Pass the Salt and Pepper: Business Basics

This chapter covers much of what you will need to do before you open your doors—naming your business, determining its business structure, and finding a location. It also includes a discussion about acquiring the necessary licenses, permits, and business insurance, which are certainly not the fascinating and fun parts of your business but are critical to a solid business.

There is no question that the right name can draw your target market to you. It can also single out your specialty food business from others and keep it sharp in clients’ memories. Before you decide on a name, you will need to firm up what kind of specialty food business you plan to have, the scope you want your business to have, and whether you want to convey a particular image. Will you have a highly specialized service (e.g., supplying gourmet whoopie pies to birthday parties or weddings) or a more general one (e.g., a retail outlet with catering services offering whatever specialty food strikes your fancy at the moment)? Will your range be local, national, or international? Do you want to produce only high-budget food items or do you want to cover most price ranges? Depending on your answers to these questions, a good name for your business could consist of any of the following:

tip

From smartphone apps, to iPads, to Twitter marketing, to cell phone credit-card processing, be prepared to use technology in your business. Everyone else is using it—from your customers to your suppliers to your competition—and they expect you to, as well!

![]() Description of your service (e.g., Gourmet Party Food, Inc.)

Description of your service (e.g., Gourmet Party Food, Inc.)

Advantages: Helps potential clients hone in on you.

Disadvantages: Creativity sometimes suffers.

![]() The type of food you specialize in (e.g., Whoop It Up!)

The type of food you specialize in (e.g., Whoop It Up!)

Advantages: Helps clients find you. You’ll get fewer calls for types of foods you don’t offer.

Disadvantages: Your specialization might change. What if you decide to do other kinds of baked goods or even savory items and beyond?

![]() Your name (e.g., Ann Smith, Inc.)

Your name (e.g., Ann Smith, Inc.)

Advantages: People you meet while networking need remember only your name. If you use your full name, you may improve your personal credit rating as you build your business.

Disadvantages: Customers won’t know what type of business this is. Worse, the IRS could confuse you and your company. And if your company goes under, your personal credit rating may suffer. Finally, if you choose to sell your business at some point, your name will become a liability. Prospective buyers prefer to buy a company that is not associated with a specific name. If Jane Doe were to buy this company and then change the name to Jane Doe, Inc., she would lose the name recognition that Ann Smith worked to build. Although you may not envision selling your company, life has a habit of throwing some unanticipated opportunities that you might decide to take advantage of and might mean having to sell your business.

![]() Qualities your business embodies (e.g., Just Desserts)

Qualities your business embodies (e.g., Just Desserts)

Advantages: Helps establish the image you want to create.

Disadvantages: This kind of name pigeonholes your business. That may be okay, just be aware that if you decide in the future to include savory pies, main meals, salads, or anything that isn’t desserts to your offerings you will have a hard time easily getting that across to potential customers.

tip

Make sure the name you select is not too restrictive. For instance, if you choose “Exclusively Cupcakes” you are limiting yourself to cupcakes—or to customers assuming all you do is cupcakes. Choose a name that encompasses a broader scope.

![]() The Name Game

The Name Game

After you’ve short-listed some ideas, ask yourself the following questions about each name:

![]() Is it easy to pronounce? People are reluctant to say a name when they’re unsure of its pronunciation. This reluctance could be fatal in an industry that relies heavily on word-of-mouth advertising.

Is it easy to pronounce? People are reluctant to say a name when they’re unsure of its pronunciation. This reluctance could be fatal in an industry that relies heavily on word-of-mouth advertising.

![]() Is it short enough? Length affects ease of pronunciation. Plus, you and your employees will have to say this name all day on the phone and still have time to do other tasks. Thus Supercalifragilisticexpialidocious, Inc. is probably not the best choice, even if you specialize in children’s food items. (This name suffers from other problems, too, that probably don’t need spelling out.)

Is it short enough? Length affects ease of pronunciation. Plus, you and your employees will have to say this name all day on the phone and still have time to do other tasks. Thus Supercalifragilisticexpialidocious, Inc. is probably not the best choice, even if you specialize in children’s food items. (This name suffers from other problems, too, that probably don’t need spelling out.)

![]() Is it easy and logical to spell? If somebody hears your company name but can’t find it or call it up on the internet or spell it to a phone operator because of a unique spelling, you will lose potential clients. For this reason—and others—don’t opt for a silly spelling of a common word. For instance, don’t even think of a name like Kountry Kupcakes.

