The Necessary Ingredient: Financing

Your funding needs will of course depend on the type of food business you are planning to start. A small specialty jam business that you conduct from your home and sell only to friends by personal sales is going to take a lot less startup funding than a bakery that makes and sells specialty whoopie pies to the public and events like weddings and anniversaries or a retail gourmet food store in an upscale part of Main Street that will require rent, deposits, utilities, leasehold improvements, special display racking, and a couple of employees, etc.

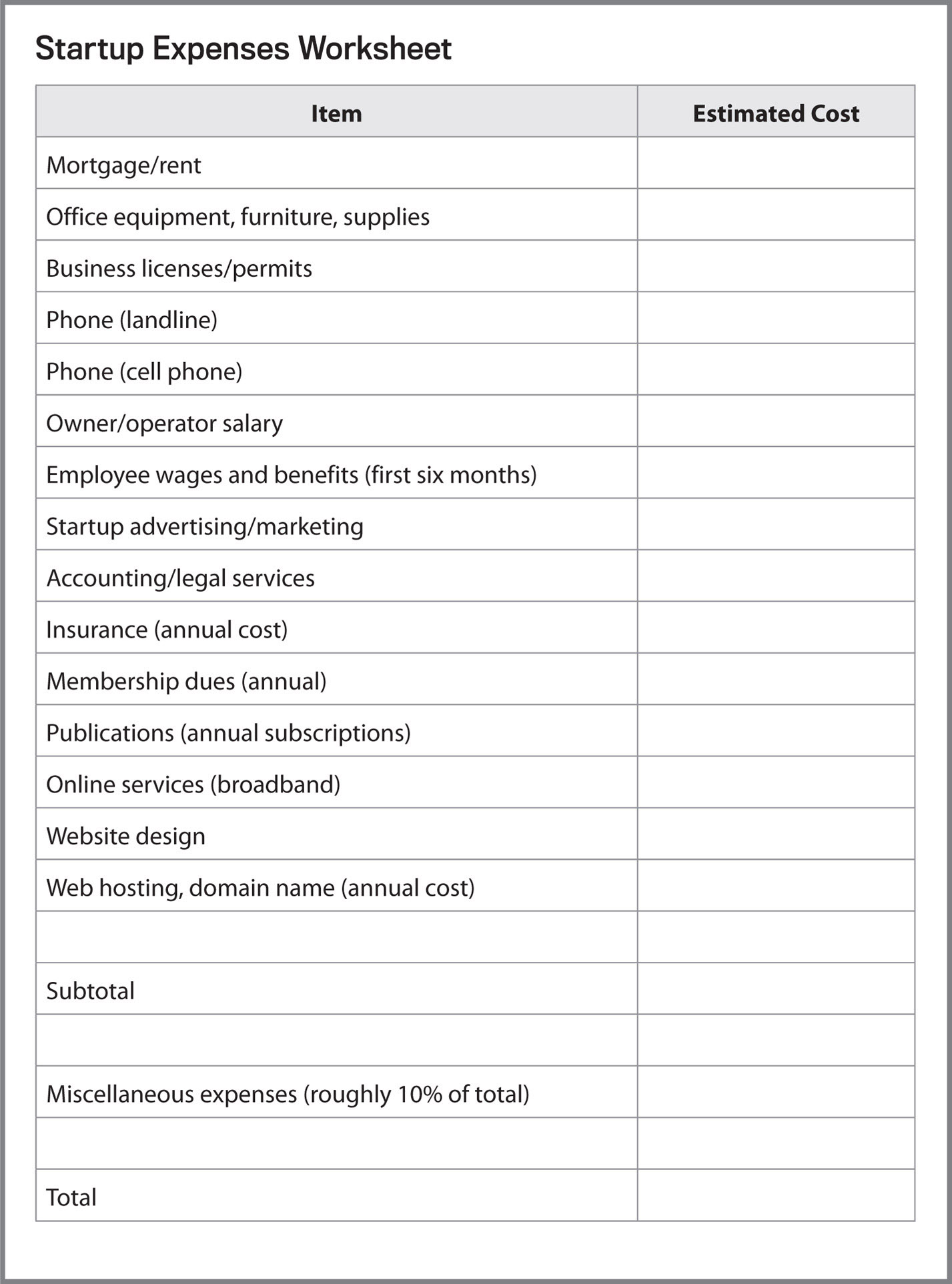

The first step is to estimate your business expenditures over the startup period (for some that may be longer than others, both because of the type of business and also personal circumstances) and over the first six months of operation. Once you have your costs put them into the “Startup Expenses Worksheet,” Figure 6–1. If you haven’t estimated those costs yet, now is a good time to do so.

