CREATIVITY AND ACTION, TWO CONCEPTS DETAILED IN THE FIRST two chapters, are more frequently associated with entrepreneurial leadership than are terms like prediction, analytical, and quantitative. As discussed in chapter 2, the popular myth assumes that entrepreneurs have a vision for a new product or service and are determined to carry it out despite any obstacles. The image of an intrepid entrepreneurial leader in a garage seldom includes printouts of regression models or chi square statistics.

Such myths do have some logical underpinnings. Analytical and data-based approaches were often not available to founders of startups. First, startups did not have the history of operations that is required to accumulate sufficient data for analysis. In addition, entrepreneurs in early-stage firms may have lacked the financial, technological, and human resources to perform extensive quantitative analyses. Analytical hardware and software and skilled people may well have been too expensive to acquire outside of large organizations. In the past analytics clearly weren’t easy for small new firms to engage. These impressions have some support in academic research (see Sarasvathy 2001).

However, we argue that similar to the misconceptions about entrepreneurs discussed in the previous chapters, neither popular conceptions nor limited academic research is sufficient to conclude that analytical thinking has no place in entrepreneurial leadership. As implied by the focus on cognitive ambidexterity in chapter 1, the prediction approach suggests that analytical and quantitative practices should be in every entrepreneurial leader’s toolkit and that entrepreneurial leaders should be confident in using them. In short we believe that prediction logic, analytics, causal logic, and the scientific method have strong roles in the creation of social and economic opportunity.

Numerous points support the growing importance of prediction logic to entrepreneurial leaders. First, many real-world leaders counter the popular stereotype of non-analytical entrepreneurial leaders. For example, a recent New Yorker article by Malcolm Gladwell (2010) argues that many entrepreneurs employ rigorous analysis to minimize the risk of their entrepreneurial ventures. In addition, many successful entrepreneurial leaders engage analytics as a core capability of their startups; these include Sergey Brin and Larry Page of Google, Jeff Bezos of Amazon.com, Michael Bloomberg of Bloomberg LP, and Reed Hastings of Netflix. Like many analytically oriented entrepreneurial leaders, these individuals see the potential in using analytics not only to differentiate their business models but also to create innovations for customers.

Second, there are many data-intensive industries, including financial services, retail, and online commerce, in which success would be difficult for any entrepreneurial leader unable to analyze data and make quantitatively based decisions. Finally, we believe that the barriers to the use of analytical tools by entrepreneurial leaders have decreased dramatically over the past several years. We discuss each of these factors in greater detail in this chapter.

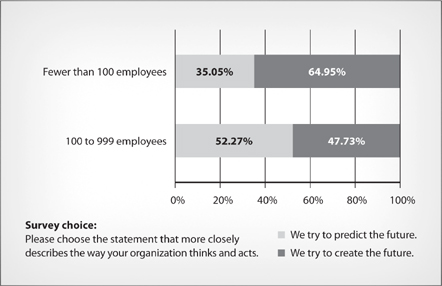

These factors further support our perspective that entrepreneurial leaders in startups and smaller firms must use not only creation logic but also prediction logic as they pursue growth. And indeed many seem to be doing so already. For example, in a recent Babson Executive Education analysis of 622 companies, we found that more than 35 percent of small ventures (with fewer than 100 employees) have a predictive orientation. That percentage grows to more than 52 percent in firms with 100 to 999 employees, many of which are led by their founders (see exhibit 3.1).

Exhibit 3.1 Predictive orientation versus creation orientation as related to firm size

While not all analytical approaches are appropriate at all times for entrepreneurial leaders, there are some approaches that fit. For example, randomized testing, which we sometimes refer to as reactive analytics (to contrast with the predictive type), involves testing various ideas to see which work better in practice. This analytical approach involves rigorous statistical comparison of randomly assigned test and control groups. It is commonly used in testing the value of marketing promotions, changes to stores and branches, alternative web page designs, and a variety of other business improvements. Without the rigor involved in randomized testing, it is impossible to know whether an intervention actually produces the desired change or whether random variations are occurring.