Is it easy and logical to spell? If somebody hears your company name but can’t find it or call it up on the internet or spell it to a phone operator because of a unique spelling, you will lose potential clients. For this reason—and others—don’t opt for a silly spelling of a common word. For instance, don’t even think of a name like Kountry Kupcakes.

![]() Is it memorable? Despite all the above warnings, you probably want to avoid a name that sounds too ordinary. Names should be meaningful and substantive.

Is it memorable? Despite all the above warnings, you probably want to avoid a name that sounds too ordinary. Names should be meaningful and substantive.

When you have selected a name, take the time to make sure it is not trademarked by another company. Even if you plan to keep your specialty food business small, it is a good idea to check for trademarks. You can do this for free at www.uspto.gov. Also, check popular search engines like Google and Yahoo! to see if the name you have chosen shows up on a search.

![]() Indications of the scope of your business (e.g., Cupertino Cupcakes)

Indications of the scope of your business (e.g., Cupertino Cupcakes)

Advantages: Anyone looking under city listings will find you.

Disadvantages: Your scope might change. What if you want to branch out to other cities?

![]() A combination of the above (e.g., Ann’s Desserts of Cupertino)

A combination of the above (e.g., Ann’s Desserts of Cupertino)

Advantages and disadvantages: The whole is not necessarily the sum of the parts. Consider carefully the advantages and disadvantages of each part of a combination name to see which apply.

aha!

Stop periodically and write out two lists: a “Priorities in my business life” list and an “Actual time spent” list. Compare the lists. Are you spending the greater proportion of your working life on the activities to which you give a high rank? If not, maybe it’s time to reorganize.

The outline above is not an exhaustive one, but it contains some of the best ideas for creating a name that will make your business a standout in the specialty food world.

For one of this book’s mentors, Susan Desjardins Burns, the name for her toffee business, Confectionately Yours, came with the business which she took on from her husband’s octogenarian aunt who decided it was time to give it up herself but wanted the business to continue.

Businesses often like to select a name that will put them at the top of an alphabetical listing, but with the demise of the phone directory that is getting less and less important. AAA Gourmet Foods may position your listing in first place, but the name is not very informative. Don’t sacrifice content for this prime position that may or may not be advantageous any longer.

If you buy an existing business and want to change the name (or have to, according to the sales agreement), you can take an element from the business’s former name or even use the whole name.

![]() Registering Your Company Name

Registering Your Company Name

Most states mandate that you register your fictitious company name officially to ensure that it is unique. This is generally done through the county and is known as filing a DBA (“doing business as”) statement. If the name you chose is already being used, you will be asked to choose something else. For this reason, it’s a good idea to have a backup name or two. There is typically a nominal ($30 to $60) cost for this service.