save

For good deals on office furniture check www.officefurniture2go.com. They offer competitive shipping and prices. There really is no need to buy new for your startup office.

The basic startup costs are for expenses you will incur whether you sell a single food item or not—these are “fixed costs” for the most part. Many specialty food businesses will need to add a line or more about the cost of ingredients. If you have a retail outlet, you will need to have food on the shelves for sale. If you do only event catering, you will at least need to include the costs of ingredients for creating food for tasting until you get a deposit for your first event. For example, if your specialty food business is gourmet cupcakes that are decorated to look like a bouquet of flowers, you will need to create some bouquets to wow customers and you will need to have fresh cupcakes at the ready for potential customers to sample. All of this costs money.

These startup costs need to include the money you require for the business as well as what you personally need for your own living expenses until your business makes a profit. If you are starting your business part time while you finish up a career in a different field, this will impact how much startup funding you will need.

Perhaps you are recently retired and have been planning and saving for your startup foodie business for a decade. This won’t lessen the amount you need for fixed costs for your business but it will greatly impact how much funding you need from outside sources to get started. If you saved enough to cover your own living expenses while you get your business up and running (good for you!), your startup funding needs will only be what is directly related to the business.

FIGURE 6–1: Startup Expenses Worksheet

Your best source of financing is you. Not only should you invest your own resources first, anyone you approach for funding will expect you to. Perhaps you are fortunate to be able to sell another business and use the proceeds toward your specialty food startup.

Here are potential sources to add to your startup pot:

![]() Friends and family. Use extreme care when exercising this option. You could very easily sour a lifelong friendship or make family gatherings very uncomfortable. Even if you are getting funding from a family member or friend, be sure to create a written contract even if you write it yourself, but it wouldn’t hurt to enlist an attorney. The contract should stipulate your obligations as well as the agreement of the transaction. Is this a loan? A gift? Is there a deadline by which the lender needs the money back? Will the lender receive interest? Percentage of profits? Spell out every deal and make sure you both understand and agree on the transaction completely.

Friends and family. Use extreme care when exercising this option. You could very easily sour a lifelong friendship or make family gatherings very uncomfortable. Even if you are getting funding from a family member or friend, be sure to create a written contract even if you write it yourself, but it wouldn’t hurt to enlist an attorney. The contract should stipulate your obligations as well as the agreement of the transaction. Is this a loan? A gift? Is there a deadline by which the lender needs the money back? Will the lender receive interest? Percentage of profits? Spell out every deal and make sure you both understand and agree on the transaction completely.

tip

If you choose to finance your business using credit cards, call around for best rates. Often, if you call and speak with a representative from your credit card company, you can negotiate a better rate than the one advertised.

![]() Credit cards. This is a financing option that should also be used with caution. Interest on credit cards can become crippling and could easily steal your profits. Be especially careful with cards with low initial rates—know exactly when those rates go up and make note of when you need to pay the startup financing before the initial period ends and the higher rate kicks in. Likewise with 0 percent cards—often the interest, when it kicks in, is much higher than average, so if you aren’t certain you can pay that debt off before the interest starts, find another option. Sometimes the interest even kicks back to the original amount of the loan even if you have paid a portion of it.

Credit cards. This is a financing option that should also be used with caution. Interest on credit cards can become crippling and could easily steal your profits. Be especially careful with cards with low initial rates—know exactly when those rates go up and make note of when you need to pay the startup financing before the initial period ends and the higher rate kicks in. Likewise with 0 percent cards—often the interest, when it kicks in, is much higher than average, so if you aren’t certain you can pay that debt off before the interest starts, find another option. Sometimes the interest even kicks back to the original amount of the loan even if you have paid a portion of it.

