CHAPTER 1

INTRODUCTION

1.1 DEFINITION OF ACCOUNTING

Accounting can be described as an information system that provides essential information about the financial activities of a business entity to various individuals or groups for their use in making informed decisions.

Accounting is primarily concerned with the design of the recordkeeping system, the preparation of summarized reports based on the recorded data, and the interpretation of those reports.

1.2 USERS OF ACCOUNTING INFORMATION

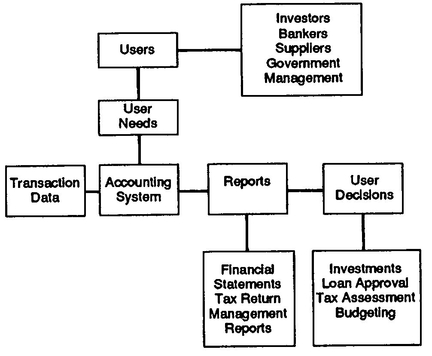

Users of accounting information can be quite varied, depending on the type of decision under consideration. Accounting information might be used for decisions involving investments, to impose income taxes, or for regulatory or managerial decisions. The process of using accounting to provide information to users is illustrated in Chart 1.2.1.

As shown in this diagram, the first step is to identify user needs. A properly designed accounting system can then generate summarized reports (using recorded transaction data) to meet those needs for accounting information. Users can then use those reports to make informed business decisions.

CHART 1.2.1

1.3 GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

This broad range of potential users has brought about the evolution of Generally Accepted Accounting Principles (GAAP) used in preparation of financial statements. Many of these principles have been formally established by standard-setting bodies such as the Financial Accounting Standards Board (FASB). Others have simply gained acceptance through widespread use. Adherence to GAAP provides a measure of consistency in preparation of financial statements.

1.4 THE ACCOUNTING EQUATION

Assets are tangible or intangible properties owned by a business. The rights or claims to those assets are equities. Owners and creditors provide resources that enable a business to purchase assets and therefore are said to have equity in that business. For instance, an owner may start a business with $10,000 cash. This cash is used to buy equipment. The owner, who provided the funds for the equipment, has a claim to that equipment.

The relation between assets and equities is shown by the equation:

Assets = Equities

Equities can be subdivided into two categories: (1) Liabilities: rights of creditors represented by debts of the business, and (2) Owner’s Equity: rights of the owner or owners.

1.5 EXPANDING THE ACCOUNTING EQUATION

Expanding the original equation by using the two categories of equities shown in 1.4 yields the accounting equation:

Assets = Liabilities + Owner’s Equity

Creditors have preferential rights to the assets of a corporation. The residual claim of the owner or owners may be better understood by restating the accounting equation as:

Assets — Liabilities = Owner’s Equity

The dollar totals of both sides of the accounting equation are always equal, since they are simply two views of the same business property. The list of assets provides a description of the various business properties, while the list of liabilities and equity indicates the funding source for those assets.

1.6 TRANSACTIONS

A transaction can be defined as an occurrence or an event that must be recorded. Any business transaction can be stated in terms of the resulting change in the three basic elements of the accounting equation. The equality of the two sides of the accounting equation must be maintained upon completion of a transaction.

As an illustration, examine the result of a transaction to purchase land for $10,000 cash.

Assets (+$10,000 land — $10,000 cash) =

Liabilities + Owner’s Equity

In this case, assets would be increased by $10,000 to reflect the land purchase and decreased by $10,000 to reflect cash paid. The net effect on assets is zero, so the accounting equation remains valid.

As another example, modify the transaction above to reflect the purchase of land by borrowing $10,000 purchase price with a bank loan (also known as a note payable).

Assets (+$10,000 land) = Liabilities (+$10,000 note payable) + Owner’s Equity

In this case, assets and liabilities are each increased by $10,000. The accounting equation therefore remains in balance.

1.7 ACCOUNTING STATEMENTS

As defined in 1.1, one of the major concerns of accounting is the preparation of summarized reports of recorded data. The principal statements used to communicate summarized data are the income statement, the statement of owner’s equity, and the balance sheet. A brief description of each statement follows:

INCOME STATEMENT:

A summary of the revenue and expenses of a business entity for a specific period of time, such as a month or a year. If total revenues for the period in question exceed total expenses, the result is net income (or net profit). If total expenses exceed total revenues, the result is a net loss.

STATEMENT OF OWNER’S EQUITY:

A summary of the changes in the owner’s equity of a business entity for a specific period of time, such as a month or a year. In a corporation, the emphasis is on reports of changes in retained earnings (net income retained in the business). Those changes are reported in the retained earnings statement.

BALANCE SHEET:

A list of the assets, liabilities and owner’s equity of a business entity as of a specific date, usually at the close of the last day of a month or a year. Assets are usually listed first, followed by a list of liabilities and a section detailing owner’s equity. Asset accounts (known as the left-hand side of the balance sheet) carry debit balances. Assets are usually listed with cash first, followed by accounts receivable, inventory, and other assets considered to be “current assets” (those easily converted to cash or expected to be converted to cash within one year). These are subtotaled and followed by a list of long-term assets such as land and equipment.

Liabilities are classified similarly. “Current liabilities” (those due within one year) are listed first, usually in the order of accounts payable, notes payable, and various other obligations such as salaries payable. These are subtotaled and followed by a listing of long-term liabilities (those due after one year). Liabilities and owner’s equity (known as the right-hand side of the balance sheet) carry credit balances. Table 1.7.1 reflects the proper classification of accounts and balance sheet format.

| Current Assets: | Current Liabilities: | ||

|---|---|---|---|

| Cash | Accounts payable | ||

| Accounts receivable | Notes payable | ||

| Notes receivable | (includes current portion of long-term debt) | ||

| Marketable securities | |||

| Inventory | Other payables | ||

| Prepaid expenses | Total Current Liabilities | ||

| Total Current Assets | |||

| Long-term Liabilities: | |||

| Long-term Assets: | |||

| Notes payable | |||

| Land | (net of current portion) | ||

| Office Equipment | Bonds payable | ||

| Plant and equipment | Total Long-term Liabilities | ||

| Total Property, Plant and Equipment | |||

| Total Liabilities | |||

| Total Long-term Assets | |||

| Owner’s Equity: | |||

| Other Assets: | |||

| Capital stock | |||

| Goodwill | Retained earnings | ||

| Intangible assets | Total Owner’s Equity | ||

| Total Other Assets | |||

| Total Liabilities and Owner’s Equity | |||

| Total Assets | |||

The statement of cash flows is an important supplemental financial statement. This statement summarizes cash receipts and cash disbursements for a business during a given period of time, such as a month or a year. This statement supplements the income statement (which may be prepared on an accrual basis), providing users with information about an entity’s ability (or inability) to meet its current cash obligations.