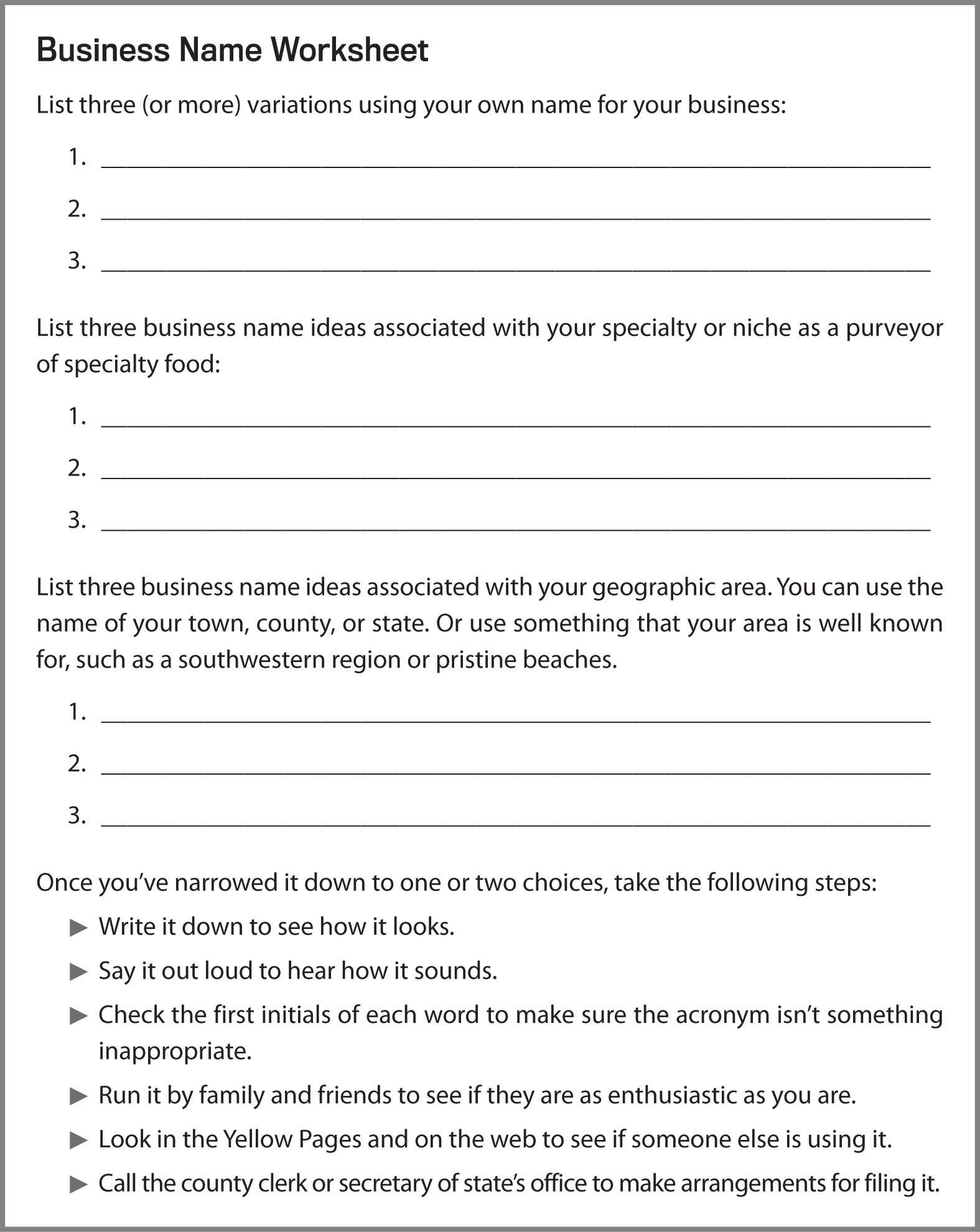

A good name is well worth the effort you’ll put into finding it. With some thought, you can end up with a name as unique as your business. Use the worksheet in Figure 4–1 to help you craft your business name.