![]() Equity. Home equity is certainly an option but again, one to be considered carefully. While it can wisely utilize your investment in your home, remember—you are utilizing your investment in your home. You still need to pay interest on the loan and you need to be sure to leave enough equity available to you for a large unexpected home repair. The last thing you need is to compromise what is often a homeowner’s most significant asset.

Equity. Home equity is certainly an option but again, one to be considered carefully. While it can wisely utilize your investment in your home, remember—you are utilizing your investment in your home. You still need to pay interest on the loan and you need to be sure to leave enough equity available to you for a large unexpected home repair. The last thing you need is to compromise what is often a homeowner’s most significant asset.

![]() Venture capital. Venture capitalists are private lenders. They tend to invest in high-risk businesses that have potential for huge returns if successful. Few specialty food startup businesses will be able to gain the attention of venture capitalists.

Venture capital. Venture capitalists are private lenders. They tend to invest in high-risk businesses that have potential for huge returns if successful. Few specialty food startup businesses will be able to gain the attention of venture capitalists.

![]() Crowdfunding Sites to Check Out

Crowdfunding Sites to Check Out

![]() www.Kickstarter.com: creative projects

www.Kickstarter.com: creative projects

![]() www.Indiegogo.com: creative, personal, hobbyist

www.Indiegogo.com: creative, personal, hobbyist

![]() www.Crowdfunder.com: investment raising

www.Crowdfunder.com: investment raising

![]() www.RocketHub.com: creative with campaign guidance

www.RocketHub.com: creative with campaign guidance

![]() www.Appbackr.com: mobile apps

www.Appbackr.com: mobile apps

![]() Banks. Your good old basic bank will likely be the most fruitful place to go for business funding. For this typically conservative, more traditional source of funding, you will need a thoughtful and detailed business plan. Local banks will be more interested in financing local businesses. Don’t bring your pie-in-the-sky ideas; save those for down the road when your fundamental business is up and running and a proven good investment.

Banks. Your good old basic bank will likely be the most fruitful place to go for business funding. For this typically conservative, more traditional source of funding, you will need a thoughtful and detailed business plan. Local banks will be more interested in financing local businesses. Don’t bring your pie-in-the-sky ideas; save those for down the road when your fundamental business is up and running and a proven good investment.

![]() Small Business Administration. Contact the SBA (www.sba.gov) for information about financing your startup business. They often work through local banks and can help you secure lending.

Small Business Administration. Contact the SBA (www.sba.gov) for information about financing your startup business. They often work through local banks and can help you secure lending.

![]() Crowdfunding. Whether crowdfunding is a potential funding source for your business will depend on the type of specialty food business you are planning. Many crowdfunding sources do best with a product that you can promise to send people in exchange for their investment. See the sidebar above for a list of several crowdfunding sites and explore a few to figure out how others set up their pitch.

Crowdfunding. Whether crowdfunding is a potential funding source for your business will depend on the type of specialty food business you are planning. Many crowdfunding sources do best with a product that you can promise to send people in exchange for their investment. See the sidebar above for a list of several crowdfunding sites and explore a few to figure out how others set up their pitch.

Being wise with your capital needs and heading into financing with a thorough business plan is the best advice for a new entrepreneur.

You will want to establish two different credit profiles: personal and business. Before you have business credit, you will have a personal credit profile. This should be as rosy as you can possibly make it. A key to having a good personal credit profile is to get rid of debt if you have it. Clark Howard, at his website subtitled “Money in Your Pocket,” offers five steps for getting out of debt:

1. Make a conscious decision to stop borrowing money.

2. Establish a starter Emergency Fund of $1,000. You need something for emergencies instead of using credit cards (see number 1).

3. Create a realistic budget and stick to it. Cut a few things like gym memberships you pay regularly but rarely utilize, cut dining out in half, make coffee at home instead of stopping at the café.

4. Organize your debt. Decide whether to pay off high-interest debt first (called “laddering”) or whether you want to tackle debt from the lowest amount owed on up which can give you a boost toward your goal as you see a debt paid off.