These methods are particularly useful in conjunction with creation logic. After an entrepreneurial leader has taken action, he or she can employ these prediction-oriented techniques to evaluate actions and guide future decisions. This continuous cycle of doing and learning defines entrepreneurial leadership. Here’s how Joshua Herzig-Marx, a recent MBA graduate and an entrepreneur of a data-oriented business, describes his approach:

Testing and learning requires two things we determined early on. One is that it has to be easy enough that we can run a lot of tests. The second thing is that it has to be easy enough that you can learn quickly about what is working and what isn’t. Testing and learning is really about the ability to turn dials quickly and create an ability to see what happened. We use a random control group for directional measurement. In everything we do, in every promotion we run, we try to design a hypothesis-driven test.

Entrepreneurial leaders need to consider when in the entrepreneurial life cycle is it most conducive to use analytics and when is it not. The earliest stages of product and service development—sometimes referred to as the “fuzzy front end” of the process—typically do not yield much data and are more appropriate for engaging creation logic. At this stage potential customers of new products may be of limited value in specifying what they need. As business conditions become more unknowable, entrepreneurial leaders may have to rely more on creation logic, expertise within their personal and professional networks, and small-scale testing to calibrate demand. Once action is taken and some data are gathered, a prediction approach based on employing analytics can be useful for assessing the action and using this new data to guide future actions.

For example, Alessi, a well-known Italian design studio, develops new product designs by first conceptualizing the product using creative and intuitive design logic and then testing it using an analytical approach. Alberto Alessi, the head of this family business, notes:

We have a very helpful tool that we call, ironically, “the formula.” It’s a mathematical model that we use once we have a well-done prototype. Not the first or the second prototype, but from the third one on. The purpose of the formula is to understand what the reaction of our final customers could be toward this new product and what the product’s life could be should we decide to start production (Capozzi and Simpson 2009).

The quantitative formula, which was derived from an analysis of 300 design projects at Alessi, assesses such factors as sensory appeal, ease of use by customers, function, and price. Alberto Alessi states that the formula is an excellent predictor of sales for familiar product categories but that it must be “tuned” for new categories.

In some industries entrepreneurial leaders are almost compelled to use analytics to make decisions. These industries tend to involve large numbers of consumers, large volumes of transactions, and hence large amounts of data. The only way to know customer preferences and behaviors, determine the success of new products, and monitor operations is to use and analyze data.

In financial services, for example, data are usually plentiful; and because money is generally an undifferentiated product, analytics is a good way to select assets, forecast values, and make automated and semi-automated decisions. Many recent financial entrepreneurial leaders established hedge funds in the past couple of decades because of the relative freedom from regulation and the potential outsized returns. Hedge funds often employ quantitative strategies for asset management and trading. For example, one of the most successful hedge funds ever, Paulson and Co. (founded by John Paulson), based many of its gains on an initial intuition that housing prices might decline, which would offer opportunities for shorting investment assets linked to housing prices and mortgage repayments. A quotation from a book about the firm and its activities describes the analytical approach:

They crunched the numbers, tinkered with logarithms and logistic functions, and ran different scenarios, trying to figure out what would happen if housing prices stopped rising. Their findings seemed surprising: Even if prices just flatlined, homeowners would feel so much financial pressure that it would result in losses of 7 percent of the value of a typical pool of subprime mortgages. And if home prices fell 5 percent, it would lead to losses as high as 17 percent (Zuckerman 2010).

Other industries are similarly data-rich and analysis-intensive. For example, we recently surveyed analytical applications and trends in the retail industry (Davenport 2009). The results indicate 18 well-established trends in retail analytics, including analytical applications, organizational trends, and strategic initiatives. Some of the analytical applications include assortment optimization, customer-driven marketing, fraud detection, integrated forecasting, and localization. In addition, we found five more emerging analytical trends, such as real-time offers and video analytics. Given so many options, the greatest difficulty for analytics in retail is often deciding which capability to build first.