FIGURE 4–1: Business Name Worksheet

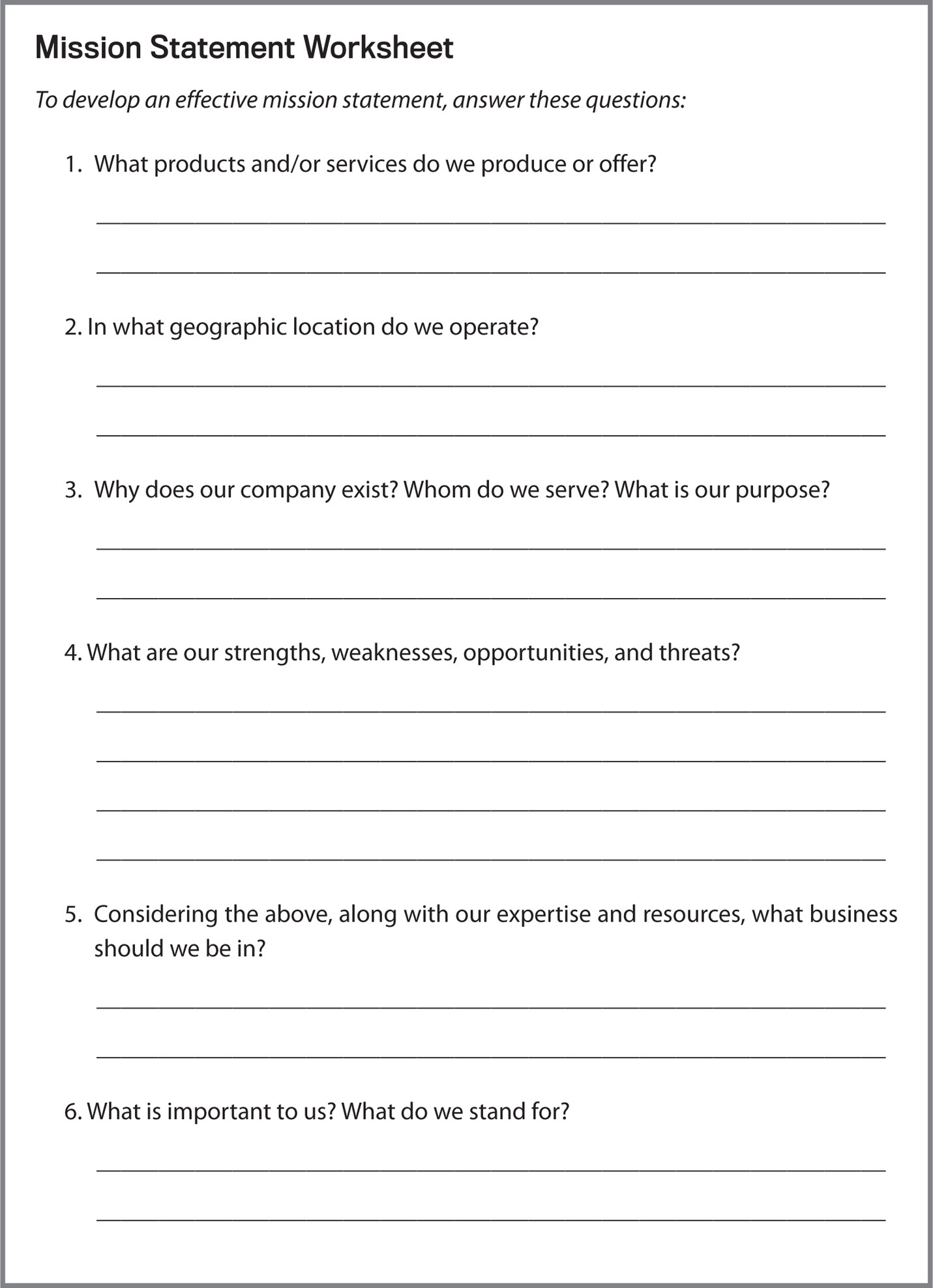

Your mission statement should be more than a sentence or two about what you do—it should serve as a framework and reminder of your specific goals and help keep you on track while making decisions down the road. Those decisions might seem confusing, but if you can look at your mission and put them in that context, then your mission statement will be doing the job it’s intended to do.

That’s why constructing your mission statement should come from your heart and soul. It should reflect why you wanted to start your business in the first place, the key thing you want to spend most of your time on. It should leave no doubt in anyone’s mind what kind of business you are.

Your mission statement should not just serve you and your business but should appeal to the range of customer types you intend to serve as well as any potential investors in startup or expansion funding. It should get across your enthusiasm and intent. See Figure 4–2 on page 43 for a worksheet to help you develop your mission statement.

Here are a couple mission statements from specialty food purveyors:

![]() DPI Specialty Foods (http://dpispecialtyfoods.com): “DPI’s mission is to provide all customers with an extensive variety of specialty foods from around the world, including Gourmet, Natural, Organic, Gluten-Free, Local and Ethnic foods.”

DPI Specialty Foods (http://dpispecialtyfoods.com): “DPI’s mission is to provide all customers with an extensive variety of specialty foods from around the world, including Gourmet, Natural, Organic, Gluten-Free, Local and Ethnic foods.”

![]() Omaha Steaks (www.omahasteaks.com): “We deliver exceptional experiences that bring people together. Guaranteed.”

Omaha Steaks (www.omahasteaks.com): “We deliver exceptional experiences that bring people together. Guaranteed.”

After you have written your mission statement, put it on probation. Ask customers if they feel it expresses what they were looking for when they found you and if what they got was what the mission statement says. When you are sure it’s right, put it on your website and in marketing materials. If you have a retail store, post it where customers will see it and post it where employees will constantly be able to read it and be reminded of why you are doing what you do.

warning

Having office space in your retail shop is very convenient and probably a good idea. However, do not get involved in office work while you are the only one in the shop. Your office work will suffer from the (hopefully) regular interruptions, and customers do not like to walk into an unattended space where they have to seek you out in the back room to help them. Most will walk out instead.