5. Throw any excess cash at your debt.

Come to think of it, these aren’t bad suggestions for business debt, too. If you want to read more about these five steps, go to the website at www.clarkhoward.com/paying-off-credit-card-debt.

Networking is more than a buzzword—it will help you with all aspects of your business, including funding. In addition to tapping your network as you formulate your business, work toward expanding your network. Attend chamber of commerce functions in your market area, go to conferences, seminars, and trade shows to expand your network, and most of all, reach out to your friends, former colleagues, and other acquaintances; let them know you are starting a business, and ask them to let their friends and acquaintances know.

tip

There are five things an entrepreneur should be prepared to show a loan officer:

1. A business plan showing how you will use the financing

2. Proof that you pay your obligations when due

3. Proof that you have enough equity to cover the obligation

4. That your team has enough experience to implement your plan

5. That your sales prospects are strong enough to repay the loan

We could have discussed business plans in Chapter 4, since business plans are part of the salt-and-pepper basics of any startup. But business plans usually come into practical use when you are trying to obtain financing, so we’ll talk about creating one here in the money chapter.

Your business plan should include a broad discussion of the specialty food industry, particularly as it pertains to your specific part of the industry—i.e., retail, service, events. Also include information about your business structure, your clients, the competition and how you will fit into it, your income, cash flow, and expenses, and other relevant financial information. This is the chief instrument you will use to communicate your ideas to others—not only bankers but other business people and potential partners. And the business plan will become the basis for any loan proposal.

stat fact

Fifty-two percent of all small businesses are homebased, according to SCORE’s Small Biz Stats & Trends (www.score.org/node/148155).

A relevant business plan will help you gauge your progress in starting and building your business. Use it as an operating tool to help you manage your business. The plan will help you cement the logistics and growth curve of your new business. And don’t be afraid to veer from your plan if it makes sense—you need to have a plan to begin with in order to veer from it.

The Components of a Successful Business Plan

Every thorough and useful business plan should contain the following seven components:

1. Executive summary. As the name suggests, this section summarizes your entire business plan. It includes details about the nature of your business, the type and scope of services that you will provide, the legal form of your business (covered in Chapter 4), and your vision and goals for the business.

2. Business description. In this section you’ll describe the gourmet and specialty food business as a whole and your chosen target market. Use specifics here, hard numbers, and facts. Along with those found throughout this book, you’ll find more business statistics at websites like www.census.gov, www.statista.com, and www.dol.gov (Department of Labor).

3. Market strategies. Here you will describe exactly how you will reach out to and market to prospective clients. Again, be as specific as possible. Will you advertise in the Yellow Pages? Join professional organizations for networking? Create a website? Use newsletters as a marketing device? Social media? Include as many of these details as possible. Also, take time in this section to write about the ways in which your company is unique and, therefore, better than your competitors.

4. Competitive analysis. In this section, focus on likely competitors in your field. Discuss how your business will differ from other specialty food businesses in your market area. Also, don’t forget to focus on other potential competitors, such as gourmet sections of high-end grocery stores or restaurants providing gourmet and specialty food catering services. Why are your services preferable to those of your competitors? It is essential that you clearly formulate the ways in which your company will differentiate itself from competitors. This will require a little boots-on-the-ground research.

warning

Don’t consider your business plan just a document necessary for obtaining financing that you rarely look at again. A business plan can be a strategic plan for your business that should be looked at and updated with some regularity.

5. Design and development plan. This is an opportunity to discuss how you will develop markets for your business and develop an ever-broadening client base. Set specific goals. Perhaps you plan to cater to 12 events during your first year of business and to grow that number to 50 events per year by your fifth year in the specialty food business. Or maybe you plan to eventually host classes at your retail site or rent your commercial kitchen space out to other specialty food businesses.

6. Operations and management plan. How will you run your business on a day-today basis? Will this be a part- or full-time career for you? Will you hire employees? Consider a typical day in your business and describe it here and how you will facilitate this operation.