Although the most aggressive users of retail analytics are large chain retailers, it would be difficult for entrepreneurial leaders in this industry to compete without some level of prediction logic and analytical capability. Small emerging retailers have, for example, made effective use of loyalty cards and the data derived from them. Leveraging analytics and prediction logic also provides emerging firms with a way to help larger retailers and product vendors solve problems for which they previously had no data. For example, Joshua Herzig-Marx’s company, Incentive Targeting, has used analytics to gather new and unusual data on retail grocery customers. Herzig-Marx’s firm is able to provide clients and product vendors with data-driven answers to questions about customers and innovation:

We get asked all the time, “What else do people who buy my product buy?” Or, “If a customer bought my product last month, how many of them are going to buy again next month?” Another sort of question companies ask about is whether they should extend a product category like “organic.” For instance, a common type of question is “Are new parents who buy a lot of organic products more likely to respond to an offer for organic diapers?”

Online retailers and e-commerce sites have even more data available to them than do brick-and-mortar stores. Each visit to a website generates a large amount of data on the number of unique visitors, time spent on the site, click-throughs, and conversion rates. By leveraging prediction logic to analyze these data, entrepreneurial leaders can design their sites, test changes, and present customized offers to customers based on previous behavior. Through the use of these different types of analytics, entrepreneurial leaders can use prediction logic to analyze data and create opportunity.

Beyond the growing business value of analytics, the other advantage is that entrepreneurial leaders can more easily embrace analytical approaches as the barriers to their use steadily erode. Analytics used to require large information technology (IT) organizations, massive data warehouses full of proprietary transaction data, costly software and hardware, and expensive PhD analysts. Most, if not all, of these barriers, however, are now smaller or nonexistent.

Data, for example, are available from a variety of public sources (sometimes for free), and it’s very easy to generate and capture online data no matter how small the organization or department. Analysis tools are also more readily available. Just as many students learn analytics in part through spreadsheets, the same technology sits on every entrepreneurial leader’s computer. Microsoft Excel is still the most common analytical tool, and the latest version can handle more than a million rows of data while generating a variety of statistical and optimization analyses. For analyses of web data, the most common web analytics tool, Google Analytics, is free. More-powerful analytical software is increasingly available on a software-as-a-service basis, where you can buy software “by the drink” rather than acquire an entire package. Even developing one’s own analytical tools is becoming cheaper with open-source software and rapid application prototyping approaches.

Analytical services are rarely free, but the options for acquiring them are proliferating and costs are declining. Individuals with MBAs can perform detailed analyses, and even those with PhDs in statistics are available on an outsourcing basis from low-cost India-based firms. There is no reason why entrepreneurial leaders cannot make use of analytics.

Because cognitive ambidexterity requires entrepreneurial leaders to be proficient with both creation and prediction logics, we require all of our business programs to include substantial analytical course-work. In our degree programs, all students have required prediction logic courses and are able to take many other prediction logic elective courses. The pedagogy that underlies these courses helps students develop prediction logic and demonstrates the connection between the prediction and creation approaches.

At the most basic level, in introducing students to prediction logic we teach them a range of quantitative tools. We also teach students about the importance of in-context interpretation and communicating results. Students learn to select analytical tools and the implications these choices have for future action based on creation logic. In this way students learn how they can build from prediction logic and analytical understanding to communicate with and generate interest in others who may be involved in subsequent actions. For more-experienced students, particularly at the graduate level, our pedagogy regarding prediction logic is based on cross-functional integration. Analytical courses are taught as integrated modules with other business functions and skills. Students learn how analytics are fundamentally linked to the decisions they make as they pursue social and economic opportunity.

As discussed in chapter 2, we rely heavily on experiential learning to teach prediction logic. Experiential learning enables students to see and feel the impact that different analytical tools have on the actions they take and how gathering different data can lead to different outcomes. The following examples show how students are introduced to the use of analytics in courses that are focused on starting and growing companies, rather than in courses designed to teach the analytical tools themselves. In this way, through learning by doing, students observe firsthand the power of combining an analytical (prediction) approach and a creation approach to pursue opportunities.

One of our core entrepreneurship courses is Venture Growth Strategies. It is offered in two separate versions, one for undergraduates and one for MBA students; each section is appropriate to the skills and the needs of the student cohort. This course focuses on the opportunities and the challenges of managing growth in entrepreneurial settings, either in an individual company or as a part of a larger corporation. Growth is the ultimate resource constrainer, stretching all systems in a company to the limit and often beyond. Consequently, the course emphasizes management “at the limit” of what students may have already learned in other functional courses. Budding entrepreneurial leaders are introduced to a series of frameworks, analytical skills and techniques, and decision-making tools that they can use in growing entrepreneurial businesses.