The type of specialty food business you plan to start as well as the size of your business are among the factors that will determine where you set up shop. Your location can be anywhere from your home, in a retail space, or in a commercial warehouse-type location.

FIGURE 4–2: Mission Statement Worksheet

![]() Office Location Pointers

Office Location Pointers

The type of specialty food business you are starting will have a lot of bearing on your office location:

![]() If you are opening a retail shop, you will want to be sure your shop has some space for a small office. You can plan a half hour before and/or after opening to keep office work up-to-date.

If you are opening a retail shop, you will want to be sure your shop has some space for a small office. You can plan a half hour before and/or after opening to keep office work up-to-date.

![]() If your specialty food business is more of a wholesale operation, carving out an office in your wholesale space is a good idea. Then, assuming you have employees, you can be making client calls and lining up deliveries, but if questions arise you are there.

If your specialty food business is more of a wholesale operation, carving out an office in your wholesale space is a good idea. Then, assuming you have employees, you can be making client calls and lining up deliveries, but if questions arise you are there.

![]() Having a home office space is logical if you are not the one who is doing the day-to-day business of your business. That is, if others are doing the baking or cooking or bottling or staffing the retail storefront, then you can work remotely and it probably doesn’t matter. However, few startup businesses have the luxury of the owner being that hands-off.

Having a home office space is logical if you are not the one who is doing the day-to-day business of your business. That is, if others are doing the baking or cooking or bottling or staffing the retail storefront, then you can work remotely and it probably doesn’t matter. However, few startup businesses have the luxury of the owner being that hands-off.

If you’re starting small, a homebased specialty food business may be the ideal choice for you. This option keeps overhead low and saves travel time to and from the office. One potential problem is that friends and family might drop in at all hours because you’re “not really working.” Be firm. Set up business hours and stick to them.

aha!

Consider sharing space with a related business. For example, you could set up shop with a noncompeting type of gourmet food—and if you each do your own catering, you can still operate as distinct businesses. You might not only save money but also gain referrals. If you elect to share space, however, make sure you have a clear contract stating how space and responsibilities will be shared. Also, be sure to share space with a well-respected business—your reputation will be mixed with theirs, good or bad!

Congratulations! You have named your business, have your DBA in hand, and you are considered the owner of a legitimate business. Now you will need to make the decision to operate as one of four business entities: a sole proprietorship, a partnership, a limited liability company (LLC), or a corporation.

![]() Separating Home and Business

Separating Home and Business

If you opt for a homebased business, you need to allocate a space that is to be used solely for your business. It could be a small area, a desk tucked into the corner of the dining room, for instance, but it must be devoted to your specialty food business. It is also wise to have separate phone lines for your home and for your business. Chances are your main business phone will be a cell phone anyway. However, nothing will kill your credibility faster than using your home phone line with its answering machine featuring your three-year-old singing the theme song from Frozen. While cute, this is not professional.

Keeping home and business as separate as possible, especially when they are in the same building, will also help when tax time rolls around since your business phone expenses will be deductible.

Sole proprietor is the easiest type of business to form. All you have to do is file a DBA, as already discussed, then open a business checking account in that name. You can use your personal credit card to pay for business expenditures, yet you still get tax benefits like business expense deductions.

While it is easy, there is a downside to the sole proprietorship. You are personally liable for any losses, bankruptcy claims, legal actions, and so on. That can wipe out both your personal and business assets if major problems arise.

Perhaps you are planning to work with someone else to form your business. Then you are forming a general partnership. While a little more complicated to form than sole proprietorships, they are easier than corporations. You don’t have to file any documents to make them legal but you do want a crystal clear partnership agreement stating what each partner is responsible for.

warning

Never put a client on hold to speak with another client. Let your voice mail pick up any incoming calls you can’t answer yourself.

A third type of business entity is the limited liability company, or LLC, which has the tax structure of a partnership, yet protects the business owner from personal liability. This structure protects each partner’s personal interests.

tip

To find out if you need additional licenses or permits, check these sources:

![]() Small Business Administration, www.sba.gov

Small Business Administration, www.sba.gov

![]() Small Business Development Center, www.sba.gov

Small Business Development Center, www.sba.gov

![]() Service Corps of Retired Executives, www.score.org

Service Corps of Retired Executives, www.score.org

And always talk with the municipality in which you do business.