7. Financial factors. This is the section in which to focus on your financial expectations. Even if you are opening the business as a very part-time occupation—for instance, only creating product during the summer fresh-fruit growing season—you will need to forecast your financial future. Consider where you would like to be, financially, with your business in one year and in five years, and include that information here.

Buying Equipment and Inventory

We’ll cover specific food-related equipment in other parts of this book, but there are some basic office equipment needs for any small business, whatever the industry. There are some must-haves and there are some it-would-be-nice-to-haves for your business to operate efficiently and effectively.

warning

Remember to add a percentage of your fixed costs to the fee you charge for your products or catering services! This is how you pay the bills.

Whatever the location of your food-making operation (see Chapter 7 for a full discussion on location), you need to carve out some office-type space. It doesn’t need to be a lot of space but it needs to be enough to enable you to be comfortable doing things like invoicing, ordering, and financial planning. If you don’t like doing those things to begin with, you definitely won’t want to do them in a place that is uncomfortable, cramped, or disorganized.

Basic office equipment includes:

![]() Desk. An office desk should be large enough for you to spread out and look at several things at once, whether it’s numerous spreadsheets or a laptop and spreadsheet, or catalogs and your laptop and the spreadsheet that tells you how much you budgeted to spend on whatever you are ordering.

Desk. An office desk should be large enough for you to spread out and look at several things at once, whether it’s numerous spreadsheets or a laptop and spreadsheet, or catalogs and your laptop and the spreadsheet that tells you how much you budgeted to spend on whatever you are ordering.

![]() Phone. Cell phones have often replaced the need for a landline phone. However, some people still prefer to have a landline for their business contact line where messages can be left. Then your cellphone can be used for times when you are away from your office. If you do decide to have a landline installed in your office, be sure it has a built-in voicemail function (almost standard these days). You probably also want a cordless option, depending on the size of your office space.

Phone. Cell phones have often replaced the need for a landline phone. However, some people still prefer to have a landline for their business contact line where messages can be left. Then your cellphone can be used for times when you are away from your office. If you do decide to have a landline installed in your office, be sure it has a built-in voicemail function (almost standard these days). You probably also want a cordless option, depending on the size of your office space.

![]() Other furniture. At least one file cabinet will help you keep organized. You can add cabinets as you need them, but at some point you will only want to keep files in your office that are active or relatively new; you can put the rest in storage boxes in a closet or other storage area. Although you likely won’t spend a lot of time at your desk in the food business, it is still a good idea to have a comfortable, ergonomic chair. If you may have a visitor in your office—a salesperson, potential client, or potential employee—make sure to have a couple of side chairs. A lot of great office furniture can be found at surplus sales.

Other furniture. At least one file cabinet will help you keep organized. You can add cabinets as you need them, but at some point you will only want to keep files in your office that are active or relatively new; you can put the rest in storage boxes in a closet or other storage area. Although you likely won’t spend a lot of time at your desk in the food business, it is still a good idea to have a comfortable, ergonomic chair. If you may have a visitor in your office—a salesperson, potential client, or potential employee—make sure to have a couple of side chairs. A lot of great office furniture can be found at surplus sales.

![]() Computer. A decent computer that is either new or no more than a year old will allow you to save money doing some of your marketing and advertising materials yourself. A laptop or even a tablet may be sufficient. Once again, however, make sure you get a keyboard and any accessories that will help make it ergonomic and comfortable for you to use. See “The Best Computer” on page 72 for more specifics on computer purchasing.

Computer. A decent computer that is either new or no more than a year old will allow you to save money doing some of your marketing and advertising materials yourself. A laptop or even a tablet may be sufficient. Once again, however, make sure you get a keyboard and any accessories that will help make it ergonomic and comfortable for you to use. See “The Best Computer” on page 72 for more specifics on computer purchasing.

![]() Internet access. Not only will you need internet service from your telecommunications provider and a modem to access the internet, a wireless router is highly recommended. They are inexpensive (in the range of $100), eliminate the need for a cord from your computer to the modem, and allow any type of computer to tap into the wireless service within its range. If your office is in a large retail space or your food prep area and the area is large, you may also want to consider a booster to allow you strong wireless access in the full area. Or simply budget for a tech-savvy consultant to do this all for you!