To teach prediction logic, we rely on non-traditional, experiential learning methods as well as more-traditional case-based methods. Some classroom meetings include discussions of traditional cases and readings describing growth-related issues. Guest speakers, including entrepreneurial leaders in high-growth firms, provide additional perspective.

What makes the course different from more-traditional courses is that a central module revolves around a sophisticated international simulation exercise in which student teams build and grow virtual businesses and compete with one another in a high-growth environment. The teams start with a clean slate in planning their strategies, and, equally important, the simulation is extremely responsive to the different strategies undertaken by the participating teams. This provides students with a dynamic learning experience that reflects real-world conditions and outcomes.

During the simulation each student team is asked to manage the growth of a multiproduct company, with products ranging from a single, undifferentiated, imported product to a portfolio of highly differentiated products. Management decisions involve strategy, marketing, finance, production, technology, R&D, and other functional areas. The course thus provides students with an opportunity to apply functional skills they have learned in other courses to build a growing company in a highly competitive, rapidly changing environment.

A key learning component of the simulation is the use of analytics to support decision-making. The simulation software provides students with data on market share, pricing, profitability, fixed and variable costs, return on investment (ROI), and other important performance measures. Students use these data as a component of their decision-making and observe the results of their decisions. They are also able to purchase additional market research data on competitors’ results. In this way students are introduced to the use of analytics in making and adjusting decisions and strategies over time.

Learning is further reinforced by having students prepare a term paper on a high-growth company facing a growth crisis. Students apply course concepts and tools learned in the simulation to the analysis of the growth crisis, the generation of alternative courses of action, and the selection and the justification of their recommendation for how the company should proceed.

The traditional cases in this course also illustrate the use of analytics by entrepreneurs who are building companies. As mentioned earlier, while some companies and industries lend themselves to the use of analytics, we believe that all companies can benefit from a prediction/analytical approach in conjunction with a creation approach. Two of the cases used in the Venture Growth Strategies course illustrate this principle: Patio Rooms of America (Bygrave 1999) and Matt Coffin (Bygrave 2006). These cases describe the distinctive methods used by two management degree recipients in building their companies, and in both cases analytics are a key component of success.

Patio Rooms of America illustrates MBA graduate John Esler’s use of both prediction analytics and creation to build a new organization. The case outlines the process Esler follows in starting and growing a company that constructs patio room additions to existing houses in the New England area. Patio Rooms describes Esler’s handling of a variety of issues facing the company, including marketing, sales, operations, finance, and planning. The particular applicability of the Patio Rooms case stems from its illustration of Esler’s use of analytics in sales, marketing, and operations. Despite the fact that Esler’s business is at a very early stage, he insists on the development and the use of metrics. He devises systems to collect and analyze data relating to lead generation, closing sales, pricing, capacity utilization, efficiency, cash flow, profitability, and employee performance. He continuously monitors the business’s success factors and adjusts his strategy and tactics based on the actual results.

The Matt Coffin case describes the creation of a highly successful Internet-based business. The case traces serial entrepreneur Matt Coffin’s journey from Babson’s undergraduate program through a variety of entrepreneurial ventures to the ultimate creation of his company Lowermybills.com. The case illustrates the interaction among Coffin’s engagement of creation logic, his desire to create social opportunity by helping people lower their monthly bills, and his use of analytics in areas ranging from website design to advertising placement to employee motivation.

A key lesson from the juxtaposition of the two cases is that the use of analytics can be a crucial component in the success of traditional bricks-and-mortar businesses that don’t easily lend themselves to the collection and the analysis of data as well as in the success of Internet-based businesses, which generate large amounts of readily available real-time data.

