the longer term trader is not very interested in competing at that price. A local top or bottom is formed when only one single print defines the top or bottom of the range. This condition implies that the market offered a price opportunity which no one really wanted (i.e., no evidence of competition [see Figure B.7: Panel #1—Intel Corporation].

2. Range Extension occurs when the longer term trader enters the market with enough volume to tip the initial balance and extend the range up or down. Range extension up indicates longer term buying while range extension down indicates longer term selling. However, there are occasions when both the longer term buyer and seller are active at a range extreme, but not at the same price and time (recall that longer term buyers and sellers generally do not trade with each other). For example, if an extreme is formed after a range extension up, the market moves up first to shut off buying and then moves down to shut off selling. This is an example of both longer term buyers and sellers trading in the same price area but at different times. Both kinds of activity at the extremes are identified to evaluate the impact of longer term buying and selling (see Figure B.7: Panel #2—Coffee).

3. The Value Area is determined each trading session by price rotations around the modal price (i.e., the price with the highest TPO count or the fairest price). The value area is computed by counting 70% of all TPOs surrounding the fairest price. In other words, the value area is an estimate of fair value which is approximated by one standard deviation of the session’s trading volume (recall the student example earlier). When a longer term trader makes a trade in the value area, he is buying low or selling high in relation to a longer term view, not in relation to today’s value. This behavior creates an imbalance in today’s value area. Longer term trader activity is measured by counting TPOs. The following procedure can be used to determine which side contains the longer term imbalance, 1) a line is drawn through the fairest price, and 2) TPOs are counted on either side of the fairest price until a single print is encountered. The imbalance is assigned to the side with the smaller number of TPOs because the longer term trader activity represents the smaller percentage of total trade in the value area. For example, if the TPO count was 22 above and 12 below the fairest price, that would indicate net TPO selling with a mild bias toward lower prices (see Figure B.7: Panel #3—S&P 500 Index). Note that TPO buying and selling in the value area is not applicable on trend days, as the market is still in search of a fair value area.

After identifying and evaluating longer term trader activity correctly in today’s profile graphic, the user can readily determine whether longer term buyers or sellers were in control of the current trading session.

Market Profile, on the other hand, offers an alternative approach to traditional trend analysis by evaluating market activity over different time periods. In its simplest form, an evaluation of the profile graphic on consecutive days can help define the start or continuation of the short term price trend. For example, if today’s value area is higher than yesterday’s value area, then the current market price trend is up. Moreover, if tomorrow’s value area is higher than today’s, then the current market uptrend has continued. By monitoring market activity in this fashion, the trader is able to readily identify trend continuation or change. Similarly by combining daily consecutive profile graphics into a larger cumulative profile graphic, an evolving picture of longer term balance or imbalance emerges. The profile graphic in Figure B.5 (Sugar) on page 483 illustrate this point. A cursory review of the individual sessions ( 2⁄ 10— 2⁄ 13) in the upper panel suggest an uptrending market without a hint of reversal. When these four (4) consecutive sessions are combined (lower panel), however, a cumulative balanced picture springs forth. Once balanced, a market moves to a state of imbalance which, more often than not, begins after a final test at the fairest price.

The Market Profile method can be used to analyze any price data series for which continuous transaction activity is available. This includes listed and unlisted equities, U.S. government notes and bonds (prices or yields), commodity futures and options, where applicable. The profile graphic presents the movement of prices, per unit of time, in two dimensions—vertically (i.e., directionally) and horizontally (i.e., frequency of occurrence). When price action is viewed in this way, a picture of price discovery unfolds which is unavailable in the traditional one dimensional (vertical) bar chart.

The profile graphic offers unique advantages over the standard bar chart:

In short, the profile graphic provides a substantial amount of price information per unit of time, allowing the trader to identify patterns and dynamics which would not be readily apparent using other methods.

*This appendix was prepared by Dennis C. Hynes.

1The Market Profile® is a registered trademark of the Chicago Board of Trade (CBOT), hereafter referred to as Market Profile or the profile. The concept was developed by J. Peter Steidlmayer, formerly of the CBOT. For further information on the subject, contact the CBOT or read Mr. Steidlmayer’s latest book: 141 WEST JACKSON—1996.

2Originally introduced for commodity futures prices, the format can be used for any price data series where continuous transaction activity is available.

3Letter assignments can vary between vendors. For example, CQG assigns uppercase letters A through Z from 8:00 am CST while lowercase letters from a through z from 10:00 p.m. CST.