Internet access. Not only will you need internet service from your telecommunications provider and a modem to access the internet, a wireless router is highly recommended. They are inexpensive (in the range of $100), eliminate the need for a cord from your computer to the modem, and allow any type of computer to tap into the wireless service within its range. If your office is in a large retail space or your food prep area and the area is large, you may also want to consider a booster to allow you strong wireless access in the full area. Or simply budget for a tech-savvy consultant to do this all for you!

![]() Printer. If you plan to do some of your marketing and advertising materials yourself, a good printer is essential. The equipment itself is relatively inexpensive—these days you can buy a printer that produces high-quality printing as well as scans, copies, and faxes for under $150. However, the ink cartridges are where you will spend the money. Two rounds of black and color ink replacement cartridges, and you will have already spent the same as the cost of the printer itself. While you are at it, make sure to get a fast print speed of 15 to 20 black pages per minute.

Printer. If you plan to do some of your marketing and advertising materials yourself, a good printer is essential. The equipment itself is relatively inexpensive—these days you can buy a printer that produces high-quality printing as well as scans, copies, and faxes for under $150. However, the ink cartridges are where you will spend the money. Two rounds of black and color ink replacement cartridges, and you will have already spent the same as the cost of the printer itself. While you are at it, make sure to get a fast print speed of 15 to 20 black pages per minute.

![]() Camera. Phone cameras are such high quality these days that you may not find the need to have more than that. And that is especially true if you plan to hire a photographer to take shots of your finished work for marketing and advertising purposes. That said, a basic digital SLR with a couple of different lens sizes can be had for under $500 and seems to always be a worthwhile investment.

Camera. Phone cameras are such high quality these days that you may not find the need to have more than that. And that is especially true if you plan to hire a photographer to take shots of your finished work for marketing and advertising purposes. That said, a basic digital SLR with a couple of different lens sizes can be had for under $500 and seems to always be a worthwhile investment.

![]() Software. The basic Microsoft Office suite of Word, Excel, PowerPoint, and Access typically provides all you will ever need in the range of word processing, spreadsheet production, marketing and presentation software. The possibilities are endless for using these software tools these days, from a stripped-down version for your iPad like DocstoGo that costs around $15, to several hundred dollars for a full suite for your personal desktop or for multiple computers. Don’t forget to sign up for some kind of antivirus software; free malware is available, or for under $100 per year you can get a subscription to Norton AntiVirus or other protection, which is essential in today’s electronic world.

Software. The basic Microsoft Office suite of Word, Excel, PowerPoint, and Access typically provides all you will ever need in the range of word processing, spreadsheet production, marketing and presentation software. The possibilities are endless for using these software tools these days, from a stripped-down version for your iPad like DocstoGo that costs around $15, to several hundred dollars for a full suite for your personal desktop or for multiple computers. Don’t forget to sign up for some kind of antivirus software; free malware is available, or for under $100 per year you can get a subscription to Norton AntiVirus or other protection, which is essential in today’s electronic world.

tip

Brand recognition is the name of the game in business. It is typically worth the cost to have a graphic design firm design a logo for you. They will make your logo memorable, professional, and unique. Clip art can look tacky and may show up in another food-related business’s materials. When you have your logo, be sure to use it in everything about your business, from business cards to website to food labels.

Use Figure 6–2 on page 71 as a shopping guide for equipping your office with supplies. You probably already have some of these and some you may not want to use—for example, fax machines are slowly fading out of use with scanners being part of even the simplest printers, but some businesses still use faxes so you may find it is a purchase you need to make.

FIGURE 6–2: Office Supplies Checklist

After you’ve done your shopping (not buying, just shopping!), fill in the purchase price next to each item, add up your costs, and you’ll have a head start on estimating your startup costs. Of course, this is not a complete list of supplies that you may need, so tailor it to what you think you will use.

![]() The Best Computer

The Best Computer

These days you are almost able to get away with having nothing more than a tablet computer to run a business. A tablet can perhaps handle enough basic software, email, and internet searches to allow you to operate your business efficiently and effectively. They are portable and inexpensive—spend a little more and you don’t even need wifi—satellite connection will allow you to use it almost anywhere, anytime.