A second example of an entrepreneurship course that uses experiential learning and analytics is the Entrepreneurship Intensity Track. This is an elective course for graduate students who intend to start an entrepreneurial endeavor directly after graduation. To apply for the course, students must have a complete business plan and must successfully navigate through two screenings. The first consists of interviews with entrepreneurship faculty members; the second entails a presentation that attracts an experienced mentor who is willing to work with the student throughout the semester. The class is structured such that participants spend the majority of their time in the field, meeting with potential customers, developing their network of individuals who will help create the opportunity, obtaining product prototypes, and building their entrepreneurial teams.

What is unique about this course is that at this stage of the entrepreneurial process, students are more likely to apply creation logic in their approach. The course focuses students’ attention on the importance of engaging prediction logic even at this early stage of a startup venture. Students use analytics in varying degrees of sophistication, depending on the nature of the particular business. Some businesses such as Internet-based enterprises lend themselves more readily to analytics. The design of websites, the analysis of customer behaviors and reactions to alternative offerings related to pricing, product presentation, and, as mentioned earlier, the availability of reasonably priced (or even free) analytical tools—all make it easy for students to understand the use of analytics in their decision-making.

Increasingly, students are also recognizing the importance of analytics and prediction logic in more-traditional startup contexts. For example, Internet-based market survey tools make it possible for entrepreneurial leaders to obtain useful data to assess and guide intuitive hypotheses concerning customers and product offerings. The analysis of such data can guide their future actions and creation approach as they connect with customers to build a robust market entry strategy. Similar data can be obtained regarding supply-chain actors and other crucial elements in building a new venture. Perhaps the most important learning is seeing firsthand the interplay of creation and prediction logics though hypothesis formulation, conducting small-scale tests that allow for analysis of market feedback, and more-effective action.

Students are encouraged to develop and use two unique analytical tools: planning timelines and dashboard techniques. At the outset of the course, students create timelines that detail and prioritize the important milestones that they intend to achieve during the semester, leading to the establishment of their businesses. Additionally, instructors call upon all students to make individual dashboard presentations enumerating the metrics and the data that they have chosen to inform their decisions about midcourse corrections. Depending on the particular business, data may be more or less difficult to obtain. Nonetheless all course participants are aware of the necessity of choosing factors they must measure, determining how they will obtain the data, and anticipating how they will use the data to make decisions and adjust their strategies.

These courses and techniques represent a work in progress. They provide examples of some ways in which students can gain insight into how to combine prediction and creation approaches in the development and the implementation of entrepreneurial thought and action.

In this chapter we highlight the importance that analytics, a mode of prediction logic, plays as a complement to creation logic for entrepreneurial leaders of startup endeavors. For these leaders, building social networks for funding and expertise, building opportunities based on whom you know, and selective risk-taking—all affect the success of a new venture. As our entire society becomes more reliant on data and analysis, however, entrepreneurial leaders also need to do the same. Indeed it is difficult to imagine that an entrepreneurial leader could ultimately succeed in several data-intensive industries without an analytical orientation from the outset. Through a number of examples of prediction logic courses, we have illustrated how management educators can frame courses that enable entrepreneurial leaders to develop cognitive ambidexterity.

Bygrave, W. 1999. Patio Rooms of America. Babson Park, MA: Babson College Case Collection.

Bygrave, W. 2006. Matt Coffin. Babson Park, MA: Babson College Case Collection.

Capozzi, M. M., and J. Simpson. 2009. “Cultivating Innovation: An Interview with the CEO of a Leading Italian Design Firm.” McKinsey Quarterly, February. http://www.mckinseyquarterly.com/Cultivating_innovation_an_interview_with_the_CEO_of_a_leading_Italian_ design_firm_2299.

Davenport, T. H. 2009. Realizing the Potential of Retail Analytics: Plenty of Food for Those with the Appetite. Babson Park, MA: Babson Working Knowledge Research Center Report.

Gladwell, M. 2010. “The Sure Thing: How Entrepreneurs Really Succeed.” New Yorker, January 18. http://www.newyorker.com/reporting/2010/01/18/100118fa_fact_gladwell.

Sarasvathy, S. D. 2001. “Causation and Effectuation: Toward a Theoretical Shift from Economic Inevitability to Entrepreneurial Contingency.” Academy of Management Review 26 (2): 243–64.

Zuckerman, G. 2010. The Greatest Trade Ever: The Behind-the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History. New York: Crown Business.