The last type of business arrangement is the corporation. It is established as a totally separate legal entity from the business owner. Establishing a corporation requires filing articles of incorporation, electing officers, and holding an annual meeting. Very small businesses do not usually choose this route initially because the costs are prohibitive and the company must pay corporate taxes. On the other hand, a corporation will find it easier to obtain financing, which would be useful if you decided to franchise your business or expand in a big way.

Although the process for creating a corporate structure is more complicated and expensive than other structures, it does offer protection to business owners and their assets. It alone is legally responsible for its actions and debts. As an employee of the corporation, your personal assets are protected in most situations, even though you may own all or most of the stock.

If deciding on a legal form for your business keeps you up at night, consider this: Your business structure is not carved in stone. It can be changed.

tip

Some cities provide packets with explanations and all the forms you’ll need for the various licenses and permits, so investigate this possibility at your town clerk’s office. Also, it’s a good idea to ask more than one city or county employee about the licenses you need, especially if you get information that is confusing or not what you expected.

Most cities and counties require business operators to obtain various licenses and permits to comply with local regulations. For everyday operation of a food business, you may need the following:

![]() Business license: ensures proper zoning and parking

Business license: ensures proper zoning and parking

![]() Vendor’s permit (varies from state to state): allows you to buy and resell

Vendor’s permit (varies from state to state): allows you to buy and resell

![]() Health department permit: if you handle food

Health department permit: if you handle food

![]() Liquor, wine, and beer licenses: if you yourself serve alcohol

Liquor, wine, and beer licenses: if you yourself serve alcohol

![]() Sign permit: covers size, location, and sometimes the type of sign you may use

Sign permit: covers size, location, and sometimes the type of sign you may use

![]() County permits: may be applicable if you are located outside city limits

County permits: may be applicable if you are located outside city limits

warning

Be aware that distinctive trademarks are protected. For example, you may need permission to use any relevant brand names on literature you circulate about your business.

Check local regulations to see which of the above licenses and permits you’ll need or if there are others depending on what you plan to do in your business, like actually host rather than just cater events.

Knowing what kind of insurance to carry and how much to obtain is an important aspect of good risk management. Don’t view insurance as an option. It is absolutely imperative for any business to have the appropriate insurance.

As the owner of a specialty food business, you are most likely to need the following types of insurance:

warning

If you operate your business from your home, you may need additional coverage. Your homeowner’s policy may be sufficient, but if you plan to store or use expensive machinery, such as a computer, or if customers or clients will visit your home for business purposes, you may want to purchase additional coverage. Set up an appointment with your agent to go over your overall insurance coverage.

![]() General liability insurance. This is the one type of insurance you must carry. General liability insurance protects a business against accidents and injuries that might occur at your office or retail site.

General liability insurance. This is the one type of insurance you must carry. General liability insurance protects a business against accidents and injuries that might occur at your office or retail site.

![]() Workers’ compensation insurance. If you have employees, you will also want this type of insurance. You are liable for injury to employees at work caused by problems with equipment or working conditions. In every state, an employer must insure against potential workers’ comp claims. However, employee coverage and the extent of the employer’s liability vary among states.

Workers’ compensation insurance. If you have employees, you will also want this type of insurance. You are liable for injury to employees at work caused by problems with equipment or working conditions. In every state, an employer must insure against potential workers’ comp claims. However, employee coverage and the extent of the employer’s liability vary among states.

![]() Auto insurance. Cars and trucks are sources of liability. Even if your business does not own a vehicle, you can be liable for injuries and property damage caused by employees operating their own or someone else’s car while on company business.

Auto insurance. Cars and trucks are sources of liability. Even if your business does not own a vehicle, you can be liable for injuries and property damage caused by employees operating their own or someone else’s car while on company business.

![]() Food-specific insurance. Don’t leave out this important ingredient! Look for an insurance company that knows the specific needs of a food and/or beverage manufacturer or retailer.

Food-specific insurance. Don’t leave out this important ingredient! Look for an insurance company that knows the specific needs of a food and/or beverage manufacturer or retailer.

![]() Bonding. This is pertinent particularly if part of your business includes catering. You may need bonding to protect you if one of your employees steals or damages something at an event site. Vendors should carry their own protection. Check your state’s legal requirements.