A laptop is the next best thing. Laptops are powerful and can be quite small. They can use more complicated software. And they are no longer considerably more expensive than desktop computers to get similar storage and speed.

Desktop computers have come a long way as well. No longer the computer of choice, desktops have had to adapt to the portable world where users can get a lot out of their smartphones, which have become minitablets. Desktop computers, or at least their monitors, are going in the opposite direction—instead of more compact, monitors seem to be getting larger and larger. If you are going to have your computer tied to your desk, you might as well have something that is highly visible and can give you lots of space to create on. Computers like the HP Envy has a 23” touch screen that functions like a tablet and has the CPU housed within the monitor so it is sleek, without cords everywhere, but unlike most tablets, has USB ports for thumb drives and other accessories. It also has a movable arm attached to its screen which means you can move the monitor for the most comfortable position for you, including standing.

Computers like the Envy are great if your business requires you to do a lot of design work where you may be sitting at your desk a lot or if you plan to do a lot of your back-office tasks such as bookkeeping and supply ordering yourself.

Do your research online, then utilize the personnel of places like Best Buy, Staples, or local computer businesses to help you decide which choice is best for you. Your computer is not likely to be your largest expenditure, but it could be the item you purchase that you use the most every day.

![]() Purchasing an Existing Business

Purchasing an Existing Business

Perhaps you are thinking about starting your own specialty food business by purchasing one that already exists. Maybe you have patronized this business many times, have always been attracted to it, and feel like you could do it better, take it to the next level. This is the way many business owners get into business. But you likely need to be prepared to jump right in pretty quickly.

Here are a few things to think about when purchasing an existing business:

![]() You will definitely want to set aside funding for legal help for the due diligence that is important in researching an existing business.

You will definitely want to set aside funding for legal help for the due diligence that is important in researching an existing business.

![]() Make a marketing plan for the turnover of the business so that you can be sure to retain existing customers. Will customers jump ship because the existing owner is so popular and equated with the business? Or will prior customers come back because they have been dissatisfied but are willing to try out the business under new management?

Make a marketing plan for the turnover of the business so that you can be sure to retain existing customers. Will customers jump ship because the existing owner is so popular and equated with the business? Or will prior customers come back because they have been dissatisfied but are willing to try out the business under new management?

![]() If the current owner is popular and an asset to the business, be sure to build in a transition period where the owner continues with the business for a certain amount of time.

If the current owner is popular and an asset to the business, be sure to build in a transition period where the owner continues with the business for a certain amount of time.

Another way to purchase an existing business, or more precisely purchase into an existing business, is to buy a franchise. Look on “franchiseopportunities.com” under “Gourmet and Specialty Franchises” and other franchise sales websites to see if something fits what you are interested in. Pizza, frozen yogurt, and barbecue are a few commonly franchised specialty foods as well as a few better-known shops like Edible Arrangements and Cold Stone Creamery.

Step into the franchise world with your eyes wide open. While it can be a great way to enter the specialty foods market, it also can be expensive and restrictive. Plan to have a lawyer look over a franchise contract and tell you exactly what you are committing to.

Inventory for a food business will also vary widely depending on the business you plan to start. Again, we will discuss food-specific inventory later in this book. But at this stage you will want to think through your nonperishables and hard goods required to start up and get your business established.

You will need bowls and dishes and measuring tools and storage containers, etc. But will you need displayware for your finished product—either those that are ready for sampling in your showroom or the food items you take to an event? If you are selling food items in a gift basket, you will need lots of inventory to create the final baskets—from the basket itself to the stuffer material, to rolls of cellophane for covering, to ribbon and even scissors to cut the ribbon.

warning

Don’t buy huge amounts of inventory of things like gift wrap or baskets unless, for example, you can get a ridiculously good deal on large quantities of a classic basket. Colors and designs go in and out of style. You don’t want to be stuck with years of inventory on something that you used only a portion of, only to have it get dusty and old-looking, not to mention taking up precious space.