Bonding. This is pertinent particularly if part of your business includes catering. You may need bonding to protect you if one of your employees steals or damages something at an event site. Vendors should carry their own protection. Check your state’s legal requirements.

To do business (and protect your company as you do it), you’ll need a variety of documents. Invoices and purchase orders are standard fare for any business. However, if you plan to do special orders and events or catering, you will want specific kinds of forms.

Proposals simply tell clients what you will do for them and at what cost. It is an important selling tool and might consist of any or all of the following elements:

tip

We’ve all heard it: A picture is worth a thousand words. Photos in your proposal packet can make a powerful impact on prospective clients. Consider hiring a professional photographer to capture some stellar images for you; at the very least, invest in a high-quality digital camera. Even though phone cameras are now quite high quality, don’t rely on images from your camera to use to market your business in print advertising and brochures.

![]() History of your company. Provide one if relevant.

History of your company. Provide one if relevant.

![]() Letters of reference. Kudos from clients for whom you done similar work.

Letters of reference. Kudos from clients for whom you done similar work.

![]() Write-ups. A complimentary newspaper or magazine article featuring your business is often a valuable tool for selling your services to others. You may also want to include photographs.

Write-ups. A complimentary newspaper or magazine article featuring your business is often a valuable tool for selling your services to others. You may also want to include photographs.

![]() Description of services. This tells exactly how you will achieve what your client is asking from your business.

Description of services. This tells exactly how you will achieve what your client is asking from your business.

![]() Listing of additional services. If you also will provide floral design, specialty dishware, or some other service, describe those services completely. Does the dishware belong to the client after? If it is supposed to come back to you, how will it get there?

Listing of additional services. If you also will provide floral design, specialty dishware, or some other service, describe those services completely. Does the dishware belong to the client after? If it is supposed to come back to you, how will it get there?

![]() Cost estimate. This accompanies any proposal.

Cost estimate. This accompanies any proposal.

![]() Term of validity. Make sure you include in your proposal an expiration date for the estimate. You don’t want to be expected to follow through on that proposal five years from now for the listed price for five years ago!

Term of validity. Make sure you include in your proposal an expiration date for the estimate. You don’t want to be expected to follow through on that proposal five years from now for the listed price for five years ago!

tip

Quotes from satisfied customers, called “testimonials,” are great to include in marketing pieces, proposals, and ads. They are more convincing if they include a real name (or first name, last initial); just be sure to get the customer’s permission.

Customers must be able to visualize your offering and understand the quality of your work when they read your proposal. Consider including in your proposal some photos of your product that is similar to what the client wants.

Lots of specialty food businesses include event catering in their list of offerings. A signed document detailing all aspects of the expectations of your participation is not only helpful but also imperative to the legal health of your business. Are you to provide dishware, utensils, napkins, chafing dishes? You likely want to be the one setting your food up to be sure it is being presented as you intended, so include that in the agreement.

While a mainly retail business setup likely won’t hand out many invoices, you will want to have a standard invoice on hand even if you only do a handful of large orders a year. You can also use invoices to show donations that you can keep copies of for your tax records. It’s always good to have written money records. Create a custom invoice on your computer in a “basic forms” folder. There is no longer a need to have invoices printed out unless you want to buy a preprinted stack at the office supply store and have a custom stamp created that you can use to customize the form.

warning

If you are going to take the time to do a written agreement for services like catering (and you should!), be sure to cover the details. For example, you might want to include a check box that gives you permission to take photographs of the food you prepare for an event and use them in your marketing materials if you desire. Most people would be flattered, but it’s always best to ask.

Again, you may not use a lot of receipts if you are a cash-based retail-focused business, but if you do those special event large orders or even smaller orders for individuals—like other business owners who are purchasing your product for business-related gifts—they will want a receipt to be able to use for tax purposes.

![]() Foundation Checklist

Foundation Checklist

Complete these items as you get your business started:

![]() Develop and write a business plan

Develop and write a business plan

![]() Create a powerful mission statement

Create a powerful mission statement

![]() Select a name for your company and apply for a DBA

Select a name for your company and apply for a DBA

![]() Choose the best business structure for your company

Choose the best business structure for your company

![]() Check local zoning laws to ensure that you are in compliance

Check local zoning laws to ensure that you are in compliance

![]() Apply for the licenses and permits you will need

Apply for the licenses and permits you will need